Introduction

Navigating the complex world of taxes can feel pretty overwhelming, especially for rural business owners who have their own set of unique challenges. But here’s the good news: getting the right CPA assistance can make tax compliance a whole lot easier and even lead to some nice financial perks. So, with all the options out there, how do you figure out which CPA is the best fit for your specific needs and goals?

This guide is here to help! We’ll walk you through a step-by-step approach to:

- Identify your tax requirements

- Evaluate potential CPAs

- Build a partnership that sets you up for long-term success

Let’s dive in!

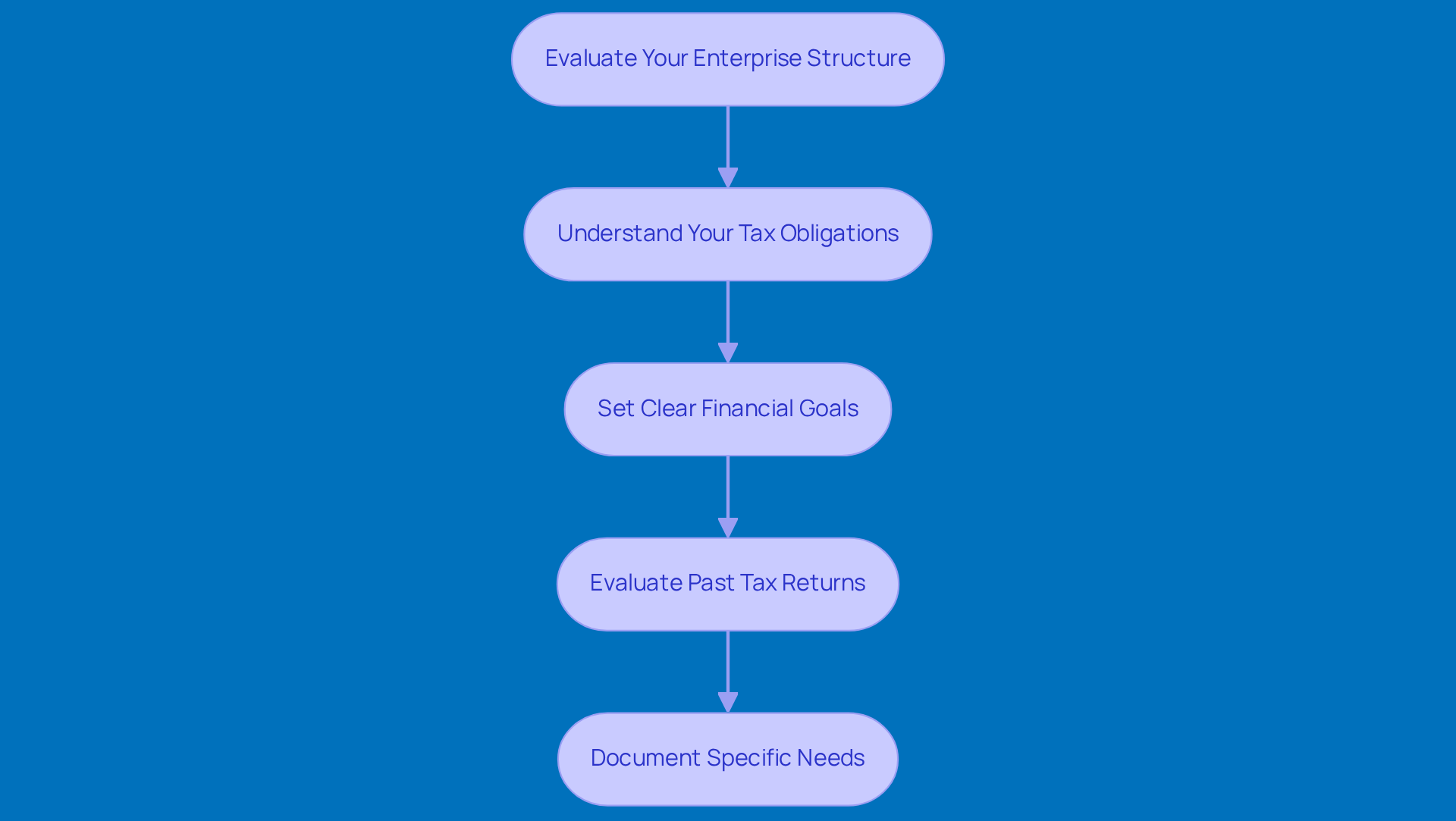

Identify Your Tax Needs and Goals

-

Evaluate Your Enterprise Structure: First things first, let’s figure out how your business is set up. Are you a sole proprietor, in a partnership, running an LLC, or maybe a corporation? This choice really shapes your tax responsibilities and the perks you might enjoy.

-

Understand Your Tax Obligations: Now, it’s time to get a grip on your tax duties. You’ll want to know what federal, state, and local taxes apply to your business type. Think income tax, sales tax, and employment taxes - these are crucial for staying compliant and planning your finances. And hey, the IRS might come knocking for audits, whether it’s to check facts or fix errors, so keeping your records straight is key. Audits can vary: some are just a few letters back and forth, while others might require you to show up in person or even have a thorough check at your place.

-

Set Clear Financial Goals: Let’s talk about your financial dreams! What do you want to achieve? Maybe it’s cutting down on taxes, boosting your cash flow, or gearing up for future investments. Setting clear goals can really steer your tax strategy and with CPA help with taxes, help you make smart decisions.

-

Evaluate Past Tax Returns: Take a look back at your previous tax returns. What patterns do you see? Are there deductions or credits you might be missing out on now? This little review can uncover some golden opportunities for tax savings and offer CPA help with taxes to shape your future strategies. And don’t forget to keep copies of your returns and any supporting documents for at least three years - longer if your situation calls for it.

-

Document Specific Needs: Lastly, jot down any unique situations that could impact your tax strategy. Maybe your income changes with the seasons, or you’re transitioning a family business. Knowing these details is super important for customizing your tax compliance and planning approach.

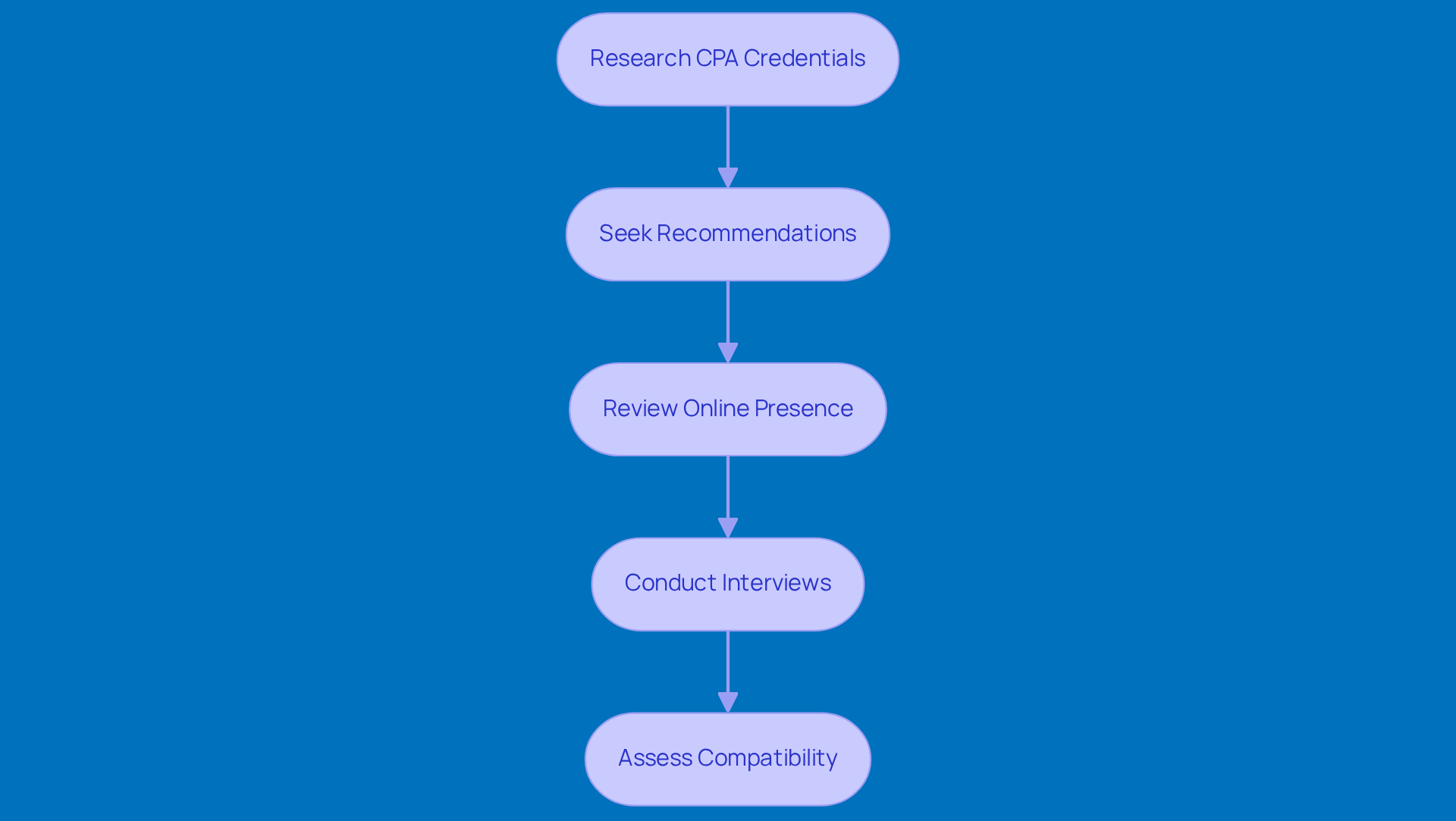

Evaluate Potential CPAs Based on Expertise and Fit

-

Research CPA Credentials: Start by looking for CPAs who have solid certifications like CPA or EA. It’s especially helpful if they’ve got experience in rural industries. Their know-how is key when it comes to navigating the tricky tax regulations that affect small businesses, and they often seek cpa help with taxes for assistance.

-

Seek Recommendations: Don’t hesitate to reach out to your local network! Ask fellow entrepreneurs for referrals to CPAs they trust. Personal recommendations can really help you find professionals who get the unique challenges that rural businesses face.

-

Review Online Presence: Take some time to check out the CPA’s website and read online reviews. This will give you a good sense of their expertise and how satisfied their clients are. Look for testimonials that highlight their experience with rural businesses and the specific tax issues relevant to your industry.

-

Conduct Interviews: Set up some initial chats with potential CPAs to talk about your specific needs and how they approach tax planning. This conversation is super important for determining how they can provide cpa help with taxes to assist you in meeting your goals and managing your tax responsibilities effectively.

-

Assess Compatibility: Pay attention to how the CPA communicates and see if their values match your organization’s philosophy. Building a strong rapport is essential for a successful partnership, as it fosters open dialogue and trust-both of which are crucial for managing your resources effectively.

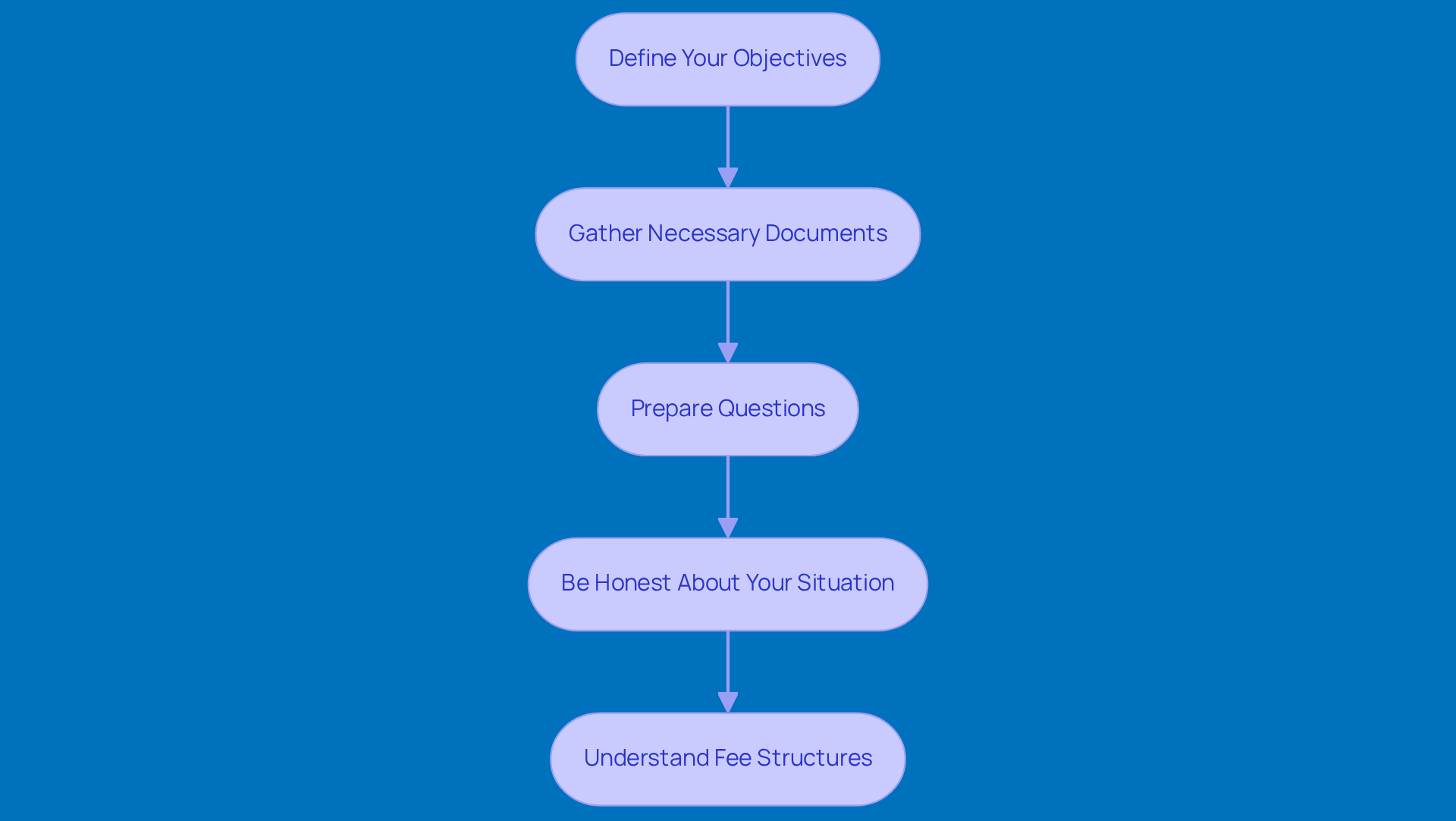

Engage Your CPA: Initial Steps and Preparation

-

Define Your Objectives: Start by clearly outlining what you want from your CPA relationship. Are you looking for CPA help with taxes, tax preparation, strategic planning, or maybe compliance assistance? Having this clarity will really guide your conversations and help your CPA tailor their services just for you.

-

Gather Necessary Documents: Before your first meeting, gather up all those essential financial documents. Think previous tax returns, profit and loss statements, bank statements, and any relevant company records. This way, the CPA can help with taxes by getting a good look at your financial health and offering you the best advice.

-

Prepare Questions: Jot down a list of questions to ask your CPA. You might want to know about their services, fee structures, or how they approach tax planning. Common questions could include strategies for tax reduction, advice on changes to your organizational structure, or insights into long-term financial planning.

-

Be Honest About Your Situation: Don’t hold back when discussing any challenges or concerns you have about your business finances. Being open allows your CPA to give you tailored advice that really addresses your specific situation and helps you tackle any potential hurdles.

-

Understand Fee Structures: Make sure you clarify how your CPA charges for their services-whether it’s hourly, a flat fee, or based on specific tasks. Knowing the fee structure upfront can save you from unexpected costs and ensure you get the services you need without breaking the bank.

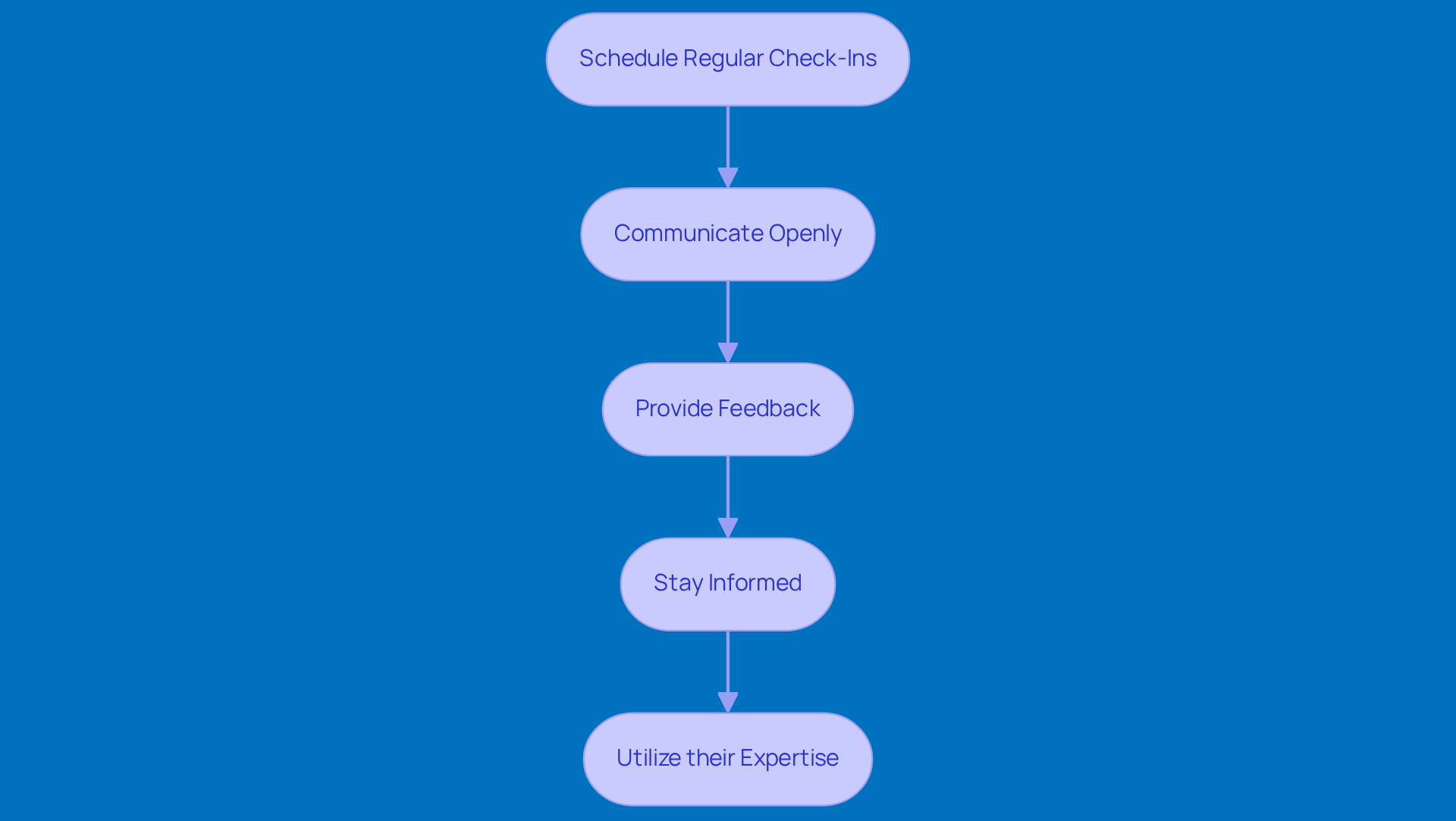

Maintain an Effective Partnership with Your CPA

-

Schedule Regular Check-Ins: It’s a good idea to set up regular meetings - think quarterly or bi-annually - to go over how your business is doing and tweak your strategies if needed. These catch-ups not only help you keep an eye on cash flow but also provide CPA help with taxes to ensure you’re on top of your tax obligations. Plus, they allow you to adjust your budget plans quickly when necessary.

-

Communicate Openly: Keep those lines of communication wide open! Share updates about your business and any changes that might affect your tax situation. This ongoing chat provides CPA help with taxes by enabling your CPA to spot potential challenges and seize opportunities, making financial management a breeze.

-

Provide Feedback: Don’t hold back on giving feedback about your CPA’s services. It’s important that they meet your expectations and adapt as your needs change. A collaborative relationship can really boost the effectiveness of their services, ensuring your CPA stays a valuable ally in your professional journey.

-

Stay Informed: Make it a point to stay updated on tax laws and regulations that could impact your business. Chat about these changes with your CPA help with taxes to ensure your tax strategies remain compliant and tailored to your specific situation.

-

Utilize their expertise: Never hesitate to ask your CPA for help with taxes, financial decisions, tax strategies, or planning for your business. Tapping into their expertise can give you valuable insights that enhance your decision-making and contribute to your business’s long-term success.

Conclusion

Understanding the ins and outs of tax obligations and getting the right CPA help is super important for rural business owners. By pinpointing their specific tax needs and goals, entrepreneurs can tackle the tricky world of tax laws with confidence. Partnering with a qualified CPA not only keeps you compliant but also helps you fine-tune financial strategies that fit the unique challenges of rural businesses.

This article lays out some essential steps for rural business owners, starting with evaluating their business structure and building a solid relationship with their CPA. Key takeaways include:

- The need to set clear financial goals

- Do your homework when choosing a CPA

- Keep the lines of communication open to nurture a collaborative partnership

By following these steps, business owners can boost their tax planning and decision-making, leading to better financial health.

In a world where tax compliance can make or break your business, taking proactive steps is a must. Rural entrepreneurs should tap into CPA expertise to navigate tax complexities, stay updated on regulatory changes, and regularly review their financial strategies. Embracing these practices not only provides immediate tax assistance but also sets the stage for sustainable growth and success down the road.

Frequently Asked Questions

How should I evaluate my enterprise structure for tax purposes?

You should determine whether your business is set up as a sole proprietor, partnership, LLC, or corporation, as this choice impacts your tax responsibilities and potential benefits.

What are my tax obligations as a business owner?

You need to understand the federal, state, and local taxes applicable to your business type, including income tax, sales tax, and employment taxes, to ensure compliance and effective financial planning.

Why is it important to keep accurate records of my taxes?

Maintaining accurate records is crucial because the IRS may conduct audits to verify information or correct errors. Audits can range from simple correspondence to in-person examinations.

How can I set clear financial goals related to taxes?

Consider what you want to achieve financially, such as reducing taxes, improving cash flow, or preparing for future investments. Clear goals can guide your tax strategy and decision-making.

What should I look for when evaluating past tax returns?

Review your previous tax returns for patterns, missed deductions, or credits. This analysis can reveal opportunities for tax savings and inform future strategies. Keep copies of your returns and supporting documents for at least three years.

What unique situations should I document that may affect my tax strategy?

Note any specific circumstances, such as seasonal income fluctuations or transitions in a family business, as these details are important for tailoring your tax compliance and planning approach.