Introduction

Limited Liability Companies (LLCs) have become a go-to option for small business owners, thanks to their mix of flexibility and tax perks. If you’re an entrepreneur, getting a grip on LLC taxation can lead to some serious savings through smart tax write-offs and keeping tabs on your expenses.

But with tax laws constantly changing, how can you make sure you’re getting the most out of your deductions while staying on the right side of the law?

In this article, we’ll explore some essential strategies and best practices to help you leverage your LLC for maximum tax benefits and boost your financial growth.

Understand LLC Taxation Basics

Limited Liability Companies (LLCs) really bring together the best of both worlds from corporations and sole proprietorships. For tax purposes, most LLCs are considered pass-through entities. This means they don’t pay federal income taxes at the organizational level. Instead, profits and losses go straight onto the members' personal tax returns. This setup helps LLC members avoid the double taxation that traditional corporations deal with. It’s a real win for small business owners, making tax reporting simpler and potentially saving them a good chunk of change.

Did you know that around 95% of U.S. firms are pass-through entities? That just shows how common and important they are in our economy! Plus, LLCs have the option to be taxed as corporations if that fits their financial game plan better, giving them some flexibility in tax planning.

Now, let’s talk about some recent changes in tax treatment for LLCs that kick in starting in 2026. The 20% Qualified Income (QBI) deduction is here to stay, which means eligible LLC operators can deduct a significant portion of their earnings. This can really help lower their overall tax bill. It’s especially great for small business owners, as it allows them to reinvest those savings back into their businesses.

Real-life examples really highlight the perks of LLC taxation. For instance, if an LLC member makes $100,000 in profit, they could save thousands in taxes compared to a C corporation, which would face corporate tax rates and extra taxes on dividends. This tax efficiency is a big reason why many small businesses are choosing the LLC structure.

Understanding the basics of LLC taxation is super important for small business owners who want to maximize their tax deductions by using LLC for tax write-offs and plan their finances wisely. With the recent changes to the 1099-K reporting requirements-where the reporting threshold has dropped to $600-it’s crucial for LLC operators to keep detailed records of their income and expenses. This not only helps in reporting income accurately but also prepares them for any potential IRS audits that might come up due to discrepancies.

By keeping their financial records organized, LLC owners can reduce stress during audits and make sure they are taking full advantage of available deductions using LLC for tax write-offs. This proactive approach is key to navigating the complexities of tax obligations and maximizing savings by using LLC for tax write-offs.

Identify Key Tax-Deductible Expenses for LLCs

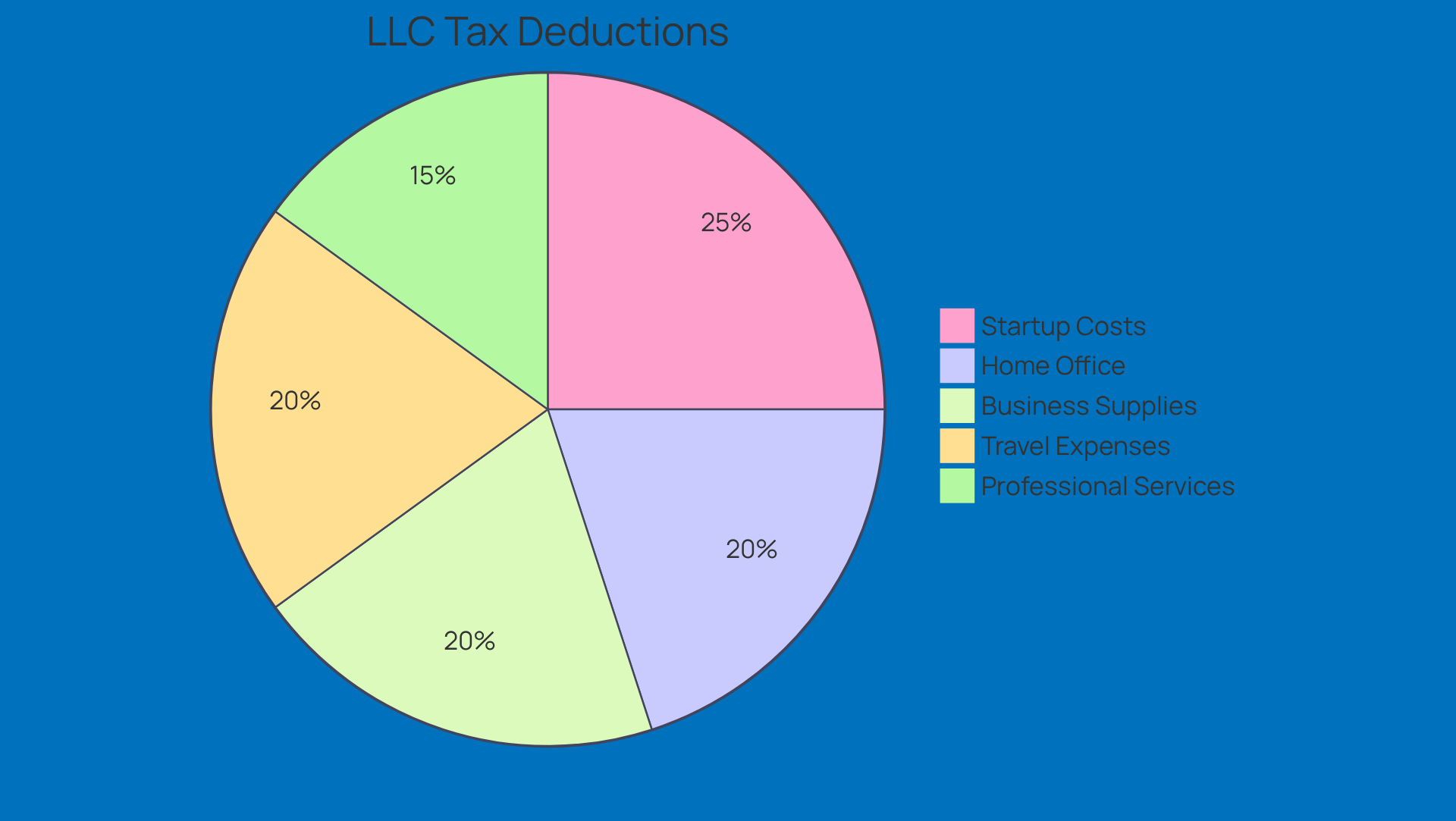

Using LLC for tax write offs allows LLCs to deduct a bunch of expenses that are considered ordinary and necessary for their operations. Let’s break down some key tax-deductible expenses you might want to keep an eye on:

- Startup Costs: If you’re starting fresh, good news! New LLCs can deduct up to $5,000 in startup costs. This can cover things like market research, advertising, and other initial expenses, as long as your total costs don’t go over $50,000.

- Home Office Deduction: Got a corner of your home that’s just for work? You can deduct related expenses like utilities, rent, and maintenance. You can figure this out using either the simplified method or the actual expense method-whichever works best for you.

- Business Supplies: Office supplies, equipment, and software costs? Fully deductible! This means you can keep your operations running smoothly without feeling the pinch when tax time rolls around.

- Travel Expenses: Heading out for business? You can deduct travel expenses like transportation, lodging, and meals. Just remember to document why you’re traveling to stay on the right side of IRS regulations.

- Professional Services: If you’re paying for accountants, consultants, or legal advice, those fees are deductible too. It’s a great way to get expert help without breaking the bank.

By keeping a close eye on these expenses, you can lower your taxable income and boost your cash flow by using LLC for tax write offs. This way, you’re setting your LLC up for some serious growth!

Implement Effective Expense Tracking and Documentation

If you want to maximize your tax write-offs, using LLC for tax write offs requires having a solid expense tracking system in place. Here are some friendly tips to help you get started:

-

Use Accounting Software: Think about investing in some accounting software that links up with your bank accounts. This way, you can automate your expense tracking and categorization. It’s a real lifesaver for making sure all your transactions are accurately recorded. Trust me, this is key for understanding your financial situation and gearing up for tax season.

-

Maintain Receipts: Don’t forget to keep either digital or physical copies of all your receipts related to business expenses. This documentation is super important for using LLC for tax write offs and ensuring compliance with IRS regulations. Plus, understanding what deductions you can claim, such as using llc for tax write offs, is crucial for keeping your finances stable.

-

Create an Expense Policy: It’s a good idea to set up a clear policy on what counts as a deductible expense. This helps keep things consistent when you’re tracking. Your policy should also outline how long to keep tax records and supporting documents. Keeping these records for the right amount of time is vital for compliance and future reference.

-

Regular Reviews: Make it a habit to review your expenses monthly. This way, you can catch any missed deductions and ensure all your records are up to date. Taking this proactive approach can help you dodge underpayment penalties and make sure you’re getting the most out of your tax efficiency.

By following these tips, you can streamline your financial management and boost your ability to claim deductions while using llc for tax write offs and staying compliant with tax regulations. So, what are you waiting for? Let’s get tracking!

![]()

Adopt Strategic Tax Planning for Long-Term Benefits

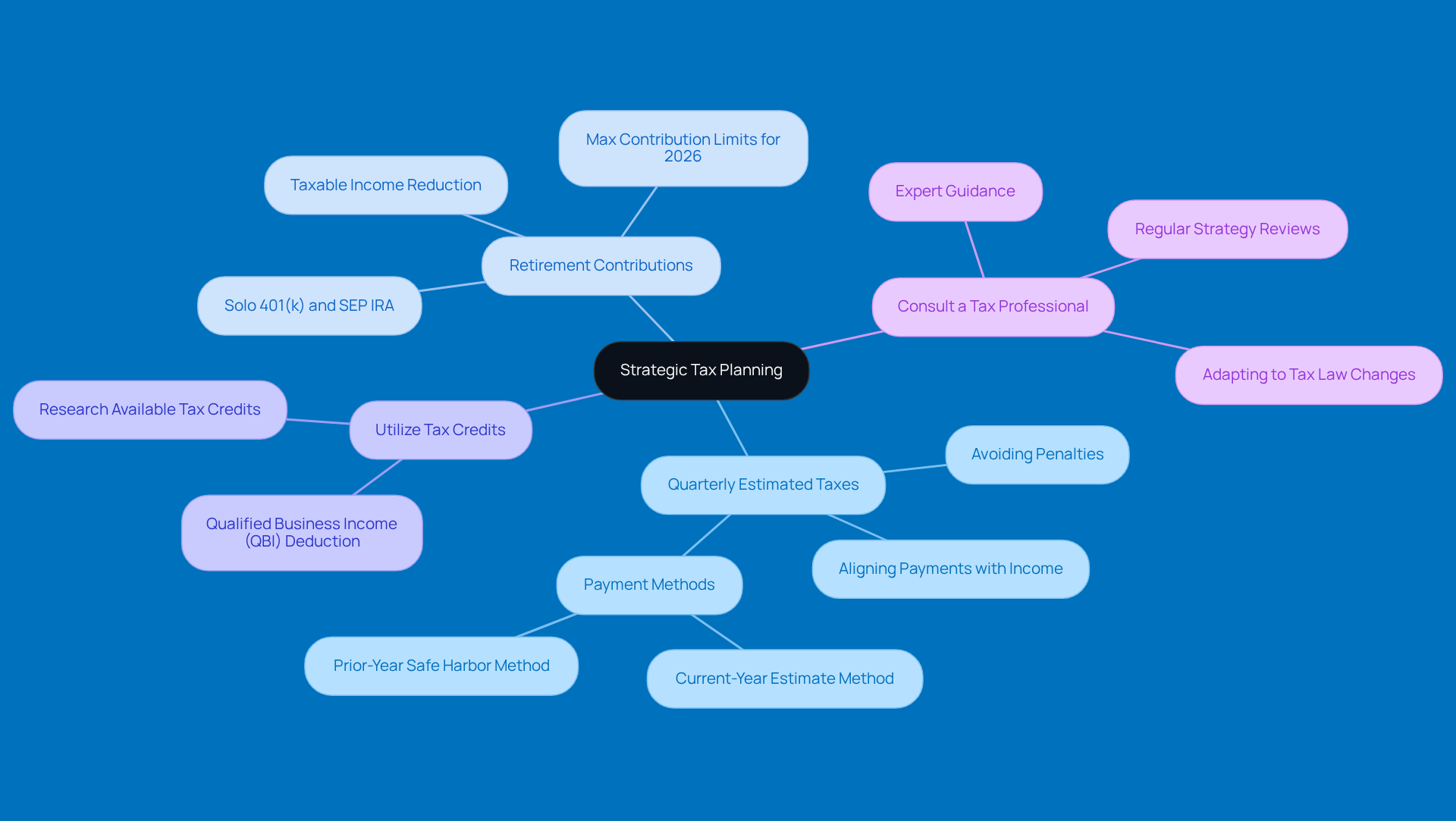

Effective tax planning is super important for LLC members who are using LLC for tax write offs to save money and set themselves up for long-term financial success. Let’s dive into some key strategies you might want to consider:

-

Quarterly Estimated Taxes: Making those quarterly estimated tax payments is a must if you want to avoid penalties and keep your cash flow in check. This proactive approach helps you align your tax responsibilities with your actual income, so you can dodge those pesky underpayment penalties that come from late or insufficient payments.

-

Retirement Contributions: Putting money into retirement accounts like a Solo 401(k) or SEP IRA not only secures your financial future but also lowers your taxable income. Keep an eye on the maximum contribution limits for 2026 - these will be crucial for LLC owners looking to optimize their tax positions while saving for retirement.

-

Utilize Tax Credits: Don’t forget to research available tax credits! For instance, the Qualified Business Income (QBI) deduction can be a game changer for your LLC. This deduction lets eligible taxpayers subtract up to 20% of their qualified income from their businesses, which is a pretty sweet tax benefit.

-

Consult a Tax Professional: Regular chats with a tax expert are key for reviewing and tweaking your tax strategy as tax laws or your business situation changes. Having an experienced advisor on your side can really help keep your tax planning effective and aligned with your business goals.

By putting these strategies into action, LLC owners can boost their financial resilience and maximize tax savings, especially using LLC for tax write offs, setting themselves up for ongoing success. So, what do you think? Ready to take charge of your tax planning?

Conclusion

Maximizing your savings through effective tax write-offs with an LLC can really boost your financial efficiency as a small business owner. By getting a grip on LLC taxation, spotting key deductible expenses, and planning your taxes strategically, you can navigate the tricky tax landscape while enjoying some serious benefits.

Throughout this article, we’ve highlighted some key insights, like the perks of pass-through taxation, the need for keeping accurate records, and the potential for big deductions. From startup costs to home office deductions and professional services, knowing what counts as a deductible expense is super important for optimizing your tax savings. Plus, taking proactive steps like making quarterly estimated tax payments and contributing to retirement can really strengthen your financial position.

But it’s not just about immediate tax savings; these practices set you up for long-term success. By embracing effective expense tracking and strategic planning, you’re not only ensuring compliance but also empowering yourself to make smart financial choices. As the world of LLC taxation keeps changing, staying informed and proactive is key to maximizing your benefits and securing a bright future. So, why not take charge of your tax planning today? It could lead to greater financial freedom tomorrow!

Frequently Asked Questions

What is the primary tax structure of Limited Liability Companies (LLCs)?

Most LLCs are considered pass-through entities for tax purposes, meaning they do not pay federal income taxes at the organizational level. Instead, profits and losses are reported on the members' personal tax returns.

What advantage do LLCs have over traditional corporations regarding taxation?

LLCs avoid double taxation that traditional corporations face, making tax reporting simpler and potentially saving members money.

How common are pass-through entities in the U.S. economy?

Approximately 95% of U.S. firms are pass-through entities, highlighting their significance in the economy.

Can LLCs choose their tax treatment?

Yes, LLCs have the option to be taxed as corporations if it better suits their financial strategy.

What is the 20% Qualified Income (QBI) deduction?

The 20% QBI deduction allows eligible LLC operators to deduct a significant portion of their earnings, helping to lower their overall tax bill.

How can LLC taxation benefit small business owners?

LLC taxation can lead to significant tax savings, allowing small business owners to reinvest those savings back into their businesses.

What changes in tax treatment for LLCs will take effect in 2026?

The 20% Qualified Income (QBI) deduction will continue to be available for eligible LLC operators starting in 2026.

Why is it important for LLC operators to keep detailed records of their income and expenses?

Keeping detailed records is crucial for accurately reporting income, preparing for potential IRS audits, and maximizing available tax deductions.

What recent change has occurred regarding 1099-K reporting requirements?

The reporting threshold for 1099-K has dropped to $600, making it essential for LLC operators to maintain organized financial records.

How can organized financial records help LLC owners during audits?

Organized records can reduce stress during audits and ensure that LLC owners are fully utilizing available tax deductions.