Overview

Let’s dive into something that might seem a bit dry but is super important for small businesses: Box 12 on the W-2 form, especially that tricky 12d code. Why does it matter? Well, understanding these codes is crucial because they can really affect your employees’ tax obligations. Plus, if there are mistakes in reporting, it could lead to some not-so-fun penalties. So, it’s essential for businesses to stay in the loop and adopt best practices in their payroll processes.

Have you ever found yourself scratching your head over tax forms? You’re not alone! Many small business owners face the same confusion. But don’t worry; getting a handle on these codes can make a big difference. Just think about it: being informed not only helps you avoid penalties but also ensures that your employees are taken care of come tax time. So, let’s keep those payroll processes sharp and efficient!

Introduction

Navigating the complex world of tax compliance can be quite a task for small business owners, but understanding the nuances of Form W-2 is key. Take Box 12, for example—it’s not just a box; it’s a treasure trove of various compensation elements and benefits, each carrying its own tax implications. As the IRS rolls out updates to regulations and guidelines, it can be a bit of a head-scratcher to interpret these codes accurately, especially that often-overlooked 12d.

So, how can small businesses tap into this information to optimize their tax situations and steer clear of costly mistakes?

Overview of Form W-2 and the Significance of Box 12

Form W-2, also known as the Wage and Tax Statement, is a pretty important document that employers need to provide to their employees and the IRS. It lays out an employee's annual wages and details the federal, state, and other taxes withheld, along with various compensation elements. Now, the 12d on W-2 is especially important because it acts like a catch-all for different types of compensation and benefits that might not show up anywhere else. You’ll find multiple codes in this box that indicate specific income types, deductions, or contributions, and each one can have a direct impact on an employee's tax return.

For small businesses, getting Box 12 right is crucial for staying on the right side of tax regulations and avoiding any potential penalties. Employers need to report various compensation elements in Box 12 according to IRS guidelines, since mistakes here can lead to audits and financial headaches. For example, elective deferrals (Code D) can actually lower taxable income, which affects the Adjusted Gross Income (AGI) reported on Form 1040, a key factor in determining eligibility for tax credits and deductions.

Successful small businesses have really shown how important careful W-2 documentation can be. Take, for instance, a local accounting firm that revamped its payroll processes to ensure every Box 12 entry was spot on. This proactive approach not only boosted compliance but also made employees happier by giving them clear insights into their compensation packages. By tapping into professional tax compliance and preparation services, business owners can navigate the complexities of tax obligations, lighten their tax load, and pave the way for long-term success.

Understanding the meaning of each Box 12 designation, such as 12d on W-2, can help business owners make smarter choices that enhance their tax situations. As the IRS keeps rolling out new instructions for tax filings, staying updated on changes in Box 12 requirements, particularly 12d on W-2, is going to be key for small businesses aiming to manage the ins and outs of tax compliance efficiently.

Detailed Explanation of Box 12 Codes and Their Tax Implications

Box 12 of the W-2 form, specifically 12d on W-2, is like a treasure chest filled with symbols, each one standing for different types of compensation or benefits that can really impact your tax situation. For small business owners, understanding these codes is super important to make sure everything’s reported accurately and in compliance. Let’s dive into some of the common codes and what they mean:

- Code A: This one’s about uncollected Social Security or RRTA tax on tips. It means the employee got tips that didn’t have Social Security tax withheld, which could change their overall tax bill.

- Code B: Similar to Code A, this code reflects uncollected Medicare tax on tips. It shows tips that weren’t subject to Medicare tax withholding, highlighting some potential tax obligations.

- Code D: Here we have elective deferrals to a 401(k) plan. This code represents employee contributions to a 401(k) retirement plan, which can help lower taxable income and provide some nice tax benefits.

- Code DD: This one reports the cost of employer-sponsored health coverage. While it doesn’t directly affect taxable income, it’s crucial for understanding the benefits offered by the employer.

- Code J: This code signifies nontaxable sick pay, meaning that this sick pay is exempt from income tax, which can be a real plus for employees.

Each of these codes, such as the 12d on W-2, plays a key role in figuring out an employee's tax obligations and possible deductions. For small business owners, keeping track of these codes is vital; getting it wrong can lead to IRS notices, fines, or missed opportunities for tax savings. So, chatting with tax professionals can provide valuable insights into navigating these rules and ensuring compliance. Remember, staying informed is the best way to keep your business on track!

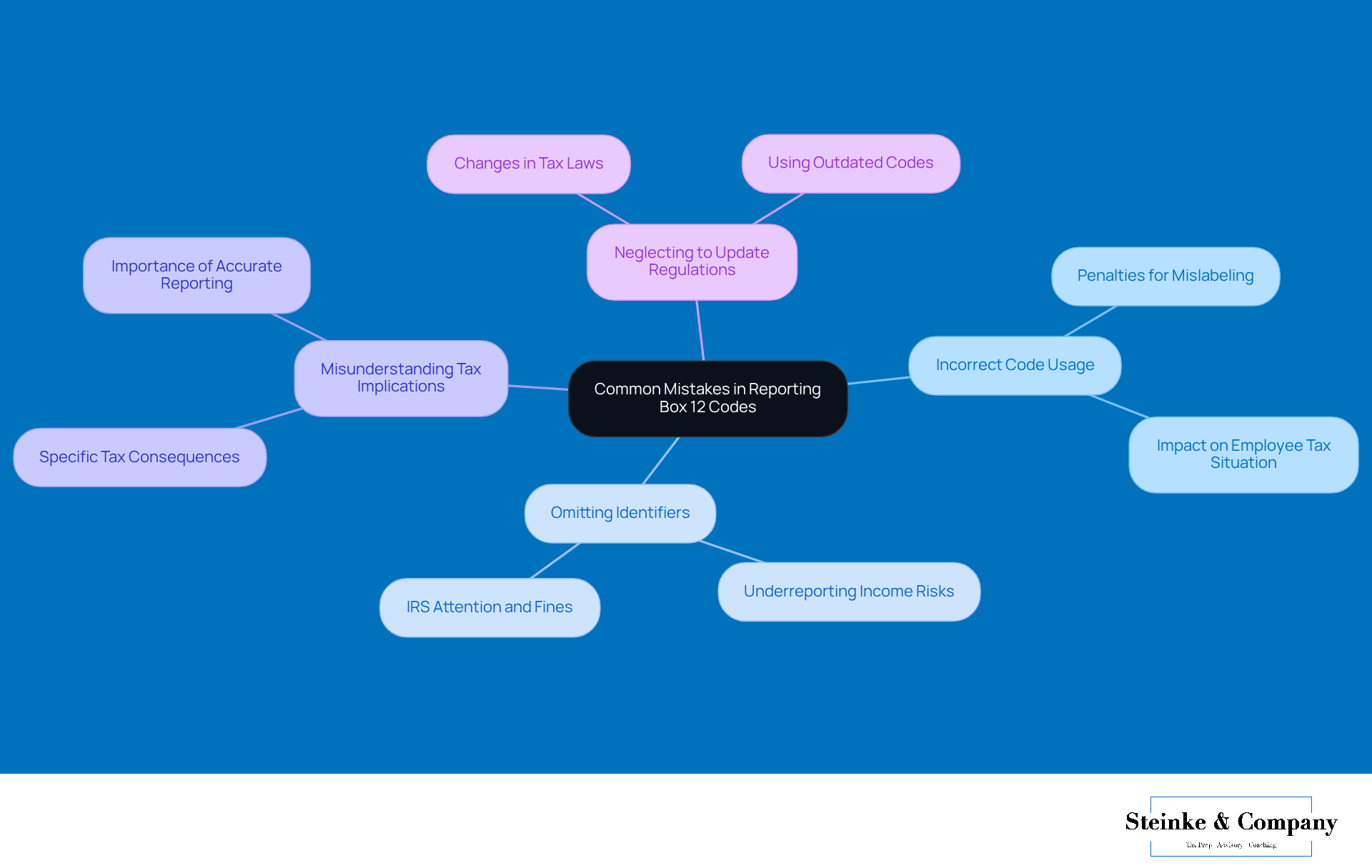

Common Mistakes to Avoid When Reporting Box 12 Codes

When it comes to reporting Box 12 codes, small business owners need to keep an eye out for some common mistakes that can really complicate things:

-

Incorrect Code Usage: Using the right code for each specific type of compensation or benefit is super important. If you mislabel identifiers, it can misrepresent an employee's tax situation and might lead to penalties ranging from $60 to $310 for each incorrect W-2 form, depending on how quickly you fix it. The IRS is pretty strict about underpayment penalties, which can add to financial stress.

-

Omitting Identifiers: If an employee qualifies for multiple identifiers, make sure to report all of them. Leaving out relevant regulations can lead to underreporting income, which might catch the IRS's attention and result in fines. Knowing the thresholds for safe harbor payments can help you stay compliant and dodge these issues.

-

Misunderstanding Tax Implications: Some regulations come with specific tax consequences that aren’t always clear right away. It’s crucial to grasp how each regulation affects taxable income and possible deductions for accurate reporting. As CPA Kristal Sepulveda puts it, "Comprehending these regulations is essential for optimizing tax savings associated with healthcare costs and benefits." This understanding can also help you manage estimated tax payments effectively to steer clear of underpayment penalties.

-

Neglecting to Update Regulations: Tax laws and regulations can change every year, so it’s essential to use the latest codes and guidelines when preparing W-2 forms. Staying updated on these changes can really help business owners navigate their tax obligations and boost compliance.

Being aware of these common pitfalls can help you ensure accurate documentation and reduce the risk of penalties. Did you know that 44% of employers reported compensation as their top concern for HR in 2025? That really highlights the need for diligence in this area! Regular training and updates on tax regulations can also help avoid these mistakes, giving you peace of mind. For instance, understanding the implications of Box 12 entries, particularly 12d on W-2, can prevent costly errors, as shown in case studies of frequent W-2 filing mistakes that led to penalties for small businesses.

Best Practices for Managing W-2 Reporting

To effectively manage W-2 reporting and ensure compliance, small business owners should consider these best practices:

-

Keep Your Records Straight: Maintaining detailed records of all employee compensation, benefits, and deductions throughout the year can make W-2 preparation a breeze. Trust me, accurate documentation is key to minimizing errors and staying compliant with IRS regulations.

-

Invest in Good Payroll Software: Using reliable payroll software that automatically updates tax codes and regulations can really save you time and reduce the risk of errors. Did you know that about 70% of small businesses are now using payroll software for their W-2 documentation? It's a trend that's definitely worth hopping on!

-

Train Your Team Regularly: It’s super important to ensure that your payroll and tax reporting staff are well-versed in the latest tax laws and W-2 requirements. Regular training sessions can help clear up any misunderstandings and mistakes, creating a culture of compliance that benefits everyone.

-

Double-Check Before You Submit: Always take a moment to review your W-2 forms for accuracy before hitting that submit button. A quick double-check of codes, amounts, and employee information can help catch errors early, saving you time and potential penalties down the line.

-

Get Professional Advice When Needed: If you ever find yourself unsure about something, don’t hesitate to consult a tax professional or accountant who specializes in business tax compliance. Their expertise can be invaluable in navigating those tricky regulations and ensuring you meet all compliance requirements.

By adopting these best practices, you can streamline your W-2 reporting process and significantly lower the risk of compliance issues. So, why not give them a try?

Conclusion

Understanding the ins and outs of Box 12 on Form W-2 is super important for small business owners trying to navigate the tricky waters of tax reporting and compliance. This box is like a treasure chest for various compensation and benefit codes that can really affect an employee's tax return. Getting these codes right not only keeps you in line with IRS regulations but also helps everyone—employers and employees alike—make the most of their tax situations.

Throughout this article, we've taken a closer look at the different Box 12 codes, like 12d. We’ve highlighted why accurate reporting matters, pointed out some common pitfalls to steer clear of, and shared best practices for managing your W-2 documentation. Whether it’s understanding how elective deferrals can help lower taxable income or recognizing what uncollected taxes mean for you, every bit of information adds to a well-rounded grasp of your tax obligations.

So, to wrap things up, staying in the loop about Box 12 codes and what they mean is key for small businesses wanting to keep things compliant and get the most out of tax benefits. Engaging with tax pros, investing in solid payroll systems, and keeping your staff educated can really set you up for success in W-2 reporting. By focusing on these practices, small business owners can not only reduce risks and boost employee satisfaction but also pave the way for long-term financial success. How are you planning to tackle your W-2 reporting this year?

Frequently Asked Questions

What is Form W-2?

Form W-2, also known as the Wage and Tax Statement, is a document that employers provide to their employees and the IRS. It details an employee's annual wages and the federal, state, and other taxes withheld.

What is the significance of Box 12 on Form W-2?

Box 12 on Form W-2 is important because it serves as a catch-all for various types of compensation and benefits that may not be listed elsewhere. It contains multiple codes that indicate specific income types, deductions, or contributions, which can directly impact an employee's tax return.

Why is it crucial for small businesses to get Box 12 right?

It is crucial for small businesses to accurately report Box 12 information according to IRS guidelines to avoid potential penalties and audits. Mistakes in this area can lead to financial complications.

How can Box 12 entries affect an employee's tax situation?

Certain entries in Box 12, such as elective deferrals (Code D), can lower taxable income, which in turn affects the Adjusted Gross Income (AGI) reported on Form 1040. This AGI is a key factor in determining eligibility for tax credits and deductions.

What can small businesses do to ensure accurate W-2 documentation?

Small businesses can improve their W-2 documentation by revamping payroll processes to ensure every Box 12 entry is accurate. This proactive approach can boost compliance and provide employees with clear insights into their compensation packages.

How can professional tax compliance services help small businesses?

Professional tax compliance and preparation services can help business owners navigate the complexities of tax obligations, reduce their tax burden, and support long-term success by ensuring accurate reporting and compliance.

Why is it important for business owners to stay updated on Box 12 requirements?

Staying updated on changes in Box 12 requirements, particularly the codes used, is essential for small businesses to manage tax compliance effectively and make informed decisions that enhance their tax situations.