Introduction

Getting a grip on business structures is super important for entrepreneurs who want to streamline their operations and manage their taxes better. If you're thinking about converting your LLC to a C Corporation, there are some exciting opportunities and a few challenges to keep in mind - especially when it comes to tax implications that could really shape your business's financial future. As you navigate this transition, you might find yourself wondering about:

- Double taxation

- Regulatory requirements

- The perks of having a more formal corporate setup

So, what should you think about to tackle these complexities and make smart choices for your growth?

Differentiate Between LLC and C Corporation Structures

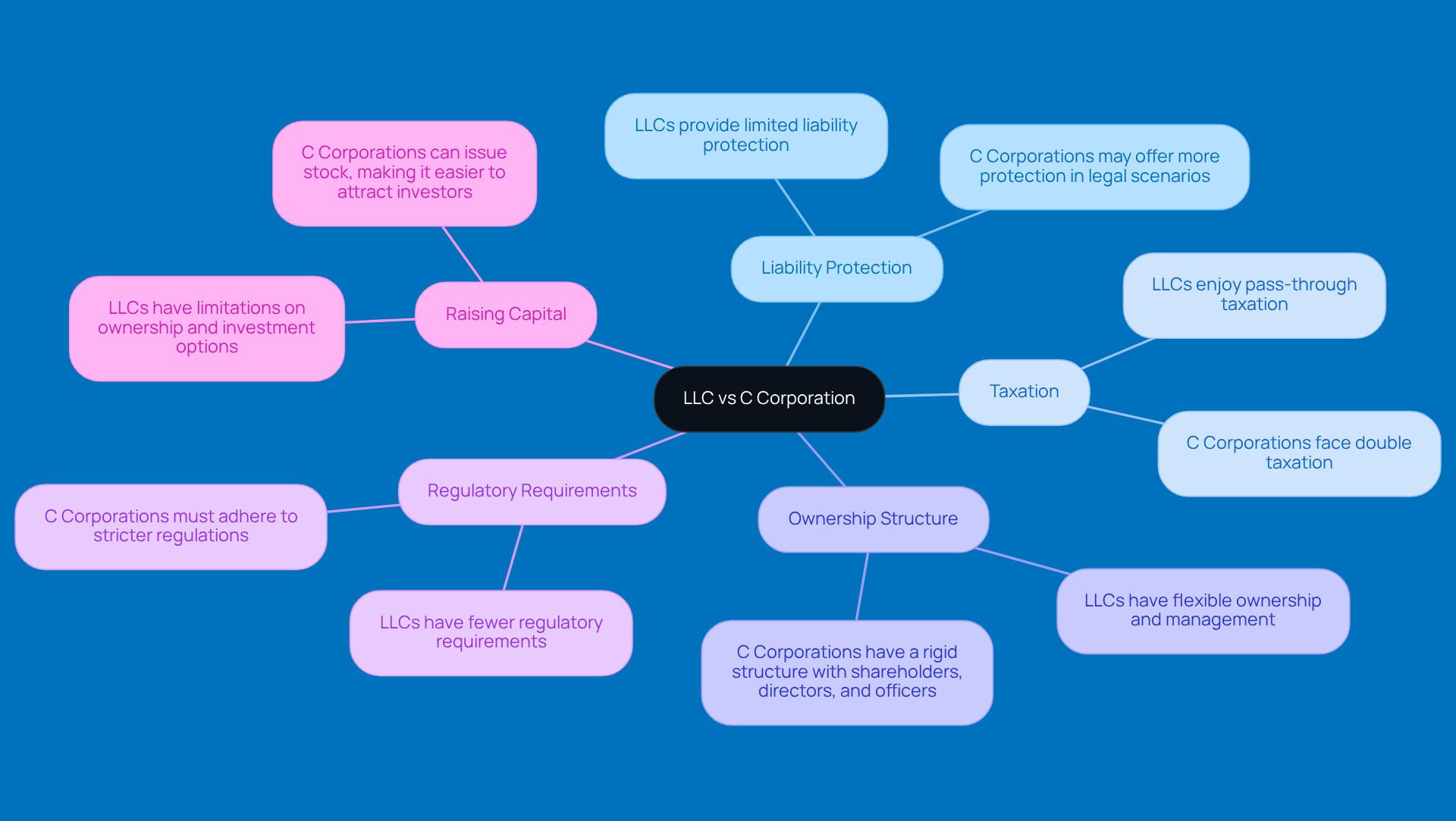

Are you considering the tax consequences of converting LLC to C Corporation? Let’s break down the key differences between these two business structures in a way that’s easy to digest:

-

Liability Protection: Both LLCs and C Corporations offer limited liability protection, which means you’re generally not on the hook for business debts. But here’s the kicker: C Corporations might give you a bit more protection in certain legal scenarios.

-

Taxation: LLCs enjoy pass-through taxation, which means profits are taxed at the individual level-no double taxation here! On the flip side, C Corporations face double taxation: the company pays taxes on its profits, and then shareholders pay taxes on any dividends they receive. Ouch!

-

Ownership Structure: LLCs are pretty flexible when it comes to ownership and management. C Corporations, however, have a more rigid structure with shareholders, directors, and officers. It’s like the difference between a casual get-together and a formal dinner party.

-

Regulatory Requirements: C Corporations have to jump through more hoops with stricter regulatory requirements, like holding regular board meetings and keeping detailed records. LLCs, on the other hand, have a more laid-back approach to these things.

-

Raising Capital: If you’re looking to attract investors, C Corporations can issue stock, making it easier to raise capital. LLCs, however, have some limitations on ownership and investment options.

For entrepreneurs, understanding the tax consequences of converting LLC to C Corporation is extremely important. It helps you figure out if making the leap to a C Corporation fits with your long-term goals. So, what do you think? Is it time to explore your options?

Explore Tax Implications of Conversion

Switching from an LLC to a C Corporation can feel like a big leap, and it definitely involves tax consequences of converting LLC to C Corporation that you’ll want to navigate carefully. But don’t worry-getting expert guidance can help make this process a lot smoother and less stressful!

-

Double Taxation: One of the biggest concerns here is double taxation. C Corporations face taxes at the corporate level, and then any dividends paid out to shareholders get taxed again at the individual level. This can lead to a heftier tax bill compared to pass-through entities like LLCs.

-

Potential Tax Benefits: On the flip side, C Corporations can tap into some pretty valuable tax benefits, like the Qualified Small Business Stock (QSBS) exclusion. If you hold the stock for over five years, you could save a bundle on capital gains taxes-definitely something to consider if you’re a long-term investor!

-

Tax Deductions: Another perk? C Corporations can deduct a variety of operational expenses, including employee benefits and salaries. This can really help lower their taxable income, boosting cash flow and supporting reinvestment strategies.

-

Loss Carryforwards: Unlike LLCs, C Corporations can carry forward losses to offset future taxable income. This is especially handy for companies that are gearing up for growth, as it allows them to reduce tax liabilities during profitable years.

-

State Taxes: Don’t forget about state taxes! There might be additional considerations at the state level, like franchise taxes or minimum taxes that specifically apply to C Corporations. Each state has its own rules, which can really impact the overall tax landscape for businesses.

-

Filing Requirements: You’ll also need to file IRS Form 8832 to let the IRS know you’re opting to be taxed as a corporation. Just a heads up-the effective date for this new classification can’t be more than 75 days before or 12 months after you file. Timing is key here to keep tax implications in check and stay compliant with state requirements.

It is super important for business owners to understand the tax consequences of converting LLC to C Corporation. It helps you gauge the financial impact of the conversion and craft smart tax strategies moving forward. With Steinke and Company’s expert tax preparation and planning services-covering everything from business to personal returns-you can ensure compliance and dodge any surprises, setting the stage for a successful business transition!

Implement the Conversion Process: Steps and Methods

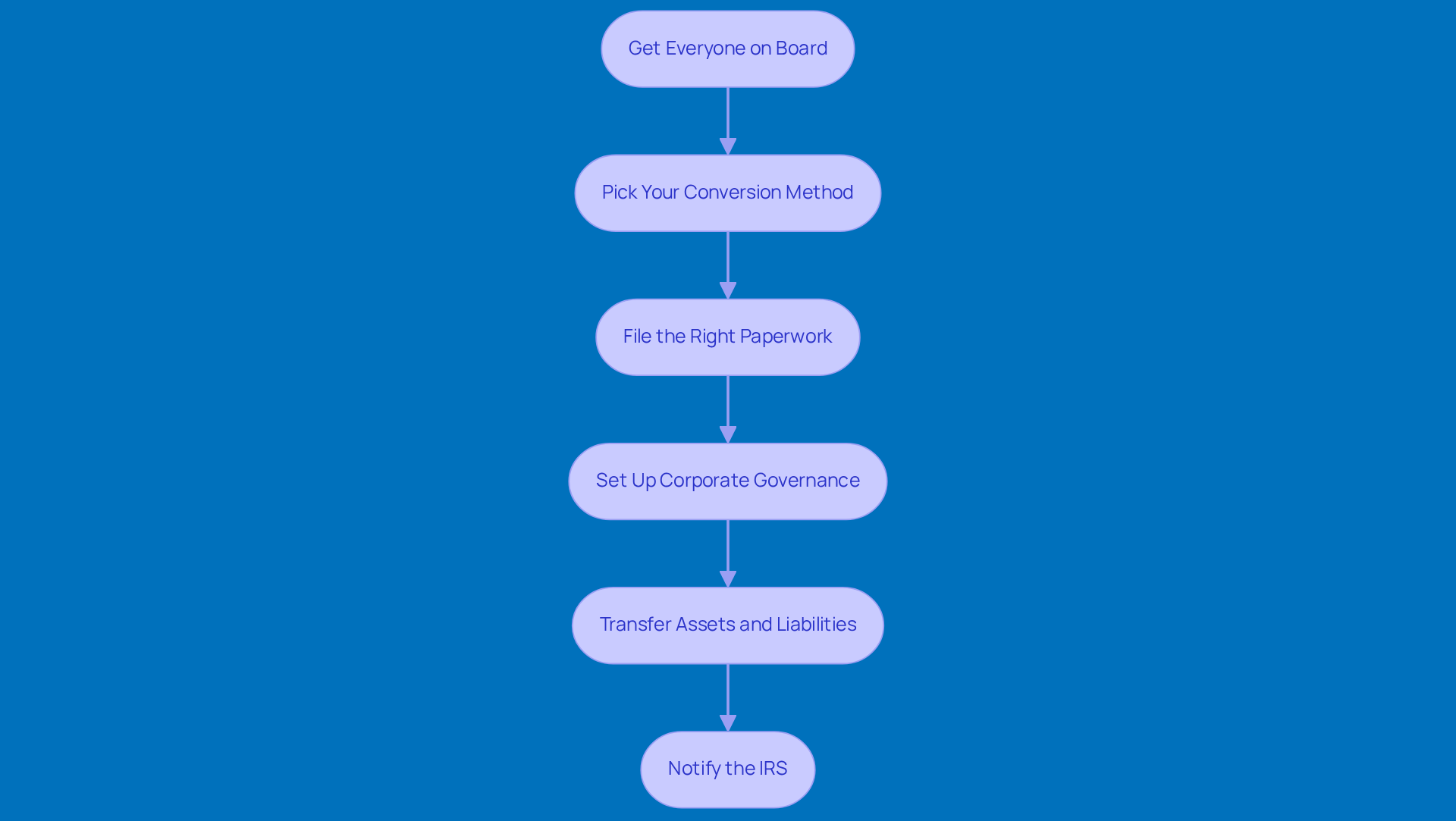

Converting your LLC to a C Corporation? Let’s break it down into some easy steps:

-

Get Everyone on Board: First things first, make sure all the members of your LLC are in agreement about the conversion. This usually means having a formal vote or getting written consent, as your operating agreement suggests. It might be a good idea to bring in some legal pros to help you navigate this and keep everything above board.

-

Pick Your Conversion Method: You’ve got a few options here:

- Statutory Conversion: This is the simplest route. Just file a certificate of conversion with the state, and you’re good to go!

- Statutory Merger: Here, your LLC merges into a brand-new C Corporation, which can make transferring assets a breeze.

- Non-Statutory Conversion: This one’s a bit trickier. You’ll need to dissolve the LLC and start a new C Company, transferring assets and liabilities manually.

-

File the Right Paperwork: You’ll need to prepare and submit some important documents to the state. This includes articles of incorporation for your new C Company and any conversion forms. Getting this right is crucial for making sure your new entity is legally recognized.

-

Set Up Corporate Governance: Time to create some bylaws and appoint directors and officers for your new corporation. This structure is key for managing operations and keeping investors happy, so make sure you’re following state laws.

-

Transfer Assets and Liabilities: Now, you’ll want to move all your assets and liabilities from the LLC to the C Company. This might involve some extra paperwork, so keep everything documented to avoid any future headaches.

-

Notify the IRS: Don’t forget to submit IRS Form 8832 to let the IRS know about your change in tax classification. This step is super important to steer clear of any tax issues down the line.

Just a heads up: when your LLC converts to a C Corporation, you should be aware of the tax consequences of converting LLC to C Corporation, as it loses that sweet pass-through taxation and will be subject to a corporate income tax rate of 21%. Additionally, the tax consequences of converting llc to c corporation include C Corporations facing double taxation-once at the corporate level and again at the shareholder level when dividends are paid out. As 1-800Accountant puts it, "The tax consequences of converting LLC to C corporation are significant steps that affect taxes, liability, and structure." By following these steps carefully, you can make a smooth transition from an LLC to a C Company, opening up new doors for growth and investment!

Understand Post-Conversion Considerations and Obligations

After you convert to a C Corporation, there are a few important things you’ll need to keep in mind:

- Ongoing Compliance: C Corporations have some pretty strict compliance requirements. You’ll need to hold regular board meetings, keep corporate minutes, and file annual reports with the state. This structured governance isn’t just red tape; it’s essential for staying legal and keeping things transparent.

- Tax Filing Requirements: You’ll also need to file Form 1120, the U.S. Company Income Tax Return, and follow corporate tax regulations, which means making estimated tax payments. The federal corporate income tax rate is a flat 21%, thanks to the Tax Cuts and Jobs Act. So, careful tax planning is key to keeping your liabilities in check. And don’t forget about those underpayment penalties from the IRS if you don’t pay enough estimated tax throughout the year. To dodge those penalties, make sure you pay at least 90% of this year’s tax liability or 100% of last year’s. Plus, using safe harbor payments and the de minimis exception can help protect you further. As Bloomberg Tax puts it, "C corporation tax planning demands a strategic, proactive approach."

- Employee Benefits and Payroll: It’s super important to review and tweak your employee benefits and payroll systems to fit your new corporate structure. This might mean changing up health insurance and retirement plans, which can really affect how happy and loyal your employees feel.

- Shareholder Communication: Keeping your shareholders in the loop about corporate performance, dividends, and any governance changes is crucial. This kind of transparency builds trust and keeps everyone engaged.

- Financial Management: Strong financial management practices are a must for tracking your corporate income and expenses. This not only helps you stay compliant with tax obligations but also maximizes potential deductions, which can really boost your corporation’s financial health. By getting a handle on estimated tax payments and underpayment penalties, including safe harbor provisions and the de minimis exception, you can sidestep unnecessary financial stress and penalties.

By keeping these post-conversion considerations in mind, you can effectively manage your new C Corporation and stay on top of all legal obligations, especially the tax consequences of converting LLC to C Corporation. This way, you’ll be setting your business up for sustainable growth!

Conclusion

Deciding to convert your LLC to a C Corporation? That’s a big step, and it comes with its fair share of tax implications and structural changes. It’s super important for business owners to really grasp what this means for their long-term goals. This shift doesn’t just change how you’re protected from liability and taxed; it also affects how you raise and manage capital.

Let’s break it down: we’re talking about differences in liability protection, taxation, ownership structure, and regulatory requirements between LLCs and C Corporations. One of the big things to keep in mind is the double taxation that C Corporations face. But hey, there are also some perks, like tax deductions and loss carryforwards that could work in your favor. Plus, we’ll go over the steps you need to take for a smooth conversion and why keeping up with compliance and financial management afterward is key.

In the end, converting from an LLC to a C Corporation isn’t a decision to take lightly. You’ll want to weigh those tax implications and operational changes carefully. Chatting with tax professionals can really help you navigate this transition, making sure it’s not just compliant but also a smart move for your future growth. So, why not take those informed steps now? It could set you up for a thriving business landscape down the road!

Frequently Asked Questions

What are the key differences between LLCs and C Corporations?

The key differences include liability protection, taxation, ownership structure, regulatory requirements, and raising capital.

How does liability protection differ between LLCs and C Corporations?

Both LLCs and C Corporations offer limited liability protection, but C Corporations may provide more protection in certain legal scenarios.

What is the taxation structure for LLCs and C Corporations?

LLCs benefit from pass-through taxation, meaning profits are taxed at the individual level without double taxation. In contrast, C Corporations face double taxation, where the company pays taxes on profits and shareholders pay taxes on dividends.

How does the ownership structure differ between LLCs and C Corporations?

LLCs have a flexible ownership and management structure, while C Corporations have a more rigid structure involving shareholders, directors, and officers.

What are the regulatory requirements for LLCs compared to C Corporations?

C Corporations have stricter regulatory requirements, such as holding regular board meetings and maintaining detailed records, whereas LLCs have a more relaxed approach.

How do LLCs and C Corporations differ in terms of raising capital?

C Corporations can issue stock, making it easier to attract investors and raise capital. LLCs have limitations on ownership and investment options, which can restrict capital raising efforts.

Why is it important for entrepreneurs to understand the tax consequences of converting from an LLC to a C Corporation?

Understanding the tax consequences helps entrepreneurs determine if converting to a C Corporation aligns with their long-term business goals.