Introduction

Understanding Qualified Improvement Property (QIP) can really change the game for businesses looking to boost their tax strategies. With the recent permanence of bonus depreciation benefits under the One Big Beautiful Bill Act (OBBBA), there’s a fantastic opportunity for companies to fully deduct qualifying interior improvements. This could mean immediate financial relief!

But here’s the catch: navigating what qualifies as QIP can be tricky, and avoiding common pitfalls is essential. So, how can businesses make sure they’re maximizing these benefits while keeping up with the ever-changing regulations? Let’s dive in!

Define Qualified Improvement Property

Qualified Improvement Property (QIP) relates to specific upgrades made to the interior of nonresidential buildings after they’ve been put into service and is significant for qualified improvement property bonus depreciation. Think of things like:

- Putting up drywall

- Upgrading lighting systems

- Modifying interior plumbing

- Installing drop ceilings

- Enhancing fire protection systems

But here’s the catch: QIP doesn’t cover costs for expanding a building, adding elevators or escalators, or messing with internal structural frameworks. Plus, to keep your qualified improvement property bonus depreciation eligibility, those improvements need to be made after the original building is up and running.

Understanding these distinctions is super important, especially with the One Big Beautiful Bill Act (OBBBA) making qualified improvement property bonus depreciation permanent. If you’re an entrepreneur looking to boost your tax benefits, strategic planning and good documentation are key. And hey, teaming up with CPAs and cost segregation specialists can really help you stay on the right side of the regulations.

So, are you ready to take advantage of QIP? Let’s make those improvements work for you!

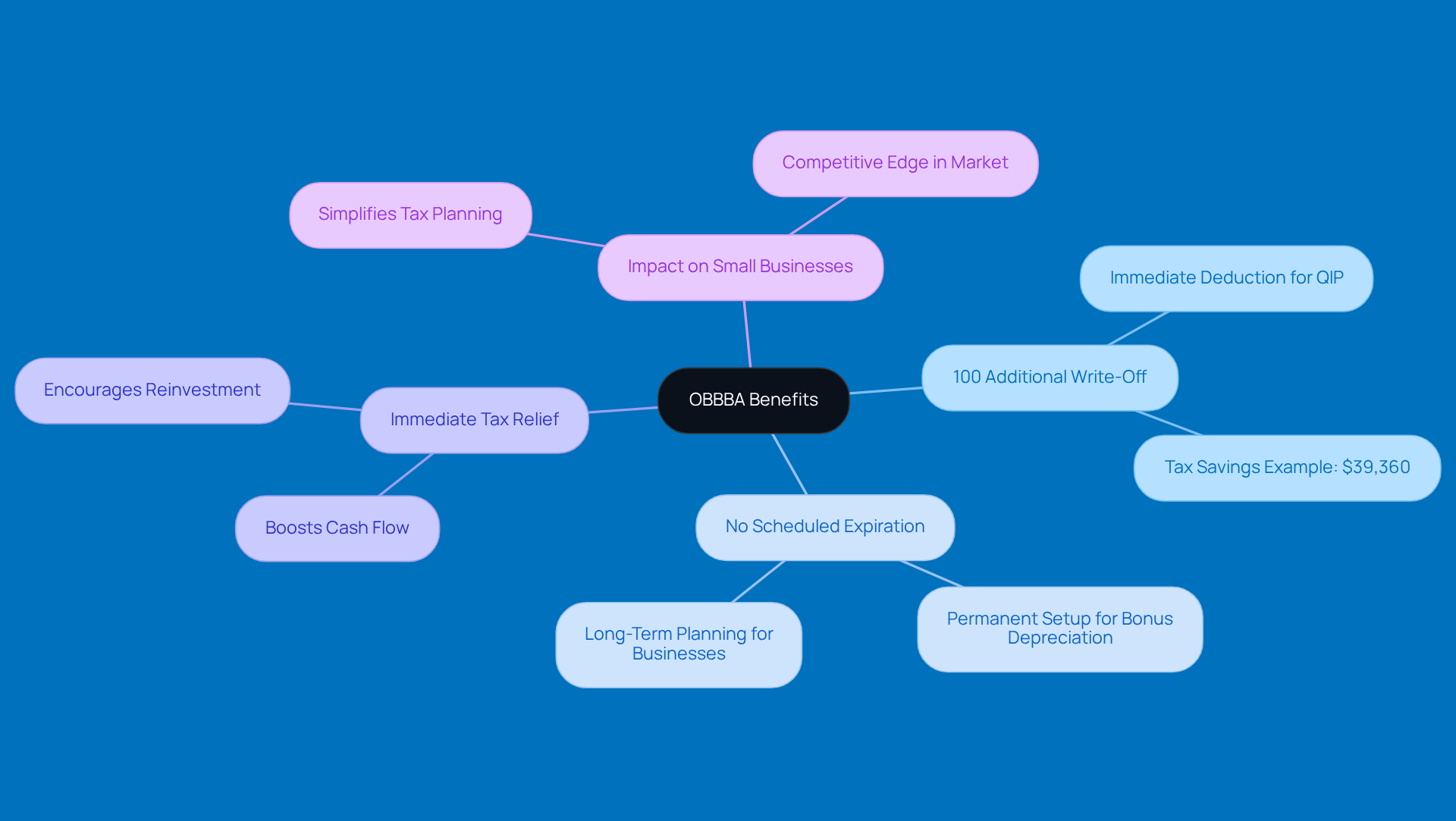

Explore Bonus Depreciation Benefits Under OBBBA

The One, Big, Beautiful Bill Act (OBBBA) is a fantastic opportunity for businesses, offering a 100% additional write-off for qualified improvement property bonus depreciation for assets that are put into use after January 19, 2025. This means companies can fully deduct the costs of qualifying improvements in the year they happen, leading to some pretty significant drops in taxable income.

With the OBBBA, we have a permanent setup for qualified improvement property bonus depreciation, ensuring there are no more phased-out benefits like we experienced in past laws.

- No Scheduled Expiration: There’s no expiration date tied to this benefit, so businesses can plan and make improvements without the stress of looming deadlines.

- Immediate Tax Relief: This provision gives immediate tax relief, which really boosts cash flow. Businesses can reinvest in their operations faster, helping them grow and stay stable.

The impact of the OBBBA on small businesses is huge! It not only simplifies tax planning but also encourages investment in property improvements. Tax experts point out that the qualified improvement property bonus depreciation can provide companies with a lasting additional write-off, giving them a competitive edge and enabling them to enhance their financial strategies effectively. Since the OBBBA rolled out, many businesses have already claimed additional write-offs, showing just how well it’s being received. For example, enhancements qualifying for QIP have led to tax savings of $39,360, allowing small businesses to tackle essential renovations and upgrades without the burden of long-term amortization plans. This strategic advantage really helps them stand out in their markets, highlighting how the OBBBA supports small business growth. As Ryan Corcoran, a partner, put it, 'The OBBBA’s reinstatement of 100% additional write-off and its extension to specific building property signify a strong motivation for businesses to invest in production assets.

Implement Strategies to Maximize QIP Benefits

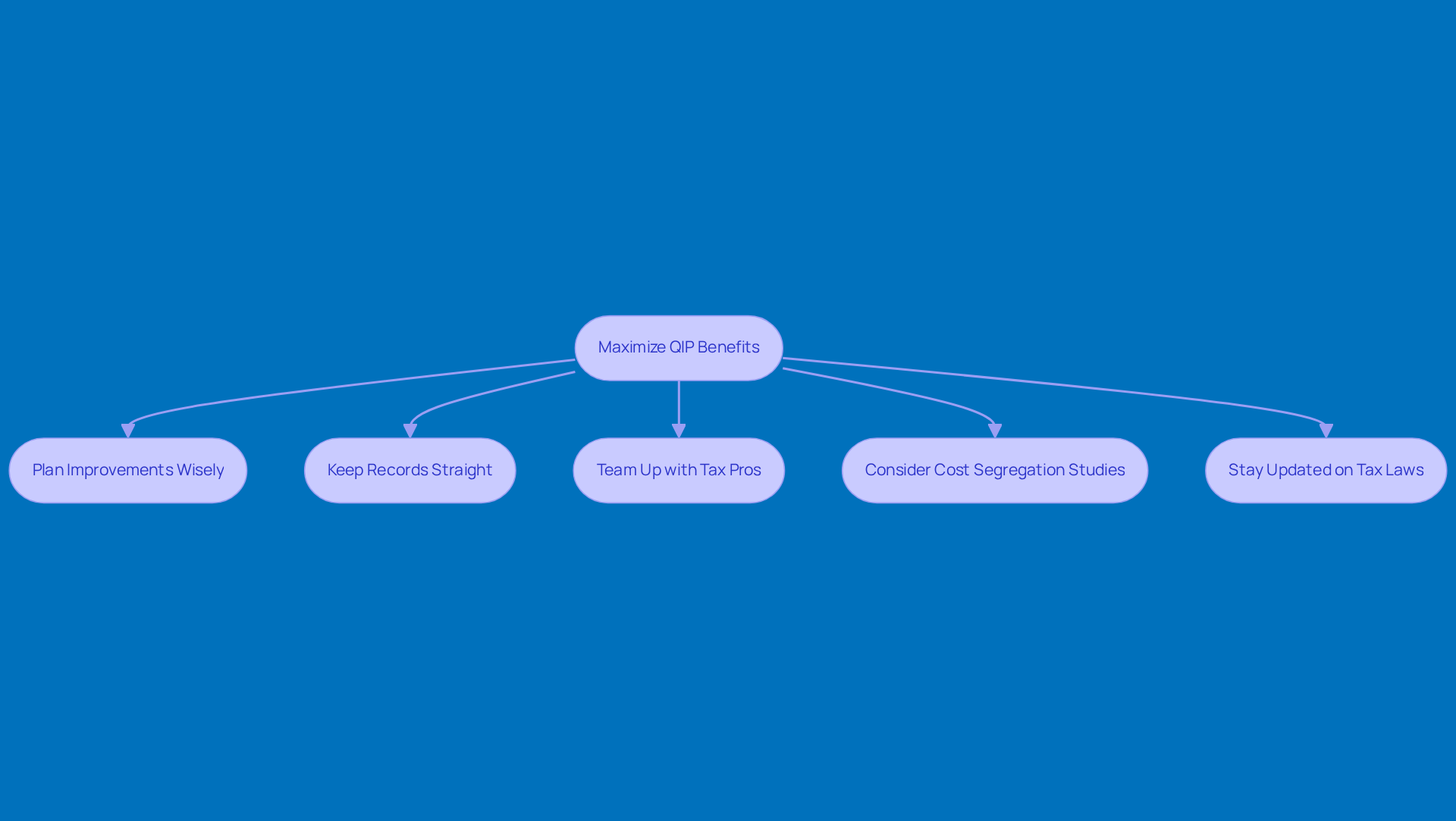

To really make the most of Qualified Improvement Property (QIP) under the One Big Beautiful Bill Act (OBBBA), here are some strategies you might want to consider:

-

Plan Your Improvements Wisely: When you're thinking about renovations, make sure to plan them out so they’re operational after January 19, 2025. This way, you can snag that full 100% tax deduction! Just a heads-up: improvements done at the same time as the original building don’t count as QIP.

-

Keep Your Records Straight: It’s super important to keep detailed records of all your QIP-related costs. Think invoices, contracts, and receipts. These will help you back up your claims for those extra write-offs.

-

Team Up with Tax Pros: Don’t go it alone! Work with tax advisors who know their stuff when it comes to QIP and bonus write-offs. This is especially crucial if your business operates in different areas, since state and federal value differences can make tax planning a bit tricky.

-

Consider Cost Segregation Studies: These studies can help you pinpoint and separate QIP from other property improvements, which means you can maximize those tax deductions.

-

Stay Updated on Tax Laws: Keep an eye on any changes in tax laws that might impact QIP and other deductions. This way, you can tweak your strategies as needed. And remember, the acquisition date is key for figuring out eligibility under the new 100% rule versus phasedown rules.

So, what do you think? Are you ready to dive into these strategies and make the most of your QIP benefits?

Identify Common Misinterpretations and Pitfalls

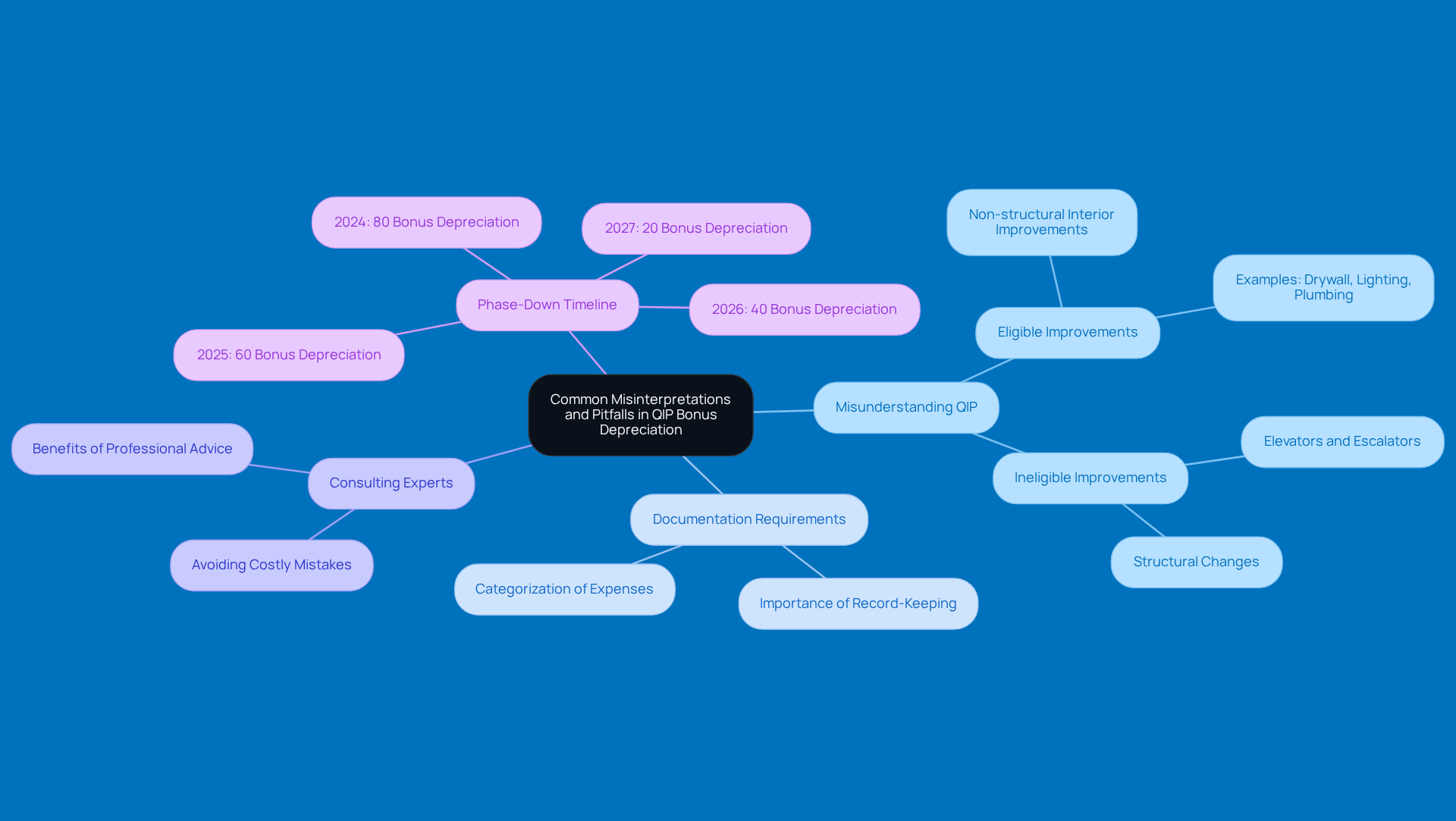

Navigating qualified improvement property bonus depreciation can feel a bit like walking through a maze for business owners. There are plenty of misinterpretations and pitfalls that could lead to missed opportunities or compliance headaches. Let’s break it down together:

- Misunderstanding What Qualifies as QIP: One common misconception is that every improvement to a nonresidential building is eligible for bonus depreciation. But here’s the scoop: only non-structural improvements to the interior qualify for qualified improvement property bonus depreciation. Think drywall installation, lighting systems, and plumbing - those are the real MVPs here.

- Ignoring Documentation Requirements: Skipping out on proper record-keeping? That could mean disallowed deductions down the line. It’s super important to keep detailed documentation of all expenses and make sure they’re categorized correctly to back up your claims. Assuming all enhancements are eligible, just because you’ve made improvements after a building is up and running doesn’t mean they all qualify for qualified improvement property bonus depreciation. Structural changes, elevators, and escalators? They don’t meet the QIP criteria, so keep that in mind.

- Neglecting to Consult Experts: Many entrepreneurs try to tackle these complexities solo, which can lead to costly mistakes. Seriously, chatting with a tax professional can be a game changer for maximizing benefits and staying compliant with the latest regulations.

And here’s something to keep on your radar: after 2023, the qualified improvement property bonus depreciation will decrease each year. We’re talking 80% for property placed in service in 2024, 60% for 2025, 40% for 2026, and 20% for 2027. As Jeffrey Ring puts it, "To qualify for the 100% deduction, the property must be acquired after January 19, 2025, based on the written binding contract date." By tackling these common pitfalls and understanding the urgency of the phase-down, you can better position your business to take full advantage of QIP benefits.

Conclusion

Maximizing the benefits of Qualified Improvement Property (QIP) under the One Big Beautiful Bill Act (OBBBA) is super important for businesses that want to boost their tax strategies. By getting a handle on what counts as QIP and taking advantage of those permanent bonus depreciation provisions, companies can really cut down their taxable income and improve cash flow. This kind of strategic planning not only helps grab immediate tax relief but also sets the stage for long-term growth and stability.

So, what should you keep in mind? First off, it’s crucial to know which improvements qualify as QIP. Plus, keeping detailed documentation is a must! And don’t forget the value of chatting with tax professionals - they can really help you navigate this stuff. The article also points out some common pitfalls business owners might face, like misunderstandings about eligibility and the need to act quickly before the benefits start to phase down in 2024. By tackling these complexities head-on, businesses can snag some serious tax savings and reinvest in their operations.

In the end, the OBBBA offers a fantastic chance for businesses to optimize their property improvements and strengthen their financial standing. Engaging with tax experts, staying updated on relevant regulations, and planning improvements wisely are key steps to maximizing those QIP benefits. Embracing these strategies not only brings immediate tax relief but also lays the groundwork for sustainable growth. So, business owners, it’s time to take action and make the most of these great provisions!

Frequently Asked Questions

What is Qualified Improvement Property (QIP)?

Qualified Improvement Property (QIP) refers to specific upgrades made to the interior of nonresidential buildings after they have been put into service, which are eligible for bonus depreciation.

What types of improvements are considered QIP?

Improvements that qualify as QIP include putting up drywall, upgrading lighting systems, modifying interior plumbing, installing drop ceilings, and enhancing fire protection systems.

What types of costs are excluded from QIP?

QIP does not cover costs associated with expanding a building, adding elevators or escalators, or altering internal structural frameworks.

When must improvements be made to qualify as QIP?

To maintain eligibility for qualified improvement property bonus depreciation, improvements must be made after the original building is operational.

Why is it important to understand QIP distinctions?

Understanding the distinctions of QIP is crucial, especially since the One Big Beautiful Bill Act (OBBBA) has made qualified improvement property bonus depreciation permanent.

How can entrepreneurs benefit from QIP?

Entrepreneurs can boost their tax benefits through strategic planning and proper documentation of qualified improvement property.

Who can help with QIP-related tax planning?

Collaborating with CPAs and cost segregation specialists can assist in navigating regulations and maximizing benefits related to qualified improvement property.