Introduction

Understanding tax regulations can feel overwhelming for small business owners, right? Especially when it comes to something like Unadjusted Basis Immediately After Acquisition (UBIA). This important metric not only affects your tax responsibilities but also opens the door to deductions that can really boost your business's financial health.

But here’s the thing: many business owners might ask themselves, how do you navigate the ins and outs of UBIA to make the most of those tax benefits? Well, diving into the details of qualified property under UBIA could be just what you need to revamp your tax strategies and snag some serious savings. So, let’s explore this together!

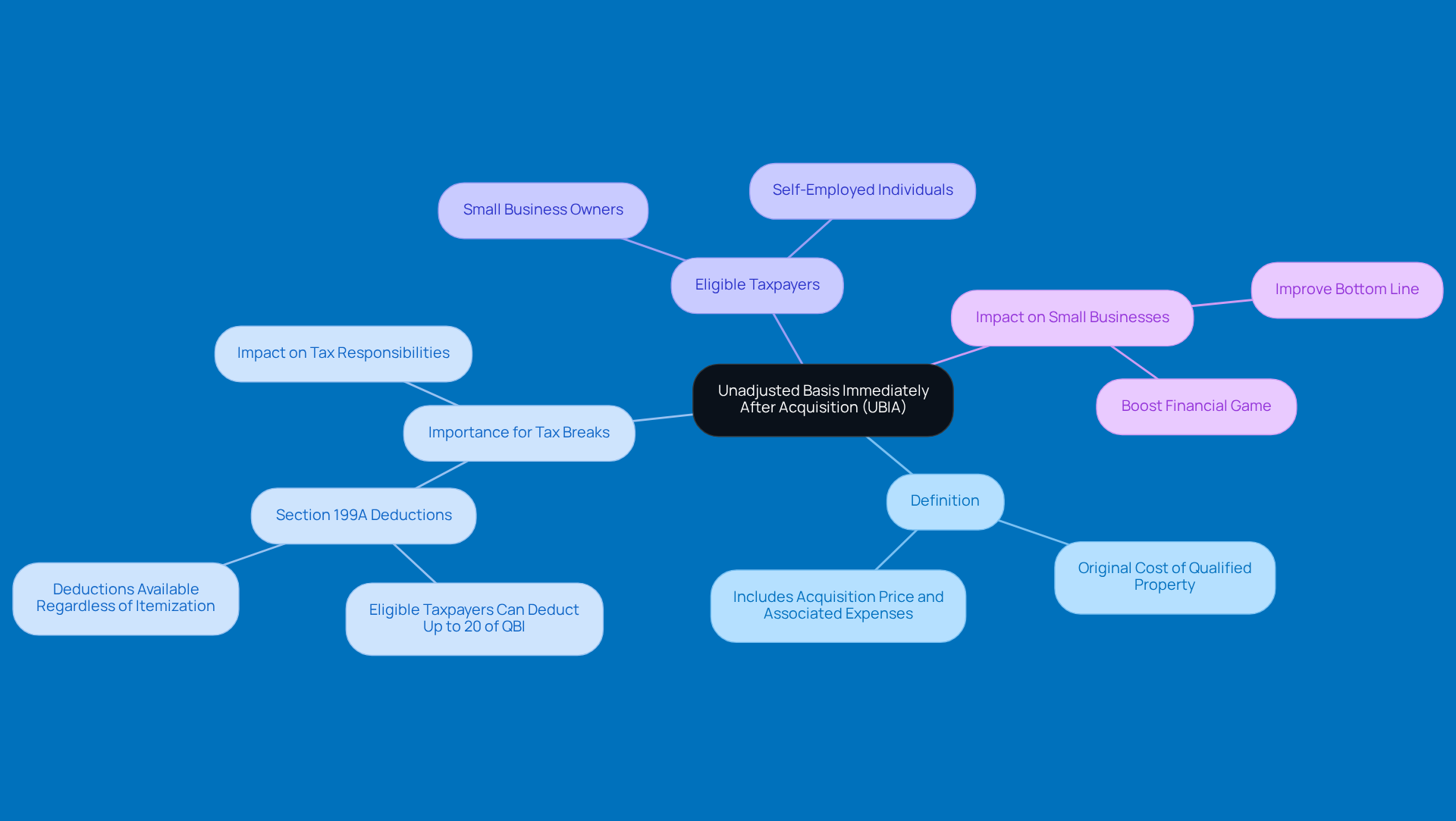

Define UBIA: Understanding the Basics of Qualified Property

Unadjusted Basis Immediately After Acquisition is simply a fancy way of describing the original cost of qualified property meaning when a business first puts it to use. This number is super important for figuring out tax breaks, especially under Section 199A of the Internal Revenue Code. Did you know that eligible taxpayers can deduct up to 20% of their qualified business income (QBI)?

For small business owners, understanding the ubia of qualified property meaning is key. It directly affects your tax responsibilities and opens the door to some pretty significant deductions. By smartly using the qualified income deduction in your tax planning, you can really boost your financial game and improve your bottom line. So, why not take a closer look at how this could work for you?

Contextualize UBIA: Its Role in Tax Regulations for Small Businesses

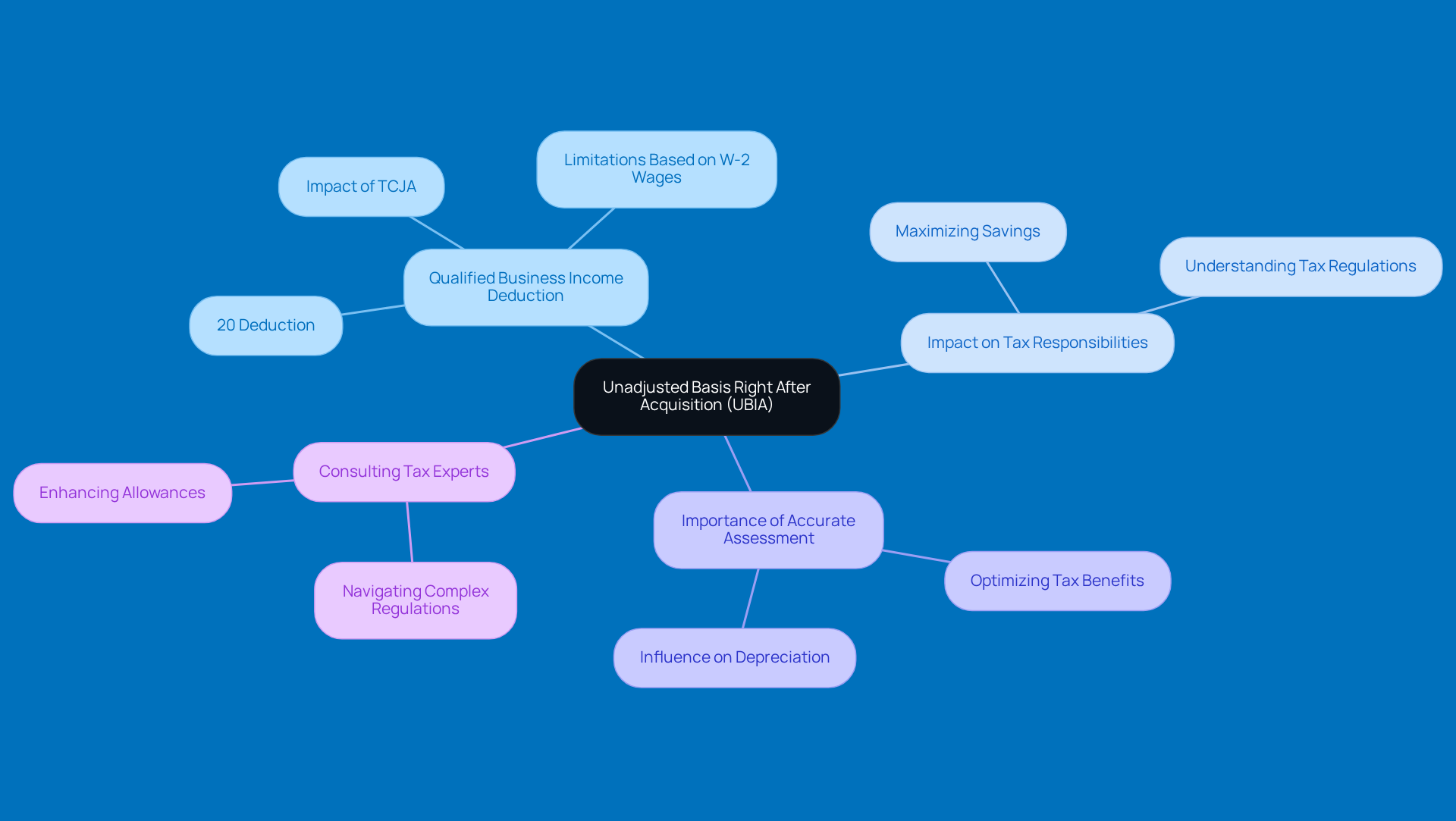

The Unadjusted Basis Right After Acquisition is super important when it comes to figuring out the Qualified Business Income Deduction under Section 199A. This deduction lets qualifying small business owners take off up to 20% of their qualified income, which can really help lower their taxable earnings. So, why is the ubia of qualified property meaning crucial right after the acquisition of qualified property? Well, it works hand-in-hand with W-2 wages to set the overall deduction limit.

For small businesses, it’s key to understand how Unrelated Business Income Activity can impact tax responsibilities. This knowledge can help you maximize your savings and stay on the right side of tax regulations. Looking ahead to 2025, the impact of this provision on tax savings is particularly noteworthy. Small business owners can leverage it to boost their financial outcomes. For instance, companies that take the time to accurately assess their unadjusted basis in assets can really optimize their tax benefits, leading to some serious tax relief.

Tax consultants often emphasize how crucial it is to grasp this concept to navigate the complexities of tax regulations effectively. By reaching out to experts, small business owners can uncover ways to enhance their allowances, ensuring they’re making the most of available tax advantages. So, have you thought about how understanding your unadjusted basis could change your tax game? It might just be the key to unlocking some great savings!

Trace the Origins: Historical Development of UBIA in Tax Law

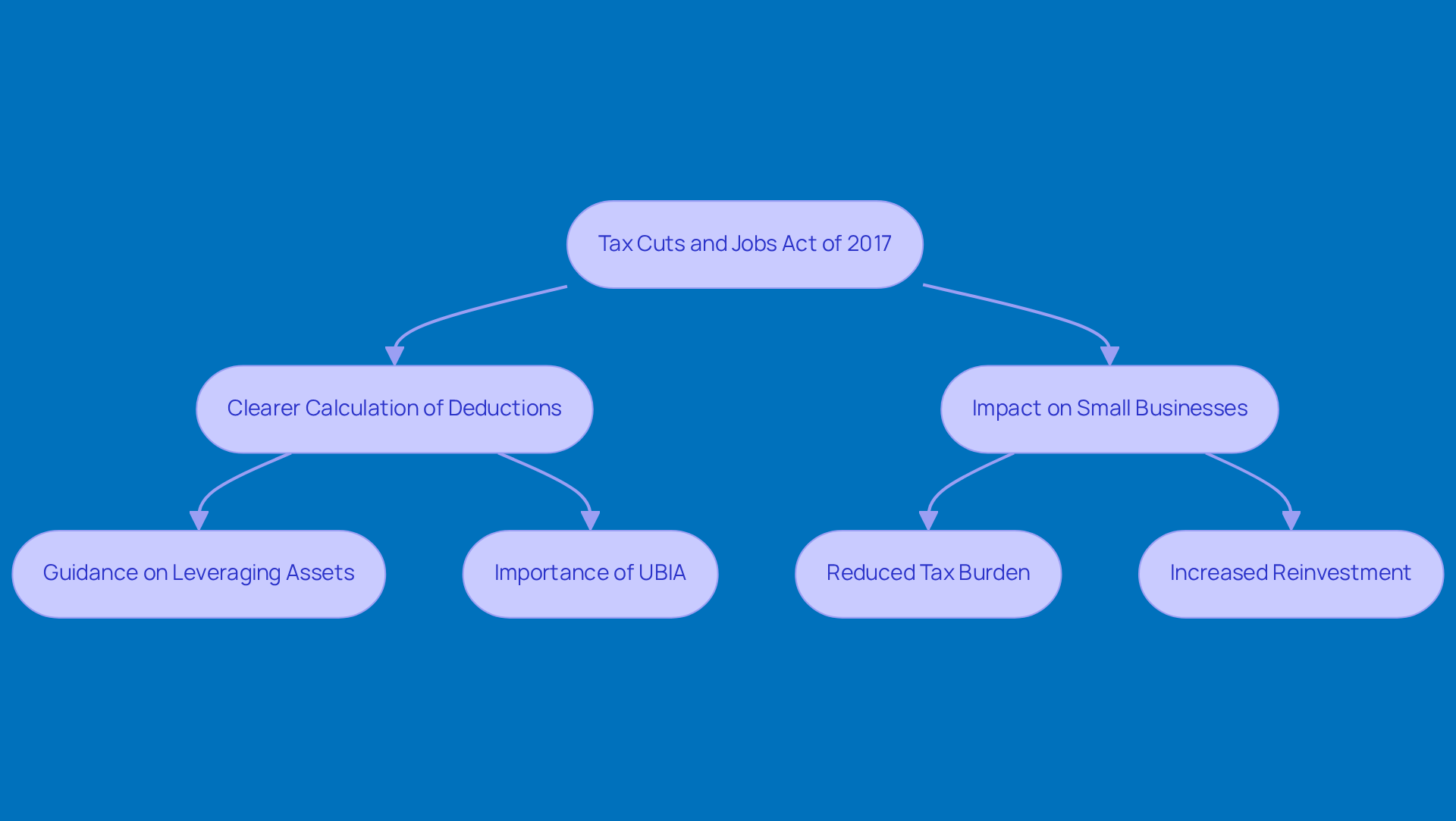

The idea of Unadjusted Basis Right After Acquisition really took shape with the Tax Cuts and Jobs Act of 2017. This act brought some big changes to the tax landscape for small businesses. Before the TCJA, tax deductions for these enterprises mostly depended on net income, without any specific rules about property basis. But with the new policy, there’s now a clearer way to calculate deductions tied to the UBIA of qualified property meaning. This gives small business owners better guidance on how to leverage their assets for tax benefits.

So, why does this matter? Well, as tax law expert Lisa Lopata points out, "A taxpayer’s section 199A allowance may be restricted to the total of:

- 25% of the W-2 salaries for an enterprise

- plus 2.5% of the UBIA."

This really highlights how crucial the UBIA of qualified property meaning is when calculating deductions under section 199A. Plus, the TCJA has generally lightened the tax burden for small businesses, leading to more reinvestment and economic growth. It’s clear that the UBIA of qualified property meaning plays a key role in shaping effective tax strategies.

Have you thought about how these changes might impact your own business? It’s worth considering how you can take advantage of these new rules!

Identify Key Characteristics: Components and Examples of UBIA

When we discuss the Unmodified Foundation Immediately Accessible of qualified property meaning, we’re essentially referring to the original cost of tangible assets that a business uses - such as machinery, equipment, and buildings. For example, if a small company buys equipment for $50,000, that is an example of the ubia of qualified property meaning. This value stays the same unless the asset is sold or disposed of in some way. It’s super important to accurately report the ubia of qualified property meaning, not just to follow tax rules but also to maximize potential benefits. Small businesses need to get a handle on these details to effectively improve their tax strategies and make the most of available credits.

So, what kind of property qualifies? Well, typical examples include:

- Commercial real estate

- Manufacturing equipment

- Vehicles used for business purposes

The income reported by small businesses can vary quite a bit, but it’s crucial for owners to keep accurate records of these assets. This helps ensure compliance and optimizes their Qualified Business Income (QBI) allowances. Tax experts emphasize that tangible assets are key players in small business tax strategies, and understanding the ubia of qualified property meaning is vital for effective tax planning and compliance.

If you’re a practitioner with clients whose QBI deduction is limited due to the unadjusted basis immediately after acquiring the ubia of qualified property meaning, it’s a good idea to take a close look at the QBI deduction regulations. There might be some planning opportunities there, as pointed out by Alex K. Masciantonio, a senior tax manager. Plus, small business owners should keep an eye on the anti-abuse rules in the final Sec. 199A regulations. These rules are designed to stop entities from artificially inflating their UBIA of qualified property meaning by buying and quickly selling property.

So, how are you managing your assets? It’s worth taking a moment to reflect on how these rules might impact your business!

Conclusion

Understanding the Unadjusted Basis Immediately After Acquisition (UBIA) of qualified property is super important for small business owners who want to make the most of their tax strategies. When you get the hang of what UBIA means, you can tap into some great deductions under Section 199A. This can really help lower your taxable income and boost your financial results. It’s not just some technical jargon; it’s a key piece that can shape the overall financial health of your business.

Throughout this discussion, we’ve pointed out how UBIA plays a direct role in the Qualified Business Income Deduction, the background of its development after the Tax Cuts and Jobs Act, and the tangible assets that qualify under this rule. Knowing the original cost of your property and reporting it accurately is crucial for maximizing those tax benefits and staying compliant with tax regulations. Plus, the insights shared here show how small business owners can use their understanding of UBIA to make smart decisions that lead to real savings.

In the end, the implications of UBIA go beyond just crunching numbers - it’s a strategic chance for small businesses to boost their financial standing. By chatting with tax experts and keeping up with the changing regulations, small business owners can navigate the tricky waters of tax law more easily. Embracing this knowledge not only helps with compliance but also empowers you to take full advantage of the tax benefits available, setting the stage for sustainable growth and success. So, why not dive in and explore how you can make UBIA work for you?

Frequently Asked Questions

What does UBIA stand for?

UBIA stands for Unadjusted Basis Immediately After Acquisition, which refers to the original cost of qualified property when a business first puts it to use.

Why is UBIA important for businesses?

UBIA is important because it is used to determine tax breaks, particularly under Section 199A of the Internal Revenue Code, which allows eligible taxpayers to deduct up to 20% of their qualified business income (QBI).

How does UBIA affect small business owners?

Understanding UBIA is crucial for small business owners as it directly impacts their tax responsibilities and enables them to take advantage of significant deductions through the qualified income deduction.

What is the potential benefit of utilizing the qualified income deduction?

By effectively using the qualified income deduction in tax planning, businesses can enhance their financial situation and improve their bottom line.