Overview

Amending an LLC operating agreement doesn’t have to be a daunting task! First things first, you’ll want to gather everyone’s consent. Once that’s sorted, it’s time to draft some clear revisions—think of it as tidying up your agreement. And don’t forget about those pesky state regulations; they’re crucial to keep everything above board.

This article walks you through a structured process, highlighting the importance of clear documentation and open communication among members. After all, who wants disputes when you can maintain legal protection with a little teamwork? So, let’s dive in and make this process as smooth as possible!

Introduction

Amending an LLC operating agreement isn’t just some bureaucratic hoop to jump through; it’s a vital step that can really protect everyone involved. This important document lays out how your limited liability company is structured and how it operates, providing both clarity and legal safety.

As businesses grow and change, it often becomes necessary to tweak this agreement—whether that’s due to new members joining, shifts in management, or keeping up with fresh regulations.

So, how can LLC owners navigate the amendment process smoothly, avoiding any potential conflicts and making sure their agreement stays relevant? Let’s dive in!

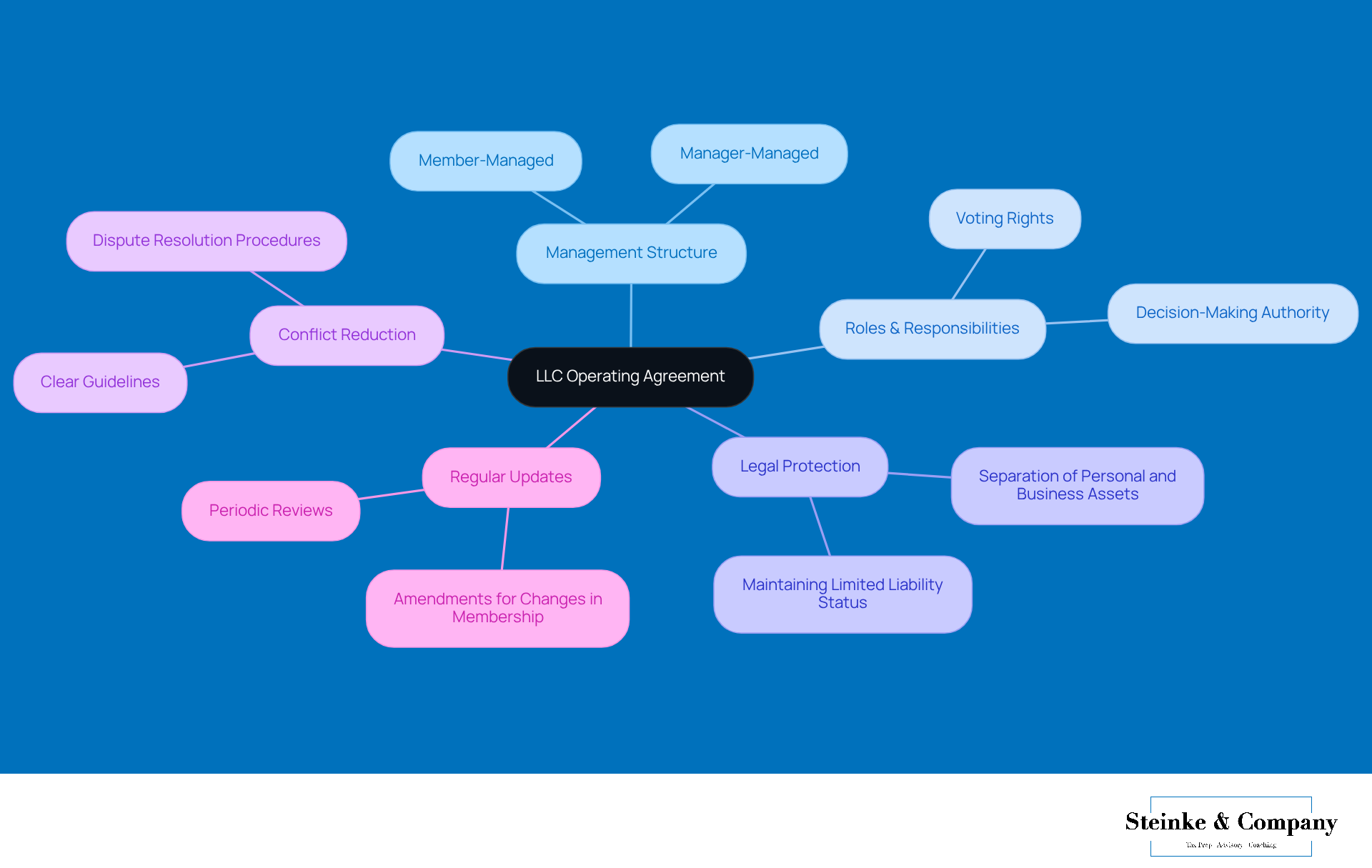

Understand the Purpose of an LLC Operating Agreement

An LLC operating agreement is a really important document that lays out how a limited liability company (LLC) runs. It explains who does what, how the management is structured, and how decisions are made. Understanding this purpose helps everyone involved stay on the same page, which can help avoid disputes and misunderstandings. Plus, it provides legal protection by clearly defining the rights and responsibilities of each participant, making sure the LLC keeps its limited liability status intact.

If your LLC has two or more participants, having this operational document becomes even more crucial. It helps reduce the chances of conflicts arising. While most states don’t require an LLC to have an operating document, not having one means your LLC will be governed solely by state laws, which might not align with what the members want. As lawyer Stephen Fishman says, having an operating document is a 'great little tool to have in place for added protection and guidance.'

It’s also super important to regularly review and update this document when amending an LLC operating agreement to reflect any changes in the business or membership. This way, the contract stays relevant and effective. Just think about it: disputes can easily arise from contracts that are vaguely defined. That’s why amending an LLC operating agreement is key to having a well-prepared document that prevents confusion and conflict. So, what’s stopping you from getting that agreement in place?

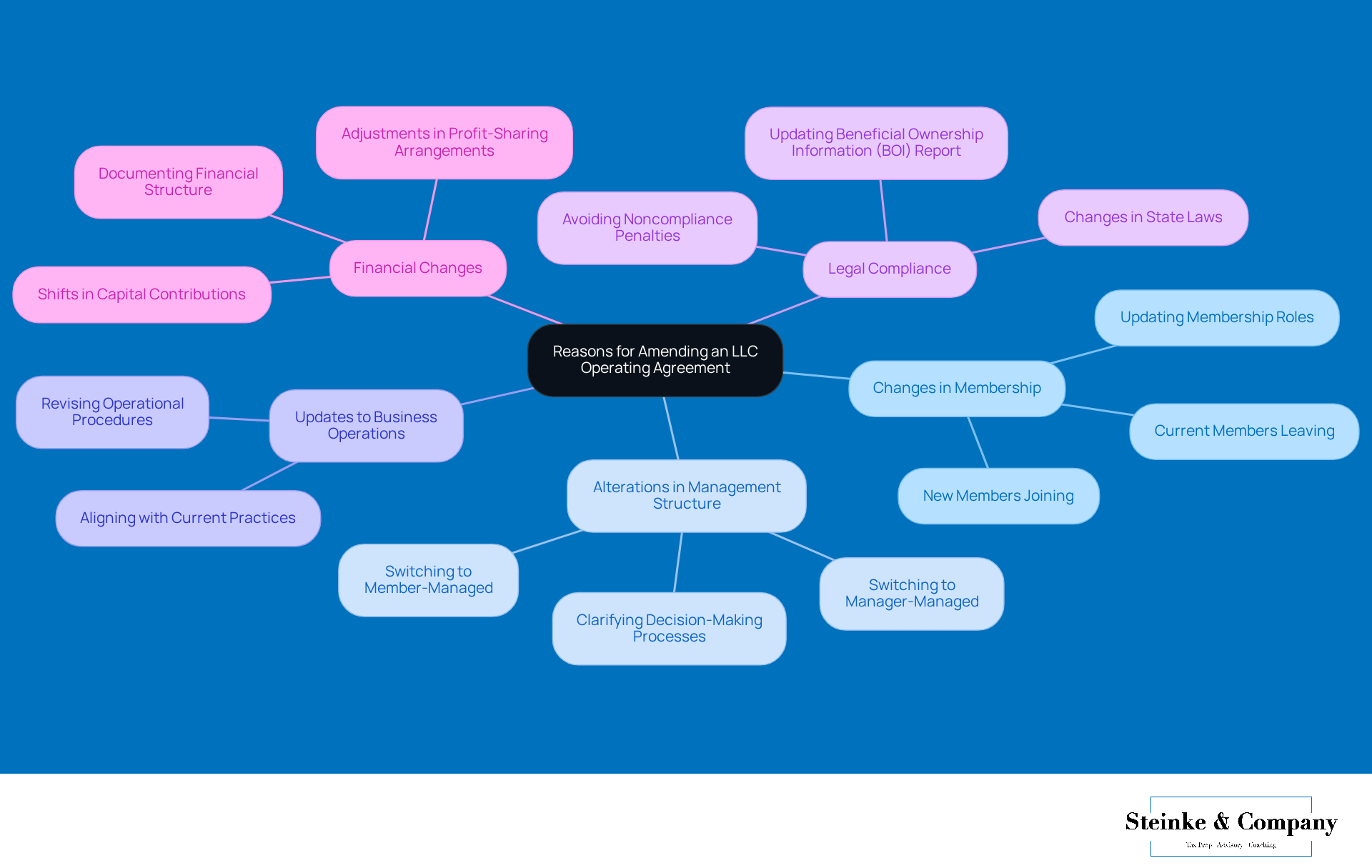

Identify Reasons for Amending Your Operating Agreement

It might be necessary to consider amending an LLC operating agreement for a few key reasons. First up, let’s talk about changes in membership. When new members join or current ones leave, it’s important to revise the document to accurately reflect these changes. This is crucial since 64% of LLCs are single-member entities, and 85% operate with just the owner as the employee. Clear membership documentation is essential here!

Next, we have alterations in management structure. If your management style shifts from member-managed to manager-managed—or vice versa—you’ll need to focus on amending an LLC operating agreement to outline the new governance framework. This keeps decision-making processes and responsibilities crystal clear.

As your business evolves, updates to business operations may also be in order. Regularly revising operational procedures helps align with current practices, ensuring you maintain efficiency and adaptability in a competitive landscape.

Don’t forget about legal compliance! Changes in state laws or regulations might require amending an LLC operating agreement to keep everything above board. Staying informed about legal requirements is vital because noncompliance can lead to some serious penalties.

Lastly, let’s discuss financial changes. Any shifts in capital contributions or profit-sharing arrangements should be documented to reflect the current financial structure of the LLC. This is especially important since 40% of LLCs generate less than $50,000 annually, and only 4% report revenues exceeding $1 million. Accurate financial documentation is key for sustainability!

Recognizing these triggers can help you maintain a productive operating arrangement by amending an LLC operating agreement that supports your LLC's growth and compliance. As Carl Breedlove wisely notes, "Changes function similarly for LLCs with S Corp election as standard LLCs," underscoring the importance of member consensus in the amendment process. And remember, consulting with a legal professional when drafting amendments is always a smart move to ensure compliance and clarity.

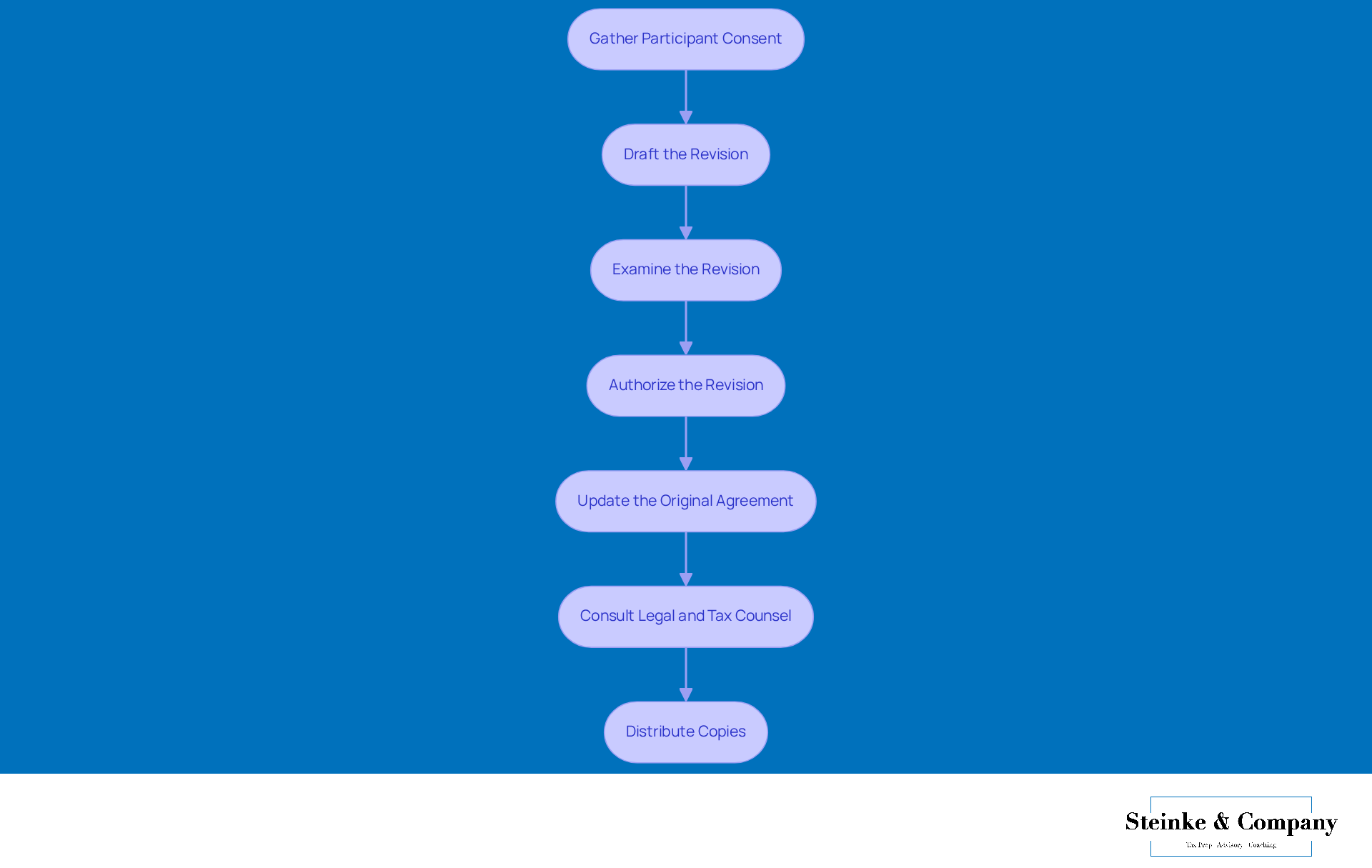

Follow the Steps to Amend Your LLC Operating Agreement

To effectively amend your LLC operating agreement, follow these friendly steps:

-

Gather Participant Consent: First things first—make sure everyone is on board with the proposed changes! This might mean holding a formal vote or getting written consent, depending on what your current agreement says. For example, if you have a five-member LLC, you might need a supermajority of 66% for certain changes, which means at least three members need to vote yes. Don’t forget to document this process properly to avoid any disputes later on!

-

Draft the Revision: Next up, prepare a clear revision document that outlines the changes being made. Be sure to include the effective date of the revision and reference the specific sections of the original contract that are being altered. For instance, you might change the profit distribution formula from equal shares to a structure based on capital contributions.

-

Examine the Revision: Allow all members to take a look at the revision to ensure everyone understands and agrees with the proposed changes. This step is super important for avoiding future conflicts—after all, we’ve all seen how spoken arrangements can lead to confusion. Keeping a clear record of changes helps prevent misunderstandings.

-

Authorize the Revision: Once everyone agrees, have each individual sign off on the revision document. This formalizes the changes and makes sure all members are on the same page with the new terms.

-

Update the Original Agreement: Now, it’s time to attach the modification to the original operating agreement or incorporate the changes directly into the document. This way, the modification becomes part of your official record.

-

Consult Legal and Tax Counsel: It’s always a good idea to check in with legal and tax counsel when drafting amendments. They can help ensure that you’re complying with state laws and aligning with your tax goals.

-

Distribute Copies: Finally, make sure to provide all participants with updated copies of the operating agreement. This way, everyone has access to the most current version. Keeping things transparent helps everyone stay informed about their rights and responsibilities.

By following these steps for amending an LLC operating agreement, you’ll ensure that your changes are legally binding and clearly communicated among all members, which helps to protect the integrity of your LLC's operations.

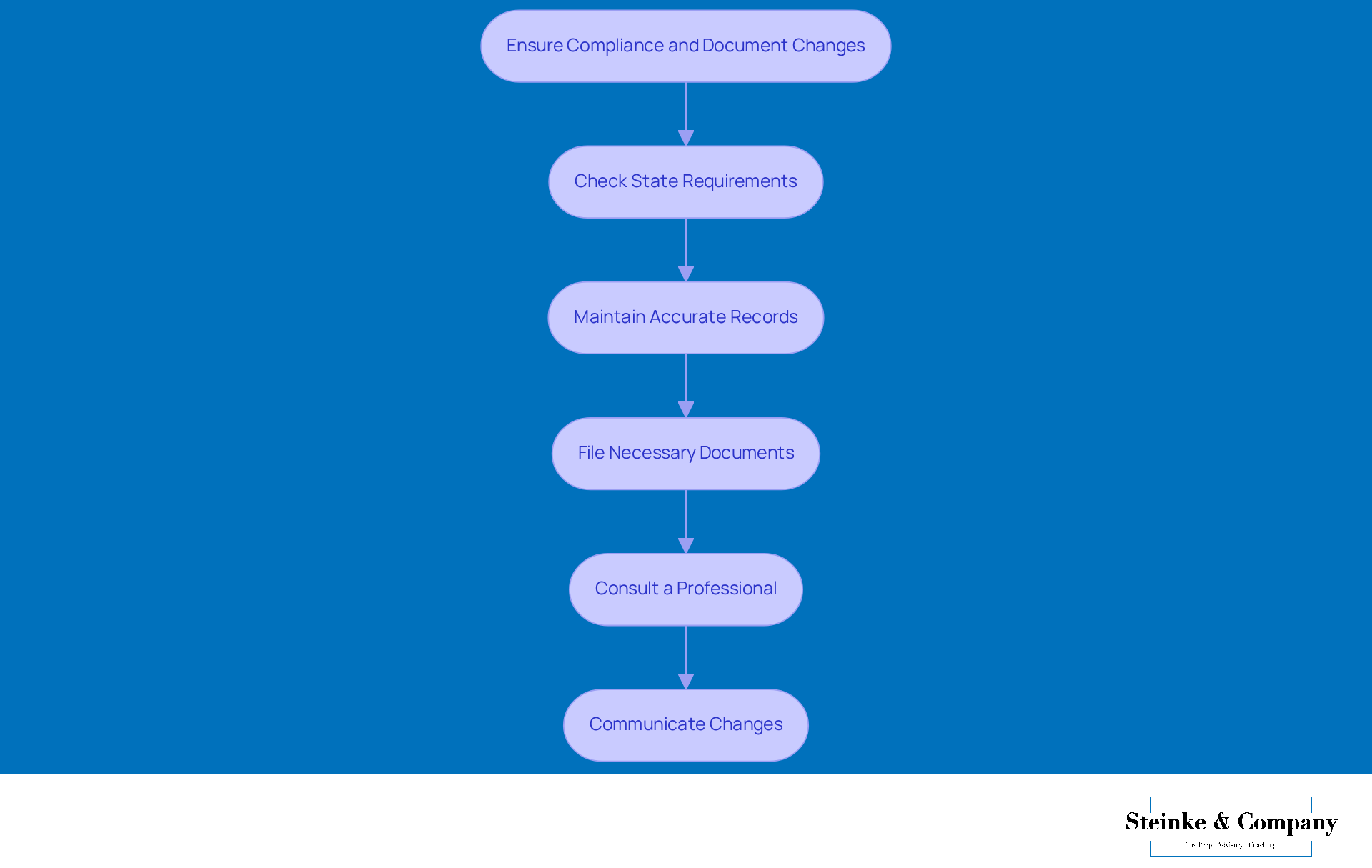

Ensure Compliance and Document Changes Properly

To keep your amended operating agreement in line with the rules and ensure everything's documented properly, here are some steps to consider:

-

Check State Requirements: Take a moment to review your state’s regulations regarding LLC operating documents. It’s essential to make sure that your changes meet any specific legal requirements when amending an llc operating agreement. For instance, states like California, New York, and Delaware insist on written contracts, while others might have different rules.

-

Maintain accurate records by always keeping a copy of the original operating agreement along with any amendments made during the process of amending an llc operating agreement. This practice helps create a clear historical record of changes, which is super important for transparency and legal protection. Plus, remember that all modifications, particularly amending an llc operating agreement, need to be documented in writing, as required by the new Act.

-

File Necessary Documents: If your state requires you to submit changes to the Secretary of State or other regulatory bodies, make sure to get this done promptly. Some states have strict deadlines for these filings, so acting quickly is key.

-

If you’re feeling uncertain about the legal implications of amending an llc operating agreement, it might be a good idea to consult a professional, such as a legal expert or a business consultant. Their insights can help you navigate state-specific requirements and ensure your amendments are compliant and protect your interests.

-

Communicate Changes: Don’t forget to inform all stakeholders, including employees and partners, about the updates to the operating contract. Clear communication is vital to ensure everyone is on the same page and understands their roles and responsibilities when amending an llc operating agreement.

By following these friendly guidelines, you can keep your LLC compliant and ensure all changes are documented properly, safeguarding the interests of everyone involved.

Conclusion

Amending an LLC operating agreement is super important! It keeps your document relevant and in tune with how your business is doing. When LLC members understand why this agreement matters and the need to keep it updated, they can dodge potential disputes and maintain a clear path for decision-making and responsibilities.

So, why should you think about amending your operating agreement? Well, changes in membership, management structure, business operations, legal compliance, and financial arrangements are all key reasons. Each of these points shows why it’s essential to take a proactive approach to your LLC’s internal governance. By following a simple process—gathering consent, drafting revisions, and ensuring compliance—you can really strengthen the integrity of the agreement and protect everyone’s interests.

Staying on top of amendments not only creates a cooperative business vibe but also helps keep your LLC’s legal standing intact. By making regular reviews and updates a priority, you ensure your operating agreement grows with your business, reinforcing its foundation for success and compliance. Taking these steps now can truly make a big difference in the long-term health and stability of your LLC. So, why not start today?

Frequently Asked Questions

What is the purpose of an LLC operating agreement?

An LLC operating agreement outlines how a limited liability company (LLC) operates, detailing roles, management structure, and decision-making processes. It helps ensure all participants are aligned, reduces disputes, and provides legal protection by defining rights and responsibilities.

Is an LLC operating agreement required by law?

Most states do not require an LLC to have an operating agreement. However, without one, the LLC will be governed solely by state laws, which may not reflect the members' preferences.

Why is having an operating agreement important for LLCs with multiple participants?

For LLCs with two or more participants, an operating agreement is crucial as it helps minimize the chances of conflicts and ensures that all members understand their roles and responsibilities.

How often should an LLC operating agreement be reviewed and updated?

It is important to regularly review and update the operating agreement to reflect any changes in the business or membership, ensuring that the document remains relevant and effective.

What can happen if an LLC operating agreement is vague or poorly defined?

Vague or poorly defined contracts can lead to disputes among members. A well-prepared operating agreement helps prevent confusion and conflict by clearly outlining the terms and conditions of the LLC's operation.