Introduction

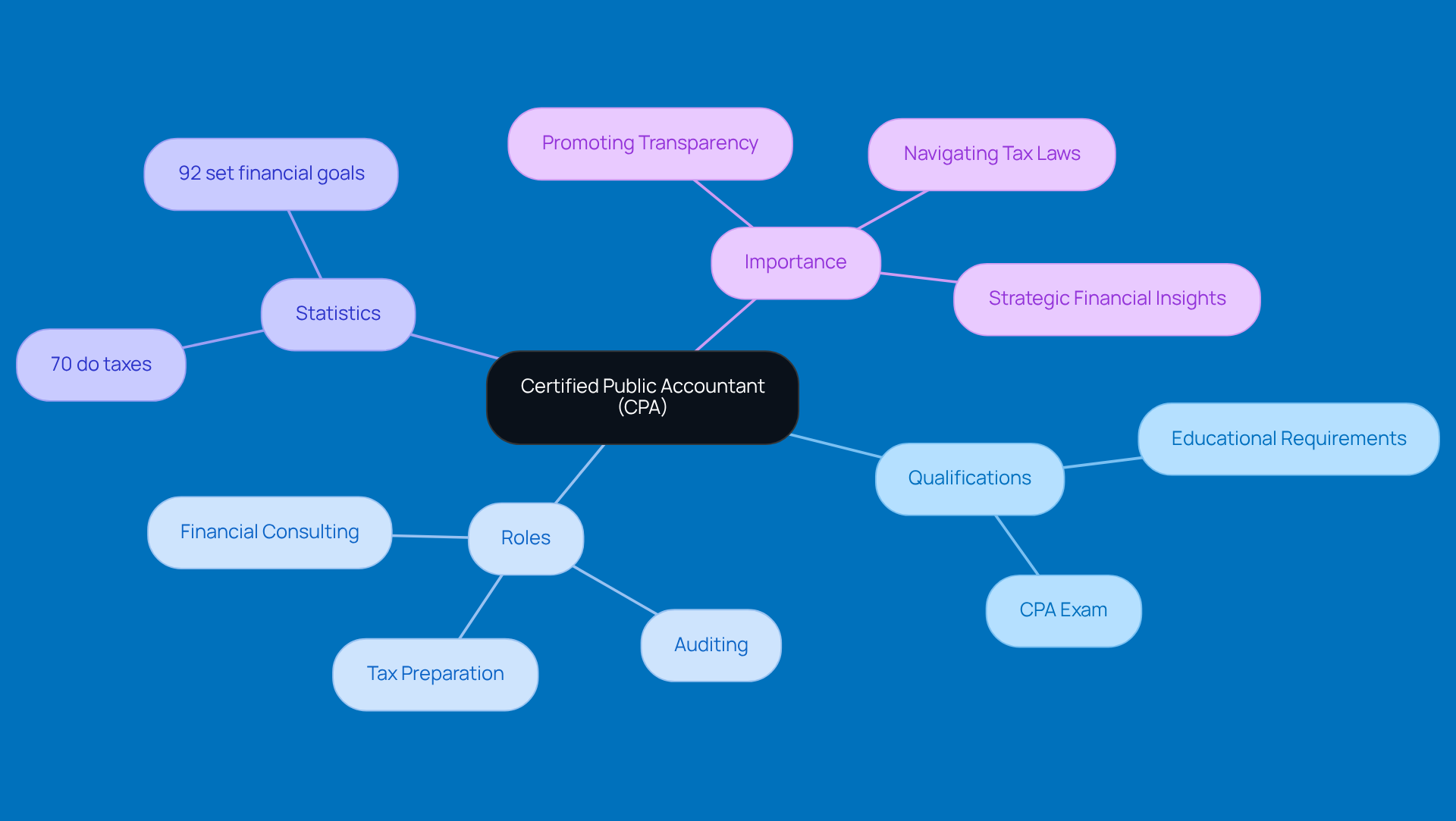

Understanding the crucial role of Certified Public Accountants (CPAs) in tax preparation goes beyond just their technical skills; it highlights their strategic importance in navigating the often tricky financial landscape. Did you know that around 70% of CPAs focus on tax-related services? This makes them invaluable allies for both individuals and businesses, offering expertise that stretches far beyond simple number crunching.

But here’s the thing: as tax laws change and compliance gets more complicated, you might wonder - how can CPAs effectively guide their clients through this maze of regulations while maximizing financial benefits? In this article, we’ll dive into the many responsibilities of CPAs in tax preparation, exploring how they impact financial health and compliance. So, let’s get started!

Define CPA: The Certified Public Accountant Explained

A Certified Public Accountant (CPA) is more than just a number cruncher; they’re licensed pros who’ve jumped through some serious hoops to earn that title. After meeting tough educational and experience requirements, they tackle the CPA exam and come out on the other side ready to help. This designation isn’t just a fancy title; it shows a commitment to high ethical standards and real expertise in the accounting world. One common question is, do CPAs do taxes, and the answer is yes, as they can handle a lot, from tax prep to auditing and financial consulting, making them essential for both individuals and businesses alike.

Did you know that about 70% of CPAs do taxes by focusing on tax preparation? That’s a big deal! It highlights how crucial they are in helping clients navigate the often confusing maze of tax laws and regulations. Plus, their ability to represent clients before the IRS really sets them apart from non-licensed accountants, making them trusted advisors when it comes to money matters.

But accountants do more than just follow the rules; they offer strategic insights that can really shape financial decisions. For instance, they help businesses understand and implement tax-efficient strategies, ensuring they meet regulatory requirements while boosting their bottom line. As we gear up for 2026, the role of accountants is becoming even more important, especially with tax laws getting more complex and the need for expert advice on resource planning.

Experts agree that CPAs play a vital role in promoting transparency and compliance, especially with new regulations like the Corporate Transparency Act coming into play. Their know-how is key in helping clients adapt to changes and make smart decisions that align with their financial goals. And with 92% of Americans setting financial goals for 2026, having a CPA in your corner can make all the difference in reaching those aspirations.

Explore CPA Responsibilities: Key Duties in Tax Preparation

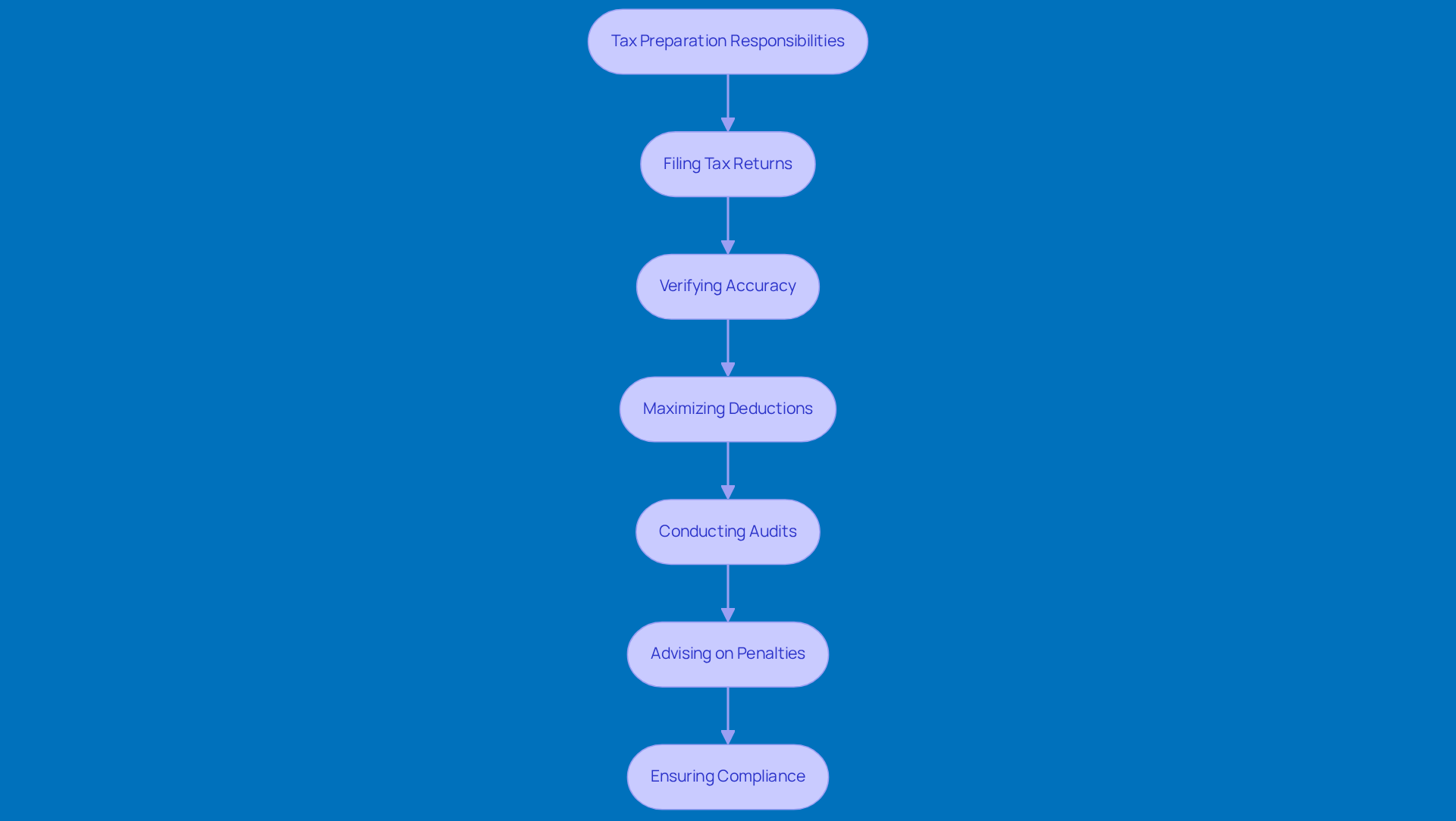

One important question is, do CPAs do taxes, as they are key players in tax preparation, with responsibilities that go way beyond just ticking boxes? They handle everything from filing federal, state, and local tax returns to verifying whether do CPAs do taxes accurately and in line with the ever-changing tax laws. For instance, did you know that starting in 2026, the standard deduction for married couples filing jointly will jump to $32,200? This makes it super important for accountants, especially since many clients wonder do CPAs do taxes, to help them strategize on how to maximize their deductions and credits, ultimately lowering their tax bills. In fact, statistics reveal that around 75% of small businesses miss out on common deductions, which can seriously impact their bottom line. This really highlights the need for professional guidance on whether do CPAs do taxes.

But that’s not all! In addition to conducting thorough audits and assessments of financial statements, certified public accountants often address the question of do CPAs do taxes, ensuring that the information is spot-on and compliant with regulations. They’re like trusted advisors, helping clients navigate tricky tax situations, including the headaches of underpayment penalties, and they often address the question of whether do CPAs do taxes. And let’s be real - those penalties can add up fast, with an interest rate of 8% annually! Accountants guide clients through this maze by advising on safe harbor payments and the importance of making timely estimated tax payments, highlighting how do CPAs do taxes. Plus, they explain the de minimis exception, which can save clients from penalties if their total tax liability minus withholdings and credits is under $1,000. This proactive approach not only helps clients dodge costly penalties but also boosts their tax compliance and financial health.

As tax compliance becomes more complex, it raises the question of whether do CPAs do taxes, highlighting their crucial expertise. They ensure that clients not only meet their obligations but also understand how do CPAs do taxes to seize opportunities for optimization. This multifaceted role really underscores how accountants contribute to the financial well-being of businesses, no matter their size. So, if you’re feeling overwhelmed by tax season, remember that a good accountant can make all the difference!

Understand CPA Qualifications: The Importance of Licensure and Ethics

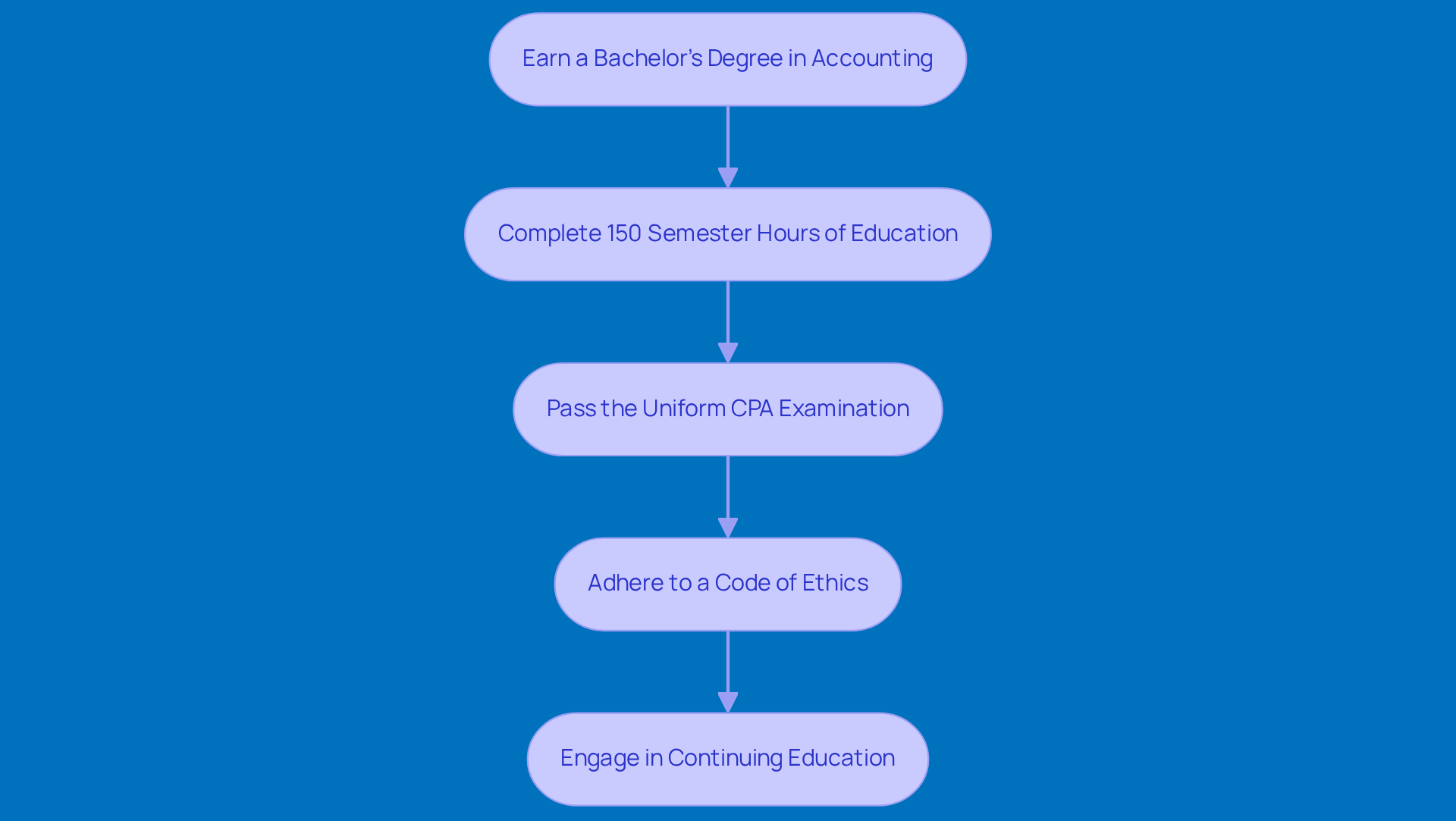

So, you want to become a CPA? Well, here’s the scoop: first, you’ll need to earn a bachelor’s degree in accounting or something similar. After that, you’re looking at 150 semester hours of education, which usually means diving into advanced classes in accounting, taxation, and business law. Once you’ve ticked off those educational boxes, it’s time to tackle the Uniform CPA Examination. This isn’t just any test; it’s a tough one that really puts your accounting knowledge to the test, especially regarding how do CPAs do taxes.

But that’s not all! As a certified public accountant, you’ll also need to stick to a strict code of ethics and keep your skills sharp with continuing education courses. This commitment helps ensure that CPAs are not only knowledgeable but also trustworthy advisors who can offer solid financial guidance.

Now, here’s something interesting: starting in 2026, some states, like Utah, are shaking things up by introducing new CPA licensure pathways. This means they’re dropping the 150-credit-hour requirement, giving you more flexibility in how you meet those educational criteria. Plus, states like New Jersey are also expanding licensure options, showing just how much the landscape of CPA qualifications is changing.

And let’s not forget about continuing education programs! These are super important for keeping CPAs up-to-date on the latest tax laws and ethical practices, which in turn helps build client trust when considering if do CPAs do taxes. So, if you’re considering this path, know that it’s not just about passing tests; it’s about being a reliable resource for your clients!

Illustrate CPA Impact: Real-World Examples in Tax Preparation

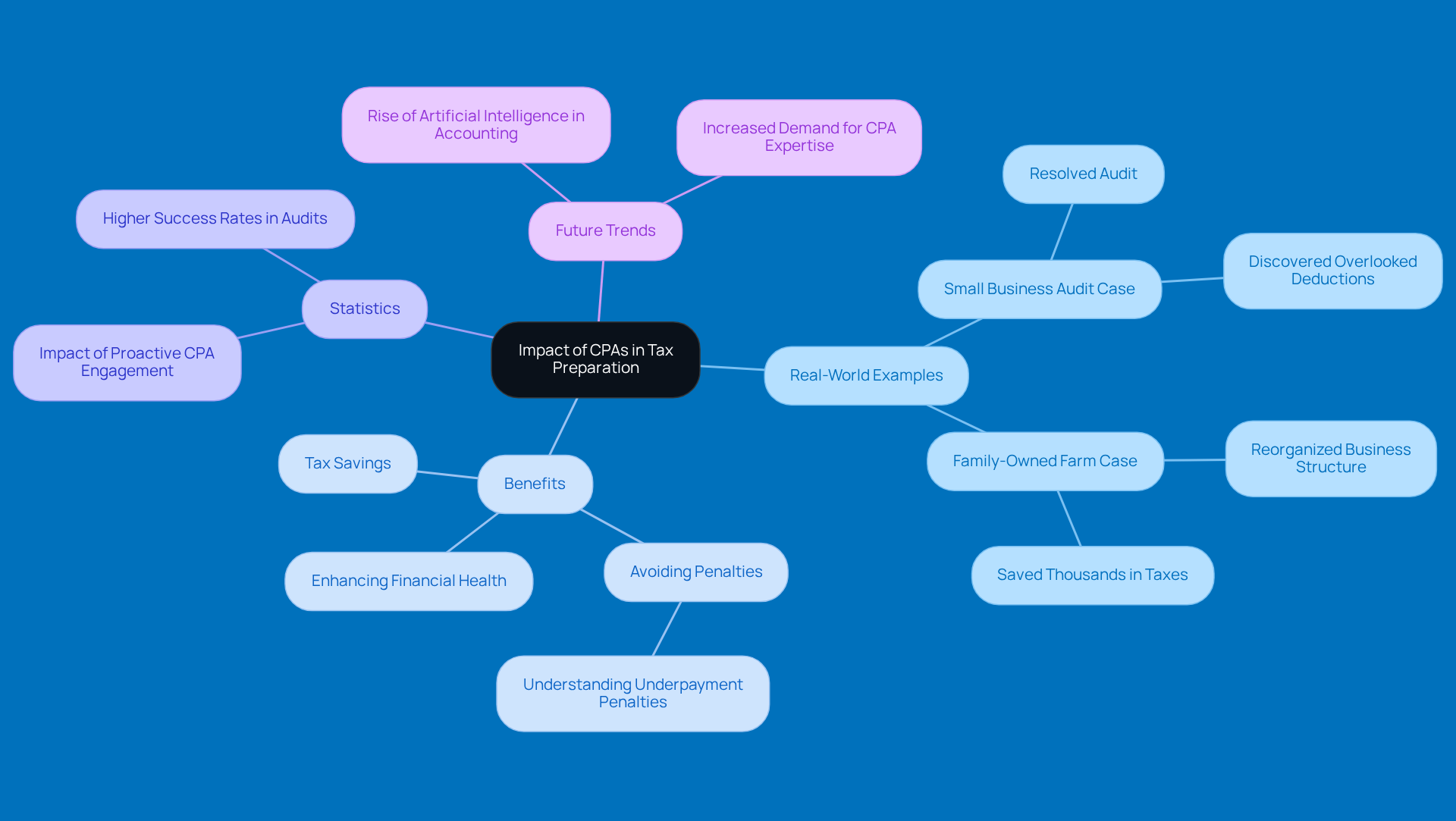

Real-world examples really highlight the huge impact of CPAs, especially when considering the question of do CPAs do taxes for tax prep and compliance. Take, for instance, a small business owner who faced an unexpected audit because of some discrepancies in their tax filings. By bringing in a CPA, they not only resolved the audit successfully but also discovered several deductions they had overlooked, leading to a nice tax refund. In another case, a family-owned farm tapped into a CPA's expertise in tax planning to reorganize their business structure, which saved them thousands in taxes each year. These stories highlight that while do CPAs do taxes, accountants also genuinely enhance their clients' financial health through smart planning and compliance.

Understanding underpayment penalties is crucial for small business owners since these can seriously impact financial stability. The IRS states that taxpayers need to pay at least 90% of their current year's tax liability or 100% of the tax shown on their previous year's return to dodge penalties. Right now, the interest rate for underpayments is 8% per year, compounded daily, which really emphasizes the need for timely compliance. A proactive CPA can help ensure you meet these requirements, as they do CPAs do taxes, minimizing the risk of those pesky fees. Statistics reveal that companies represented by certified public accountants during audits tend to have higher success rates, often achieving favorable outcomes that maximize deductions and minimize liabilities. This proactive approach means small businesses are not just prepared for audits but are also set up for long-term financial success. As Deron Hamilton, co-owner of Denman, Hamilton & Associates, puts it, 'Savvy entrepreneurs know that an accountant can be their greatest asset come tax season.' Plus, with the rise of artificial intelligence in accounting, service quality and efficiency are getting a major boost, making it even more important for small businesses to partner with CPAs who are leading the charge in these advancements.

Conclusion

When it comes to taxes, a Certified Public Accountant (CPA) is your go-to person. They’re not just number crunchers; they’re trusted advisors who help you navigate the often confusing world of tax laws and regulations. Their role stretches far beyond tax preparation, covering everything from strategic financial planning to ensuring you’re compliant with the latest rules. With tax laws constantly changing, having a CPA by your side is more important than ever.

Did you know that about 70% of CPAs focus on tax preparation? That’s a big deal! They help clients maximize deductions and steer clear of penalties. But it’s not just about compliance; CPAs offer insights that can lead to significant tax savings. Their rigorous education and commitment to ethical standards make them credible and effective in their field.

As tax compliance gets trickier, engaging a CPA becomes crucial. With financial goals getting more ambitious, having a skilled professional to guide you through the tax landscape can really make a difference. Whether you’re facing an audit, looking to optimize deductions, or planning for future success, a CPA’s impact is profound. So, why not embrace the expertise of a CPA? It can empower you to reach your financial goals while giving you peace of mind in this ever-changing tax environment.

Frequently Asked Questions

What is a Certified Public Accountant (CPA)?

A Certified Public Accountant (CPA) is a licensed professional who has met rigorous educational and experience requirements, passed the CPA exam, and demonstrates a commitment to high ethical standards and expertise in accounting.

What services do CPAs provide?

CPAs provide a range of services including tax preparation, auditing, and financial consulting, making them essential for both individuals and businesses.

Do CPAs specialize in tax preparation?

Yes, approximately 70% of CPAs focus on tax preparation, helping clients navigate complex tax laws and regulations.

How are CPAs different from non-licensed accountants?

CPAs can represent clients before the IRS, which distinguishes them from non-licensed accountants and positions them as trusted advisors in financial matters.

What strategic insights do CPAs offer?

CPAs help businesses understand and implement tax-efficient strategies, ensuring compliance with regulations while enhancing profitability.

Why is the role of CPAs becoming more important?

As tax laws become more complex, the need for expert advice on resource planning and compliance increases, making CPAs vital for individuals and businesses.

How do CPAs contribute to financial transparency and compliance?

CPAs promote transparency and compliance by helping clients adapt to new regulations, such as the Corporate Transparency Act, and make informed financial decisions.

What percentage of Americans are setting financial goals for 2026?

92% of Americans are setting financial goals for 2026, highlighting the importance of having a CPA to assist in achieving these aspirations.