Introduction

Navigating the U.S. tax code can feel like a maze, especially for those of us earning income abroad. But here’s the good news: the Foreign Earned Income Exclusion (FEIE) is a fantastic opportunity for U.S. citizens and resident aliens. It lets you exclude a big chunk of your foreign earned income from taxes, which could mean saving thousands each year!

That said, figuring out if you qualify and how to claim it can be tricky. What are some common pitfalls that expatriates run into? And how can you make sure you’re getting the most out of this benefit while steering clear of costly mistakes? Let’s dive in!

Define the Foreign Earned Income Exclusion (FEIE)

Hey there! Let’s chat about the earned income exclusion, specifically the Foreign Earned Income Exclusion (FEIE). This nifty provision in the U.S. tax code allows qualifying U.S. citizens and resident aliens to benefit from the earned income exclusion by excluding a chunk of their foreign earned income from U.S. taxes. For the tax year 2025, that amount is up to $130,000 per qualifying individual. So, if you’re earning money while working abroad, you might not have to pay U.S. taxes on that income - pretty cool, right? Just remember, you’ve got to meet specific criteria to qualify.

Now, here’s something important: even if you qualify for the FEIE, self-employment tax still applies. This is especially crucial for expatriates who are self-employed. And don’t forget, U.S. citizens and Green Card holders need to file a federal tax return every year, no matter where they live. The earned income exclusion (FEIE) is designed to help you avoid double taxation on income earned outside the U.S., providing a fantastic tax benefit for those of you working in foreign lands.

Looking ahead, in 2026, the exclusion amount will bump up to $132,900 for income earned that year. This reflects ongoing adjustments to support U.S. citizens working abroad. If you’re a U.S. taxpayer living overseas and you’ve missed some previous filings, don’t sweat it! You can use the Streamlined Filing Compliance Procedures to catch up on your filings without penalties, as long as your failure to file wasn’t willful.

Understanding and using the earned income exclusion can really boost your financial situation, allowing you to keep more of your hard-earned money. So, why not take a closer look at how this could work for you?

Identify Who Qualifies for the FEIE

To qualify for the Foreign Earned Income Exclusion (FEIE), there are a few key criteria you need to meet:

-

Foreign Earned Revenue: First off, the money you’re claiming must come from personal services you performed in a foreign country. So, things like dividends or pensions? They don’t count.

-

Tax Home in a Foreign Country: You’ve got to have your tax home set up in a foreign country. This means your main place of business or employment is outside the U.S.

-

Bona Fide Residence Test or Physical Presence Test: You’ll need to pass one of these tests:

- The Bona Fide Residence Test means you’ve lived in a foreign country for an uninterrupted period that covers an entire tax year.

- The Physical Presence Test requires you to be physically present in one or more foreign countries for at least 330 full days within any 12-month period.

Getting these criteria right is super important if you want to successfully claim the earned income exclusion. And guess what? For 2026, the exclusion limit is set to rise to $132,900, adjusted each year for inflation. That’s some serious tax relief for qualifying expatriates! Just remember, the earned income exclusion only applies to income earned through active work, so passive income is out of the picture. Understanding these requirements can really help you navigate your tax obligations while maximizing your benefits. So, are you ready to tackle your taxes with confidence?

Explain How to Claim the FEIE

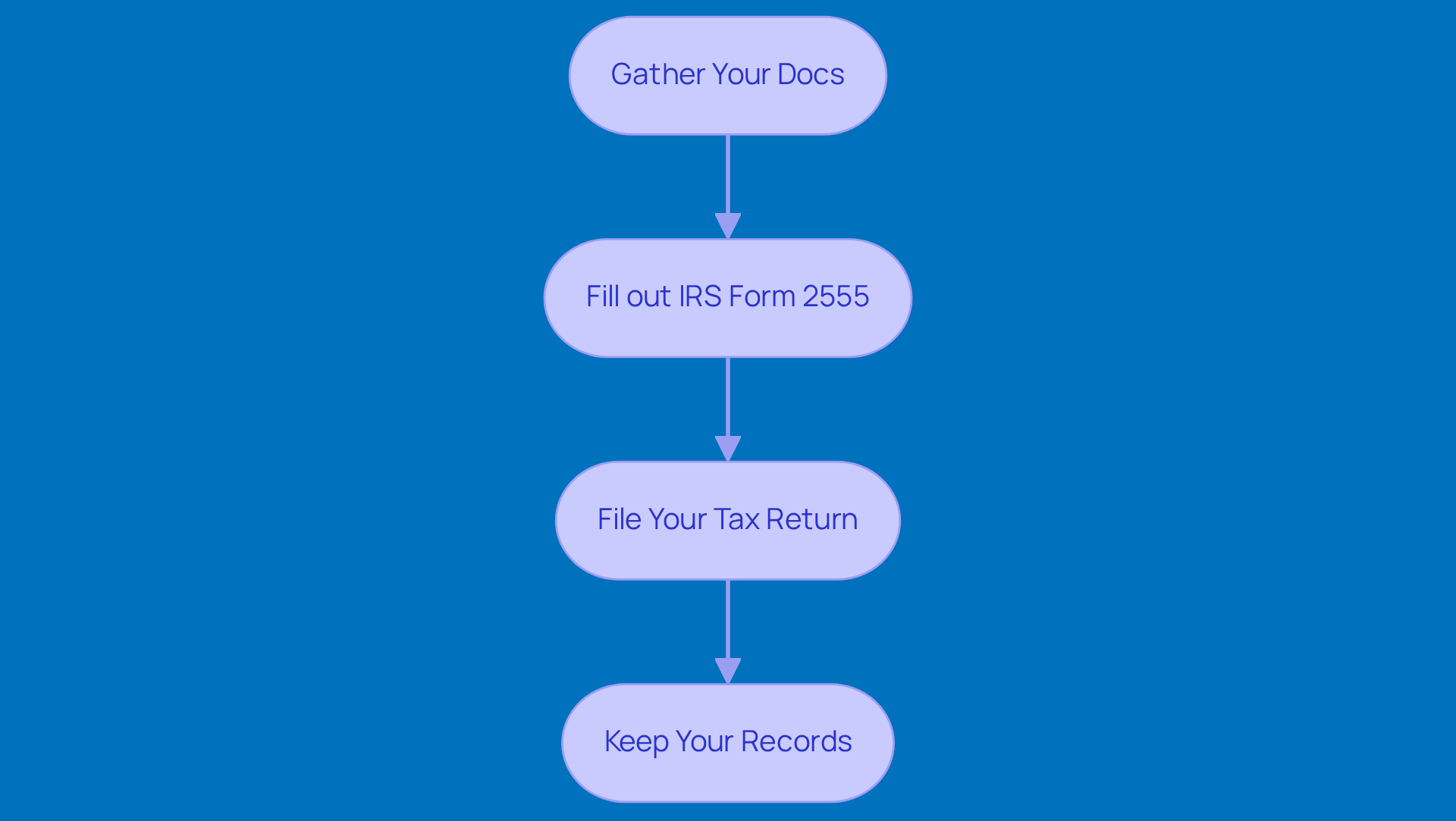

Want to claim the earned income exclusion for foreign income? Here’s how to do it in a few simple steps:

-

Gather Your Docs: First things first, you’ll want to collect all the necessary paperwork that proves your foreign earned income and shows that your tax home is in another country. Think pay stubs, employment contracts, and proof of residency. Got them? Great!

-

Fill out IRS Form 2555, as this is your ticket to claiming the earned income exclusion for the FEIE. You’ll need to provide some detailed info about your foreign income, your tax home, and which qualifying test you’re using. It might sound a bit daunting, but just take it one step at a time.

-

File Your Tax Return: When you’re ready to submit your U.S. tax return, don’t forget to attach Form 2555 to your Form 1040. Make sure everything is accurate and complete-this will help you avoid any delays or hiccups with your claim.

-

Keep Your Records: Last but not least, hang on to copies of all the documents and forms you submitted, plus any correspondence with the IRS. Trust me, this is super important in case you ever need to reference your claim later on or if an audit comes knocking.

And there you have it! Following these steps can help you navigate the earned income exclusion process with ease. If you have any questions or need a bit more guidance, feel free to reach out!

Highlight Common Mistakes to Avoid with the FEIE

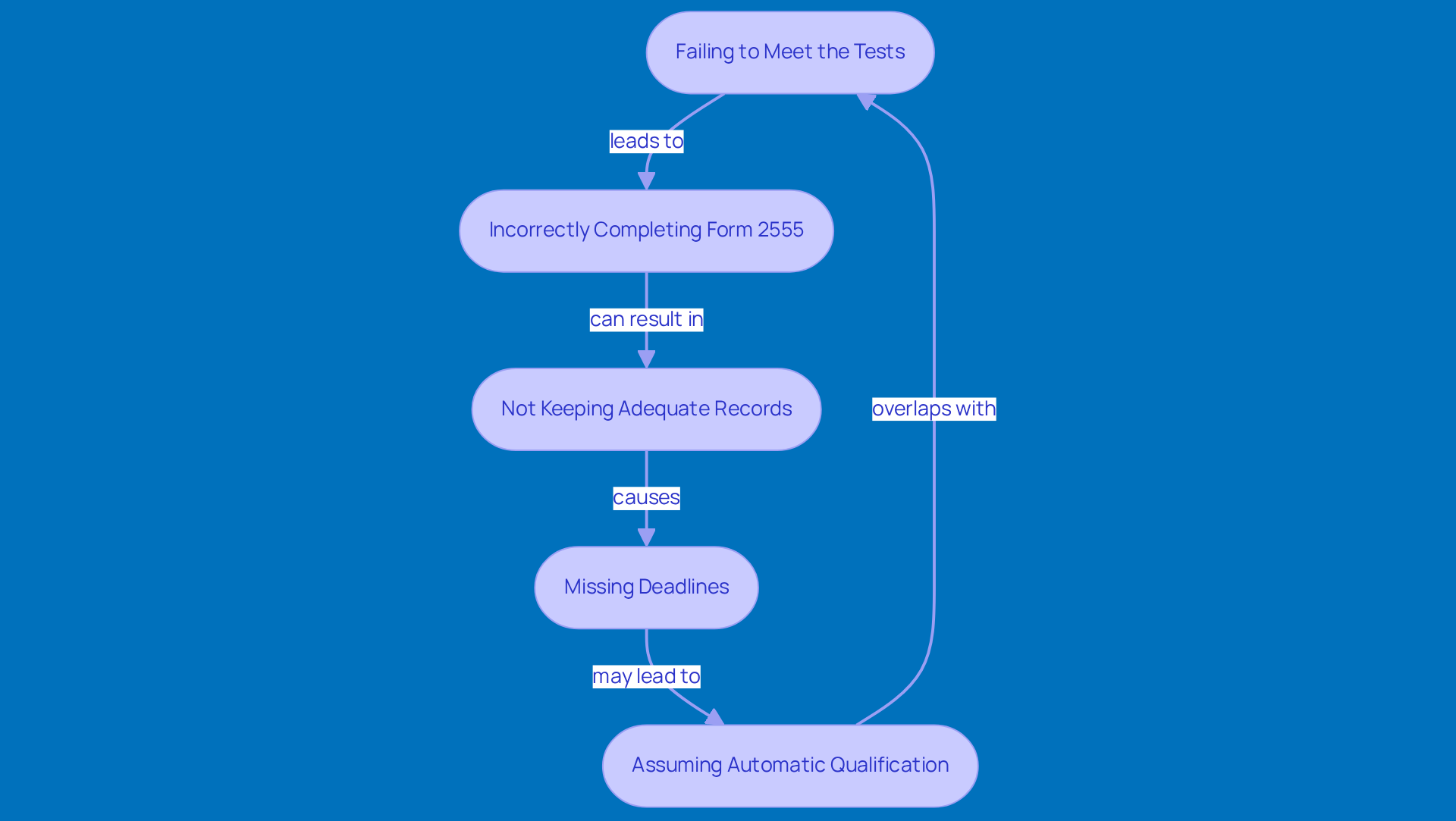

When it comes to claiming the Foreign Earned Income Exclusion (FEIE), there are a few common pitfalls you’ll want to steer clear of:

-

Failing to Meet the Tests: First off, make sure you meet either the Bona Fide Residence Test or the Physical Presence Test. It’s easy to think you qualify without really understanding what’s required, and that can lead to disqualification.

-

Incorrectly Completing Form 2555: Take a good look at Form 2555 before you submit it. Any mistakes in reporting your income or residency details can lead to denial of your exclusion. For example, if you miscount the days you spent abroad or mess up where your tax home is, you could run into trouble during IRS audits.

-

Not Keeping Adequate Records: If the IRS questions your claim, not having enough documentation can cause big headaches. Keep your records organized - think passports, employment contracts, and housing leases - to back up your eligibility for the FEIE.

-

Missing Deadlines: Don’t forget about those tax filing deadlines! U.S. expatriates get an automatic extension until June 15, but any taxes owed still need to be paid by April 15 to avoid interest charges. Missing these deadlines can put your FEIE claim at risk.

-

Assuming Automatic Qualification: Just living abroad doesn’t mean you automatically qualify for the FEIE. It’s super important to check your eligibility based on the criteria laid out, as many folks overlook this crucial step.

Statistics show that a significant number of IRS audits related to claims for the foreign earned income exclusion stem from these common mistakes. So, being aware of these pitfalls can really boost your chances of successfully claiming the FEIE and avoiding unnecessary tax headaches. Keep these tips in mind, and you’ll be on the right track!

Conclusion

Mastering the Foreign Earned Income Exclusion (FEIE) can really boost the financial well-being of U.S. citizens and resident aliens working abroad. By getting a handle on this tax provision, you can exclude a good chunk of your foreign earned income from U.S. taxes, which helps ease the pain of double taxation. And with the exclusion amount set to rise in 2026, there’s no better time to dive into how you can make the most of this valuable tax benefit.

So, what do you need to know? First off, there are eligibility criteria for the FEIE:

- Your income must come from personal services performed in a foreign country.

- You need to establish a tax home abroad.

- You have to pass either the Bona Fide Residence Test or the Physical Presence Test.

- Don’t forget about IRS Form 2555! Filling it out accurately and keeping thorough documentation is key to supporting your claims.

Watch out for common mistakes that could put your eligibility at risk.

Ultimately, understanding and using the FEIE isn’t just about maximizing tax benefits; it’s about empowering you to make smart financial choices while living and working overseas. By following the steps we’ve discussed and staying alert to potential pitfalls, you can navigate the complexities of international taxation with confidence. So, why wait? Take action today to ensure you’re fully leveraging the advantages available to you under the Foreign Earned Income Exclusion!

Frequently Asked Questions

What is the Foreign Earned Income Exclusion (FEIE)?

The Foreign Earned Income Exclusion (FEIE) is a provision in the U.S. tax code that allows qualifying U.S. citizens and resident aliens to exclude a portion of their foreign earned income from U.S. taxes. For the tax year 2025, this amount is up to $130,000 per qualifying individual.

Who qualifies for the FEIE?

To qualify for the FEIE, individuals must meet specific criteria set by the IRS, which generally involve working abroad and meeting residency or physical presence tests.

Does the FEIE apply to self-employment income?

No, even if you qualify for the FEIE, self-employment tax still applies to self-employed individuals, including expatriates.

Do U.S. citizens living abroad need to file a tax return?

Yes, U.S. citizens and Green Card holders are required to file a federal tax return every year, regardless of where they live.

What is the exclusion amount for the tax year 2026?

For the tax year 2026, the exclusion amount will increase to $132,900 for income earned that year.

What should I do if I missed previous tax filings while living abroad?

If you have missed previous filings, you can use the Streamlined Filing Compliance Procedures to catch up on your filings without penalties, provided your failure to file was not willful.

How can the FEIE benefit me financially?

The FEIE can help you avoid double taxation on income earned outside the U.S., allowing you to retain more of your income while working abroad.