Introduction

Creating a tax organizer checklist might seem a bit daunting, especially for rural business owners who have their own set of challenges when it comes to finances. But here’s the good news: a well-structured checklist can really simplify the tax prep process. It helps ensure you’re compliant and can even maximize your deductions!

So, what if I told you there’s a way to turn this overwhelming task into something efficient and manageable? In this article, we’ll explore the key components, customization tips, and best practices for crafting a tax organizer checklist that’s tailored to the unique needs of rural businesses. Let’s pave the way for a smoother tax season together!

Identify Key Components of a Tax Organizer Checklist

Creating an effective tax organizer checklist may seem daunting, but it doesn’t have to be! If you’re a rural business owner, here are some essential components to include:

- Personal Information: Start by gathering Social Security numbers, dates of birth, and contact details for all owners and partners. It’s all about having your bases covered!

- Income Documentation: Make sure to collect all sources of income, like W-2s, 1099s, and any other relevant income statements. This way, you’ll ensure comprehensive reporting and avoid any surprises.

- Expense Records: Don’t forget to document all your business-related expenses! Categorize them by type - think supplies, utilities, payroll - to make sure you can accurately claim those deductions.

- Asset Information: Include details about your organizational assets, such as equipment and property. Remember to note their purchase dates and costs; this info is crucial for depreciation calculations down the line.

- Tax Forms: Ensure you have all the necessary tax forms on hand. This includes previous year returns, estimated tax payments, and any correspondence from the IRS. You definitely want to avoid any compliance issues!

- Deductions and Credits: List out potential deductions and credits that might apply to your business. Home office deductions, vehicle expenses, and industry-specific credits can really help maximize your tax savings.

- Loan and Investment Information: Lastly, document any loans, investments, or other financial obligations that could impact your tax filings. This gives you a complete financial picture.

By pulling together these components, you’ll gain a comprehensive view of your financial situation. This is essential for precise tax preparation and strategic planning. So, are you prepared to tackle your tax organizer checklist?

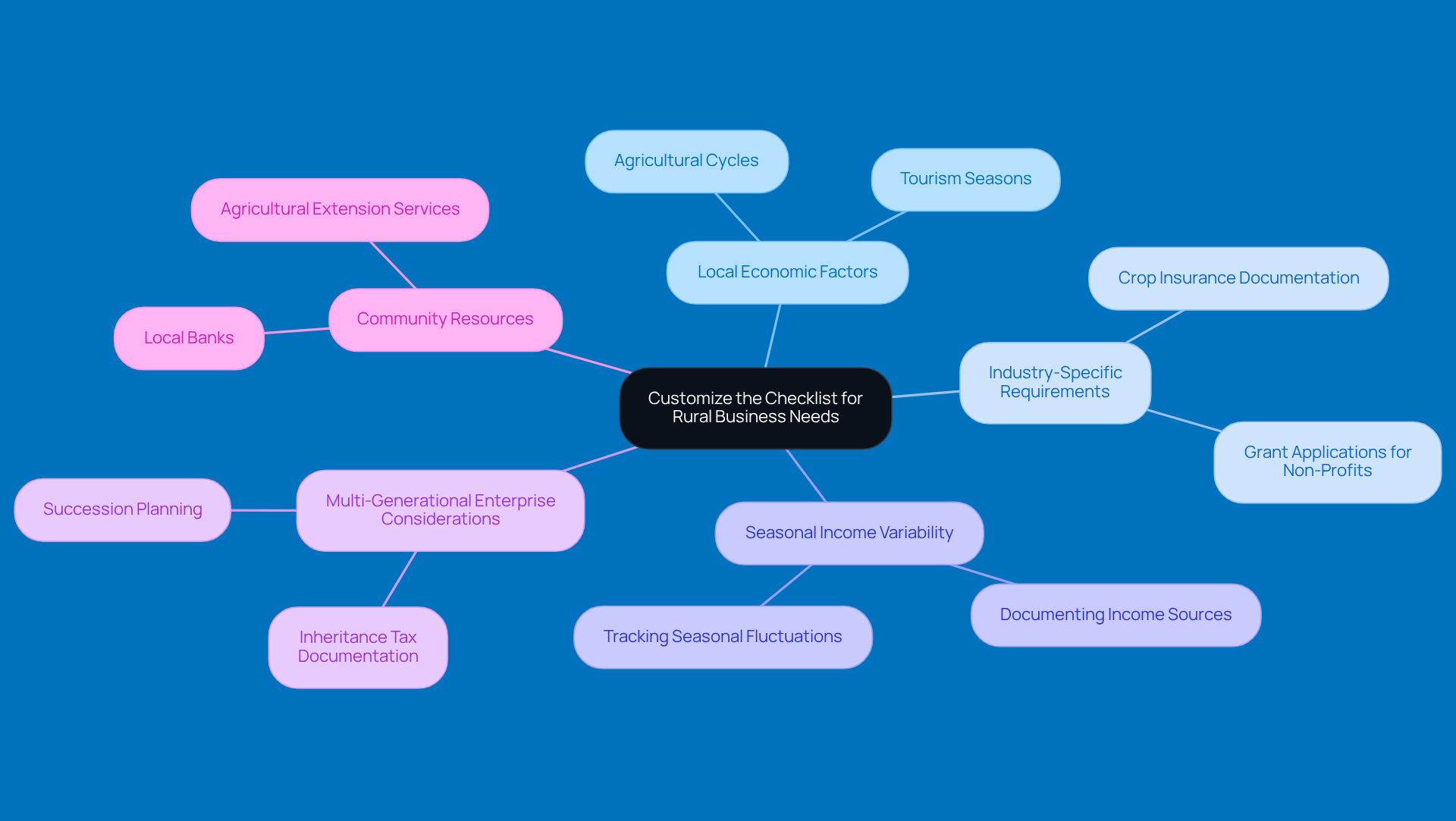

Customize the Checklist for Rural Business Needs

To customize a tax organizer checklist for rural businesses effectively, let’s dive into some strategies that really hit home:

-

Local Economic Factors: Think about how local economic conditions - like agricultural cycles or tourism seasons - affect income and expenses. Tailor your checklist to reflect these changes, making sure it aligns with the unique financial landscape of your community.

-

Industry-Specific Requirements: Don’t forget to include items that are specific to your industry. For instance, farmers might need crop insurance documentation, while non-profits could require grant applications. This way, you ensure all necessary paperwork is in one place, making the preparation process a breeze.

-

Seasonal Income Variability: It’s crucial to account for seasonal income fluctuations. Make sure your checklist includes sections that help document all income sources accurately throughout the year. This is especially important for businesses that see big swings in income due to seasonal activities.

-

Multi-Generational Enterprise Considerations: If you’re running a family-owned business, consider adding items related to succession planning and inheritance tax. This helps tackle the complexities that come with multi-generational operations, ensuring a smooth transition and compliance with tax obligations.

-

Community Resources: Tap into local resources like community banks or agricultural extension services. They can provide additional documentation or support for tax prep. Using these resources can give you valuable insights tailored to the specific needs of rural enterprises.

By customizing your tax organizer checklist to these specific needs, you can streamline your tax preparation process and ensure you’re compliant with the regulations. So, what do you think? Ready to make your tax prep a little easier?

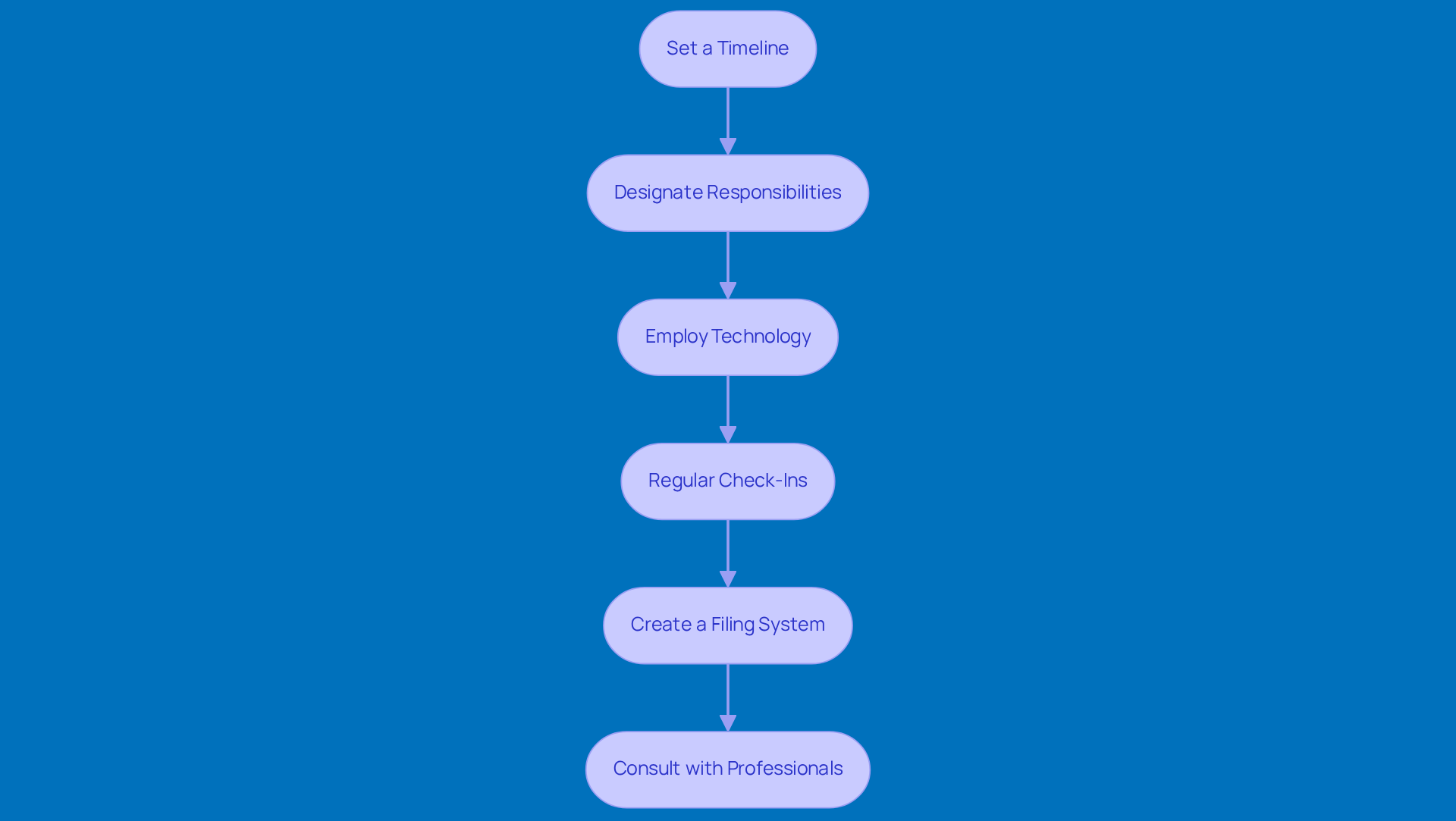

Implement the Checklist for Maximum Efficiency

To effectively implement the tax organizer checklist, rural business owners should consider these steps:

- Set a Timeline: Start gathering your documents well ahead of tax season. This way, you can dodge that last-minute scramble and really prepare thoroughly.

- Designate Responsibilities: Get your team or family involved! Assign specific tasks to make sure every item on the list gets tackled efficiently.

- Employ Technology: Why not take advantage of accounting software and apps designed for small businesses? They can really help streamline your financial document organization and automate data entry, making everything a lot smoother.

- Regular Check-Ins: Schedule some consistent check-ins to keep an eye on how things are going with gathering documentation. It’s a great way to address any hiccups that pop up along the way.

- Create a Filing System: Set up a filing system for both your physical and digital documents. This will make it super easy to access and organize everything throughout the year.

- Consult with Professionals: Don’t hesitate to team up with tax experts or advisors. They can help you go through the list and offer guidance on those tricky items, ensuring you stay compliant and maximize your deductions.

By following these best practices, owners in remote areas can really boost their tax preparation process with a tax organizer checklist. It’ll lead to a more efficient and less stressful experience when tax season rolls around!

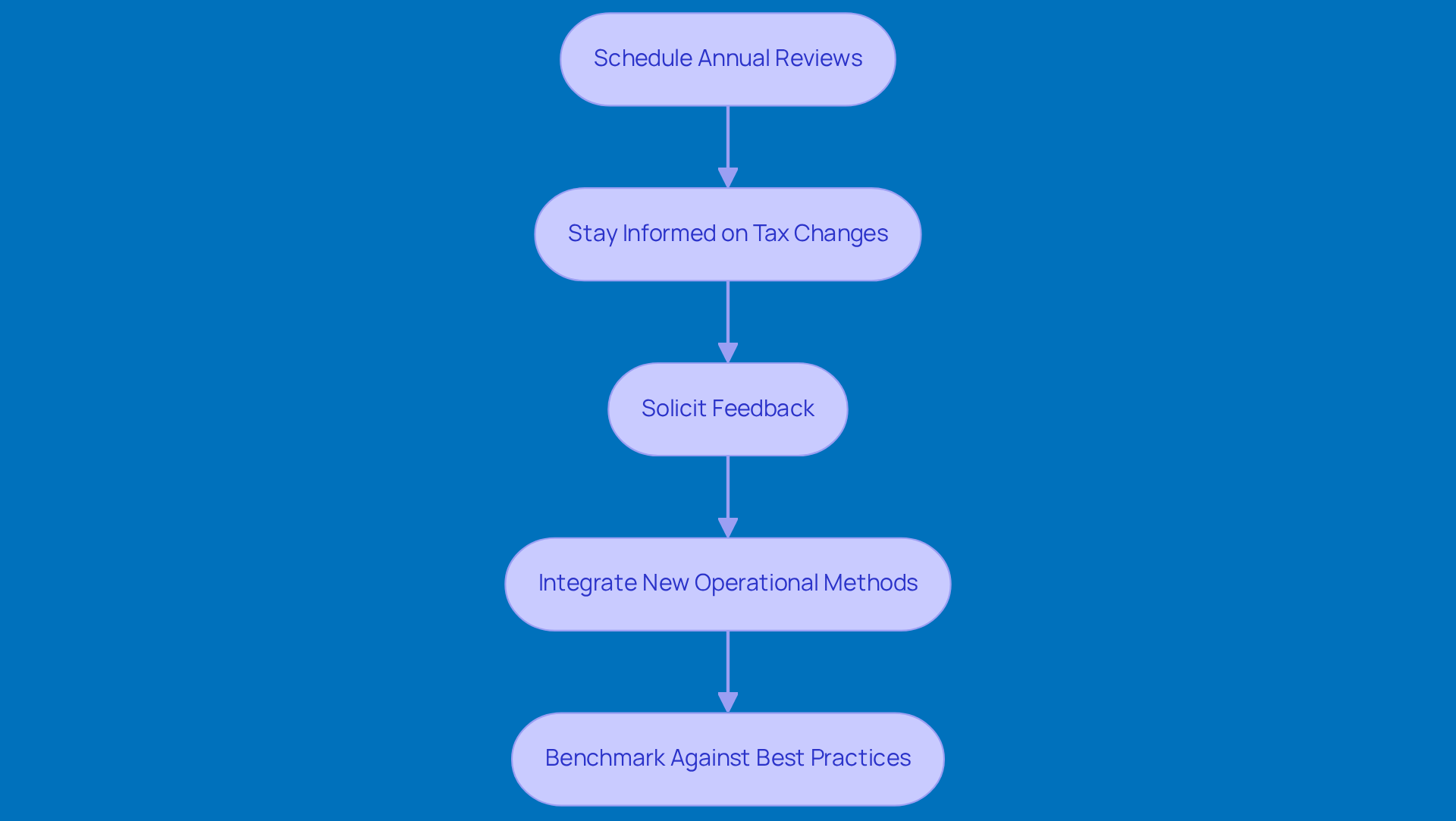

Review and Adapt the Checklist Regularly

To keep your tax organizer checklist effective, here are some friendly tips for rural business owners:

-

Schedule Annual Reviews: Pick a specific time each year-ideally right after tax season-to go over your list. This is a great chance to incorporate lessons learned and any new requirements that might pop up.

-

Stay Informed on Tax Changes: Make it a habit to check for updates in tax laws and regulations that could affect your checklist. Adjust items as needed to stay compliant and optimize your tax strategies with a tax organizer checklist.

-

Solicit Feedback: Don’t hesitate to ask your team members and tax experts for their thoughts on how well the tool is working. Their feedback can highlight areas for improvement and help ensure the list meets your current needs.

-

Integrate New Operational Methods: As your business grows, update the list to reflect new practices, technologies, or revenue sources. Staying adaptable is key to keeping your checklist relevant in a changing business landscape.

-

Benchmark Against Best Practices: Take a moment to compare your list with industry standards or best practices. This can reveal potential enhancements and give you insights into areas where your checklist might need a little boost.

By regularly reviewing and adapting your tax organizer checklist, you will be well-prepared for tax season and ready to seize new opportunities that arise from changes in the tax landscape. So, what are you waiting for? Let’s get started!

Conclusion

Creating a tax organizer checklist just for rural businesses is a smart move to boost efficiency and keep things compliant during tax season. By getting a grip on the unique challenges that rural enterprises face, business owners can whip up a checklist that really hits home, making tax prep a whole lot smoother.

Throughout this article, we’ve highlighted some key elements of a tax organizer checklist. Think personal info, income docs, expense records, and asset details. We also chatted about customization strategies, focusing on local economic factors and industry-specific needs. Plus, we stressed the importance of regularly reviewing and tweaking that checklist. And let’s not forget best practices-setting timelines, designating who’s responsible for what, and consulting with pros can really amp up the effectiveness of your tax prep.

So, here’s the deal: a well-structured tax organizer checklist is a game changer. By taking the time to create and keep this essential tool updated, rural business owners can not only make tax prep easier but also spot chances for financial growth and compliance. Embracing this proactive approach will lead to a more organized and less stressful tax season, helping rural businesses thrive in a competitive world. Ready to tackle tax season with confidence?

Frequently Asked Questions

What is the purpose of a tax organizer checklist?

A tax organizer checklist helps rural business owners gather and organize essential information needed for accurate tax preparation and strategic financial planning.

What personal information should be included in the checklist?

The checklist should include Social Security numbers, dates of birth, and contact details for all owners and partners.

What types of income documentation are necessary?

It is important to collect all sources of income, such as W-2s, 1099s, and any other relevant income statements for comprehensive reporting.

How should business-related expenses be documented?

Business-related expenses should be documented and categorized by type, including supplies, utilities, and payroll, to ensure accurate deduction claims.

What asset information should be included?

Details about organizational assets, including equipment and property, should be noted, along with their purchase dates and costs for depreciation calculations.

Which tax forms need to be gathered?

Necessary tax forms include previous year returns, estimated tax payments, and any correspondence from the IRS to avoid compliance issues.

What deductions and credits should be listed?

Potential deductions and credits, such as home office deductions, vehicle expenses, and industry-specific credits, should be listed to maximize tax savings.

Why is it important to document loans and investments?

Documenting loans, investments, and other financial obligations provides a complete financial picture that can impact tax filings.