Introduction

Understanding the ins and outs of tax yield income can really change the game for small business owners. In a world where every financial decision matters, this concept is all about the perks you can get from investments that enjoy some sweet tax benefits - think tax-exempt bonds and lower rates on certain dividends. By getting a handle on tax yield income, entrepreneurs can boost their cash flow and set their businesses up for long-term success.

But here’s the kicker: with tax regulations constantly changing, how do you navigate these twists and turns to make the most of your returns while keeping your obligations in check? It’s a tricky landscape, but don’t worry! Let’s dive into this together and figure it out.

Define Tax Yield Income

Tax revenue is all about the money you make from investments that come with some sweet tax perks, like exemptions or favorable treatment. Think about tax-exempt bonds - small businesses often use these to fund projects without having to worry about tax obligations. Plus, some dividends and capital gains enjoy lower tax rates, which can really boost your overall returns.

For small business owners, getting a grip on tax revenue is crucial. It directly affects how you plan your finances and approach investments. By making the most of tax revenue, you can maximize your returns and reduce your tax obligations by understanding what is tax yield income. This not only helps your bottom line but also supports the growth and sustainability of your business.

So, how are you planning to leverage tax revenue in your own financial strategy?

Context and Importance of Tax Yield Income

Tax revenue plays a crucial role in the financial plans of small businesses, especially in rural America, where resources can be a bit tight. By really getting to grips with tax revenue, entrepreneurs can boost their cash flow significantly, which means more money to reinvest in their operations. For example, tax-exempt bonds are a fantastic funding source for community projects, letting businesses take on initiatives without piling on extra tax liabilities.

But it doesn’t stop there! Understanding how tax revenue works helps companies make smart choices about investments and growth opportunities. This knowledge is key to building resilience and profitability in their operations. After all, navigating the complexities of rural business environments can be tricky, and having a solid grasp of tax revenue can make all the difference for long-term success.

So, how are you planning to leverage tax revenue in your own business?

Historical Development of Tax Yield Income

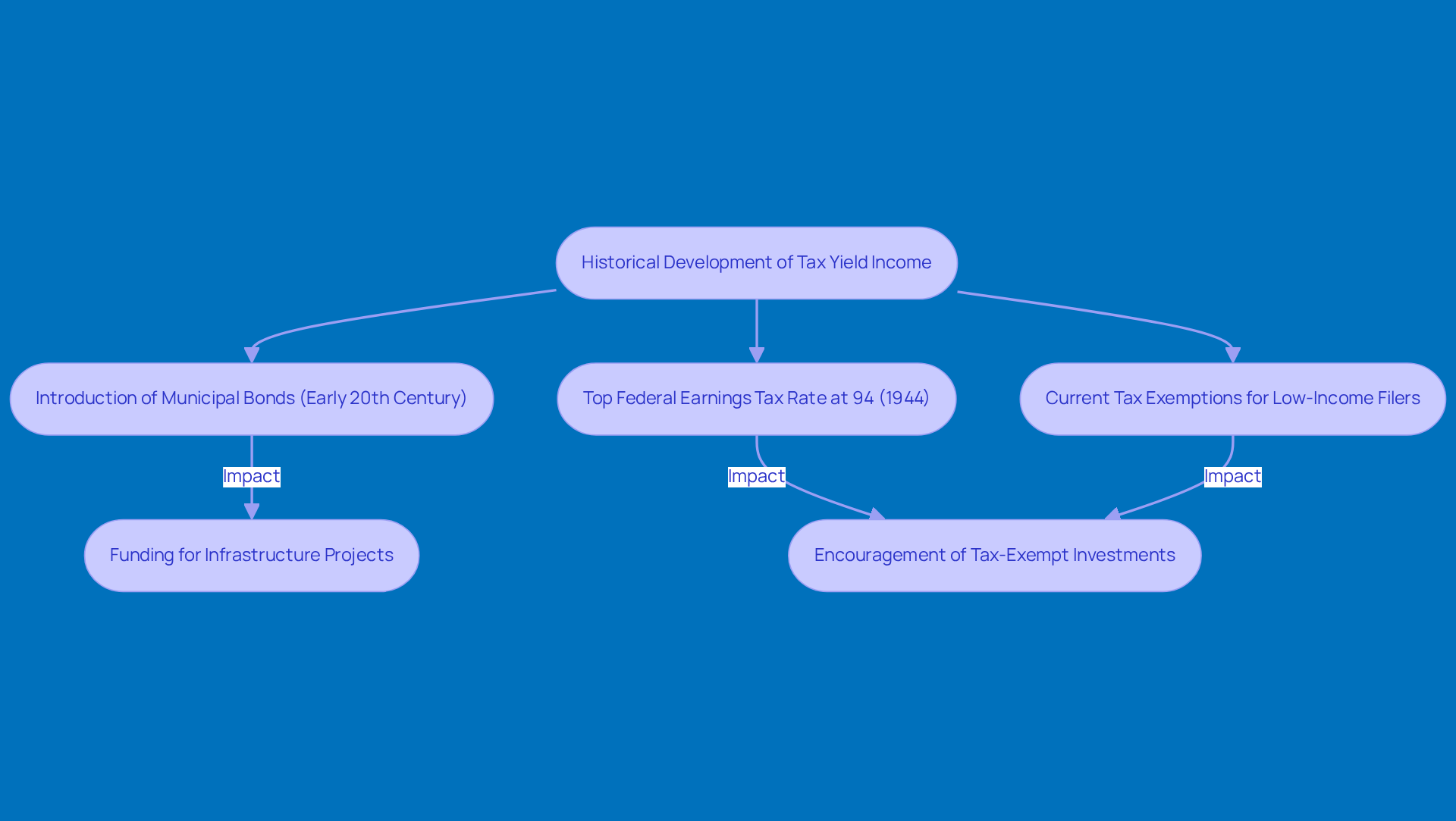

Tax revenue has seen some pretty significant shifts over the years, thanks to changes in tax laws and the economy. Historically, tax policies have been designed to encourage certain investments, which led to the creation of tax-exempt bonds and other financial tools aimed at boosting economic growth. Take municipal bonds, for instance. When they popped up in the early 20th century, they allowed local governments to fund infrastructure projects while giving investors tax-free returns. This was a win-win: it supported community projects and offered a solid investment option for folks looking to improve their tax situation.

Now, let’s talk about how tax regulations have impacted returns. Back in 1944, the top federal earnings tax rate hit a whopping 94 percent! Compare that to today, where single filers making less than $66,100 and married couples earning under $88,100 don’t have to pay federal taxes at all. This historical backdrop really shows how tax revenue plays a crucial role in shaping investment strategies and financial planning, especially for small business owners. As tax laws keep changing, it’s super important to stay on top of these shifts to navigate the complexities of financial management and make the most of tax-exempt investments.

Key Characteristics of Tax Yield Income

When we talk about tax revenue, a few key characteristics come to mind. First off, it’s often tax-exempt, which is a big plus! You’ll find that it usually comes from investments like municipal bonds - those are exempt from federal tax - and certain dividends that enjoy reduced tax rates. Plus, what is tax yield income can really boost cash flow, giving companies the chance to funnel more resources into growth initiatives.

Understanding these traits is super important for small business owners. It helps them make savvy investment decisions that align with their financial goals and tax strategies. And hey, if you want to really maximize your tax efficiency, consider reaching out to experts like Steinke and Company for tax preparation and planning services. They can help ensure you’re compliant and avoid any surprises come tax season.

Also, if you’re thinking about investing in mutual funds, keep in mind that there are strategies to dodge those pesky unexpected tax liabilities from capital gains. By using these insights, small agency owners can navigate the complexities of what is tax yield income and really optimize their financial outcomes. So, what are you waiting for? Let’s get started on making those smart moves!

Conclusion

Understanding tax yield income is super important for small business owners who want to get the most out of their financial strategies. By tapping into tax-exempt investments and taking advantage of favorable tax treatments, businesses can boost their cash flow and cut down on tax liabilities. This not only supports growth but also helps ensure sustainability. When you know how to navigate tax revenue effectively, you’re not just strengthening your company’s financial foundation; you’re also empowering yourself to make smart investment decisions.

Throughout this article, we’ve shared some key insights about the historical development of tax yield income. It’s fascinating to see how changes in tax laws have shaped investment opportunities over time. We’ve also talked about the significance of tax-exempt bonds and other financial tools that can help you maximize returns while keeping tax obligations low. These elements really highlight why understanding tax yield income can be a game-changer in today’s competitive business landscape.

So, what’s the takeaway? Embracing the nuances of tax yield income can lead to some serious benefits for small businesses. By staying in the loop about tax regulations and seeking expert guidance, you can make strategic choices that really enhance your financial health. The call to action is clear: take those necessary steps to explore how tax yield income can work for your business and open up new pathways to success!

Frequently Asked Questions

What is tax yield income?

Tax yield income refers to the money earned from investments that come with tax benefits, such as exemptions or favorable tax treatment.

How do tax-exempt bonds work for small businesses?

Small businesses often use tax-exempt bonds to fund projects without incurring tax obligations on the income generated from those investments.

What types of investments typically enjoy lower tax rates?

Some dividends and capital gains enjoy lower tax rates, which can enhance overall investment returns.

Why is understanding tax revenue important for small business owners?

Understanding tax revenue is crucial for small business owners as it directly impacts financial planning and investment strategies, allowing them to maximize returns and minimize tax obligations.

How can small business owners leverage tax revenue in their financial strategy?

By understanding and maximizing tax revenue, small business owners can improve their bottom line and support the growth and sustainability of their business.