Introduction

Navigating the tricky world of taxes can feel overwhelming for small business owners, but it’s a vital part of reaching financial success. With the right tax advice, entrepreneurs can boost their compliance and even snag some significant savings and strategic perks. The real challenge? Finding a tax professional who gets your business's unique needs.

So, what should you look for when choosing a tax advisor? And how can smart tax planning really change the game for your business's finances? Let’s dive in!

Identify the Right Tax Professional for Your Business Needs

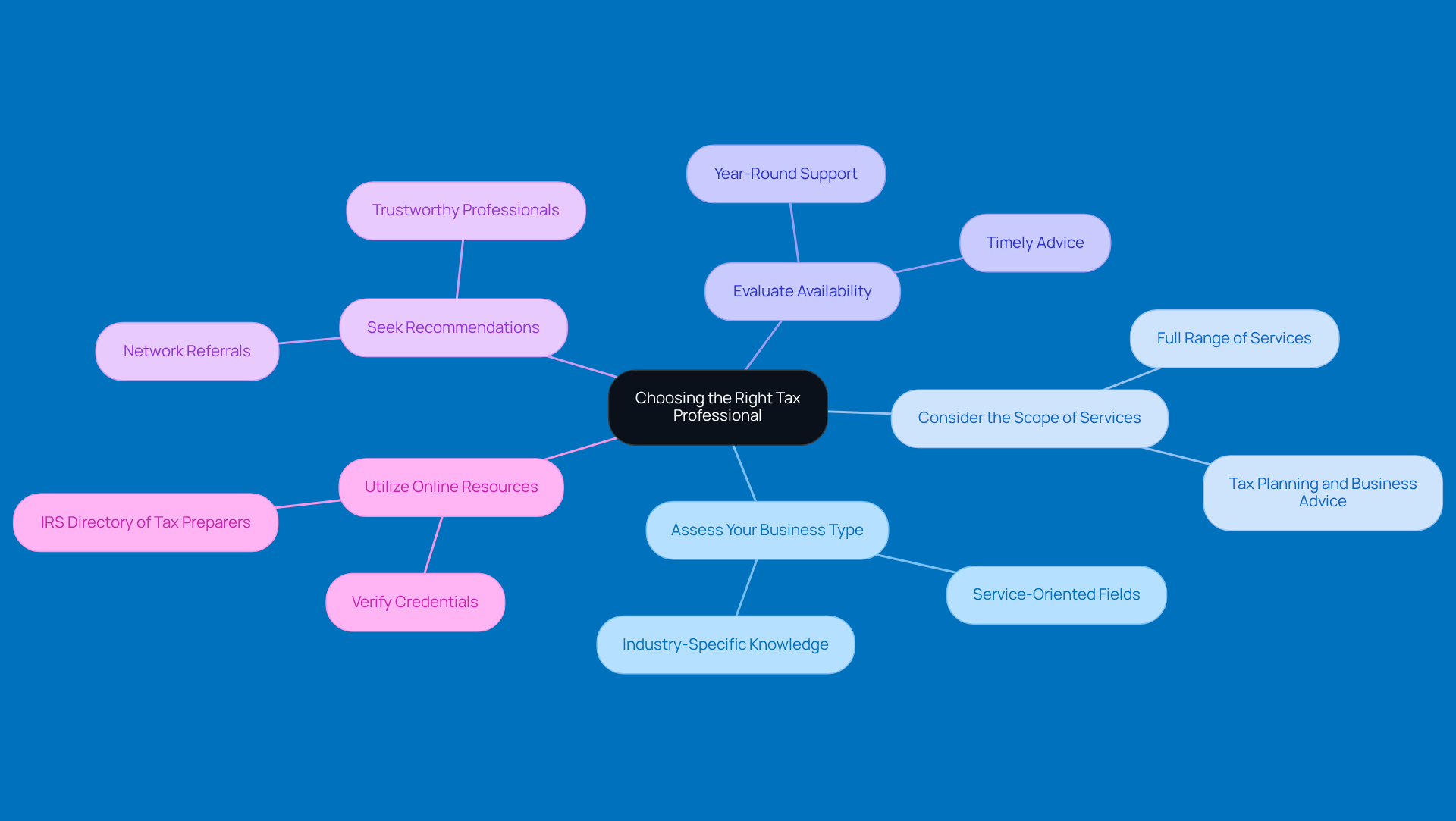

Choosing the right tax expert advice is super important for small business owners aiming for financial success. So, let’s dive into some key strategies to help you out:

- Assess Your Business Type: Not all tax pros are created equal! Different experts have different specialties. Make sure to pick someone who knows the ins and outs of your industry, especially if you’re in a service-oriented field.

- Consider the Scope of Services: Look for a tax professional who offers a full range of services. You want someone who can offer tax expert advice as well as help with tax planning and business advice, not just tax prep. This all-in-one approach can really boost your financial strategy.

- Evaluate Availability: It’s crucial that your tax consultant is available year-round, not just during tax season. You’ll want that ongoing support for effective planning and timely advice.

- Seek Recommendations: Don’t hesitate to tap into your network! Ask fellow entrepreneurs for referrals. Their experiences can guide you to trustworthy professionals.

- Utilize Online Resources: Check out tools like the IRS Directory of Federal Tax Return Preparers to find qualified tax experts in your area. This way, you can ensure they have the right credentials.

By following these strategies, you can make informed choices when selecting a consultant for tax expert advice. This will not only improve your financial well-being but also help you stay compliant. So, what are you waiting for? Get out there and find the right expert for you!

Evaluate Credentials and Experience of Tax Advisors

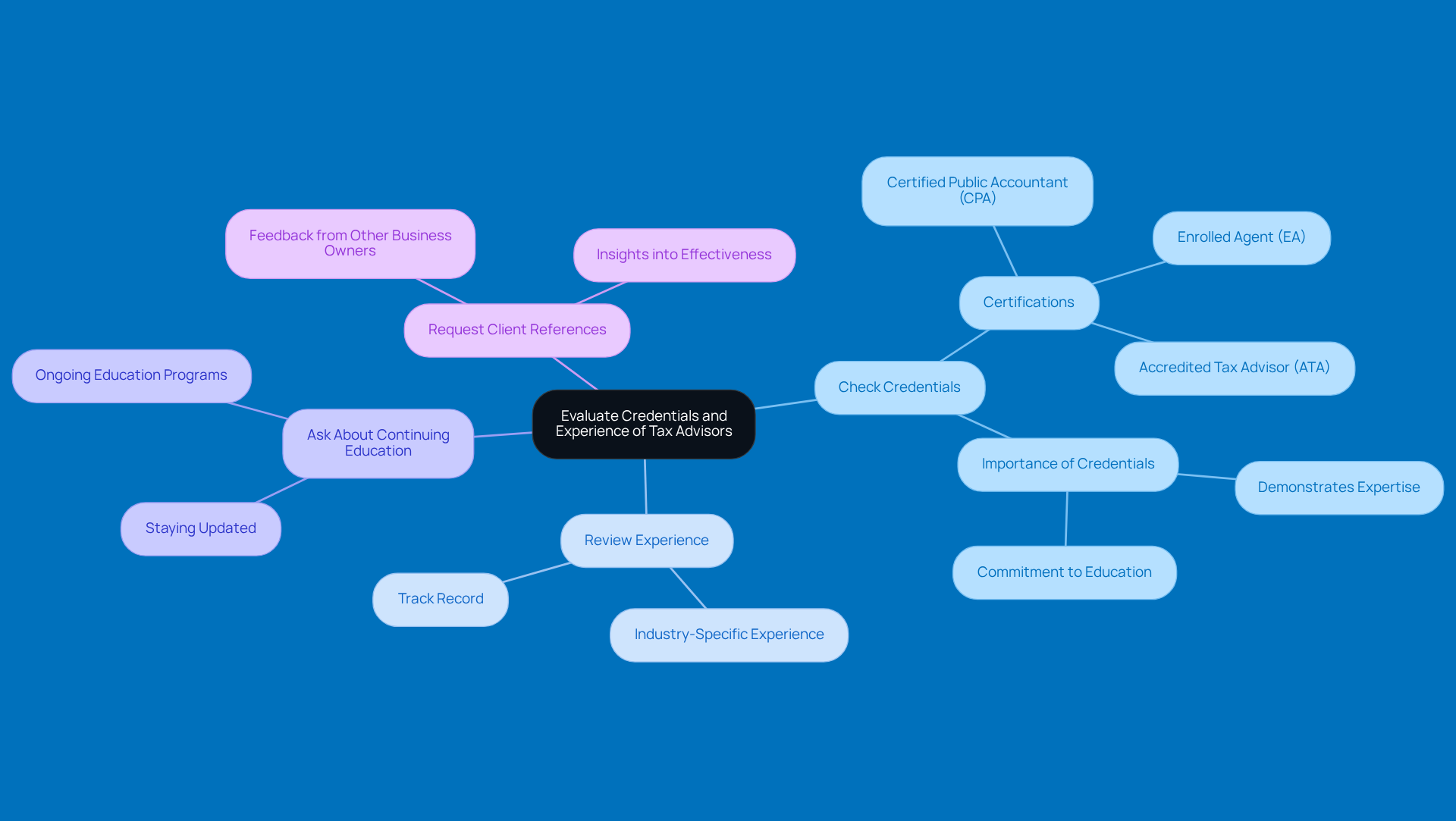

When you're on the hunt for tax expert advice, it’s super important to check out their qualifications and experience. You want someone who can really support your business needs, right? Here are a few tips to help you find the right fit:

- Check Credentials: Look for certifications like Certified Public Accountant (CPA), Enrolled Agent (EA), or Accredited Tax Advisor (ATA). These credentials show that the professional knows their stuff and is committed to staying updated by seeking tax expert advice in the ever-changing world of tax laws.

- Review Experience: Ask about the consultant’s experience with businesses like yours. If they’ve got a solid track record in your industry, they’re more likely to understand the unique challenges you face and can offer tax expert advice that’s tailored just for you.

- Ask About Continuing Education: Tax regulations change all the time, so it’s crucial to ensure your consultant is keeping up with ongoing education. This way, they’ll be in the loop about the latest strategies and compliance requirements by following tax expert advice.

- Request Client References: Don’t hesitate to ask for references from other small business owners who have worked with the consultant. Their feedback can give you valuable insights into how effective the advisor is and the quality of service you can expect.

Finding the right tax advisor doesn’t have to be a daunting task. Just keep these tips in mind, and you’ll be well on your way to making a smart choice!

Incorporate Tax Planning into Your Business Strategy

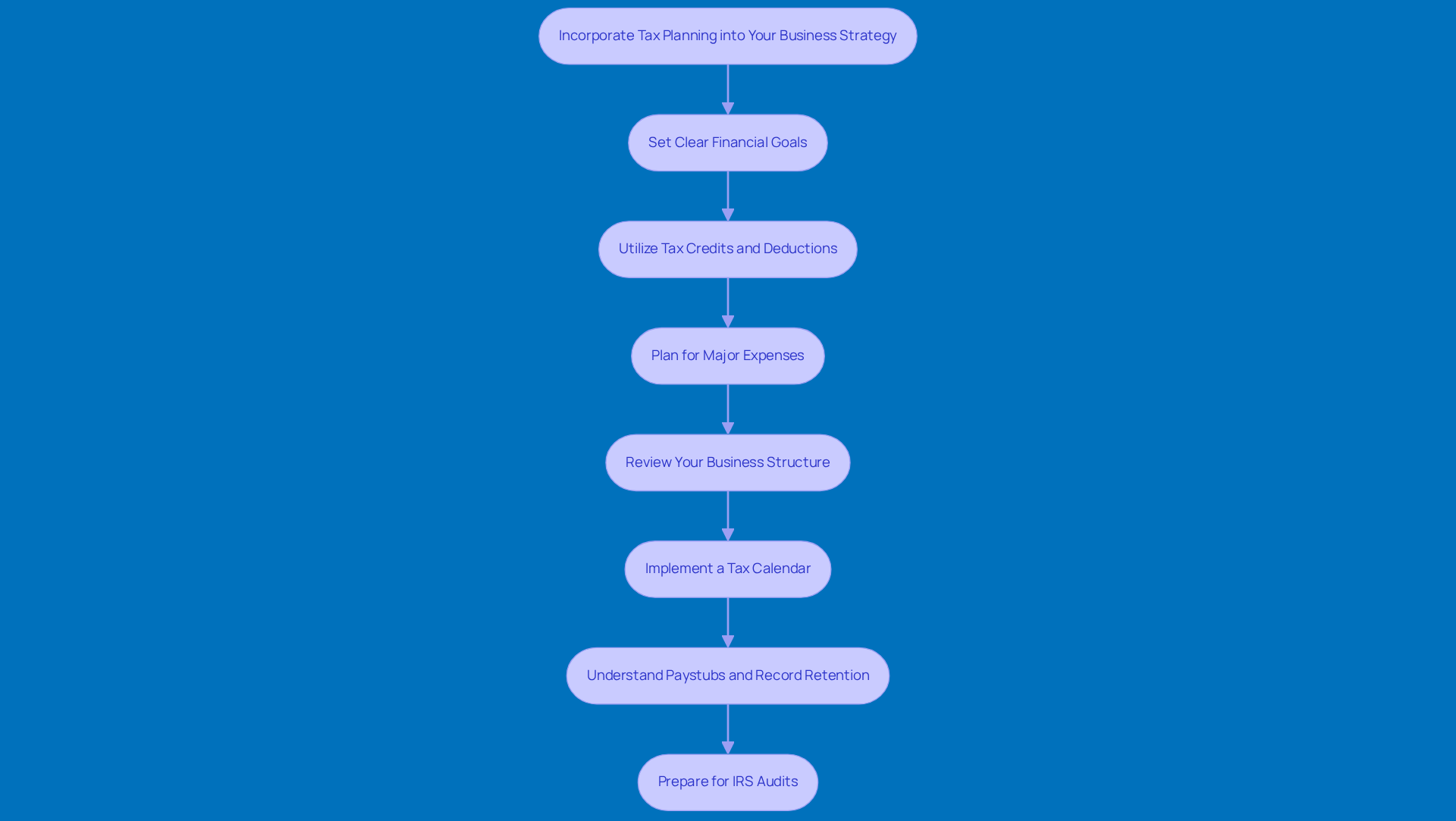

Incorporating tax planning into your business strategy can really pay off. Let’s dive into some best practices that can help you out:

- Set Clear Financial Goals: Start by defining what you want to achieve with your business. Align your tax strategy with these goals so that tax expert advice becomes an essential part of your overall approach, rather than just an afterthought.

- Utilize Tax Credits and Deductions: Get to know the tax credits and deductions available for your business. For instance, in 2026, there’s a new $6,000 deduction for taxpayers aged 65 and older, plus a permanent 20% deduction for pass-through entities. These can really help lower your tax bill! Also, don’t forget about the expanded Section 179 expensing limit of $2.5 million, which allows you to deduct equipment and software costs right away.

- Plan for Major Expenses: Timing can make a big difference in your tax situation. If you expect to earn more this year, think about accelerating some deductible expenses into the current tax year. This proactive move could save small businesses an average of 20% on taxes!

- Review Your Business Structure: The type of business you run (like an LLC or S-Corp) can impact your taxes. Regularly check in with your tax consultant for tax expert advice to make sure your structure is still the best fit for you. For example, S corporations that are fully ESOP-owned can avoid federal income tax, which is a pretty sweet deal.

- Implement a Tax Calendar: Create a tax calendar that highlights important deadlines and milestones. This will help you stay organized and compliant, ensuring you don’t miss out on valuable credits and deductions. With tax laws always changing, acting early is key to maximizing your benefits before any shifts happen.

- Understand Paystubs and Record Retention: Knowing what you earn and where your money goes is just the start of financial stability. Regularly check your paystub to ensure you’re being paid correctly and that the right amount is withheld for taxes. Plus, keep copies of your tax returns and supporting documents for at least three years. This is crucial for compliance and can make audits a lot easier.

- Prepare for IRS Audits: Understanding the audit process can take a load off your shoulders. Keep your financial statements, invoices, and receipts organized. If you get an audit notice, having tax expert advice can simplify things and ensure that your rights are protected.

Maintain Ongoing Communication with Your Tax Expert

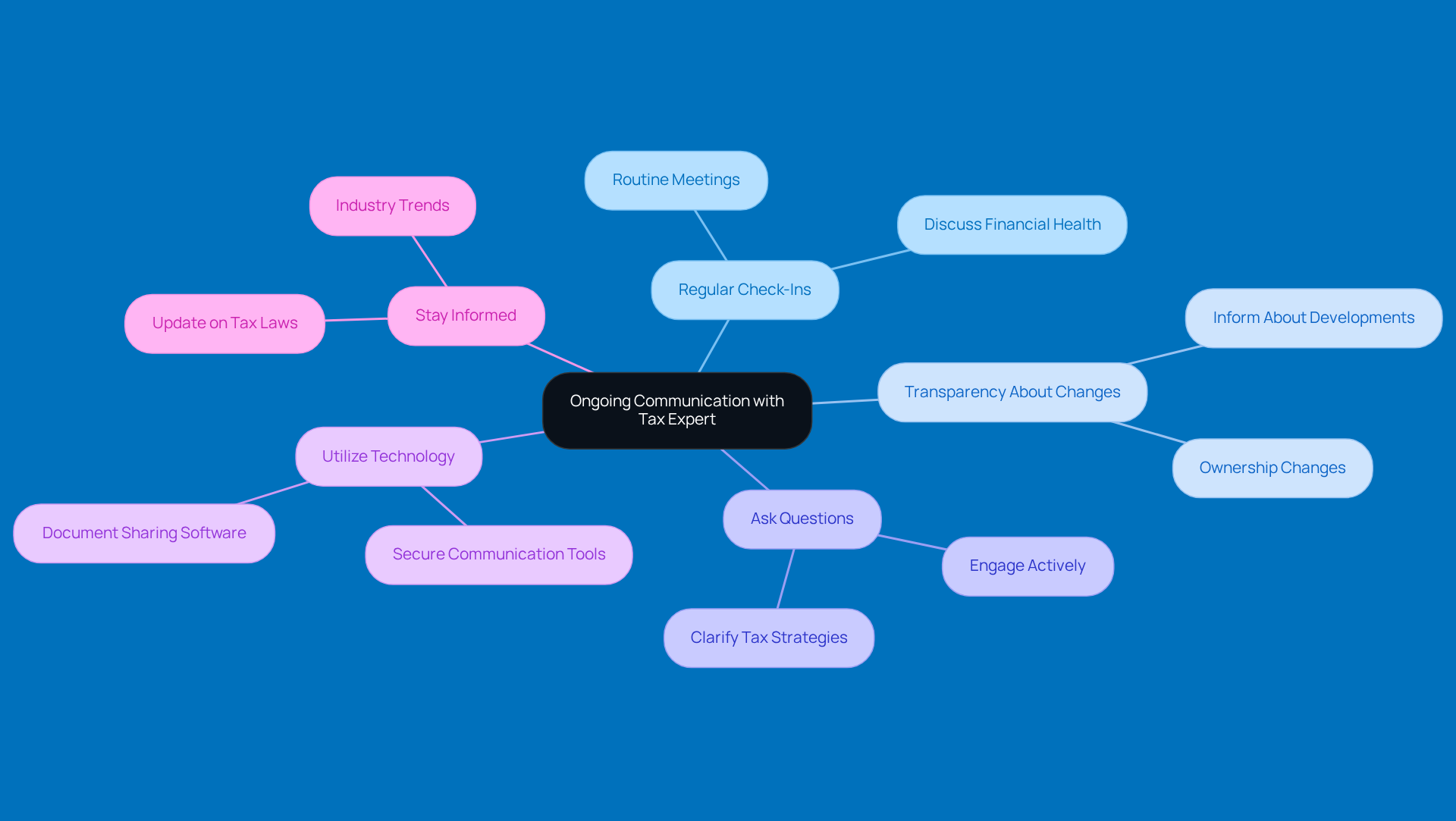

Effective communication with your tax consultant is key to optimizing your tax strategy and obtaining tax expert advice. Let’s dive into some best practices that can help you build a productive relationship:

- Schedule Regular Check-Ins: Set up a routine for meetings with your tax advisor. Regular discussions about your business’s financial health and any changes in tax laws can significantly enhance your tax expert advice.

- Be Transparent About Changes: Keep your tax consultant in the loop about any big developments in your business, like new revenue streams or ownership changes. This openness is crucial for accurate tax expert advice and compliance.

- Ask Questions: Don’t hesitate to engage by asking questions about tax strategies or regulations. A proactive approach not only clears up your understanding but also strengthens the bond through tax expert advice.

- Utilize Technology: Make the most of secure communication tools and software for easy document sharing. This can streamline your interactions and help keep your records organized, making it simpler to manage your tax obligations.

- Stay Informed: Keep yourself updated on tax law changes and industry trends. Being knowledgeable empowers you to have more meaningful discussions with your tax advisor, leading to better financial decisions.

Regular check-ins with your tax expert can provide valuable tax expert advice that can significantly impact your organization’s tax compliance and financial success. As industry experts point out, tax expert advice and keeping an ongoing dialogue are essential for navigating the complexities of tax regulations and ensuring your business stays on solid financial ground. So, how often do you check in with your tax advisor? It might be time to schedule that next meeting!

Conclusion

Wrapping up, maximizing your business success with expert tax advice is crucial for small business owners looking to boost their financial strategies. It’s all about picking the right tax professional, checking their credentials, and weaving effective tax planning into your business operations. When you do this, you can really enhance your financial outcomes and stay on the right side of tax regulations.

So, what are some key strategies? First off, think about your business's specific needs when choosing a tax advisor. Keep that communication flowing! Regular check-ins and being open about any changes in your business can really help optimize your relationship with your tax consultant. Plus, staying updated on tax laws is essential. Don’t forget to tap into available resources and networks to find the best tax pros who fit your unique business needs.

In a world where tax regulations are always changing, taking proactive steps in tax planning and building a solid partnership with tax experts can lead to some serious benefits. By prioritizing these practices, you’re not just ensuring compliance; you’re also setting your business up for sustainable growth and success. So, why not take that step today? Seek out expert tax advice tailored just for your business needs and watch your financial strategy flourish!

Frequently Asked Questions

Why is it important to choose the right tax professional for my business?

Choosing the right tax professional is crucial for small business owners as it significantly impacts financial success and compliance with tax regulations.

How should I assess my business type when selecting a tax professional?

You should ensure that the tax professional you choose has expertise in your specific industry, particularly if you are in a service-oriented field, as different experts have different specialties.

What range of services should I look for in a tax professional?

Look for a tax professional who offers a full range of services, including tax expert advice, tax planning, and business advice, rather than just tax preparation.

Why is it important for a tax consultant to be available year-round?

Having a tax consultant available year-round is important for ongoing support, effective planning, and timely advice, not just during tax season.

How can I find trustworthy tax professionals?

You can seek recommendations from fellow entrepreneurs in your network, as their experiences can help guide you to reliable professionals.

What online resources can I use to find qualified tax experts?

You can utilize tools like the IRS Directory of Federal Tax Return Preparers to find qualified tax experts in your area and ensure they have the right credentials.