Introduction

Navigating the world of taxes can feel like a real headache for small business owners, right? With all the changes in regulations, it’s no wonder many feel overwhelmed. That’s where a small business tax planner comes in - think of them as your trusty sidekick! They offer personalized strategies that not only make compliance easier but can also lead to some pretty significant financial perks.

But here’s the kicker: with all the complexities of tax laws and the risks of not planning properly, how can you make sure you’re getting the most out of these valuable resources? Understanding what a small business tax planner does and why they’re important might just be the secret sauce to not just surviving, but actually thriving in today’s competitive market. So, let’s dive in and explore how you can turn tax time from a chore into an opportunity!

Defining a Small Business Tax Planner

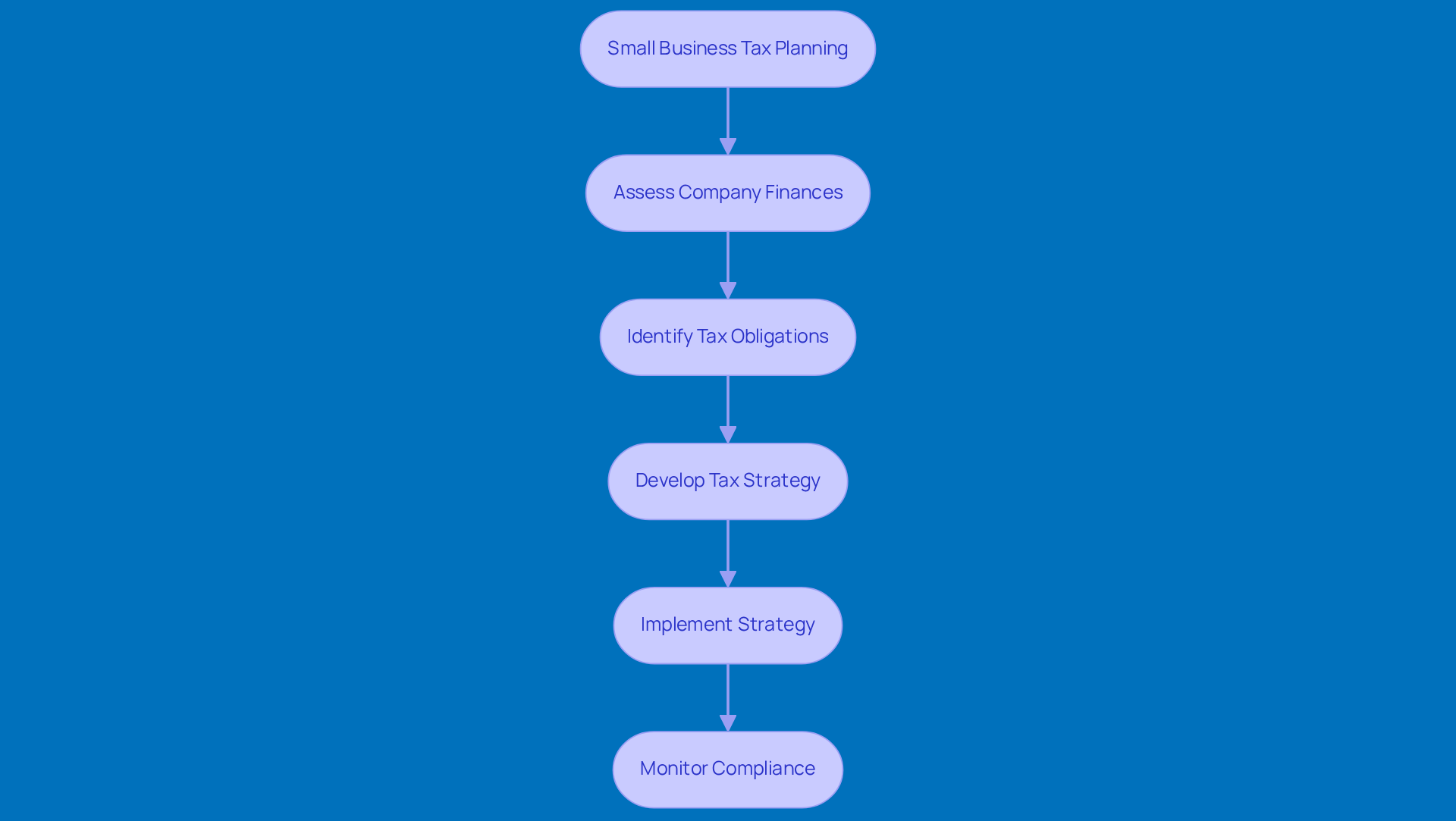

A small business tax planner acts as your go-to financial buddy, dedicated to crafting tax strategies specifically for small business owners. This role involves taking a good look at a company’s finances, spotting potential tax obligations, and coming up with a solid plan to minimize those obligations - all while staying on the right side of tax laws. Tax advisors work hand-in-hand with owners, helping them navigate the often tricky tax landscape and make smart choices that fit their financial goals. By emphasizing proactive tax planning, these experts help small businesses optimize their tax situations and boost their overall financial health.

Understanding the ins and outs of underpayment penalties is super important for business owners. The IRS can hit you with these penalties if you don’t pay enough of your tax bill through withholding or estimated tax payments during the year. A small business tax planner can help ensure that owners meet the safe harbor criteria, which protects them from penalties by prepaying a minimum amount of their tax obligation. This might involve tweaking withholdings or making timely estimated tax payments. By tapping into these expert tax prep and strategy services, small businesses can stay compliant, avoid nasty surprises, and ultimately lighten their tax burden, paving the way for growth and financial stability.

The Importance of Tax Planning for Small Businesses

Having a small business tax planner is super important for small businesses, as it can really make a difference in their financial health and growth. When owners work with a small business tax planner to use smart tax strategies, they can find deductions, credits, and other opportunities that help lower their tax bills. This proactive approach not only helps with cash flow-making it easier for companies to predict their tax obligations-but it also boosts overall profitability.

For example, businesses that actively engage in tax strategies often see higher net incomes. There are plenty of case studies out there showing how smart tax choices lead to better financial outcomes. Plus, having a solid tax strategy developed by a small business tax planner means staying compliant with changing tax laws, which helps reduce the risk of audits and penalties that can hit smaller businesses hard.

By focusing on tax strategies, small enterprises can tackle complexities with confidence, paving the way for sustainable growth. So, why not take a closer look at your tax planning? It could be the key to unlocking your business's potential!

The Evolution of Small Business Tax Planning

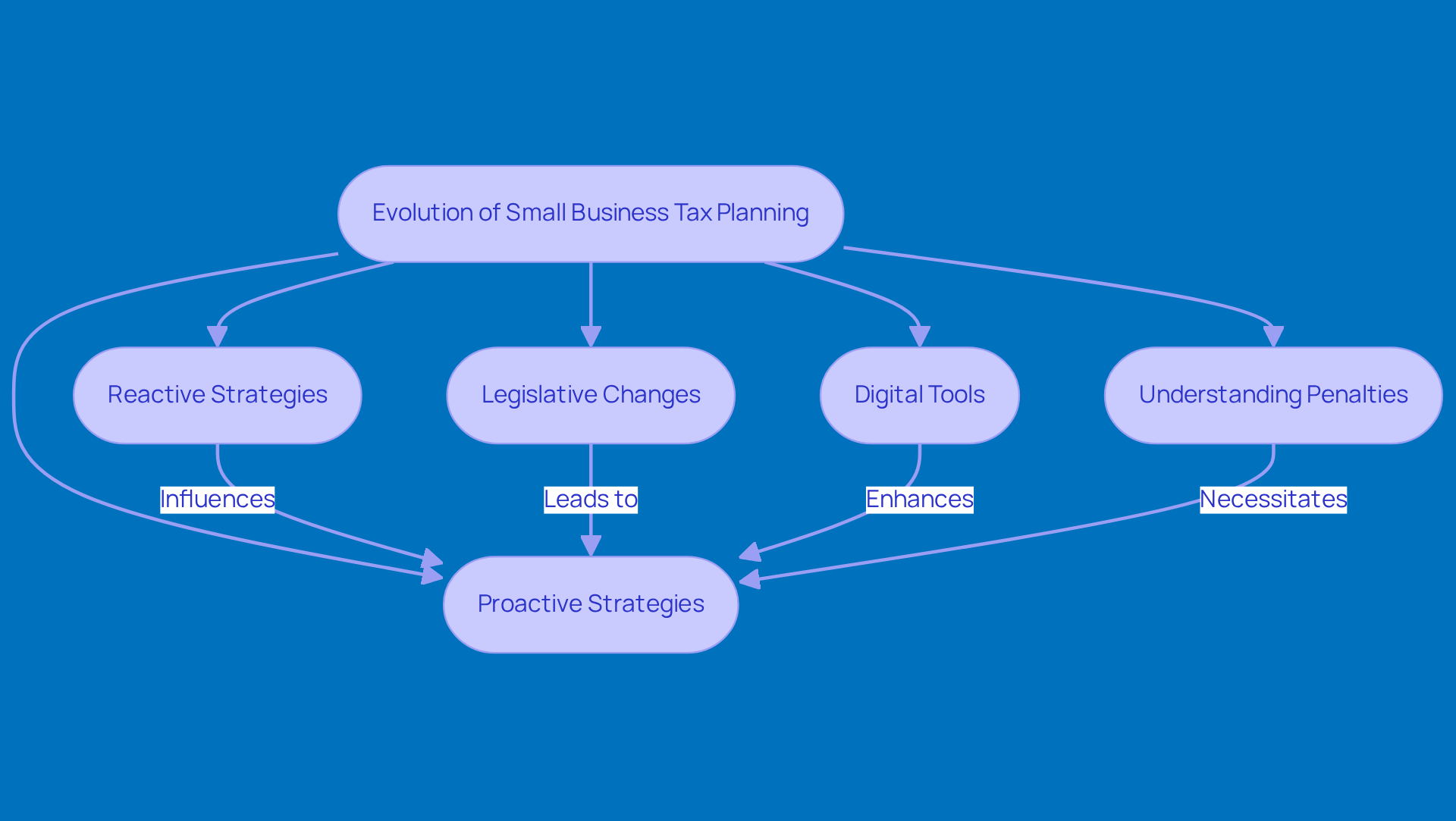

The landscape of tax strategies for small business tax planners has really shifted lately, thanks to changing tax laws and the growing complexities of the tax code. In the past, tax strategy was more of a reactive process, with business owners tackling tax issues mainly during tax season. But now, with the complexity of modern tax laws, there’s a real need to adopt proactive strategies that a small business tax planner can provide. Take the 20% Qualified Income deduction, for instance. It’s pushed many business owners to get more strategic about their tax management, allowing them to keep more cash for reinvestment and growth.

And let’s not forget about recent legislative changes, like the increase in the Section 179 expensing limit to a whopping $2.5 million. This has opened up some fantastic opportunities for businesses to improve their tax situations. These changes not only make decision-making easier but also create new paths for tax optimization that weren’t available before.

With the rise of digital tools and resources, entrepreneurs are now empowered to engage in year-round tax planning. By leveraging technology, they can make informed decisions that boost their financial outcomes, ensuring they’re ready for any shifts in tax legislation. This evolution really highlights the crucial role of a dedicated small business tax planner, who can help navigate these complexities and offer tailored guidance, ultimately setting small businesses up for long-term success.

Now, let’s talk about underpayment penalties, which are super important for small businesses. The IRS can hit you with penalties if you don’t pay enough tax throughout the year. Understanding safe harbor provisions and the de minimis exception can help you dodge those costly fees. Plus, knowing the IRS audit process and your rights can ease the stress and keep you compliant. And with the recent drop in COVID-19 tax benefits, it’s clear that proactive strategies are key to minimizing potential impacts on tax refunds.

Key Responsibilities and Skills of Small Business Tax Planners

Small business tax planners play a vital role in managing taxes effectively. They dive into financial analyses, keep up with changing tax laws, and create personalized tax strategies that fit each business's unique needs. To do this well, tax planners need strong analytical skills, a keen eye for detail, and the ability to explain complex tax concepts in a way that makes sense to clients. Plus, being proficient in tax software is a must for smooth tax preparation and planning.

Successful tax planners don’t just sit back; they take a proactive approach. They regularly review their clients' financial situations to spot new opportunities for tax savings and ways to enhance compliance. This forward-thinking mindset helps businesses navigate the tricky world of tax regulations and reach their financial goals. With the average small business tax planner managing a variety of clients, the demand for skilled professionals in this sector is increasing. It’s a reminder of how important it is to keep learning and adapting to the ever-changing tax landscape.

Conclusion

So, here’s the deal: having a small business tax planner by your side is like having a trusty co-pilot on your entrepreneurial journey. They help you navigate the often tricky waters of tax obligations and tailor strategies that fit your unique financial situation. By focusing on proactive tax planning, these pros can help you lighten your tax load while keeping you compliant with those ever-changing laws. This isn’t just about avoiding penalties; it’s about boosting your overall financial health and growth.

Throughout this article, we’ve highlighted just how important it is to engage a small business tax planner. They’re the ones who can spot deductions, credits, and opportunities that might just save you a chunk of change on your tax bill. Plus, with all the changes in legislation and technology, it’s clear that small businesses need to be proactive rather than reactive when it comes to tax planning. And let’s not forget the skills these tax planners bring to the table - analytical prowess and a solid grasp of tax laws that make them invaluable in today’s financial landscape.

In wrapping things up, it’s time for small business owners to take a fresh look at their tax planning strategies. Have you thought about how a dedicated tax planner could impact your financial success? Embracing proactive tax management not only shields you from penalties and audits but also opens doors to growth and profitability. Investing in expert tax planning isn’t just a smart financial move; it’s a strategic step toward a more secure and prosperous future for your business.

Frequently Asked Questions

What is the role of a small business tax planner?

A small business tax planner is a financial advisor dedicated to creating tax strategies for small business owners. They analyze a company's finances, identify potential tax obligations, and develop plans to minimize those obligations while ensuring compliance with tax laws.

How do small business tax planners help business owners?

They assist business owners in navigating the tax landscape, making informed decisions that align with their financial goals, and emphasizing proactive tax planning to optimize tax situations and improve overall financial health.

What are underpayment penalties, and why are they important for business owners?

Underpayment penalties are charges imposed by the IRS when taxpayers do not pay enough of their tax bill through withholding or estimated tax payments during the year. Understanding these penalties is crucial for business owners to avoid unexpected costs.

How can a small business tax planner help avoid underpayment penalties?

A small business tax planner can help ensure that business owners meet safe harbor criteria, which protects them from penalties by prepaying a minimum amount of their tax obligation. This may involve adjusting withholdings or making timely estimated tax payments.

What benefits do small businesses gain from working with a tax planner?

By utilizing expert tax preparation and strategy services, small businesses can stay compliant with tax laws, avoid unexpected financial surprises, lighten their tax burden, and ultimately pave the way for growth and financial stability.