Introduction

Understanding the ins and outs of international tax agreements can really change the game for small business owners eager to expand their horizons. Take the U.S.-India tax treaty, for example. It’s crafted to help you avoid double taxation, which means potential savings and clearer tax obligations for businesses operating across borders. But let’s be real - navigating this treaty can be tricky. Many small enterprises find themselves asking: how can they make the most of these provisions to boost their financial health and steer clear of costly mistakes?

So, if you’re a small business owner looking to tap into international markets, stick around! We’re diving into how you can leverage these tax benefits to your advantage.

Overview of the U.S.-India Tax Treaty: Purpose and Significance

The India tax treaty ensures that you don’t get taxed twice on the same income. It sets clear rules for how earnings made in one country by residents of the other are taxed. This is especially important for small businesses that are dipping their toes into international trade or services. Who wants to pay taxes twice, right?

By understanding the ins and outs of the India tax treaty, small enterprises can secure significant tax savings while remaining compliant with both U.S. and Indian tax laws. Imagine being able to streamline your operations and boost your competitiveness in the global market! It’s all about fostering growth and sustainability, and the India tax treaty can help you do just that.

So, have you thought about how this could impact your business? Understanding these provisions might just be the key to unlocking new opportunities!

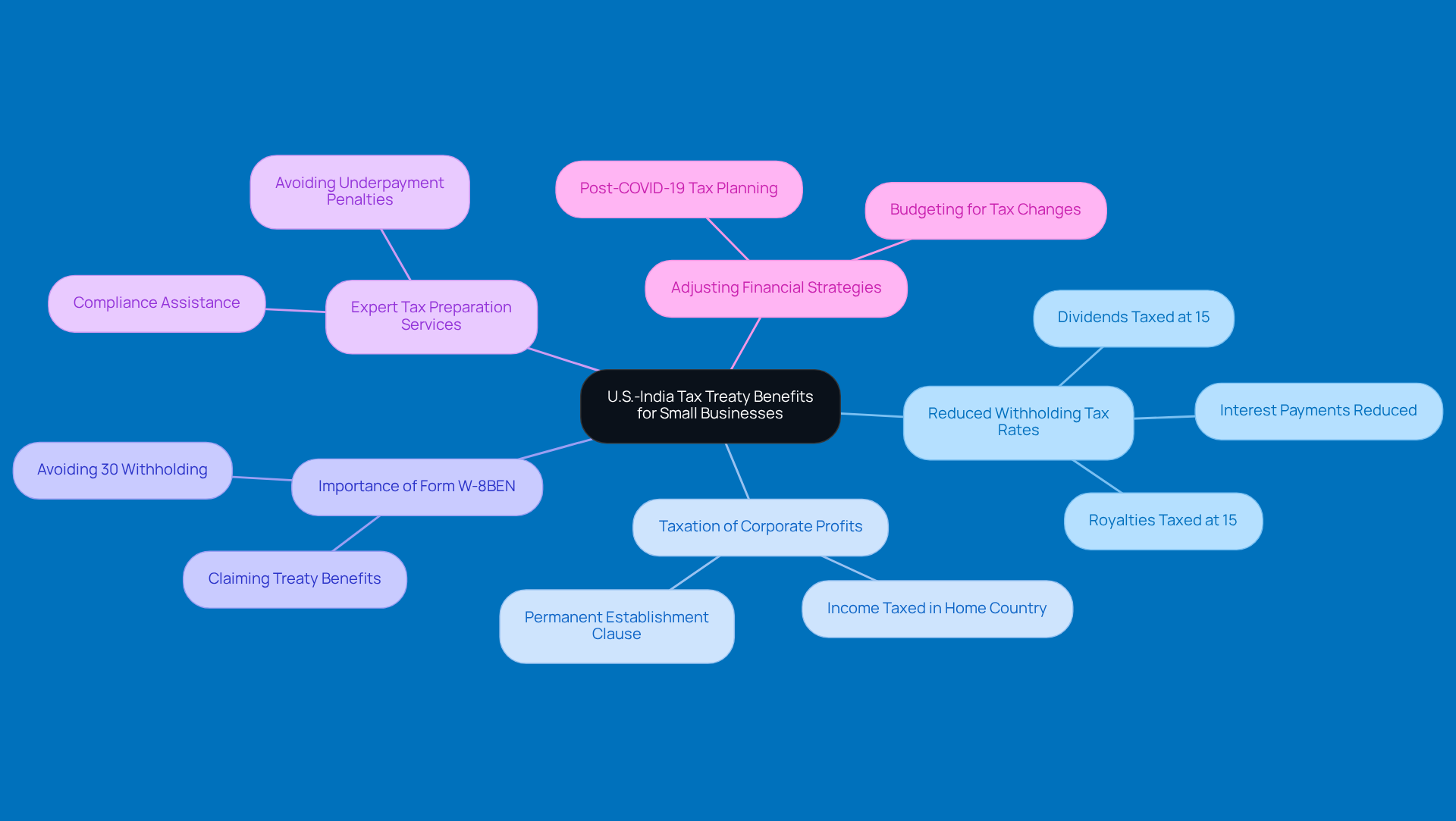

Key Provisions of the U.S.-India Tax Treaty Affecting Small Businesses

The India tax treaty provides excellent benefits for small businesses, particularly regarding reduced withholding tax rates on dividends, interest, and royalties. For example, if certain ownership thresholds are met, dividends can be taxed at just 15%. That means companies get to keep more of their hard-earned money!

But that’s not all. The treaty also clears up how corporate profits are taxed, stating that income is only taxed in the country where the business is based-unless there’s a permanent establishment in the other country. This is super important for small business owners, as it helps them plan their finances better and avoid unnecessary tax bills.

You might be wondering how this all plays out in real life. Well, many small businesses have successfully used these agreements to boost their cash flow and overall financial health. It really shows how valuable the India tax treaty can be for effective tax planning.

Now, here’s something crucial: small business owners need to understand the importance of submitting Form W-8BEN to claim those treaty benefits. If you skip this step, you could face a hefty 30% withholding on your income. Yikes! So, proper documentation is key.

As tax season rolls around, it’s a good idea to consider expert tax preparation and planning services, like those from Steinke and Company. They can help ensure you’re compliant and avoid any nasty surprises. Plus, they specialize in helping small business owners navigate potential underpayment penalties, offering tailored strategies to keep your tax compliance on point.

With recent changes in tax benefits following the end of COVID-19 relief measures, it’s more important than ever for small businesses to adjust their financial strategies. This way, they can dodge budgeting pitfalls and enhance their overall tax planning. So, how are you planning to adapt?

Claiming Benefits: Practical Steps for Small Business Owners

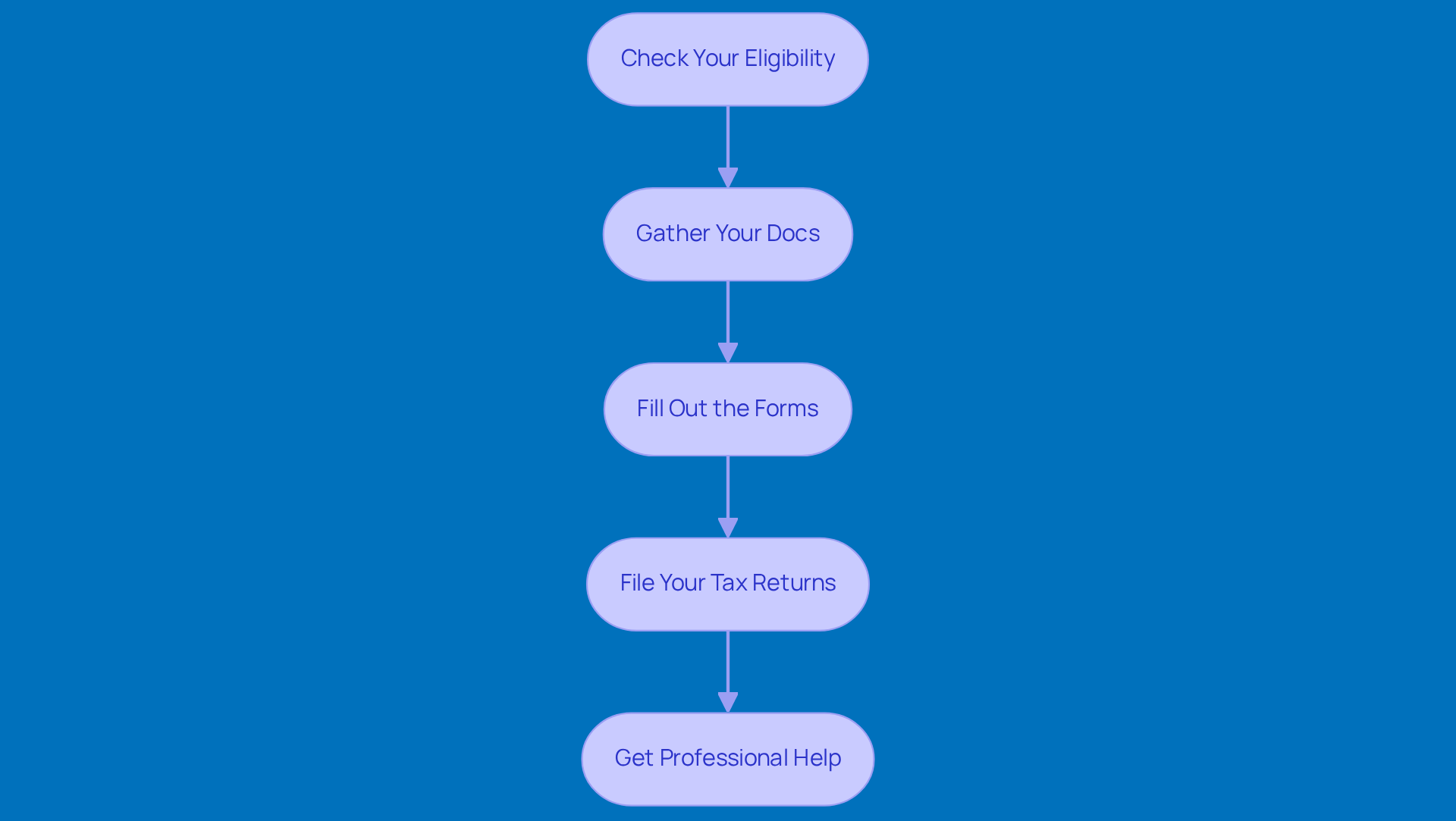

If you're a small business owner looking to claim benefits under the U.S.-India Tax Treaty, here are some practical steps to help you navigate the process:

- Check Your Eligibility: First things first, make sure you know your residency status as defined by the treaty. You need to qualify as a resident of either the U.S. or India.

- Gather Your Docs: Next up, collect the essential paperwork. This includes a Tax Residency Certificate (TRC) from U.S. tax authorities and proof of earnings, like paystubs or tax returns, to back up your claims. While you're at it, take a moment to review your paystub to ensure your earnings are accurately reflected and that the right amounts are being withheld.

- Fill Out the Forms: You'll need to complete IRS Form W-8BEN if you're an individual or W-8BEN-E for entities. This is key to securing those reduced withholding rates on applicable income.

- File Your Tax Returns: Don’t forget to submit your U.S. tax return (Form 1040 or 1040-NR) and include Form 8833. This form is crucial for disclosing your agreement-based return position, which is essential for claiming those benefits. Just a heads up: failing to submit Form 8833 can lead to fines of up to $1,000 for each missed report. Keeping accurate records of your paystubs and tax documents is also super important for compliance and can save you headaches during tax season.

- Get Professional Help: Given the complexities of international tax law, it’s wise to consult a tax professional. They can help ensure you’re compliant and make the most of your benefits. As experts say, 'Understanding the India tax treaty is one thing, but effectively applying it to your unique situation is another.'

Watch out for common documentation mistakes that can trip you up, like forgetting to provide a TRC, misfiling forms, or not including proof of earnings. By keeping detailed records, such as checking your paystubs, and following these steps, small business owners can navigate the provisions of the India tax treaty more smoothly and avoid unnecessary tax liabilities. Plus, keep in mind that the maximum withholding tax rates on different income types under the treaty can really affect your financial outcomes.

Avoiding Common Pitfalls: Challenges in Navigating the U.S.-India Tax Treaty

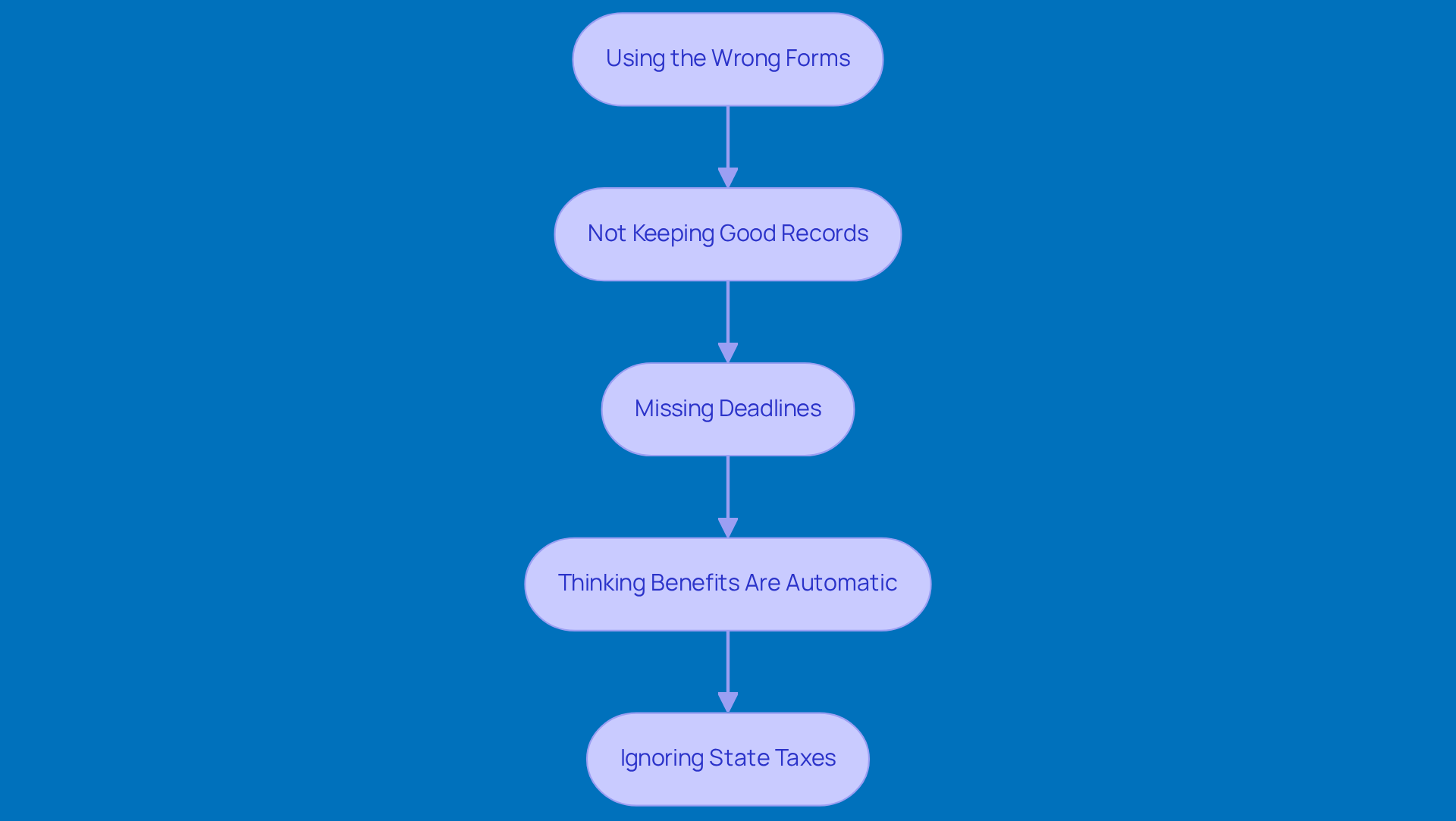

Navigating the India tax treaty can be a bit tricky for small business owners, but knowing the common pitfalls can really help you make the most of it. Let’s break down some of the challenges you might face:

-

Using the Wrong Forms: It’s easy to slip up here! If you use the wrong tax forms, you might find your treaty benefits denied. Make sure you’re using the right ones, like W-8BEN or W-8BEN-E, depending on your business type.

-

Not Keeping Good Records: Keeping track of your earnings and residency is super important. If you don’t document where your income comes from and your residency status, claiming benefits can get messy. So, keep those records tidy!

-

Missing Deadlines: Deadlines can sneak up on you! Staying on top of filing deadlines for your tax returns and forms is crucial to avoid penalties. Being proactive about these can save you a lot of headaches down the road.

-

Thinking Benefits Are Automatic: Just because you qualify for treaty benefits doesn’t mean they’ll apply automatically. You’ve got to actively claim them on your tax returns to make sure they’re recognized.

-

Ignoring State Taxes: The treaty mainly deals with federal taxes, but don’t forget about state tax obligations! They can still affect your overall tax strategy, so it’s wise to keep an eye on those.

By understanding these challenges and taking some proactive steps, you can more easily navigate the complexities of the India tax treaty and optimize your tax position. So, what steps are you planning to take to ensure you’re on the right track?

Conclusion

So, here’s the deal: understanding the U.S.-India tax treaty is super important for small business owners who want to make the most of their financial strategies. This treaty not only helps you avoid double taxation but also offers some pretty sweet benefits that can boost your cash flow and make you more competitive on the global stage. By taking advantage of what this treaty has to offer, small businesses can tackle the tricky world of international taxes with a lot more confidence and clarity.

Throughout this article, we’ve highlighted some key points, like the reduced withholding tax rates on income types such as dividends, interest, and royalties. Plus, we can’t forget about the importance of getting your paperwork right, like submitting Form W-8BEN. It’s crucial for small business owners to stay on top of their tax obligations and consider getting professional help to ensure they’re compliant and maximizing their treaty benefits. And let’s be real-avoiding common pitfalls, like using the wrong forms or missing deadlines, can save you from some costly mistakes.

In closing, the U.S.-India tax treaty is a fantastic opportunity for small businesses to broaden their horizons and improve their financial health. By actively engaging with the treaty’s provisions and putting effective tax planning strategies into action, small business owners can discover new paths for growth. So, why not embrace these insights? Not only will it help you stay compliant, but it’ll also empower your business to thrive in this interconnected marketplace!

Frequently Asked Questions

What is the purpose of the U.S.-India tax treaty?

The purpose of the U.S.-India tax treaty is to prevent double taxation on the same income and to establish clear rules for how earnings made in one country by residents of the other are taxed.

Who benefits from the U.S.-India tax treaty?

Small businesses engaging in international trade or services benefit from the U.S.-India tax treaty, as it helps them avoid paying taxes twice and can lead to significant tax savings.

How does the U.S.-India tax treaty impact small enterprises?

By understanding the provisions of the U.S.-India tax treaty, small enterprises can streamline their operations, boost competitiveness in the global market, and ensure compliance with both U.S. and Indian tax laws.

Why is it important for businesses to understand the U.S.-India tax treaty?

Understanding the U.S.-India tax treaty is important for businesses because it can unlock new opportunities for growth and sustainability while helping them manage their tax obligations effectively.