Introduction

Hey there, small business owners! Let’s chat about something that might seem a bit tricky but is super important: passive losses. Understanding these non-active deductions is key when you’re navigating the often confusing world of tax regulations. They can really shake up your financial planning, especially if you’ve got investments in rental properties or partnerships that unexpectedly take a hit.

Now, the IRS has some pretty strict rules about how you can use these losses, which raises an important question: how can you manage your tax liabilities effectively while staying on the right side of the law? In this article, we’re going to break down what passive losses are, what they mean for you, and the key characteristics you need to know. By the end, you’ll have some solid insights to help you optimize your financial strategies. So, let’s dive in!

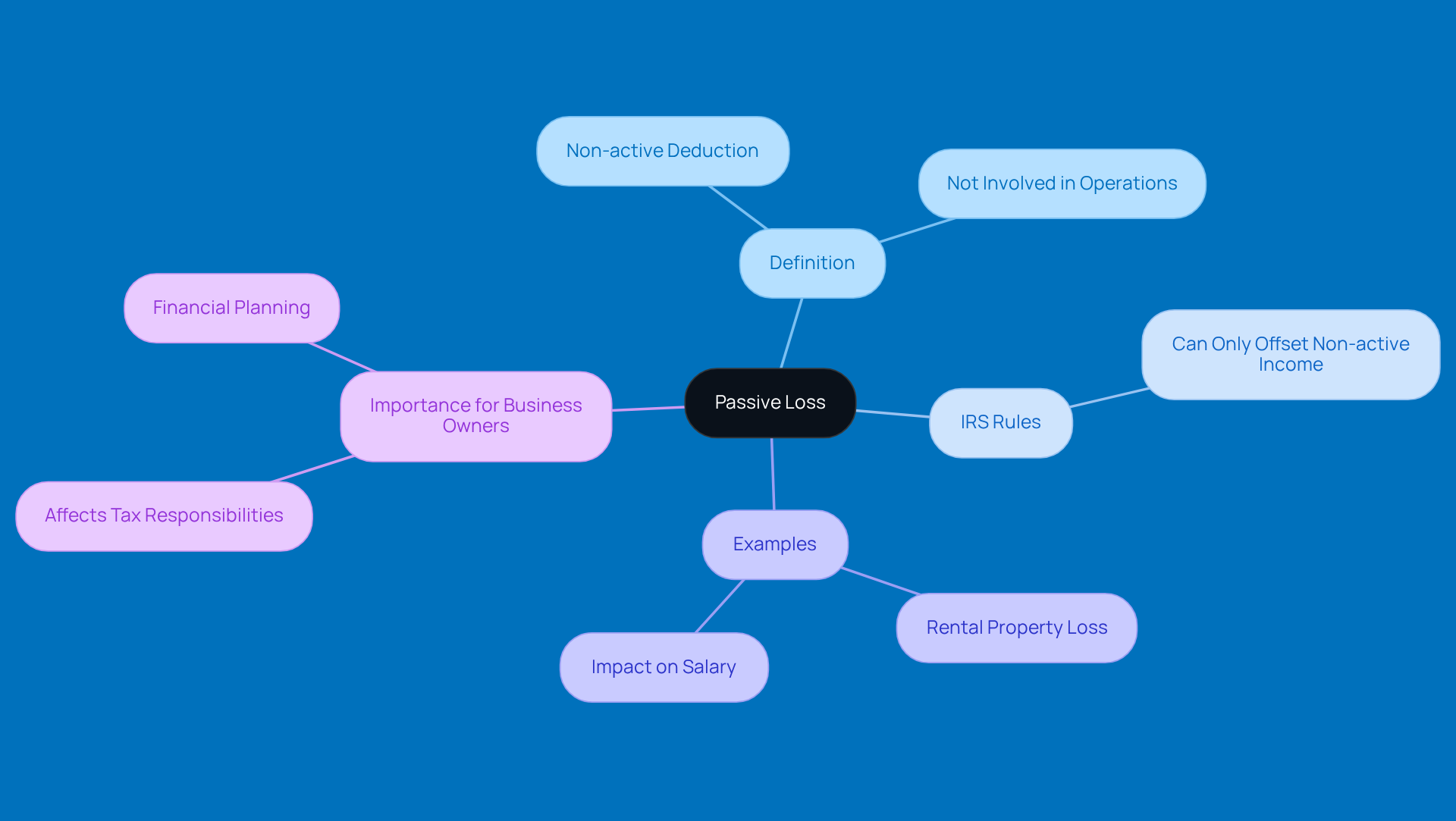

Define Passive Loss: Understanding the Concept

A non-active deduction is essentially what is a passive loss, which happens when you’re not really involved in the day-to-day operations of a business. Think about it like this: if you own a rental property or are part of a limited partnership but aren’t actively managing it, that raises the question of what is a passive loss and how these deductions come into play. According to IRS rules, what is a passive loss refers to these non-active losses that can only offset non-active income. This means you can’t use them to lower your taxable income from your active job, like your salary.

For instance, let’s say you’re a small business owner who racks up a $16,000 loss from a rental property. If you don’t have any non-active income to balance that out, you can’t apply that loss against your salary. It’s a bit of a bummer, right? But understanding what is a passive loss is super important for small business owners because it can really affect your tax responsibilities and how you plan your finances.

As we look ahead to 2026, getting a grip on how these inactive deductions fit into your overall tax picture is key for managing your business effectively. So, keep this in mind as you navigate your financial strategies!

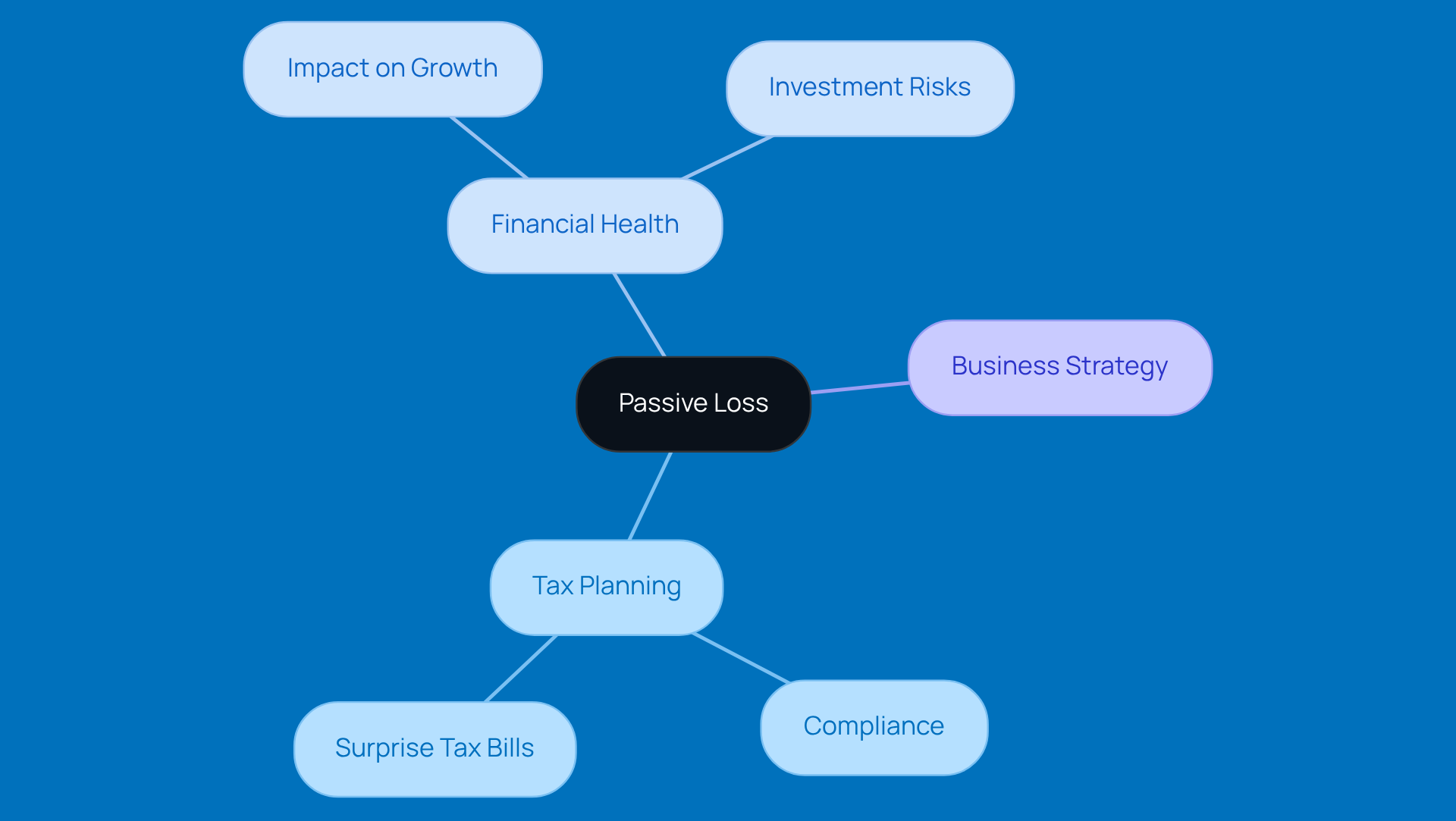

Contextualize Passive Loss: Importance for Small Business Owners

If you're a small business owner, especially in rural America, understanding what is a passive loss is essential for smart tax planning and staying compliant. Many entrepreneurs like to invest in rental properties or partnerships to mix things up with their income. But here's the catch: if those investments end up in the red, it can limit your ability to offset those losses with other income. This could lead to some surprise tax bills if you're not careful.

And let’s face it, tax regulations can be pretty tricky. Small businesses really need to understand what is a passive loss and how those inactive losses can impact their overall financial health and future growth plans. By getting a grip on the nuances of non-active financial setbacks, you can make choices that really align with your business goals. So, take a moment to think about how these deductions might play into your strategy!

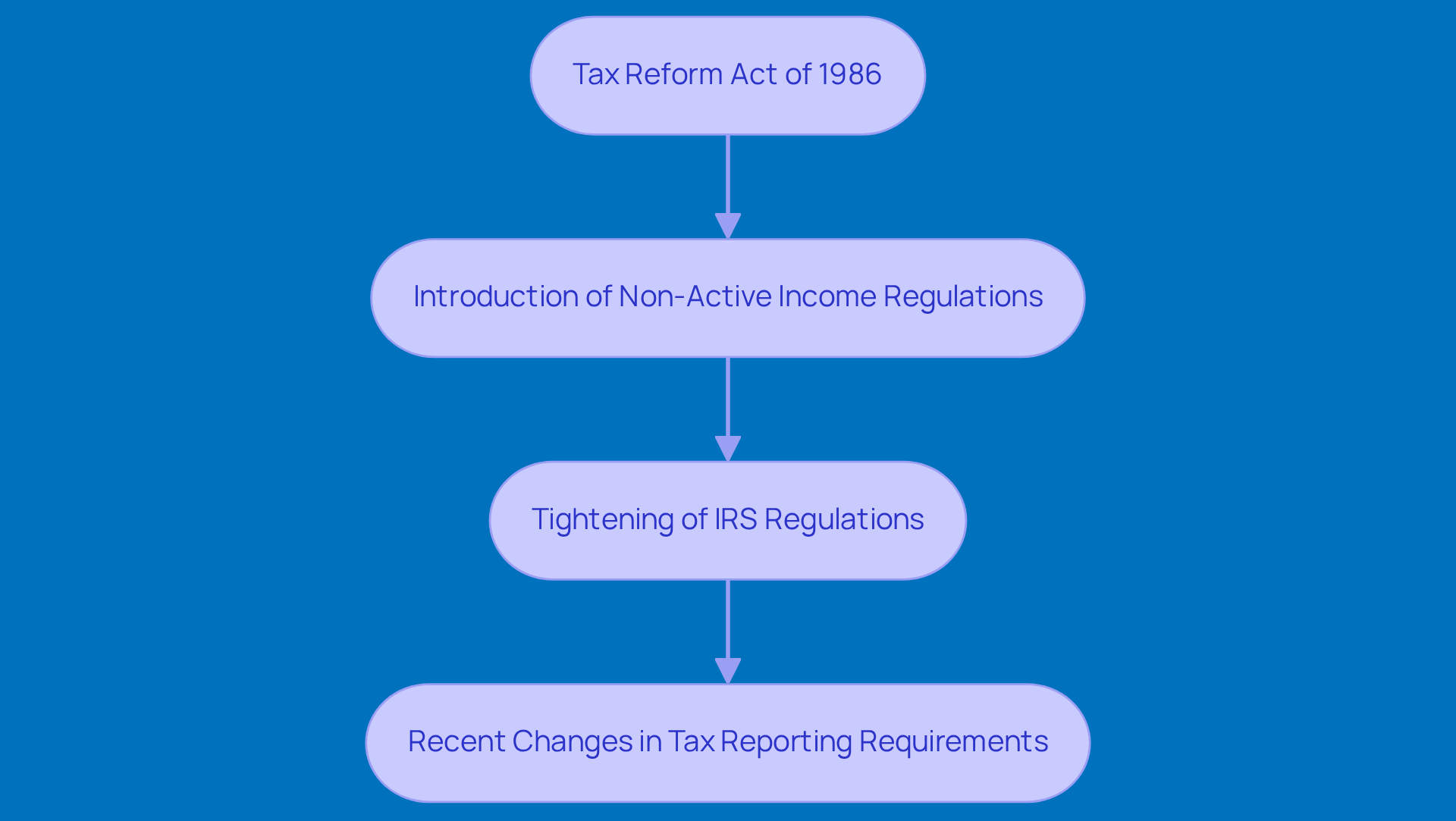

Trace the Origins: Historical Development of Passive Loss Regulations

You know, the whole idea of non-active expense regulations really kicked off with the Tax Reform Act of 1986. This law aimed to tackle some serious tax shelter abuses. Before it came along, high-earning taxpayers had a pretty sweet deal - they could use losses from non-active activities to offset their active earnings, which led to some major tax evasion tactics. So, the introduction of non-active income regulations was a direct response to these practices, establishing clear rules on what is a passive loss and how to handle losses from inactive investments for tax purposes.

Over the years, these regulations have evolved quite a bit. The IRS has tightened the screws, making sure that inactive losses can only offset inactive income. This historical backdrop is super important for small businesses to understand. It highlights why sticking to the rules is crucial and discusses what is a passive loss if they mishandle those inactive losses.

And let’s not forget about the recent changes in tax reporting requirements! With new 1099-K thresholds and the potential for underpayment penalties, small business owners really need to navigate these complexities. It’s all about optimizing those tax compliance strategies effectively. So, how are you planning to tackle these changes in your own business?

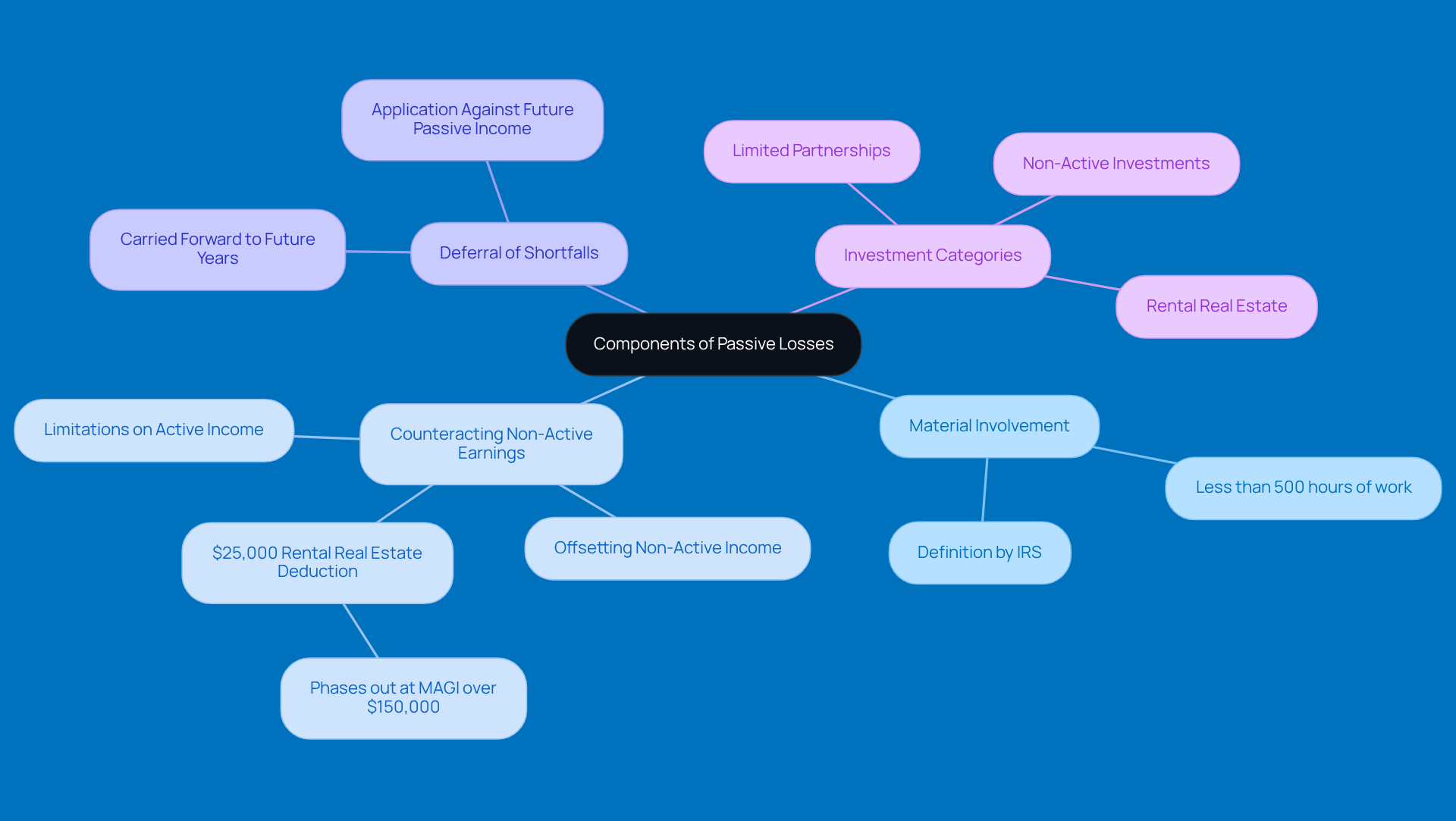

Identify Key Characteristics: Components of Passive Losses

When it comes to inactive expenditures, there are a few key traits you should know about:

-

Material Involvement: For a deficit to be considered non-active, the taxpayer really shouldn’t be materially involved in the activity. So, if you’re actively overseeing your business, those deficits might not qualify as non-active. The IRS generally defines material participation as being involved in the operation on a regular, continuous, and substantial basis-usually needing less than 500 hours of work each year.

-

Counteracting Non-Active Earnings: Non-active deficits can only be used to offset non-active earnings, like those from rental properties or limited partnerships. They can’t be applied against your active income, such as wages or salaries. For instance, if you’re a rural entrepreneur with non-active deficits from a rental property, those deficits can only reduce earnings from other non-active activities-not your paycheck from your full-time job. Plus, the IRS allows a $25,000 rental real estate deduction, which phases out completely if your Modified Adjusted Gross Income (MAGI) goes over $150,000.

-

Deferral of Shortfalls: If your inactive shortfalls exceed your inactive income, the extra shortfalls get deferred and carried forward to future tax years. This means you can apply them against future inactive income or gains from property sales. It’s a smart way for entrepreneurs to manage their tax obligations over time.

-

Investment Categories: Common sources of non-active reductions include rental real estate, limited partnerships, and specific investments where you don’t take on an active role. Understanding these traits is super important for small business owners, especially in rural areas, to navigate tax obligations effectively and optimize financial strategies.

Given the complexities of managing what is a passive loss under strict IRS rules, it’s a good idea to consult a tax professional or financial advisor. They can help ensure you’re compliant and maximize your potential benefits!

Conclusion

Understanding passive loss is super important for small business owners, especially if you're into rental properties or limited partnerships. These non-active deductions can really impact your tax obligations and financial planning. By getting a handle on passive losses, you can steer your financial strategies more effectively and dodge those unexpected tax bills.

Let’s break it down a bit. The article covers some key points about passive loss, like what it is, where it came from, and its main features. It points out that passive losses can only offset non-active income, which means you need to be materially involved in your business activities. Plus, the changes in passive loss regulations since the Tax Reform Act of 1986 really highlight how crucial it is to stay compliant and plan strategically.

So, why does all this matter? Well, recognizing the implications of passive loss is key to optimizing your tax compliance and keeping your financial health in check. It might be a good idea to chat with a tax professional to make sure you’re making the most of these deductions while sticking to IRS rules. By doing this, you can make smart choices that align with your long-term business goals and protect your financial future. What do you think? Are you ready to take charge of your tax strategy?

Frequently Asked Questions

What is a passive loss?

A passive loss is a non-active deduction that occurs when an individual is not involved in the day-to-day operations of a business, such as owning a rental property or being part of a limited partnership.

How do IRS rules define passive losses?

According to IRS rules, passive losses are non-active losses that can only offset non-active income. This means they cannot be used to lower taxable income from active jobs, like salaries.

Can you provide an example of a passive loss?

For example, if a small business owner incurs a $16,000 loss from a rental property but has no non-active income to offset that loss, they cannot apply that loss against their salary.

Why is understanding passive losses important for small business owners?

Understanding passive losses is crucial for small business owners because it can significantly affect their tax responsibilities and financial planning.

What should business owners consider regarding passive losses as we approach 2026?

Business owners should understand how passive losses fit into their overall tax picture to manage their business effectively and navigate their financial strategies.