Introduction

Understanding the K-1 tax form can feel like a real head-scratcher for small business owners, right? But getting a handle on it is super important for your financial success. This essential document breaks down each partner's or shareholder's share of income, deductions, and credits. Plus, it’s key to staying on the right side of IRS regulations.

With so much at stake and the threat of penalties hanging over your head, how can you tackle the K-1 filing process without losing your mind? Don’t worry! This guide is here to shine a light on the key steps and strategies you need to make sense of the K-1 form. By the end, you’ll be empowered to optimize your tax outcomes and steer clear of common pitfalls.

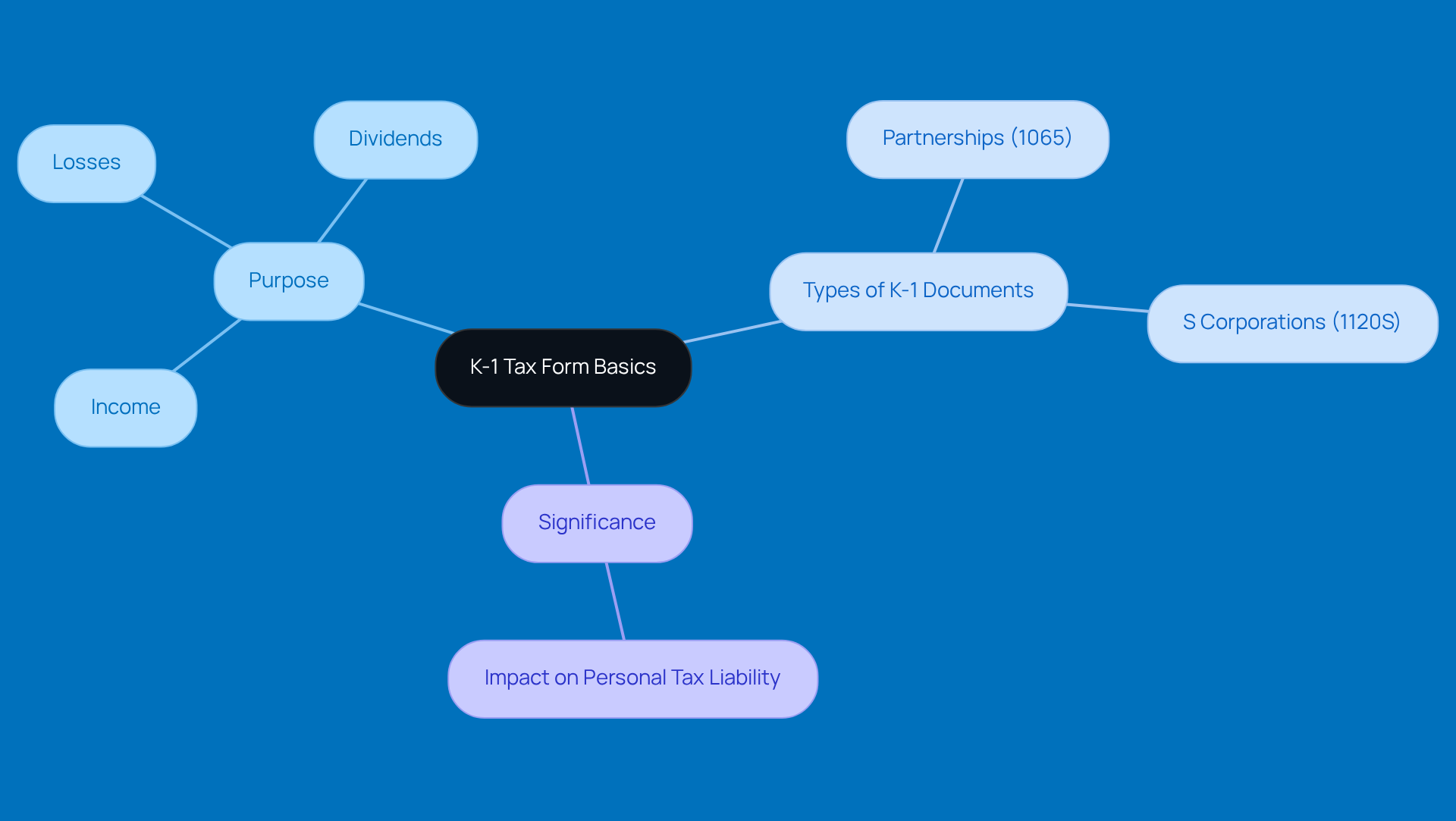

Understand the K-1 Tax Form Basics

The tax K1 form, specifically Schedule K-1 (Document 1065), is very important for partnerships and S corporations. It breaks down each partner's or shareholder's share of earnings, deductions, credits, and other tax-related goodies. Understanding the tax K1 form is essential for accurately reporting earnings on your individual tax returns. Let’s dive into the essentials:

- Purpose: The K-1 form lays out the income, losses, and dividends that each partner or shareholder is responsible for. This is crucial for individual tax filings that require the tax K1 form. The tax K1 form helps ensure that income is taxed at the individual level, meaning there is no double taxation at the corporate level-pretty neat, right?

- Types of K-1 Documents: There are different types of K-1 documents, like those for partnerships (1065) and S corporations (1120S). While they serve a similar purpose, each one is tailored to fit the specific entity type, reflecting the unique financial setup of the business.

The significance of the tax K1 form is that it functions as a pass-through entity, meaning the income is taxed at the individual level rather than at the corporate level. This can really impact personal tax liability, so it’s super important for small business owners to understand the tax K1 form and what it means for them.

For example, in 2022, over $2.5 trillion was allocated to partners through K-1 documents. That really shows how vital they are for financial planning! By getting a handle on these basics, small business owners can gear up for the filing process and stay compliant with IRS regulations, ultimately making the most of their tax outcomes.

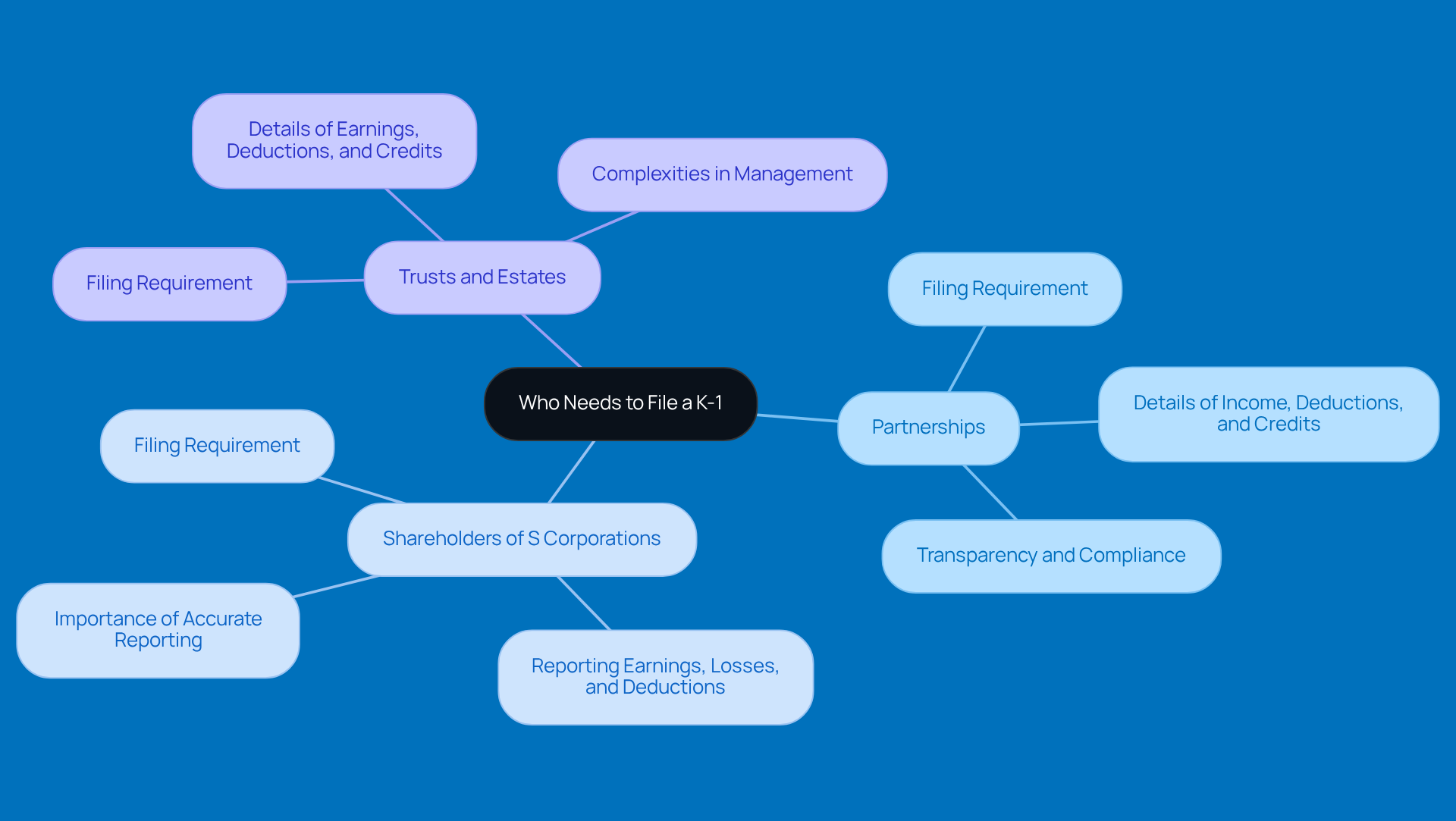

Identify Who Needs to File a K-1

The tax K1 form is an essential document that certain entities and individuals must file if they are involved in partnerships or S corporations. Let’s break down who needs to file:

-

Partnerships: If you’re in a partnership with more than one partner, you’re required to file a K-1 for each partner. The tax K1 form details everyone’s share of the partnership's income, deductions, and credits. It’s all about keeping things transparent and compliant with IRS regulations. And hey, Steinke and Company is here to help you navigate these requirements, ensuring everything’s accurate and minimizing any surprises come tax season.

-

Shareholders of S corporations receive a tax K1 form that reports their individual shares of the corporation's earnings, losses, and deductions. S corporations are super popular, with millions of returns filed each year, so accurate reporting on the tax K1 form is crucial. With Steinke and Company’s expert tax compliance services, you can rest easy knowing your K-1 filings are in good hands, letting you focus on what really matters-growing your business.

-

Trusts and Estates: Beneficiaries of trusts or estates might also receive a tax K1 form that details their share of earnings, deductions, and credits. Managing K-1s in trusts can get a bit tricky, but don’t worry! Steinke and Company offers tailored tax planning and advisory services to help you navigate these complexities and support your growth.

Understanding the filing requirements for the tax K1 form is essential for staying on the right side of IRS regulations. This way, everyone can report their income accurately and avoid any potential penalties. With Steinke and Company by your side, you can tackle tax season with confidence, knowing you have the support you need for long-term success.

Know the K-1 Filing Deadlines

Filing deadlines for the tax K1 form are super important if you want to remain compliant and avoid those pesky penalties. So, let’s break down the key dates you need to remember:

- Partnerships: If you’re part of a calendar-year partnership, make sure to get those K-1 forms out to your partners by March 15, 2026, for the 2025 tax year. And if you need a little extra time, don’t worry - if the partnership opts for an extension, this deadline can be adjusted.

- S Corporations: The same goes for S corporations; you’ll need to provide K-1 documents to your shareholders by March 15, 2026.

- Trusts and Estates: For trusts and estates, K-1 documents are generally due by April 15, 2026.

Staying on top of these deadlines is crucial for keeping your tax game strong. Missing them can lead to some serious penalties, which can be a real headache, especially for small business owners. In fact, businesses that manage their K-1 deadlines well often find that the tax K1 form makes tax season a breeze, allowing them to focus on growth instead of compliance stress. So, by prioritizing these deadlines, you can dodge unnecessary complications and make sure your tax obligations are squared away on time.

Review the Contents of a K-1 Form

The tax K1 form is super important for tax reporting, and it contains key information that small business owners really need to check out. So, what should you be on the lookout for?

- Entity Information: This part includes the name, address, and Employer Identification Number (EIN) of the partnership or S corporation. It’s crucial for pinpointing where your income is coming from.

- Partner/Shareholder Information: Here, you’ll find your personal details like your name, address, and tax identification number (TIN). This ensures the IRS can match your earnings to your tax return accurately.

- Revenue Items: This section breaks down your share of the entity's earnings, including regular business revenue, rental income, and interest. Getting a grip on these numbers is key since they directly affect your overall tax bill.

- Deductions and Credits: Any deductions or credits you can claim based on your share of the entity's activities will be listed here. These can really help lower your taxable earnings, so it’s worth taking a close look at this section.

- Other Information: This might include capital gains, losses, and any other financial details that could impact your tax situation.

By carefully reviewing these components, small business owners can make sure they report their income and deductions accurately on their personal tax returns, which can really help optimize their financial outcomes. Plus, keeping accurate records-kind of like checking your paystubs-is super important for financial stability and compliance. Did you know that partnerships have a lower audit rate of less than 0.1% compared to individuals at 0.2%? That just highlights how crucial precise reporting is. If you spot any discrepancies on a K-1, it’s vital to reach out to the issuer with your supporting documents to stay compliant. And don’t forget, K-1 forms need to be in your hands by March 15 each year, so planning ahead is key for tax compliance. If you need help navigating the tax K1 form and ensuring your tax reporting is accurate, consider reaching out to the experts at Steinke and Company!

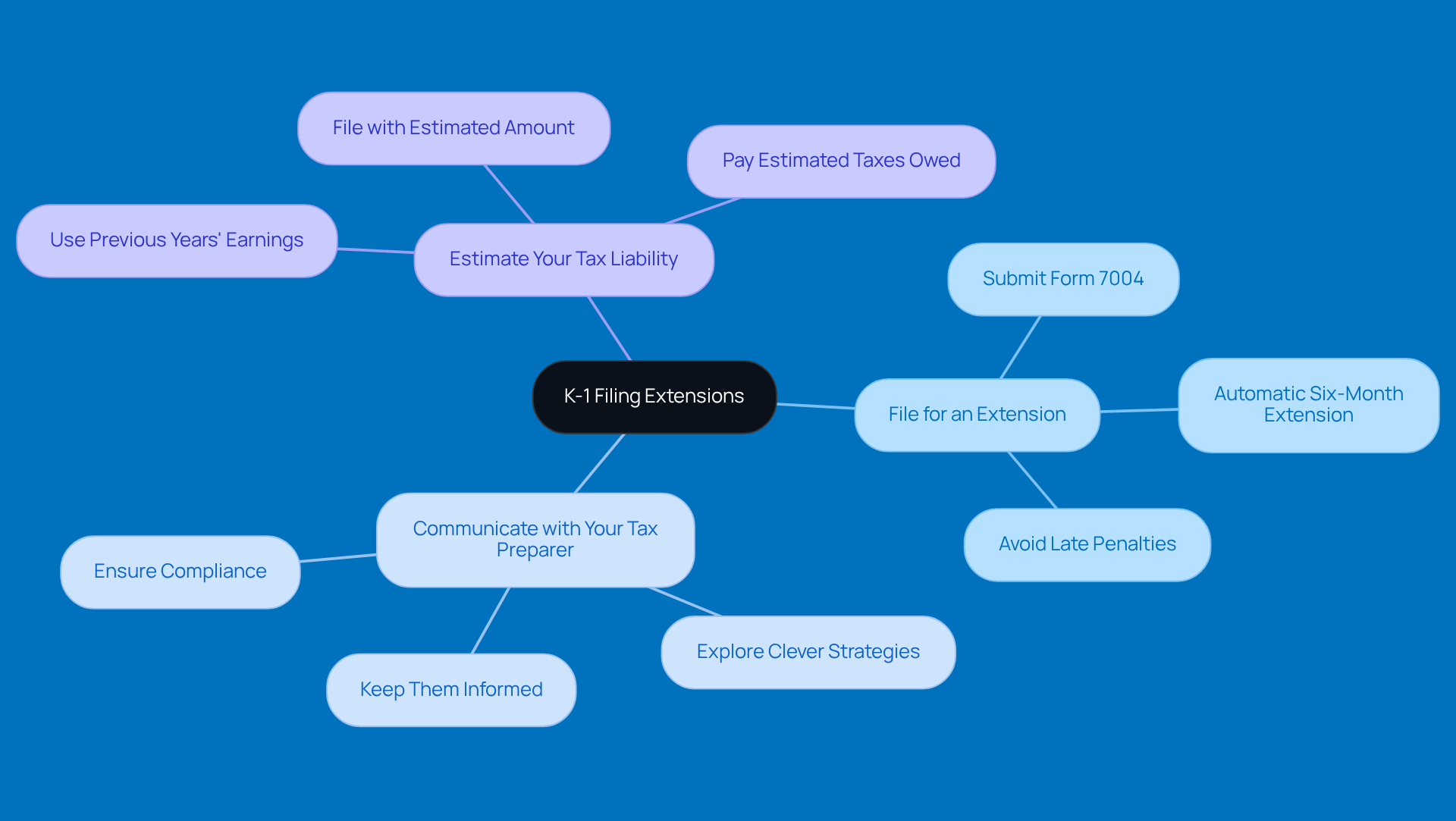

Explore Options for K-1 Filing Extensions

If you ever find yourself needing a bit more time to file your K-1 because of delays or other hiccups, here are a few options to consider:

-

File for an Extension: You can submit Form 7004 to snag an automatic six-month extension for your business tax return. This also gives you extra time for the tax K1 form filings. It’s super helpful if your tax K1 form is running late, letting you dodge those pesky penalties for late submissions.

-

Communicate with Your Tax Preparer: Keep your tax pro in the loop about any delays. They might have some clever strategies up their sleeve to help you navigate the filing process and make sure you’re staying compliant with your tax obligations.

-

Estimate Your Tax Liability: If getting your K-1 on time seems impossible, why not estimate your tax liability based on what you earned in previous years? Filing your return with an estimated amount can keep you on track, but don’t forget to pay any estimated taxes owed to steer clear of penalties.

By checking out these options, small business owners can effectively manage their tax obligations, even when the tax K1 form documentation is delayed.

Conclusion

Mastering the K-1 tax form is a crucial step for small business owners involved in partnerships or S corporations. This important document lays out each partner's or shareholder's share of income, deductions, and credits, and it’s key for staying on the right side of IRS regulations. Getting a handle on the K-1 form can really affect your individual tax liability, so it’s super important for small business owners to understand its significance.

In this guide, we’ve explored the key aspects of the K-1 form, like the different types of K-1 documents, who needs to file them, and the deadlines you need to keep in mind. We also highlighted what’s inside the K-1 form, stressing the importance of accurate reporting to get the best tax outcomes. Plus, we talked about options for filing extensions, giving small business owners some handy strategies to manage their tax obligations effectively.

Ultimately, staying informed about the K-1 tax form not only helps you dodge penalties but also empowers you to make smart financial decisions. As the tax landscape keeps changing, taking proactive steps to understand and manage K-1 filings can lead to better financial health and compliance. So, don’t hesitate to tap into expert resources and support to navigate these complexities. This way, you can maximize your tax benefits and keep the stress at bay during tax season!

Frequently Asked Questions

What is the purpose of the K-1 tax form?

The K-1 tax form, specifically Schedule K-1 (Document 1065), outlines each partner's or shareholder's share of earnings, deductions, credits, and other tax-related items. It is essential for accurately reporting earnings on individual tax returns and helps ensure that income is taxed at the individual level, avoiding double taxation at the corporate level.

What types of K-1 documents exist?

There are different types of K-1 documents, including those for partnerships (1065) and S corporations (1120S). Each type serves a similar purpose but is tailored to fit the specific entity type, reflecting the unique financial setup of the business.

Why is the K-1 form significant for small business owners?

The K-1 form functions as a pass-through entity, meaning income is taxed at the individual level rather than at the corporate level. This can significantly impact personal tax liability, making it crucial for small business owners to understand the K-1 form and its implications for them.

Who is required to file a K-1 form?

Partnerships with more than one partner must file a K-1 for each partner, detailing their share of the partnership's income, deductions, and credits. Shareholders of S corporations also receive a K-1 form that reports their individual shares of the corporation's earnings, losses, and deductions. Additionally, beneficiaries of trusts or estates may receive a K-1 detailing their share of earnings, deductions, and credits.

How can Steinke and Company assist with K-1 filings?

Steinke and Company provides expert tax compliance services to help navigate K-1 filing requirements, ensuring accuracy and minimizing surprises during tax season. They also offer tailored tax planning and advisory services for managing K-1s in trusts, supporting clients in their growth and compliance with IRS regulations.