Introduction

Navigating the world of business structures can feel a bit like wandering through a maze, right? Understanding the differences between S Corporations and Partnerships is super important for business owners. Each option has its own set of perks and challenges that can really affect things like taxes, liability, and how flexible your operations can be. Did you know that nearly 70% of small businesses lean towards Partnerships because they’re so adaptable?

So, which structure really fits your business goals and risk tolerance? Let’s dive into this comparison and uncover what makes each option tick, along with what it means for your choices.

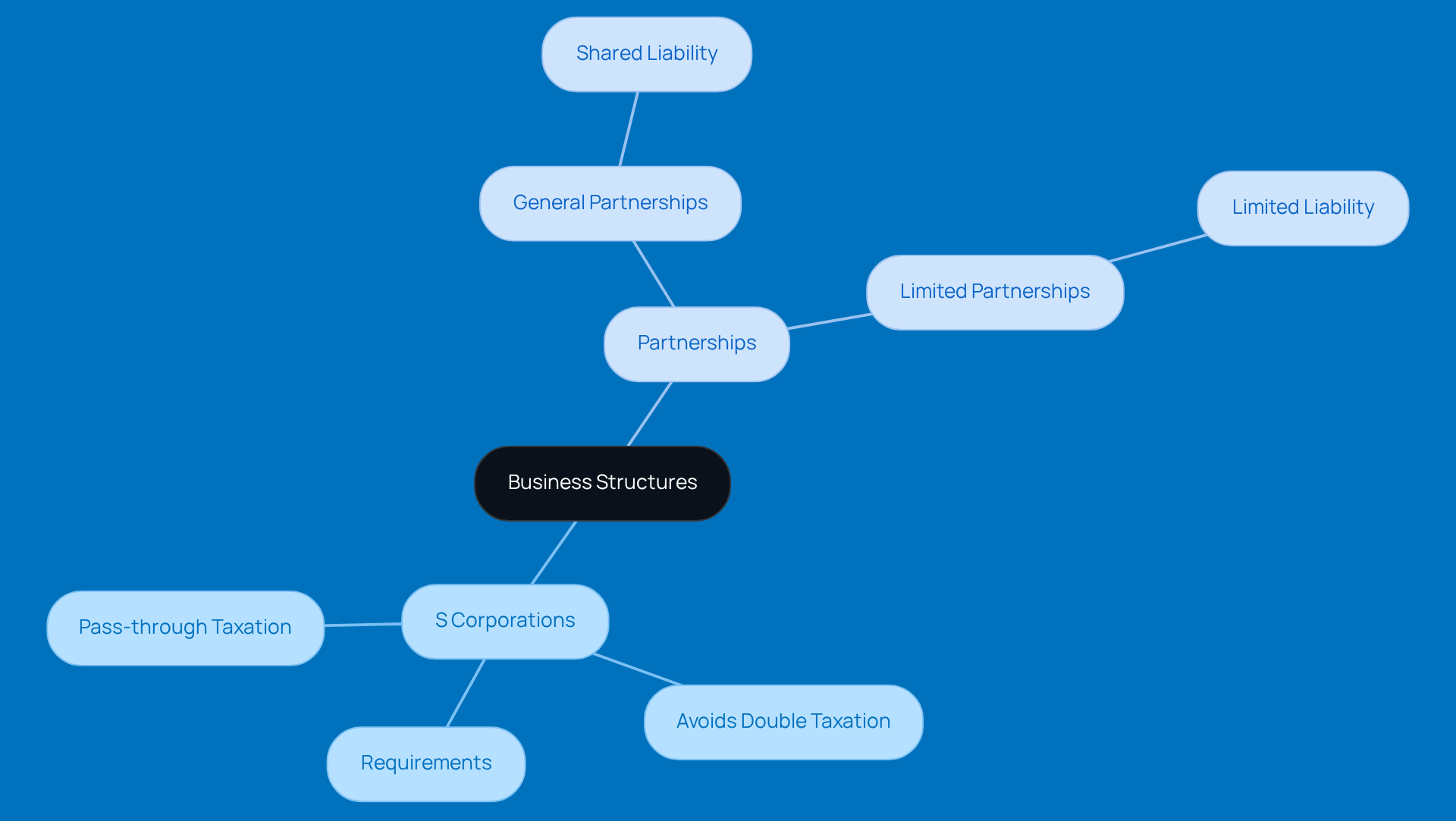

Define S Corporations and Partnerships

So, what’s the deal with S Corporations? Well, an S Corp is a special kind of corporation that meets certain requirements set by the Internal Revenue Code. This setup lets it pass income, losses, deductions, and credits directly to its shareholders. The best part? It avoids that pesky double taxation that can hit other business structures.

Now, let’s chat about Partnerships. This is where two or more folks come together to share ownership and management duties. Profits and losses flow right through to the partners' tax returns. There are two main types:

- General partnerships, where everyone shares liability

- Limited partnerships, where some partners have limited liability and don’t get too involved in the day-to-day management

Are you considering the difference between S Corp and partnership to find out which structure might work for you? It’s worth considering how each option aligns with your business goals!

Examine Legal and Tax Implications

S Corporations are pretty neat because they offer limited liability protection to their shareholders. This means that your personal assets are usually safe from any corporate debts or obligations. However, there are some rules to keep in mind, like limits on how many shareholders you can have and who those shareholders can be. The best part? S Corps avoid double taxation! Instead of the corporation being taxed, the income gets reported on the shareholders' individual tax returns.

Now, let’s chat about Partnerships. Unlike S Corps, Partnerships don’t provide that same limited liability. This means that if things go south, associates are personally on the hook for financial obligations. But there’s a silver lining! Partnerships benefit from pass-through taxation, which means profits and losses are reported on each member's individual tax returns. This can simplify tax obligations, but it also means personal assets are exposed to the risks of the business.

So, whether you’re leaning towards an S Corp or a Partnership, it’s essential to consider the difference between S Corp and Partnership while weighing the pros and cons. What’s your experience with these business structures? Have you found one to be more beneficial than the other?

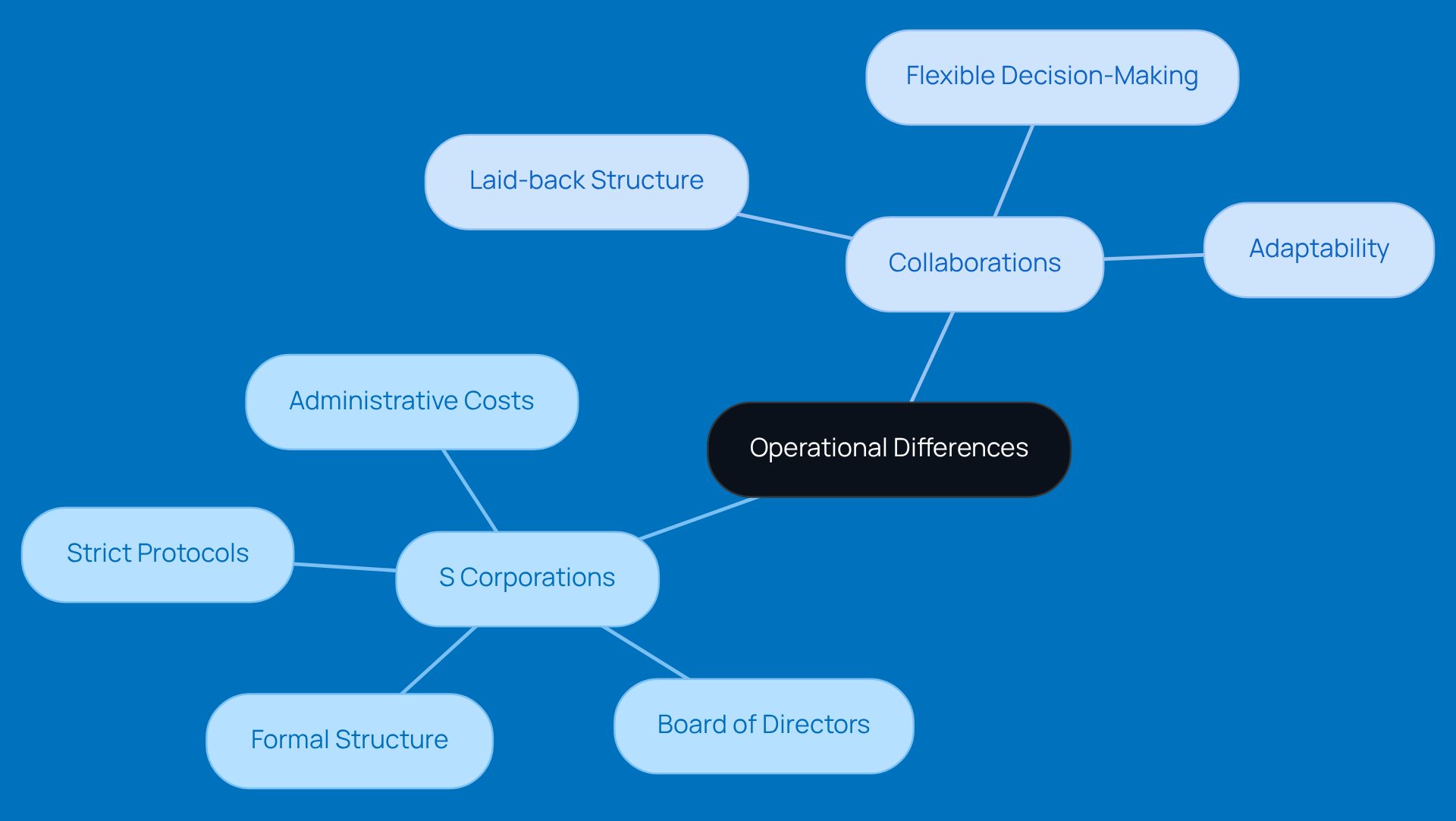

Analyze Operational Differences

When it comes to S Corporations, there’s a bit of a formal vibe going on. They need a board of directors, corporate officers, and regular meetings, which can bump up those administrative costs. Plus, they have to stick to strict operational protocols and keep detailed records.

On the flip side, Collaborations are usually more laid-back. They let associates run the show without all the formalities. Decisions can be made together, and the structure can be shaped to fit what the partners want. This flexibility makes it a breeze to adapt when things change.

So, which one sounds better to you? The structured S Corporation or the adaptable Collaboration? It really depends on what you’re looking for!

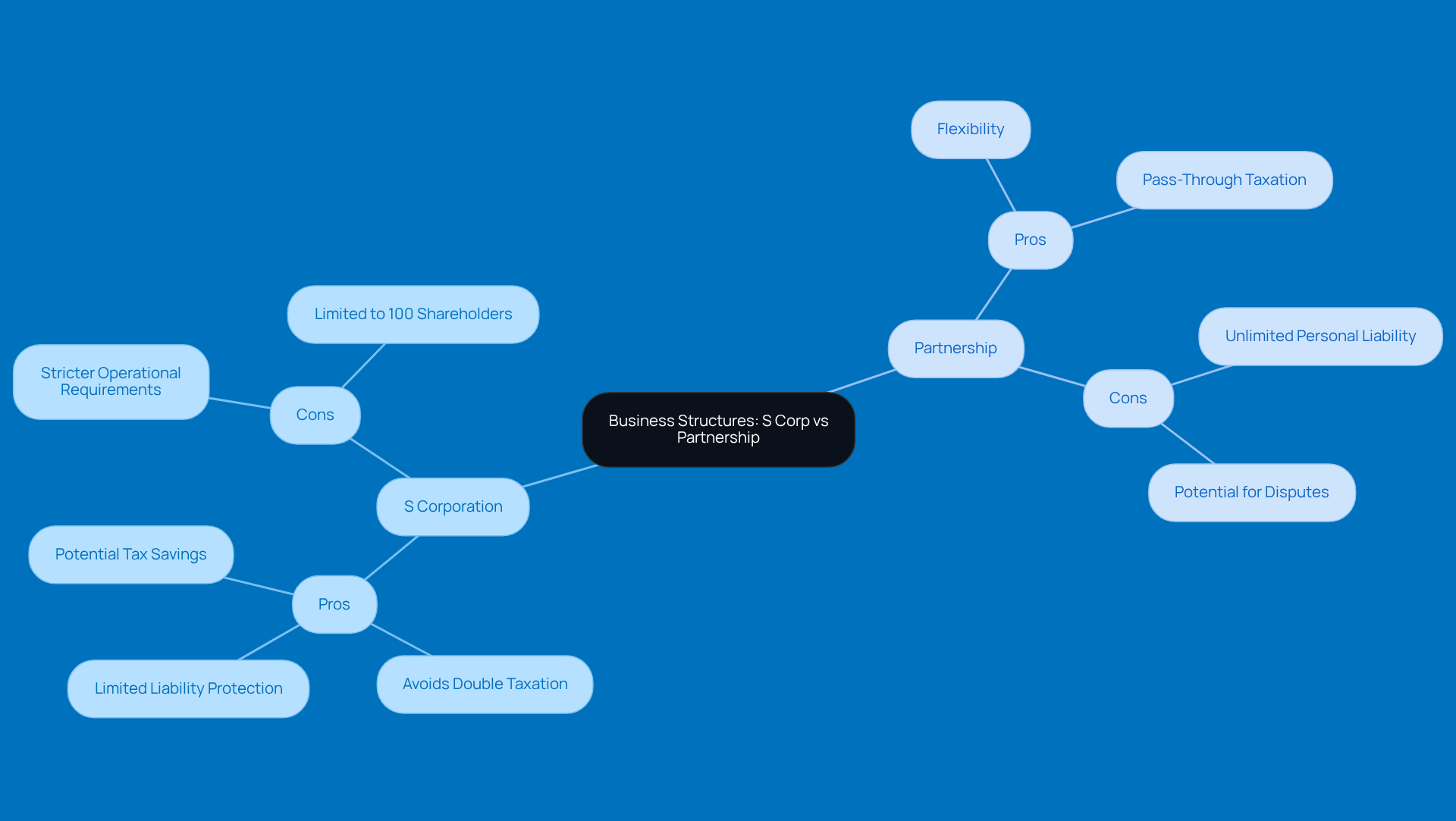

Evaluate Pros and Cons of Each Structure

S Corporations come with some pretty neat perks. For starters, they offer limited liability protection, which means your personal assets are safe from business debts. Plus, they help you avoid double taxation since profits are only taxed at the shareholder level. And let’s not forget about the potential tax savings! By mixing salary and distributions, owners can really cut down on self-employment taxes. But, like anything, there are downsides. S Corps have stricter operational requirements, like needing annual meetings and keeping detailed records. They also limit ownership to just 100 shareholders, all of whom must be U.S. citizens or resident aliens.

On the flip side, Partnerships are often the go-to choice for those who value flexibility and a simple setup. They allow for pass-through taxation, which means profits and losses show up on the partners' individual tax returns, avoiding corporate tax altogether. This can be a real win for small businesses looking to keep things straightforward. However, Partnerships come with their own set of challenges. For one, partners face unlimited personal liability, meaning personal assets could be on the line if the business runs into debt or legal trouble. Plus, decision-making can get a bit messy, leading to disputes among partners.

Let’s look at some real-world scenarios: a small business operating as a Partnership might enjoy the easy setup and tax benefits, but it could also be in hot water if one partner makes a bad financial call. On the other hand, an S Corporation might draw in investors thanks to its stability and limited liability, but it could also be bogged down by the administrative tasks that come with compliance.

Financial advisors often stress the importance of understanding the difference between S Corp and Partnership. As one expert put it, "Choosing the right organizational structure is crucial; it can impact everything from taxes to personal liability." Interestingly, nearly 70% of small businesses are opting for Partnerships these days, thanks to their flexibility and tax perks. This trend really highlights their appeal in today’s economic landscape. So, as a business owner, it’s essential to weigh these pros and cons carefully to find the structure that fits your goals and risk tolerance.

Conclusion

Understanding the differences between S Corporations and Partnerships is super important for any business owner wanting to pick the best structure for their venture. Each option has its own perks and challenges that can really impact your financial and operational results. By taking a closer look at these differences, you can make smart choices that fit your goals and comfort with risk.

In this article, we’ve explored the key features of S Corporations and Partnerships, shining a light on their legal and tax implications, how they operate, and the pros and cons of each.

- S Corporations offer limited liability protection and dodge double taxation, but they come with stricter operational rules.

- Partnerships provide flexibility and simpler tax processes, but they do expose partners to unlimited personal liability.

Ultimately, the choice between these structures boils down to what your business specifically needs.

So, when it comes to deciding between an S Corporation and a Partnership, don’t rush it! It’s crucial to weigh the benefits and drawbacks of each structure, keeping in mind factors like liability, taxes, and how you want to manage things. Chatting with a financial advisor or legal expert can give you tailored insights that fit your unique business situation, helping you choose a structure that sets you up for long-term success and stability.

What are your thoughts on this? Have you considered how these options might fit into your plans?

Frequently Asked Questions

What is an S Corporation?

An S Corporation, or S Corp, is a special type of corporation that meets specific requirements set by the Internal Revenue Code, allowing it to pass income, losses, deductions, and credits directly to its shareholders while avoiding double taxation.

What are the main advantages of an S Corporation?

The main advantage of an S Corporation is that it avoids double taxation, meaning that the corporation's income is only taxed at the shareholder level rather than at both the corporate and individual levels.

What is a Partnership?

A Partnership is a business structure where two or more individuals come together to share ownership and management responsibilities, with profits and losses flowing directly through to the partners' tax returns.

What are the two main types of Partnerships?

The two main types of Partnerships are General Partnerships, where all partners share liability, and Limited Partnerships, where some partners have limited liability and are not involved in day-to-day management.

How should one decide between an S Corporation and a Partnership?

When deciding between an S Corporation and a Partnership, it is important to consider how each structure aligns with your business goals, including factors like taxation, liability, and management involvement.