Introduction

Understanding the ins and outs of financial transactions often comes down to one key idea: due diligence. Think of it as your safety net, helping investors and businesses take a closer look at potential investments, weigh risks, and make sure everything's above board with regulations. As the finance world keeps changing, due diligence is getting more complex, too. It’s not just about ticking boxes anymore; it’s about diving deeper.

So, how do you navigate this maze of information to make smart choices and steer clear of costly mistakes? It’s a challenge, but with the right approach, you can tackle it head-on. Let’s explore how to make due diligence work for you!

Define Due Diligence in Finance

When we discuss what is due diligence in finance, we’re diving into the nitty-gritty of investigating and verifying information about a potential investment or business deal. This process is super important for figuring out the economic health, risks, and overall viability of a target company or asset. Typically, it involves looking at financial statements, tax records, legal agreements, and operational data to make sure all the facts are spot on and easy to understand.

For small businesses handling financial information, it’s crucial to get a grip on regulations like the Gramm-Leach-Bliley Act (GLBA). This act applies to any institution that’s heavily involved in providing financial products or services - think lending, brokering, advising, or insurance. So, if your business collects or processes customer financial data, you’ll want to check if the GLBA is relevant to you.

Understanding what is due diligence in finance is essential, as the goal of thorough investigation is to cut down on uncertainties and help you make informed choices, protecting the interests of investors and everyone involved in the transaction. For example, doing your tax due diligence might mean checking tax returns and ensuring compliance with tax regulations, which ties directly into GLBA requirements.

In the end, what is due diligence in finance acts like a safety net against potential pitfalls in financial transactions through thorough investigation. It empowers stakeholders to make decisions based on a clear understanding of the risks and opportunities at play. So, next time you’re faced with a financial decision, remember that a little due diligence can go a long way!

Explore the Historical Context of Due Diligence

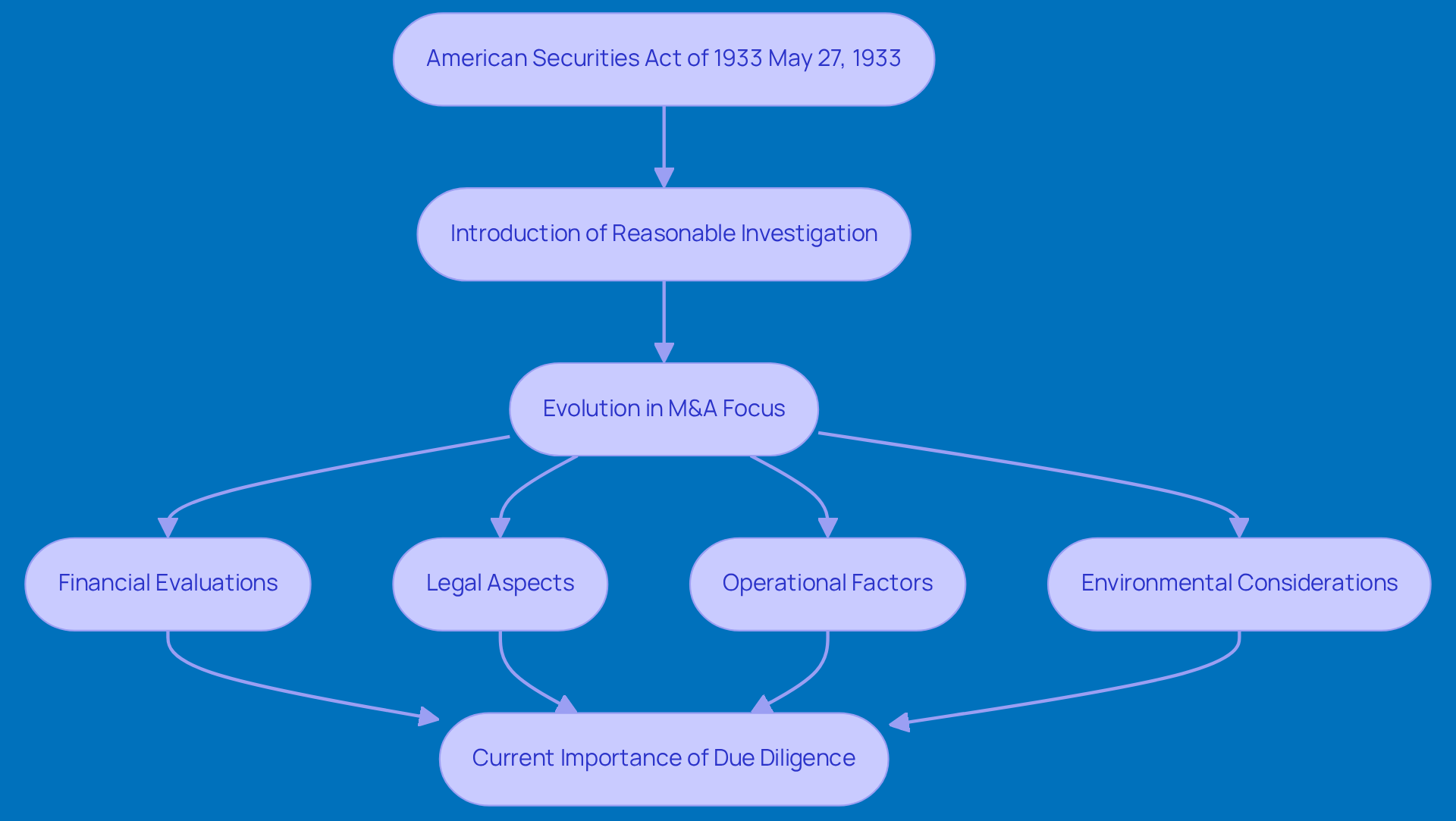

The concept of due care traces back to the American Securities Act of 1933, which was signed into law on May 27, 1933. This act introduced the idea of 'reasonable investigation' to help protect investors from fraud. It made it clear that underwriters are responsible for any misrepresentations in the documents they provide. This highlights just how important it is to understand what is due diligence in finance for conducting a thorough examination in financial transactions.

Over the years, the notion of due care has evolved quite a bit, especially in the realm of mergers and acquisitions (M&A). Initially, the focus was mainly on financial evaluations, but now it covers a wider range of factors, including legal, operational, and environmental aspects. This shift reflects the increasing complexity of financial transactions and the need for a comprehensive evaluation to safeguard investments.

Today, it is essential to understand what is due diligence in finance for any significant financial decision. It ensures that all potential challenges are identified and addressed before moving forward. So, think of due care not just as a box to check off; it’s a strategic necessity for businesses. Plus, with ongoing risk monitoring and proactive governance being crucial in today’s environment, the SEC is actively reviewing filed documents to ensure compliance and protect investors.

Have you ever considered what is due diligence in finance and how much of it is involved in major financial decisions? It’s a lot, but it’s all about making sure everything is in order before taking that leap!

Identify Key Characteristics and Components of Due Diligence

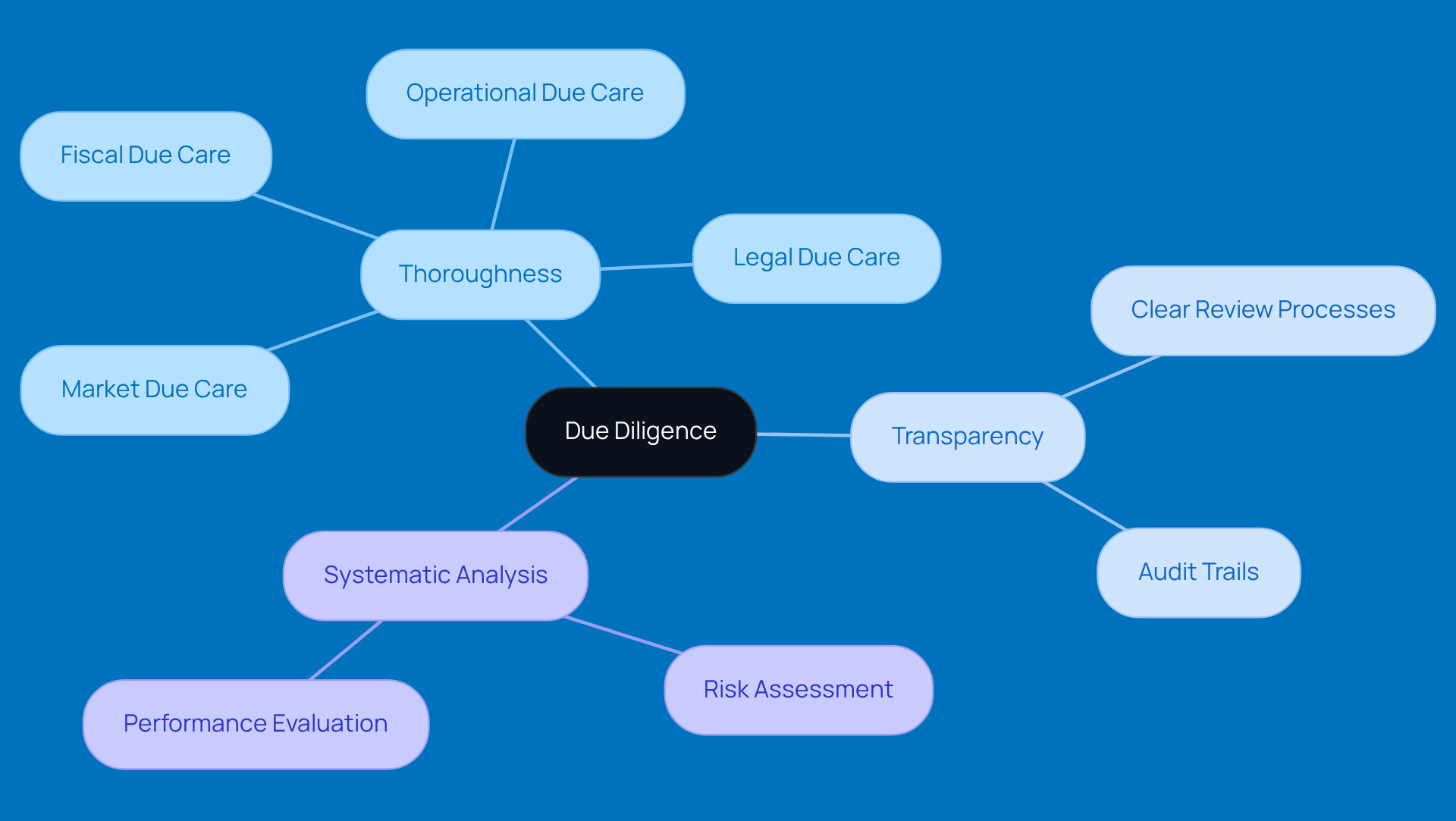

When we talk about due process, a few key characteristics really stand out: thoroughness, transparency, and systematic analysis. So, what does that actually look like? Well, it usually involves several important elements:

- Fiscal due care: This means taking a good look at financial statements and tax returns.

- Legal due care: Here, we’re examining contracts and making sure everything complies with regulations.

- Operational due care: This is all about assessing how efficiently a business runs.

- Market due care: Finally, we evaluate the competitive landscape and market conditions.

Each of these components is crucial for piecing together a complete picture of the target entity. By understanding these aspects, stakeholders can make informed decisions based on a well-rounded view of potential risks and opportunities. So, next time you’re diving into due process, remember these elements-they’re your roadmap to clarity!

Provide Real-World Examples of Due Diligence in Finance

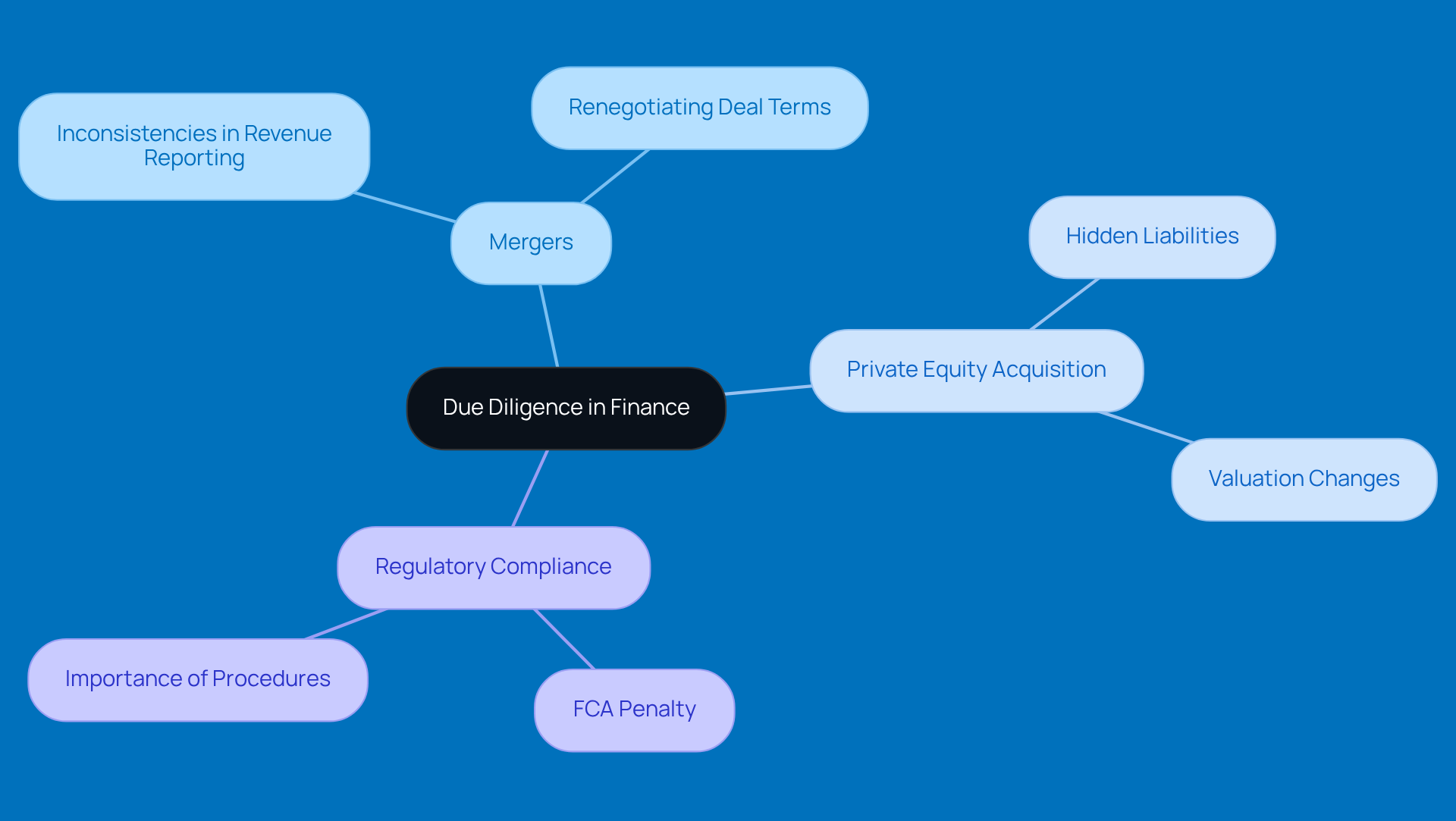

You know, real-world examples of thoroughness really show how crucial it is in financial dealings. Take mergers, for instance. When companies come together, thorough financial investigations can reveal inconsistencies in revenue reporting. This can lead to renegotiating deal terms or even pulling out of the transaction altogether.

One notable case involved a private equity firm that was doing its homework on a potential acquisition. They uncovered hidden liabilities like pending lawsuits and regulatory fines. These discoveries changed the valuation of the target company significantly, proving that thorough investigation is key to protecting investors. It ensures decisions are based on accurate and complete information.

And let’s not forget about the Financial Conduct Authority's hefty £44 million penalty on Nationwide for failing to exercise due care. This really highlights the importance of having strict procedures in place to ensure compliance and avoid costly consequences. The FCA pointed out how slow the institution was to address critical issues, emphasizing the fallout from not being thorough enough.

Statistics show that a whopping 75% of mergers face delays and misunderstandings. This really drives home the point that understanding what is due diligence in finance isn’t just a box to check; it’s a vital part of safeguarding investments and paving the way for successful financial outcomes. So, next time you think about a merger or acquisition, remember: thoroughness isn’t just nice to have - it’s essential!

Conclusion

Understanding due diligence in finance isn’t just some academic exercise; it’s a crucial practice that protects your investments and helps you make informed decisions. When you dig deep into potential investments, you can reduce risks and boost your chances of financial success. Think of it as your safety net, allowing you to tackle the complexities of financial transactions with a bit more confidence.

So, what’s the deal with due diligence? It’s a multi-layered process that covers financial, legal, operational, and market aspects. Over the years, its importance has really grown, especially in mergers and acquisitions. A thorough evaluation can save you from some pretty costly mistakes. Just look at the scrutiny companies face during high-stakes negotiations - those diligent practices can make all the difference in achieving financial success.

At the end of the day, due diligence is about more than just ticking boxes; it’s about creating a culture of transparency and accountability in financial dealings. It’s a good idea for stakeholders to see due diligence as an ongoing commitment, not just a box to check off. By prioritizing thorough investigations, you and your organization can lay a strong foundation for sustainable growth and smart decision-making in your financial journey.

Frequently Asked Questions

What is due diligence in finance?

Due diligence in finance refers to the process of investigating and verifying information about a potential investment or business deal to assess the economic health, risks, and overall viability of a target company or asset.

What does the due diligence process typically involve?

The due diligence process typically involves reviewing financial statements, tax records, legal agreements, and operational data to ensure that all information is accurate and comprehensible.

Why is due diligence important for small businesses?

Due diligence is important for small businesses because it helps them understand regulations, such as the Gramm-Leach-Bliley Act (GLBA), and ensures compliance when handling customer financial data, which is crucial for protecting both the business and its customers.

What is the Gramm-Leach-Bliley Act (GLBA)?

The Gramm-Leach-Bliley Act (GLBA) is a regulation that applies to institutions involved in providing financial products or services, such as lending, brokering, advising, or insurance, and it mandates the protection of customer financial information.

How does due diligence help in financial decision-making?

Due diligence helps in financial decision-making by reducing uncertainties and enabling stakeholders to make informed choices based on a clear understanding of the risks and opportunities involved in a transaction.

What is the role of tax due diligence?

Tax due diligence involves checking tax returns and ensuring compliance with tax regulations, which is important for adhering to GLBA requirements and protecting the interests of investors and other parties in a transaction.

How can due diligence act as a safety net in financial transactions?

Due diligence acts as a safety net by thoroughly investigating potential pitfalls in financial transactions, empowering stakeholders to make decisions based on a well-informed understanding of the associated risks and opportunities.