Introduction

Navigating the world of taxes can feel pretty overwhelming for small business owners, right? With all those complex regulations and the pressure to maximize profits, it’s no wonder many feel lost. That’s where a small business tax specialist comes in - your invaluable ally who knows how to simplify tax prep, compliance, and strategic planning just for you.

But here’s the kicker: these experts aren’t just about helping you avoid penalties. They can actually unlock financial opportunities that drive your growth! Understanding their role could be the secret sauce to your business’s financial success and sustainability. So, let’s dive in and see how they can make a difference for you!

Define the Role of a Small Business Tax Specialist

If you're running a small business, you understand how tricky tax matters can get, and a small business tax specialist can be invaluable. That’s where a tax expert for enterprises comes in, offering tailored advice just for you. These pros handle everything from tax preparation and compliance to planning and advisory services. Unlike your average tax preparer, a small business tax specialist focuses on the unique needs of small businesses, assisting you in navigating complex tax regulations, obtaining the best deductions, and ensuring compliance with federal and state laws.

Why is this specialization so important? Well, many small businesses simply don’t have the resources to tackle tax issues on their own. By tapping into the expertise of a small business tax specialist, you can make smarter financial decisions that align with your goals, ultimately boosting your financial health. Take Steinke and Company, for example. They provide a range of services, including proactive tax planning, compliance checks, and strategic advice from a small business tax specialist to help small businesses avoid those costly underpayment penalties.

And here’s a fun fact: the U.S. tax preparation services sector is projected to hit a whopping $14.3 billion by 2026! That just shows how crucial skilled tax experts are in helping businesses thrive in a competitive landscape. So, if you’re feeling overwhelmed by tax season, remember that you don’t have to go it alone. Reach out to a tax expert and take the stress out of your financial planning!

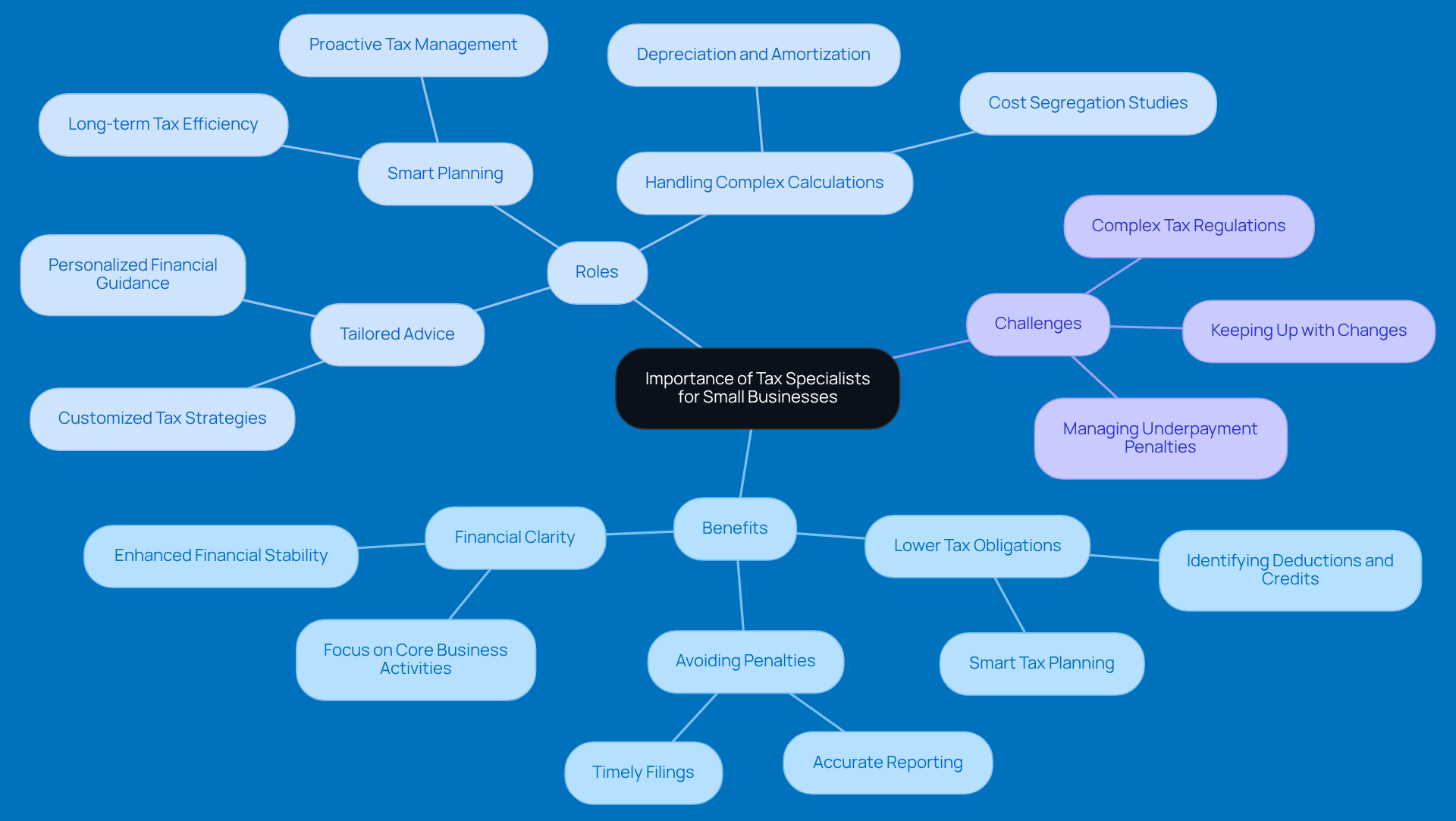

Contextualize the Importance of Tax Specialists for Small Businesses

Small business tax specialists play a huge role for small businesses, don’t they? As independent business owners juggle everything from daily operations to keeping customers happy, it’s easy to feel swamped by the maze of tax regulations. That’s where a small business tax specialist comes in as an essential partner. They offer tailored advice that helps entrepreneurs cut down on their tax bills while staying on the right side of the law.

Did you know that many small businesses struggle with accurately reporting their income and expenses? According to IRS data, this can lead to hefty penalties, especially underpayment penalties that can rack up interest at a staggering 8% per year, compounded daily! Hiring a small business tax specialist not only helps avoid these pitfalls but also allows owners to focus on what they do best, confident that their tax matters are in capable hands. This teamwork fosters financial clarity and boosts the overall sustainability and growth potential of the business.

For instance, companies that bring in tax advisors often find themselves with lower tax obligations thanks to smart planning and uncovering missed deductions and credits. This can lead to better financial stability and the ability to reinvest in growth initiatives. Plus, tax experts can tackle tricky calculations around depreciation and amortization, ensuring entrepreneurs are ready for any financial bumps in the road.

By getting ahead of tax issues - like understanding the impact of reduced COVID-19 tax benefits and managing underpayment penalties through safe harbor payments and the de minimis exception - small businesses can navigate the complexities of tax regulations with confidence. So, why not consider teaming up with a small business tax specialist? It could make all the difference!

Outline Key Responsibilities of Small Business Tax Specialists

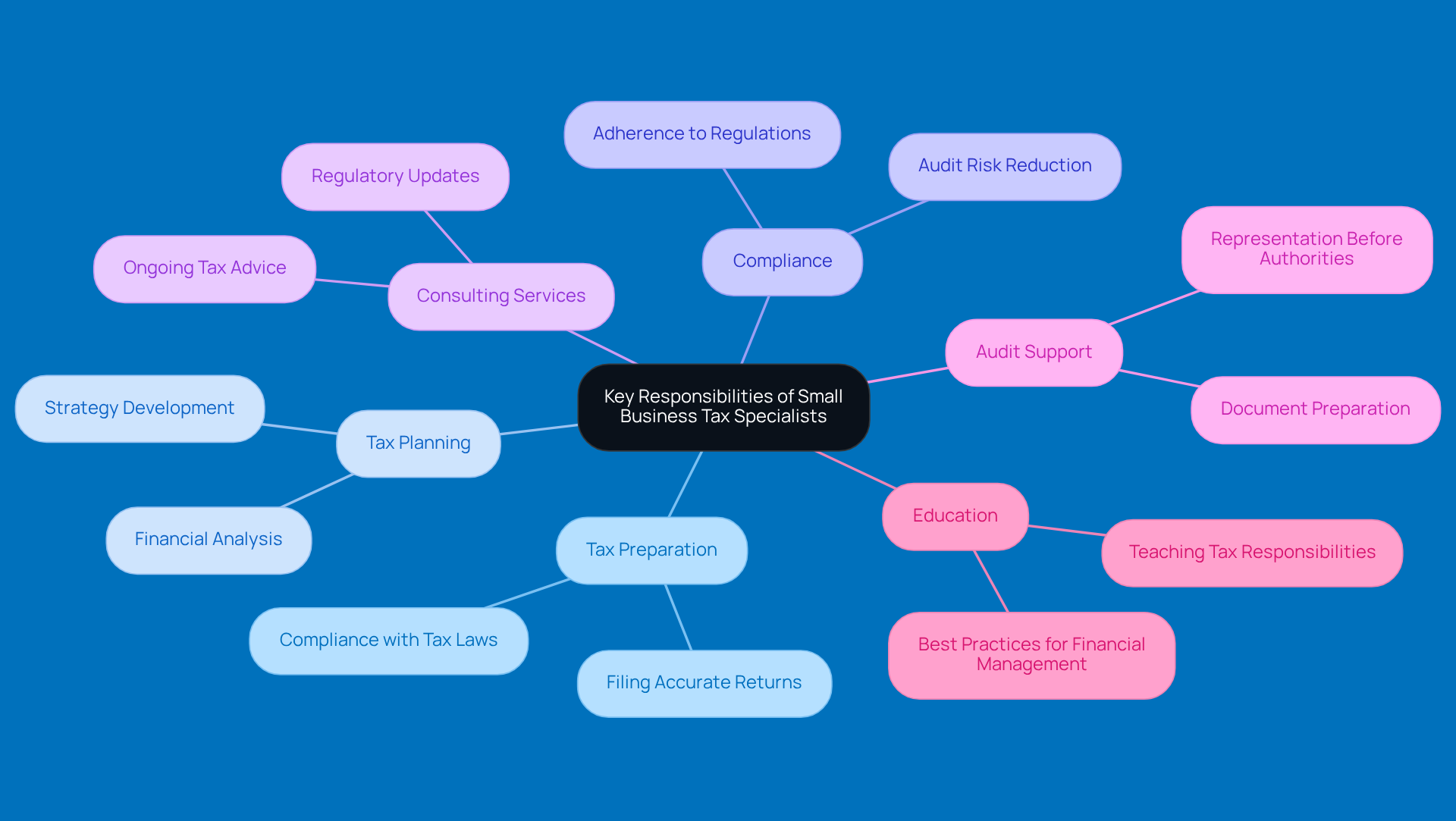

Small business tax specialists are like the unsung heroes of efficient tax management, handling a variety of important tasks that are crucial for their clients' financial health. Let’s break down what they do:

- Tax Preparation: These specialists whip up and file accurate tax returns, making sure everything complies with the tax laws. This is key to dodging those pesky penalties!

- Tax Planning: They craft strategies aimed at trimming down tax obligations by carefully examining financial info, helping businesses keep more of their hard-earned profits.

- Compliance: A big part of their job is ensuring that businesses stick to federal, state, and local tax regulations. This significantly cuts down the risk of audits and penalties.

- Consulting Services: Tax experts provide ongoing advice about tax-related matters, including updates on changes in tax regulations and how these might impact operations.

- Audit Support: If a tax audit comes knocking, these pros step in to help clients prepare the necessary documents and represent them before tax authorities, easing the stress of those tough situations.

- Education: They also take the time to teach entrepreneurs about their tax responsibilities and the best practices for managing finances, empowering them to make smart decisions.

These roles really showcase how vital a small business tax specialist is for local businesses, assisting them in navigating the complexities of taxation. Did you know that the average small business spends about 13 hours just getting their tax submissions ready? With a tax professional in their corner, this process can be a breeze, letting owners focus on what they do best!

Identify Qualifications and Skills of Effective Tax Specialists

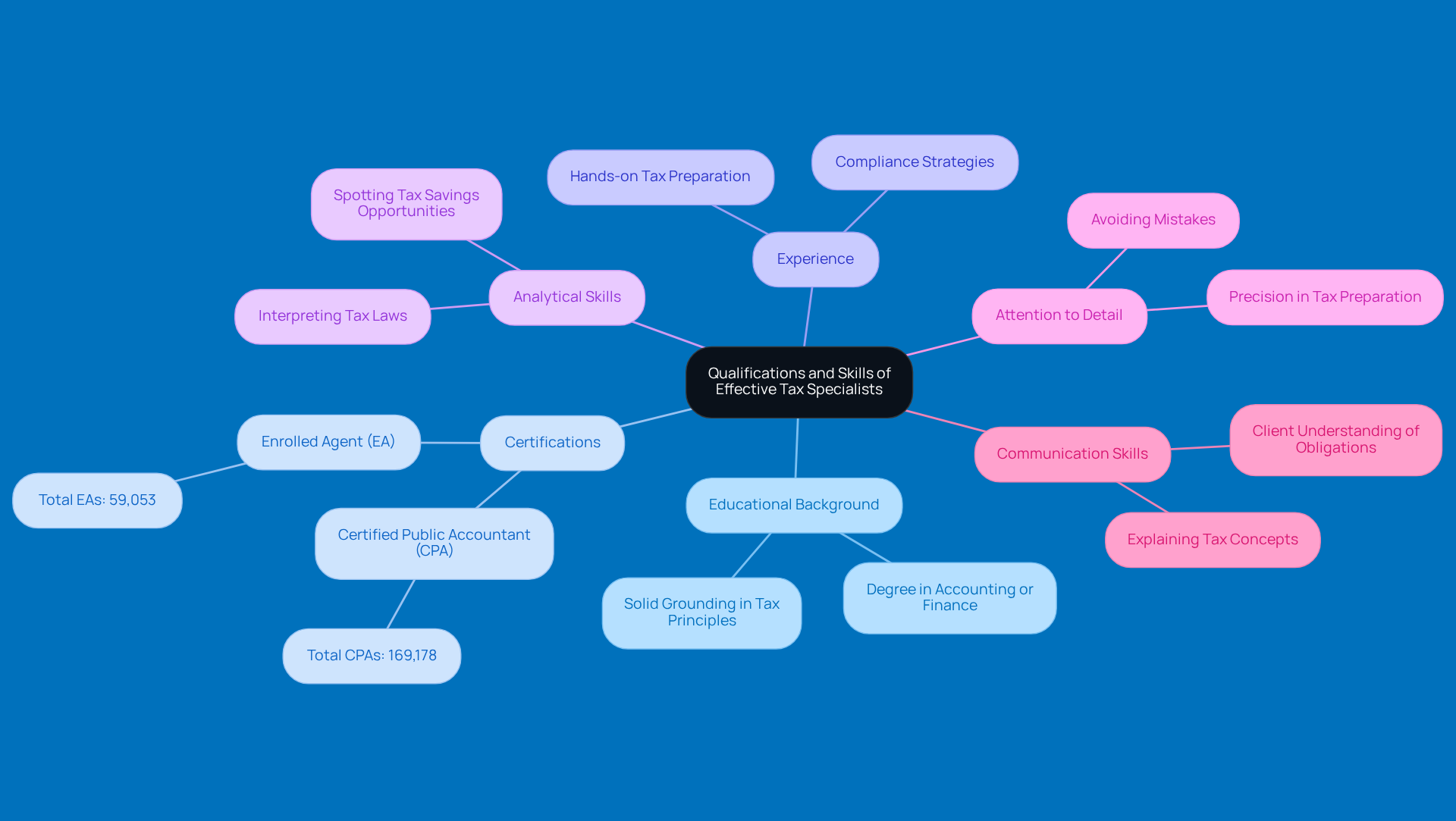

When it comes to small business tax experts, it’s all about blending formal qualifications with essential skills to provide top-notch service. Let’s break down what makes these professionals stand out:

- Educational Background: Most tax experts start with a degree in accounting, finance, or something similar. This gives them a solid grounding in tax principles and regulations, which is super important.

- Certifications: You’ll often find that many tax pros hold certifications like Certified Public Accountant (CPA) or Enrolled Agent (EA). As of 2025, there are around 169,178 CPAs and 59,053 EAs out there, showing just how competitive this field can be!

- Experience: Hands-on experience in tax preparation and compliance is key. It helps these professionals tackle complex tax situations and come up with strategies to avoid those pesky underpayment penalties.

- Analytical Skills: Strong analytical skills are a must! They help in interpreting tax laws and spotting opportunities for tax savings, ensuring clients get the most out of their deductions and credits while steering clear of penalties.

- Attention to Detail: Precision is everything in tax prep. Even a tiny mistake can lead to big problems, so being meticulous is crucial.

- Communication Skills: Good communication is vital. Tax experts need to explain tax concepts clearly, helping clients understand their obligations and options, especially when it comes to underpayment penalties and compliance strategies.

All these qualifications and skills come together to make a small business tax specialist an invaluable partner for small business owners. As industry experts often say, a good accountant is like a blessing in disguise! So, when you’re looking for someone to help you navigate the tricky world of taxes, make sure you choose a qualified professional.

Conclusion

Small business tax specialists are like your trusty guides through the often confusing world of taxes. They’re here to help entrepreneurs tackle their tax obligations with confidence and ease. By offering personalized advice and expert support, these pros not only help small business owners manage their taxes effectively but also boost their financial health and sustainability.

Let’s break down what these specialists do. They handle everything from tax preparation and compliance to strategic planning and ongoing consulting services. Their expertise can save businesses from costly penalties and even uncover potential deductions and credits that can really lighten the tax load. Plus, with their relevant degrees, certifications, and sharp analytical and communication skills, they become invaluable partners in making smart financial decisions.

Understanding the value of small business tax specialists can really empower entrepreneurs. By teaming up with these experts, businesses can take the stress out of tax season, concentrate on what they do best, and set themselves up for growth and success. So, why not embrace this partnership? It’s not just a smart move; it’s a strategic investment in the future of your small business!

Frequently Asked Questions

What is the role of a small business tax specialist?

A small business tax specialist provides tailored advice for small businesses, handling tax preparation, compliance, planning, and advisory services to help navigate complex tax regulations.

How does a small business tax specialist differ from an average tax preparer?

Unlike an average tax preparer, a small business tax specialist focuses specifically on the unique needs of small businesses, assisting them in obtaining deductions and ensuring compliance with federal and state laws.

Why is it important for small businesses to hire a tax specialist?

Small businesses often lack the resources to manage tax issues independently. A tax specialist can help them make informed financial decisions, which can enhance their financial health and avoid costly penalties.

What services do small business tax specialists typically offer?

They offer a range of services, including proactive tax planning, compliance checks, and strategic advice tailored to the needs of small businesses.

What is the projected growth of the U.S. tax preparation services sector?

The U.S. tax preparation services sector is projected to reach $14.3 billion by 2026, highlighting the importance of skilled tax experts for businesses.

How can a small business tax specialist help during tax season?

A small business tax specialist can alleviate the stress of tax season by providing expert guidance, ensuring compliance, and helping to maximize deductions, making financial planning more manageable.