Introduction

Tax forms can be a real headache, right? Especially for small business owners trying to keep up with all the compliance rules. Among these forms, the 12a tax form is super important for reporting income, deductions, and credits. It can really affect your business's financial health! But here’s the kicker: many entrepreneurs don’t realize how crucial this form is, which can lead to missed opportunities and some pretty costly mistakes.

So, how can getting a handle on this form change not just your tax obligations but also the whole financial journey of your business? Let’s dive in and explore!

Understand the Purpose of Form 12a

The 12a tax form is essential for small entrepreneurs, particularly those in a service-focused field. It helps you report specific tax details to the IRS, which is super important for staying on the right side of federal tax regulations. But it’s not just about reporting; understanding this document can really change how you view your tax obligations and your overall financial health.

Think about it: The 12a tax form is essential for reporting deductions and credits that can significantly impact your tax return. By getting a handle on the 12a tax form, you can manage your tax responsibilities more effectively. And who doesn’t want to boost their financial results and keep their business thriving? So, take the time to master the 12a tax form - it could make a world of difference!

Identify Key Sections of the 12a Tax Form

The 12a tax form consists of several key sections, each designed to assist you in reporting your taxes accurately. Understanding these sections is super important for staying compliant and avoiding mistakes, especially since the IRS can hit you with underpayment penalties if you’re not careful.

-

Identification Information: This part collects basic details about your business, like your name, address, and Employer Identification Number (EIN). Getting this right is crucial - mistakes can slow down the processing of your form. Did you know that about 30% of small business owners mess this up? It often happens because they forget or misplace their EINs.

-

Income Reporting: Here, you’ll report your total income for the year. This number is key for figuring out what you owe in taxes and making sure you’re following IRS rules. For example, a small bakery reported its income incorrectly last year, which led to an audit and some hefty penalties. Knowing how to report your income can save you from underpayment penalties that can rack up interest at 8% per year, compounded daily. Yikes!

-

Subtractions and Credits: This section lets you claim any qualifying deductions or credits, which can really help lower your taxable income. Many small business owners overlook this part and miss out on potential savings. A recent study found that nearly 40% of small businesses don’t claim all their qualifying expenses, which could mean losing out on thousands of dollars. Using deductions wisely can also help you meet safe harbor requirements, keeping you safe from those pesky underpayment penalties. For instance, safe harbor payments let you avoid penalties by prepaying a minimum amount of your tax throughout the year.

-

Signature and Date: Finally, you’ll need to sign and date the form, confirming that all the info you provided is accurate. This step is essential to validate your submission.

Getting to know these sections not only makes filling out the form easier but also helps you dodge common mistakes. By mastering the 12a tax form, you can confidently and clearly tackle your tax responsibilities, avoiding the pitfalls that many small business owners encounter, such as those costly underpayment penalties.

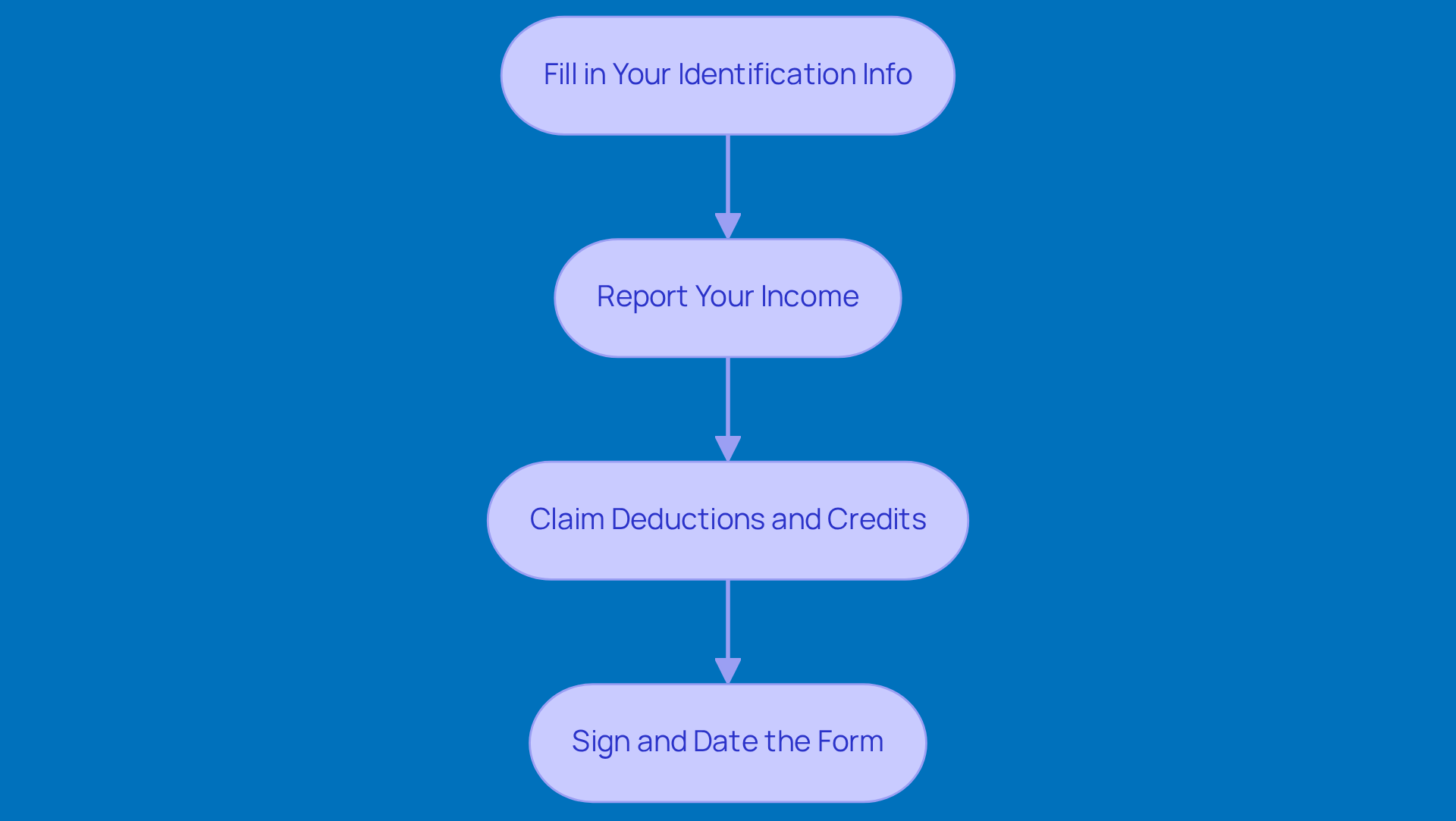

Complete Each Section of the 12a Tax Form Step-by-Step

To successfully tackle the 12a Tax Form, just follow these easy steps:

-

Fill in Your Identification Info:

- Start by entering your business name and address in the right spots. Make sure the name matches what’s on your EIN records.

- Don’t forget to input your Employer Identification Number (EIN)-it’s crucial for IRS identification.

-

Report Your Income:

- In the income section, jot down your total gross income for the year. This should include all the revenue your business has generated.

- Double-check your calculations to avoid any hiccups; mistakes can lead to complications down the line.

-

Claim Deductions and Credits:

- Take a look at the list of eligible deductions and credits. Common write-offs include operational costs, depreciation, and health insurance premiums.

- Enter the amounts in the right fields, and keep your documentation handy to back up each claim. Did you know that small businesses often claim deductions averaging 20% of their gross income? That’s why keeping thorough records is so important!

-

Sign and Date the Form:

- Once you’ve filled everything out, make sure to sign and date the form. This certifies that all the info you provided is accurate.

- And hey, don’t forget to keep a copy of the completed form for your records-it could be super helpful later on.

By following these steps, you’ll ensure that your 12a tax form is completed correctly and submitted on time. This not only reduces the chance of mistakes but also boosts your potential deductions!

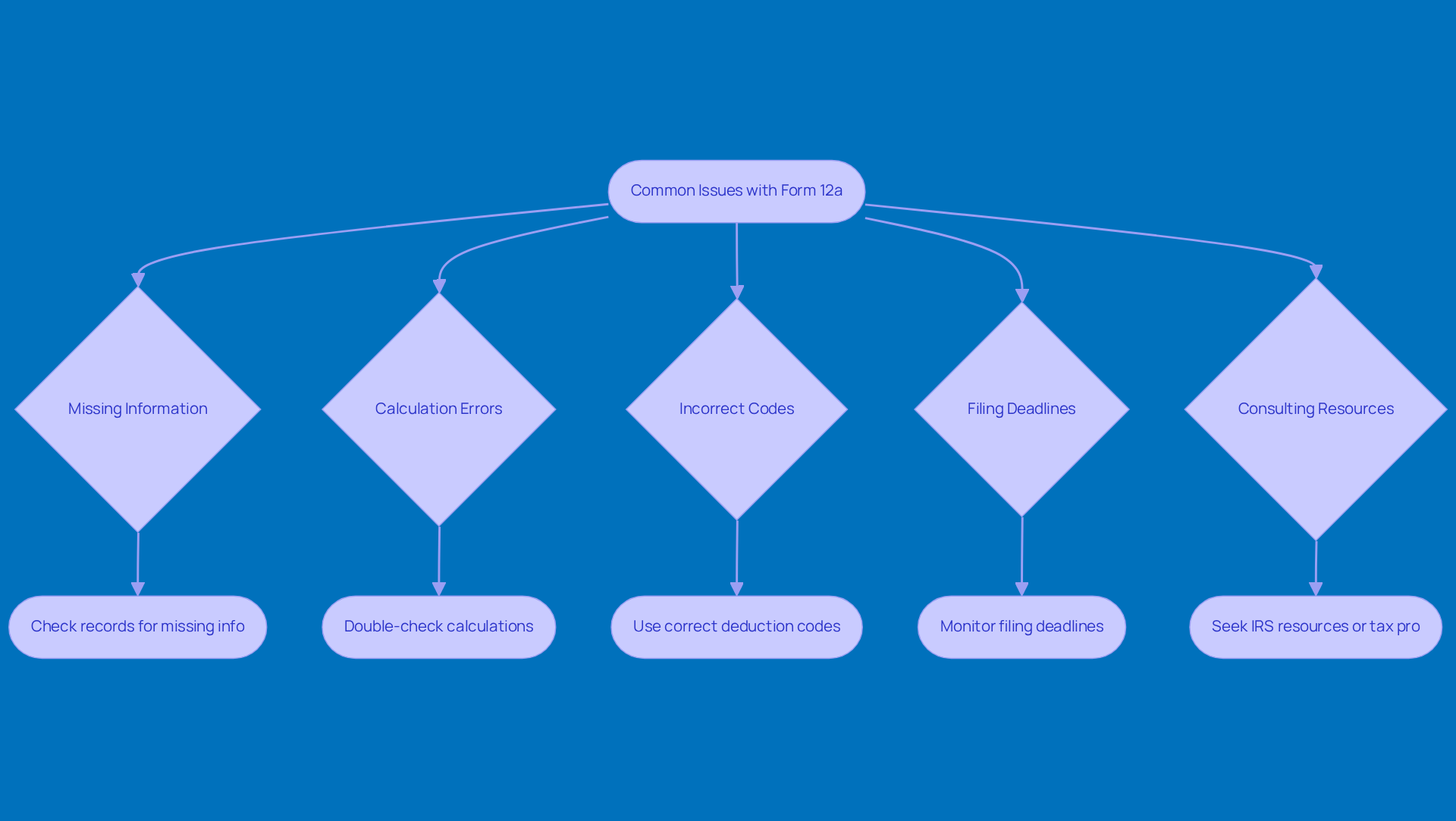

Troubleshoot Common Issues with Form 12a

When you're filling out the 12a tax form, you might encounter a few common hiccups. No worries! Here’s how to tackle them like a pro:

-

Missing Information:

- If you spot any blank fields, take a moment to check your records. Missing info can really slow things down and create headaches later on.

-

Calculation Errors:

- Double-check those income and deduction calculations! Using a calculator or a spreadsheet can really help keep things accurate. Just so you know, calculation errors are one of the top issues folks face when submitting taxes, and they can lead to some pretty big mistakes in tax liabilities.

-

Incorrect Codes:

- Make sure you’re using the right codes for deductions and credits. If you’re not sure, don’t hesitate to look up IRS guidelines or ask a tax pro for some clarity.

-

Filing Deadlines:

- Keep an eye on those filing deadlines to dodge any penalties. If you’re getting close to a deadline, think about e-filing to speed things up and cut down on mistakes.

-

Consulting Resources:

- If you hit a snag that you can’t figure out, tap into IRS resources or reach out to a tax professional. They can offer tailored advice that fits your situation perfectly.

By staying aware of these common issues and knowing how to tackle them, you can fill out the 12a tax form with a lot more confidence and accuracy!

Conclusion

Mastering the 12a tax form is super important for small business owners, especially those in service industries. This form isn’t just a way to report income and claim deductions; it’s a chance for entrepreneurs to take charge of their tax responsibilities and boost their financial health. When you really understand the 12a tax form, it can make a big difference in your business’s success by keeping you compliant with IRS rules and helping you save money.

In this guide, we’ve broken down the key parts of the 12a tax form, like your identification info, how to report income, and the ins and outs of subtractions and credits. Plus, we can’t forget the importance of signing and dating the form! Each section is crucial for filling it out correctly, helping you steer clear of common mistakes like calculation errors or missing info. By following the step-by-step process we’ve laid out, you can tackle tax reporting with confidence and clarity.

In a world where financial health is key, mastering the 12a tax form isn’t just a chore; it’s a smart move for your business growth. Taking the time to understand and fill out this form accurately can lead to some serious financial perks and peace of mind. So, why not seize the opportunity to boost your tax knowledge and ensure you’re compliant? It’s all about setting yourself up for a thriving business future!

Frequently Asked Questions

What is the purpose of Form 12a?

The 12a tax form is essential for small entrepreneurs, particularly in service-focused fields, as it helps report specific tax details to the IRS and ensures compliance with federal tax regulations.

Why is it important to understand the 12a tax form?

Understanding the 12a tax form can change how you view your tax obligations and overall financial health, allowing you to manage your tax responsibilities more effectively.

How does the 12a tax form impact tax deductions and credits?

The 12a tax form is crucial for reporting deductions and credits that can significantly affect your tax return, potentially boosting your financial results.

Who should use the 12a tax form?

The 12a tax form is particularly important for small entrepreneurs, especially those operating in service-oriented industries.

What is the benefit of mastering the 12a tax form?

Mastering the 12a tax form can make a significant difference in managing tax responsibilities and improving the financial health of a business.