Introduction

Navigating the world of small agencies can feel like a tricky maze, right? With financial pressures, regulatory hurdles, and the constant push for innovation, it’s no wonder many feel overwhelmed. That’s where business advisory firms come in - they’re like trusty sidekicks, offering tailored expertise that can really boost operational efficiency and profitability.

But here’s a thought: what happens to those small businesses that decide to go it alone, skipping out on these advisory services? It’s worth exploring the vital role these firms play. Not only do they provide unique benefits, but they also help avoid the potential risks and missed opportunities that come with going solo. So, let’s dive in and see why partnering with a business advisory firm might just be the best decision you make!

Define the Role of Business Advisory Firms in Supporting Small Agencies

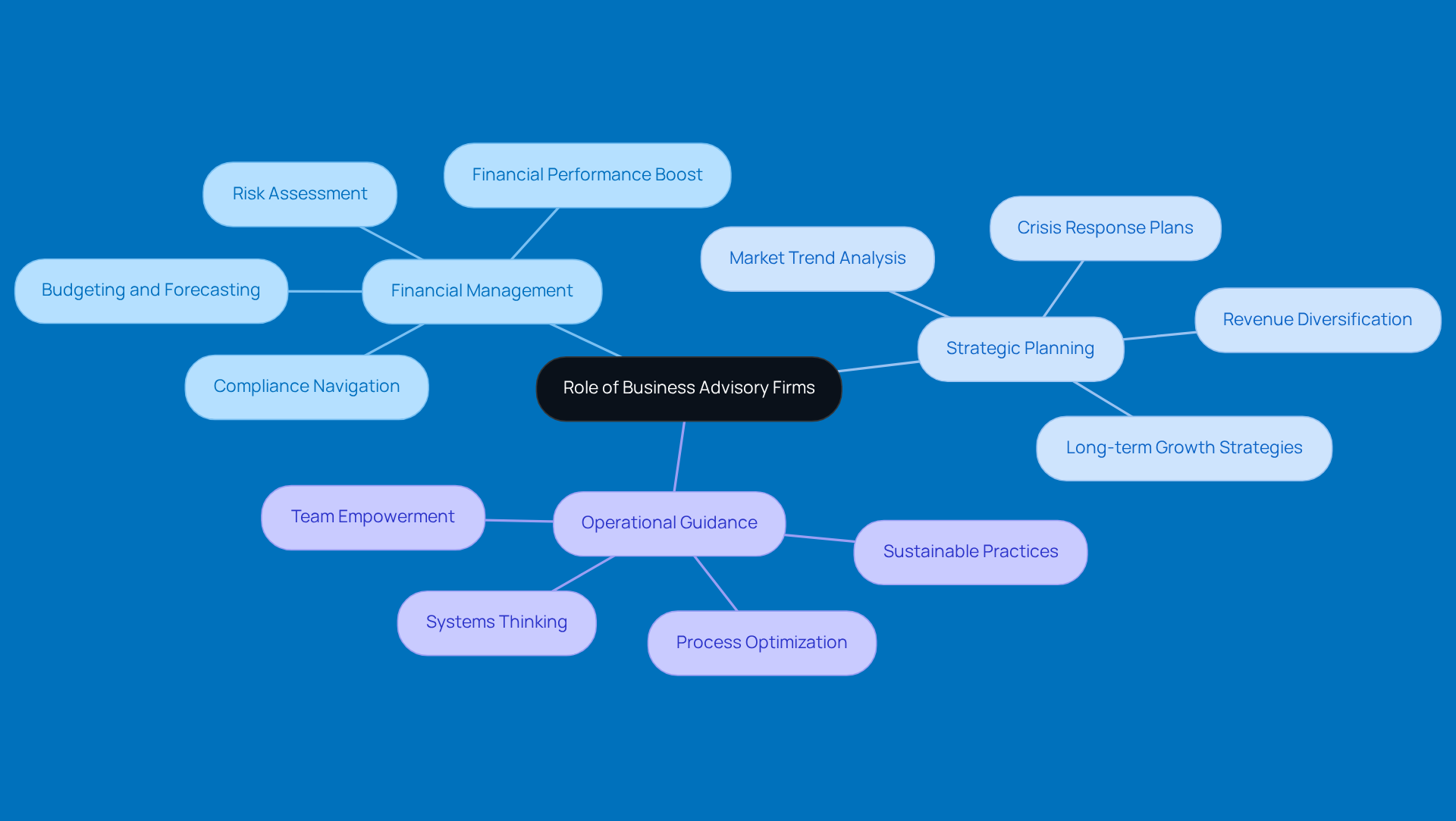

Small organizations can rely on business advisory firms as trusty sidekicks, providing a comprehensive range of services that include:

- Financial management

- Strategic planning

- Operational guidance

These firms play a key role in helping small businesses navigate the tricky waters of compliance, boost their financial performance, and craft long-term growth strategies. By providing tailored advice that addresses the unique challenges faced by smaller companies, advisory firms empower business owners to make informed decisions that align with their goals and values.

This support is especially crucial for small businesses in rural areas, where resources can be tight and the need for specialized expertise is even greater. Effective consultants don’t just bring clarity and spot blind spots; they also create a collaborative atmosphere that encourages experimentation and sustainable practices. As a result, small businesses can build their resilience and adaptability in a constantly changing economic landscape.

So, if you’re a small business owner, consider how business advisory firms could help you tackle your challenges and seize new opportunities. After all, having a knowledgeable partner by your side can make all the difference!

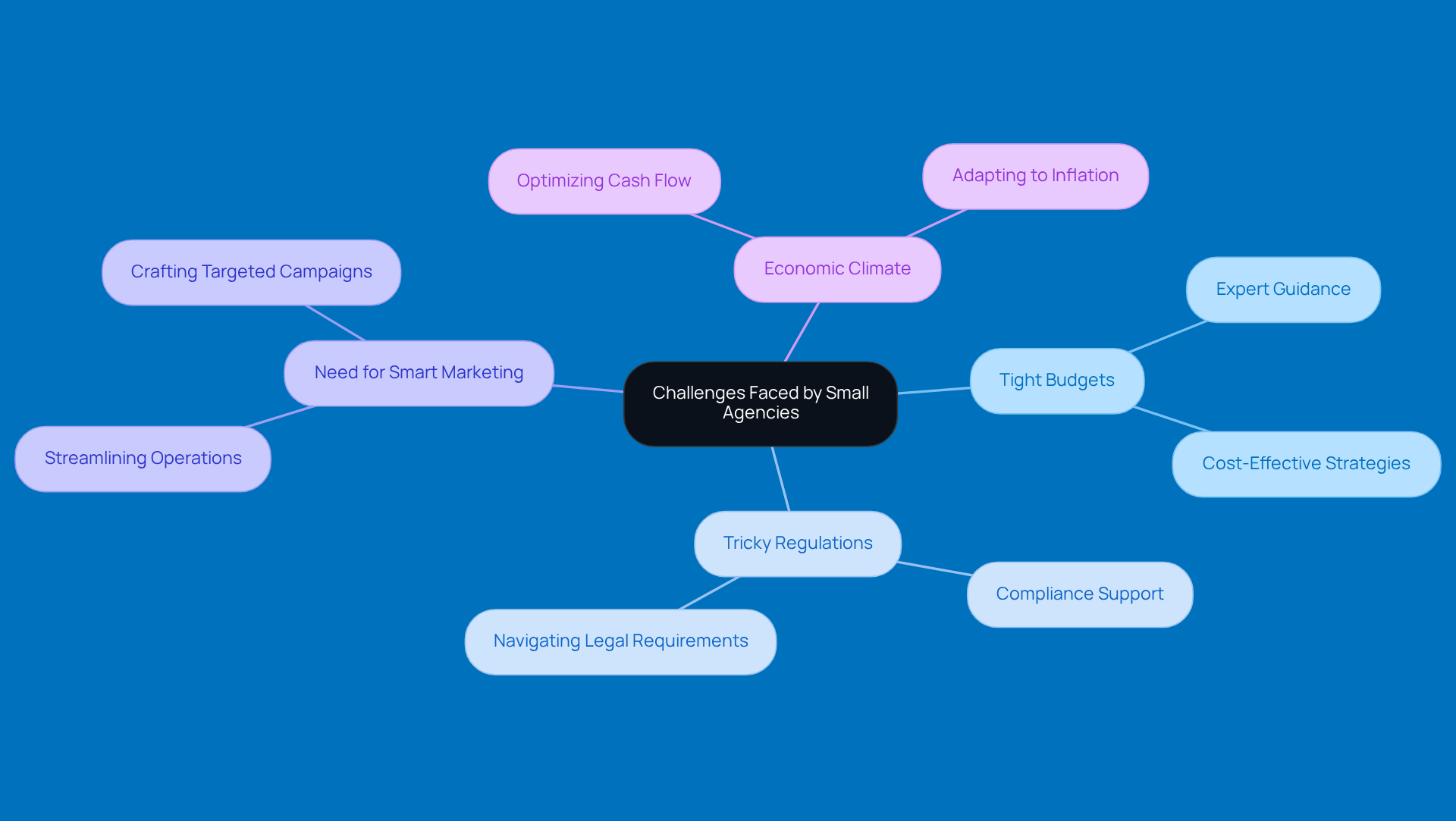

Identify Key Challenges Small Agencies Face That Advisory Firms Address

Small organizations often face a bunch of challenges, like tight budgets, tricky regulations, and the need for smart marketing strategies. It’s no wonder many owners feel overwhelmed! With so much on their plates, they might struggle to find the time or know-how to tackle these issues, leading to stress and even the risk of failure. And let’s not forget the current economic climate - high inflation and rising operational costs make it even tougher for small agencies to stay profitable. In fact, did you know that 58% of small businesses say inflation is their biggest worry? Plus, with wages going up and supply chain hiccups, profit margins are getting squeezed. Understanding and managing underpayment penalties is also key for business owners to avoid hefty IRS fines. By keeping up with estimated tax payments and using strategies like safe harbor payments and the de minimis exception, small organizations can reduce the financial risks tied to underpayment penalties.

This is where business advisory firms play a crucial role - they're like your trusty sidekick in navigating these challenges! They offer expert guidance tailored to the unique needs of small organizations. Think of them as your go-to resource for streamlining operations, optimizing cash flow, and crafting marketing strategies that really connect with your audience. For instance, many small businesses are now embracing technology to boost efficiency; a whopping 79% say that tech implementation has helped them dodge price hikes despite inflation. By collaborating with business advisory firms, smaller organizations can access vital resources and insights that empower them to make smart decisions, ultimately fostering resilience and growth in a competitive landscape.

So, if you’re feeling the pinch, remember you’re not alone! There are ways to navigate these challenges and come out stronger.

Highlight the Unique Benefits of Engaging Business Advisory Services

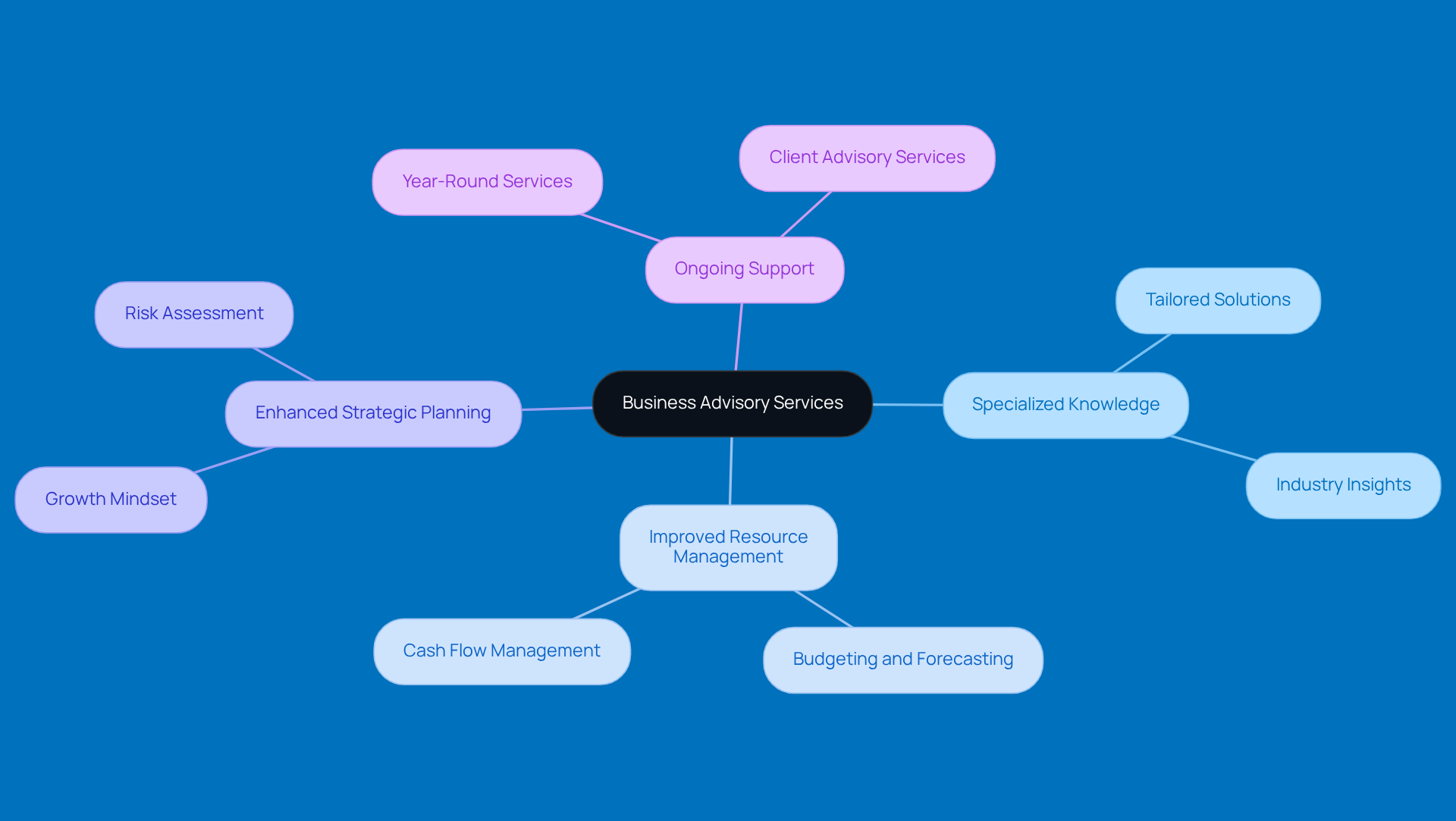

Business advisory firms can be a game changer for small firms, providing a variety of benefits such as specialized knowledge, improved resource management, and enhanced strategic planning skills. Business advisory firms craft tailored solutions that tackle the unique challenges small businesses face, helping them streamline operations and boost profits. For instance, companies that have teamed up with consulting firms often see significant improvements in their management practices, leading to better budgeting, forecasting, and cash flow management. This is especially important during uncertain economic times when keeping financial stability is key.

Plus, business advisory firms come with a wealth of experience from various industries, allowing them to provide insights that spark innovative solutions. By tapping into this expertise, small firms can zero in on their core strengths while ensuring their operations run smoothly and comply with regulations. The trend towards year-round advisory services, as seen in the success stories of firms like Gary Wood's, shows how small organizations can thrive with ongoing support instead of just relying on traditional tax compliance. This proactive approach not only enhances resource management but also helps businesses seize growth opportunities, adapt to market changes, and ultimately thrive in a competitive landscape.

Now, if a company wants to grow from $1 million to $10 million, it’s all about adopting a growth mindset, reassessing risk tolerance, and rolling out effective marketing strategies. Understanding the ins and outs of cash, accrual, and hybrid accounting methods is crucial for making smart financial decisions that align with growth goals. By focusing on these strategies, small firms can navigate the tricky waters of growth and achieve lasting success.

Examine the Risks of Operating Without Business Advisory Support

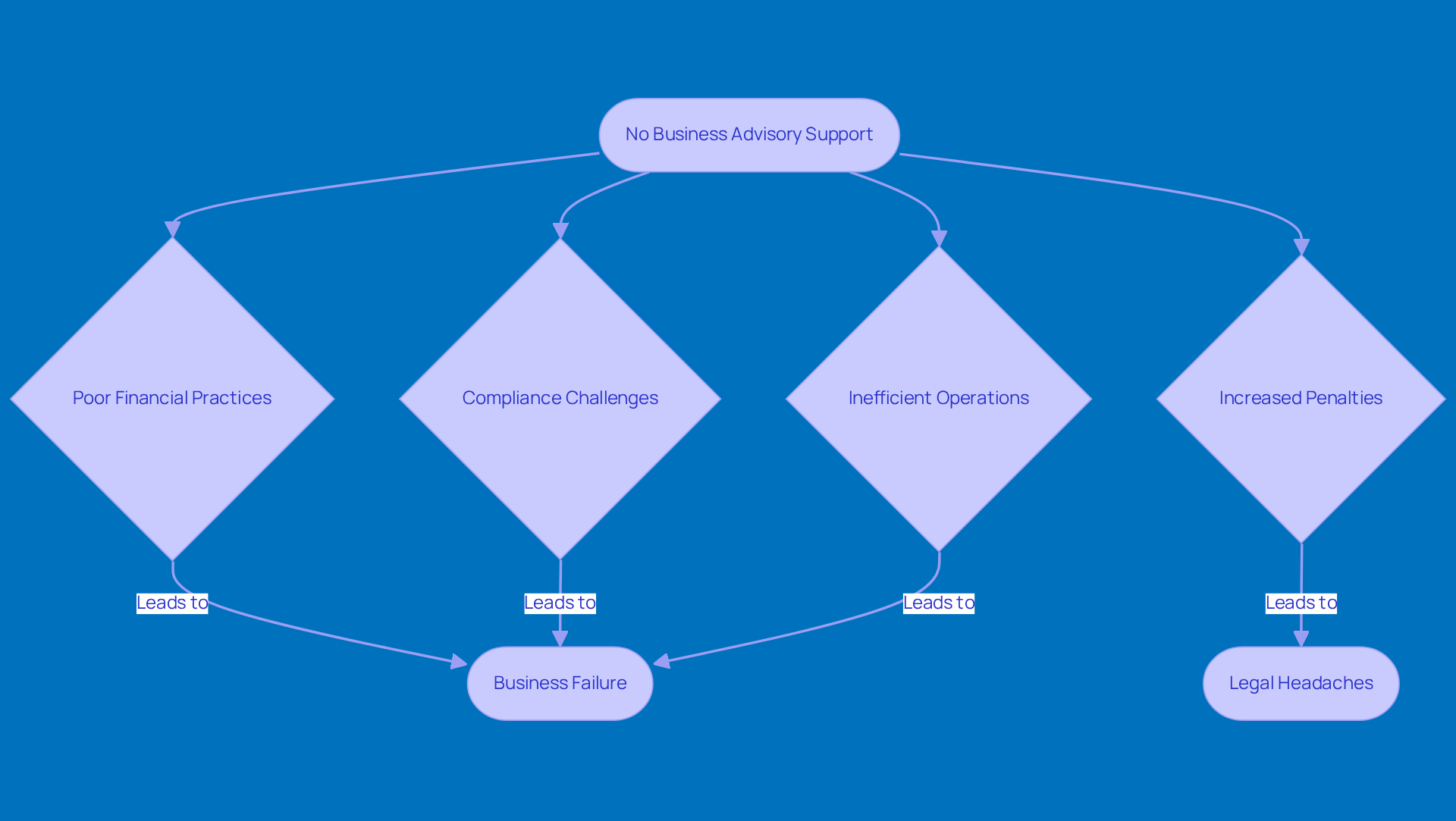

Running a small business without the help of consultancy firms can really put you at risk, especially when it comes to managing money and staying compliant with regulations. Did you know that nearly 50% of small businesses don’t make it past five years? Often, it’s due to poor financial practices and a lack of strategic oversight. Without expert advice, agency owners might feel swamped by complicated tax rules, which can lead to expensive penalties and legal headaches.

Plus, if you don’t have a solid financial plan in place, your operations might become inefficient, making it tough to keep up with changing market conditions. For example, many small businesses find themselves spending way too much time on regulatory compliance, which really cuts into their growth potential. It’s a bit of a catch-22, isn’t it?

In the end, not having advisory support can seriously hold back a small agency’s chances of thriving. It’s a good reminder to think about the long-term effects of your operational choices and the real value that professional guidance can bring to the table. So, what do you think? Could a little expert advice make a difference for your business?

Conclusion

Small agencies really have a lot to gain by teaming up with business advisory firms. These firms are like trusted allies, helping navigate the tricky waters of today’s economy. They offer tailored support that empowers small business owners to make smart decisions, streamline their operations, and foster sustainable growth. By tapping into the expertise of advisory firms, small organizations can boost their financial management, strategic planning, and operational efficiency, setting themselves up for long-term success.

Let’s face it, small agencies face a ton of challenges - tight budgets, regulatory compliance, and ever-changing market conditions. Business advisory firms step in to tackle these issues head-on, providing specialized knowledge and resources that help businesses optimize their operations and adapt to changes effectively. The perks of engaging these services go beyond just ticking boxes for compliance; they encourage a proactive approach to growth, turning potential risks into exciting opportunities.

In a world where nearly half of small businesses don’t make it past five years, having expert advisory support is crucial. Small agencies really need to see the value in these partnerships to navigate challenges and grab opportunities for growth. By embracing the insights and guidance from business advisory firms, small businesses can boost their resilience, sharpen their operational strategies, and truly thrive in a competitive marketplace. So, why wait? Investing in advisory support now could be the game-changer between stagnation and success!

Frequently Asked Questions

What services do business advisory firms provide to small agencies?

Business advisory firms provide a range of services including financial management, strategic planning, and operational guidance.

How do business advisory firms assist small businesses?

They help small businesses navigate compliance issues, improve financial performance, and develop long-term growth strategies by offering tailored advice for their unique challenges.

Why is the support of advisory firms particularly important for small businesses in rural areas?

In rural areas, resources can be limited, and the need for specialized expertise is greater, making the support of advisory firms crucial for small businesses.

What qualities should effective consultants possess when working with small businesses?

Effective consultants should bring clarity, identify blind spots, and foster a collaborative atmosphere that encourages experimentation and sustainable practices.

How can small businesses benefit from partnering with business advisory firms?

Partnering with advisory firms can help small businesses build resilience and adaptability in a changing economic landscape, enabling them to tackle challenges and seize new opportunities.