Overview

Hey there! Let’s talk about the K-1 tax form. This little document is super important for:

- Partnerships

- S corporations

- Certain trusts

It’s how they report earnings, deductions, and credits to their partners or shareholders, which then affects their personal tax filings. If you’re a small business owner, understanding K-1 forms is key. Why? Because accurate reporting is essential for staying compliant, and it can really impact your tax liabilities, especially with all the recent changes in IRS regulations and deadlines.

So, what’s the takeaway here? Well, knowing how to handle K-1 forms can save you a lot of headaches down the road. It’s all about making sure you’re on top of your game when it comes to taxes. Have you ever had to deal with a K-1 form? If so, you know how crucial it is to get it right! Let’s make sure you’re prepared and informed.

Introduction

Navigating the world of tax documentation can feel like a maze, right? For small business owners, especially those dealing with partnerships and S corporations, it can be pretty overwhelming. That’s where the K-1 tax form comes into play—it’s a key player in connecting business entities with individual tax responsibilities.

And with tax regulations constantly changing, including new forms like Schedules K-2 and K-3, getting it right is more important than ever.

So, how can small business owners tackle their K-1 forms effectively to meet IRS requirements and steer clear of those pesky penalties?

Define the K-1 Tax Form: Purpose and Importance

What is a K1 tax form? It is an important document referred to as the K-1 tax schedule or Schedule K-1 by the IRS. It’s used to report earnings, deductions, and credits from partnerships, S corporations, and certain trusts. Think of it as a way for pass-through entities to keep their partners or shareholders in the loop about their share of the earnings, losses, and other tax-related goodies. It’s crucial because it helps folks accurately report their income on personal tax returns, which raises the question of what is a k1 tax form, reflecting their slice of the financial pie.

For small business owners, especially those in partnerships or S corporations, understanding what is a k1 tax form is crucial. It directly affects tax liabilities and compliance, especially with the recent changes that brought in new Schedules K-2 and K-3. These updates clarify what used to be line 16 on Schedule K-1, which is crucial for small business owners to understand what is a k1 tax form and to stay on top of the rules. The partnership agreement is a big deal here, as it determines how profits are shared, which impacts what goes on each partner's K-1. This highlights the need for keeping accurate records and chatting with tax pros to navigate what is a k1 tax form and avoid any underpayment penalties.

To steer clear of those pesky underpayment penalties, small business owners might want to think about adjusting their estimated tax payments throughout the year and making sure they meet safe harbor requirements. Plus, understanding the changes to COVID-19 tax benefits is super important, as these can really shake up tax liabilities and refunds. Remember, what is a k1 tax form is related to the fact that K-1 documents need to be in taxpayers' hands by March 15, which is crucial for compliance. Missing these deadlines can lead to some hefty penalties from the IRS, so timely and accurate tax compliance is a must.

Real-life examples illustrate the impact of what is a k1 tax form. For instance, partners need to keep an eye on their basis, which includes capital contributions and their share of profits, to ensure accurate tax reporting. By managing K-1 documents well, business owners can ensure they know what is a k1 tax form, stick to IRS regulations, and lower the chances of penalties. It’s also worth noting that K-1 income might be seen as earned income for general partners and active owners, which can affect their tax responsibilities. With the recent cuts to COVID-19 tax benefits, grasping the ins and outs of K-1 reporting is even more crucial for small business owners as they plan their tax strategies. Ultimately, the K-1 statement isn’t just a tax form; it is essential for understanding what is a k1 tax form and serves as a vital part of financial transparency and accountability in partnerships and S corporations. Consulting with tax professionals, like those at Steinke and Company, can offer valuable insights into K-1 reporting and help ensure all deductions and credits are claimed accurately, paving the way for long-term success and tax efficiency.

Explore Types of K-1 Forms: Partnerships, S-Corporations, and Trusts

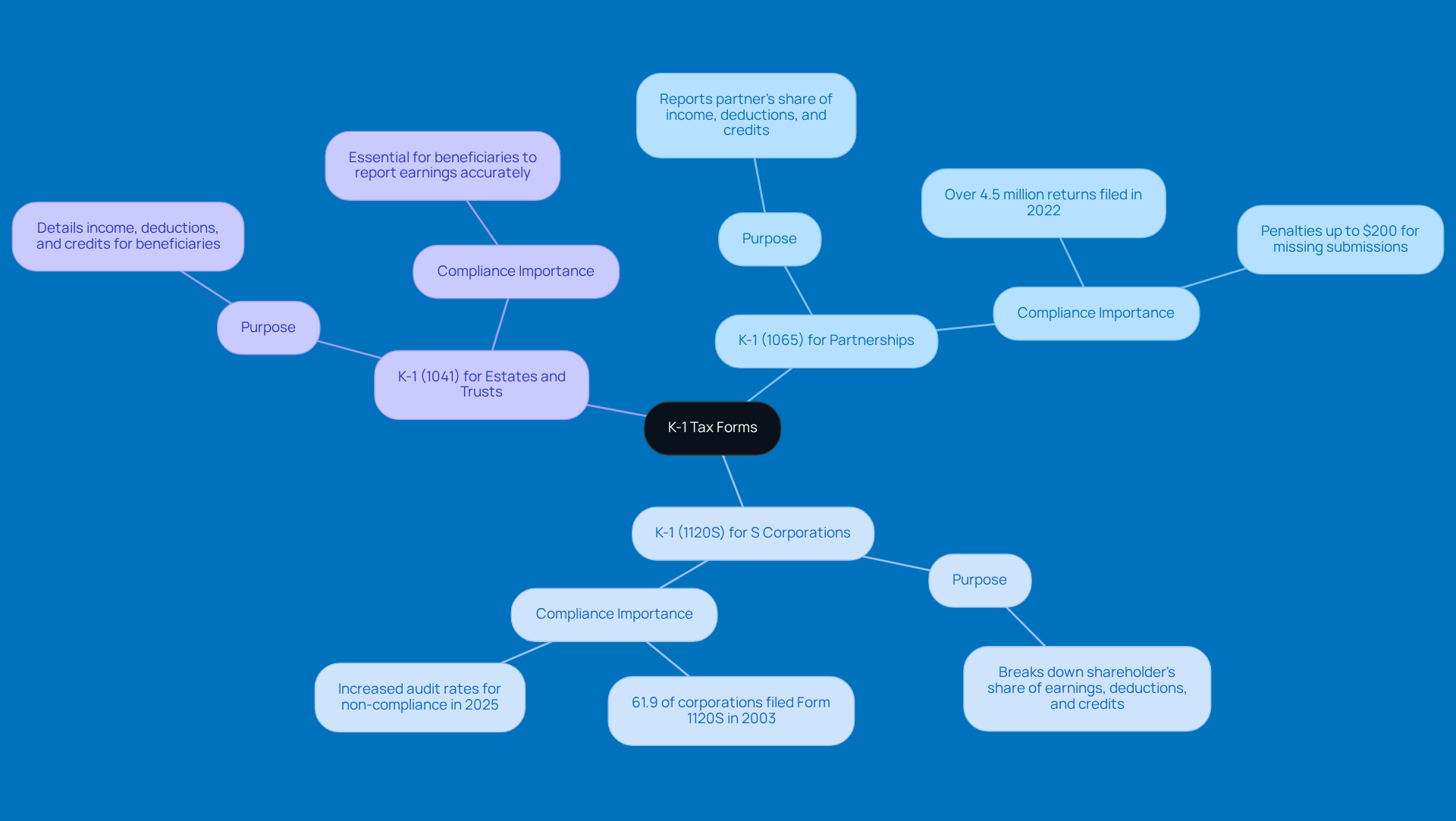

To understand what is a K-1 tax form, it's important to note that K-1 statements are super important tax documents that come in three main flavors, each tailored for specific entities: K-1 (1065) for partnerships, K-1 (1120S) for S corporations, and K-1 (1041) for estates and trusts. Understanding what is a K-1 tax form is essential for accurate tax reporting and compliance, particularly as the IRS maintains a closer watch and the potential for audits looms.

-

K-1 (Document 1065): This one’s for partnerships, reporting each partner's share of income, deductions, and credits. It’s crucial for partners to accurately reflect their earnings on their individual tax returns, as this relates to what is a K-1 tax form. In 2022, partnerships filed over 4.5 million returns, showing just how vital this structure is in the tax world. Missing a K-1 submission can hit you with penalties of up to $200 for each one, so timely and accurate filing is a must! If you’re feeling overwhelmed, expert tax prep services like those from Steinke and Company can help partnerships navigate these requirements smoothly, keeping surprises at bay and ensuring compliance.

-

K-1 (Document 1120S): This document, provided by S corporations, breaks down each shareholder's slice of the corporation's earnings, deductions, and credits. It’s essential for shareholders to understand what is a K-1 tax form and their related tax obligations. Fun fact: S corporations made up 61.9 percent of all corporations filing tax returns back in 2003, highlighting their significance and the role of K-1 (Form 1120S) in tax compliance. With the IRS ramping up scrutiny on K-1 filings, audit rates for non-compliance have noticeably increased in 2025. Small business owners really need to get a grip on these documents and might want to consider professional help to tackle the complexities of their tax responsibilities.

-

K-1 (Form 1041): This form is for estates and trusts, detailing the income, deductions, and credits assigned to beneficiaries. Beneficiaries need to use this info to accurately report their share of the estate's or trust's earnings on their personal tax returns.

Recognizing these distinctions not only helps with compliance but also empowers small business owners to manage their tax responsibilities effectively. Plus, understanding what is a K-1 tax form can significantly influence financial decisions. For example, handling K-1 documents proactively can improve tax situations, as seen in real-world cases like Allison and Brian. With the IRS's evolving requirements, including what is a K-1 tax form and the new exemption criteria for Schedules K-2 and K-3, staying informed is more crucial than ever. If you’re looking for more guidance on IRS audits and your rights, check out our FAQs for essential steps to prepare and reduce stress.

Analyze Key Components of a K-1 Form: Income, Deductions, and Distributions

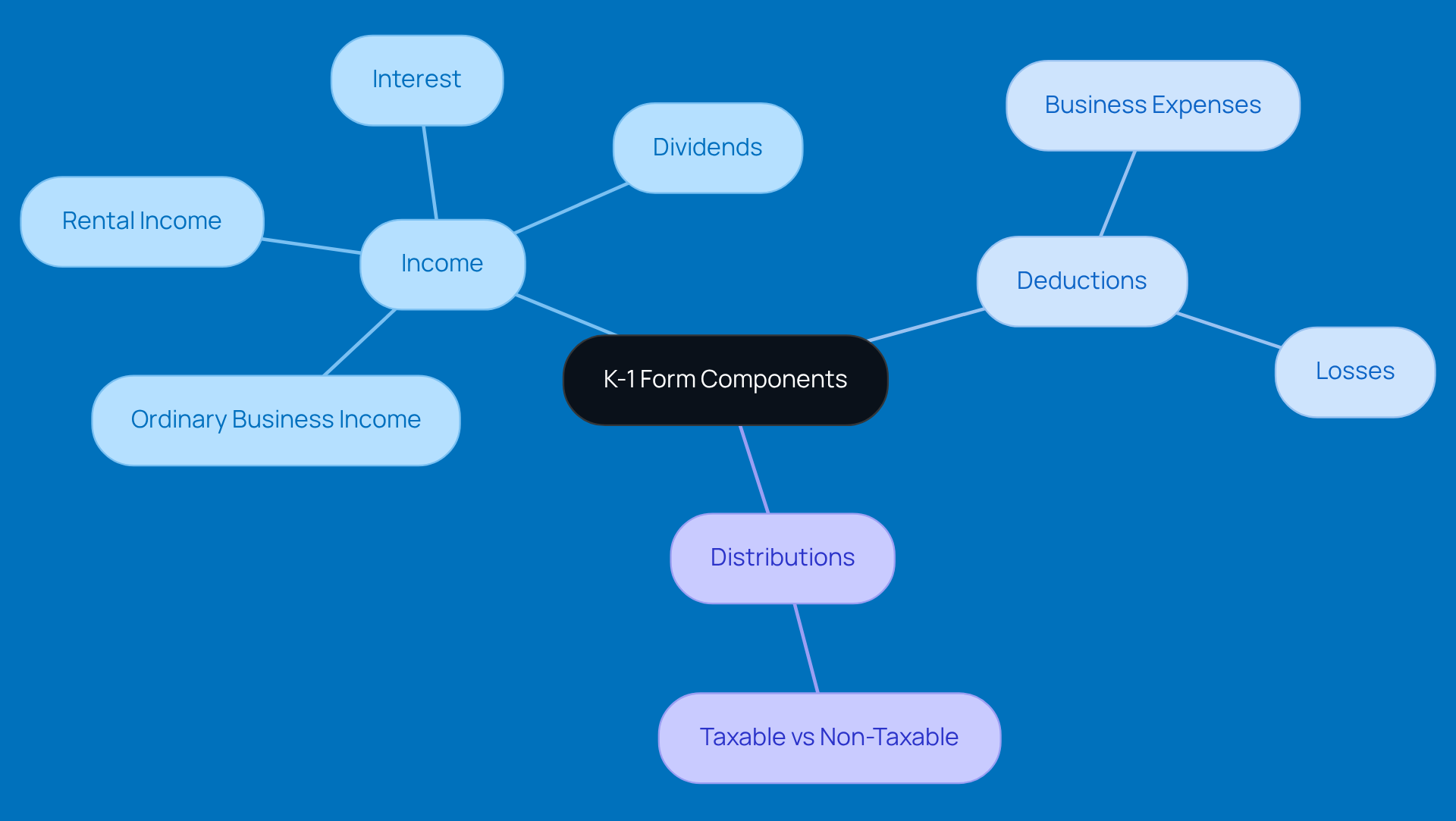

A K-1 form has a few key parts that are super important for getting your taxes right:

-

Income: This part shows what share of the entity's income belongs to the partner or shareholder. It can include things like ordinary business income, rental income, interest, and dividends. This income usually gets taxed at the individual’s tax rate. For instance, if you’re a partner in a small business, those regular earnings can really affect your overall tax bill. Understanding this income is crucial, especially when you think about how it fits into the bigger picture of tax record-keeping and compliance. After all, accurate reporting can help you dodge issues with the IRS.

-

Deductions: In understanding what is a K-1 tax form, it is important to note that it also lists any deductions that the partner or shareholder can claim, like business expenses or losses. These deductions can really help lower your taxable income. For example, if you’ve spent money on business-related expenses, you can report those on your K-1, which might just lighten your tax load.

-

Distributions: This section tells you about any distributions made to the partner or shareholder during the tax year. It’s important to know that not all distributions are taxable. It really depends on the entity’s earnings and the partner’s basis in the partnership. So, if you’re a partner getting distributions, you might not owe taxes on those amounts if they don’t go over your investment basis in the partnership.

Understanding what is a K-1 tax form is key for filling out your personal tax returns accurately and staying on the right side of IRS regulations. Tax pros often say that paying close attention to the details on your K-1 can help small business owners make the most of their deductions and steer clear of any tax season headaches. So, keep an eye on those details!

Understand the Impact of K-1 Forms on Personal Tax Filing

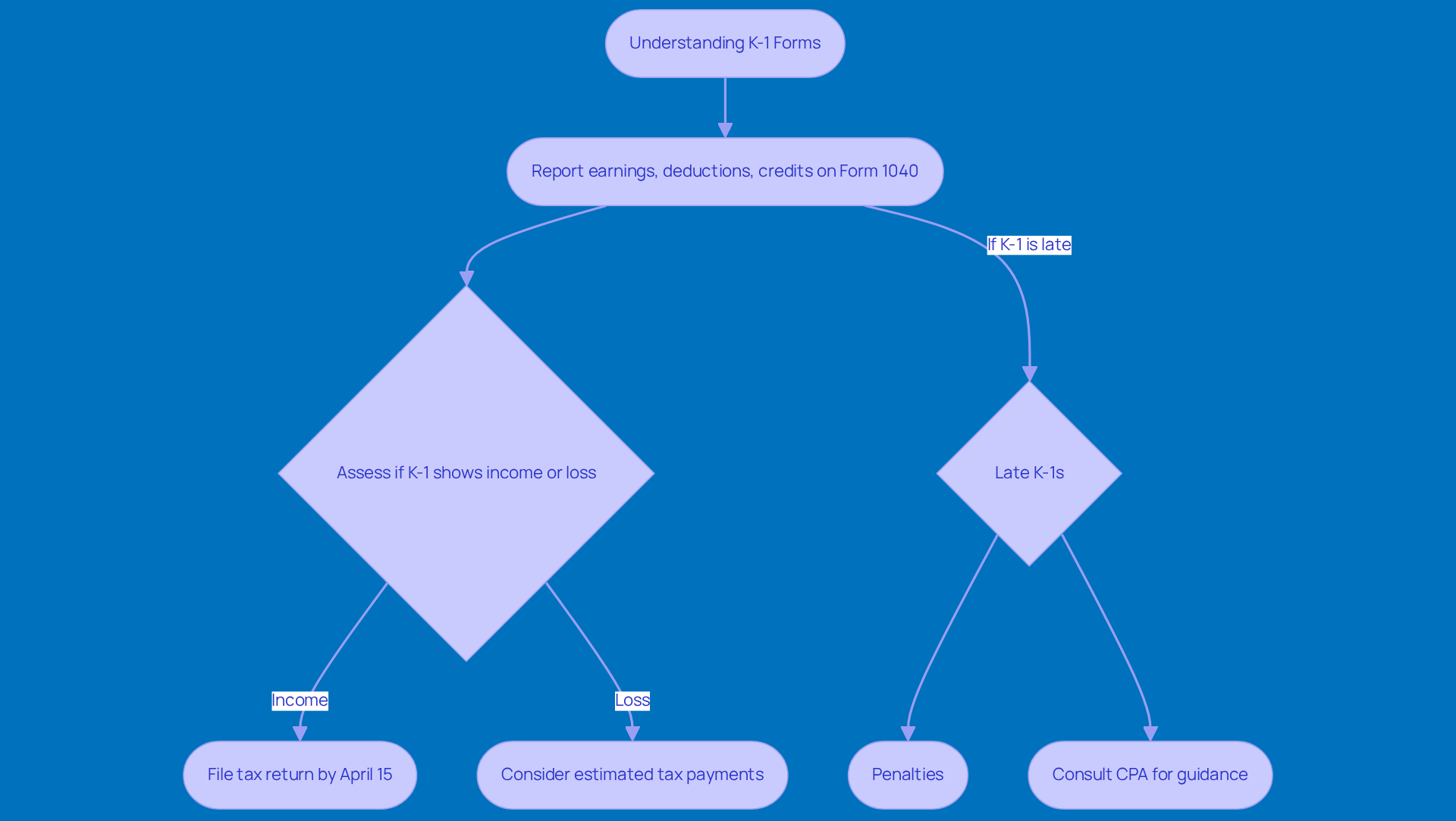

When it comes to filing your personal taxes, understanding what is a K-1 tax form can really shake things up. You’ll need to report the earnings, deductions, and credits from that K-1 on your Form 1040. This income usually gets taxed at your marginal tax rate, which can have a big impact on what you owe. But if your K-1 shows a loss, you might be able to use that to offset other income, which could help lighten your tax load.

If you’re a small business owner, you should definitely keep an eye on K-1 forms. They often come in after the tax filing deadline, which can complicate your tax prep. Many partnerships and S corporations ask for extensions, causing delays in getting those K-1s out. This can lead to missed deadlines and penalties if you don’t get that info into your tax returns on time. Just think about it: tax returns that include K-1 data are due by April 15, but K-1s are usually expected by March 15. That’s a pretty tight squeeze!

So, understanding what is a K-1 tax form and how it impacts your taxes is super important for planning and compliance. To dodge the headaches that come with late K-1s, small business owners should consider making estimated tax payments based on last year’s income. You might also want to look into strategies like the de minimis exception, which lets you avoid penalties if your total tax liability minus withholdings and credits is under $1,000. And don’t forget about safe harbor payments—they can protect you from underpayment penalties if you meet certain thresholds.

Being proactive can really help, too! Early chats with your investment managers and filing for extensions when you see delays coming can ease the stress of late K-1s. Plus, teaming up with a CPA can give you the expert guidance you need to navigate these tricky waters, helping you manage your tax obligations without all the fuss.

Conclusion

Understanding the K-1 tax form is super important for small business owners, especially if you're in a partnership or running an S corporation. This key document acts like a bridge between your business's financial activities and your personal tax obligations. It helps ensure that all those earnings, deductions, and credits are reported accurately. By getting a handle on the K-1 form, you can tackle your tax liabilities more effectively and stay on the right side of IRS regulations.

Throughout this article, we've highlighted some key insights, like the different types of K-1 forms, what they include, and how they affect your personal tax filings. Remember, timely and accurate reporting is crucial to dodge penalties and make the most of those deductions. Plus, with the ever-changing tax laws—like those updates related to COVID-19 benefits—it's more important than ever to stay informed and proactive about your tax planning.

So, as a small business owner, make it a priority to understand the K-1 tax form and what it means for your financial health. Engaging with tax professionals can really help you navigate compliance effectively. By taking these steps, you can not only reduce the risks tied to tax liabilities but also set yourself up for long-term success and financial transparency in your partnerships and corporations. What steps will you take next to ensure you're on top of your tax game?

Frequently Asked Questions

What is a K-1 tax form?

The K-1 tax form, also known as Schedule K-1, is a document used to report earnings, deductions, and credits from partnerships, S corporations, and certain trusts. It informs partners or shareholders about their share of the earnings, losses, and other tax-related items.

Why is the K-1 tax form important?

The K-1 tax form is crucial because it helps individuals accurately report their income on personal tax returns, which affects their tax liabilities and compliance. It is especially important for small business owners to understand the K-1, especially with recent updates to tax regulations.

What recent changes have been made to the K-1 tax form?

Recent changes include the introduction of new Schedules K-2 and K-3, which clarify previous reporting requirements on Schedule K-1. These updates are important for small business owners to understand to ensure compliance and accurate reporting.

How does the partnership agreement impact the K-1 form?

The partnership agreement determines how profits are shared among partners, which directly impacts what is reported on each partner's K-1. Accurate record-keeping and communication are essential to ensure correct reporting.

What should small business owners do to avoid underpayment penalties related to K-1 forms?

Small business owners should consider adjusting their estimated tax payments throughout the year and ensure they meet safe harbor requirements to avoid underpayment penalties.

When do K-1 documents need to be provided to taxpayers?

K-1 documents must be in taxpayers' hands by March 15 to ensure compliance with IRS regulations. Missing this deadline can result in significant penalties.

How can K-1 income affect tax responsibilities for partners?

K-1 income may be considered earned income for general partners and active owners, which can influence their overall tax responsibilities and liabilities.

Why is it important to consult with tax professionals regarding K-1 reporting?

Consulting with tax professionals can provide valuable insights into K-1 reporting, ensuring that all deductions and credits are claimed accurately, which can lead to long-term success and tax efficiency for small business owners.