Overview

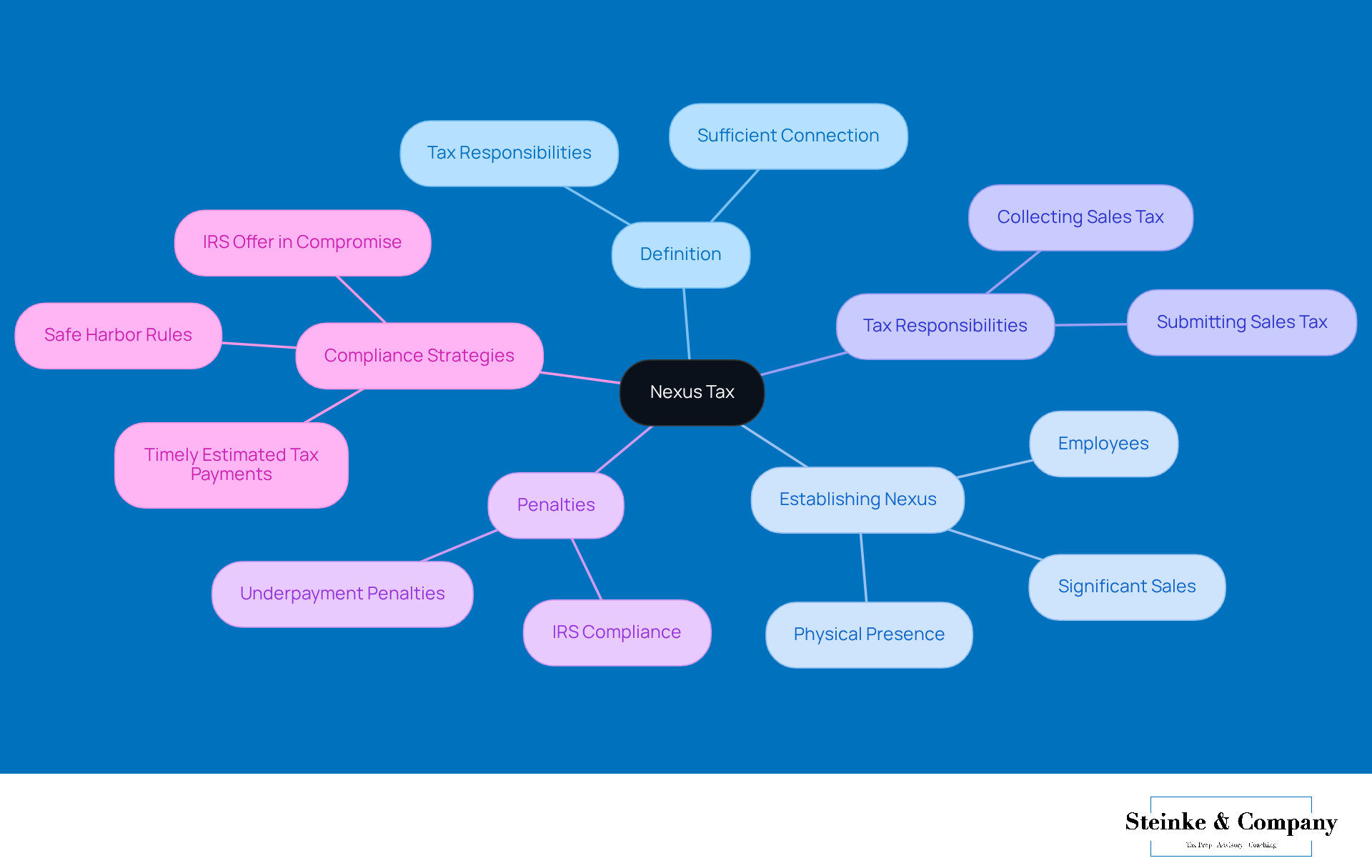

Nexus tax is all about the tax responsibilities that pop up when a business has a significant connection, or 'nexus,' with a certain area. This connection can come from having a physical presence, where employees are located, or even just making a lot of sales there.

It’s super important for small business owners to get a grip on nexus tax because not keeping up with these obligations can lead to some serious penalties. Plus, it can really mess with your financial planning, especially as you start to branch out into new areas.

So, have you thought about how nexus tax might affect your business as you grow?

Introduction

Hey there, small business owners! Let’s talk about something that can feel pretty overwhelming: nexus tax. Understanding the ins and outs of this tax is super important as you navigate the tricky world of tax compliance. As your business grows and starts reaching across state lines, the responsibilities that come with nexus can really shake up your financial planning and operational strategies.

But here’s the kicker: figuring out the different types of nexus—like physical or economic—can be a real challenge. Plus, the penalties for not getting it right can hit hard. So, how can you effectively manage these obligations? It’s all about safeguarding your growth and steering clear of those costly mistakes. Let’s dive in and explore how to tackle this together!

Define Nexus Tax: Understanding the Basics

What is nexus tax refers to the tax responsibilities that arise when a business has a sufficient connection, or 'nexus,' with a specific region or jurisdiction. This connection can be established in a few different ways, like having a physical presence, employees, or making significant sales in that area. Essentially, the nexus tax requires companies to collect and submit sales tax on transactions happening within that jurisdiction. For small business owners, especially those juggling operations in multiple states, understanding what is nexus tax is crucial, as it directly impacts their tax compliance obligations and financial planning.

Now, it’s also important for small business owners to keep an eye out for potential underpayment penalties from the IRS. These can sneak up if they don’t meet their tax obligations throughout the year. To steer clear of these penalties, making timely and accurate estimated tax payments is key, all while sticking to the safe harbor rules laid out by the IRS. This proactive approach not only helps in managing tax liabilities effectively but also acts as a safety net against unexpected financial burdens when tax season rolls around. Plus, small enterprises might want to consider the IRS Offer in Compromise as a way to tackle tax liabilities, especially with the recent cuts in COVID-19 tax benefits that could affect their tax refunds. Staying informed and tweaking tax strategies accordingly is essential for keeping compliance in check and optimizing financial outcomes.

Explain the Importance of Nexus Tax for Small Businesses

Understanding what is nexus tax is super important for small businesses because it defines their duty to collect sales tax in various areas. If they don’t follow connection tax laws, they could face some hefty penalties, like fines and interest on unpaid taxes, which can pile up quickly.

For instance, imagine a small online seller who ships products to customers in different regions—they really need to understand where they have a connection to make sure they’re on the right side of the law and avoid those pesky underpayment penalties from the IRS. These penalties can get pretty steep, especially with the current interest rate for underpayments sitting at 8% per year, compounded daily.

Plus, as more regions roll out economic connection regulations, small businesses have to keep an eye on their sales limits to dodge any surprise tax bills. Understanding what is nexus tax not only helps businesses stay compliant but also plays a crucial role in strategic planning and budgeting. Ultimately, it can protect them from unnecessary financial stress and penalties. So, keeping informed about these rules? Definitely a smart move!

Identify Types of Nexus Tax: Physical, Economic, and More

Hey there, small business owners! Let’s chat about some types of nexus you really should know about:

-

Physical Nexus: This one’s pretty straightforward. It happens when your business has a physical presence in a state—think storefronts, warehouses, or even employees. If you’ve got a physical footprint, you’re on the hook to collect and remit sales tax in that area.

-

Economic Nexus: Now, this is where things get a bit more interesting. Economic nexus kicks in when your sales or transactions cross a certain threshold in a region, even if you don’t have a physical presence there. Many places set the bar at around $100,000 in sales or 200 transactions. So, keep an eye on those numbers!

-

Click-Through Nexus: Ever heard of this one? It comes into play when you have agreements with in-state affiliates who send customers your way. This creates a tax obligation for you, so it’s worth noting.

-

Marketplace Connection: If you’re selling through online marketplaces, you might find yourself facing tax responsibilities based on how those marketplaces operate in your state.

Understanding what is nexus tax is crucial for effectively managing your tax obligations. So, take a moment to reflect on how these might apply to your business—it could save you some headaches down the road!

Discuss the Implications of Nexus Tax on Business Operations

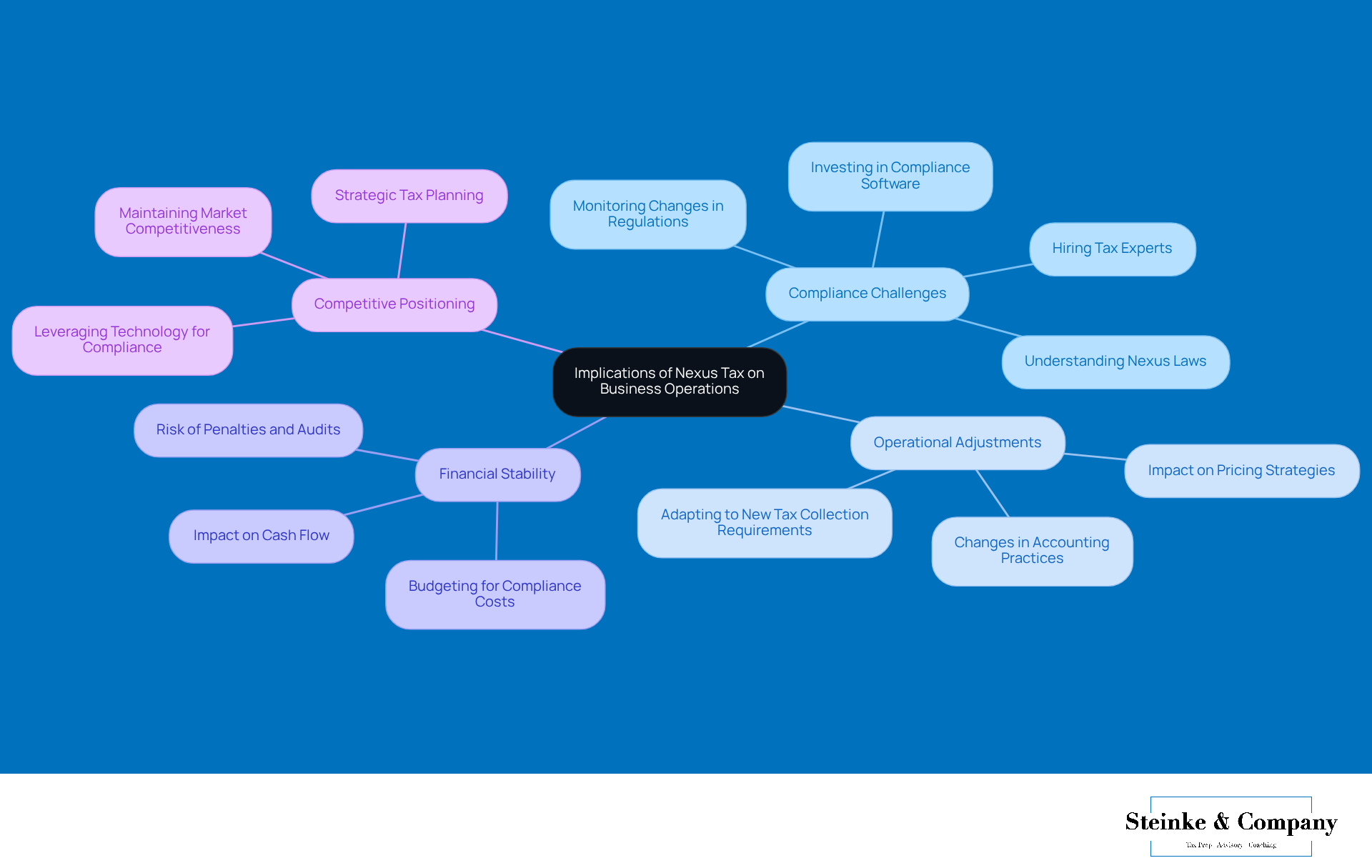

The effects of connection tax on commercial activities can be quite significant and a bit complex, right? Small businesses often find themselves needing to spend time and resources just to figure out what is nexus tax and their responsibilities. This sometimes means hiring tax experts or investing in tax compliance software—definitely not the most exciting part of running a business!

Take, for example, a small e-commerce company looking to expand into a new state. Suddenly, it might have to start collecting and remitting sales tax, which can really complicate things like accounting and pricing strategies. And let’s be honest, nobody wants to deal with that added stress! But getting this adjustment right is crucial, as it can really affect how competitive they are in the market.

Interestingly, case studies have shown that companies using tax compliance software often optimize their processes, reducing the chance of mistakes and ensuring they stay compliant on time. Plus, let’s not forget that ignoring connection tax laws can lead to audits, penalties, and even reputational damage. Yikes! So, it’s super important for businesses to manage these responsibilities proactively.

By effectively navigating what is nexus tax, small businesses can keep their operations running smoothly and maintain financial stability. This positions them for sustainable growth in what’s becoming an increasingly complex tax landscape. So, how are you tackling these challenges in your own business?

Conclusion

Understanding nexus tax is crucial for small business owners as they navigate the sometimes tricky waters of tax compliance across different areas. This tax obligation kicks in when a business establishes a solid connection, or "nexus," to a particular region, which can significantly affect financial planning and operational strategies. By getting a handle on the nuances of nexus tax, small enterprises can manage their tax liabilities more effectively and steer clear of those pesky penalties.

In this article, we've explored the various types of nexus tax, like:

- Physical nexus

- Economic nexus

- Click-through nexus

- Marketplace nexus

Each brings its own set of tax responsibilities. We can't stress enough how important it is to comply on time to avoid underpayment penalties. Plus, don't forget that tax compliance software or expert advice can really help streamline your operations. By taking a proactive approach, businesses can minimize audit risks and ensure they have competitive pricing strategies.

In a world where tax regulations are always changing, staying in the loop about nexus tax isn’t just about ticking boxes; it’s a real strategic advantage. Small business owners should regularly check in on their nexus obligations and adjust their practices as needed. This kind of vigilance not only protects against financial headaches but also sets businesses up for sustainable growth in a competitive market. So, why not take a moment to assess your nexus situation today? It could be the key to your business's success!

Frequently Asked Questions

What is nexus tax?

Nexus tax refers to the tax responsibilities that arise when a business has a sufficient connection, or 'nexus,' with a specific region or jurisdiction, requiring them to collect and submit sales tax on transactions occurring within that area.

How can a business establish nexus?

A business can establish nexus through various means, such as having a physical presence, employing workers, or making significant sales within the jurisdiction.

Why is understanding nexus tax important for small business owners?

Understanding nexus tax is crucial for small business owners, especially those operating in multiple states, as it directly impacts their tax compliance obligations and financial planning.

What are the potential penalties for underpayment of taxes?

Small business owners may face underpayment penalties from the IRS if they do not meet their tax obligations throughout the year.

How can businesses avoid underpayment penalties?

To avoid underpayment penalties, businesses should make timely and accurate estimated tax payments and adhere to the safe harbor rules set by the IRS.

What is the IRS Offer in Compromise?

The IRS Offer in Compromise is a program that allows taxpayers to settle their tax liabilities for less than the full amount owed, which can be particularly useful for small enterprises facing challenges due to recent cuts in COVID-19 tax benefits.

What should small businesses do to manage tax liabilities effectively?

Small businesses should stay informed about their tax obligations and adjust their tax strategies accordingly to ensure compliance and optimize financial outcomes.