Introduction

Understanding estate planning can feel a bit overwhelming, right? Especially when you start diving into strategies that might really affect your tax situation. One interesting approach is the alternative date of death valuation. This little gem in the Internal Revenue Code lets executors take a fresh look at the value of a deceased person's assets six months after they’ve passed away. It can help lower tax burdens, especially in those unpredictable markets. But, it’s not all smooth sailing; there are some unique challenges and decisions that can’t be undone. So, how can executors navigate this tricky terrain to make smart choices that safeguard their beneficiaries and optimize tax outcomes? Let’s explore!

Define Alternative Date of Death Valuation

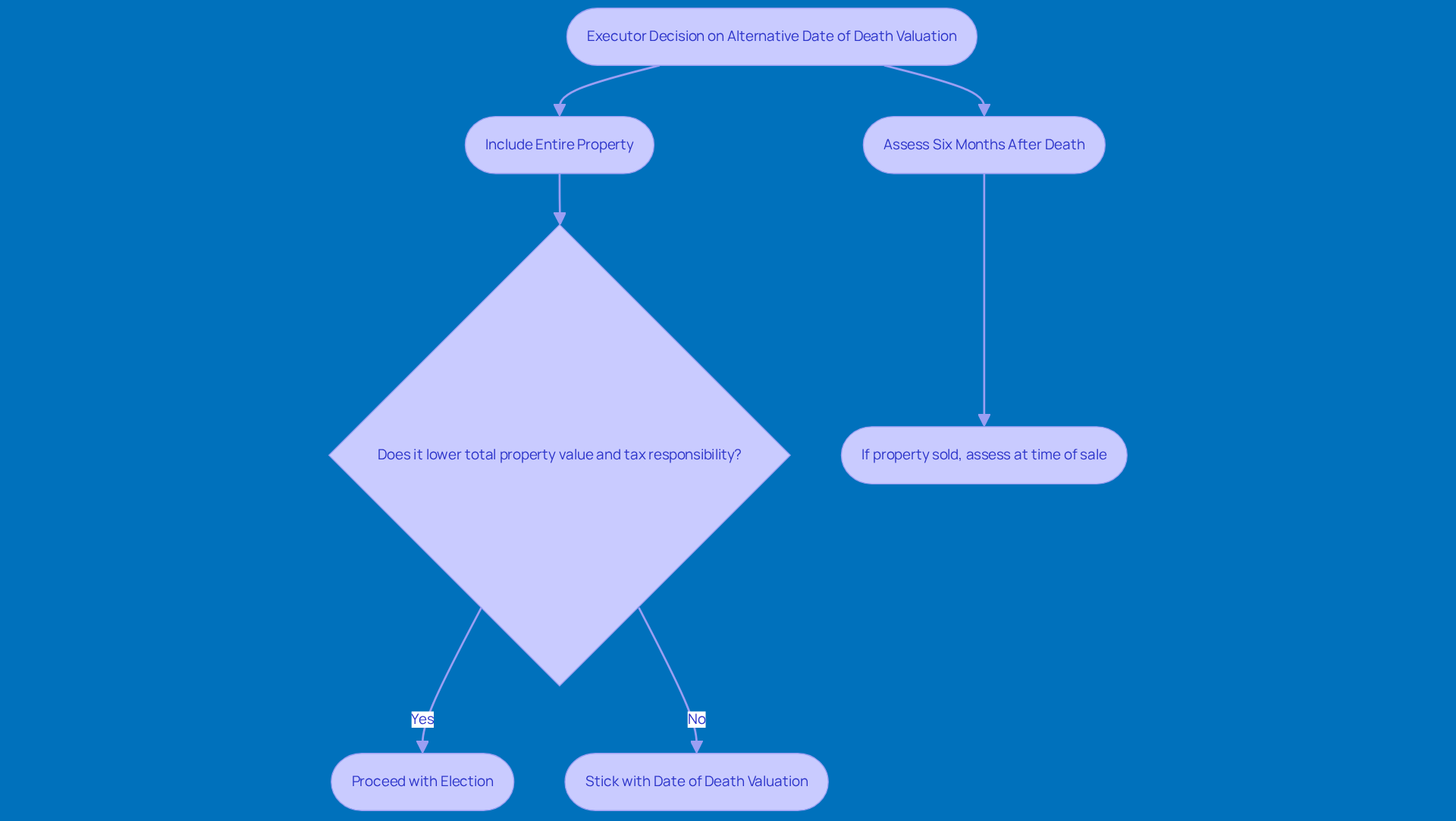

Have you ever heard about the alternative time of death assessment? It’s a neat little option in the Internal Revenue Code (IRC) Section 2032 that allows the executor of a property to make an alternative date of death valuation by assessing the assets six months after the decedent's passing instead of at the moment of death. This can be a real lifesaver, especially if the market value of those assets has taken a hit after the passing. Who wouldn’t want to potentially lower their tax bill, right?

To take advantage of this option, the executor needs to include the entire property in the election. But here’s the catch: it can only be done if it results in a lower total property value and tax responsibility compared to the alternative date of death valuation. It’s a strategic move that can really help avoid overpaying those pesky inheritance taxes, especially when the market is all over the place.

Just a heads up, though! If any property gets sold during that six-month window, it has to be assessed at the time of sale. And once you make this decision, there’s no turning back. So, it’s important to weigh your options carefully. Have you thought about how this could impact your own situation?

Explain the Importance of Alternative Valuation Date

When it comes to inheritance tax planning, the alternative date of death valuation is a game changer. It gives you a chance to significantly reduce the tax burden on an inheritance. How? Well, by allowing the assessment of assets six months after the date of death, executors can take advantage of market shifts that might lower asset values. This can lead to a decrease in both the gross inheritance amount and the tax obligation that comes with it.

This strategy really shines in fluctuating markets, where asset prices can take a nosedive after someone passes away. For instance, if you have properties tied to closely-held businesses or real estate, opting for an alternative date of death valuation can lead to a better tax outcome. It aligns the tax basis more closely with fair market value at the time of sale, which can help reduce the risk of capital gains taxes for heirs.

But here’s the catch: the alternative valuation date has to be applied consistently across all assets. This means you need to think carefully about the types of assets you have and the current market conditions. Plus, it’s super important to keep your will or trust updated, especially with changing tax laws and personal circumstances - like if you get married, move, or see big shifts in your asset values. If you don’t, you might end up with your assets distributed in a way you didn’t intend.

There are plenty of case studies showing that properties that make good use of this strategy can save a lot on taxes, especially when asset values are expected to drop. Financial advisors often emphasize the importance of chatting with planning specialists to navigate these complexities. So, in a nutshell, the alternative date of death valuation serves as a smart tool for inheritance tax planning, helping executors make informed choices that can protect wealth for future generations.

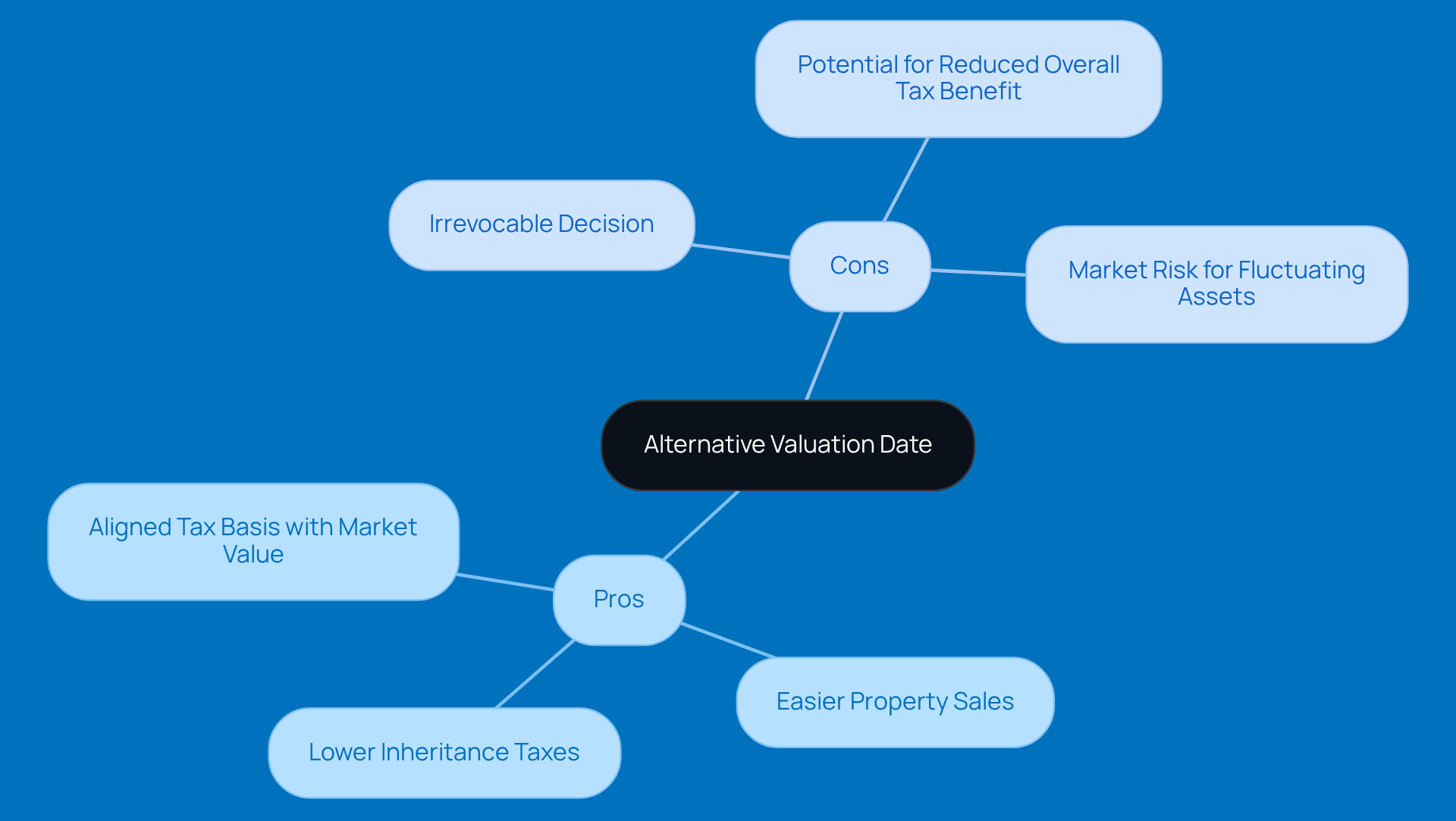

Discuss Pros and Cons of Alternative Valuation Date

Choosing the alternative valuation moment can really pay off, especially when it comes to lowering those pesky inheritance taxes. This option lets you assess assets at a lower market value if they’ve dropped since the date of death, which can lead to some nice tax savings for both the inheritance and its beneficiaries. Plus, it can make selling property a lot easier since the tax basis will align more closely with the fair market value at the time of sale. That means less capital gains tax to worry about!

But hold on, there are some important drawbacks to think about. This election has to cover the whole property, so if some assets go up while others go down, the overall tax benefit might not be as great as you hoped. And let’s not forget, once you make this choice, it’s set in stone. That can be risky, especially if the market takes a turn for the worse. For instance, properties tied to fluctuating assets like stocks could face challenges if the market dips after you’ve made your decision. Executors really need to take a good look at the assets and current market conditions before jumping in, making sure it fits into their overall planning strategy.

Statistics indicate that a significant number of properties can benefit from the alternative date of death valuation, especially in a shaky market. But remember, since this election is irrevocable, it’s super important to think it through to avoid any surprises down the line. Chatting with planning professionals can provide some valuable insights into the complexities of this decision, helping executors navigate the trade-offs involved.

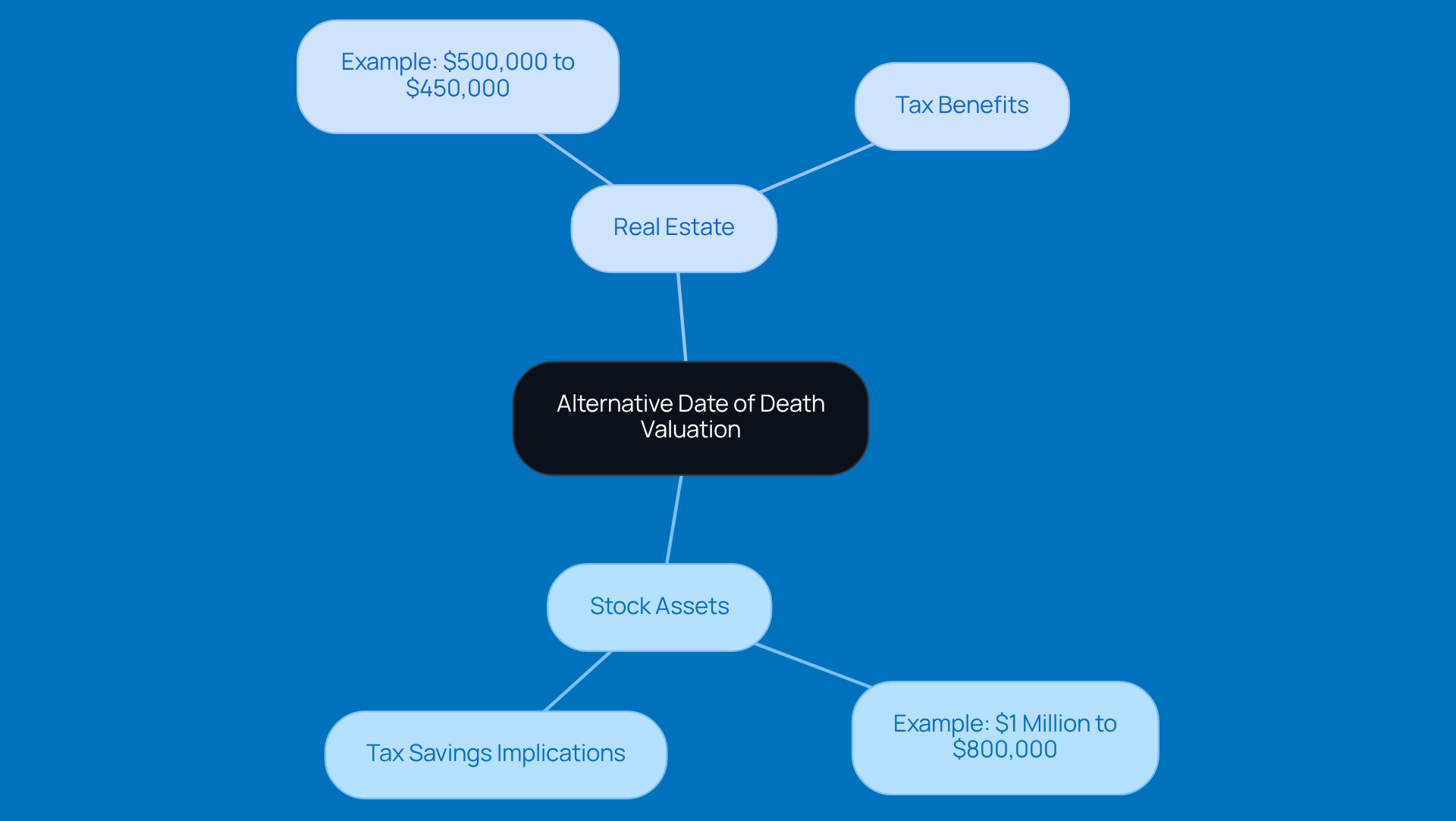

Provide Examples of Alternative Valuation Applications

Utilizing an alternative date of death valuation can significantly impact inheritance tax responsibilities, particularly for holdings with substantial stock assets. Picture this: if someone passes away during a stock market peak, the value of those assets might look inflated. But here’s the kicker - by choosing the alternative date of death valuation six months later, when the market has dipped, the property can report a lower value. This means lower tax obligations! For instance, if the stock was worth $1 million at death but dropped to $800,000 six months later, that choice could lead to some serious tax savings.

And it’s not just stocks that can benefit from this strategy. Let’s say a decedent owned a property valued at $500,000 at the time of death, but the real estate market took a hit, bringing it down to $450,000 six months later. The executor could choose the alternative date of death valuation, which reflects the reduced worth and ultimately lightens the overall tax burden.

These examples really highlight how strategically significant the alternative date of death valuation can be in effective property planning. It allows executors to optimize tax results and ensure the property’s value is accurately represented. Plus, life events like changes in marital status, moving, or welcoming new children can mean it’s time to update legal documents. Regular evaluations are key! Understanding these strategies is crucial for maximizing tax efficiency and making sure your estate plan stays effective and true to your wishes.

Conclusion

When it comes to the alternative date of death valuation, as laid out in the Internal Revenue Code, there’s a real chance for executors to cut down on tax liabilities for inherited assets. This method lets you assess property values six months after death, which can really help lighten the tax load-especially in those unpredictable markets where asset values can swing wildly.

Throughout this discussion, we’ve seen how this valuation approach can be a game changer. It has the potential to lower inheritance taxes and make sure tax bases reflect current market values. But, let’s not forget, this choice isn’t without its complexities. Executors need to take a good look at their assets and the market conditions to make sure this strategy fits their estate planning goals.

So, what does all this mean for you? If you’re involved in estate planning, it’s super important to grasp the implications of the alternative date of death valuation. Teaming up with financial advisors and planning specialists can really help you navigate these waters, ensuring that the decisions you make today will safeguard wealth for future generations. By embracing this knowledge, you can make more informed choices that ultimately protect the financial legacy you leave behind.

Frequently Asked Questions

What is the alternative date of death valuation?

The alternative date of death valuation is an option provided in the Internal Revenue Code (IRC) Section 2032 that allows the executor of a property to assess the assets six months after the decedent's passing instead of at the moment of death.

Why would someone want to use the alternative date of death valuation?

This option can help lower the tax bill if the market value of the assets has decreased after the decedent's passing, potentially reducing overall inheritance taxes.

What must an executor do to take advantage of this option?

The executor must include the entire property in the election for the alternative date of death valuation.

Are there any restrictions on using the alternative date of death valuation?

Yes, it can only be elected if it results in a lower total property value and tax responsibility compared to the valuation at the time of death.

What happens if any property is sold during the six-month window?

If any property is sold during that six-month period, it must be assessed at the time of sale, not at the alternative date of death.

Is the decision to use the alternative date of death valuation reversible?

No, once the decision is made to use the alternative date of death valuation, it cannot be changed.