Introduction

Navigating the world of starting a nonprofit can feel a bit overwhelming, right? Especially when it comes to that all-important 501(c)(3) application. This designation isn’t just about tax exemptions; it can really boost your fundraising efforts and give your organization some serious credibility in the community. But let’s be real - the road to getting this status is often filled with twists and turns that can trip up even the most passionate organizations. So, how can you, as an aspiring nonprofit, tackle the application process and ensure your mission not only survives but thrives? Let's dive in!

Understand the Purpose of the 501(c)(3) Application

Before we jump into the application process, let’s take a moment to chat about what 501(c)(3) status really means. This designation allows nonprofit organizations to be exempt from federal income tax, which means more funds can go directly toward their mission. Plus, when people donate to 501(c)(3) organizations, those contributions are tax-deductible for the donor. This can really boost your fundraising efforts! Understanding these perks will help you articulate your organization’s mission and purpose in the 501(c)(3) application, which is crucial for obtaining that approval.

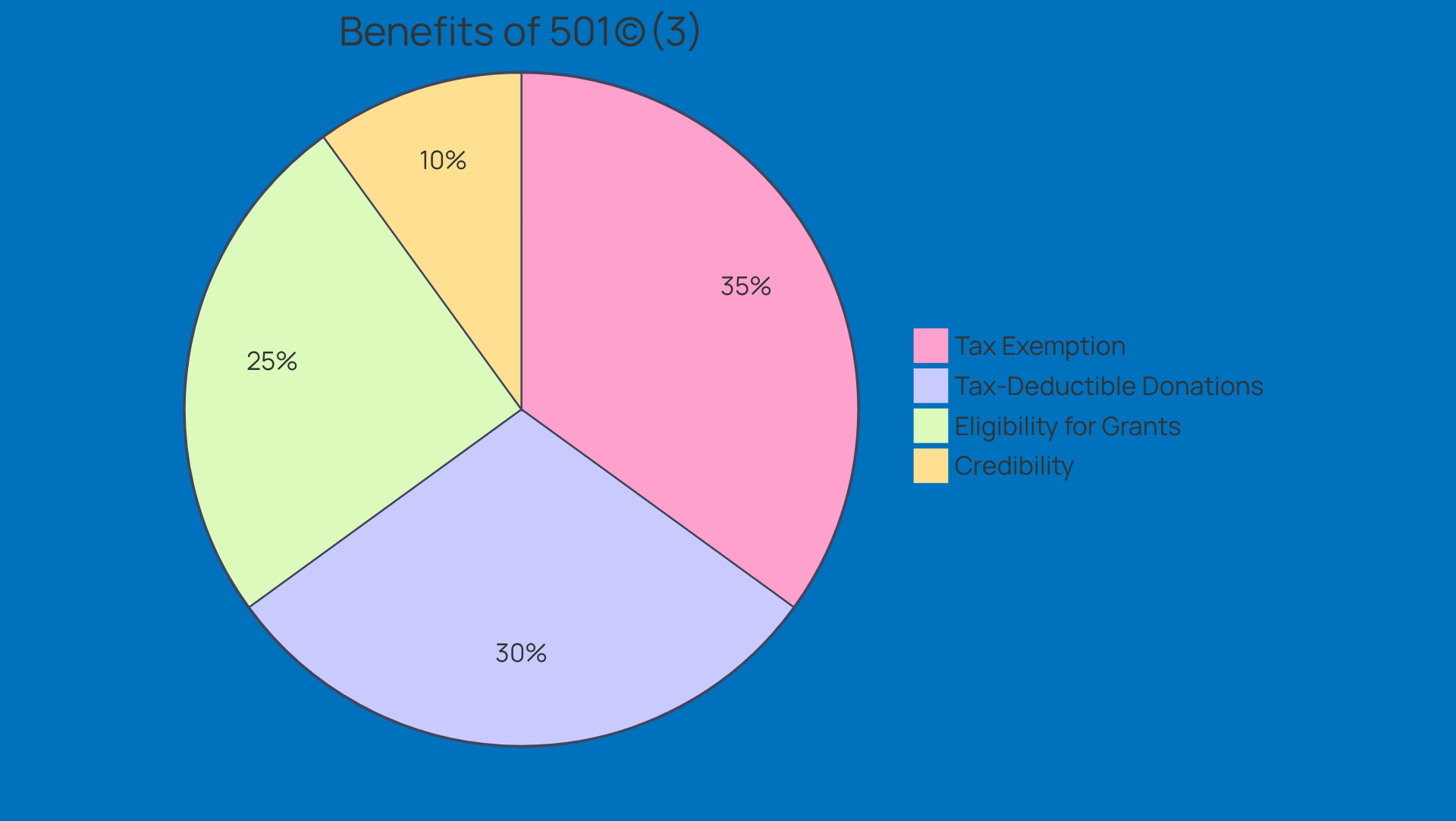

Key Benefits of 501(c)(3) Status:

- Tax Exemption: Organizations don’t pay federal income tax on revenue tied to their exempt purposes.

- Tax-Deductible Donations: Donors can deduct their contributions on their tax returns, which encourages bigger donations.

- Eligibility for Grants: Many foundations and government entities only fund organizations with 501(c)(3) status.

- Credibility: Achieving this status can enhance your organization’s reputation and trustworthiness in the community.

So, what do you think? These benefits can really make a difference for your nonprofit!

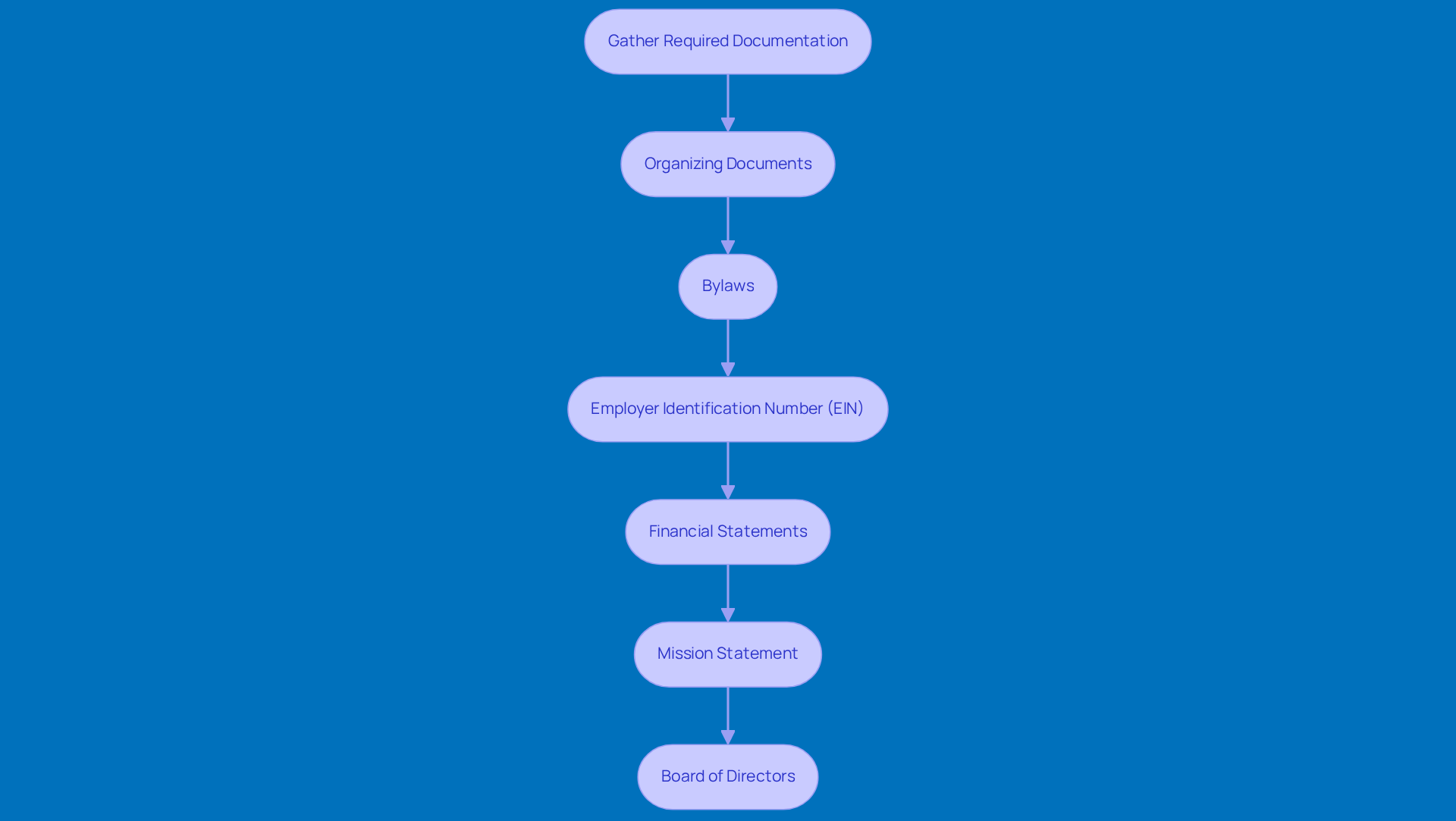

Gather Required Documentation and Information

If you're looking to snag that coveted 501(c)(3) application status, you'll need to gather a few key documents and bits of info. Let’s break it down:

-

Organizing Documents: First up, you’ll need your Articles of Incorporation or a trust document that lays out your nonprofit's purpose. These foundational docs must meet IRS requirements, so they clearly reflect your mission and structure.

-

Bylaws: Next, draft some bylaws that govern how your organization will operate. Think of it as your rulebook! Make sure to include the organization's name, purpose statement, and the rules for meetings and amendments. Well-structured bylaws are super important for showing that you have a solid governance plan.

-

Employer Identification Number (EIN): Don’t forget to get an EIN from the IRS. This number is essential for tax purposes and to open a bank account in your nonprofit's name.

-

Financial Statements: You’ll also want to prepare a budget and financial projections for the next three years. This shows how you plan to use your funds and is key for demonstrating your organization’s sustainability.

-

Mission Statement: Clearly articulate your mission and the specific charitable purpose you serve. A compelling mission statement is crucial for getting potential donors and stakeholders on board with your goals.

-

Board of Directors: Lastly, list out your board members, including their roles and responsibilities. Picking reliable board members who share your nonprofit's mission is critical - they’ll help guide your organization and keep you compliant with legal requirements.

Now, here’s a fun fact: preparing all this documentation can take newbies over 100 hours! That’s a lot of time, right? Plus, the IRS Form 1023 can stretch up to 28 pages, and with attachments, your submission could total around 100 pages. The whole process for the 501(c)(3) application can take anywhere from 3 to 9 months for IRS review. So, having these documents ready to go will really help speed things up and avoid any unnecessary delays. In the end, it’ll boost your nonprofit's credibility and get you operationally ready to make a difference!

Complete the Application Form Step-by-Step

Filling out the 501(c)(3) application by completing Form 1023 might feel a bit overwhelming at first, but don’t worry! Breaking it down into sections can really simplify things:

- Basic Information: Start with your entity's name, address, and EIN. Easy peasy!

- Organizational Structure: Describe how your nonprofit is set up, including its governing documents and bylaws.

- Narrative Description: This is your chance to shine! Clearly explain your entity's mission, the activities you’ll undertake, and how these activities support your charitable purpose.

- Financial Information: Share your budget, along with projected income and expenses for the next three years.

- Public Charity Status: Let them know if your organization will be a public charity or a private foundation.

- Signature and Verification: Don’t forget to have an authorized individual sign the form, confirming that all the info is accurate.

Take your time with each section, and if you have any questions, consider chatting with a tax professional. As Jonathon Tonioli wisely says, "We strongly recommend working with a professional to ensure you complete the form properly." Common mistakes, like incomplete narratives or off-target financial projections, can really hurt your chances of approval for your 501(c)(3) application. Did you know that about 30% of tax-exempt submissions get follow-up requests for more info? Yikes! Working with a CPA can help you dodge these pitfalls and make sure your 501(c)(3) application is spot-on.

Oh, and just a heads up: the filing fee for Form 1023 is $600, while the 1023-EZ costs $275. So, it’s super important to prepare a well-structured application to boost your chances of success!

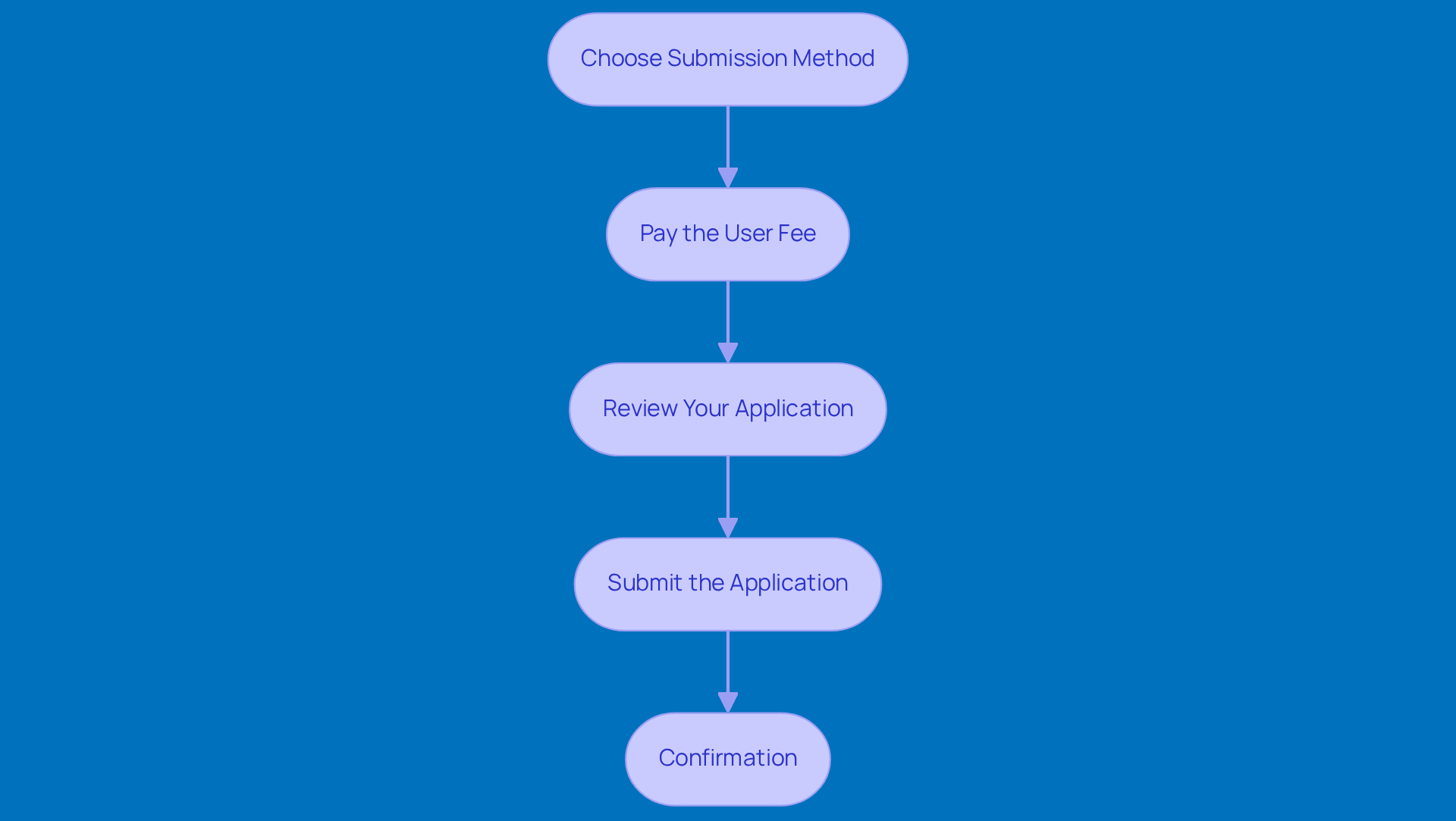

Submit Your Application and Payment

Once you’ve wrapped up Form 1023, it’s time to get your application submitted! Here’s how to do it:

- Choose Your Submission Method: You’ll need to submit your application electronically through Pay.gov. Make sure you’ve got an account set up before diving in!

- Pay the User Fee: The standard fee for Form 1023 is $600, but if you’re using 1023-EZ, it’s a bit lighter at $275. You can pay directly from your bank account or use a credit card-whatever works best for you.

- Review Your Application: Before hitting that submit button, take a moment to double-check all your info for accuracy and completeness. As Sunita Lough, the Commissioner of the IRS Tax Exempt/Government Entities Division, puts it, "Given how complex tax issues can be, an important element we always take into consideration at the IRS is looking to make things simpler whenever we can."

- Submit the Application: Just follow the prompts on Pay.gov to upload your completed form and make your payment. Easy peasy!

- Confirmation: After you submit, keep an eye out for a confirmation email. Hang onto that-it’s your proof of submission.

Now, be prepared for a processing period that can stretch from a few weeks to several months, depending on how intricate your request is and the IRS’s workload. For instance, in FY 2021, the average processing time for 1023-EZ applications was about 94 days, which is a lot quicker than the 138 days for the longer Form 1023. This really shows how important it is to pick the right form based on your entity’s needs. Plus, if you file using Form 1023-EZ, you won’t have income limits after the first three years, giving you more room to grow!

Conclusion

Getting that 501(c)(3) status is a game-changer for any nonprofit looking to make a real impact and stay financially healthy. This designation not only gives you tax-exempt status but also boosts your credibility and opens up a world of funding opportunities. If you’re serious about fulfilling your mission, this step is absolutely essential.

Now, let’s talk about what it takes to secure this status. You’ll need to:

- Understand the benefits

- Gather the right documents

- Fill out the application form

- Submit it correctly

Each step requires a keen eye for detail, whether it’s crafting a mission statement that resonates or making sure your financial projections align with your goals. Watch out for common pitfalls like incomplete narratives or mistakes in your submission - these can really slow down the approval process, so thorough preparation is key.

As you embark on this journey, it’s important to think about the bigger picture of achieving that 501(c)(3) status. It not only helps nonprofits operate more effectively but also builds trust in the community, which can lead to greater donor engagement and support. If you’re considering this path, investing time and resources into mastering the application process can pay off big time, ultimately boosting your organization’s ability to make a meaningful difference in the lives of those you serve. So, are you ready to take the plunge?

Frequently Asked Questions

What is the purpose of the 501(c)(3) application?

The 501(c)(3) application is intended for nonprofit organizations to obtain federal income tax exemption, allowing more funds to be directed toward their mission and making donations tax-deductible for donors.

What are the key benefits of obtaining 501(c)(3) status?

The key benefits include tax exemption from federal income tax on revenue tied to exempt purposes, tax-deductible donations for donors, eligibility for grants from foundations and government entities, and enhanced credibility and trustworthiness in the community.

How does 501(c)(3) status impact fundraising efforts?

With 501(c)(3) status, contributions are tax-deductible for donors, which can encourage larger donations and improve fundraising efforts for the organization.

Why is understanding the benefits of 501(c)(3) status important for organizations?

Understanding these benefits helps organizations articulate their mission and purpose effectively in the 501(c)(3) application, which is crucial for obtaining approval.