Introduction

Understanding capital gains tax can feel like navigating a maze, especially for those managing trusts. But don’t worry, it’s crucial to grasp these details since they can really affect your financial outcomes. In this article, we’ll break down trust capital gains tax rates, look at the differences between short-term and long-term gains, and share some strategies to help you minimize those pesky tax liabilities.

As tax laws change and your personal situation evolves, how can you, as a trustee, tackle these complexities to make the most of your estate planning and leave a lasting financial legacy? Let’s dive in!

Define Capital Gains Tax and Its Relevance to Trusts

Capital profits tax is basically a tax on the money you make when you sell things like stocks, bonds, or real estate. So, when an entity sells a property and makes a profit, that profit is subject to capital gains tax. This can really affect the financial health of the organization, so it’s something to keep in mind.

Understanding the trust capital gains tax rate is crucial for both trustees and beneficiaries. It can really influence how decisions are made about managing and distributing assets. Plus, there are ways to structure entities to help minimize those trust capital gains tax rate liabilities. That’s why it’s crucial for anyone involved in managing an entity to get a good grasp on these tax implications.

And hey, don’t forget to regularly check and update your will! Tax laws change, and so do personal situations. Life events like getting married, moving, or seeing a big change in your asset value can make your estate planning documents outdated. This could impact your tax liabilities and how your assets are distributed. So, keeping your estate planning documents up-to-date is essential for effectively managing the trust capital gains tax rate within trusts.

Explore Trust Capital Gains Tax Rates: Short-Term vs. Long-Term

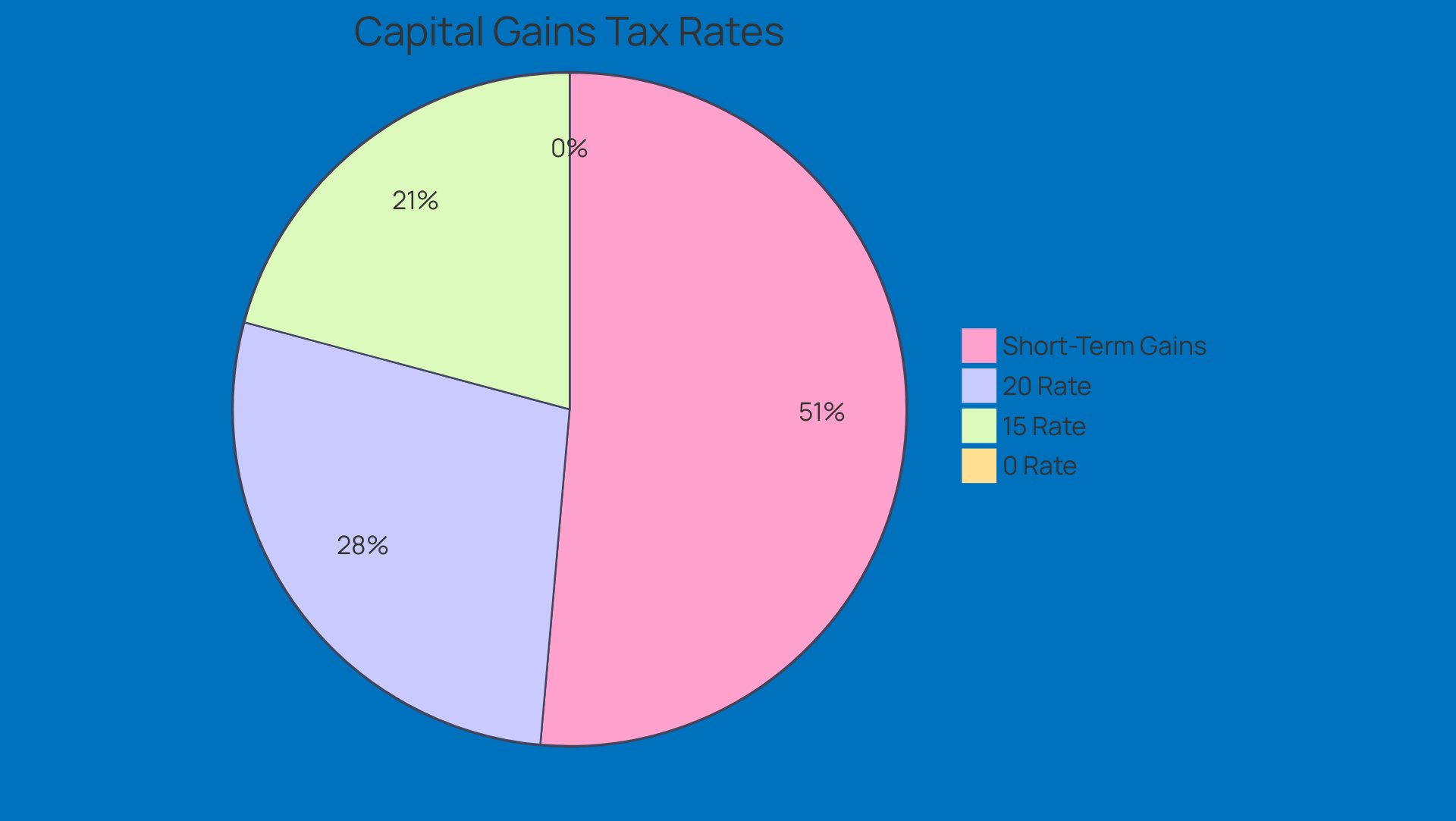

When discussing the trust capital gains tax rate, the situation can become complicated based on whether the profits are classified as short-term or long-term. Short-term capital profits - think of assets held for a year or less - are taxed at standard income tax rates, which can climb up to a hefty 37%. Yikes, right?

On the flip side, long-term capital profits, which apply to assets held for over a year, enjoy much friendlier tax rates of 0%, 15%, or 20%. The rate you pay depends on your income level. For example, in 2026, if your capital gains are between $0 and $3,300, you won’t pay any taxes at all! But if your gains fall between $3,300 and $16,250, you’ll be looking at a 15% tax rate. And if you’re raking in more than $16,250? Well, that’s when the 20% rate kicks in.

Understanding these differences is super important for trustees in relation to the trust capital gains tax rate. It can really help you optimize your tax outcomes. So, keep these distinctions in mind as you navigate the world of trust capital profits!

Implement Strategies to Minimize Capital Gains Tax in Trusts

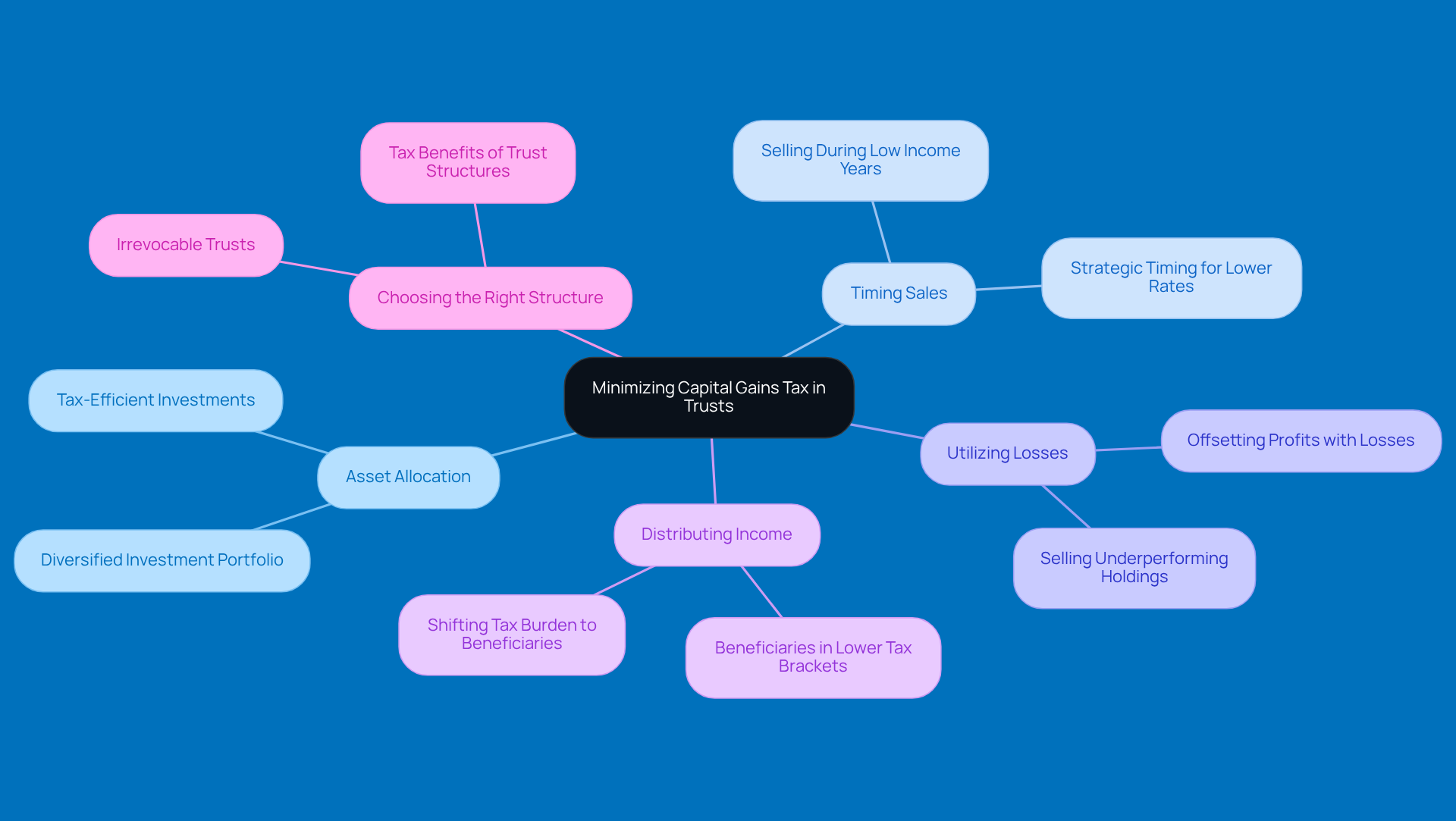

To effectively minimize capital gains tax within trusts, trustees can use a few smart strategies:

-

Asset Allocation: Think of a well-diversified investment portfolio as your best friend. By spreading investments across different categories, trustees can manage profits and losses more easily, which helps lower overall tax liability. For instance, putting some of the fund's resources into tax-efficient investments can really help in cutting down those capital appreciation taxes.

-

Timing Sales: Timing is everything, right? When it comes to selling properties, doing so during years when the entity's income is lower can result in a lower trust capital gains tax rate. This means you get to handle taxes in a more favorable way.

-

Utilizing Losses: Here’s a powerful tip: offsetting profits with losses from other investments can be a game changer. By strategically selling off underperforming holdings, trustees can lower the fund's taxable income, which helps in managing the trust capital gains tax rate more effectively.

-

Distributing Income: Ever thought about distributing income to beneficiaries? This can shift the tax burden to individuals who might fall into lower tax brackets. Not only does this minimize the overall tax liability, but it also ensures that beneficiaries get their intended wealth without being hit with excessive taxes.

-

Choosing the Right Structure: Picking the right type of arrangement is key. For example, irrevocable arrangements can provide significant tax benefits by keeping holdings out of the grantor's taxable estate, which can help dodge estate and trust capital gains tax rate under certain conditions.

Implementing these strategies takes some careful planning and a solid understanding of the organization’s financial goals. As financial planners often say, effective asset allocation isn’t just about growth; it’s about preserving wealth and optimizing tax efficiency for future generations. So, don’t forget to regularly review and tweak the fund's investment strategy to keep up with changing market conditions and financial objectives.

What strategies have you found helpful in managing taxes? Let’s keep the conversation going!

Assess Capital Gains Tax Implications for Estate Planning with Trusts

When it comes to estate planning, grasping the ins and outs of the trust capital gains tax rate in fiduciary arrangements is super important. Trusts can be fantastic tools for managing how property is distributed and taxed after the grantor passes away. So, when assets are moved into a trust, they might just qualify for a 'step-up' in basis. What does that mean? Well, it adjusts the asset's value to its fair market price at the time of the grantor's death. This little tweak can significantly lower the trust capital gains tax rate for beneficiaries when they decide to sell inherited properties.

For example, let’s say you have a stock that you bought for $100,000, and by the time it’s inherited, it’s worth $250,000. The new basis becomes $250,000, which means capital gains tax only kicks in on any profit above that amount. Pretty neat, right? Plus, if you plan strategically about when to sell properties or make distributions, you can further cut down on the trust capital gains tax rate exposure.

Being proactive with your estate planning, especially regarding the trust capital gains tax rate, can significantly enhance the financial legacy you leave behind. It ensures that more of your estate's value sticks around for future generations. And don’t forget, keeping your will or trust updated to reflect any changes in tax laws or your personal situation is key. Ignoring this could lead to some unintended consequences regarding how your assets are distributed and the tax liabilities that come with them.

Lastly, understanding the importance of filing a tax return can open the door to potential refunds and credits that might just benefit your estate planning strategy, particularly with regard to the trust capital gains tax rate. So, have you thought about how these factors play into your own estate planning?

Conclusion

Understanding trust capital gains tax rates is super important for effective financial planning, especially if you’re a trustee or a beneficiary. The insights shared here really highlight how capital gains tax plays a big role in managing and distributing trust assets. By getting a handle on the differences between short-term and long-term capital gains, you can make smart choices that optimize your tax outcomes and protect your financial interests.

So, what are some key strategies for minimizing capital gains tax within trusts? Well, thoughtful asset allocation, timing your sales just right, and using losses to offset profits can make a big difference. Plus, distributing income to beneficiaries can shift the tax burden to those in lower tax brackets, which is a great way to enhance tax efficiency. These techniques not only help manage immediate tax liabilities but also set up a more favorable financial legacy for future generations.

Ultimately, proactive estate planning that includes a solid understanding of trust capital gains tax can really impact the wealth that gets passed on. Regularly updating your estate planning documents and using strategic tax management techniques are crucial steps in preserving wealth and minimizing tax exposure. Engaging with these concepts can empower you to navigate the complexities of trust management and seize opportunities to enhance your financial legacy. So, why not take a moment to reflect on how these strategies could work for you?

Frequently Asked Questions

What is capital gains tax?

Capital gains tax is a tax on the profit made from selling assets such as stocks, bonds, or real estate.

How does capital gains tax affect trusts?

Capital gains tax can significantly impact the financial health of trusts, influencing decisions made by trustees and beneficiaries regarding asset management and distribution.

Why is it important to understand the trust capital gains tax rate?

Understanding the trust capital gains tax rate is crucial for trustees and beneficiaries as it affects financial decisions and can help in structuring entities to minimize tax liabilities.

What should individuals involved in managing trusts do regarding capital gains tax?

Individuals should gain a good understanding of the tax implications related to capital gains tax to make informed decisions about managing and distributing trust assets.

Why is it important to regularly update your will in relation to capital gains tax?

Regularly updating your will is important because tax laws change, and personal situations can evolve, which may affect tax liabilities and asset distribution. Keeping estate planning documents current is essential for effective management of trust capital gains tax.