Overview

Are you a small business owner working abroad? If so, you might be excited to hear about the Foreign Earned Income Exclusion (FEIE). This nifty provision allows you to exclude up to $130,000 of your foreign earned income from U.S. taxes, which can really lighten your tax load.

Imagine what you could do with that extra cash! The FEIE helps you keep more of your hard-earned money, allowing you to reinvest in your business or even treat yourself a little. However, it’s crucial to meet the eligibility criteria and stay on top of your tax compliance to make the most of these financial perks.

So, if you’re looking to maximize your earnings while living the expat life, the FEIE could be a game changer. Just remember to check those eligibility boxes and keep everything above board—your future self will thank you!

Introduction

Understanding the Foreign Earned Income Exclusion (FEIE) is super important for small business owners trying to navigate the twists and turns of U.S. tax law while working abroad. This handy provision lets qualifying American citizens and resident aliens exclude up to $130,000 of their foreign earned income from U.S. taxes. That’s a great way to lighten the financial load and boost international business opportunities!

But here’s the kicker: many entrepreneurs don’t even know about the eligibility criteria and the practical perks that come with the FEIE. So, how can small business owners tap into this exclusion to really maximize their financial potential and expand their global footprint? Let’s dive in!

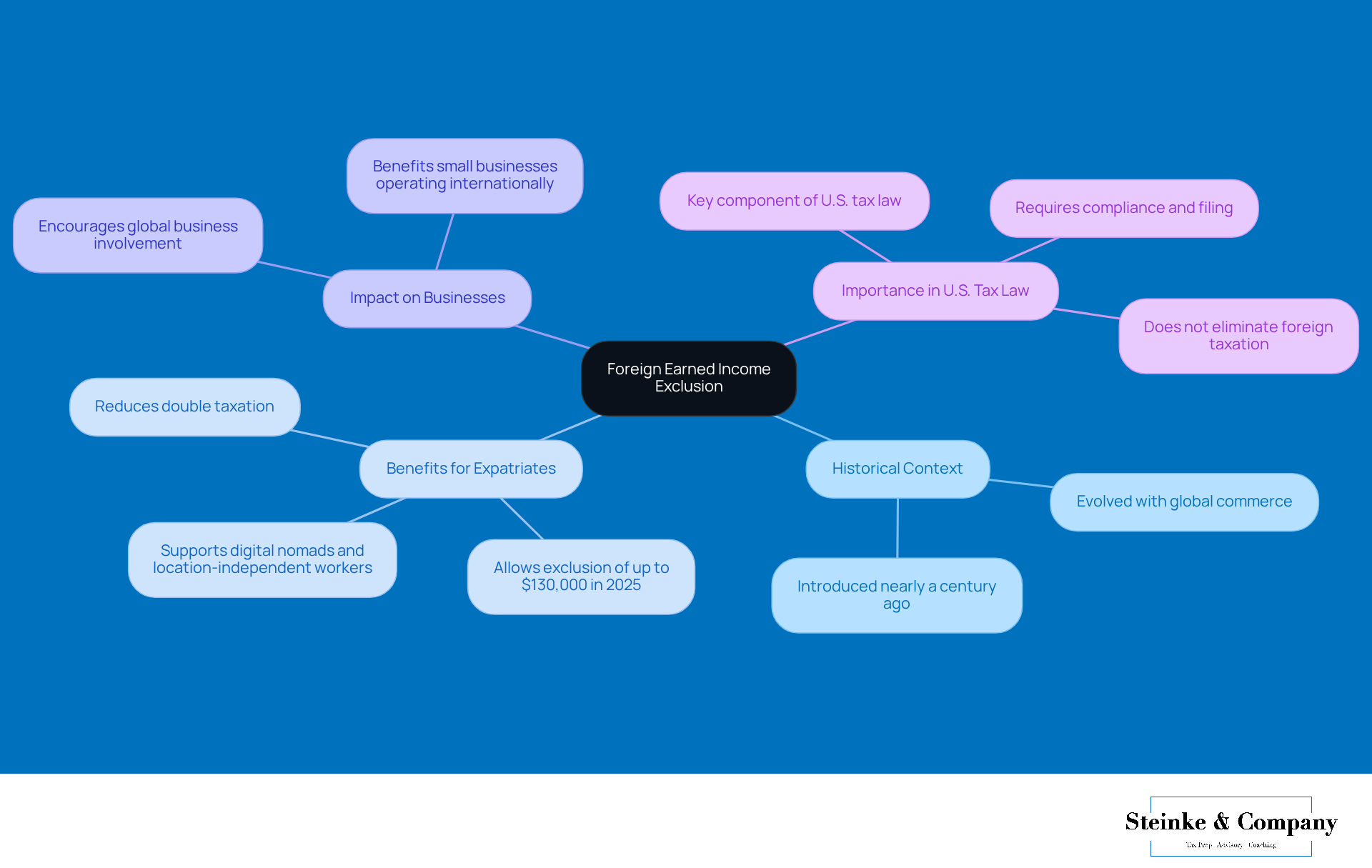

Define Foreign Earned Income Exclusion

Understanding what does foreign earned income exclusion mean is essential, as the Foreign Earned Income Exclusion (FEIE) is a game-changer in U.S. tax law. The foreign earned income exclusion allows qualifying American citizens and resident aliens to exclude a hefty chunk of their foreign earned income from U.S. taxes, which is what does foreign earned income exclusion mean. For the tax year 2025, that exclusion amount is set at $130,000! This means that small business folks earning income while living and working abroad can potentially dodge U.S. taxes on that income, provided they meet certain criteria. This exclusion is a real win for expatriates because it helps them avoid double taxation and raises awareness about what does foreign earned income exclusion mean, encouraging Americans to dive into international business.

Now, let’s talk about how the FEIE benefits small enterprises, especially freelancers or independent contractors. By taking advantage of this exclusion, they get to keep more of their hard-earned cash, which can be reinvested into their businesses or used for personal expenses. Imagine a small business owner making $150,000 while living in a low-tax area. They could exclude $130,000 from their taxable income, which really cuts down their overall tax bill.

But that’s not all! The foreign earned income exclusion also boosts financial flexibility for expatriates, giving them the freedom to invest in growth opportunities or personal ventures. It’s a crucial tool for U.S. citizens living abroad, helping them manage their tax responsibilities while exploring international opportunities. However, it’s super important for small business owners to understand what does foreign earned income exclusion mean in order to claim the FEIE. This includes filing Form 2555 and proving either the Physical Presence Test or the Bona Fide Residence Test.

Along with leveraging the Foreign Earned Income Exclusion, small business leaders should stay on top of their tax obligations to avoid any nasty underpayment penalties. This means making timely estimated tax payments, adjusting withholdings as needed to meet IRS safe harbor rules, and being aware of the de minimis exception. By understanding these guidelines and employing strategies like adjusting withholdings and making estimated tax payments, small business operators can dodge the financial hit from underpayment penalties while maximizing the benefits of the FEIE.

In summary, what does foreign earned income exclusion mean for small business owners overseas is that it offers significant tax perks and encourages the expansion of U.S. businesses into international markets, driving economic growth and global collaboration. Plus, small business owners should think about how the Foreign Earned Income Exclusion impacts financial aid eligibility for their dependents, as this can shape their overall financial game plan.

Contextualize Within U.S. Tax Law

The Foreign Earned Income Exclusion was created to simplify what does foreign earned income exclusion mean for U.S. citizens working abroad. Before it came into play, many expatriates had to deal with the headache of being taxed on their foreign income by both the U.S. and the country they were living in. Established under Section 911 of the Internal Revenue Code, this exclusion shows that the U.S. government recognizes the importance of supporting American businesses operating globally. By allowing exemptions for foreign earned income, it not only encourages global business involvement but also lightens the financial load for expatriates.

For instance, small businesses like digital marketing agencies and consulting firms that operate internationally can really benefit from the Foreign Earned Income Exclusion. These companies often hire remote employees or contractors in low-tax areas, allowing them to leverage the exclusion to reduce their overall tax bills. This exclusion has been a vital resource for expatriates, helping them keep more of their hard-earned income while navigating the complicated world of global taxation.

Looking back, the foreign earned income exclusion has evolved to keep pace with the changing landscape of global commerce. It was introduced nearly a century ago in response to the growing number of Americans seeking opportunities overseas. Today, it remains a key component of U.S. tax law, providing essential support for both expatriates and American businesses. As tax law experts point out, understanding what does foreign earned income exclusion mean is crucial for creating a favorable environment for U.S. citizens working abroad, enabling them to thrive without the heavy burden of double taxation.

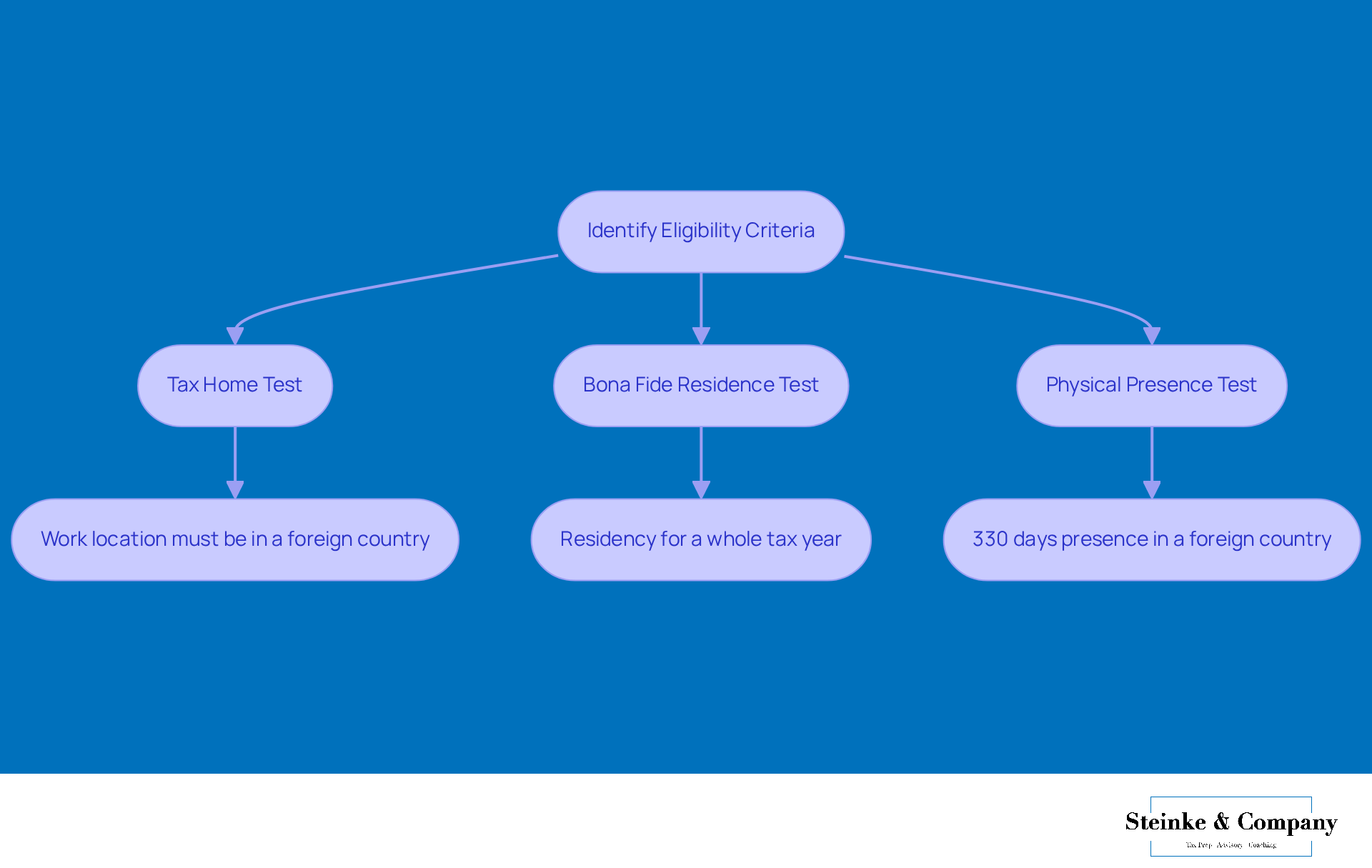

Identify Eligibility Criteria

If you're a small business owner seeking to understand what does foreign earned income exclusion mean, there are a couple of key criteria you'll need to meet:

- The Tax Home Test

- Either the Bona Fide Residence Test or the Physical Presence Test.

First up, the Tax Home Test means your primary work location has to be in a foreign country. On the other hand, the Bona Fide Residence Test requires that you establish residency in that foreign country for a whole tax year without interruption.

Now, if that sounds a bit tricky, there's also the Physical Presence Test. This one’s a bit easier to grasp—you just need to be physically present in a foreign country for at least 330 full days within any 12-month period. Meeting these criteria is super important if you want to claim the exclusion and understand what does foreign earned income exclusion mean to lower your tax bills.

Interestingly, many small business owners might actually qualify for this exclusion. For instance, those who have relocated abroad for work often find they fit under the Physical Presence Test, especially if they keep a close eye on their time spent overseas. This organized approach not only helps with tax compliance but can also make financial planning a whole lot smoother for expats. So, if you think you might qualify, it’s definitely worth looking into understanding what does foreign earned income exclusion mean!

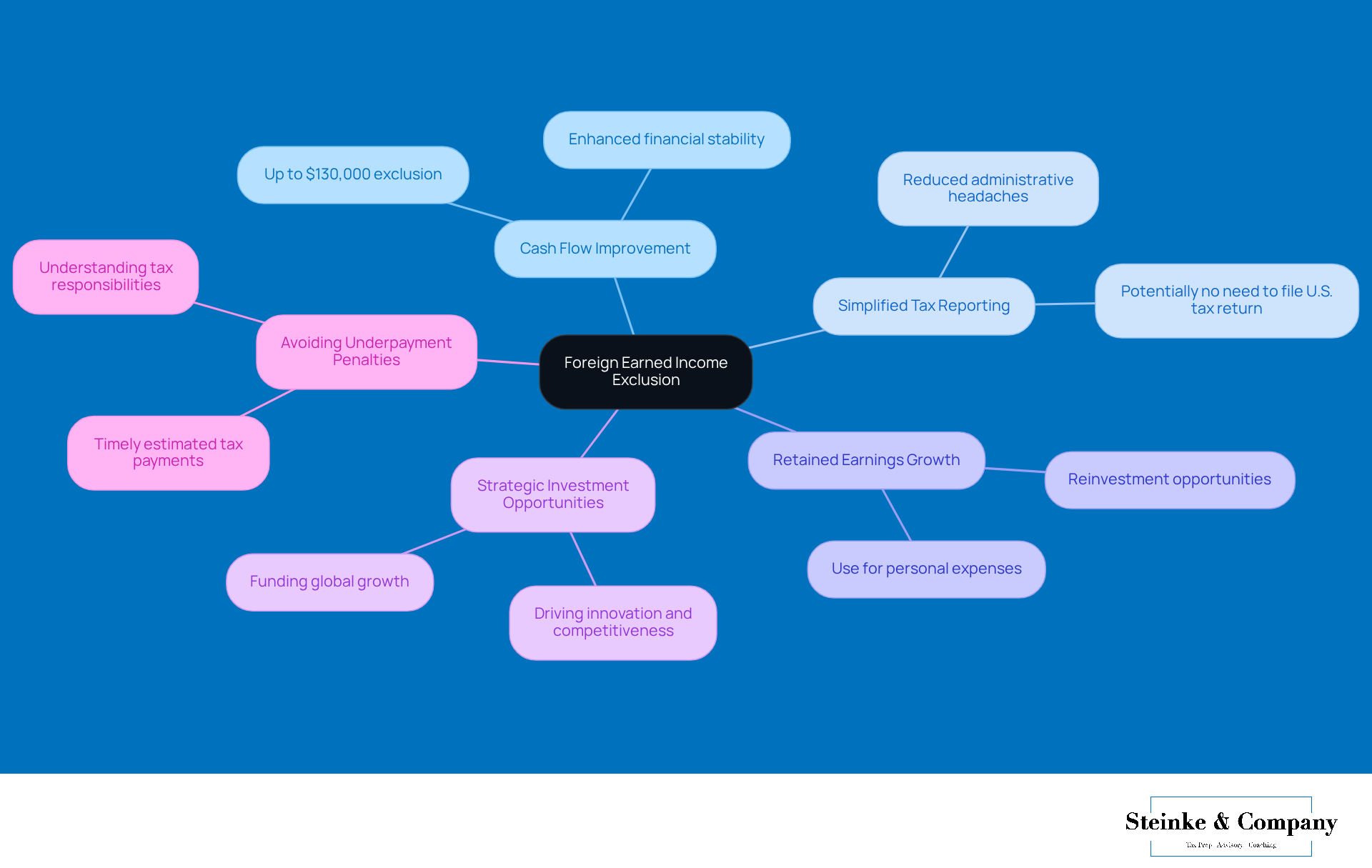

Explore Practical Implications and Benefits

The Foreign Earned Income Exclusion is what does foreign earned income exclusion mean for small businesses operating abroad. It offers some significant perks, especially when it comes to cash flow and keeping an eye on finances. By allowing you to exclude up to $130,000 of your foreign earned income from U.S. taxes in 2025, it raises the question of what does foreign earned income exclusion mean for boosting your retained earnings. This extra cash can either be reinvested back into your business for growth and expansion or used for personal expenses, which can help improve your overall financial stability.

Plus, understanding what does foreign earned income exclusion mean simplifies tax reporting for those who qualify. You might not even need to file a U.S. tax return for your overseas earnings, which cuts down on administrative headaches. This streamlined process can help you manage your cash flow better, letting you allocate resources more effectively. For example, if you're an entrepreneur relocating to a new country to broaden your service offerings, you can take advantage of what does foreign earned income exclusion mean to lighten your tax load while also investing in your business's global growth.

That said, it’s crucial for small business owners to keep a close eye on their overall tax responsibilities. Understanding underpayment penalties is key. The IRS requires that you pay at least 90% of your current year’s tax liability or 100% of what you owed last year to steer clear of penalties. Right now, the interest rate for underpayments is 8% per year, compounded daily. This really highlights the importance of making timely estimated tax payments. By following safe harbor rules and considering the de minimis exception when it applies, you can dodge costly penalties that might eat into the financial benefits of what does foreign earned income exclusion mean.

But the financial perks of the FEIE, which relate to what does foreign earned income exclusion mean, go beyond just saving on taxes; it can actually reshape the way expatriate entrepreneurs operate. By lowering your overall tax burden, you can enhance your cash flow, paving the way for strategic investments that drive innovation and competitiveness in the global arena. This kind of strategic edge is vital for small businesses looking to thrive in our increasingly interconnected world.

Conclusion

The Foreign Earned Income Exclusion (FEIE) is a fantastic opportunity for small business owners working abroad. It lets you exclude a good chunk of your foreign earned income from U.S. taxes. This essential tax benefit not only eases the stress of double taxation but also encourages American entrepreneurs to dive into international markets, which can really boost economic growth and collaboration worldwide.

As we wrap up, several key insights about the FEIE have come to light. From the Tax Home Test to the Bona Fide Residence and Physical Presence Tests, understanding these criteria can help small business owners position themselves to get the most out of their tax benefits. For instance, being able to exclude up to $130,000 of foreign income in 2025 can significantly improve cash flow. This means more money to reinvest in your business or personal projects, all while simplifying your tax reporting.

So, why is it important for small business leaders to really understand the Foreign Earned Income Exclusion? Well, by grasping its nuances and actively leveraging it, you can optimize your financial strategies, steer clear of potential underpayment penalties, and thrive in our increasingly interconnected world. Embracing this opportunity can lead to greater financial stability and innovation, setting the stage for your small business to succeed internationally. Ready to take advantage of this? Let’s make the most of it!

Frequently Asked Questions

What is the Foreign Earned Income Exclusion (FEIE)?

The Foreign Earned Income Exclusion (FEIE) allows qualifying American citizens and resident aliens to exclude a significant portion of their foreign earned income from U.S. taxes. For the tax year 2025, this exclusion amount is set at $130,000.

How does the FEIE benefit small business owners?

The FEIE benefits small business owners by allowing them to exclude a large amount of their foreign earned income from taxation, which can significantly reduce their overall tax bill. This means they can keep more of their earnings to reinvest in their businesses or for personal expenses.

What criteria must be met to qualify for the FEIE?

To qualify for the FEIE, small business owners must file Form 2555 and prove either the Physical Presence Test or the Bona Fide Residence Test.

What financial advantages does the FEIE provide to expatriates?

The FEIE provides financial flexibility to expatriates by allowing them to manage their tax responsibilities effectively. This flexibility can enable them to invest in growth opportunities or personal ventures while avoiding double taxation.

What should small business owners do to avoid underpayment penalties?

Small business owners should make timely estimated tax payments, adjust withholdings as needed to meet IRS safe harbor rules, and be aware of the de minimis exception to avoid underpayment penalties.

How does the FEIE encourage U.S. businesses to expand internationally?

The FEIE encourages U.S. businesses to expand into international markets by providing significant tax perks, which can drive economic growth and global collaboration.

How does the FEIE impact financial aid eligibility for dependents?

Small business owners should consider how the Foreign Earned Income Exclusion impacts financial aid eligibility for their dependents, as it can influence their overall financial planning.