Introduction

Understanding tax brackets is super important for married couples looking to boost their financial health, especially in 2021. The federal tax landscape is full of opportunities and challenges, and this guide is here to help you navigate it all.

We’ll break down the specific tax brackets for those filing jointly and share some actionable strategies to help you save on taxes and improve your financial situation.

So, how can couples tackle the complexities of tax calculations and planning to keep more of that hard-earned cash? Let's dive in!

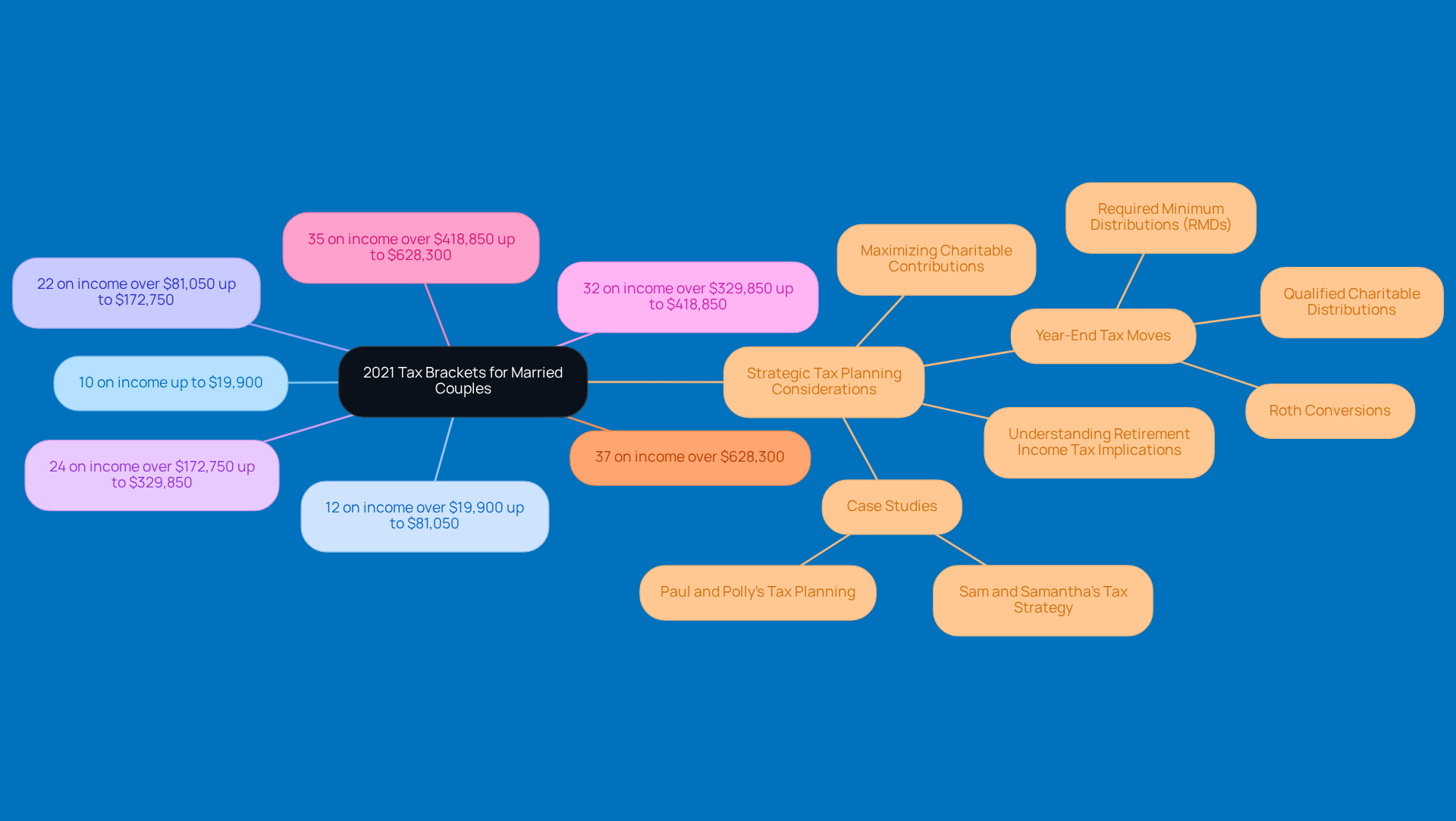

Understand the 2021 Tax Brackets for Married Couples

In 2021, if you’re a married couple filing jointly, here’s how the federal income tax brackets break down:

- 10% on income up to $19,900

- 12% on income over $19,900 up to $81,050

- 22% on income over $81,050 up to $172,750

- 24% on income over $172,750 up to $329,850

- 32% on income over $329,850 up to $418,850

- 35% on income over $418,850 up to $628,300

- 37% on income over $628,300

Understanding these brackets is super important for effective financial planning. They show how different parts of your income get taxed at different rates. For instance, if two people earn a combined $100,000, they’ll pay 10% on the first $19,900, 12% on the income between $19,901 and $81,050, and 22% on the rest up to $100,000. This tiered structure really emphasizes the need for strategic tax planning. By knowing how your earnings are taxed, couples can boost their financial outcomes.

And let’s not forget about the tax implications of various retirement income sources! For example, Social Security benefits might not be fully taxable depending on your total earnings. Plus, understanding the ins and outs of Roth and traditional IRAs can significantly impact your tax obligations. As Andrea Ward, CPA, puts it, "It’s not just about filling out forms at the end of the year; it’s about managing your finances throughout the year to lower your tax bill."

Couples should also think about making some strategic moves before the year wraps up. Maximizing charitable contributions before December 31 can really help with tax efficiency and prevent any surprises come tax time. Take Sam and Samantha, for example. They want to spend $120,000 net of taxes this year. By understanding the 2021 tax brackets married filing jointly and applying smart tax strategies, they can work towards hitting their financial goals.

Calculate Your Combined Taxable Income

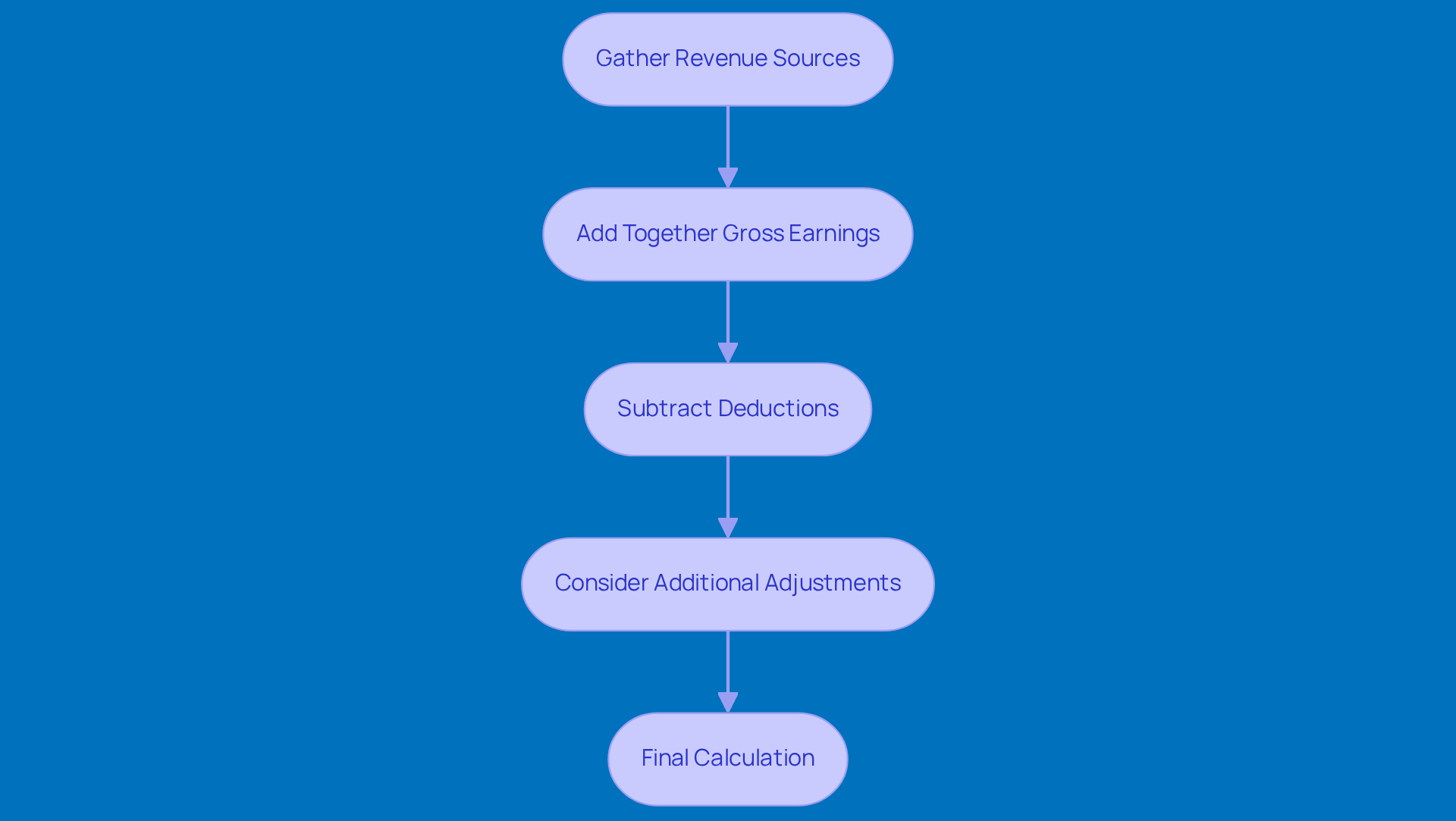

Calculating your combined taxable income as a married couple filing jointly can feel a bit daunting, but it doesn’t have to be! Just follow these simple steps:

-

Gather Revenue Sources: Start by collecting all your revenue streams. This means wages, bonuses, rental income, and any other profits you both have. Understanding your paystub is key here - it gives you the lowdown on your gross earnings and any deductions.

-

Add Together Gross Earnings: Next, combine your gross earnings. For instance, if Spouse A makes $60,000 and Spouse B brings in $40,000, you’re looking at a total of $100,000. Easy peasy, right?

-

Subtract Deductions: Now, let’s talk deductions. You’ll want to identify any that apply, like the standard deduction, which is $25,100 for the 2021 tax brackets married filing jointly. So, if you take that off your total gross earnings, you’ll have $100,000 - $25,100, which leaves you with $74,900. Don’t forget to check your paystub for any non-taxed deductions that might affect your taxable earnings!

-

Consider Additional Adjustments: If you have any other adjustments to your earnings - like contributions to retirement accounts or student loan interest - make sure to subtract those too. Keeping track of these adjustments is super important for your financial health and staying compliant.

-

Final Calculation: Finally, the number you end up with is your total taxable earnings. This figure will help determine your tax bracket and liability. By following these steps, you and your partner can confidently assess your taxable earnings and optimize your tax situation.

So, how does that sound? Ready to tackle your taxes together?

Estimate Your Tax Liability Based on Income

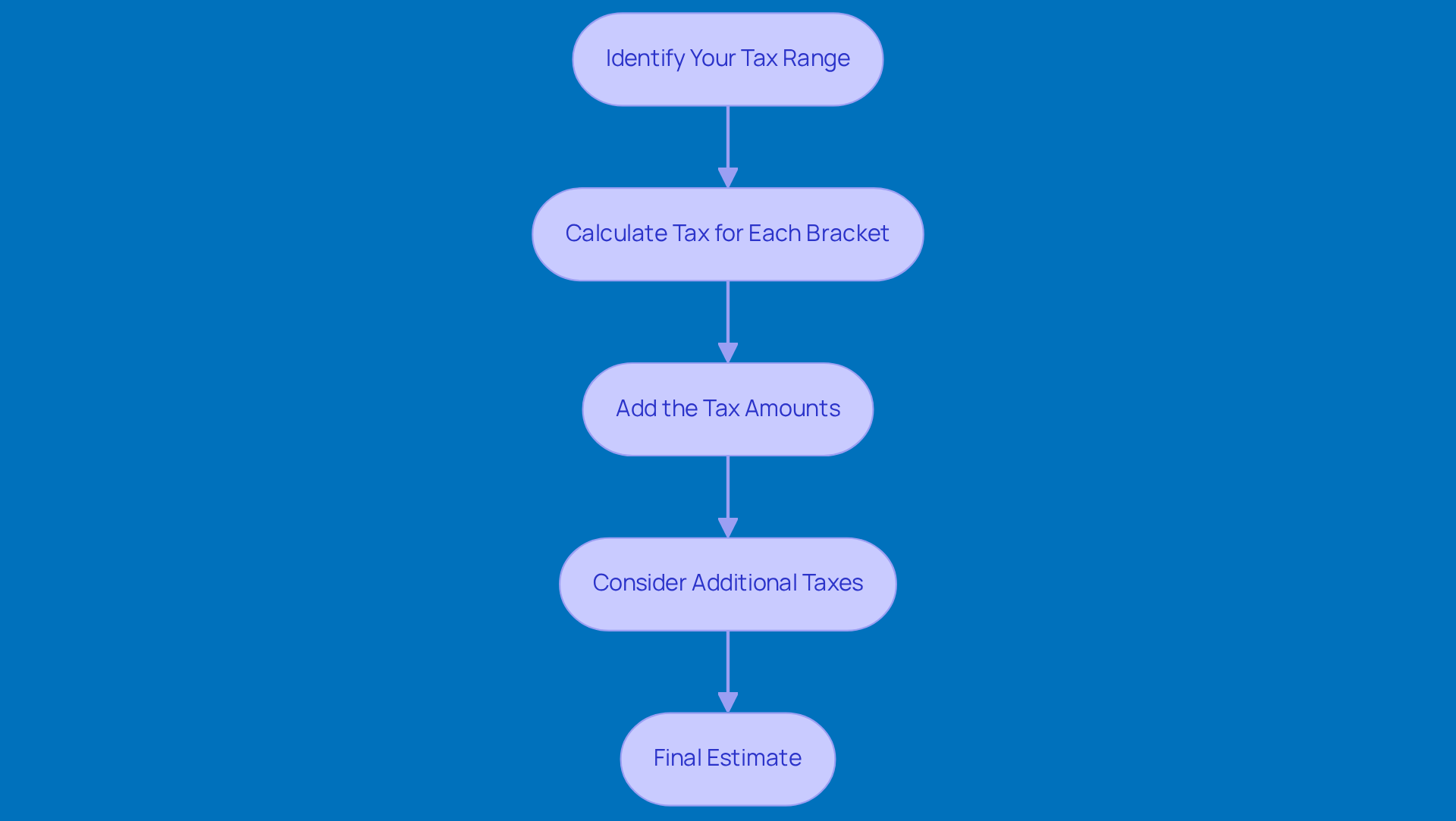

Estimating your tax liability based on your combined taxable income can feel a bit daunting, but it doesn’t have to be! Let’s break it down step by step.

First up, Identify Your Tax Range. Take a look at your total taxable earnings from the previous section. For example, if you earned $74,900, you’d find yourself in the 12% tax range. Pretty straightforward, right?

Next, it’s time to Calculate Tax for Each Bracket. Here’s how it works:

- For the first $19,900, you owe 10%, which comes to $1,990.

- Then, for the income between $19,901 and $74,900 (that’s $55,000), you owe 12%, totaling $6,600.

Now, let’s Add the Tax Amounts together. So, you’d combine:

- $1,990 (10% bracket) + $6,600 (12% bracket) = $8,590. Easy peasy!

Don’t forget to Consider Additional Taxes. If you have any extra taxes, like self-employment tax or alternative minimum tax (AMT), make sure to factor those in.

Finally, you’ll arrive at your Final Estimate. For this example, the total estimated tax liability for the pair is $8,590. And there you have it! You’re one step closer to understanding your taxes.

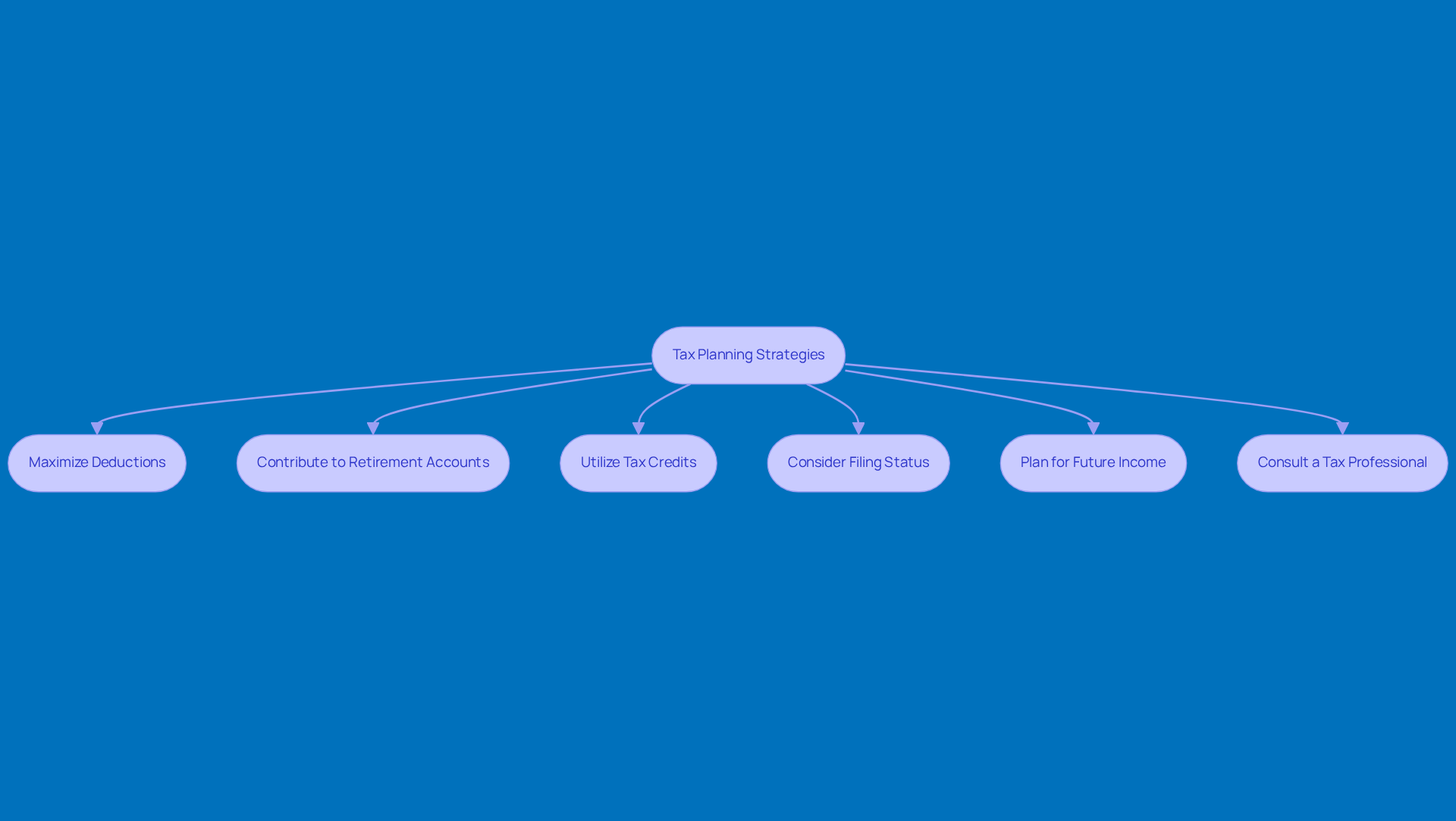

Implement Tax Planning Strategies to Optimize Savings

Looking to save on taxes? Let’s chat about some smart strategies you can use, especially with a little help from Steinke and Company’s proactive tax planning services. They offer 1-3 meetings a year to review your tax return and books, making it easier to stay on top of things.

-

Maximize Deductions: First off, make sure you’re taking full advantage of all available deductions. For instance, in 2026, the standard deduction for married couples filing jointly is $27,700. Don’t forget about itemized deductions like mortgage interest and charitable contributions - they can really add up!

-

Contribute to Retirement Accounts: Next, think about contributing to tax-advantaged retirement accounts like a 401(k) or IRA. This can significantly lower your taxable earnings. For 2026, you can contribute up to $23,500 to a 401(k), plus an extra $7,500 if you’re 50 or older. That’s a nice little boost!

-

Utilize Tax Credits: Have you looked into tax credits? They can be a game changer! For example, the Child Tax Credit can give you up to $2,000 per qualifying child, and the Earned Income Tax Credit can directly reduce your tax bill. Definitely worth exploring!

-

Consider Filing Status: Now, let’s talk about your filing status. Is it better for you to file jointly or separately? Generally, the 2021 tax brackets married filing jointly offer better tax rates and access to various deductions and credits, making it the go-to choice for most couples.

-

Plan for Future Income: If you’re expecting a big jump in income, consider deferring some income or accelerating deductions. This proactive approach can help you stay within those lower tax brackets and minimize your tax liability for the current year.

-

Consult a Tax Professional: Finally, don’t hesitate to reach out to a tax professional. Steinke and Company can provide tailored strategies that fit your unique financial situation. Their expert insights and regular check-ins will help you maximize your tax savings and navigate those tricky tax laws.

So, what do you think? Ready to take charge of your tax savings?

Conclusion

Understanding the 2021 tax brackets for married couples filing jointly is super important for managing your finances effectively. These brackets have a tiered structure that shows how different parts of your income are taxed, which really highlights the need for some smart tax planning. By getting a handle on these concepts, couples can make choices that boost their financial well-being.

Throughout this article, we’ve shared some key insights on how to:

- Calculate your combined taxable income

- Estimate your tax liability

- Implement effective tax planning strategies

From maximizing deductions and contributions to retirement accounts to exploring available tax credits, these strategies can really make a difference in your overall tax burden. And let’s not forget the value of consulting a tax professional - getting tailored advice can be a game changer for your unique financial situation.

Ultimately, mastering the 2021 tax brackets and putting proactive tax strategies into action can lead to some serious savings and better financial health for married couples. By taking charge of your tax planning and staying in the loop about the ins and outs of the tax code, you can navigate your financial future with confidence and skill. Embracing these practices not only gets you ready for tax season but also empowers you to reach your bigger financial goals. So, what are you waiting for? Let’s get started on this journey together!

Frequently Asked Questions

What are the federal income tax brackets for married couples filing jointly in 2021?

The federal income tax brackets for married couples filing jointly in 2021 are as follows: 10% on income up to $19,900, 12% on income over $19,900 up to $81,050, 22% on income over $81,050 up to $172,750, 24% on income over $172,750 up to $329,850, 32% on income over $329,850 up to $418,850, 35% on income over $418,850 up to $628,300, and 37% on income over $628,300.

How does the tiered tax structure work for married couples?

In the tiered tax structure, different portions of a couple's income are taxed at different rates. For example, if a couple earns a combined $100,000, they will pay 10% on the first $19,900, 12% on the income between $19,901 and $81,050, and 22% on the remaining income up to $100,000.

Why is it important for married couples to understand tax brackets?

Understanding tax brackets is important for effective financial planning, as it helps couples know how their earnings are taxed, allowing them to make strategic tax decisions that can boost their financial outcomes.

What are some tax implications of retirement income sources for married couples?

Retirement income sources, such as Social Security benefits, may not be fully taxable depending on a couple's total earnings. Additionally, understanding the differences between Roth and traditional IRAs can significantly affect tax obligations.

What strategic moves can couples make before the end of the year to improve tax efficiency?

Couples can maximize charitable contributions before December 31 to enhance tax efficiency and avoid surprises during tax season.

How can understanding tax brackets help couples achieve their financial goals?

By understanding the 2021 tax brackets and applying smart tax strategies, couples can work towards their financial goals, such as net spending targets, while managing their tax liabilities effectively.