Introduction

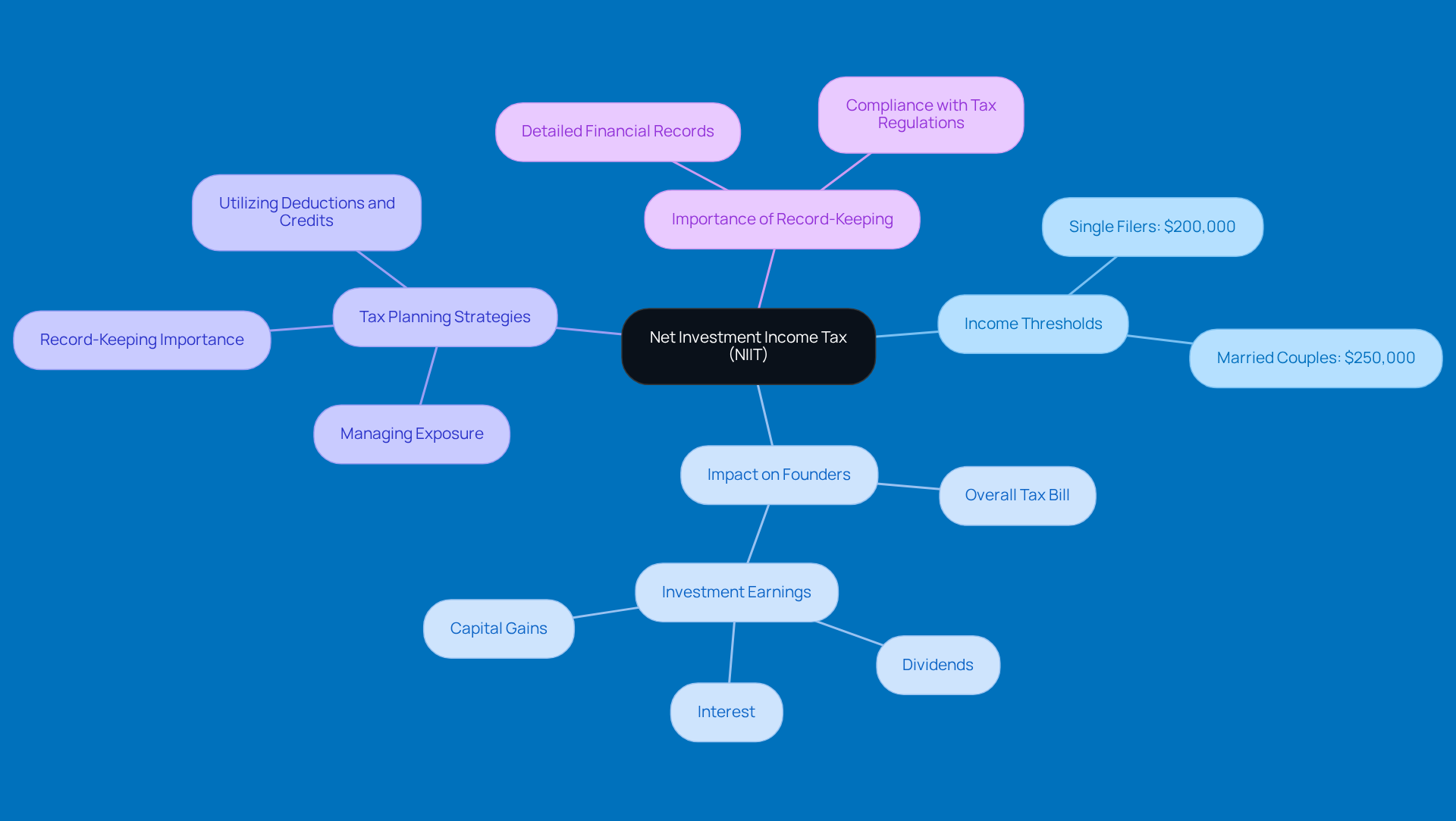

Navigating the ins and outs of the Net Investment Income Tax (NIIT) can feel pretty overwhelming for founders, right? Especially when you’re trying to make the most of your financial outcomes. It’s super important to grasp how this 3.8% tax on certain investment earnings can impact your overall tax bill - after all, strategic financial planning is key!

With tax regulations constantly changing and the stakes being so high, you might be wondering: how can you manage your exposure to the NIIT while staying compliant and still optimizing those investment gains? Well, you’re in luck! This guide is here to walk you through mastering the NIIT calculator, giving you the tools to take charge of your financial future.

Understand the Net Investment Income Tax (NIIT) and Its Importance for Founders

The Net Investment Earnings Tax hits a 3.8% charge on certain net investment earnings for folks whose modified adjusted gross earnings go over specific limits: $200,000 for single filers and $250,000 for married couples filing together. For founders, getting a grip on the ins and outs of the Net Investment Income Tax is super important. Why? Because it can really impact their overall tax bill, especially when they’re raking in significant investment earnings from dividends, interest, and capital gains.

By managing their exposure to this tax, founders can plan their finances more strategically. This way, they can dodge unexpected tax surprises and optimize their financial outcomes. And let’s be real, with tax regulations changing all the time - especially looking ahead to 2026 - proactive tax planning is key for sustainable business growth.

Plus, smart tax planning can help lower tax liability. Just look at the case studies where clients have slashed their federal tax obligations through careful management of their MAGI. High-income individuals often stress the importance of keeping detailed financial records and making the most of state-specific deductions and credits to navigate the NIIT effectively.

So, by adopting these strategies, founders can hang onto a bigger slice of their investment gains while aligning their financial practices with their long-term goals. How’s that for a win-win?

Calculate Your Net Investment Income: Step-by-Step Instructions

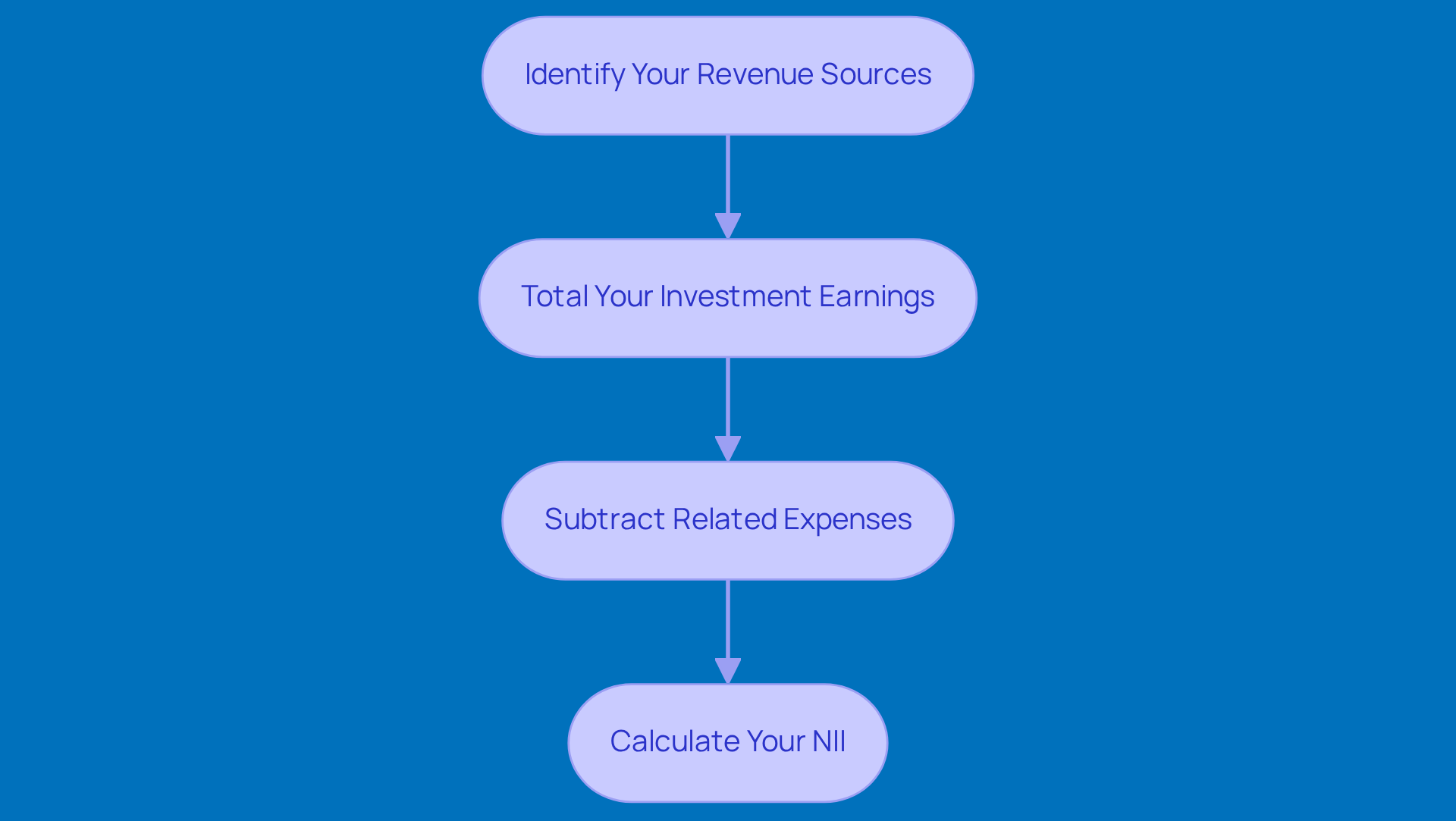

Calculating your Net Investment Income (NII) with a niit calculator can seem a bit daunting, but it’s really just a step-by-step process. Let’s break it down together:

-

Identify Your Revenue Sources: First things first, gather all your investment earnings. This includes dividends, interest, capital gains, and even rental revenue. Think of it as collecting all the goodies from your investments!

-

Total Your Investment Earnings: Next up, add up all those revenue sources. This will give you a clear picture of your total investment earnings. It’s like counting your treasure!

-

Subtract Related Expenses: Now, it’s time to take a look at any expenses that are directly tied to making that money. This could be investment advisory fees or management fees. Don’t forget to deduct these from your total earnings.

-

Calculate Your NII: Finally, take the total investment income and subtract those expenses. The number you get is your NII. This calculation is super important for figuring out your responsibilities under the Net Investment Income Tax using the niit calculator.

And there you have it! By following these steps, you’ll have a solid understanding of your NII. If you have any questions or need a little more help, don’t hesitate to reach out!

Determine If Your MAGI Exceeds the NIIT Threshold

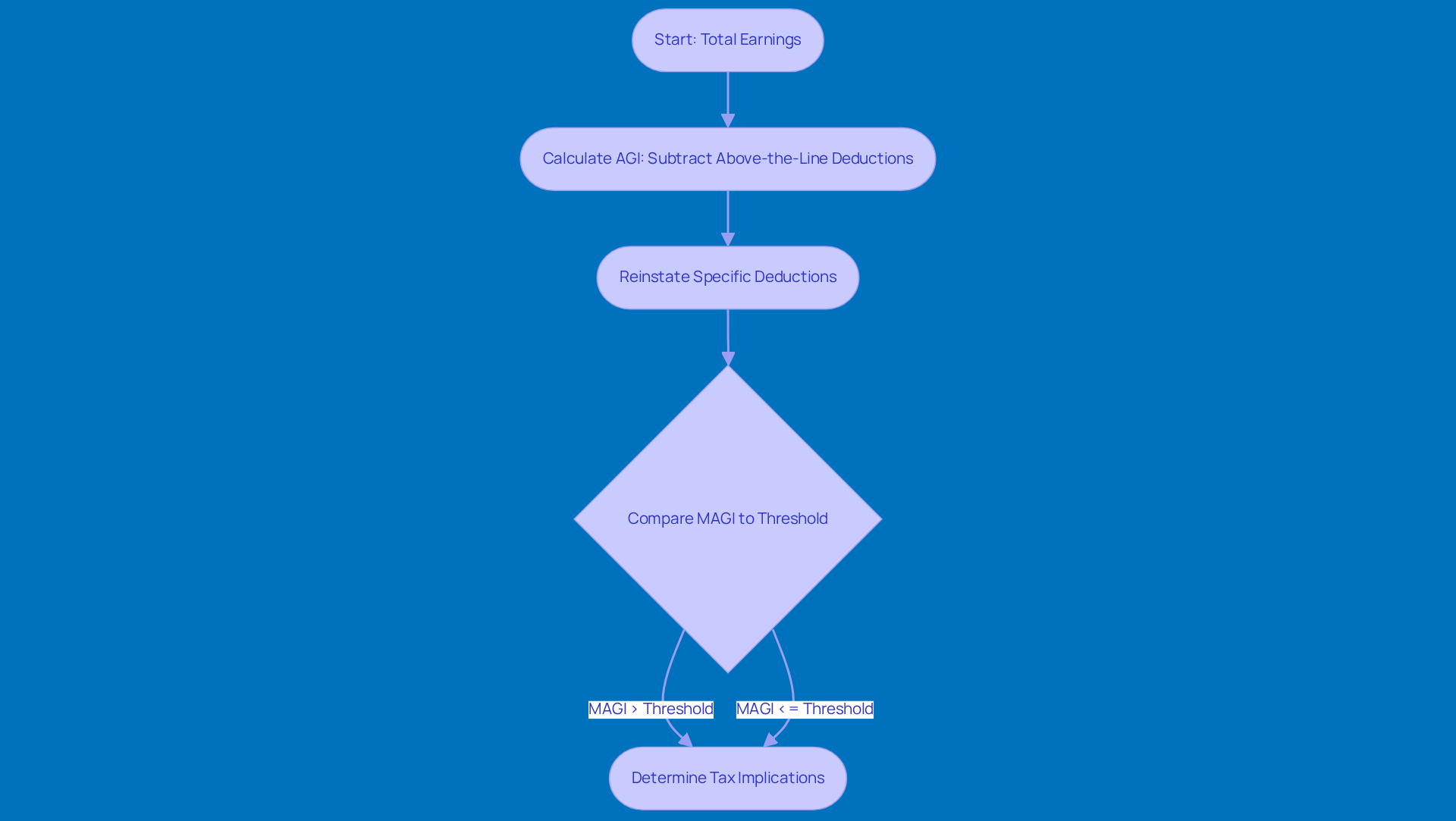

Wondering if your Modified Adjusted Gross Income (MAGI) exceeds the threshold according to the niit calculator? Let’s break it down step by step:

- Calculate Your Adjusted Gross Earnings (AGI): Start with your total earnings and subtract any above-the-line deductions. This includes things like retirement contributions and student loan interest. Easy enough, right?

- Reinstate Specific Deductions: Now, for the Net Investment Income Tax, you’ll want to add back any deductions you left out of your AGI. This could be something like the foreign earned revenue exclusion.

- Compare Your MAGI to the Threshold: Here’s the big one - if your MAGI is over $200,000 for single filers or $250,000 for married couples filing jointly, you’re looking at the Net Investment Income Tax. According to the niit calculator, this tax applies to the lesser of what exceeds the threshold or your investment income. For instance, if you’re a single filer making $100,000 and you pull in $150,000 from selling stocks, your MAGI would be $250,000, which is over the limit. Understanding this is key to knowing your potential tax bill. And hey, it might be a good idea to chat with a CPA or tax accountant for some tailored advice on your situation!

Compute Your NIIT Base: Essential Calculations

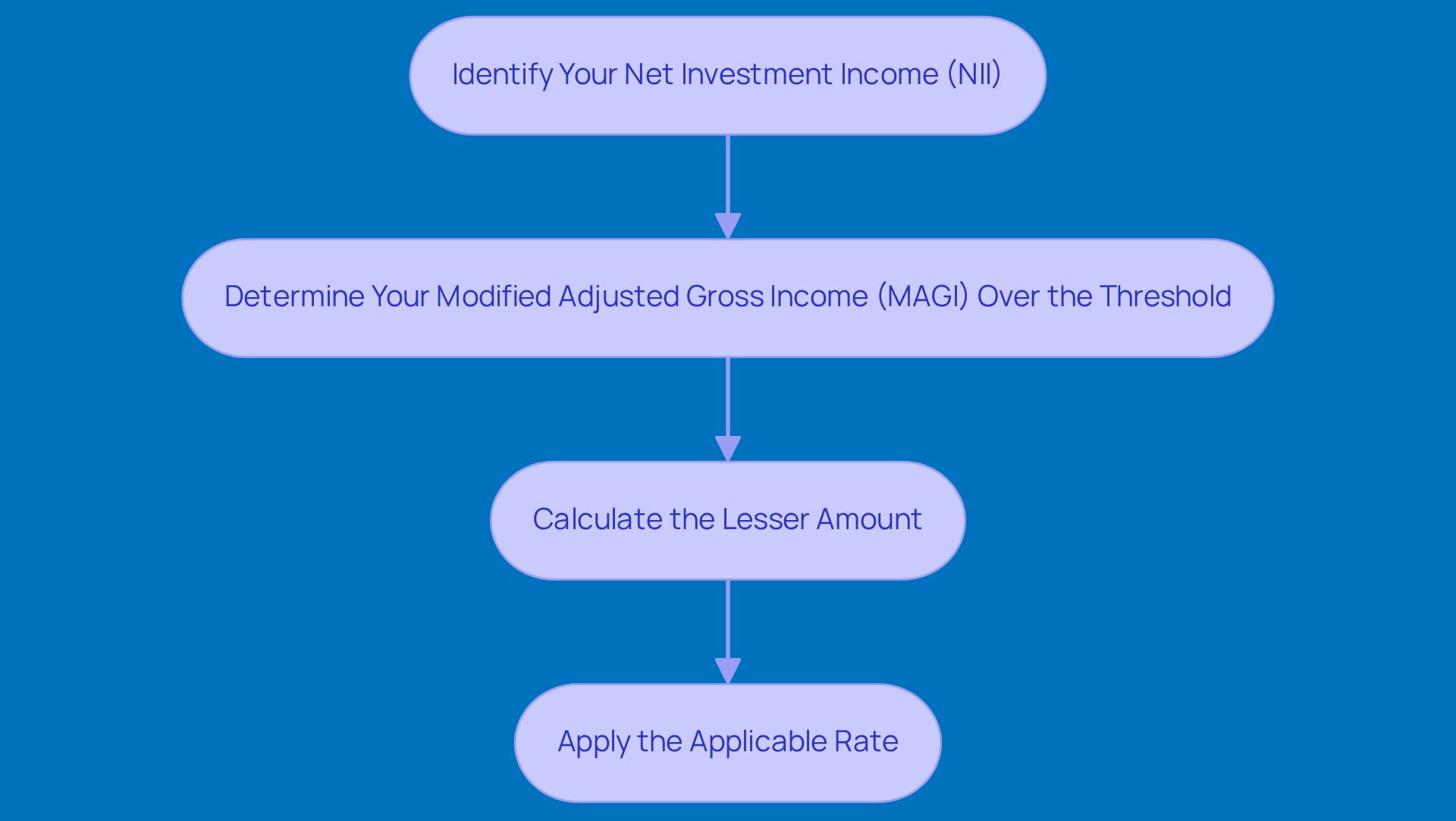

To figure out your NIIT base, just follow these simple steps:

-

Identify Your Net Investment Income (NII): Start with the NII you calculated earlier. This includes things like interest, dividends, capital gains, and rental income. Got it?

-

Determine Your Modified Adjusted Gross Income (MAGI) Over the Threshold: Next, subtract the applicable threshold from your modified adjusted gross income. For example, if your MAGI is $220,000 as a single filer, your excess is $20,000 since the threshold is $200,000. Easy enough, right?

-

Calculate the Lesser Amount: The tax hits you on the lesser of your net investment income or the amount by which your MAGI exceeds the threshold. So, if your NII is $15,000, that’s your tax base. But if your NII is $30,000, your tax base would be $20,000, reflecting that MAGI excess.

-

Apply the Applicable Rate: Finally, multiply your base by 3.8% to find out your liability. For instance, if your investment base is $20,000, your liability would be $760.

Understanding these calculations is super important, especially since the NIIT calculator can significantly impact your overall tax bill. If you’re a small business owner, keeping tabs on these numbers can help you avoid any surprise tax liabilities and stay compliant. So, keep this info handy!

Explore Real-World Examples of NIIT Calculations for Founders

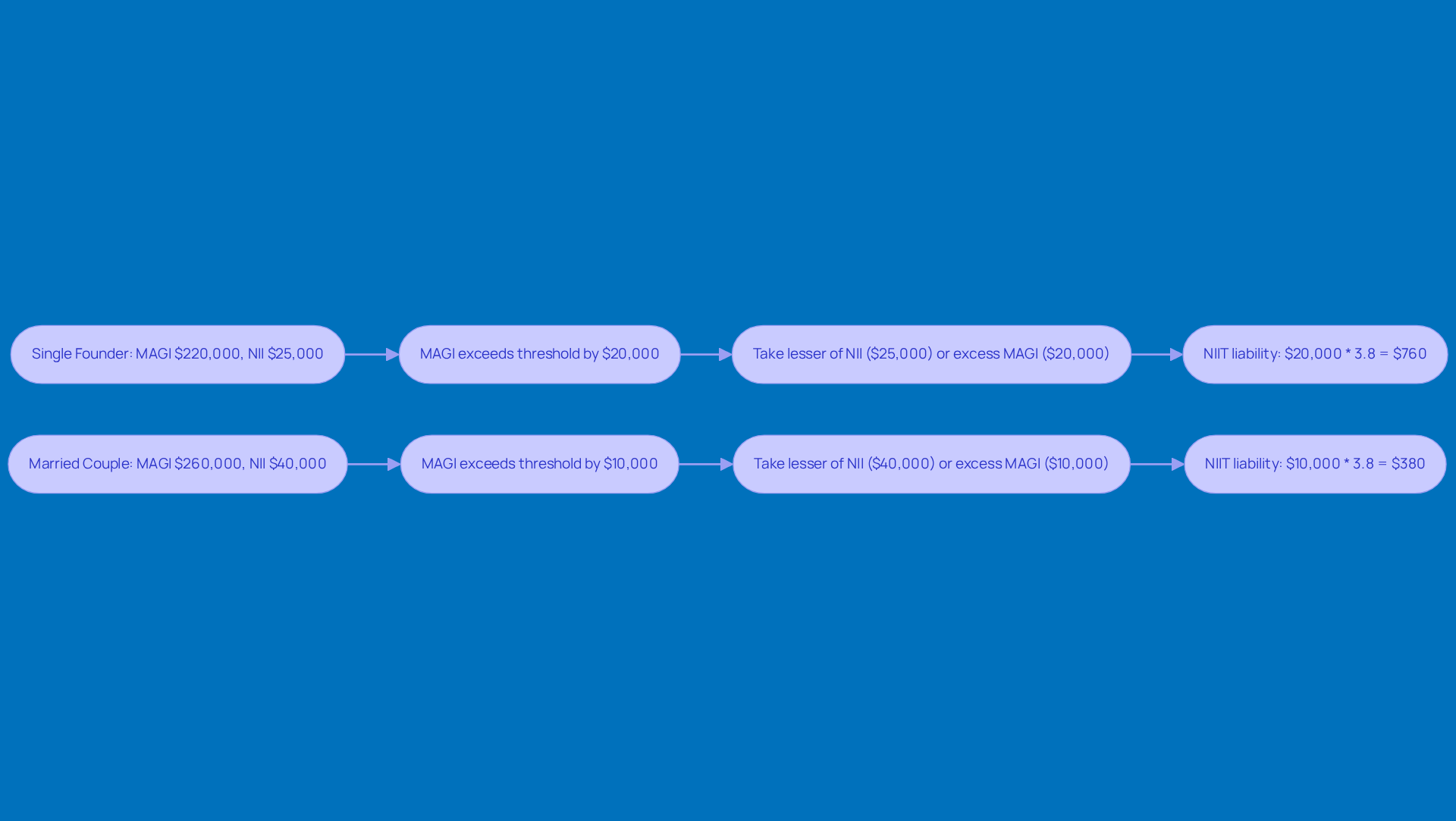

Let’s break down how the Net Investment Income Tax (NIIT) works with some real-world examples that might hit close to home:

Example 1: Picture a single founder who’s got a Modified Adjusted Gross Income (MAGI) of $220,000 and a Net Investment Income (NII) of $25,000. Here’s the scoop:

- Their MAGI is over the threshold by $20,000.

- To determine the net investment income tax base, we can use the niit calculator to take the lesser of the net investment income ($25,000) or the amount by which the MAGI exceeds the threshold ($20,000).

- So, the NIIT liability? It’s $20,000 multiplied by 3.8%, which comes out to a neat total of $760.

Example 2: Now, let’s look at a married couple with an adjusted gross income of $260,000 and a net investment income of $40,000. Here’s how it shakes out:

- Their MAGI exceeds the threshold by $10,000.

- Again, we take the lesser of the net investment income ($40,000) or the excess MAGI ($10,000).

- This means their additional tax liability is $10,000 multiplied by 3.8%, leading to a total of $380.

These examples really show how different MAGI and NII figures can directly affect your liability as calculated by the niit calculator. It’s all about understanding your potential tax obligations, right? So, keep these figures in mind as you navigate your financial landscape!

Conclusion

Mastering the Net Investment Income Tax (NIIT) is super important for founders who want to get the most out of their financial strategies. When you understand how this tax works and put some smart planning into action, you can really protect your investment earnings from those pesky unexpected tax bills. This proactive approach not only helps with managing your finances but also keeps you on track with your long-term business goals.

In this article, we’ve laid out some key steps to help you:

- Calculate your Net Investment Income

- Figure out if your Modified Adjusted Gross Income (MAGI) is over the NIIT threshold

- Work out your NIIT base

We even shared some real-world examples to show how different MAGI and NII figures can impact your tax liabilities. It really highlights why accurate calculations and keeping good records are so crucial. And hey, don’t forget to use tools like the NIIT calculator to get a clearer picture of your tax obligations!

Understanding and managing the NIIT is a big deal. By taking control of your tax strategy, you can keep more of your investment gains, making sure your financial choices support both your current needs and future dreams. Plus, chatting with a CPA or tax professional can really boost your efforts, giving you personalized advice that fits your unique situation. Embracing this knowledge lets you navigate your financial landscape with confidence and a bit of foresight. So, are you ready to take charge of your tax strategy?

Frequently Asked Questions

What is the Net Investment Income Tax (NIIT)?

The Net Investment Income Tax (NIIT) is a 3.8% tax on certain net investment earnings for individuals whose modified adjusted gross income exceeds specific thresholds: $200,000 for single filers and $250,000 for married couples filing jointly.

Why is understanding the NIIT important for founders?

Understanding the NIIT is crucial for founders because it can significantly impact their overall tax bill, especially when they earn substantial investment income from dividends, interest, and capital gains. Managing exposure to this tax allows for more strategic financial planning.

How can founders manage their exposure to the NIIT?

Founders can manage their exposure to the NIIT by planning their finances proactively, keeping detailed financial records, and utilizing state-specific deductions and credits. This can help them avoid unexpected tax surprises and optimize their financial outcomes.

What are the steps to calculate Net Investment Income (NII)?

The steps to calculate NII include: 1. Identify your revenue sources, such as dividends, interest, capital gains, and rental income. 2. Total your investment earnings by adding up all revenue sources. 3. Subtract related expenses, like investment advisory or management fees, from your total earnings. 4. Calculate your NII by taking the total investment income and subtracting the expenses.

How does calculating NII relate to the NIIT?

Calculating your NII is essential for determining your responsibilities under the NIIT. The NII calculation helps identify the amount subject to the 3.8% tax.

What should high-income individuals focus on to navigate the NIIT effectively?

High-income individuals should focus on maintaining detailed financial records and maximizing state-specific deductions and credits to navigate the NIIT effectively. This can help lower their tax liability.