Introduction

Understanding the ins and outs of nonprofit CFO services is super important for organizations aiming for financial stability and operational excellence. These specialized services aren’t just about keeping an eye on the numbers; they’re crucial for navigating the tricky waters of funding and compliance. With nonprofits facing more economic pressures and changing regulations, you might wonder: how can a nonprofit CFO turn financial hurdles into stepping stones for growth and sustainability?

In this article, we’ll explore the significance and key functions of nonprofit CFO services, shining a light on how they can really make a difference for charitable organizations. So, let’s dive in and see what these financial wizards can do!

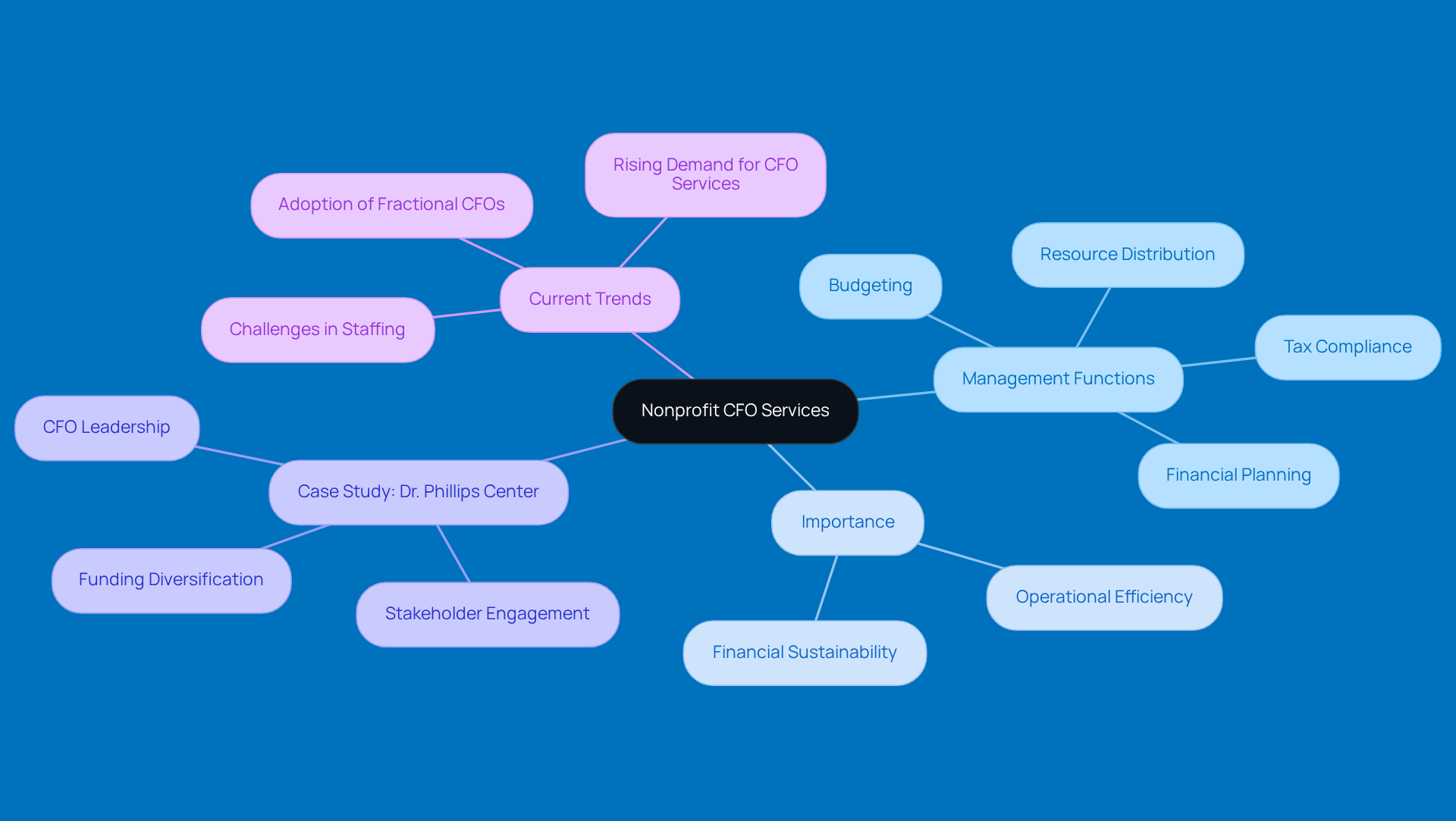

Defining Nonprofit CFO Services: An Overview

Nonprofit CFO services for charities cover a full range of management functions that cater specifically to the unique needs of charitable organizations. These services include everything from managing financial planning and budgeting to keeping up with tax regulations and ensuring resources are distributed effectively to support the mission. Think of a charitable CFO as a strategic partner, handling the complexities of resource management while keeping things transparent and accountable to stakeholders. This role is crucial for nonprofits aiming for financial sustainability and operational efficiency, especially as we head into 2025, where rising economic pressures and the need for innovative funding strategies are becoming more pronounced.

Take the Dr. Phillips Center for the Performing Arts, for example. Under the leadership of CFO Cecilia Kelly, they've successfully diversified their funding sources. She emphasizes the importance of engaging stakeholders and strategic financial planning. This approach not only boosts financial health but also fosters trust and collaboration within the community.

And here's a thought: with 55% of organization leaders identifying financial health as their top concern, the demand for CFO services is skyrocketing. Nonprofits that take advantage of nonprofit CFO services can look forward to better financial oversight, improved compliance with changing regulations, and a stronger ability to fulfill their missions. As the world of charitable finance keeps evolving, the CFO's role is becoming even more essential in guiding organizations toward sustainable growth and resilience.

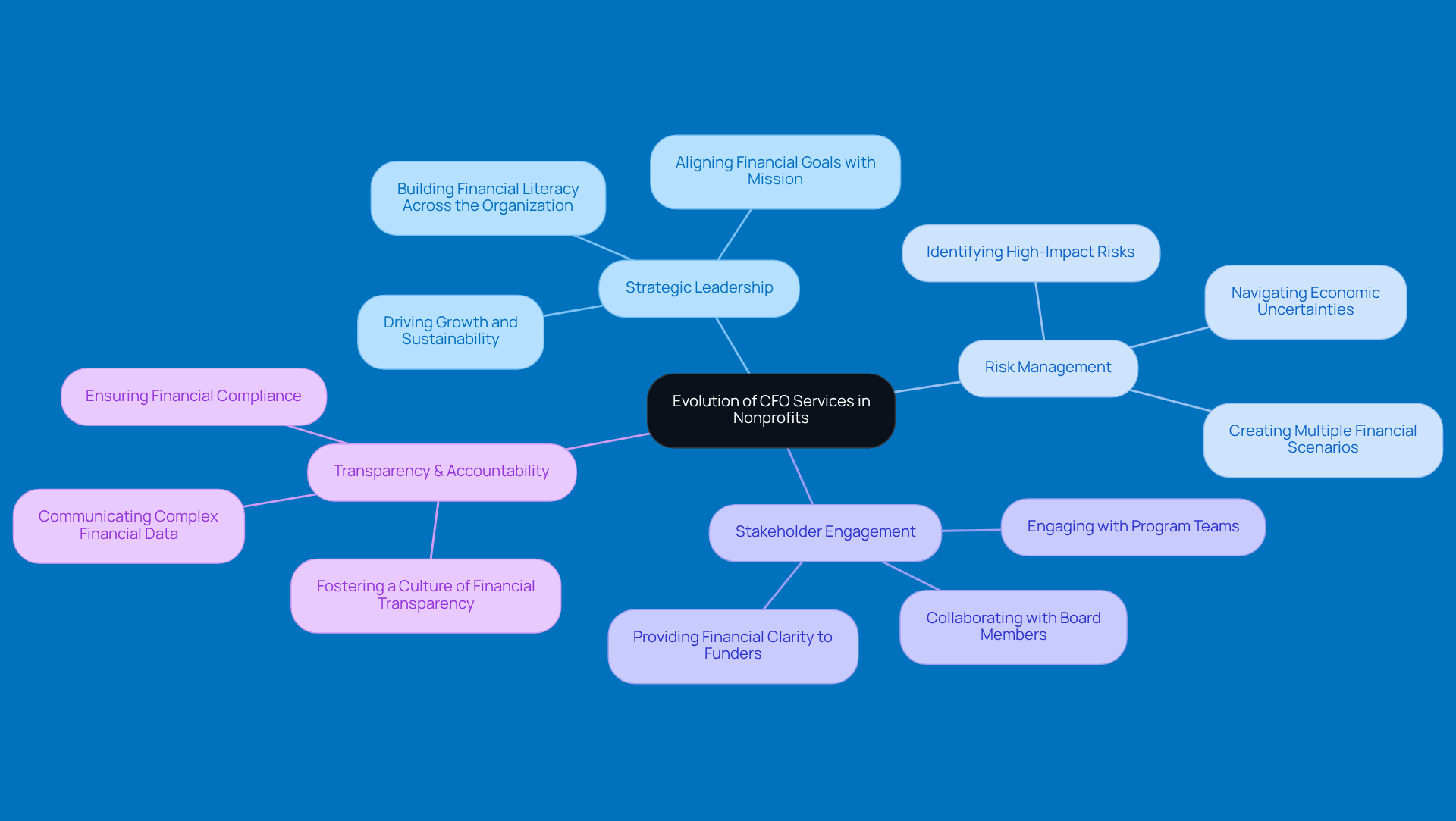

The Context and Evolution of CFO Services in Nonprofits

The role of the CFO in charitable organizations has really changed over the years. It used to be all about crunching numbers and making sure everything was compliant. But now, today’s CFO is more like a strategic leader, essential for driving growth and sustainability. This shift is largely due to the increasing complexity of economic regulations, which demand more transparency and accountability than ever before.

As nonprofits face challenges like unpredictable funding and closer scrutiny from donors and regulators, nonprofit CFO services have seen an expansion in their role. Nowadays, they’re utilizing nonprofit CFO services not just to manage finances, but also to dive into risk management, strategic planning, and engage with a variety of stakeholders - think board members and program teams - to ensure everything aligns with the organization’s mission. It’s a big job!

This evolution really shows how CFOs are becoming catalysts for impact rather than just gatekeepers of resources. They’re using financial data to make informed decisions and foster a culture of economic literacy throughout the organization. So, next time you think about a CFO, remember they’re not just about the numbers; they’re about making a real difference!

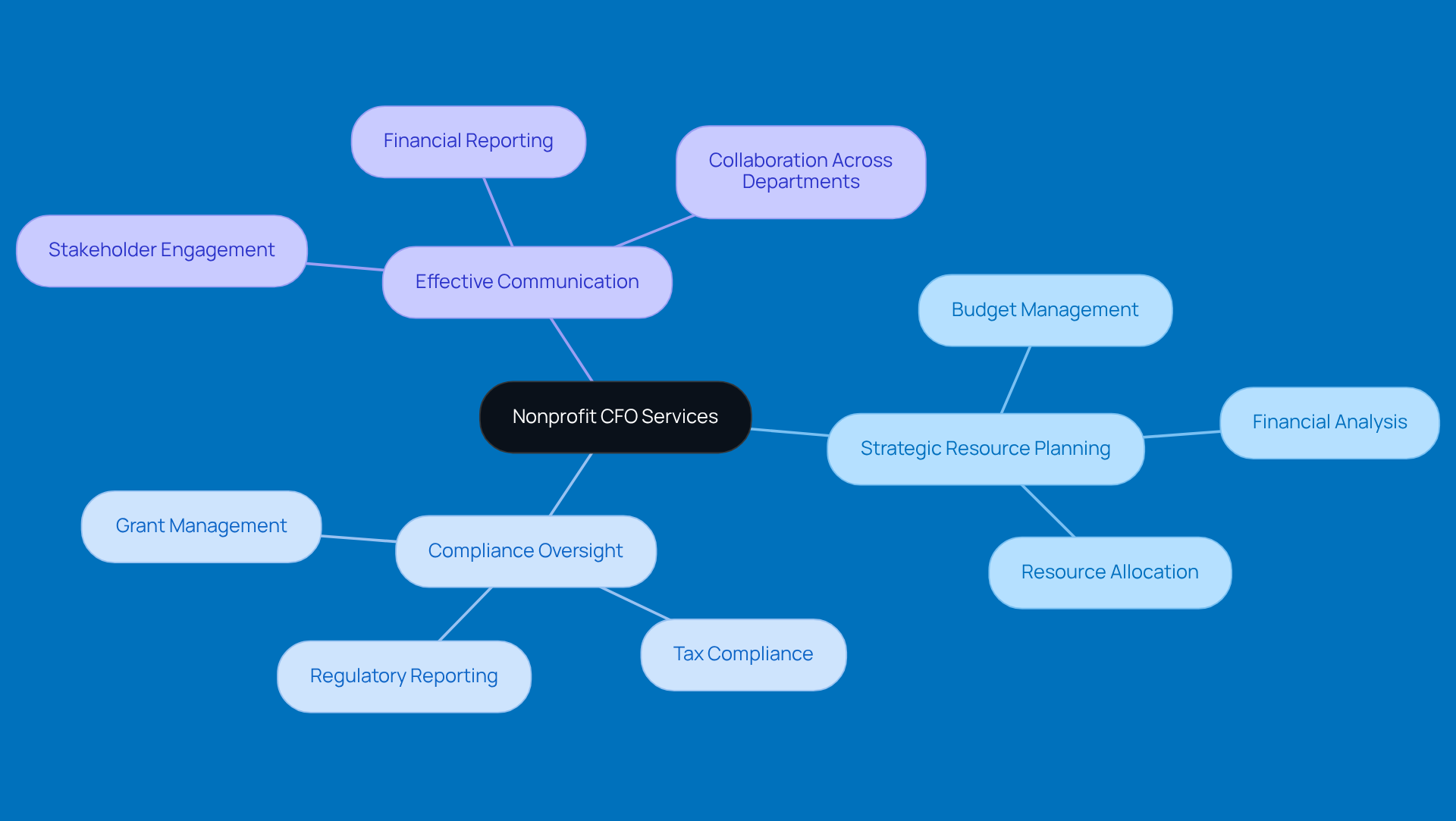

Key Characteristics and Functions of Nonprofit CFO Services

When considering nonprofit CFO services, several key traits come to mind:

- Strategic resource planning

- Compliance oversight

- Effective communication with stakeholders

A charitable CFO wears many hats, from creating and managing budgets to ensuring everything aligns with tax regulations. They also provide analyses that help guide decision-making.

One of the big parts of their job is grant management. This means they help organizations track funding sources and make sure they stick to donor stipulations. It’s all about keeping things transparent and trustworthy, right? Effective CFOs in the charity sector truly shine by leveraging nonprofit CFO services to foster collaboration across departments. They ensure that budget strategies are not just sound but also in sync with the organization’s mission and objectives.

This holistic approach doesn’t just enhance transparency; it builds trust with donors, which is crucial for supporting the organization’s long-term sustainability and impact. So, how does your organization approach these challenges? It’s worth reflecting on!

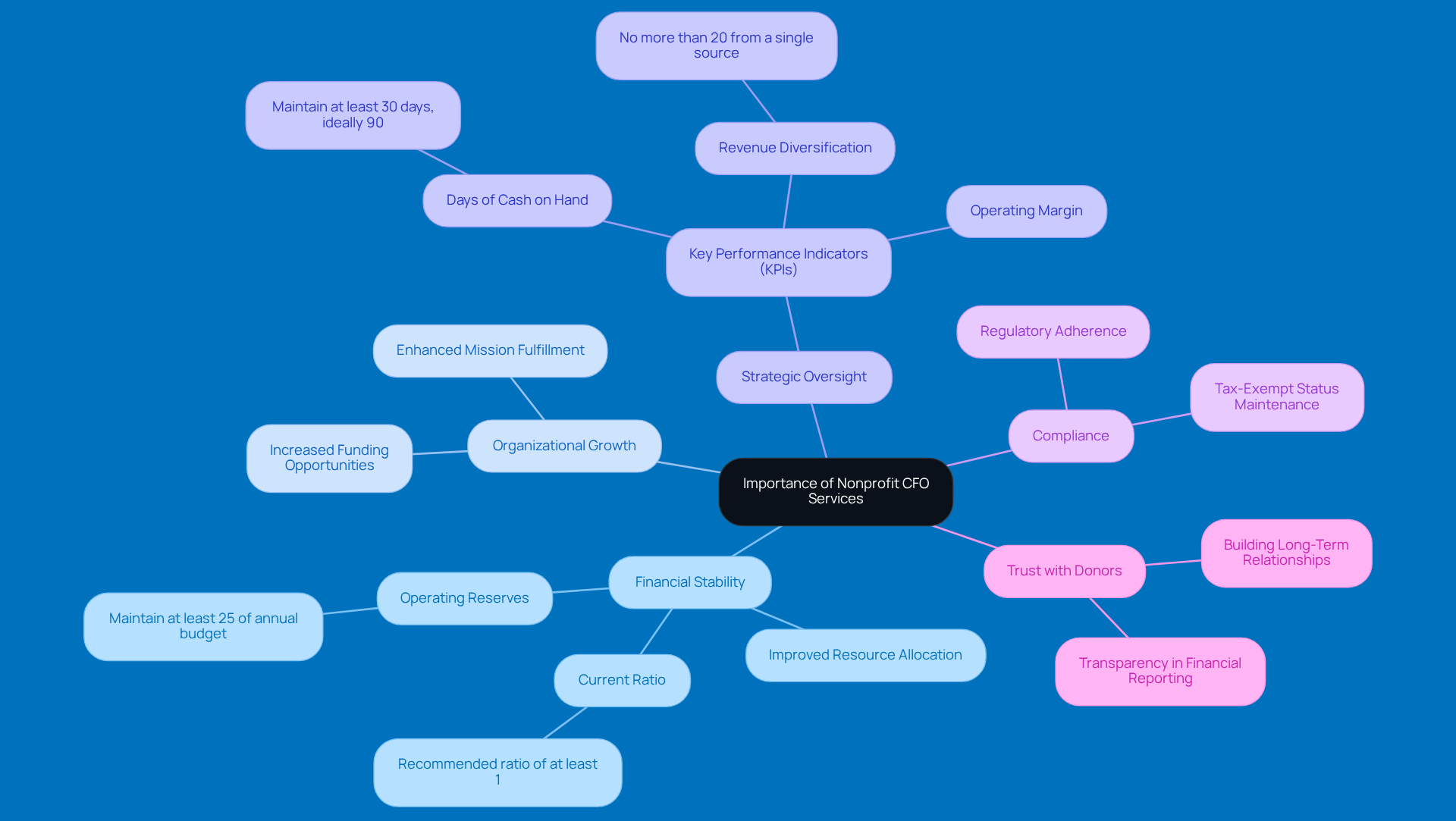

The Importance of Nonprofit CFO Services: Enhancing Financial Stability and Growth

Nonprofit CFO services are crucial for boosting economic stability and facilitating organizational growth. By offering nonprofit CFO services that include strategic financial oversight, CFOs help organizations navigate complex funding landscapes, improve how resources are allocated, and stay compliant with regulations. This proactive approach builds trust with donors and stakeholders, setting the stage for long-term success.

For example, organizations that use nonprofit CFO services often see better financial health, more funding opportunities, and a stronger ability to fulfill their missions. Think about it: key performance indicators (KPIs) like the current ratio - measuring how well an organization can meet short-term obligations - and the operating reserve, which tracks funds saved for unexpected expenses, are crucial metrics that CFOs help keep an eye on.

In the end, the availability of nonprofit CFO services is vital for boosting organizational effectiveness and ensuring a lasting impact. So, if you’re part of a nonprofit, consider how a CFO could help you navigate your financial journey!

Conclusion

Nonprofit CFO services are crucial for keeping charitable organizations financially healthy and running smoothly. By shifting the traditional role of a CFO to that of a strategic partner, these services help nonprofits tackle complex financial challenges while staying accountable to their supporters. This change shows just how important it is for organizations to adopt innovative financial strategies, especially as they deal with growing economic pressures.

Throughout this article, we’ve seen how nonprofit CFOs handle key tasks like strategic resource planning, compliance oversight, and effective communication with stakeholders. Take CFO Cecilia Kelly at the Dr. Phillips Center for the Performing Arts, for example. Her strategic initiatives highlight the real benefits of proactive financial management. Plus, the focus on grant management and transparency really emphasizes how these services build trust with donors and boost long-term sustainability.

In the end, we can’t underestimate the importance of nonprofit CFO services. They not only help ensure financial stability and growth but also guide organizations in achieving their missions more effectively. So, nonprofits should really think about how integrating CFO services can improve their financial strategies and enhance their overall impact in the community. Embracing this approach isn’t just about managing finances; it’s about building trust, fostering collaboration, and creating resilience within the nonprofit sector. What do you think? Are you ready to take that next step?

Frequently Asked Questions

What are nonprofit CFO services?

Nonprofit CFO services encompass a range of management functions tailored to the unique needs of charitable organizations, including financial planning, budgeting, tax regulation compliance, and resource distribution to support the mission.

Why is the role of a nonprofit CFO important?

The nonprofit CFO acts as a strategic partner, managing resource complexities while ensuring transparency and accountability to stakeholders, which is crucial for financial sustainability and operational efficiency.

What challenges are nonprofits facing that increase the demand for CFO services?

Nonprofits are experiencing rising economic pressures and the need for innovative funding strategies, leading to a heightened demand for CFO services.

Can you provide an example of effective nonprofit CFO leadership?

The Dr. Phillips Center for the Performing Arts, under CFO Cecilia Kelly, has successfully diversified its funding sources by emphasizing stakeholder engagement and strategic financial planning.

What benefits do nonprofits gain from utilizing CFO services?

Nonprofits that utilize CFO services can expect better financial oversight, improved compliance with changing regulations, and a stronger capacity to fulfill their missions.

What is the current concern among organization leaders regarding nonprofit finances?

55% of organization leaders identify financial health as their top concern, highlighting the increasing need for effective CFO services in the nonprofit sector.