Overview

Let's chat about the role of a Tax Director, shall we? This position is all about defining the key responsibilities and essential skills that make these professionals crucial to business operations. Tax Directors play a vital part in ensuring compliance with tax laws while also optimizing tax strategies.

Why does this matter? Well, it not only protects the company from pesky penalties but also boosts its financial health and supports strategic growth.

Think about it: a Tax Director isn’t just crunching numbers; they’re helping shape the financial future of the company. They’re the ones who navigate the complex world of tax regulations, making sure everything is above board. And let’s be honest, who wouldn’t want someone like that on their team?

In essence, the impact of a Tax Director extends far beyond just compliance. They’re instrumental in crafting strategies that foster growth and sustainability.

So, if you’re considering this career path or just curious about what they do, remember that these professionals are key players in the business landscape!

Introduction

Welcome to the intricate world of corporate finance, where one key player stands out: the Tax Director. This senior leader doesn’t just ensure compliance with the ever-evolving tax laws; they also craft strategies that can significantly boost a company's financial performance. As businesses navigate the complexities of tax obligations, the role of a Tax Director becomes more crucial than ever, acting as a bridge between regulatory adherence and strategic financial planning.

But here’s a thought: with the landscape constantly shifting, how can organizations tap into the expertise of a Tax Director? It’s not just about avoiding pitfalls; it’s about seizing opportunities for growth! Let's dive into how this role can transform challenges into stepping stones for success.

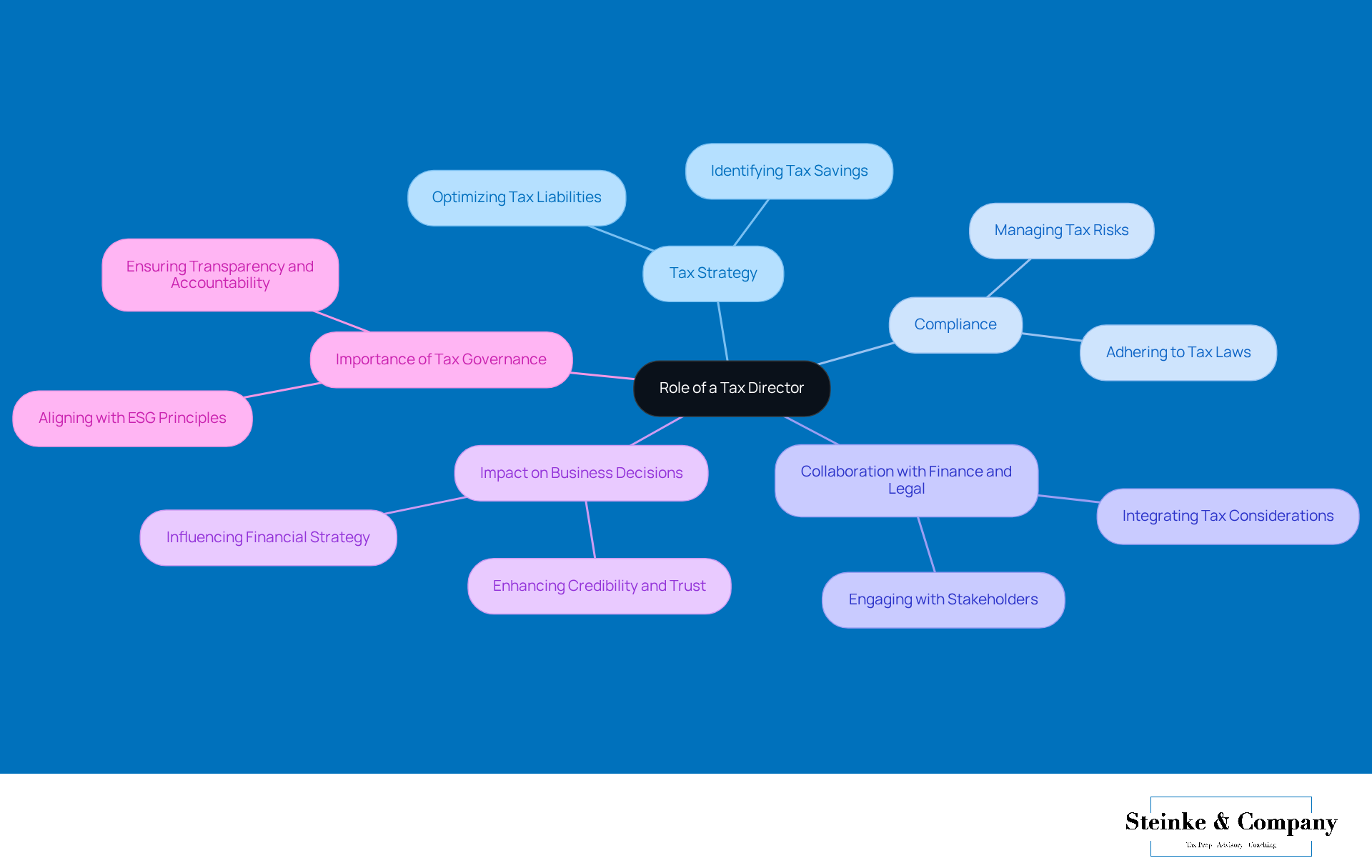

Define the Role of a Tax Director

So, what exactly does a Tax Executive do? Well, think of them as the senior leader who’s in charge of a company’s tax strategy and compliance. This role is super important because it ensures that the company plays by the tax laws while also finding ways to optimize those tax liabilities. By shaping the financial strategy, the Tax Manager offers insights that can really sway business decisions.

They work hand-in-hand with teams like finance and legal to make sure tax considerations fit neatly into the overall business strategy. Essentially, the tax director serves as that vital link between the financial goals of the company and its compliance responsibilities. This way, the business can thrive within legal frameworks while maximizing its financial efficiency.

And let’s not forget about the numbers! The IRS is processing over 266.6 million tax returns in FY 2024 and raking in more than $5.1 trillion in gross taxes. This really highlights how crucial effective tax governance is. Tax Directors play a crucial role not only in keeping the organization safe from penalties but also in boosting its credibility and trustworthiness in a competitive market. Pretty important, right?

Outline Key Responsibilities of a Tax Director

The key responsibilities of a Tax Director cover several important areas:

-

A Tax Director ensures that the organization adheres to all federal, state, and local tax regulations for tax compliance. This includes preparing and submitting tax returns, managing audits, and responding to inquiries from tax authorities. It's crucial for maintaining the entity's reputation and avoiding penalties.

-

The tax director plays a crucial role in developing strategies that minimize tax liabilities. This means looking at the tax consequences of business decisions and transactions, which helps the entity improve its financial performance while staying compliant with tax rules.

-

In their advisory role, tax directors also provide strategic advice to senior management on a range of tax-related issues, such as mergers and acquisitions, international tax matters, and changes in legislation. Their insights are key for making informed decisions that align with the organization’s financial goals.

-

Team Leadership: Leading and mentoring the tax department staff is essential. It ensures that the team is well-trained and up-to-date on current tax laws and practices. Good leadership promotes a culture of continuous learning and adaptation within the tax function.

-

Collaboration: The tax director works closely with other departments, like finance and legal, to weave tax considerations into broader business strategies and operations. This teamwork ensures that tax implications are factored into all aspects of the business, making everything run more smoothly.

Now, let’s chat about compensation. The average salary of Tax Directors in the U.S. reflects their expertise and the crucial nature of their role, often exceeding six figures depending on the company and location. Successful Tax Directors not only implement compliance strategies that meet regulatory requirements but also take advantage of tax incentives and credits, ultimately boosting the entity's bottom line.

So, what do you think? The role of a tax director is both challenging and rewarding, don’t you agree?

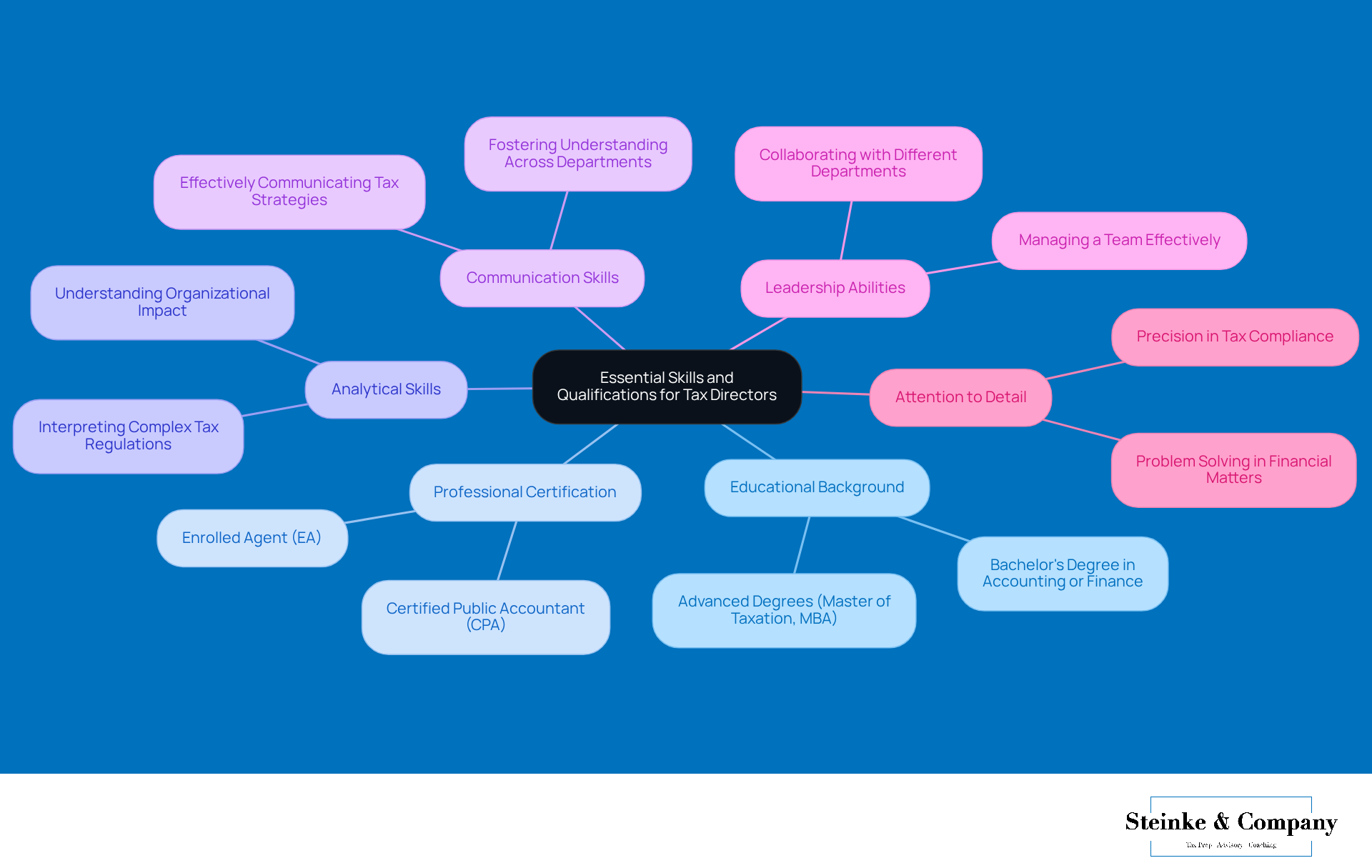

Identify Essential Skills and Qualifications for Tax Directors

When it comes to the role of a Tax Director, there are some essential skills and qualifications that really make a difference. Let’s break it down:

-

Educational Background: Most Tax Directors start with a bachelor's degree in accounting, finance, or something similar. Many take it a step further, earning advanced degrees like a Master of Taxation or an MBA to sharpen their expertise.

-

Professional Certification: Credentials such as Certified Public Accountant (CPA) or Enrolled Agent (EA) are not just nice to have; they’re often crucial for building credibility in this role. Did you know that a significant number of tax directors possess these certifications? It really shows how important they are!

-

Analytical Skills: Strong analytical skills are a must. You need to be able to interpret complex tax regulations and understand their impact on the organization. As Warren Buffett wisely said, "In the world of business, the rearview mirror is always clearer than the windshield." This really highlights the need for clarity in financial matters.

-

Communication Skills: It’s vital to communicate tax strategies and compliance issues effectively, especially to those who aren’t tax pros. This helps foster understanding and collaboration across the board.

-

Leadership Abilities: A successful Tax Manager should have solid leadership skills to manage a team effectively and collaborate with different departments. ADEC Innovations' case study shows how good leadership can drive operational growth and boost team performance.

-

Attention to Detail: Precision is key in tax compliance, making attention to detail absolutely critical. Accountants often play the role of problem solvers, providing clarity in financial matters—something that can’t be overlooked!

These qualifications not only enhance the effectiveness of a tax director but also significantly contribute to the overall financial health and compliance of the organization. And just for a chuckle, remember: "An accountant is someone who solves a problem you didn’t know you had in a way you don’t understand." This really captures the unique role they play in navigating the complexities of finance!

Explain the Impact of a Tax Director on Business Operations

The role of a Tax Chief really makes a difference in how a business operates, thanks to a mix of ensuring compliance and smart financial planning. By sticking to tax laws, a Tax Manager helps avoid nasty penalties and audits that can throw a wrench in the works and lead to extra costs. Plus, with some strategic tax planning, they can find significant savings that boost resource allocation and overall profits.

For instance, by spotting relevant tax credits and deductions, a Tax Manager can give cash flow a nice little boost, making it easier to reinvest in growth opportunities. Their know-how is also super important during mergers and acquisitions. Addressing tax implications early on can make transactions smoother and help dodge potential liabilities.

Ultimately, a Tax Director not only safeguards the business from compliance headaches but also enhances its financial health and supports strategic growth goals. So, how does your business handle its tax strategy? It might be time to take a closer look!

Challenges Faced by Tax Directors

Tax directors encounter numerous challenges that can significantly affect their effectiveness and the overall health of their organizations. Let's break down some of these key issues:

-

Evolving Tax Regulations: The world of tax laws is always changing, which means Tax Directors must continuously learn and adapt to remain compliant and strategically nimble. This is especially important since many provisions from the Tax Cuts and Jobs Act are set to expire at the end of 2025, which could mean higher tax burdens for businesses. Recent surveys even show that 70% of respondents see increased tax authority funding and scrutiny as a major challenge—talk about urgency!

-

Resource Constraints: Often, companies don’t allocate enough resources to their tax departments, which can really limit their ability to implement effective tax strategies. Without proper investment, managing compliance and optimizing tax positions can become a real struggle.

-

Cross-Departmental Collaboration: Bringing tax considerations into broader business decisions requires smooth communication and teamwork across departments. But let’s be honest, that’s not always easy—especially in larger organizations where silos can pop up.

-

Risk Management: Tax Directors navigate a fine line between compliance and aggressive tax planning. If strategies get too aggressive, they might attract unwanted attention from tax authorities, creating a bit of tension between managing risks and achieving strategic goals.

-

Technology Integration: Embracing new technologies for tax compliance and reporting comes with its own set of challenges. Not only do these technologies require a financial investment, but they also call for training and adjustments for the tax team. And in resource-tight environments, that can feel like a huge hurdle.

As the tax landscape keeps evolving—thanks to digitalization and G20/OECD initiatives—tax directors must tackle these challenges head-on to keep their organizations compliant and competitive. Building strong relationships with tax authorities is also key; it helps create a collaborative environment that can lighten the compliance load. So, how are you navigating these challenges in your own organization?

Conclusion

The role of a Tax Director is absolutely vital to keeping a business financially healthy and compliant. By overseeing tax strategy and making sure everything aligns with regulations, they act as a key link between a company’s financial ambitions and its legal duties. This position not only protects the organization from penalties but also boosts its credibility, which ultimately helps build a stronger business model.

In this article, we’ve highlighted some key responsibilities of a Tax Director:

- Ensuring compliance with tax laws

- Crafting strategies to minimize tax liabilities

- Offering strategic advice to senior management

The essential skills for this role—think analytical prowess, leadership, and a keen eye for detail—really underscore the complexity and importance of solid tax governance. Plus, the challenges Tax Directors face, from changing regulations to limited resources, show just how crucial it is to adapt and collaborate within organizations.

So, let’s wrap this up! The importance of a Tax Director is huge. As businesses navigate the tricky waters of tax compliance and strategy, having a Tax Director on board is simply indispensable. Companies should definitely prioritize bringing a skilled Tax Director into their operations—not just to reduce risks but also to seize opportunities for financial optimization. Embracing this role can lead to better decision-making and long-term success in today’s competitive market. What are your thoughts on integrating a Tax Director into your business strategy?

Frequently Asked Questions

What is the primary role of a Tax Director?

The primary role of a Tax Director is to oversee a company's tax strategy and compliance, ensuring adherence to tax laws while optimizing tax liabilities. They serve as a crucial link between the company's financial goals and compliance responsibilities.

What are the key responsibilities of a Tax Director?

Key responsibilities of a Tax Director include ensuring tax compliance with federal, state, and local regulations, preparing and submitting tax returns, managing audits, developing strategies to minimize tax liabilities, providing strategic advice on tax-related issues, leading the tax department staff, and collaborating with other departments like finance and legal.

How does a Tax Director contribute to a company's financial performance?

A Tax Director contributes to a company's financial performance by developing strategies that minimize tax liabilities, providing insights on the tax implications of business decisions, and advising senior management on tax-related issues, which helps align decisions with the organization's financial goals.

Why is effective tax governance important for a company?

Effective tax governance is important because it helps maintain the organization's reputation, avoids penalties, boosts credibility, and enhances trustworthiness in a competitive market.

What is the average salary of a Tax Director in the U.S.?

The average salary of Tax Directors in the U.S. often exceeds six figures, reflecting their expertise and the critical nature of their role within the company.

What kind of collaboration does a Tax Director engage in?

A Tax Director collaborates closely with departments such as finance and legal to integrate tax considerations into broader business strategies and operations, ensuring that tax implications are factored into all aspects of the business.