Introduction

Understanding the ins and outs of the Foreign Earned Income Exclusion (FEIE) is super important for American expats trying to navigate the tricky world of international taxes. This handy provision lets eligible citizens exclude a good chunk of their overseas earnings from U.S. taxes, which can really help lighten the financial load and give you more control over your income.

But let’s be real - the eligibility requirements and the details of claiming this exclusion can feel overwhelming, especially when you throw double taxation into the mix.

So, how can expats make the most of the FEIE to improve their tax situation while staying on the right side of U.S. laws?

Define the Foreign Earned Income Exclusion (FEIE)

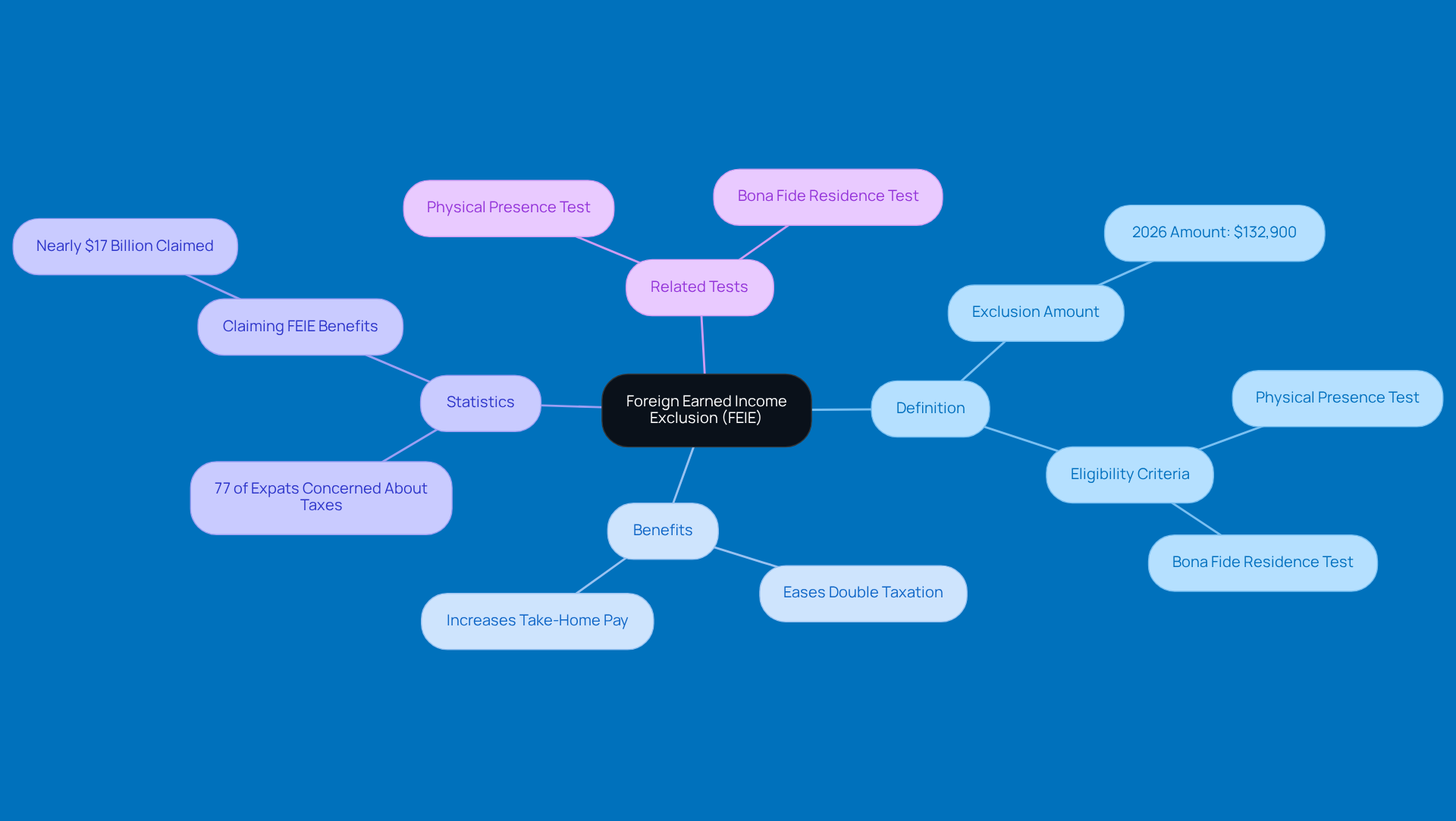

The foreign earned income exclusion definition is a pretty important part of American tax law. The foreign earned income exclusion definition allows qualifying citizens and resident aliens to leave a portion of their overseas earnings out of domestic taxes. For the tax year 2025, that exclusion is set at $130,000 for each qualifying individual. The foreign earned income exclusion definition aims to ease the pain of double taxation on income earned abroad, offering some financial relief to expatriates who still have to deal with American tax laws while living and working in other countries.

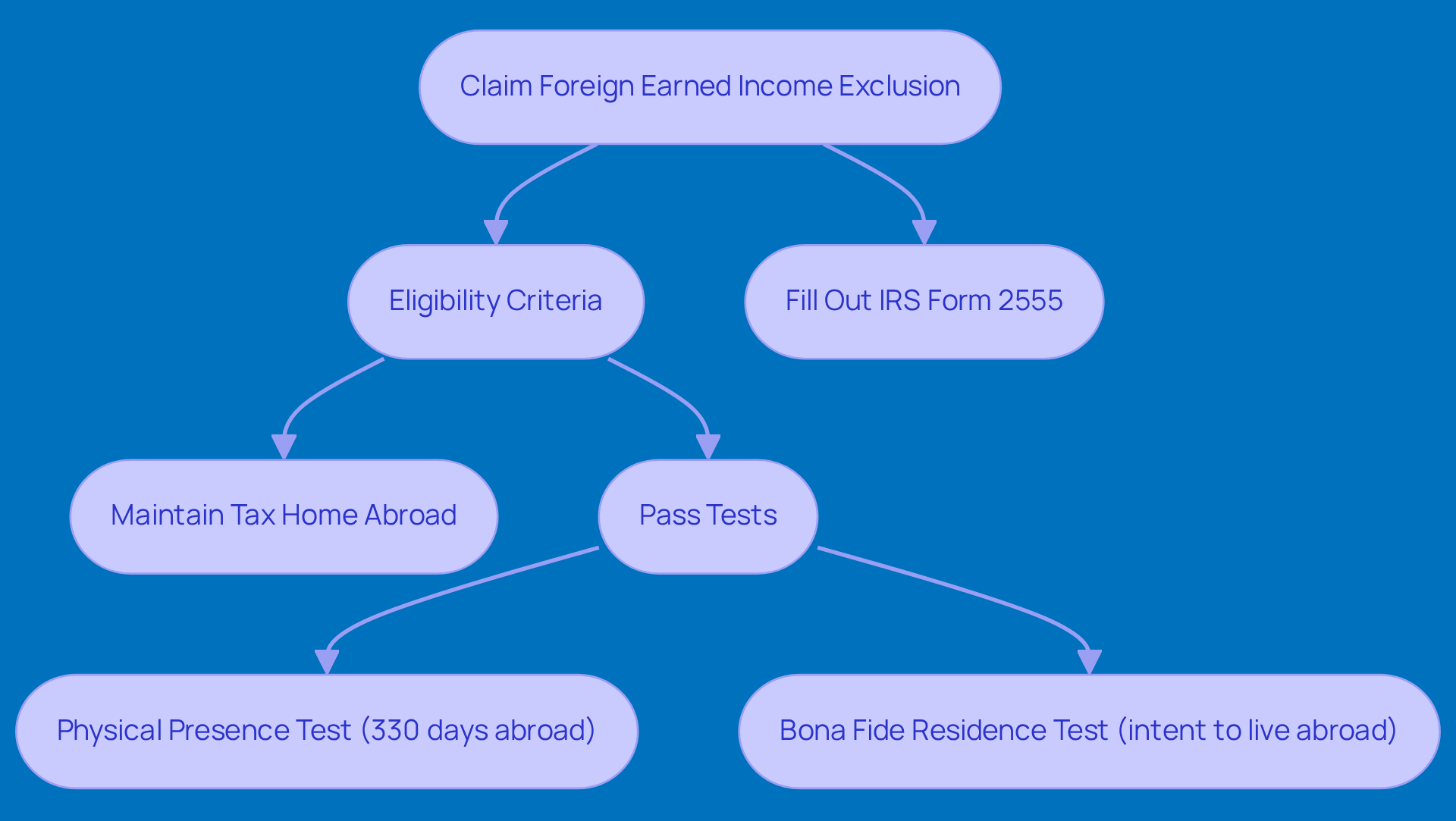

So, how do you claim this exclusion? Well, you’ll need to fill out IRS Form 2555. But hold on! There are some eligibility criteria you have to meet first. You need to maintain a tax home in another country and pass either the Physical Presence Test or the Bona Fide Residence Test. A key takeaway from the Lemay v. Commissioner case is that your tax home must be outside the U.S. to qualify for this exclusion.

Now, let’s break down those tests a bit. The Physical Presence Test means you’ve got to be physically present in foreign countries for at least 330 full days during any 12-month period. On the flip side, the Bona Fide Residence Test is more about your intent to live abroad rather than just counting days spent in another country.

And here’s a little bonus: if you’re married, both you and your spouse can claim the FEIE limit separately! That means you could potentially exclude up to $260,000 together if you both qualify. Just a heads-up, though - the IRS has done away with Form 2555-EZ, so now everyone has to use the full Form 2555.

Contextualize the Importance of FEIE for U.S. Expats

The foreign earned income exclusion definition reveals how the FEIE is a game-changer for American expats by easing the financial burden of double taxation. If you’re one of the many Americans living abroad, you know the struggle of being taxed by both your home country and your host nation. The good news? The FEIE lets you exclude up to $132,900 of your foreign-earned income from U.S. taxes for the 2026 fiscal year. That means you get to keep more of your hard-earned money for yourself and your investments.

This exclusion is a lifesaver, especially for folks in service-oriented jobs where pay can fluctuate based on where you are and the conditions of your work. As a Greenback Specialist puts it, "Filing U.S. taxes as an American abroad is complex. We help make it easy for you." And it’s true-statistics show that nearly 77% of expats worry about managing their tax responsibilities. That’s why understanding and using the foreign earned income exclusion definition is crucial.

By navigating your tax duties, including the Physical Presence Test or the Bona Fide Residence Test, you can really optimize your finances and improve your quality of life while living overseas. Plus, there are plenty of real-life stories out there of expats who have successfully used the FEIE to lower their taxable income. In today’s complicated international tax landscape, understanding the foreign earned income exclusion definition is a vital tool for achieving financial stability. So, have you thought about how the FEIE could work for you?

Identify Eligibility Criteria for the Foreign Earned Income Exclusion

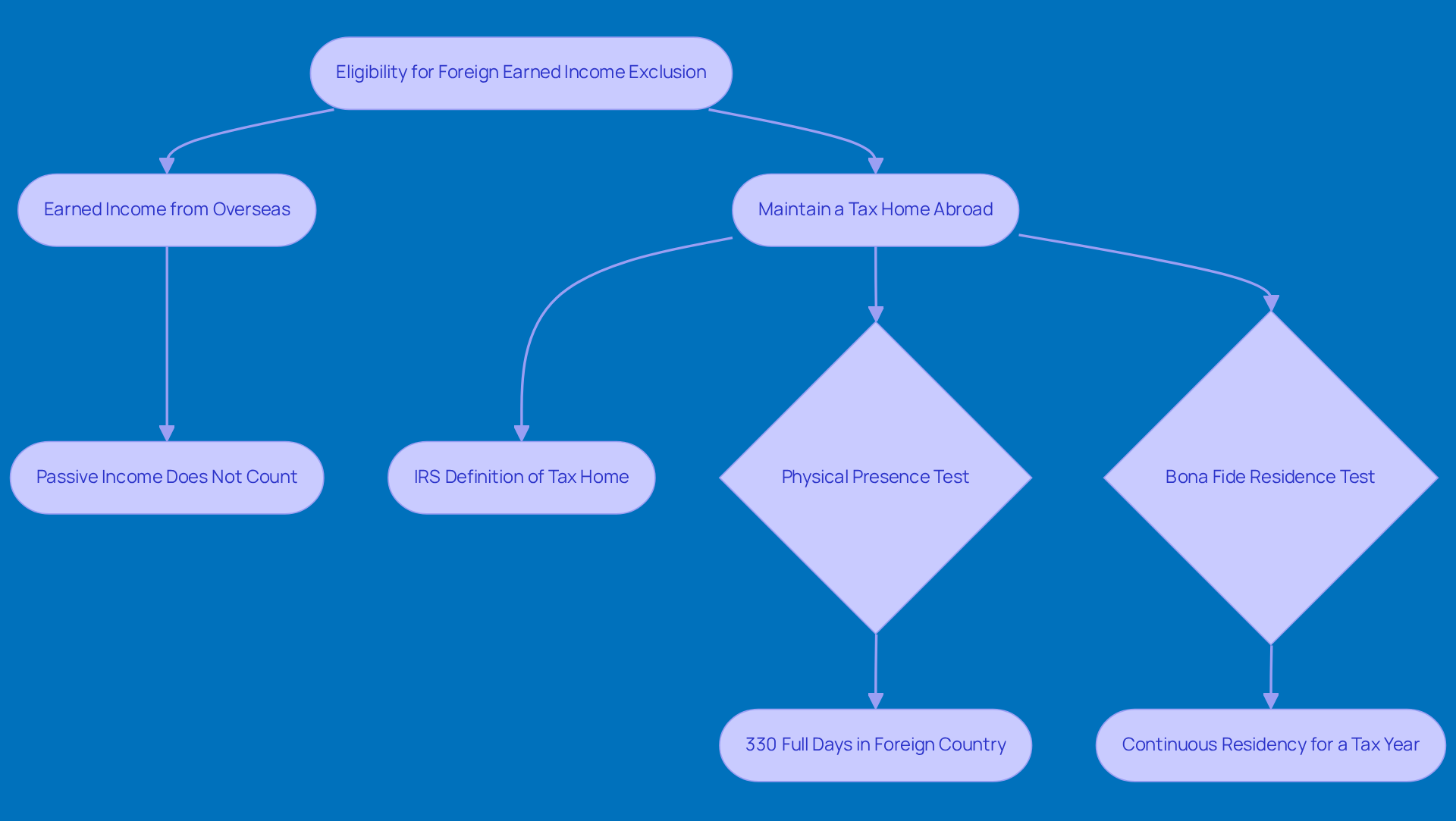

To qualify for the foreign earned income exclusion definition, you’ve got to meet a few key criteria. First off, you need to have earned income from overseas - think wages, salaries, and professional fees for services you provided in another country. Just a heads up, passive income like dividends or interest doesn’t count here.

Next up, it’s important to maintain a tax home in another country. The IRS defines a tax home as the main spot where you do your business or work, and it has to be outside the U.S.

Now, here’s where it gets a bit tricky: you need to pass one of two tests to show you’re eligible. There’s the Physical Presence Test, which means you’ve got to be physically present in another country for at least 330 full days within any 12-month period. The cool part? That 12-month period can cross over tax years! On the flip side, there’s the Bona Fide Residence Test. This one requires you to prove that you’ve set up residency in another country for a continuous stretch that includes a whole tax year.

Let’s look at some real-life examples to make this clearer. Take Sarah, for instance. She’s an American expat who qualifies under the Bona Fide Residence Test because she moved abroad with no set end date and kept her main home there all year long. Then there’s Robert, who doesn’t qualify since his time overseas doesn’t cover a full calendar year, which is a must for maintaining residency for an entire tax year.

Understanding the foreign earned income exclusion definition is crucial for expats who want to claim the FEIE and reduce their U.S. tax bills. Missing any of these requirements could mean losing out on the benefits of the exclusion, and nobody wants that!

Clarify What Counts as Foreign Earned Income

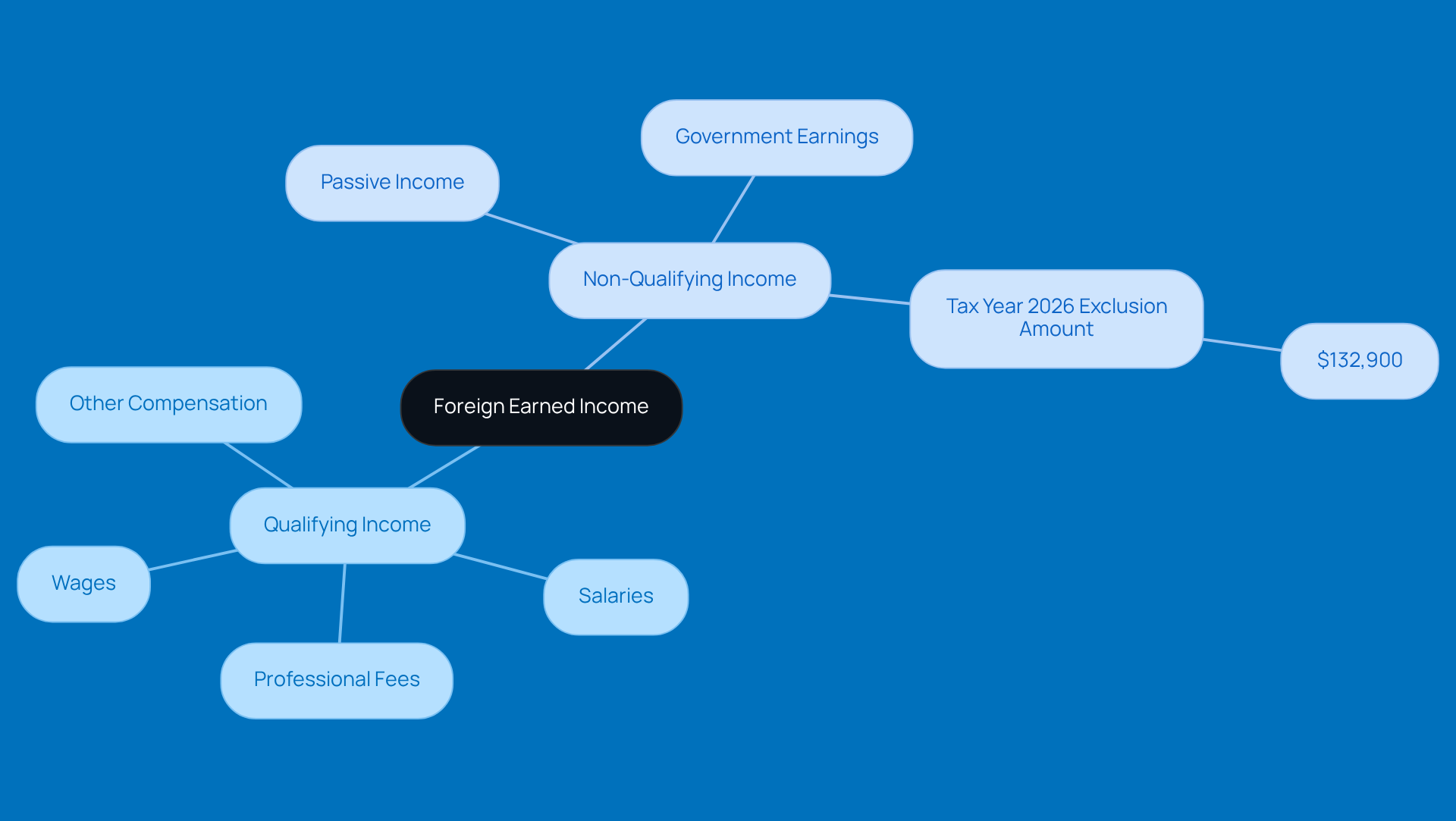

Earnings from abroad are basically the money you make for working in another country. This can include wages, salaries, professional fees, and other forms of compensation for the services you provide. But here’s the catch - not all earnings meet the foreign earned income exclusion definition. For instance, passive income like dividends, interest, capital gains, and pensions don’t count as overseas earned revenue, so they can’t be excluded.

Also, if you’re working for a government entity in the U.S. or certain international organizations, those earnings might not be eligible for the FEIE either. For the tax year 2026, the Foreign Earned Income Exclusion amount is set at $132,900. This is super important for expatriates to keep in mind when figuring out their potential tax exclusions. Understanding the foreign earned income exclusion definition is essential for expats to accurately determine their tax exemptions and remain compliant with American tax laws.

As the IRS puts it, "You must run the full tax calculation multiple ways to find the lowest liability." This really emphasizes the need for thorough tax planning if you’re living abroad. Think about it - real-life examples of foreign earned income could be a U.S. citizen working as a consultant in London or a teacher at an international school in Tokyo. Both of these folks might qualify for the FEIE, which is a great way to save on taxes!

Conclusion

The foreign earned income exclusion (FEIE) is a big deal in American tax law, especially for expatriates. It lets them exclude a chunk of their overseas earnings - up to $130,000 for the 2025 tax year - from U.S. taxes. This is a game changer for those facing double taxation while working abroad, helping them keep more of their hard-earned cash.

In this article, we’ve covered some key insights about the FEIE. We talked about:

- Who’s eligible

- The importance of having a tax home outside the U.S.

- The need to pass either the Physical Presence Test or the Bona Fide Residence Test

- What types of income qualify for this exclusion

Remember, only earned income from foreign sources counts - passive income? Not so much. Understanding this is crucial for expatriates who want to make the most of their tax situation and steer clear of any potential traps.

So, why is grasping the foreign earned income exclusion so important for U.S. citizens living abroad? Well, it helps with better financial management and can really improve your quality of life. With the FEIE, expatriates can focus more on their work and personal lives without the stress of excessive taxes hanging over their heads. By taking advantage of this exclusion, they can maximize their financial benefits while navigating the sometimes tricky waters of international tax law.

Have you thought about how the FEIE could impact your finances? It’s worth considering as you plan your next steps abroad!

Frequently Asked Questions

What is the Foreign Earned Income Exclusion (FEIE)?

The Foreign Earned Income Exclusion (FEIE) allows qualifying American citizens and resident aliens to exclude a portion of their overseas earnings from domestic taxes. For the tax year 2025, the exclusion is set at $130,000 for each qualifying individual.

What is the purpose of the FEIE?

The FEIE aims to alleviate the burden of double taxation on income earned abroad, providing financial relief to expatriates who must navigate American tax laws while living and working in other countries.

How can one claim the FEIE?

To claim the FEIE, you must fill out IRS Form 2555. However, you must first meet certain eligibility criteria.

What are the eligibility criteria for the FEIE?

To qualify for the FEIE, you need to maintain a tax home in another country and pass either the Physical Presence Test or the Bona Fide Residence Test. Additionally, your tax home must be outside the U.S.

What is the Physical Presence Test?

The Physical Presence Test requires you to be physically present in foreign countries for at least 330 full days during any 12-month period.

What is the Bona Fide Residence Test?

The Bona Fide Residence Test focuses on your intent to live abroad rather than simply counting the days spent in another country.

Can married couples both claim the FEIE?

Yes, if both spouses qualify, they can each claim the FEIE limit separately, potentially excluding up to $260,000 together.

Has there been any change in the forms used to claim the FEIE?

Yes, the IRS has eliminated Form 2555-EZ, so now everyone must use the full Form 2555 to claim the FEIE.