Overview

When you think about tax preparers, you might picture a bunch of serious folks in suits. But in reality, they come in all shapes and sizes! Tax professionals include:

- Certified Public Accountants (CPAs)

- Enrolled Agents (EAs)

- Tax attorneys

- Non-credentialed preparers

Each of these experts brings different skills and services to the table, helping you tackle the often confusing world of taxes.

So, how do these pros help you? Well, they’re like your personal guides through the maze of tax laws. They ensure you’re compliant with all the rules while also helping you optimize your financial strategies. It’s a pretty big deal, right? Their expertise can make a huge difference in how effectively you manage your taxes.

Next time you’re thinking about your taxes, consider reaching out to one of these professionals. They’re here to help you navigate the complexities and make the process a whole lot smoother. After all, who wouldn’t want a little extra support when it comes to something as important as taxes?

Introduction

Tax preparers are like your trusty guides in the often confusing world of taxes. Did you know that around 57% of tax returns in the U.S. are handled by these pros? Their expertise is a game changer for both individuals and small businesses. But as tax laws keep changing and getting more complex, you might wonder: how can different types of tax preparers—like CPAs and enrolled agents—help you snag those deductions and steer clear of any tax traps?

Getting to know the various roles and qualifications of tax preparers is super important if you want to make the most of your financial strategies and stay compliant in this ever-shifting tax landscape. So, let’s dive in and explore how these experts can support you on your financial journey!

Defining Tax Preparers: Roles and Responsibilities

Tax specialists, known as what are tax preparers called, are the go-to experts who help folks and businesses get their tax returns in order. They gather financial info, calculate what you owe, and make sure you’re following all those tricky tax laws. While their qualifications can vary, they all share a common goal: helping clients navigate the maze of tax regulations with ease.

For small business owners, relying on tax pros is pretty significant. Did you know that about 57% of tax returns in the U.S. are handled by what are tax preparers called professionals? That just shows how much people depend on expert advice to handle their tax responsibilities. What are tax preparers called? They are tax professionals who not only make the filing process easier but also provide strategic tips on how to save on taxes, ensuring clients can take full advantage of deductions and credits, like the Qualified Business Income deduction.

As we look ahead to 2025, tax preparation is about to change. We’re expecting a drop in standard deductions and the removal of the SALT deduction cap. These shifts will make tax professionals, often referred to as what are tax preparers called, even more important, as they’ll help local entrepreneurs adjust to new rules and fine-tune their financial strategies. In fact, businesses that work with tax experts often find they’re better prepared for audits and have more consistent tax practices, which is crucial in today’s ever-changing economy.

Plus, what are tax preparers called? They are tax professionals who assist local entrepreneurs with financial planning for the long haul. They guide clients through potential tax changes and help them make smart decisions that align with their financial goals. This proactive approach is key, especially since the U.S. tax code is now over 74,000 pages long!

So, in a nutshell, tax professionals aren’t just there to help you file your taxes; they’re your strategic partners. They empower entrepreneurs to tackle their tax obligations confidently, ensuring compliance while maximizing financial opportunities. How’s that for a win-win?

Types of Tax Preparers: Understanding the Spectrum

When considering what tax preparers are called, there are a few different types you should know about, each with their own qualifications and services. Let’s break it down:

-

Certified Public Accountants (CPAs): These folks are licensed by state boards and have gone through some serious training in accounting and tax law. They can represent you before the IRS and offer a wide range of financial services, which makes them a go-to choice for those tricky tax situations. Did you know there are about 208,488 CPAs currently active? That’s a lot of expertise! Plus, they can help you manage underpayment penalties with strategies like safe harbor payments and the de minimis exception—super helpful for small business owners.

-

Enrolled Agents (EAs): EAs are federally licensed tax pros who specialize in taxation. They have the right to represent taxpayers before the IRS and must keep up with ongoing education to stay sharp on tax laws. With around 64,045 EAs out there, they’re great at tackling tax problems and controversies thanks to their deep understanding of tax regulations. They can also share tips on optimizing tax compliance and steering clear of those pesky penalties.

-

Tax Attorneys: If you need legal advice on tax issues, these professionals are your best bet. They hold law degrees and specialize in tax law, which means they can represent you in tax disputes, even in Tax Court. Their expertise is crucial if you’re facing serious legal challenges with the IRS, especially when it comes to options like the Offer in Compromise for settling tax debts.

-

Non-Credentialed Preparers: Now, these individuals might not have formal qualifications, but they can still prepare tax returns, usually under the watchful eye of more qualified professionals. Just keep in mind, they can’t represent you before the IRS, so they might not be the best fit for complex tax matters.

Understanding these differences is key for small business owners when they want to know what tax preparers are called. A mix of CPAs, EAs, and Tax Attorneys can really help cover all your tax needs, ensuring everything from preparation to compliance is handled smoothly. And don’t forget to consider how reduced COVID-19 tax benefits might impact your tax situation—those changes can really shake up your refunds! Also, watch out for those 'ghost' preparers who don’t sign tax returns; they can be a real risk for fraud.

Including quotes from CPAs and EAs about their roles in tax prep can also add some authority and relatability to the conversation. So, what do you think? Have you had any experiences with these different types of tax preparers?

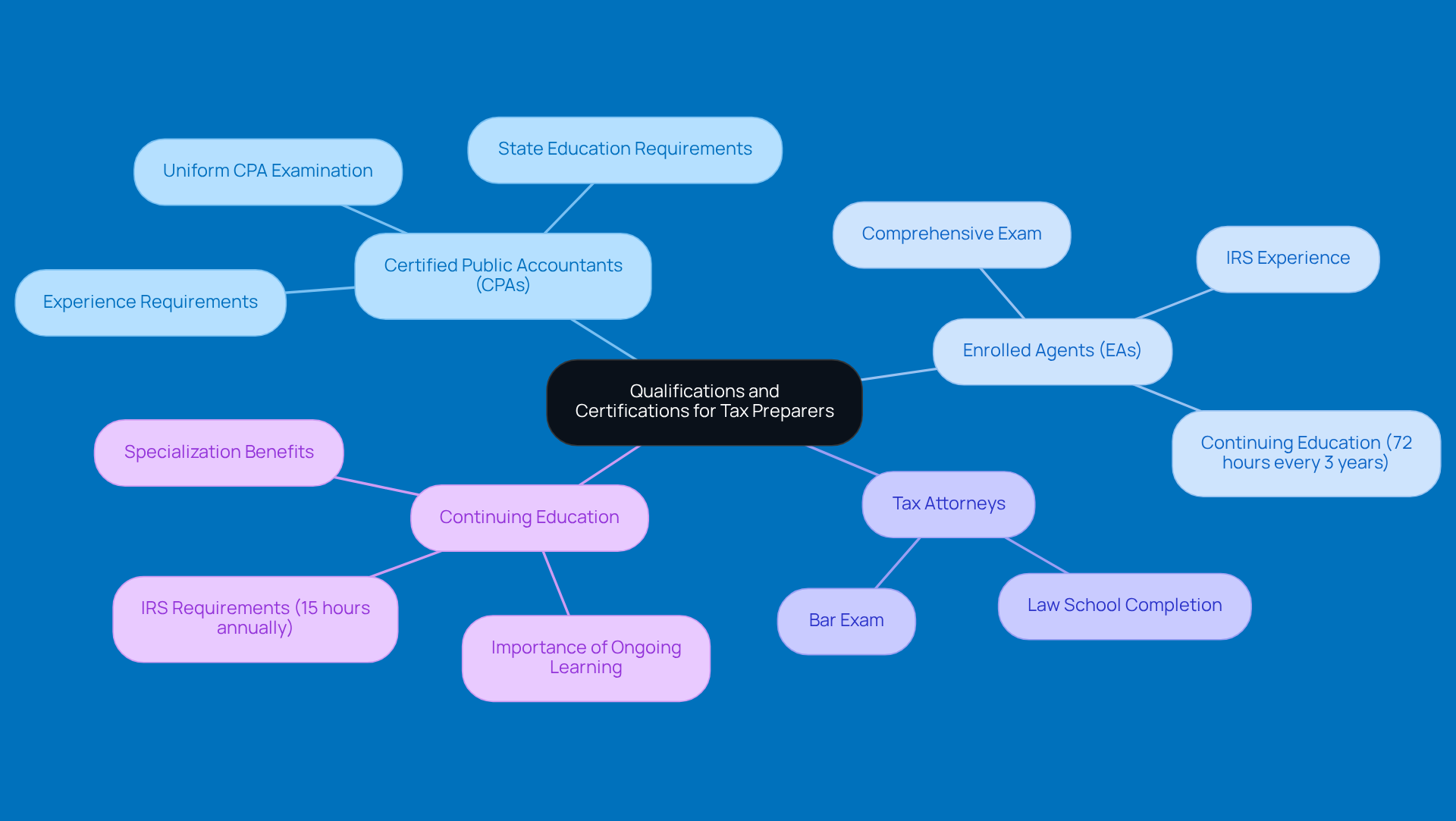

Qualifications and Certifications for Tax Preparers

If you're thinking about what are tax preparers called, the first step to becoming one is to snag a Preparer Tax Identification Number (PTIN) from the IRS. Now, while you don’t necessarily need formal education, many folks in this field come from accounting or finance backgrounds, which definitely helps boost their skills.

- Certified Public Accountants (CPAs) have to pass the Uniform CPA Examination and meet specific state education and experience requirements. This ensures they really know their stuff.

- Enrolled Agents (EAs) need to pass a comprehensive exam that dives into all aspects of the tax code or show relevant experience working for the IRS. This gives them a solid grasp of tax regulations.

- Tax Attorneys must complete law school and pass the bar exam in their states, which equips them with the legal know-how to tackle complex tax issues.

Continuing education is super important for all tax pros, which raises the question of what are tax preparers called. It keeps them in the loop about changing tax laws and helps them maintain their credentials. For example, the IRS requires tax professionals to complete 15 hours of continuing education credits each year, including ethics training. This ongoing learning not only sharpens their knowledge but also makes them more effective at providing accurate and compliant services to clients.

Did you know that tax professionals who keep up with ongoing education are often better at handling the complexities of tax law? It’s true! Plus, case studies show that those who specialize in niche areas through continued learning can really stand out in a crowded market, meeting specific client needs more effectively. As the tax landscape gets trickier, the importance of ongoing education for tax professionals is something we can’t overlook.

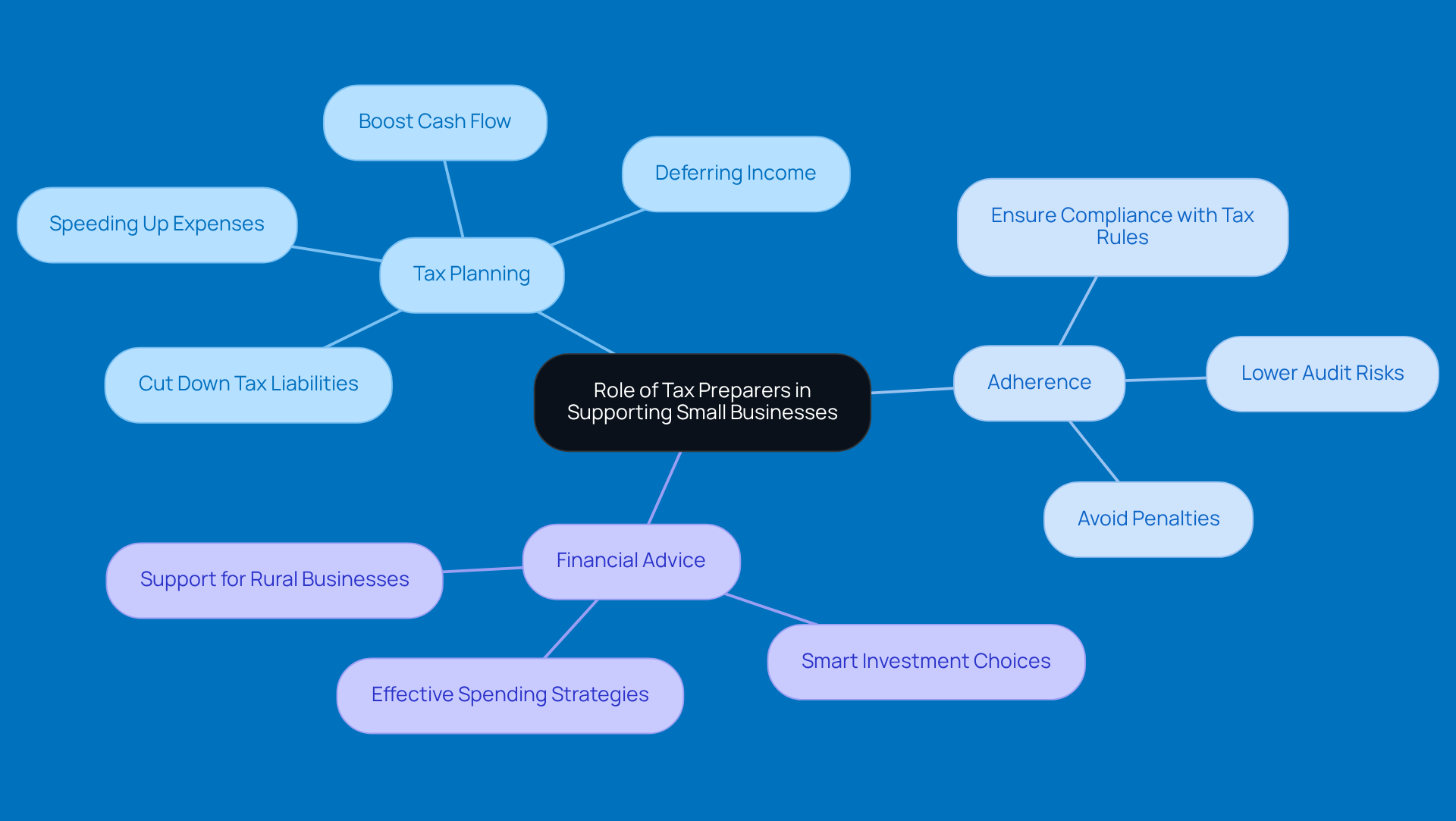

The Role of Tax Preparers in Supporting Small Businesses

Tax professionals are key allies for small businesses, offering services that go way beyond just filing taxes. They empower entrepreneurs by breaking down tax responsibilities, uncovering potential deductions, and crafting tax strategies that fit their financial goals.

Let’s dive into some key areas where tax preparers really shine:

- Tax Planning: By taking a close look at a business's financial situation, tax preparers can whip up strategies to cut down tax liabilities and boost cash flow. For example, they might suggest deferring income or speeding up expenses to get the best tax results.

- Adherence: Tax pros make sure businesses stick to federal and state tax rules, which can seriously lower the chances of audits and penalties. This is especially important for smaller businesses that might not have the resources to tackle complicated tax laws on their own.

- Financial Advice: Many tax preparers also offer financial management tips, helping small business owners make smart choices about investments and spending. This all-encompassing approach helps businesses not just survive but thrive in competitive markets.

In rural areas, where businesses often face unique economic hurdles, having a savvy tax preparer is even more crucial. They provide tailored support that reflects local conditions, helping small businesses make the most of available resources. Statistics show that small businesses using tax planning services tend to grow faster, underscoring how these strategies can drive sustainable development.

Small business owners frequently express their appreciation for what are tax preparers called, noting how their guidance has led to significant savings and improved financial health. This partnership is essential for building resilient businesses that contribute to the vibrancy of rural economies.

So, if you’re a small business owner, consider how a tax professional could help you navigate the complexities of taxes and set you on a path to success!

Conclusion

Tax preparers, often known by various names, really make a difference when it comes to simplifying the tax filing process for both individuals and businesses. Their expertise not only helps ensure compliance with those tricky tax laws but also empowers clients to seize financial opportunities. By understanding the different types of tax preparers—like Certified Public Accountants (CPAs), Enrolled Agents (EAs), and Tax Attorneys—you can see the diverse qualifications and services available to meet your specific tax needs.

Throughout this article, we’ve uncovered how tax professionals play a vital role for small businesses. They provide invaluable support in tax planning, keeping up with regulations, and offering financial advice, which can lead to significant savings and better financial health. Plus, the importance of ongoing education in this field is huge; it equips tax preparers with the know-how to navigate the ever-changing tax landscape.

So, in a nutshell, working with a qualified tax preparer isn’t just about filing returns; it’s about building a strategic partnership that can really drive your business success and resilience. If you’re a small business owner, think about the benefits of teaming up with these professionals to boost your financial strategies and ensure compliance. It’s all about fostering growth and sustainability in your ventures!

Frequently Asked Questions

What are tax preparers and what roles do they play?

Tax preparers are tax specialists who assist individuals and businesses in organizing their tax returns. They gather financial information, calculate tax liabilities, and ensure compliance with tax laws.

How significant is the role of tax preparers for small business owners?

Tax preparers play a crucial role for small business owners, as approximately 57% of tax returns in the U.S. are handled by tax professionals. Their expertise helps clients navigate tax responsibilities and optimize tax savings.

What changes in tax preparation are expected by 2025?

By 2025, there is an anticipated decrease in standard deductions and the removal of the SALT deduction cap. These changes will increase the importance of tax professionals in helping clients adjust to new regulations and refine their financial strategies.

How do tax preparers help businesses prepare for audits?

Businesses that collaborate with tax experts tend to be better prepared for audits and maintain consistent tax practices, which is essential in a constantly evolving economic landscape.

In what ways do tax preparers assist with long-term financial planning?

Tax preparers guide clients through potential tax changes and help them make informed decisions that align with their financial goals, providing a proactive approach to financial planning.

What is the overall value of working with a tax preparer?

Tax preparers serve as strategic partners, empowering clients to confidently manage their tax obligations while ensuring compliance and maximizing financial opportunities.