Introduction

Understanding the ins and outs of insurance proceeds taxation is super important for effective financial planning, especially for new parents juggling a bunch of financial responsibilities.

So, let’s dive into how life insurance benefits are usually non-taxable, but there are some exceptions that might catch you off guard with unexpected tax bills.

It can get a bit confusing with all the tax rules and policy features at play, right?

So, how can you navigate these complexities to make sure you’re getting the most out of your benefits and steering clear of any pitfalls?

Understand the Basics of Life Insurance Taxation

Understanding the taxation of life benefits is super important for both policyholders and beneficiaries, especially for new parents juggling a lot of financial responsibilities. Generally speaking, when beneficiaries receive life insurance proceeds, those funds aren’t considered taxable income, making insurance proceeds taxable a non-issue. According to IRS guidelines, these proceeds are excluded from gross income, so beneficiaries don’t have to report them on their tax returns. But, there are a few exceptions to keep in mind. For instance, if a contract is transferred for valuable consideration, the proceeds might be taxable. Plus, any interest income that comes from those proceeds is taxable too.

Let’s break it down with an example: if a beneficiary gets a $200,000 death benefit, that amount is usually non-taxable. However, if the policyholder took out a loan against the policy and that loan amount exceeds the premiums paid, the excess could be considered insurance proceeds taxable if the policy lapses.

Tax professionals really stress the importance of understanding these details. As one expert put it, "Navigating the tax effects of life coverage can greatly influence monetary planning and estate administration." New parents should also be aware of tax breaks that can lighten their financial load, like the child tax credit and the earned income tax credit, which can lead to some serious savings come tax season.

Staying updated on IRS regulations and potential exceptions is key to maximizing the benefits of life policies and ensuring you’re following tax laws. As we look ahead to 2025, the IRS is still holding firm on these principles, reminding us that while life coverage proceeds are generally non-taxable, it’s crucial to consider ownership changes and interest income to avoid any unexpected tax bills, particularly because insurance proceeds taxable may apply. For new parents, getting a grip on these tax implications is especially vital as they plan for future expenses, like college savings and other financial commitments. It’s worth noting that about 40% of Americans will leave a financial burden to a loved one when they pass, which highlights just how important it is to understand life coverage taxation for effective financial planning. And in many cases, the funds from selling a policy aren’t subject to tax, which helps clarify how life coverage policies are taxed.

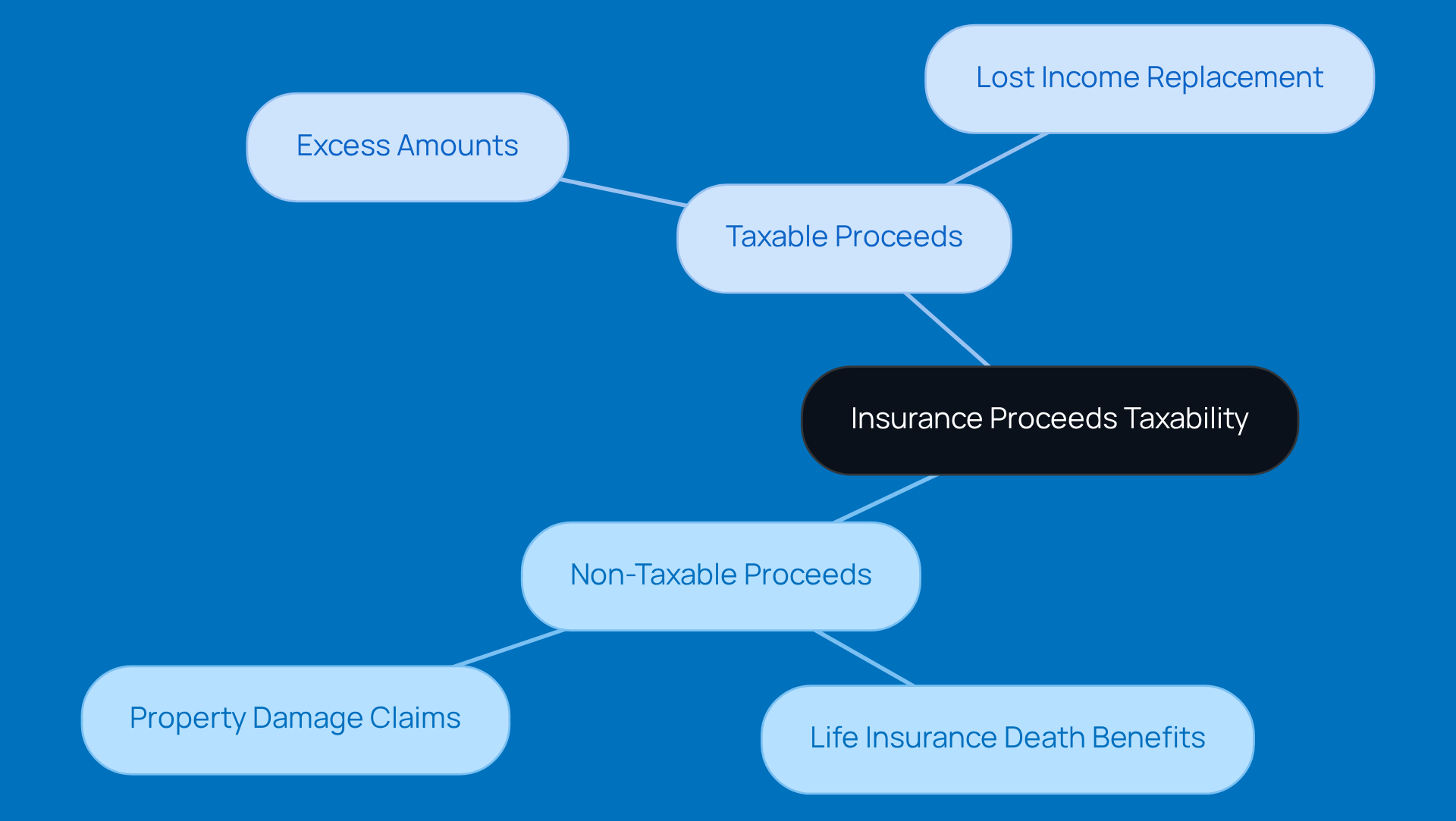

Identify Taxable and Non-Taxable Insurance Proceeds

When it comes to handling compensation proceeds, it’s super important to know the difference between amounts that are insurance proceeds taxable and those that are non-taxable. Generally speaking, life insurance death benefits are non-taxable, which is great news! But here’s where it gets a bit tricky: proceeds from certain claims, like those for property damage, might not be taxable if you use them to restore or replace the damaged property.

For example, if you get a payout from a property insurance claim to cover repairs, that amount usually isn’t taxable. However, if the proceeds are more than what the insured asset was originally worth or if they’re meant to replace lost income, then the insurance proceeds taxable may require you to pay taxes on that. Understanding these differences is key for accurate tax reporting and smart financial planning.

So, what’s the takeaway? Consulting with a financial advisor can really help you figure out how specific claims might affect your tax situation. They can offer tailored insights that ensure you stay compliant while optimizing your financial outcomes. It’s all about making sure you’re in the best position possible!

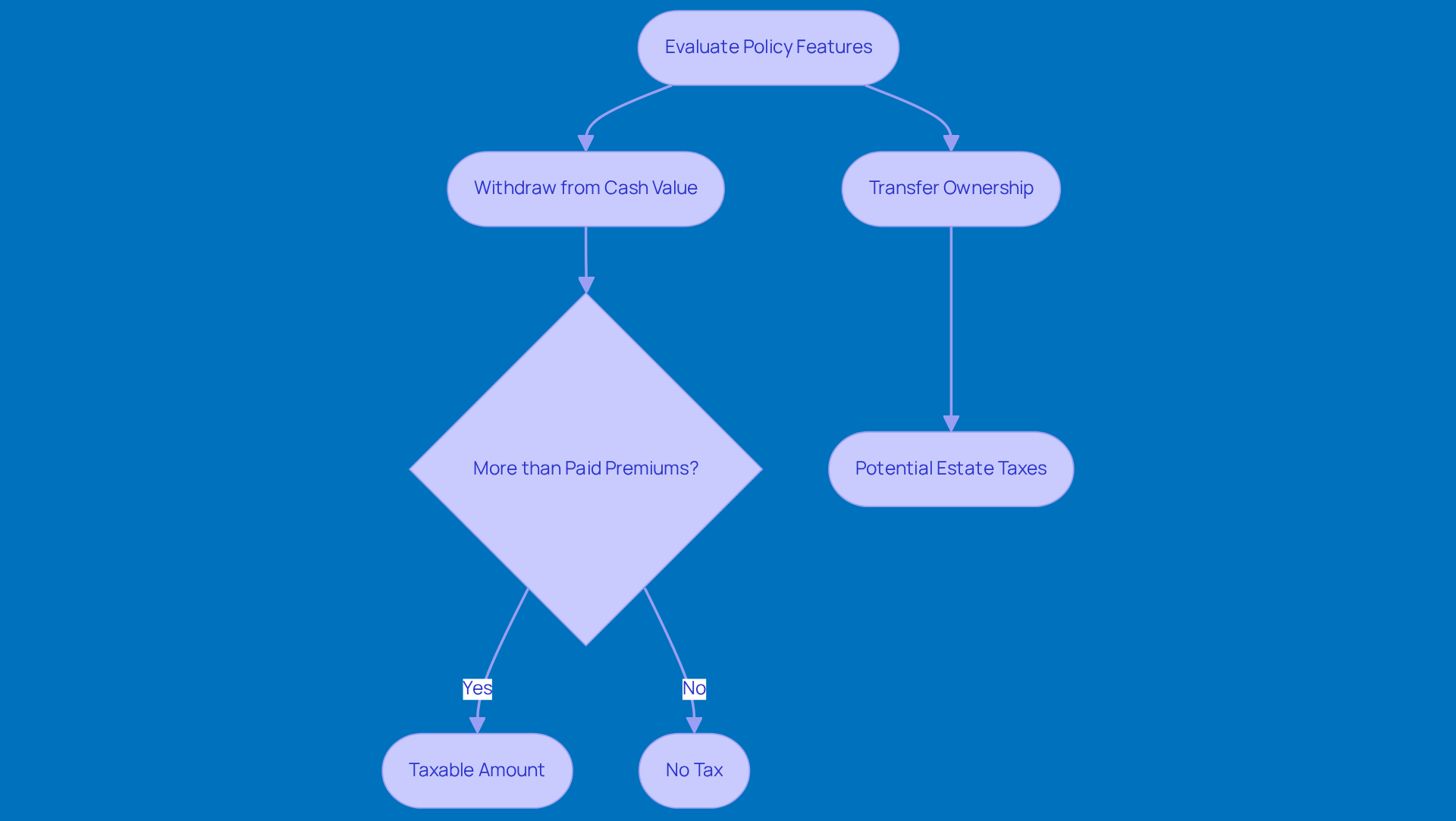

Evaluate Policy Features Impacting Tax Liability

When it comes to life insurance plans, certain features tied to cash value accumulation can significantly affect whether the insurance proceeds are taxable. For instance, if you decide to withdraw or take out a loan against your cash value, you might face taxes if those amounts go beyond what you’ve paid in premiums. So, while tapping into that cash value can give you some financial wiggle room, it’s super important to keep an eye on the fact that the insurance proceeds taxable may have potential tax consequences.

Now, let’s talk about ownership transfers. If you hand over your life insurance policy to someone else for something of value, that can trigger tax obligations too. This means that the death benefits might become insurance proceeds taxable, which could impact the financial safety net you intended for your loved ones.

To put this into perspective, imagine you’ve built up a nice chunk of cash value in your whole life insurance policy. If you decide to withdraw more than what you’ve paid in premiums, you could end up facing ordinary income tax on that extra amount. And if you transfer ownership to a family member? Well, the death benefit might be subject to estate taxes, depending on how much your overall estate is worth.

With all these moving parts, it’s really crucial for policyholders to take a good look at their policy details and chat with a tax professional. Understanding the ins and outs of cash value life insurance and the fact that insurance proceeds may be taxable can help you dodge any unexpected liabilities and ensure your financial strategies align with your long-term goals.

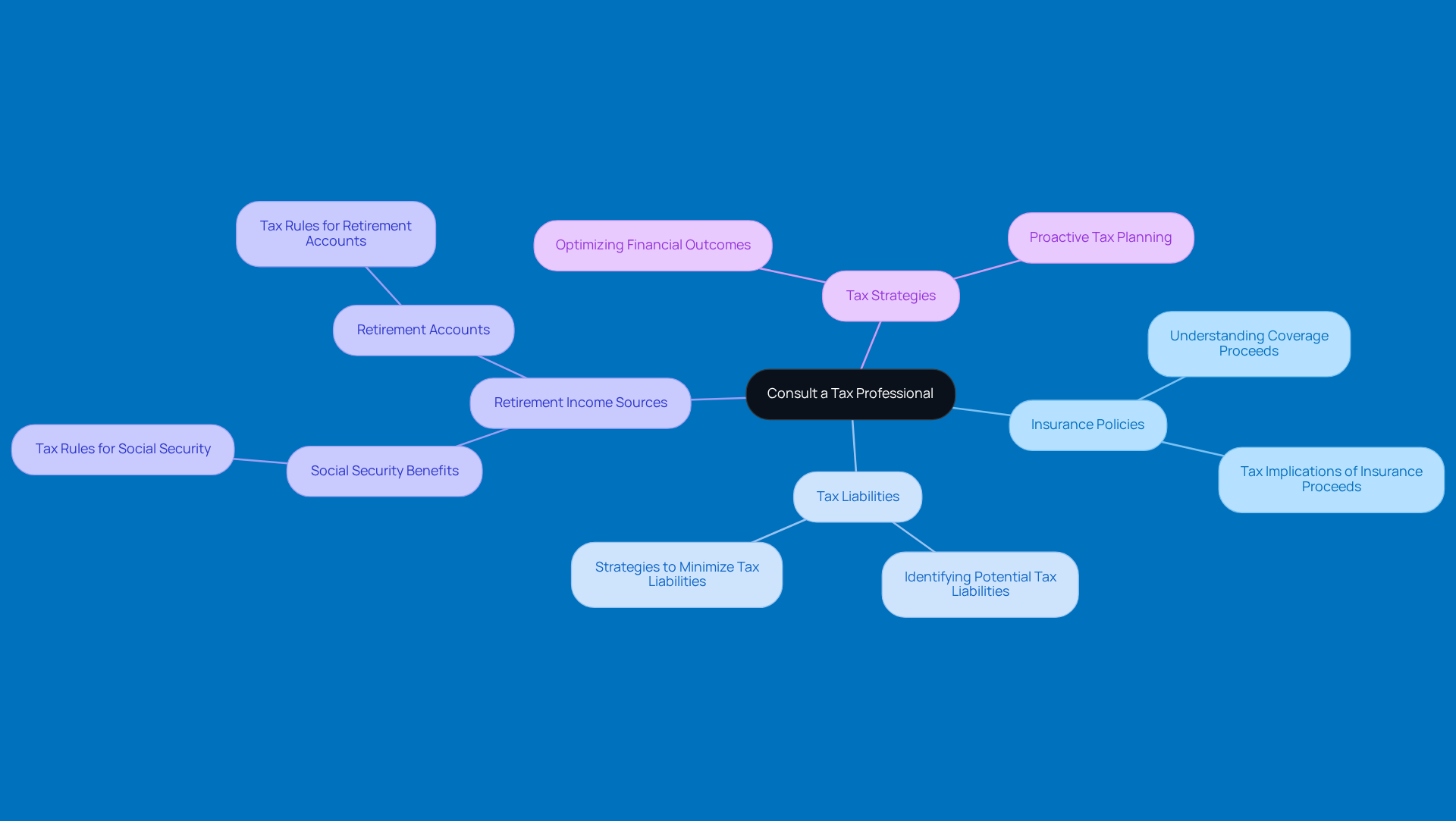

Consult a Tax Professional for Personalized Guidance

Navigating the ins and outs of coverage proceeds and understanding that insurance proceeds taxable can feel pretty overwhelming, right? Especially when you think about how it all ties into your retirement income and tax strategies. That’s why it’s super important to chat with a tax professional who can give you personalized guidance based on your unique situation. A qualified tax advisor can help you understand the details of your insurance policies, figure out any potential tax liabilities, and come up with strategies to lighten your tax load.

Now, here’s the thing: different sources of retirement income, like Social Security benefits and retirement accounts, come with their own tax rules. These can really shape your overall financial strategy. So, when you’re on the hunt for a tax pro, look for someone who has solid experience with insurance-related tax issues and knows the latest IRS regulations inside and out. This proactive approach not only helps you make informed decisions but also boosts your chances of optimizing your financial outcomes.

And get this - statistics show that working with a tax professional can really amp up the effectiveness of your tax planning. This is especially true when it comes to insurance proceeds taxable, where having specialized knowledge can help you dodge potential pitfalls. So, why not take that step? It could make a world of difference!

Conclusion

Understanding the taxation of insurance proceeds is super important for effective financial planning, especially for policyholders and beneficiaries. While life insurance proceeds are usually exempt from income tax, there are certain situations - like ownership transfers or loans against the policy - that can lead to unexpected tax liabilities. Knowing these details can really help you make better financial decisions and avoid pitfalls that could affect your financial legacy.

This article highlights some key aspects of insurance taxation. It breaks down the difference between taxable and non-taxable proceeds, discusses the implications of policy features like cash value accumulation, and stresses the importance of chatting with a tax professional. Most beneficiaries won’t have to worry about taxes on death benefits, but understanding potential exceptions and how policy details can influence things is crucial for getting the most out of life insurance.

Ultimately, working with a tax professional can give you personalized insights that fit your unique financial situation. By staying informed and proactive about insurance taxation, you can navigate your financial future more smoothly and ensure your loved ones are protected without the stress of unexpected tax consequences. Taking these steps now can lead to significant savings and peace of mind down the road.

Frequently Asked Questions

Are life insurance proceeds considered taxable income for beneficiaries?

Generally, life insurance proceeds are not considered taxable income for beneficiaries, meaning they do not have to report these funds on their tax returns.

What are some exceptions to the non-taxable status of life insurance proceeds?

Exceptions include situations where a contract is transferred for valuable consideration, which may make the proceeds taxable. Additionally, any interest income generated from the proceeds is taxable.

Can you provide an example of when life insurance proceeds might be taxable?

If a beneficiary receives a $200,000 death benefit, that amount is usually non-taxable. However, if the policyholder took out a loan against the policy and the loan amount exceeds the premiums paid, the excess could be considered taxable if the policy lapses.

Why is it important to understand life insurance taxation?

Understanding life insurance taxation is crucial for effective monetary planning and estate administration. It helps avoid unexpected tax bills and ensures compliance with tax laws.

What tax breaks should new parents be aware of?

New parents should consider tax breaks like the child tax credit and the earned income tax credit, which can provide significant savings during tax season.

How often should one stay updated on IRS regulations regarding life insurance?

It is important to stay updated on IRS regulations and potential exceptions regularly to maximize the benefits of life policies and ensure compliance with tax laws.

What should new parents consider when planning for future expenses related to life insurance?

New parents should understand the tax implications of life insurance as they plan for future expenses, such as college savings and other financial commitments.

What percentage of Americans are expected to leave a financial burden to their loved ones?

About 40% of Americans are expected to leave a financial burden to a loved one when they pass, highlighting the importance of understanding life insurance taxation for effective financial planning.