Introduction

If you’re in the software development game, understanding the financial landscape is key to thriving in today’s competitive market. There’s a lot at stake, especially when it comes to the potential tax benefits tied to these costs. Figuring out how software development costs are treated for tax purposes can really make a difference for your organization’s bottom line. But with tax regulations constantly changing, how can you make sure you’re not just compliant but also getting the most out of your deductions?

In this article, we’re diving into the nitty-gritty of software development expenses. We’ll share insights on effective reporting, explore potential tax implications, and discuss strategies to optimize your tax benefits, especially with the latest legislative changes in mind. So, let’s get started!

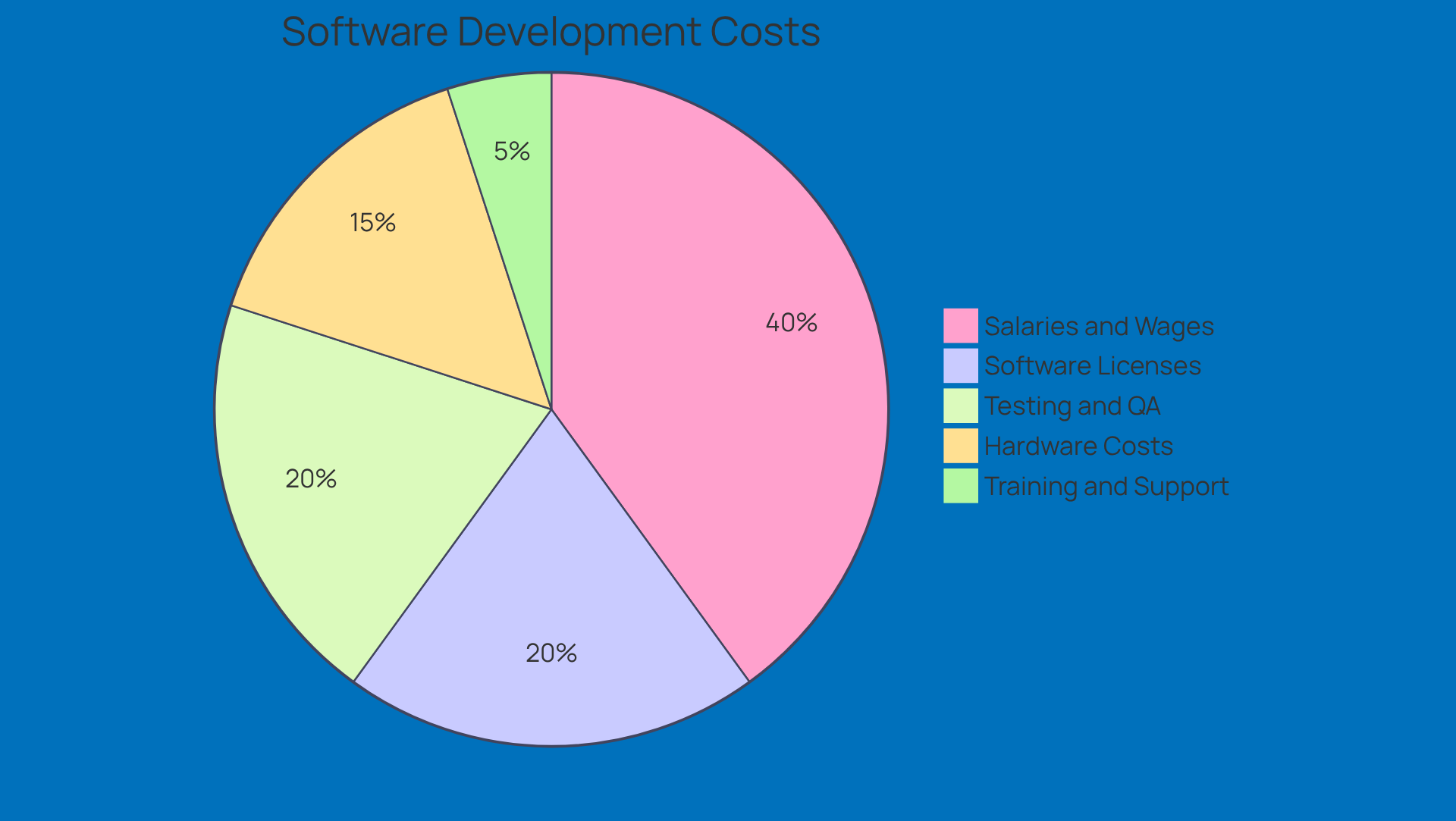

Define Software Development Costs and Their Components

Creating an app comes with a variety of costs that pop up throughout its lifecycle. Let’s break down some key components:

- Salaries and Wages: This covers the paychecks for developers, project managers, and anyone else directly involved in the software development process. In 2026, programmers in the U.S. are expected to earn between $120,000 and $150,000 a year. That’s a reflection of just how high the demand is for skilled pros in this field!

- Software Licenses: Getting the right software tools and licenses can really impact your budget. Licensing fees for essential tools can add up quickly, sometimes costing thousands more than you planned.

- Hardware Costs: Don’t forget about the hardware! Servers, computers, and other tech essentials can set you back quite a bit. Depending on your project’s scale and tech stack, you might spend anywhere from $5,000 to $20,000 on hardware.

- Testing and Quality Assurance: Making sure your software meets quality standards before it goes live is crucial. This can take up 15-25% of your total project budget, which shows just how important thorough testing is. Plus, annual maintenance can also eat up another 15-25% of your initial budget, so keep that in mind!

- Training and Support: Educating your team on new applications and providing ongoing support is key to a smooth rollout. Many organizations set aside 10-15% of their overall budget for training and support to ensure everyone’s on the same page and can use the system effectively.

Understanding software development costs tax treatment is crucial for accurately tracking expenses and maximizing potential tax benefits. As Mindpath points out, knowing what to expect can help organizations stay competitive and make smarter decisions. Plus, breaking projects into smaller tasks can really help with budgeting. By keeping an eye on all these costs, companies can navigate the complexities of tax regulations related to software development costs tax treatment much more effectively.

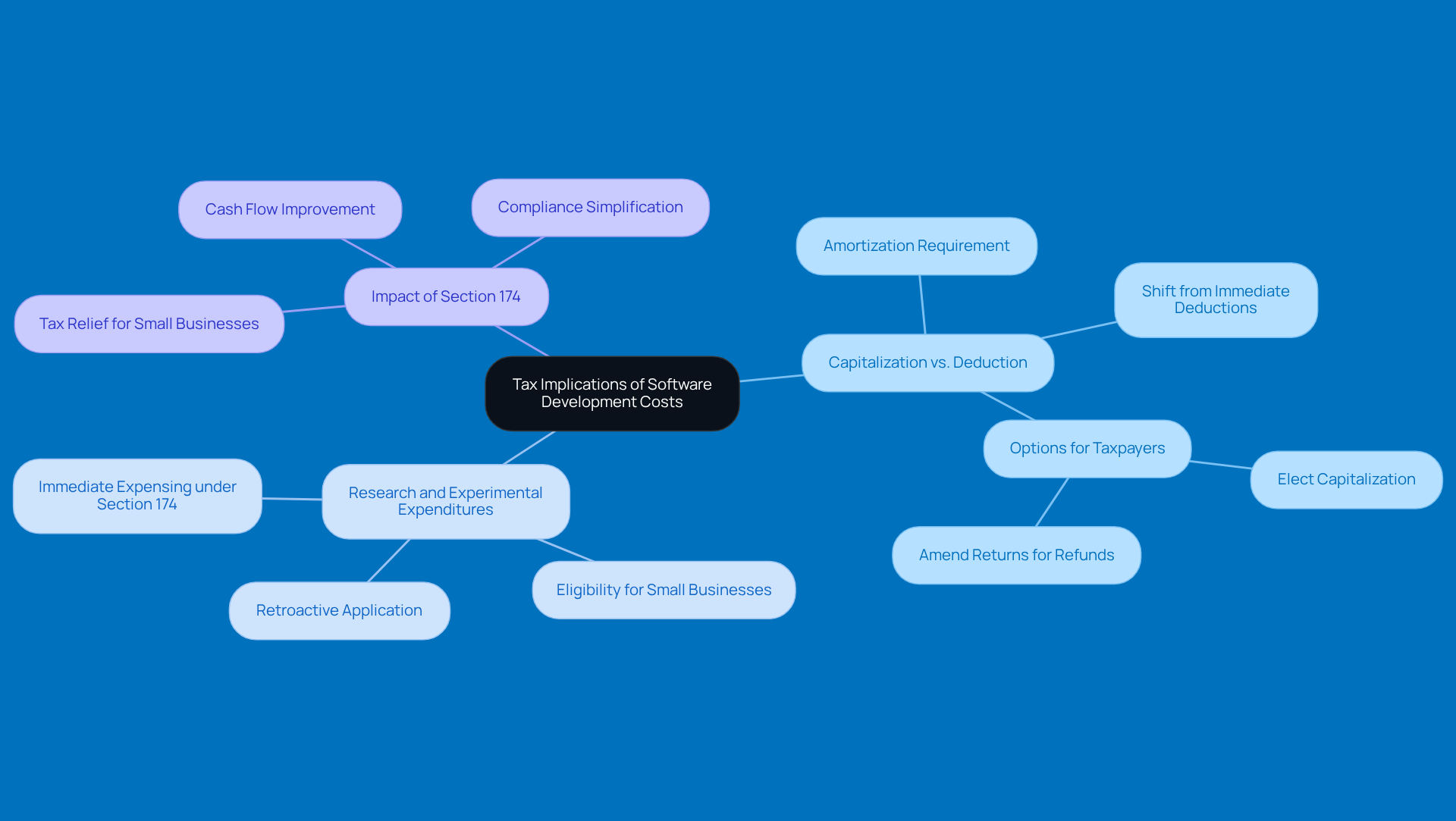

Explore Tax Implications of Software Development Costs

The software development costs tax treatment associated with program creation expenses has seen some big changes lately, especially with the new laws coming into play. Let’s break down a few key points:

- Capitalization vs. Deduction: These days, tax rules usually require that programming expenses be capitalized and then amortized over five years for domestic costs. This is a shift from the old rules that allowed for immediate deductions, making things a bit trickier for businesses.

- Research and Experimental (R&E) Expenditures: Some of those program creation costs might actually qualify as R&E expenditures. This means you can expense them right away under Section 174 of the One Big Beautiful Bill Act (OBBBA), starting in 2025. This is especially great news for small businesses diving into innovative projects.

- Impact of Section 174: Thanks to Section 174, businesses can now deduct domestic programming expenses in the year they incur them. This is a game-changer for tax relief, helping small businesses boost cash flow and reinvest in their operations more effectively.

Understanding the implications of software development costs tax treatment is crucial for smart tax planning and compliance, especially as businesses navigate the ever-changing tax landscape. Here at Steinke and Company, we like to meet 1-3 times a year to go over your tax return or current books, spot any missed opportunities, and lay out a clear strategy to lighten your tax load and help your business grow. Consulting with our qualified tax advisors can really help you tackle these complexities and craft a plan that fits your business goals.

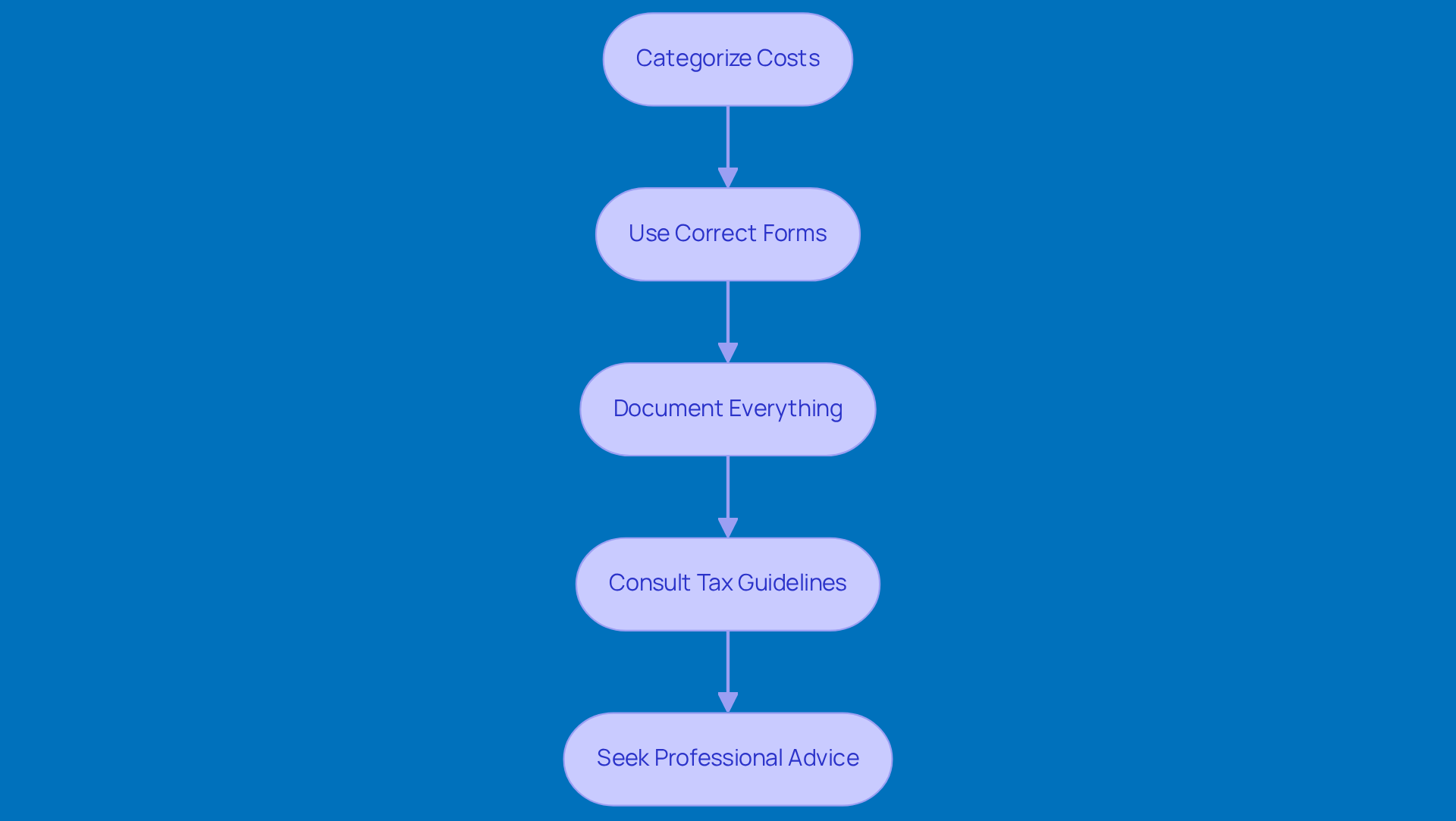

Report Software Development Costs on Tax Returns

When it comes to reporting software development costs on your tax returns, small business owners should follow these simple steps:

-

Categorize Costs: Start by clearly classifying all your development expenses into distinct categories, like salaries, licenses, and hardware. This organization not only helps in accurate reporting but also keeps you compliant with tax regulations.

-

Use Correct Forms: Make sure you’re using the right tax forms for reporting these costs. For instance, Form 4562 is usually required for the depreciation and amortization of digital assets. It’s a good idea to double-check!

-

Document Everything: Keep thorough records of all costs tied to your application creation. This means saving invoices, contracts, and payroll records - these documents are crucial for backing up your claims.

-

Consult Tax Guidelines: Regularly check in with IRS guidelines and your state’s tax regulations to stay on top of reporting requirements. Keeping updated on these rules is key to staying compliant.

-

Seek Professional Advice: Don’t hesitate to reach out to a tax professional. They can help you navigate the complexities of reporting requirements and maximize your potential deductions. Their expertise can really make a difference in optimizing your tax strategies.

Accurate reporting not only keeps you compliant but also enhances the software development costs tax treatment, helping you take full advantage of available tax benefits. So, why not get started today?

Maximize Tax Benefits from Software Development Costs

Do you want to make the most of your tax benefits from the software development costs tax treatment? Here are some friendly strategies to consider:

- Leverage R&D Tax Credits: If your software development qualifies as R&D, don’t forget to claim that R&D tax credit! It can really help offset those costs.

- Utilize Section 179 Deductions: For certain program purchases, think about using Section 179 to deduct the full cost in the year you buy it. Why spread it out over years when you can take it all at once?

- Keep Detailed Records: Make sure to keep meticulous records of all your programming expenses. This way, you can back up your claims for deductions and credits without a hitch.

- Consult with a Tax Professional: It’s a good idea to regularly chat with a tax advisor. They can keep you in the loop about changes in tax laws and help you spot new opportunities for savings.

- Plan for Future Projects: When you’re planning your software development projects, think strategically. Timing your expenditures can help you maximize deductions in those favorable tax years.

By implementing these strategies, you could see some substantial tax savings related to software development costs tax treatment, which can really boost your agency's profitability. So, why not give it a shot?

Conclusion

Understanding how software development costs are taxed is super important for agencies trying to manage their budgets and stay compliant. By breaking down the different parts of software development expenses - from salaries and hardware to testing and training - organizations can get a clearer view of their financial situation and fine-tune their tax strategies.

This article shares some key insights, like:

- Why it matters to capitalize versus deduct software development expenses

- What recent tax law changes mean for you

- How R&D tax credits can be a game changer

It really highlights the need for accurate reporting and keeping good records to ensure compliance and make the most of available deductions. Plus, chatting with tax professionals is a must for businesses looking to boost their financial strategies and tap into tax benefits.

In a tax landscape that’s always changing, staying informed and proactive can really make a difference for an agency’s bottom line. By putting into practice the strategies we’ve discussed - like leveraging R&D credits and using Section 179 deductions - businesses can lighten their tax load and reinvest in future projects. Embracing these practices will help agencies not just survive but thrive in a competitive environment, all while maximizing their software development investments.

Frequently Asked Questions

What are the main components of software development costs?

The main components of software development costs include salaries and wages, software licenses, hardware costs, testing and quality assurance, and training and support.

How much can salaries and wages for software developers range in the U.S. by 2026?

Salaries for programmers in the U.S. are expected to range between $120,000 and $150,000 a year in 2026.

What impact do software licenses have on the budget?

Software licenses can significantly impact the budget, as licensing fees for essential tools can add up quickly, sometimes costing thousands more than initially planned.

What are the expected hardware costs for software development?

Hardware costs can vary widely depending on the project's scale and tech stack, potentially ranging from $5,000 to $20,000.

How much of the total project budget should be allocated to testing and quality assurance?

Testing and quality assurance can take up 15-25% of the total project budget, highlighting the importance of thorough testing.

What percentage of the budget is typically set aside for training and support?

Many organizations allocate 10-15% of their overall budget for training and support to ensure effective use of new applications.

Why is understanding software development costs and their tax treatment important?

Understanding software development costs and their tax treatment is crucial for accurately tracking expenses and maximizing potential tax benefits, helping organizations stay competitive and make smarter decisions.

How can breaking projects into smaller tasks assist with budgeting?

Breaking projects into smaller tasks can help with budgeting by allowing companies to keep a closer eye on costs and navigate the complexities of tax regulations related to software development.