Introduction

Local taxes really are the lifeblood of our communities. They fund essential services that shape our everyday lives, from education to public safety. When we take a closer look at the two main types of local taxes - property taxes and sales taxes - we can see just how much they impact local economies and the quality of life for all of us.

But here's a question for you: as municipalities lean more on these taxes, how can small business owners like yourself navigate the complexities of local levies while ensuring compliance and making the most of your resources?

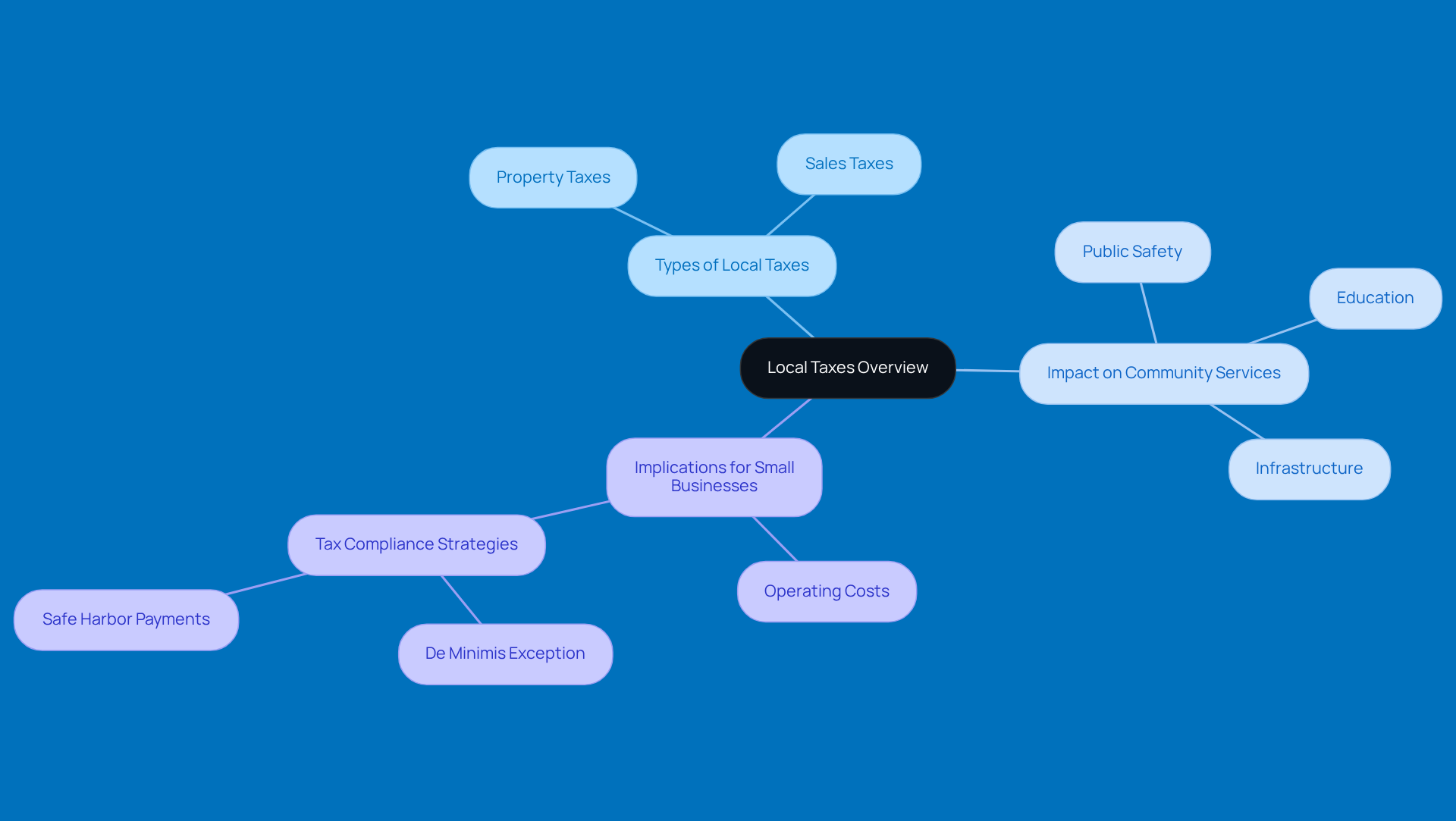

Define Local Taxes: An Overview

Local assessments are super important charges that local government bodies - like cities, counties, and municipalities - use to raise funds for essential public services and infrastructure. When discussing local levies, one might ask, what are two types of local taxes, such as property taxes and sales taxes? They play a vital role in financing community programs like education, public safety, and keeping our infrastructure in good shape, which directly impacts the quality of life for everyone living there.

In 2026, community levies are more crucial than ever! They provide the financial support needed for vital services. Take Minnesota, for example. Municipalities there have increasingly leaned on community sales levies to lighten financial loads, with 32 municipalities and five counties getting the green light for new sales levies just in 2023. This trend really highlights how much we’re relying on local revenues to fund big projects, like community centers and public libraries.

For small business owners, understanding what are two types of local taxes is crucial, as they can significantly impact operating costs and overall profitability. Local levies not only back community resources but also shape the economic landscape where businesses operate. When municipal governments have the funds they need, small businesses can flourish in a supportive community, benefiting from better infrastructure and services that enhance their working environment.

Plus, small business owners should keep an eye on strategies to dodge underpayment penalties on estimated levies. For instance, the de minimis exception lets taxpayers with a total tax liability minus withholdings and credits of less than $1,000 avoid penalties. And don’t forget about safe harbor payments! These require prepayment of the lesser of 90% of the current year’s tax or 100% of the previous year’s tax (110% for higher-income taxpayers), which can really help ease financial stress. Taking a proactive approach to tax planning can ensure compliance while maximizing resources. Also, the suggestions from the Taxes Advisory Task Force stress the need for smoother processes in tax approvals, which can further help small businesses navigate these complexities.

Explore Two Main Types of Local Taxes

When discussing regional levies, one might ask, what are two types of local taxes? They are real estate charges and sales duties. Both of these are super important for funding community resources and have a direct impact on small businesses.

Real Estate Taxes: These taxes are based on the assessed value of real estate and are a key revenue source for local governments. They help fund essential services like public education, emergency services, and keeping our infrastructure in shape. The tax rate can vary depending on where you live, usually calculated as a percentage of the property's assessed value. For instance, if your home is valued at $200,000 and the local tax rate is 1%, you’d be looking at a $2,000 bill each year. And don’t forget, recent changes - like easing the disability rating requirement for property tax relief for veterans - show just how much property taxation is evolving.

Sales Taxes: Now, let’s talk about sales taxes. These are charged on the sale of goods and services and are collected right at the point of sale, typically as a percentage of the sale price. Local rates can really vary, often funding community projects and initiatives. For example, a city might slap a 2% sales tax on retail purchases, which goes towards local services and infrastructure. Plus, in 2026, some states like Illinois and Arkansas are planning to eliminate state-level grocery taxes. This could really shake things up for consumer spending and how small businesses price their products.

It is super important for small business owners to understand what are two types of local taxes. They directly affect pricing strategies and profit margins, which ultimately shape the financial health of your business. So, keep these in mind as you navigate your entrepreneurial journey!

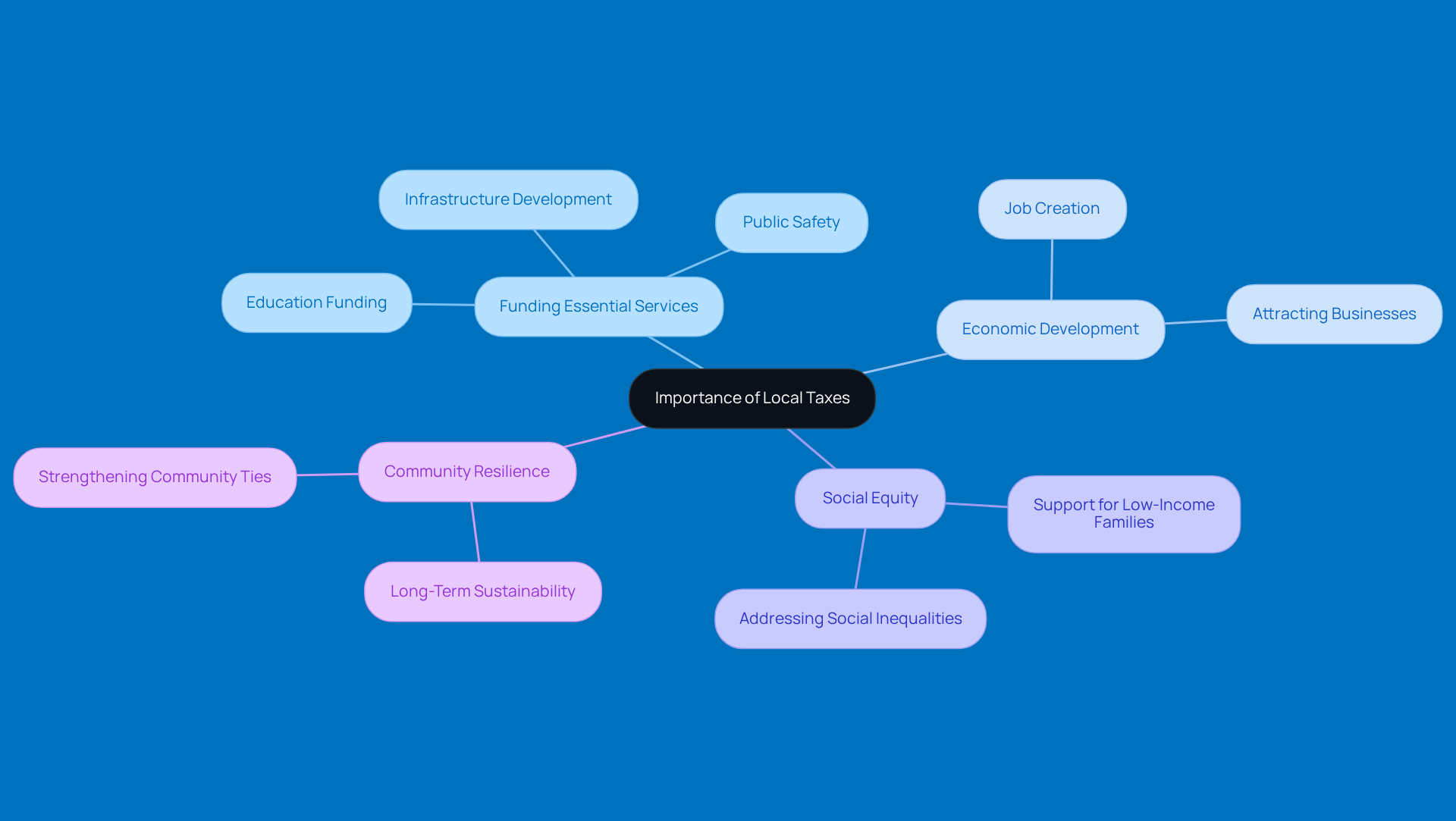

Understand the Importance of Local Taxes

Regional levies play a crucial role in keeping our communities thriving. They provide the necessary funding for essential areas like education, public safety, and infrastructure development. Imagine if municipalities didn’t have these funds-upkeeping roads, schools, and emergency services would become a real challenge, and that could lead to a dip in the quality of life for everyone living there. Take Arizona, for instance. When they switched to a flat income tax, municipalities lost about $225 million in just one year! That really highlights how tax policies can impact community resources.

But it’s not just about keeping things running; regional taxes can also boost economic development. A community with well-maintained infrastructure and top-notch public amenities is way more attractive to businesses and new residents. This, in turn, creates jobs and energizes the local economy. Carolyn Berndt pointed out that "Key outreach from community leaders nationwide produced several municipal government victories, including the preservation of tax-exemption on municipal bonds, which is essential for financing community infrastructure projects." This shows just how important these taxes are for funding vital projects.

Moreover, regional taxes can help address social inequalities by funding initiatives that support low-income families and at-risk groups, ensuring everyone has fair access to essential resources. Just look at the Salem, Oregon Revenue Task Force. When city officials were faced with the challenge of finding alternative revenue sources after voters rejected a payroll tax, it became clear how municipal tax decisions can directly impact essential services.

This holistic approach to regional taxation not only strengthens community ties but also fosters long-term economic resilience and sustainability. So, next time you think about taxes, remember-they're not just numbers; they’re the backbone of our communities!

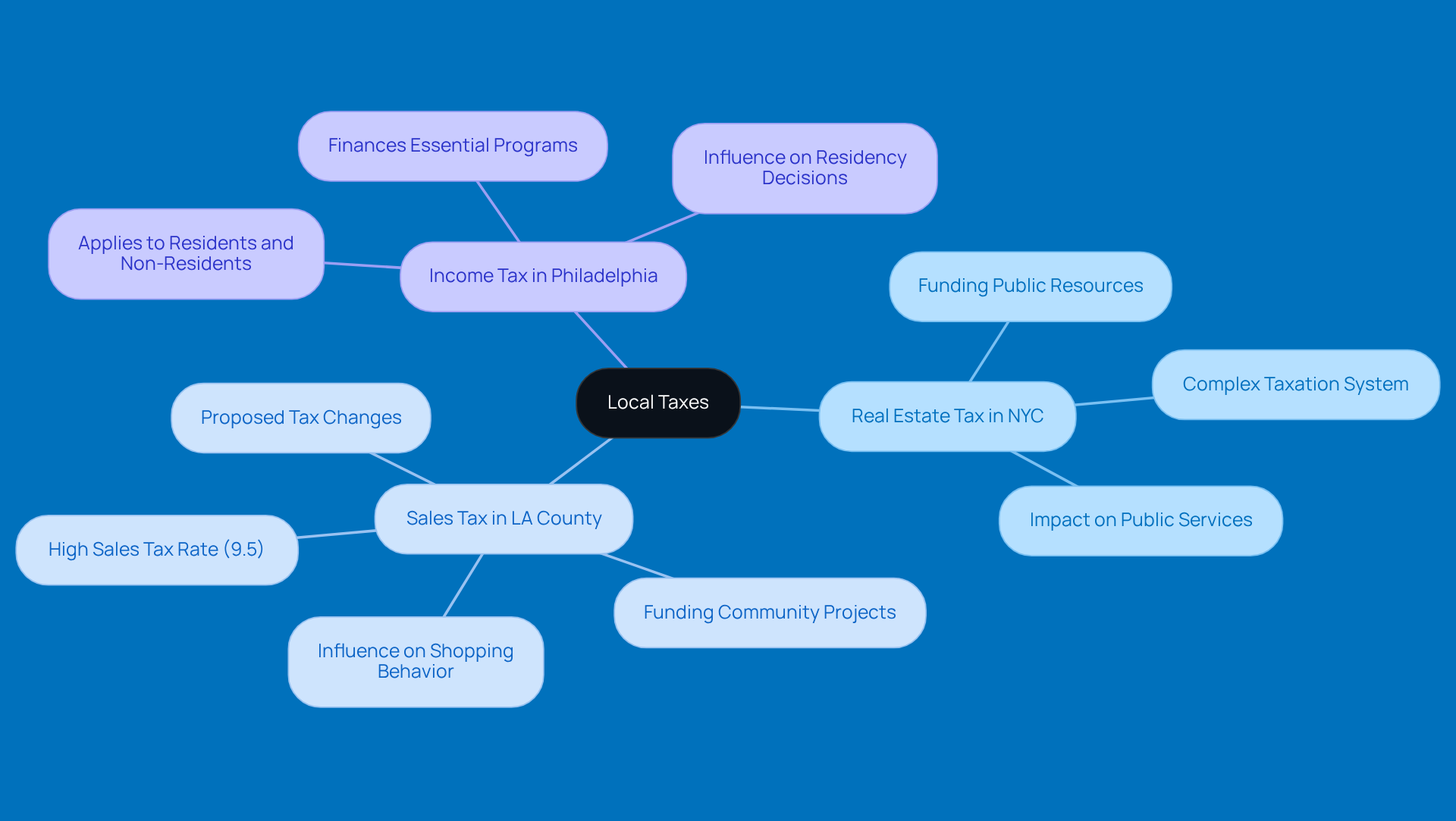

Examine Real-World Examples of Local Taxes

Real-world examples of local levies really show how diverse their applications and impacts can be across different places.

Example 1: Real Estate Tax in New York City: So, New York City relies heavily on real estate taxes to fund its public resources. The city's taxation system is quite complex, with different rates for residential and commercial buildings. This revenue is crucial for keeping the city's extensive public transportation system, schools, and emergency services running smoothly. A 2023 report from the Lincoln Institute of Land Policy and Minnesota Center for Fiscal Excellence highlighted property tax rates in over 100 US cities, underscoring just how important a solid property tax system is for municipal fiscal health.

Example 2: Sales Tax in Los Angeles County: Now, let’s talk about Los Angeles County, which has a sales tax of 9.5%-one of the highest in the nation! This tax revenue helps fund community projects, like improving public transportation and various services. But here’s the kicker: that high sales tax can actually change how people shop, with some residents heading to neighboring areas where the tax rates are lower. Plus, there’s a ballot proposal from the California Legislature for the November 2026 election that could shake things up for future sales tax initiatives, showing just how dynamic the tax landscape can be.

Example 3: Income Tax in Philadelphia: Over in Philadelphia, there’s an income tax that applies to both residents and non-residents working in the city. This tax helps finance essential programs, including public education and safety services. The regional income tax system can really influence where people choose to live and work, since higher tax rates might deter some potential residents. These examples really highlight the vital role of local taxes, specifically in the context of what are two types of local taxes that play a part in funding community services and shaping economic behavior.

So, what do you think about these local taxes? Have you noticed how they impact your community?

Conclusion

Local taxes are like the financial backbone of our communities, right? They provide the essential funding for services that really enhance our quality of life. It’s super important to understand the different types of local taxes - especially property taxes and sales taxes - because they shape not just public services but also the economic landscape where businesses thrive.

Throughout this article, we’ve seen just how significant local taxes are, highlighted by various examples and insights. For instance, real estate taxes play a crucial role in funding education, emergency services, and infrastructure. On the flip side, sales taxes can directly influence how we shop and even drive local economic development. And let’s not forget how these taxes are evolving, especially with recent legislative changes and community initiatives. They’re key in addressing both our immediate needs and long-term sustainability.

But here’s the thing: local taxes are more than just financial obligations. They’re essential tools for fostering community growth and resilience. By getting involved with local tax policies and understanding what they mean for us, individuals and business owners can really contribute to a thriving community. It’s all about supporting equitable access to resources and services. So, embracing the role of local taxes? That’s a step toward ensuring our communities stay vibrant and can meet the needs of everyone living here. What do you think? How do you see local taxes impacting your community?

Frequently Asked Questions

What are local taxes and why are they important?

Local taxes are charges imposed by local government bodies, such as cities and counties, to raise funds for essential public services and infrastructure. They are crucial for financing community programs like education, public safety, and maintaining infrastructure, which directly affects the quality of life for residents.

What are two common types of local taxes?

Two common types of local taxes are property taxes and sales taxes. These taxes help fund community resources and services.

How have local taxes been utilized in Minnesota recently?

In 2023, 32 municipalities and five counties in Minnesota have implemented new community sales levies to help alleviate financial burdens. This trend highlights the increasing reliance on local revenues to support significant projects such as community centers and public libraries.

How do local taxes impact small business owners?

Local taxes can significantly affect the operating costs and overall profitability of small businesses. Adequate funding from local levies allows municipal governments to provide better infrastructure and services, creating a supportive environment for small businesses to thrive.

What strategies can small business owners use to avoid underpayment penalties on local taxes?

Small business owners can utilize the de minimis exception, which allows taxpayers with a total tax liability minus withholdings and credits of less than $1,000 to avoid penalties. Additionally, safe harbor payments require prepayment of the lesser of 90% of the current year’s tax or 100% of the previous year’s tax, helping to alleviate financial stress.

What recommendations have been made to improve the tax approval process for small businesses?

The Taxes Advisory Task Force has suggested smoother processes in tax approvals to assist small businesses in navigating the complexities of local taxes, which can enhance their ability to comply and optimize their resources.