Introduction

Navigating tax obligations can feel like a maze, right? Especially if you’re self-employed or running a small business. Estimated tax payments are super important for staying on the IRS's good side and avoiding those nasty surprises come tax season. But here’s the kicker: a lot of folks don’t really know what’s required or how to manage these payments without a hitch. So, how do you make sure you’re chipping in the right amounts at the right times to dodge penalties and keep your finances in check?

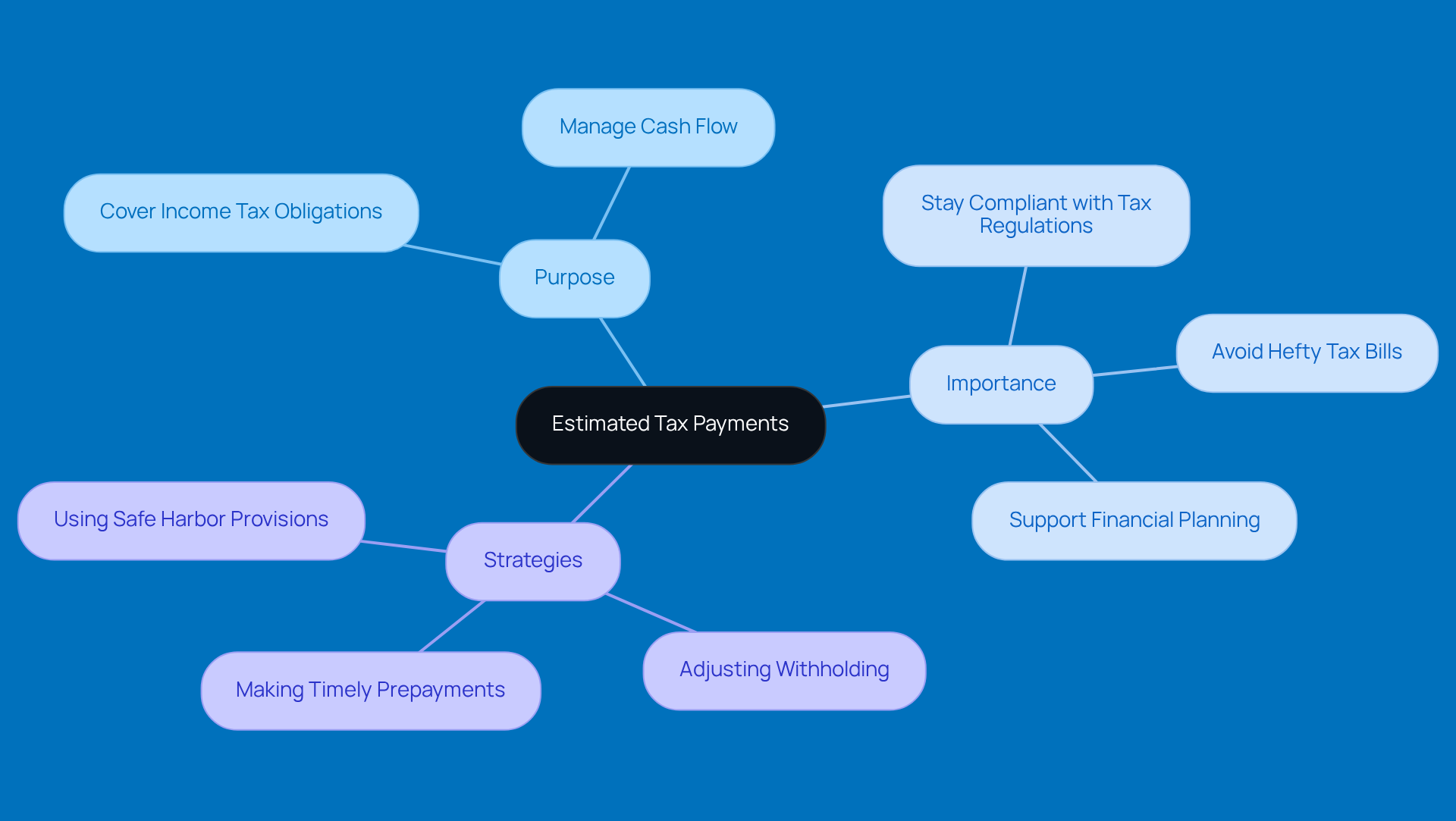

Define Estimated Tax Payments: Purpose and Importance

What is an estimated tax payment? It refers to the periodic sums sent to the IRS to cover your income tax obligations when there’s no withholding involved. This is especially important for self-employed folks, freelancers, and small business owners who don’t have taxes automatically deducted from their paychecks. The main goal here? To help you stay on top of your tax responsibilities throughout the year, so you don’t end up with a hefty tax bill when tax season rolls around.

By making these projected contributions, you can manage your cash flow better and reduce the risk of facing big penalties for underpayment. Understanding what an estimated tax payment is really important, as it helps you stay compliant with tax regulations and supports your overall financial planning. To dodge those pesky underpayment penalties, think about strategies like:

- Adjusting your withholding

- Making timely prepayments

- Using safe harbor provisions

to ensure you’re meeting your tax obligations all year long.

And hey, with the recent changes to the 1099-K reporting requirements-where the threshold for reporting has dropped to just $600-small business owners and gig economy participants need to be extra careful. Keeping a close eye on your income and expenses can help you avoid any unexpected tax liabilities. So, how are you tracking your finances these days?

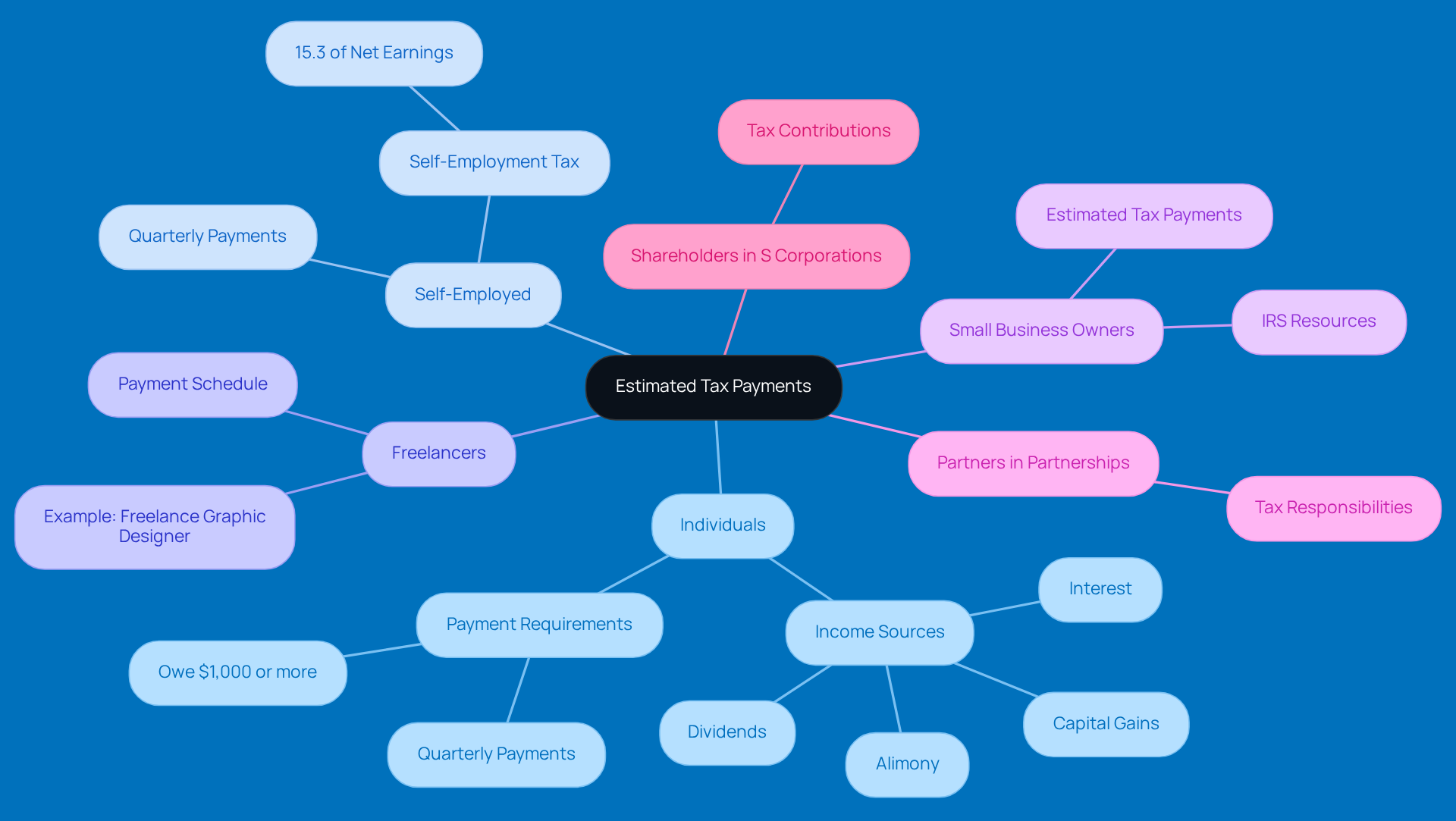

Identify Who Needs to Make Estimated Tax Payments

If you’re an individual or a business expecting to owe $1,000 or more when you file your yearly tax return, it's important to know what an estimated tax payment is and make some pre-paid tax contributions. This isn’t just for big corporations; self-employed folks, freelancers, and small business owners who don’t have enough tax withheld from their income are in the same boat. And let’s not forget about partners in partnerships and shareholders in S corporations - they also need to chip in based on their share of the income.

For instance, if you’re a freelance graphic designer earning income without any tax withholding, you’ll want to understand what an estimated tax payment is and send in your contributions every three months. It’s all about staying on top of your tax responsibilities! Understanding these requirements is key to avoiding penalties and keeping things smooth with the IRS.

Believe it or not, a good number of small business owners are already making these projected tax contributions. It really highlights how important this practice is for effective financial management. So, if you haven’t started yet, now’s the time to get on board!

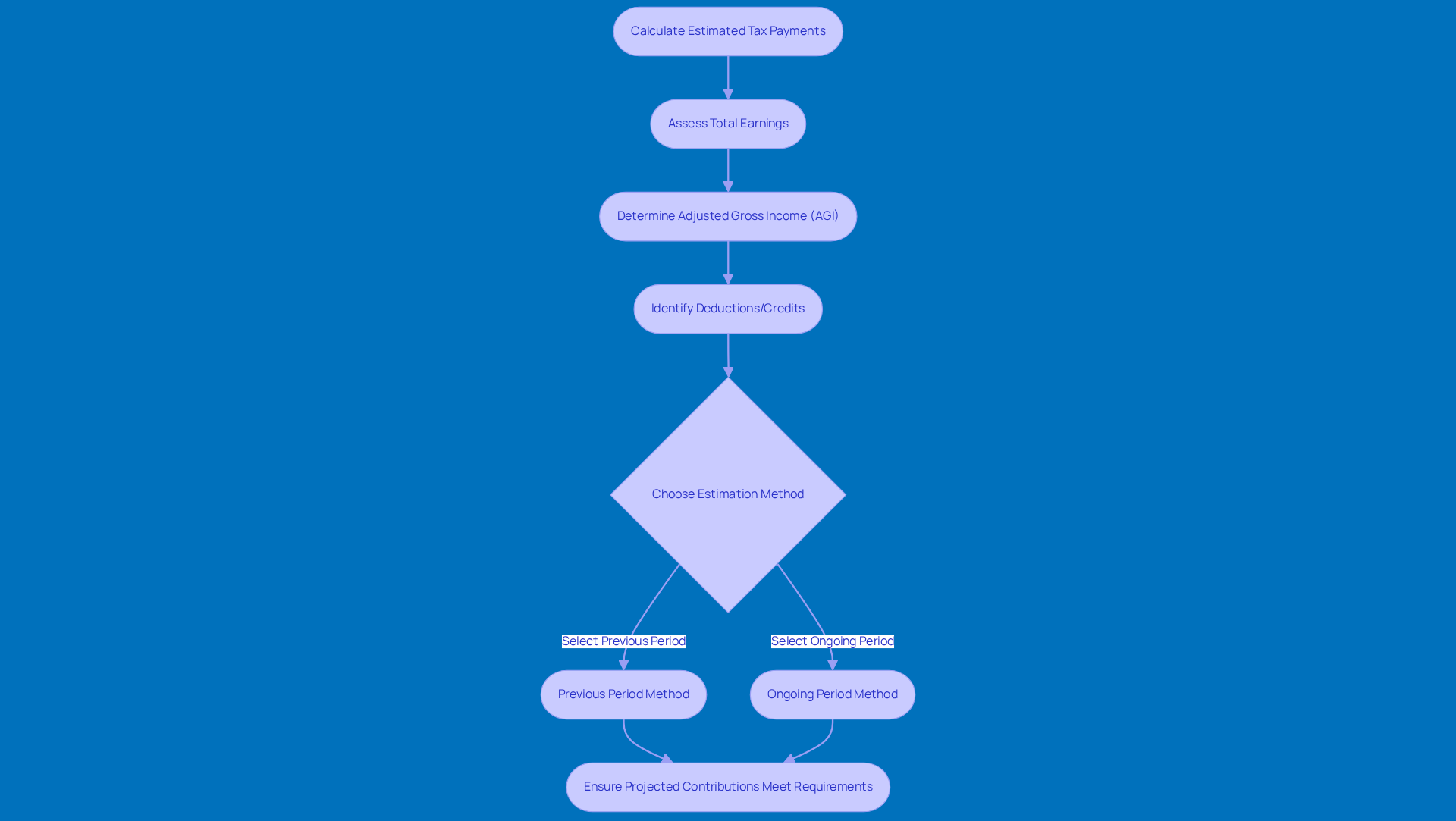

Explain How to Calculate Estimated Tax Payments

When it comes to figuring out your projected tax contributions, the first step is to take a good look at your total earnings for the period. This includes your wages, any self-employment income, and those little extra sources of cash that might come your way. After that, you’ll want to nail down your expected adjusted gross income (AGI), taxable income, and any deductions or credits you can claim. Don’t forget about the IRS Form 1040-ES! It’s a handy tool that comes with a worksheet designed to help you calculate your projected tax liability.

Now, taxpayers usually have two ways to figure out their projected contributions:

- The previous period method lets you base your projections on what you owed last year.

- The ongoing period method requires you to forecast your income and tax obligations for the current year.

Which one sounds easier to you?

To avoid any nasty fines, make sure your total projected contributions meet at least 90% of your current tax obligation or 100% of what is an estimated tax payment you owed last year. For example, if your tax obligation from last year was $5,000, aim to pay at least that much in projected taxes this time around to steer clear of underpayment penalties. Plus, if you think you’ll owe $1,000 or more when you file your return, it’s important to know what is an estimated tax payment and to make those contributions to stay on track and plan your finances.

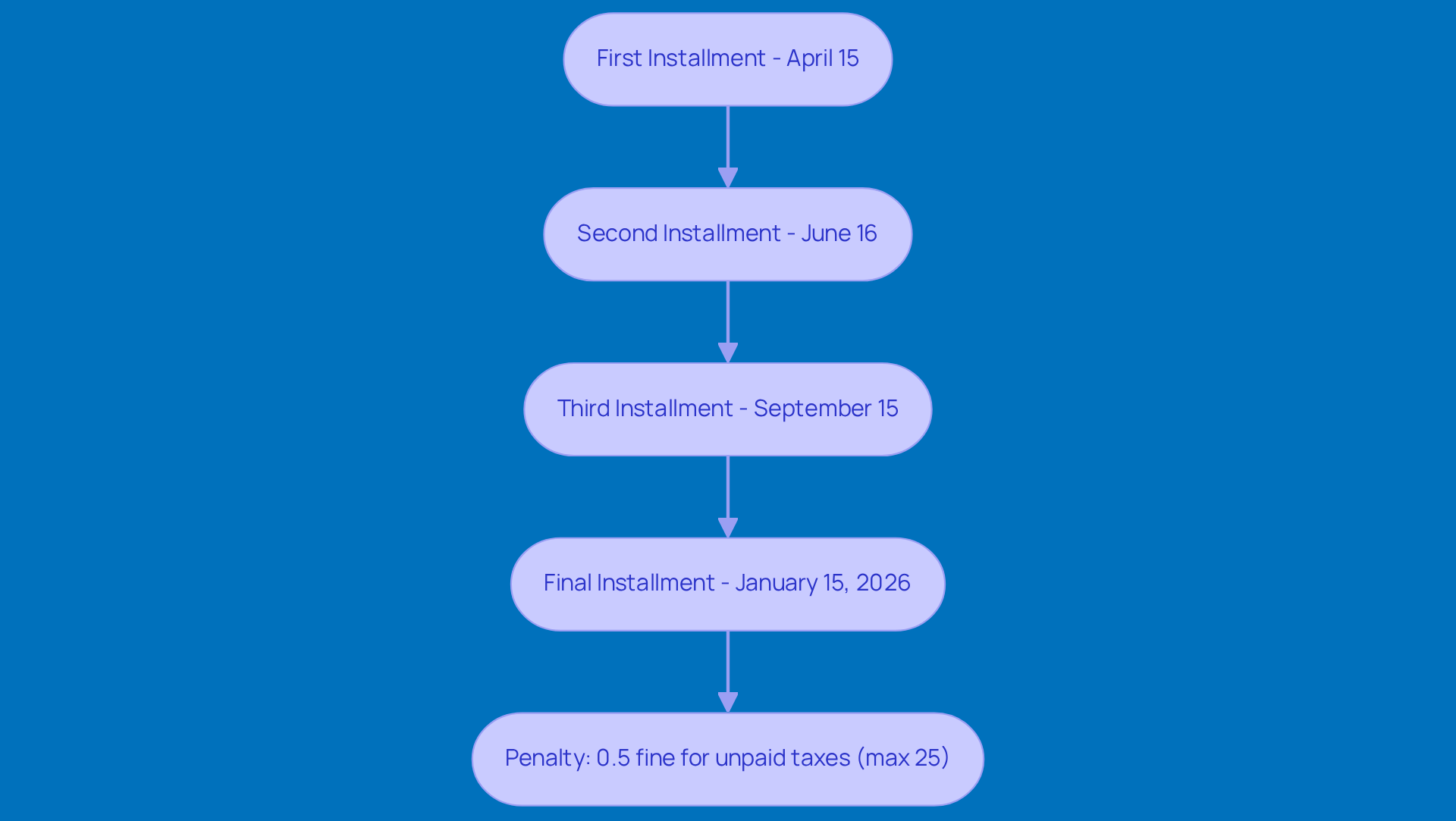

Outline When Estimated Tax Payments Are Due

Hey there! If you're a taxpayer, you probably know what an estimated tax payment is, as these contributions are usually due quarterly. For the 2025 tax year, mark your calendars:

- The first installment is due on April 15

- The second on June 16

- The third on September 15

- The last one on January 15, 2026

Missing these dates can lead to some pretty hefty late fees, so it’s a good idea to keep an eye on them. Did you know the IRS charges a fine of 0.5% of any unpaid tax for each month it’s overdue? That can add up to a maximum of 25%! And if a due date falls on a weekend or holiday, don’t worry - the deadline shifts to the next business day. By sticking to these deadlines, you can meet your obligations related to what an estimated tax payment is and dodge those unnecessary financial headaches.

Small business owners, especially those in rural areas, often juggle these schedules by using accounting software or getting advice from tax pros. It’s all about making sure your payments are accurate and compliant. Have you thought about how you manage your tax deadlines? It might be worth considering a little help to keep everything on track!

Conclusion

Understanding estimated tax payments is super important for anyone who might owe taxes, especially if you’re self-employed or running a small business. These periodic payments help you dodge a hefty tax bill at the end of the year and keep you in line with tax regulations. By making these contributions, you can manage your cash flow better and steer clear of penalties for underpayment.

Throughout this article, we’ve shared some key insights about why estimated tax payments matter, who needs to make them, how to figure out what you owe, and why it’s crucial to stick to those payment deadlines. And let’s not forget the new reporting requirements, like the lowered threshold for 1099-K forms, which really highlight the need to keep a close eye on your income and expenses to avoid any surprise tax bills.

So, with all this in mind, it’s clear that being proactive about estimated tax payments isn’t just about following the rules; it’s a vital part of good financial management. By getting a handle on the process and using smart strategies, you can protect yourself from penalties and make tax season a whole lot smoother. It’s time to take charge of your tax responsibilities and make informed choices that lead to a more secure financial future. What steps will you take today to stay ahead of your tax game?

Frequently Asked Questions

What is an estimated tax payment?

An estimated tax payment refers to periodic sums sent to the IRS to cover income tax obligations when there’s no withholding involved, particularly for self-employed individuals, freelancers, and small business owners.

Why are estimated tax payments important?

Estimated tax payments help individuals stay on top of their tax responsibilities throughout the year, preventing a hefty tax bill when tax season arrives. They also aid in better cash flow management and reduce the risk of facing penalties for underpayment.

Who needs to make estimated tax payments?

Self-employed individuals, freelancers, and small business owners who do not have taxes automatically deducted from their paychecks are typically required to make estimated tax payments.

What are some strategies to avoid underpayment penalties?

Strategies to avoid underpayment penalties include adjusting your withholding, making timely prepayments, and using safe harbor provisions to ensure you meet your tax obligations throughout the year.

What recent changes should small business owners be aware of regarding tax reporting?

Small business owners and gig economy participants should be aware that the threshold for 1099-K reporting has dropped to just $600, making it essential to closely monitor income and expenses to avoid unexpected tax liabilities.