Introduction

You know, the intersection of family and business can really open up some unique opportunities, especially for small business owners who want to make the most of their tax strategies. Take the Hire Your Kids Tax Strategy, for instance. It’s a clever way for parents to involve their kids in legitimate work, and it comes with some pretty significant tax benefits that can ease the financial burden of running a business.

But here’s the big question: how can this strategy strike the right balance between teaching family responsibility and maximizing those tax savings? Diving into the details of this approach not only shows its potential for financial relief but also highlights how it can help teach invaluable life skills to the next generation. So, let’s explore this together!

Define the Hire Your Kids Tax Strategy

Have you ever thought about how you can turn your kids into little earners while also getting some tax benefits? The hire your kids tax strategy offers a clever approach for business owners to employ their children in legitimate roles within their companies. By paying them a salary, parents can write off those payments as business expenses, which helps lower the overall taxable income of the business. This means that kids can earn money without hitting the tax radar, especially if they stay under the standard deduction limit of $12,950 for 2022. So, if your child makes up to that amount, they won’t owe any federal income tax at all! How cool is that?

But wait, there’s more! If your child is under 18 and works in a sole proprietorship run by a parent, they don’t even have to worry about Social Security and Medicare taxes. That’s a double win! Plus, this strategy isn’t just about saving money; it’s also a fantastic way to teach kids valuable skills and how to manage money. Imagine them learning about budgeting and responsibility while earning their own cash!

Real-life examples show how effective this can be. Families running sole proprietorships have successfully hired their kids for tasks like managing social media or keeping the books, ensuring the work is age-appropriate and well-documented. Just remember, keeping proper records - like job descriptions and timecards - is key to staying on the right side of IRS regulations. This not only helps with taxes but also establishes a hire your kids tax strategy that sets up the next generation for financial success.

And here’s a little bonus: parents can encourage their kids to put some of that hard-earned cash into an IRA. This way, they can save for retirement and enjoy tax-free growth, especially if they go for a Roth IRA. So, employing your kids and helping them save can really boost the financial future for both your business and your child. Why not give it a shot?

Contextualize the Strategy for Small Business Owners

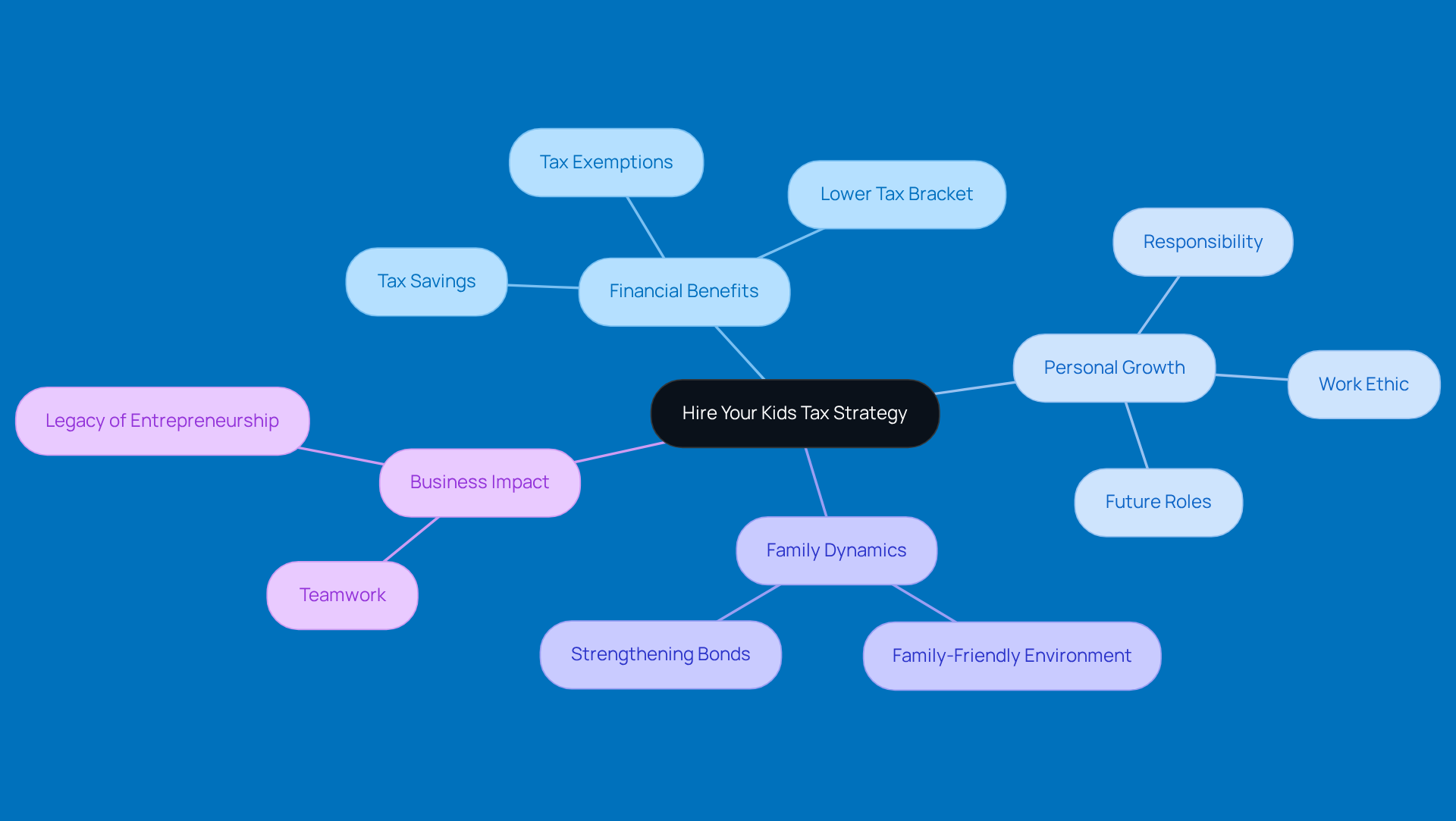

If you're a small business owner, particularly in a rural area or managing a family business, the hire your kids tax strategy could be a game changer for you. Many of these entrepreneurs face hurdles like unpredictable income and limited resources, not to mention the constant need for fresh ideas to keep their businesses afloat. By utilizing a hire your kids tax strategy, they can bring their kids into the mix to shift income to a lower tax bracket, which can really lighten the tax load.

But it’s not just about the money! This strategy also helps instill a sense of responsibility and work ethic in young people, prepping them for future roles in the family business or whatever path they choose. Plus, having the kids involved creates a family-friendly work environment, which strengthens those family bonds and builds a legacy of entrepreneurship.

Did you know that more and more small business owners are tapping into family employment strategies? They’re seeing the perks of tax savings while also nurturing personal growth. For instance, many families have successfully navigated tax implications by ensuring their dependents are doing legitimate work, which opens the door to tax exemptions and deductions. This not only boosts the financial health of the business but also fosters a culture of teamwork and responsibility among family members.

So, why not consider this approach? It could be a win-win for your family and your business!

Trace the Origins and Legal Framework

Have you ever thought about hiring your kids? The Hire Your Kids Tax Strategy provides a clever method for parents to involve their children in their businesses while also saving on taxes! According to IRS rules, if you hire your kids under 18 for legitimate work in your unincorporated business, their wages are exempt from Social Security and Medicare taxes. Pretty cool, right?

This strategy was designed to encourage families to work together and utilize a hire your kids tax strategy to provide small business owners with some tax relief. Over the years, tax reforms, especially the Tax Cuts and Jobs Act, have made the hire your kids tax strategy increasingly appealing for small business owners. It’s essential for parents to understand these rules to stay compliant and make the most of this tax benefit.

Plus, the history of tax regulations supporting family employment shows just how much we value family-run businesses in our economy. It’s a great way to foster generational wealth and teach kids about financial responsibility. So, why not consider bringing your kids into the fold? It could be a win-win for your family and your business!

Highlight Key Characteristics and Benefits

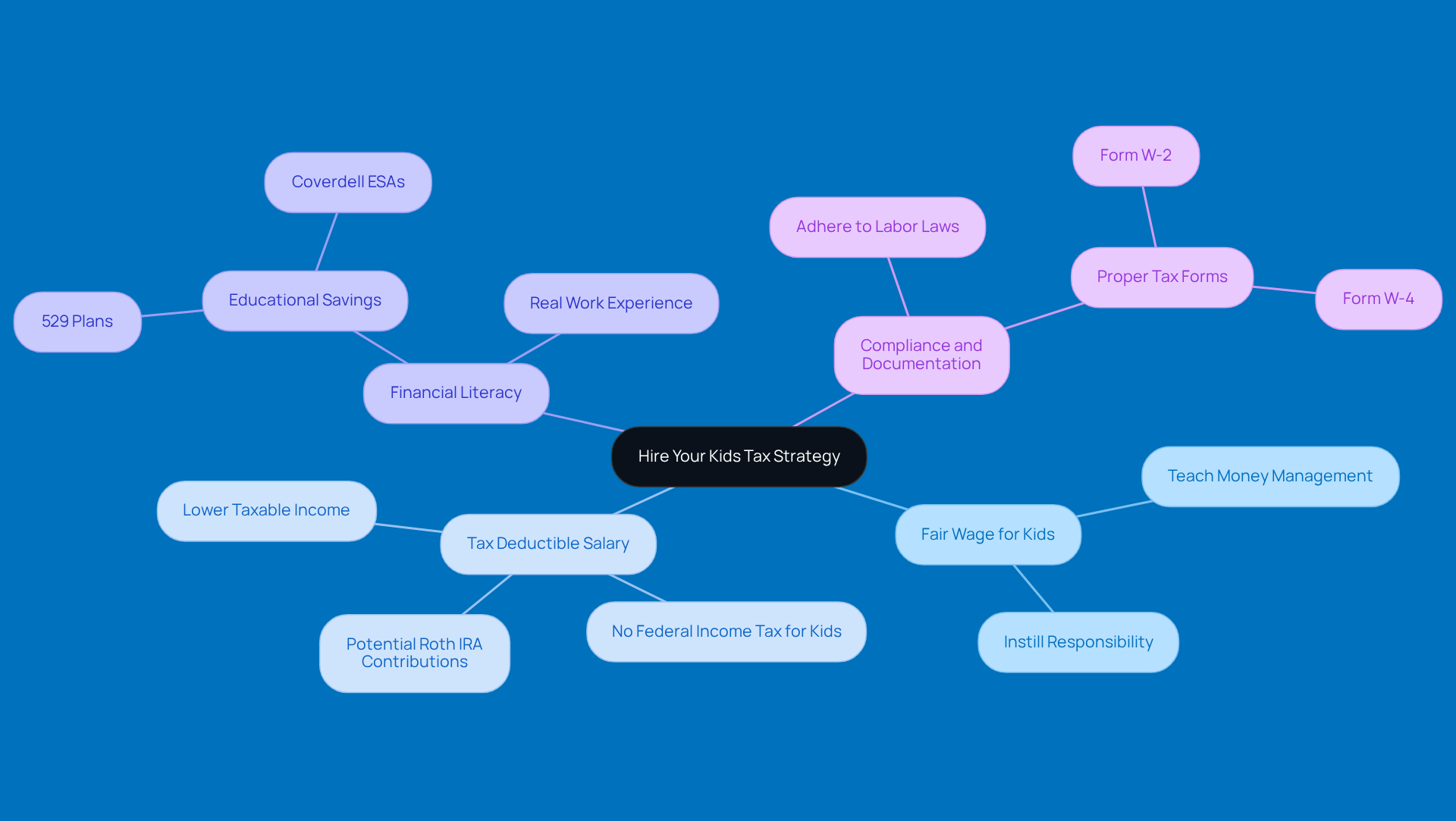

The features of the Hire Your Kids Tax Strategy make it an excellent choice for small business owners. For starters, it lets parents pay their kids a fair wage for real work, and guess what? That salary can be fully deducted as a business expense! This means that the money paid to minors can help lower the business's taxable income, while the kids can earn some cash without having to worry about federal income tax, as long as they stay below the standard deduction limit.

The perks of this strategy are pretty extensive. Not only does it cut down the business's taxable income, but it also serves as a fantastic way to teach kids important money management skills and instill a sense of responsibility. For instance, if a parent pays their child $15,000 for work done, that amount is fully deductible. This significantly reduces the parent's taxable income while giving the child tax-free earnings. How great is that?

Plus, this approach can help families save for future educational expenses or other financial goals. By funneling the child's earnings into educational savings plans like 529 plans or Coverdell ESAs, families can really boost their financial planning. The dual benefit of tax savings for the business and financial literacy for the child makes the hire your kids tax strategy an appealing and smart choice for many small business owners.

Now, for new parents, understanding the financial implications of raising a child is super important. The government offers various tax credits and deductions, like the Child Tax Credit and the Child and Dependent Care Credit, which can help ease some of the costs of parenting. Just remember, it’s crucial to follow labor laws and keep proper documentation of the employment arrangement to back up this strategy. For example, there’s a case study about a dentist who hired her 15-year-old son to help with admin tasks. He earned about $6,000 a year without payroll taxes, thanks to the sole proprietorship setup. This really highlights the importance of sticking to IRS guidelines while maximizing the financial benefits of hiring your kids. And hey, Steinke and Company can help ensure you’re compliant and avoid any surprises come tax season, making this strategy even more effective!

Conclusion

The Hire Your Kids Tax Strategy is a fantastic opportunity for small business owners. Not only can it help lighten your tax load, but it also gives your kids a chance to learn valuable life skills. By hiring your children for legitimate roles in your family business, you can deduct their salaries as business expenses, which lowers your taxable income. Plus, your kids can earn money tax-free up to a certain limit, all while picking up a sense of responsibility and financial know-how that’ll serve them well in the future.

Throughout this article, we’ve explored some key insights, like the tax perks of hiring minors, the legal framework behind this strategy, and real-life stories of families who’ve made it work. We’ve highlighted how small business owners can navigate the tricky waters of tax regulations while giving their kids meaningful work experiences. And let’s not forget the importance of keeping proper documentation and sticking to IRS guidelines-this way, families can truly make the most of this approach.

In the end, the Hire Your Kids Tax Strategy is more than just a smart financial move; it’s a way to strengthen family ties, instill a solid work ethic, and prepare the next generation for success. So, if you’re a small business owner, consider this strategy not just for its immediate tax benefits but also for the lasting impact it can have on your kids’ financial education and your family legacy. Embracing this approach could lead to a win-win for both your family and your business, setting the stage for a brighter financial future.

Frequently Asked Questions

What is the Hire Your Kids Tax Strategy?

The Hire Your Kids Tax Strategy allows business owners to employ their children in legitimate roles within their companies, enabling them to pay their kids a salary that can be written off as a business expense, thereby lowering the overall taxable income of the business.

How does this strategy benefit children financially?

If children earn up to the standard deduction limit of $12,950 for 2022, they won’t owe any federal income tax at all, allowing them to earn money without hitting the tax radar.

Are there any tax exemptions for children under 18?

Yes, if a child under 18 works in a sole proprietorship run by a parent, they do not have to pay Social Security and Medicare taxes.

What skills can children learn from this strategy?

Children can learn valuable skills such as budgeting and responsibility while earning their own cash through age-appropriate tasks.

Can you provide examples of tasks children can perform?

Families running sole proprietorships have successfully hired their kids for tasks like managing social media or keeping the books, as long as the work is appropriate for their age and well-documented.

What records should parents keep when using this strategy?

Parents should maintain proper records, including job descriptions and timecards, to ensure compliance with IRS regulations and to substantiate the hire your kids tax strategy.

How can parents help their children save for the future?

Parents can encourage their kids to put some of their earnings into an IRA, particularly a Roth IRA, which allows for tax-free growth and helps set them up for financial success in the future.