Introduction

Understanding the ins and outs of bonus depreciation can really change the game for businesses looking to fine-tune their tax strategies. Thanks to the recent updates from the One Big Beautiful Bill Act, companies now have the chance to claim a full 100% deduction on qualifying assets in the year they’re put into service. This can make a big difference in their taxable income!

But, let’s be real - navigating the eligibility criteria and potential pitfalls isn’t always a walk in the park. So, how can small business owners make the most of this tax advantage while steering clear of common mistakes that could cost them valuable deductions?

Define Bonus Depreciation: Understanding the Basics

Hey there! Let’s talk about bonus write-offs. They’re a pretty neat tax perk that lets companies deduct a big chunk of the cost of qualifying assets in the year they start using them. Thanks to the One Big Beautiful Bill Act (OBBBA), businesses can claim a whopping 100% bonus depreciation by year for eligible property they snag and put into service after January 19, 2025. This means they can take the full deduction right away instead of spreading it out over the asset's life, which can really lower their taxable income for that year.

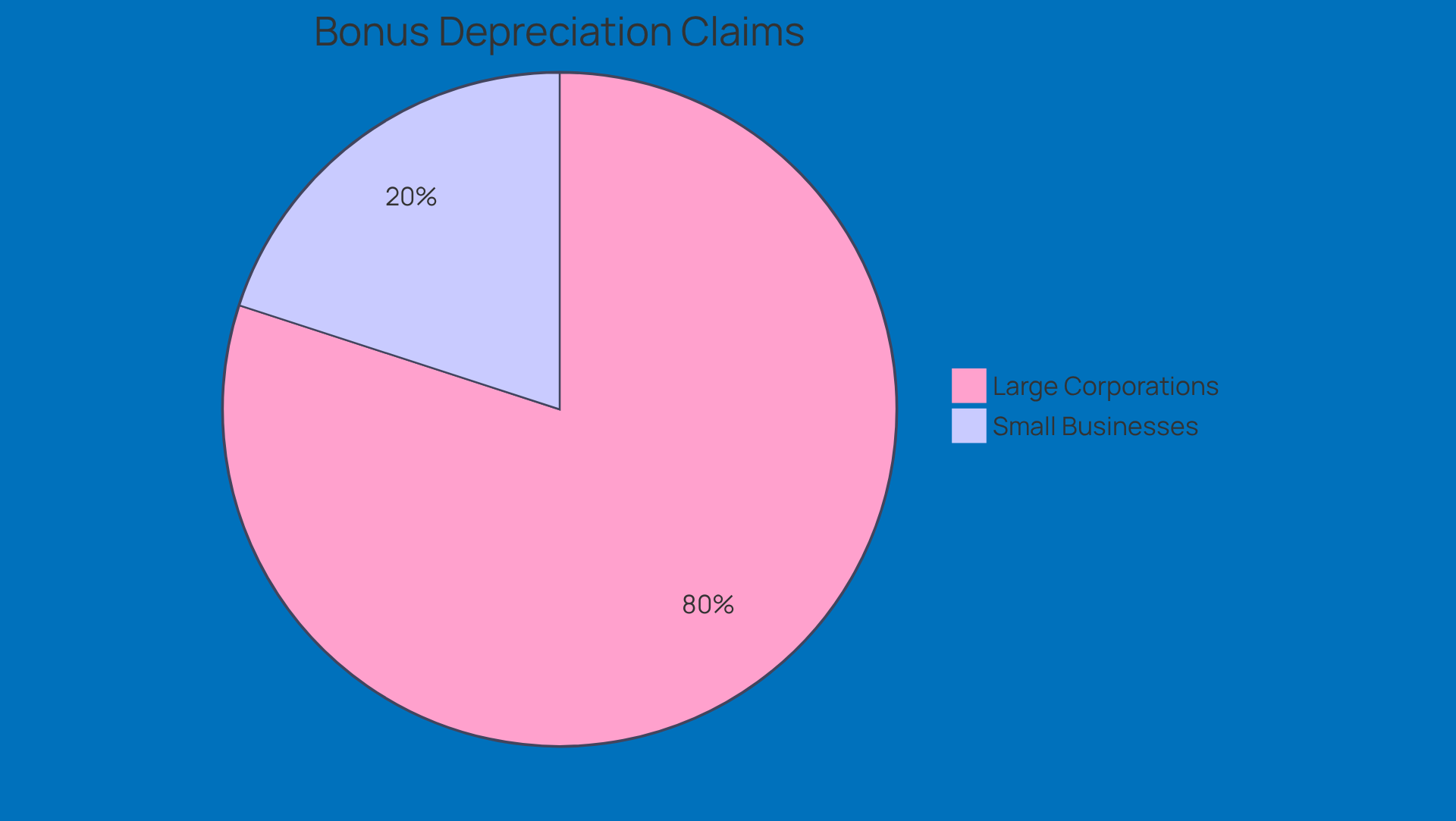

Now, if you’re a small business owner, this is especially good news! Not only does it give you some immediate tax relief, but it also encourages you to invest in new equipment or property. Just think about it: from 2018 to 2022, companies used bonus write-offs to deduct a staggering $2.7 trillion! And get this - over 80% of those deductions came from corporations with more than $1 billion in gross receipts. That really shows how important this is for tax planning.

In fact, for the tax year 2022 alone, the total bonus depreciation by year across all industries hit $628.4 billion. As small businesses gear up for 2026, getting a handle on bonus depreciation by year could lead to some serious tax savings and better cash flow. So, why not make it a key part of your financial strategy? It could really pay off!

Identify Eligibility: Who Qualifies for Bonus Depreciation?

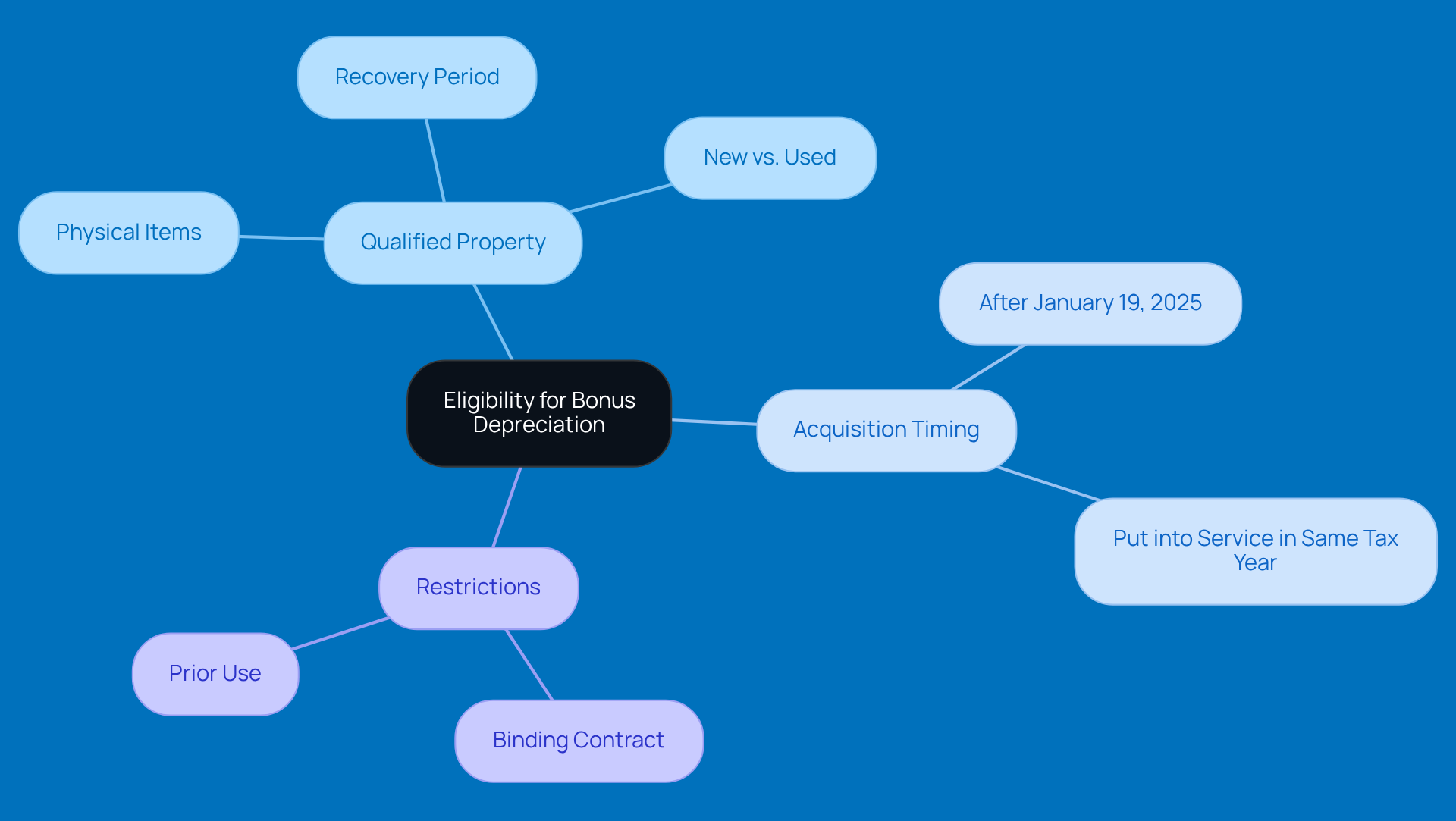

If you want to snag some extra write-offs, there are a few things you need to keep in mind. First off, qualified property includes physical items that have a recovery period of 20 years or less. Think machinery, equipment, and certain vehicles. But here’s the catch: the property must be acquired after January 19, 2025, and it needs to be put into service within the same tax year to take advantage of the 100% bonus depreciation by year brought back by the One Big Beautiful Bill Act.

Both new and used property can qualify, as long as it wasn’t used by you before you bought it. And just a heads up - if you snagged an asset under a binding contract before the effective date, you won’t be able to claim this deduction. Understanding these criteria is super important for entrepreneurs looking to maximize their tax savings. So, keep these points in mind as you plan your purchases!

Implement Strategies: Maximizing Benefits of Bonus Depreciation

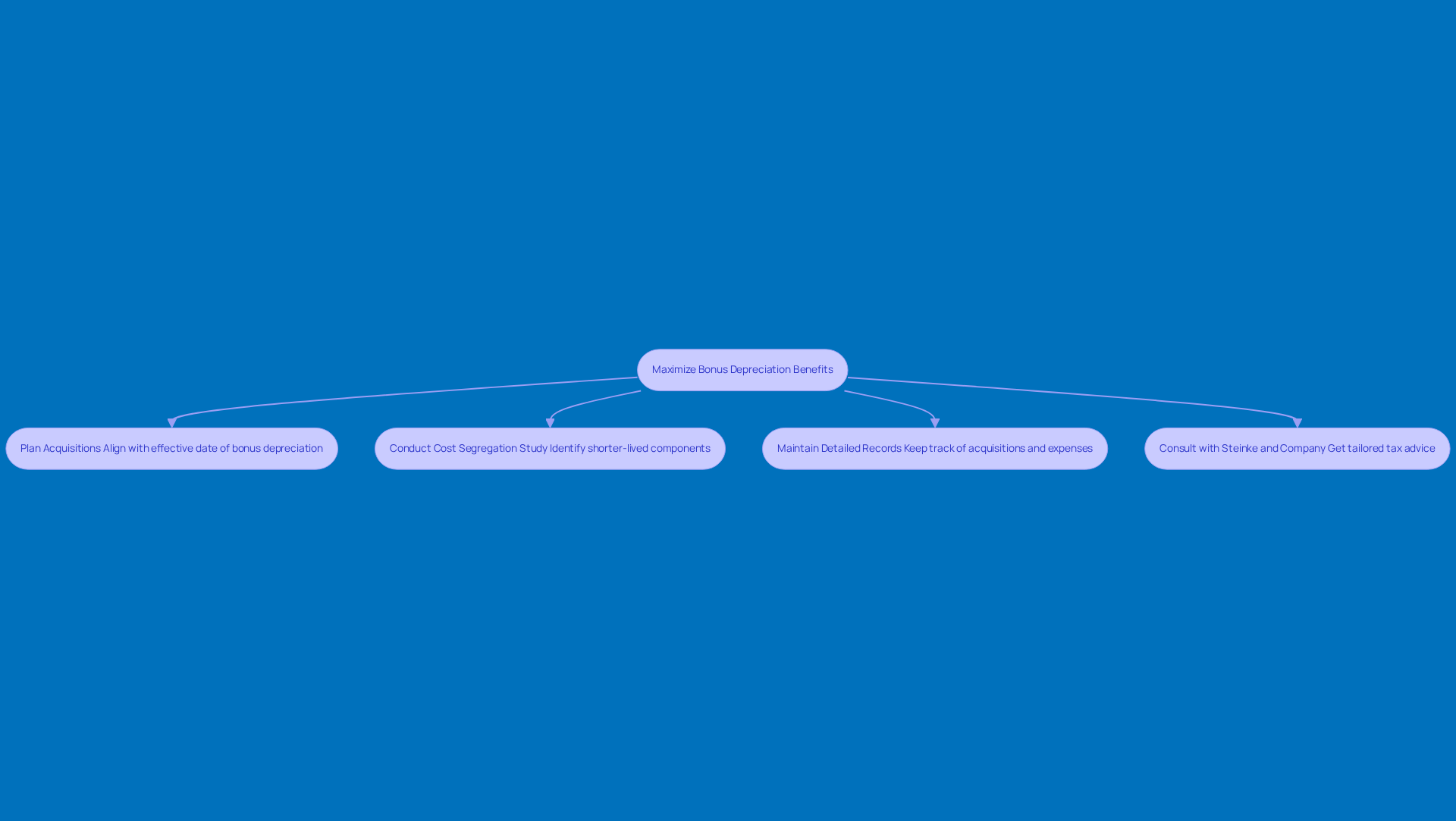

If you're a small business owner looking to maximize your benefits from bonus depreciation by year, it’s a good idea to explore some strategies - ideally with a little help from Steinke and Company’s tax planning services. First off, timing is everything! Planning your acquisitions to align with the effective date of the bonus depreciation by year provisions can really pay off. For example, if you get your resources up and running right after January 19, 2025, you can benefit from bonus depreciation by year for that tax year.

Another smart move? Consider a cost segregation study. This can help you pinpoint parts of your property that might qualify for shorter depreciation periods, maximizing those deductions. And don’t forget to keep detailed records of all your acquisitions and their expenses. This not only helps you stay compliant but also makes the claiming process a breeze.

Lastly, chatting with Steinke and Company can give you tailored advice to ensure you’re accounting for all eligible assets, which can really boost your business’s growth and efficiency. Regular check-ins and strategic planning sessions - maybe 1 to 3 times a year - can take your tax strategy and organizational growth to the next level. So, why not start planning today?

Navigate Challenges: Avoiding Common Pitfalls in Bonus Depreciation

Bonus write-offs can be a great way to snag some tax advantages, but small business owners need to watch out for common pitfalls. One big mistake? Not keeping enough documentation for acquisitions, which can make audits a real headache. It’s super important to keep precise records - think invoices and service dates - so you’re covered when it counts.

Another thing to keep in mind is misclassifying property. Not every asset qualifies for those bonus write-offs, and getting it wrong can mean losing out on deductions. Plus, some owners might decide to skip the bonus write-offs without really understanding the long-term impact, which could cost them some serious tax savings down the line.

To steer clear of these risks, it’s a good idea for business owners to:

- Stay informed about tax law changes

- Chat with tax pros

- Really get to know the rules regarding bonus depreciation by year

Did you know that audit challenges often pop up because of documentation errors? That’s why keeping meticulous records is a must!

And here’s a little food for thought: case studies show that businesses frequently miss out on deductions due to documentation slip-ups. So, taking a proactive approach to asset documentation isn’t just smart - it’s essential!

Conclusion

Maximizing tax savings through bonus depreciation is a fantastic strategy for small businesses. Thanks to the recent changes from the One Big Beautiful Bill Act, companies can now deduct 100% of qualifying asset costs in the year they’re put into service. This can really boost cash flow and help with tax planning! As we look ahead to the effective date in 2025, understanding and leveraging this benefit can lead to some serious financial perks.

Throughout this article, we’ve shared key insights on:

- Who qualifies for bonus depreciation

- Why proper documentation is essential

- How to make the most of these benefits

It’s worth noting that both new and used property can qualify, as long as they meet certain conditions. Plus, a little proactive planning - like timing your acquisitions with the effective date and chatting with tax pros - can really enhance your chances of maximizing these write-offs.

With the potential for significant tax savings and the positive impact on business growth, it’s super important for small business owners to stay informed and ready. By getting a handle on the ins and outs of bonus depreciation and steering clear of common pitfalls - like misclassifying assets or not having enough documentation - you can make sure you’re not leaving any money on the table. So, why wait? Taking action now to implement these strategies will not only optimize your tax savings but also pave the way for long-term financial success!

Frequently Asked Questions

What is bonus depreciation?

Bonus depreciation is a tax benefit that allows companies to deduct a significant portion of the cost of qualifying assets in the year they begin using them.

What does the One Big Beautiful Bill Act (OBBBA) provide regarding bonus depreciation?

The OBBBA allows businesses to claim a 100% bonus depreciation for eligible property that is acquired and put into service after January 19, 2025.

How does bonus depreciation affect taxable income?

Bonus depreciation enables businesses to take the full deduction for qualifying assets immediately, which can significantly lower their taxable income for that year.

Why is bonus depreciation particularly beneficial for small business owners?

It provides immediate tax relief and encourages investment in new equipment or property, which can enhance their financial position.

How much did companies use bonus write-offs from 2018 to 2022?

Companies used bonus write-offs to deduct a total of $2.7 trillion during that period.

What percentage of bonus depreciation deductions came from large corporations?

Over 80% of the deductions came from corporations with more than $1 billion in gross receipts.

How much bonus depreciation was recorded across all industries for the tax year 2022?

The total bonus depreciation across all industries for the tax year 2022 was $628.4 billion.

How can understanding bonus depreciation benefit small businesses as they prepare for 2026?

Understanding bonus depreciation can lead to significant tax savings and improved cash flow, making it an important aspect of financial strategy.