Introduction

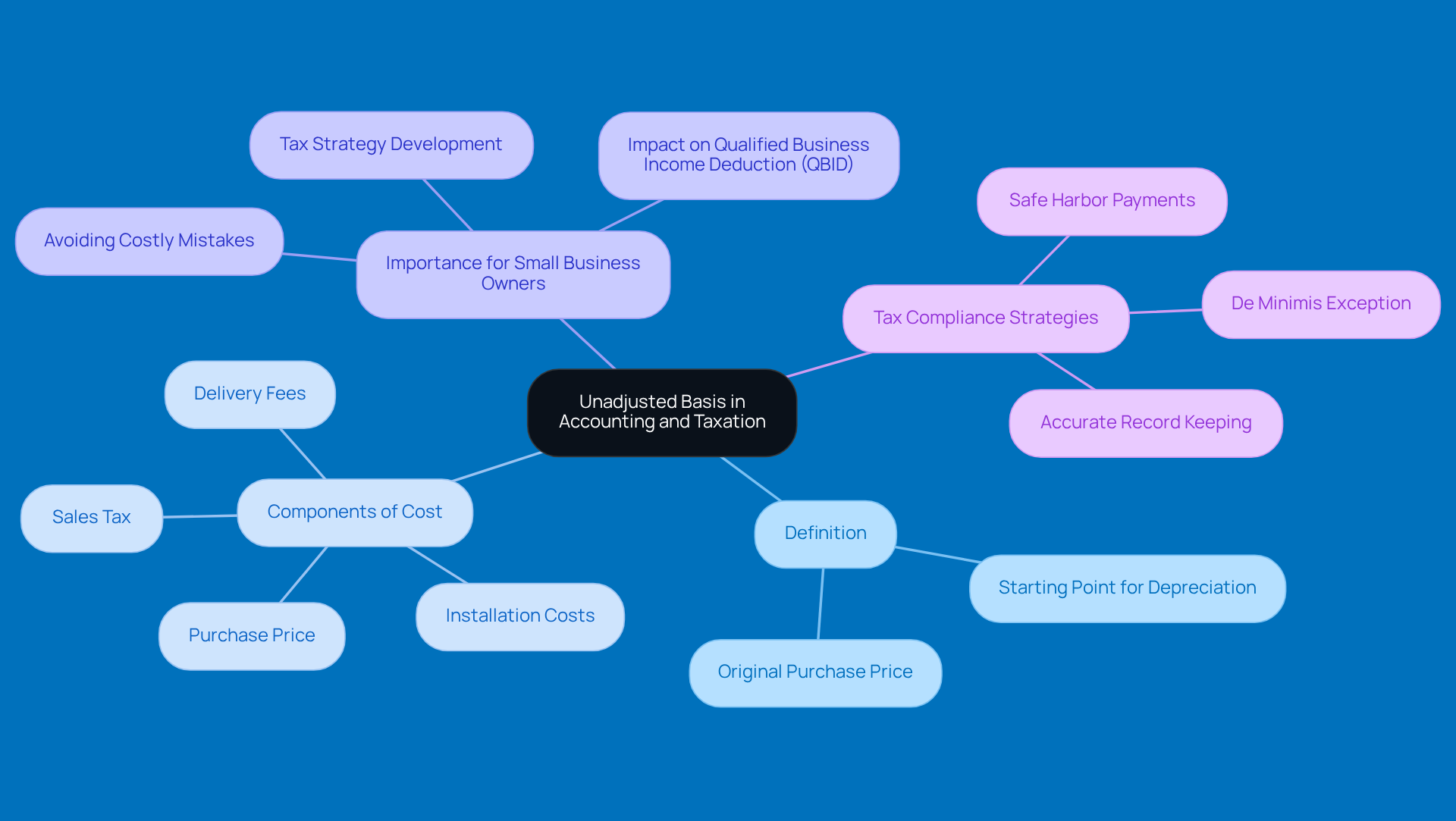

Getting a grip on the concept of unadjusted basis is super important for small business owners trying to navigate the tricky waters of accounting and taxes. This original cost isn’t just about the purchase price; it also includes all those extra expenses that come along for the ride. Think of it as your go-to reference point for figuring out depreciation and understanding gains or losses when you sell an asset.

As tax rules change and the spotlight on compliance gets brighter, the real challenge is keeping these records straight. It’s all about optimizing your tax strategies and making sure you’re playing by the rules. So, how can small business owners tap into this knowledge to protect their financial health and steer clear of costly mistakes? Let’s dive in!

Define Unadjusted Basis in Accounting and Taxation

Unmodified value is all about the original purchase price of a resource, including any extra costs that come with it. We're talking about the cash price, sure, but also things like sales tax, delivery fees, and installation costs. Understanding the unadjusted basis is super important for small business owners because it serves as the starting point for figuring out depreciation and spotting gains or losses when you sell an asset. For instance, if a company buys a vehicle for $30,000 and adds $2,000 in sales tax and $1,000 for delivery, the total initial value of that vehicle would be $33,000.

Now, fast forward to 2026. As small business owners face shifting tax rules and more scrutiny from the IRS, getting a grip on original cost becomes even more crucial. A recent survey showed that 79% of small business owners are expecting revenue growth this year. This highlights just how important it is to keep accurate records of original value to sharpen tax strategies and stay compliant. Plus, knowing the value on an unadjusted basis is key for figuring out the Qualified Business Income Deduction (QBID) under Section 199A, which can really impact your tax bills. As businesses navigate the tricky waters of property sales, understanding the unadjusted basis is essential to avoid costly mistakes and penalties, making careful financial management a must.

And hey, small business owners should definitely think about strategies to dodge underpayment penalties. Making safe harbor payments or using the de minimis exception can be lifesavers. Keeping accurate records not only helps you nail down that initial amount but also cuts down on the risks tied to underpayment penalties. With all the recent changes to tax benefits, getting a handle on these financial details can really boost your overall tax compliance.

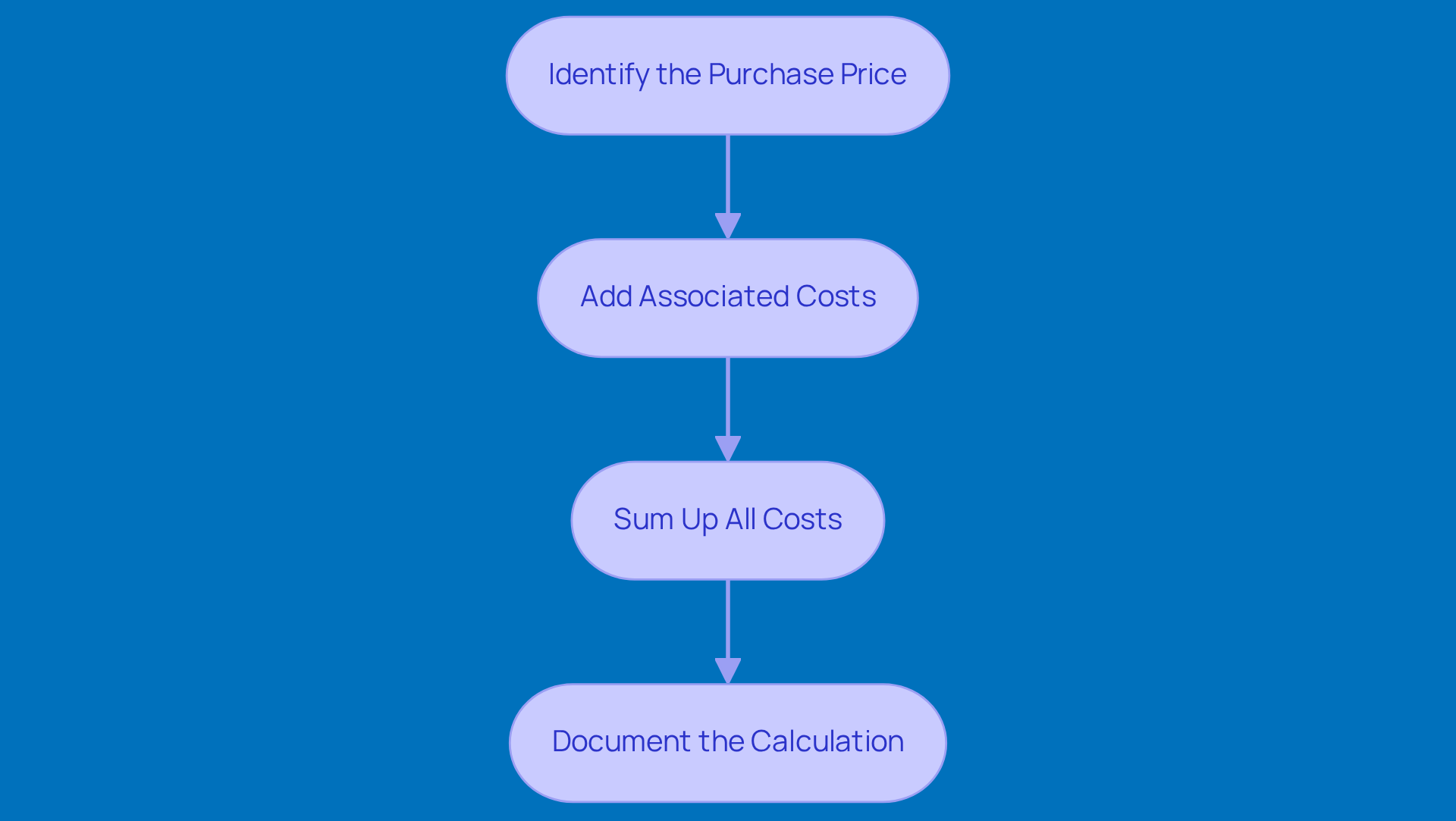

Calculate Unadjusted Basis: Step-by-Step Examples

Are you calculating the unadjusted basis of an asset? Let’s break it down together! Here’s how you can do it step by step:

-

Identify the Purchase Price: First things first, figure out how much you paid for the item. For example, if you snagged a piece of machinery for $50,000, that’s your starting point.

-

Add Associated Costs: Next, don’t forget to include any extra costs that came with acquiring the asset. This could be things like:

- Sales tax: $3,500

- Delivery fees: $1,000

- Installation costs: $2,000

-

Sum Up All Costs: Now, let’s add everything together. In our example, it looks like this:

- Unadjusted Basis = Purchase Price + Sales Tax + Delivery Fees + Installation Costs

- Unadjusted Basis = $50,000 + $3,500 + $1,000 + $2,000 = $56,500

-

Document the Calculation: Finally, make sure to keep a record of this calculation for your financial records and tax filings. It’s super important for compliance and can really help clear things up during audits.

And there you have it! Simple, right? If you have any questions or need a hand with your calculations, feel free to reach out!

Explore Tax Implications of Unadjusted Basis for Small Businesses

The original value is super important when it comes to figuring out tax obligations for small businesses. Let’s break down some key points:

-

Depreciation Calculations: The unadjusted basis is what you’ll use to calculate depreciation, which can help lower your taxable income. For example, if your original value for a piece of equipment is $56,500, that’s the number you’ll use to figure out how much depreciation you can claim each year. This is crucial for small business owners who want to avoid underpayment penalties by accurately reporting their tax liabilities throughout the year.

-

Capital Gains Tax: When you sell an asset, you’ll subtract the original value from the sale price to find out your capital gains. So, if you sell that equipment for $70,000, your capital gain would be $70,000 - $56,500 = $13,500, which is subject to capital gains tax. It’s really important to understand this calculation, especially with the reduced COVID-19 tax benefits that might affect your overall tax refund.

-

Qualified Business Income (QBI) Deduction: The original value also plays a big role in figuring out the QBI deduction under Section 199A. A higher original value can boost your deduction amount, giving you some nice tax relief as a small business owner. As you gear up for the next tax year, think about how changes in tax benefits could impact your QBI deduction and overall tax strategy.

To steer clear of underpayment penalties, small business owners might want to look into strategies like safe harbor payments. These let you prepay a minimum amount of your tax obligation throughout the year. There’s also the de minimis exception, which means you won’t face penalties if your total tax liability minus withholdings and credits is less than $1,000. By getting a handle on these implications and strategies, you can really optimize your tax planning and boost your business’s financial health.

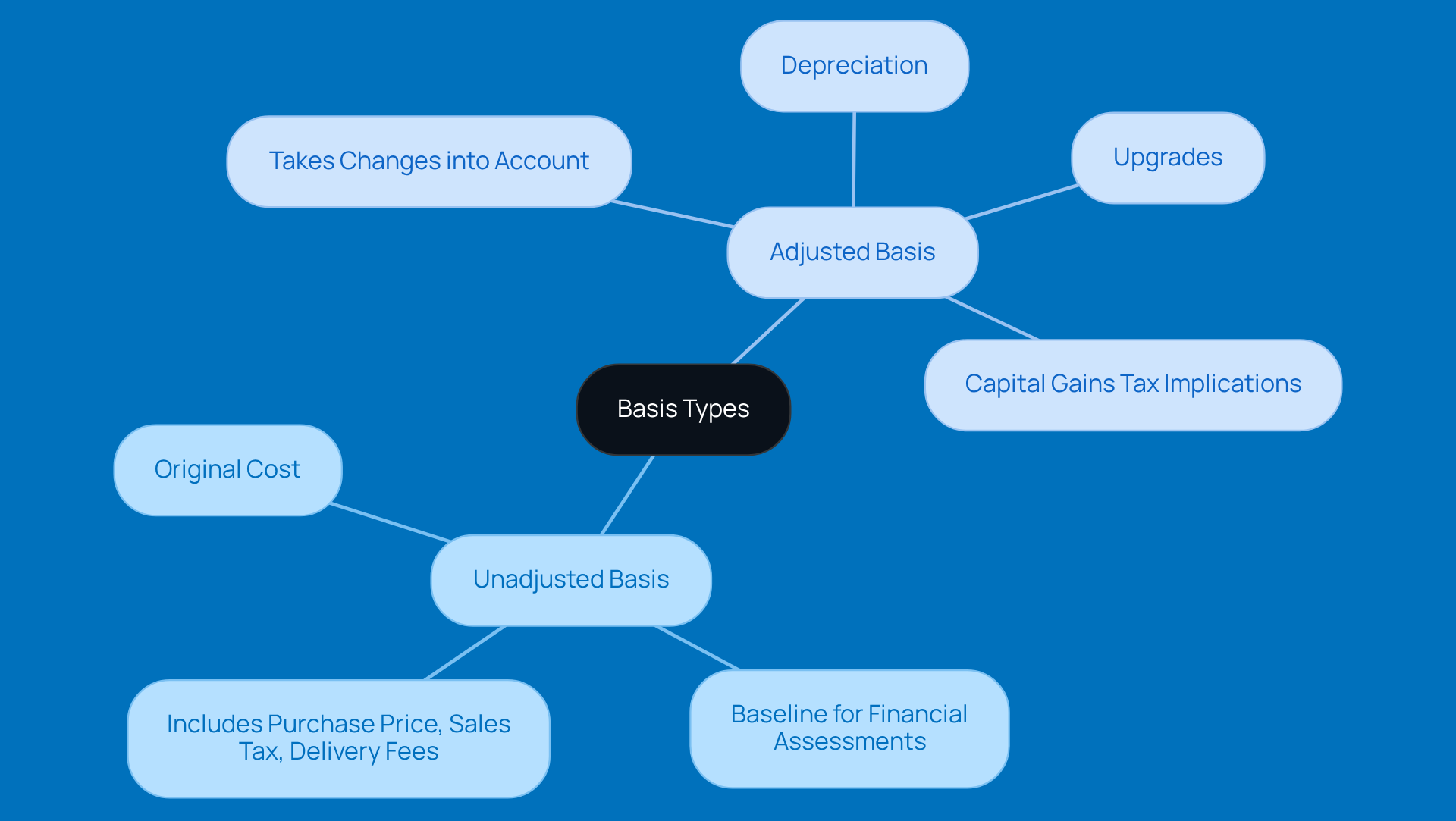

Differentiate Between Adjusted and Unadjusted Basis

Understanding the difference between adjusted values and unadjusted basis is super important for managing resources effectively, especially in rural business settings.

The unadjusted basis can be thought of as the original cost of an item. It includes everything you spent to get it - like the purchase price, sales tax, delivery fees, and installation costs. This number stays the same over time and acts as your baseline for financial assessments.

- Adjusted Value: On the flip side, the adjusted value takes into account any changes in the item's worth. This could be due to depreciation, upgrades, or other modifications. For example, if you bought a piece of machinery for $56,500 and it’s lost $10,000 in value over the years, its adjusted value would be $46,500. This number is key when figuring out gains or losses when you sell the item and what taxes you might owe.

Now, why does understanding adjusted valuation matter? Well, it goes beyond just keeping your books in order; it’s crucial for tax reporting too. When you sell a resource, the difference between what you sell it for and its adjusted value determines your capital gains tax. And with tax regulations changing in 2026, having a solid grasp of these concepts is vital for optimizing your tax strategies and staying compliant.

In summary, while the unadjusted basis serves as a solid reference point, the adjusted basis offers a more dynamic perspective on an asset's value over time. This insight is essential for effective financial planning and tax reporting. Got it? Let’s keep these concepts in mind as we navigate the financial landscape!

Conclusion

Understanding the unadjusted basis is super important for small business owners. It’s like the backbone of good financial management and staying on top of tax compliance. This concept includes the original purchase price of an asset plus any extra costs you might have incurred. It’s not just a starting point for figuring out depreciation; it also plays a big role in determining capital gains and your tax obligations. As tax rules change, getting a grip on this principle becomes even more crucial for keeping everything in line and optimizing your tax strategies.

In this article, we’ve covered some key insights, like how to accurately calculate the unadjusted basis and what it means for things like depreciation, capital gains, and the Qualified Business Income Deduction. By factoring in those associated costs, you can better navigate potential underpayment penalties and make smarter financial decisions. Plus, understanding the difference between adjusted and unadjusted basis really highlights why it’s essential to know how asset valuation changes over time, which is key for effective tax reporting.

Ultimately, getting a handle on the unadjusted basis can really boost your financial literacy and tax planning. With everything changing in the tax landscape, taking proactive steps to understand and apply these principles can lead to some serious benefits. You’ll be setting yourself up for a stronger financial strategy and staying compliant with your tax obligations. Embracing this knowledge not only helps you avoid costly mistakes but also positions your business for sustainable growth and success. So, why not dive in and start mastering this concept today?

Frequently Asked Questions

What is unadjusted basis in accounting and taxation?

Unadjusted basis refers to the original purchase price of an asset, including additional costs such as sales tax, delivery fees, and installation costs. It serves as the starting point for calculating depreciation and determining gains or losses upon the sale of the asset.

Why is understanding unadjusted basis important for small business owners?

Understanding unadjusted basis is crucial for small business owners as it helps in accurately calculating depreciation, identifying gains or losses when selling assets, and ensuring compliance with tax regulations, especially with the evolving tax rules and scrutiny from the IRS.

Can you provide an example of how unadjusted basis is calculated?

For example, if a company purchases a vehicle for $30,000 and incurs $2,000 in sales tax and $1,000 for delivery, the total unadjusted basis of that vehicle would be $33,000.

How does unadjusted basis relate to the Qualified Business Income Deduction (QBID)?

Knowing the unadjusted basis is key for calculating the Qualified Business Income Deduction (QBID) under Section 199A, which can significantly affect a business's tax liabilities.

What strategies can small business owners use to avoid underpayment penalties?

Small business owners can consider making safe harbor payments or utilizing the de minimis exception to avoid underpayment penalties. Keeping accurate records of the unadjusted basis also helps mitigate risks associated with underpayment.

Why is it essential to keep accurate records of original value?

Keeping accurate records of the original value is essential for sharpening tax strategies, ensuring compliance with tax regulations, and avoiding costly mistakes and penalties related to property sales and tax filings.