Introduction

Hey there! If you're a small agency owner, understanding the ins and outs of Limited Liability Companies (LLCs) is super important, especially when it comes to tackling the tricky world of federal taxes. LLCs offer a unique mix of liability protection and tax flexibility, making them a great choice for entrepreneurs who want to keep their assets safe while also getting the most out of their tax strategies.

But here's the thing: tax rates change, and classifications can shift. So, how can you, as a small business owner, make the most of the LLC federal tax rate to lighten your tax load? In this article, we’ll dive into the details of LLC taxation, sharing insights and practical tips to help you make smart decisions for your financial future. Let’s get started!

Define LLCs and Their Tax Framework

A Limited Liability Company (LLC) is a pretty cool business structure that combines the liability protection of a corporation with the tax flexibility of a sole proprietorship. This mix makes LLCs especially appealing for small agency owners due to the advantages of the LLC federal tax rate. They help keep personal assets safe from business liabilities while allowing profits to be taxed at the individual’s personal tax rate. Did you know that 96% of LLCs are classified as small businesses? Many of these operate right from home, making them super accessible for entrepreneurs.

LLCs can be set up as single-member or multi-member entities, giving you the flexibility to choose your tax classification. You can go with a sole proprietorship, partnership, S corporation, or C corporation. This flexibility is key for optimizing strategies related to the LLC federal tax rate. For example, LLC members can take advantage of the Qualified Business Income (QBI) deduction, which lets eligible pass-through entities deduct up to 20% of their business income, depending on their taxable income. How great is that?

Tax pros often stress the importance of keeping business transactions separate from personal ones to maintain that limited liability. Regularly updating your records and understanding state tax regulations is crucial for staying compliant. As experts point out, smart planning helps LLC operators manage their responsibilities efficiently with respect to the LLC federal tax rate, allowing them to focus on growing their businesses without unnecessary interruptions.

Real-world examples really show off the benefits of LLC tax flexibility. Take a small tech startup that formed an LLC and quickly attracted more investors, leading to rapid growth. Or consider a two-person bakery that used the LLC structure to share responsibilities and scale operations smoothly. These stories highlight how LLCs not only provide legal protection but also open up growth opportunities for small agency owners. So, if you’re thinking about starting your own venture, an LLC might just be the way to go!

Explore the Federal LLC Tax Rate Structure

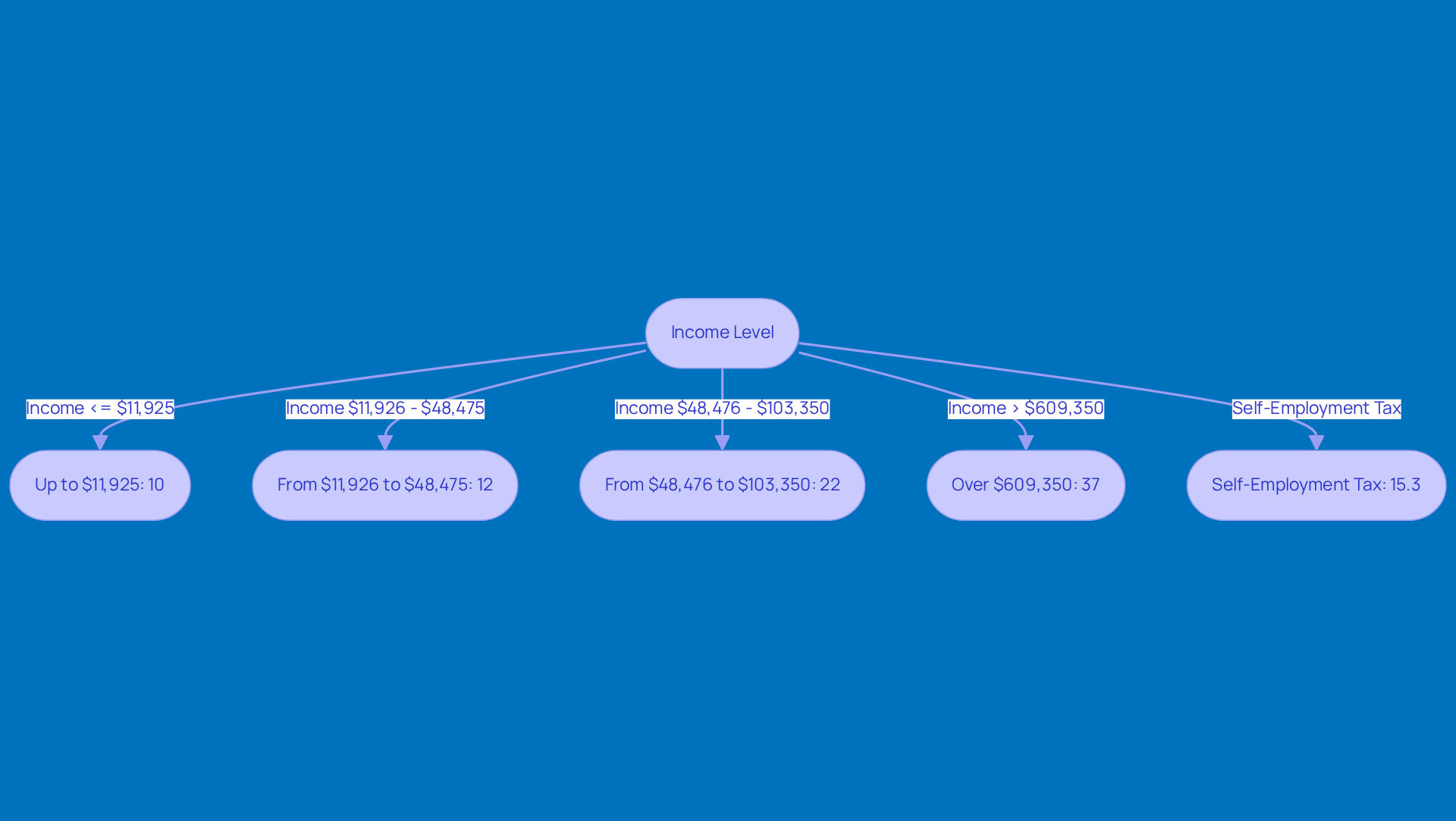

Hey there! So, in 2025, the LLC federal tax rate will depend on how much you earn. If you're filing as a single person, here’s the breakdown:

- You’ll pay 10% on earnings up to $11,925.

- Then 12% on anything from $11,926 to $48,475.

- It goes up to 22% for earnings between $48,476 and $103,350.

- If you’re really raking it in, you could be looking at a hefty 37% on amounts over $609,350.

But wait, there’s more! If you’re running an LLC, you also need to think about self-employment taxes, which are currently at 15.3%. This covers your Social Security and Medicare contributions. So, it’s not just about figuring out your earnings tax; you’ve got to calculate your self-employment tax too. It can feel a bit overwhelming, right?

Effective tax planning is key here. You really want to get a good grip on the LLC federal tax rate to stay compliant with federal tax laws and optimize your finances. For example, if you’re a small agency operator, you can manage your tax liabilities smartly by taking advantage of deductions and credits available to you. This can really help in lowering your overall tax burden.

So, how are you planning to tackle your taxes this year? Remember, a little strategy goes a long way!

Analyze Tax Classifications: S-Corp vs. C-Corp

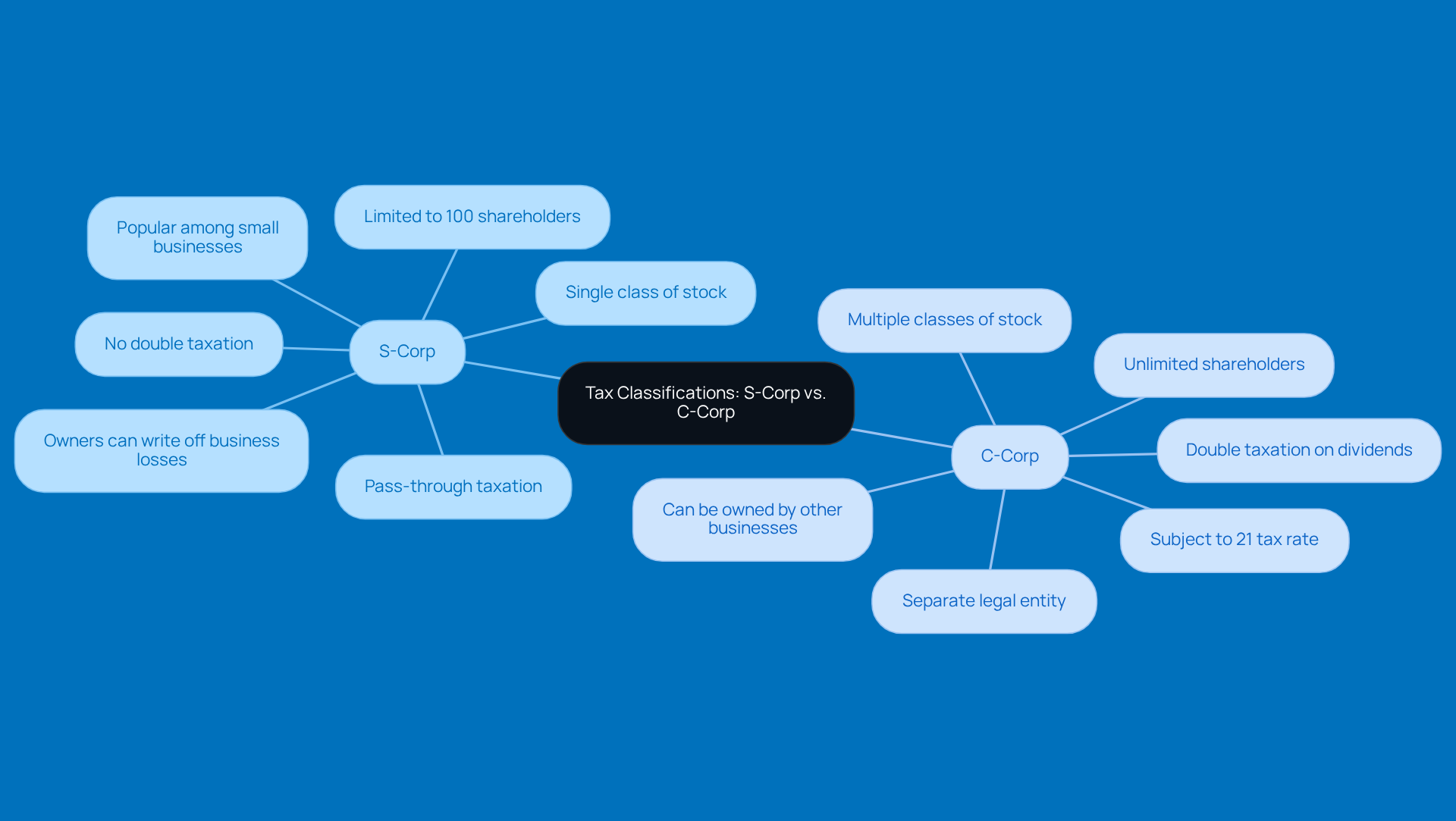

When it comes to tax classifications, LLCs have a couple of options regarding the LLC federal tax rate: they can choose to be taxed as an S-Corporation or a C-Corporation.

Now, an S-Corp is pretty neat because it lets profits and certain losses flow right through to your personal earnings. This means you can dodge corporate taxes and avoid that pesky double taxation. For small agency managers looking to lighten their tax load, this setup can be a real game-changer.

On the flip side, we have the C-Corp. This one’s treated as its own legal entity and is subject to the LLC federal tax rate of 21%. If you decide to distribute profits as dividends, guess what? You’ll face more taxes at the individual level, leading to that double taxation we just talked about.

As we look ahead to 2025, it’s interesting to note that a significant number of LLCs are leaning towards S-Corp status. This trend shows that small businesses are catching on to the perks of pass-through taxation.

So, why does all this matter? Understanding these classifications is key for small agency owners to navigate the LLC federal tax rate. It helps you pick the tax structure that works best for your operations. Have you thought about which option might suit your business? It’s worth a little reflection!

Conclusion

Understanding the LLC federal tax rate is super important for small agency owners who want to make the most of their financial strategies. This business structure not only gives you liability protection but also offers some serious tax flexibility. It lets you optimize your tax obligations based on what you earn. By picking the right tax classification - whether it’s a sole proprietorship, partnership, S-Corporation, or C-Corporation - you can navigate the tricky world of taxes and boost your financial outcomes.

In this article, we’ve shared some key insights about the federal tax rate structure for LLCs, including those tiered tax brackets and the self-employment taxes you need to keep in mind. We also talked about the pros and cons of S-Corp versus C-Corp classifications, showing how these choices can really impact your tax burdens and overall business strategy. Knowing these details empowers small agency owners like you to make informed decisions that align with your growth goals.

But here’s the thing: the implications of the LLC federal tax rate go beyond just compliance. They’re a chance for small agency owners to strategically plan their finances and cut down on tax liabilities. By taking advantage of the benefits that LLCs offer and staying updated on tax classifications, you can set your business up for success while keeping your personal assets safe. So, taking proactive steps in tax planning isn’t just a good idea; it’s essential for sustainable growth and long-term prosperity. Ready to take charge of your financial future?

Frequently Asked Questions

What is an LLC?

A Limited Liability Company (LLC) is a business structure that combines the liability protection of a corporation with the tax flexibility of a sole proprietorship.

Why are LLCs appealing for small agency owners?

LLCs are appealing for small agency owners because they offer liability protection for personal assets while allowing profits to be taxed at the individual’s personal tax rate.

What percentage of LLCs are classified as small businesses?

96% of LLCs are classified as small businesses.

How can LLCs be structured in terms of membership?

LLCs can be set up as single-member or multi-member entities, providing flexibility in choosing the tax classification.

What tax classifications can LLC members choose from?

LLC members can choose to be classified as a sole proprietorship, partnership, S corporation, or C corporation.

What is the Qualified Business Income (QBI) deduction?

The Qualified Business Income (QBI) deduction allows eligible pass-through entities, such as LLCs, to deduct up to 20% of their business income based on their taxable income.

Why is it important to keep business transactions separate from personal ones in an LLC?

Keeping business transactions separate from personal ones is important to maintain limited liability and ensure compliance with tax regulations.

What should LLC operators do to manage their responsibilities effectively?

LLC operators should regularly update their records and understand state tax regulations to stay compliant and manage their responsibilities efficiently.

Can you provide examples of how LLCs benefit small businesses?

Yes, examples include a small tech startup that formed an LLC and attracted investors for rapid growth, and a two-person bakery that used the LLC structure to share responsibilities and scale operations smoothly.

Is forming an LLC a good option for starting a new venture?

Yes, forming an LLC can be a great option for starting a new venture due to its legal protection and growth opportunities.