Introduction

Navigating the world of business taxes can feel like a maze for small agency owners, right? But getting a handle on it is super important for your financial health and growth. A solid tax strategy doesn’t just help you find those hidden deductions and credits; it can also boost your cash flow, making it easier to allocate resources wisely.

Now, with tax laws changing all the time and the different business structures out there, how can agency owners keep their tax strategies sharp and effective? It’s a bit of a puzzle, but don’t worry - we’re here to help you piece it together!

Understand the Importance of a Business Tax Strategy

If you're a small agency owner, having a clear tax strategy is super important for navigating the maze of tax regulations. It helps you spot potential deductions and credits that can really lighten your tax load. Plus, when you understand the ins and outs of tax laws, you can make smarter decisions that fit your financial goals.

But it doesn't stop there! A solid business tax strategy not only ensures compliance but also boosts your cash flow. This means you can allocate resources better and invest in opportunities that help your business grow. And hey, don’t forget to regularly review and update your strategy as tax laws change. It’s key to keeping everything effective and your financial health in check.

So, how often do you take a look at your tax strategy? It might be time to give it a refresh!

Assess Your Current Tax Situation and Business Structure

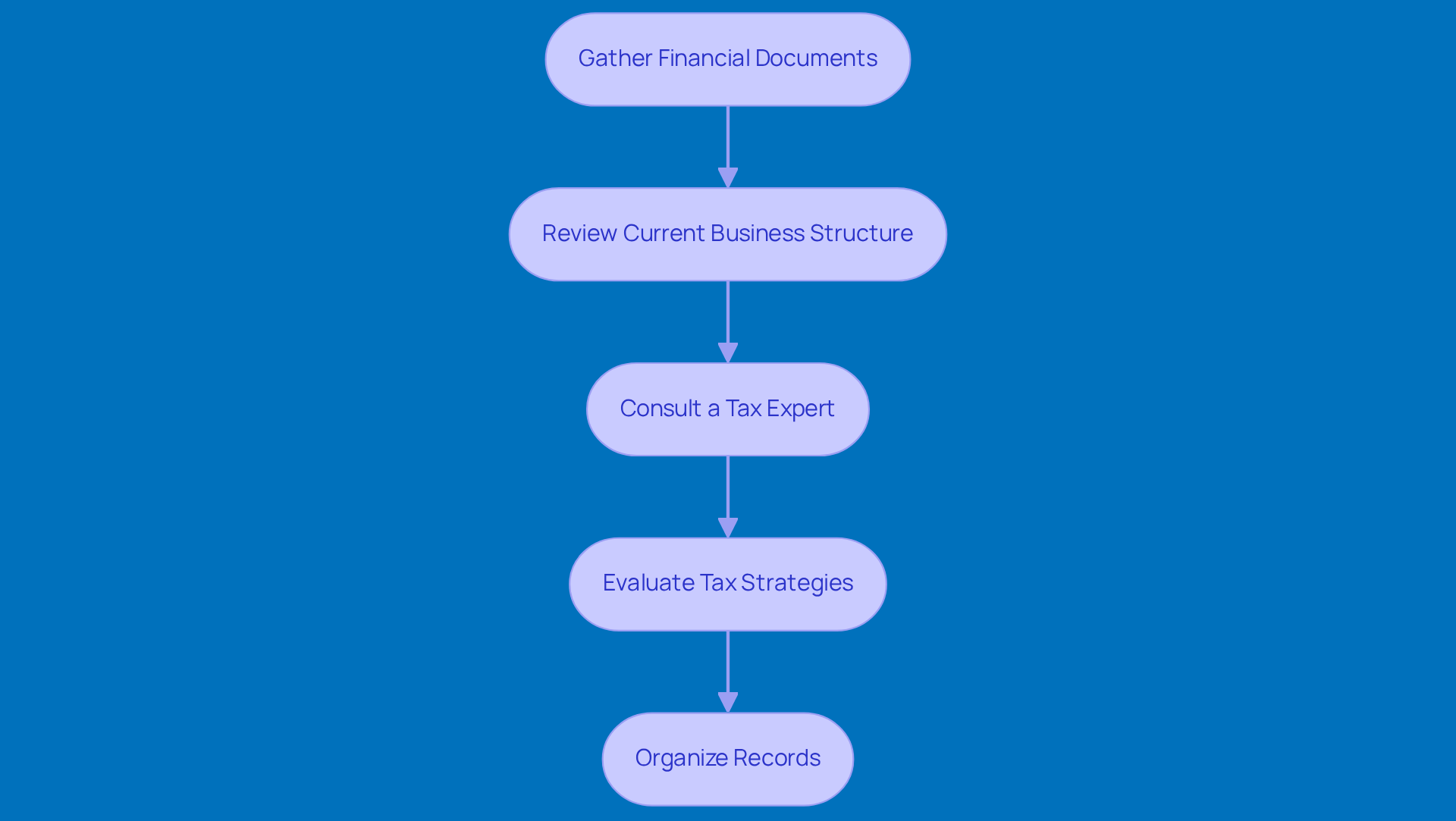

Let’s kick things off by gathering all those important financial documents. You’ll want to have your previous tax returns, profit and loss statements, and balance sheets handy. And don’t overlook your paystub! It’s packed with essential info about your earnings and withholdings, which can really impact your tax situation. Typically, paystubs show your wages, taxes withheld, and any deductions for benefits-crucial details for accurate tax reporting.

Next up, take a good look at your current business structure. Are you a sole proprietor, in a partnership, running an LLC, or a corporation? Each type comes with its own set of implications related to business tax strategy. For instance, LLCs often offer liability protection while letting profits flow through to your personal tax returns, which can help lighten your overall tax load. It’s super important to regularly assess your entity structure, especially if your business has grown since you started. Inefficiencies can lead to hefty tax bills once your annual revenue hits that $1 million mark.

And if you’re thinking about expanding across state lines or even internationally, be aware that this can add more tax complexities to the mix. That’s where a tax expert can really come in handy. They can help you evaluate your current situation and uncover any missed opportunities for deductions or credits. This thorough check-up will set you up for success with effective business tax strategies that align with your goals.

Don’t forget about keeping your records organized! Understanding how long to retain tax documents-like holding onto tax returns for at least three years-will help you stay compliant and make audits a breeze if they come up. Remember, being proactive with your business tax strategy can save you from penalties and enhance your tax efficiency.

Implement Key Tax Strategies for Optimization

Looking to optimize your tax situation? Here are some friendly strategies to consider:

-

Maximize Deductions: Keep good records of all your operational expenses-think travel, home office costs, and more. For example, if you use a company vehicle, expenses like maintenance and tolls can be 100% deductible when you document them properly. Who doesn’t love a good deduction?

-

Utilize Retirement Plans: Contributing to retirement plans is a win-win! Not only does it secure your future, but it also helps reduce your taxable income. Small businesses can really take advantage of high contribution limits in plans like SEP-IRA and Solo 401(k). It’s a great way to save on taxes while planning for tomorrow.

-

Timing Income and Expenses: Here’s a little tip: consider deferring income to the next tax year or speeding up expenses into the current year. For instance, if you’re a consultant, you might prepay some expenses or hold off on invoicing to manage your tax liabilities better. It’s all about strategy!

-

Leverage Tax Credits: Don’t forget to check out tax credits that might be available for your industry or location. There are credits for hiring certain demographics or investing in renewable energy. Plus, small businesses can claim credits for contributions to retirement plans, which can really lighten the tax load.

-

Review Entity Structure: It’s a good idea to regularly assess if your current business structure is the most tax-efficient. For example, switching from a sole proprietorship to an S-Corp can save you a chunk on self-employment taxes, especially if your business is doing well.

By applying these strategies, small agency owners can create an effective business tax strategy that turns tax burdens into tactical benefits, boosting profitability and financial stability. So, why not give them a try?

Monitor and Adjust Your Tax Strategy Regularly

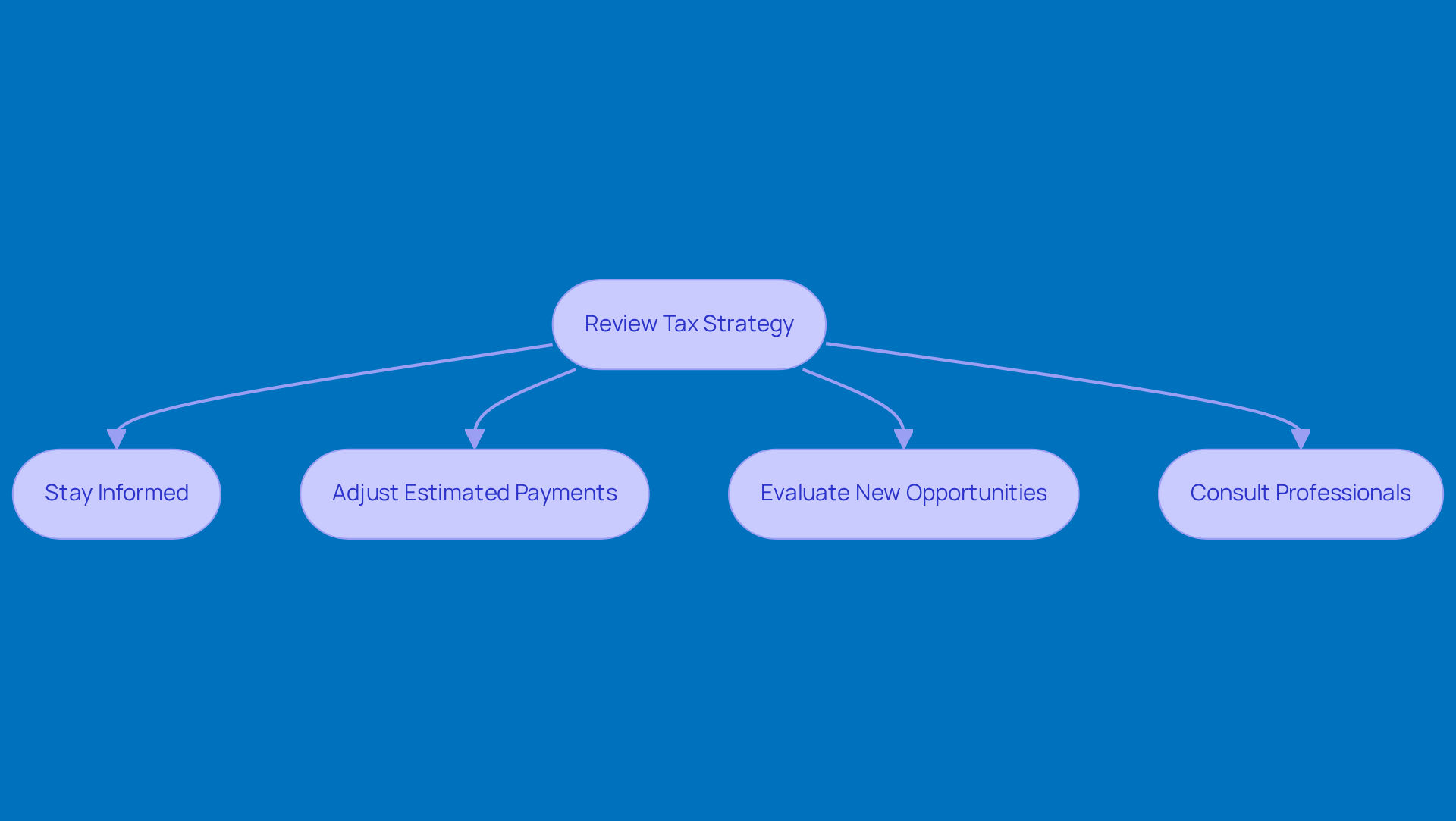

Tax laws are always changing, which means it’s super important for small agency owners to regularly check in on their tax strategies. Doing quarterly assessments of how your finances stack up against your tax plan can really help you stay ahead of the game. Here are some key actions to consider during your reviews:

- Stay Informed: Keep an eye on any changes in tax legislation that might impact your business and tax obligations. It’s like keeping your finger on the pulse!

- Adjust Estimated Payments: If your income fluctuates, don’t hesitate to tweak your estimated tax payments. This way, you can dodge those pesky penalties.

- Evaluate New Opportunities: Look out for any new deductions or credits that might have popped up since your last review. They could give your tax position a nice boost!

- Consult Professionals: Make it a point to chat with tax experts regularly. They can help you navigate compliance requirements and find the best strategies for your unique needs.

By staying flexible and informed, you can make sure your tax strategy aligns with your business goals and keeps your financial health in check. So, how often do you review your tax strategies? It might be time to set a reminder!

Conclusion

Creating a solid business tax strategy is super important for small agency owners who want to tackle the tricky world of tax regulations. A smart tax plan not only helps you spot potential deductions and credits but also boosts your cash flow and supports better financial choices. Plus, keeping this strategy updated as tax laws change is key to staying compliant and keeping your finances in good shape.

In this article, we’ve chatted about some key strategies to optimize your tax situation. We covered:

- Maximizing deductions

- Using retirement plans

- Timing your income and expenses

- Leveraging tax credits

- Reviewing your business structure

Each of these strategies is crucial for turning tax obligations into real opportunities for growth and profit. By taking a proactive approach to tax planning, small agency owners can really enhance their financial outcomes.

At the end of the day, you can’t underestimate the importance of regularly checking in on and adjusting your business tax strategy. Staying up-to-date with tax legislation, exploring new opportunities, and consulting with professionals are all vital steps to ensure your tax strategies align with your business goals. By embracing these practices, you’ll not only boost your financial stability but also empower yourself to make smart decisions that pave the way for long-term success.

Frequently Asked Questions

Why is having a business tax strategy important for small agency owners?

A clear tax strategy helps small agency owners navigate tax regulations, identify potential deductions and credits, and make informed financial decisions.

How does a solid business tax strategy benefit cash flow?

It ensures compliance with tax laws and enables better resource allocation, allowing for investments in growth opportunities.

Should a business tax strategy be reviewed regularly?

Yes, it is important to regularly review and update your tax strategy as tax laws change to maintain its effectiveness and ensure financial health.