Introduction

Tax laws can feel like a daunting maze for small business owners, right? It’s all too easy to miss out on opportunities or feel the financial pinch. That’s where tax credit consultants come in - they’re like your trusty guides through this complex landscape, helping you find significant savings and boost your financial stability. But here’s the kicker: many business owners don’t realize the potential pitfalls of going it alone. Could skipping professional guidance be putting your success at risk?

Understand the Value of Tax Credit Consultants for Small Businesses

Tax credit consultants play a vital role for small businesses, especially in rural areas, as they help navigate the tricky world of tax laws. Many small business owners find tax incentives overwhelming and often miss out on valuable opportunities. That’s where Steinke and Company comes in! They offer proactive tax planning services that help businesses discover and claim incentives they might not even know exist, like the Employee Retention Credit (ERC), which can provide significant financial relief.

This expertise is crucial for small businesses that typically can’t afford to hire full-time tax specialists. By working with the tax credit consultants at Steinke and Company, small enterprises can improve their tax situations, significantly reducing their liabilities and boosting cash flow. Plus, these advisors create tailored strategies that align with the unique realities of small businesses, addressing issues like access to paid family and medical leave (PFML) for employees.

With over 33 million small businesses in the U.S., tax credit consultants can provide effective advising that makes a huge difference, helping these organizations thrive despite the challenges they face. And let’s not forget about understanding underpayment penalties! Knowing how to avoid them is essential for owners to stay compliant and dodge unnecessary fees.

As tax benefits continue to evolve, especially after the reduction of COVID-19 tax incentives, Steinke and Company is committed to guiding small businesses through these changes, ensuring they’re ready for tax season. So, if you’re a small business owner, why not reach out and see how they can help you? You might be surprised at what you could be missing!

Explore the Benefits of Tax Credits and Compliance Support

Tax incentives are a fantastic financial boost for small businesses, helping them reinvest and grow. Take the Research and Development (R&D) tax incentive, for example. It not only sparks innovation but can also lead to some serious savings - up to $500,000 a year for qualifying businesses! And then there's the Work Opportunity Tax Credit (WOTC), which encourages hiring from specific groups. Companies can save anywhere from $2,400 to $9,600 for each qualified employee, depending on certain criteria.

At Steinke and Company, we have tax credit consultants who assist organizations in identifying these opportunities and managing the application process. We make sure everything's compliant with regulations, which is super important. This support helps reduce the risk of audits and penalties that can come from incorrect claims. By keeping accurate records and offering ongoing guidance, we help small businesses stay on top of changing tax laws, allowing them to adjust their strategies smoothly.

Understanding financial and tax planning is key to avoiding budgeting headaches and achieving success. For instance, knowing how to read paystub details can help owners confirm they’re getting the right payments and that the correct amounts are being deducted for taxes. This kind of knowledge is crucial for overall financial stability and compliance, making tax season a lot less stressful.

When you combine the perks of tax incentives with professional advice, you get stronger businesses that are better equipped to face financial challenges. Just look at one of our clients who claimed $123,000 in R&D tax benefits - they managed to offset their tax bill and carry forward a $13,000 advantage, which really boosted their financial planning. These success stories show how tax incentives can transform a company’s financial landscape, paving the way for sustainable growth and stability.

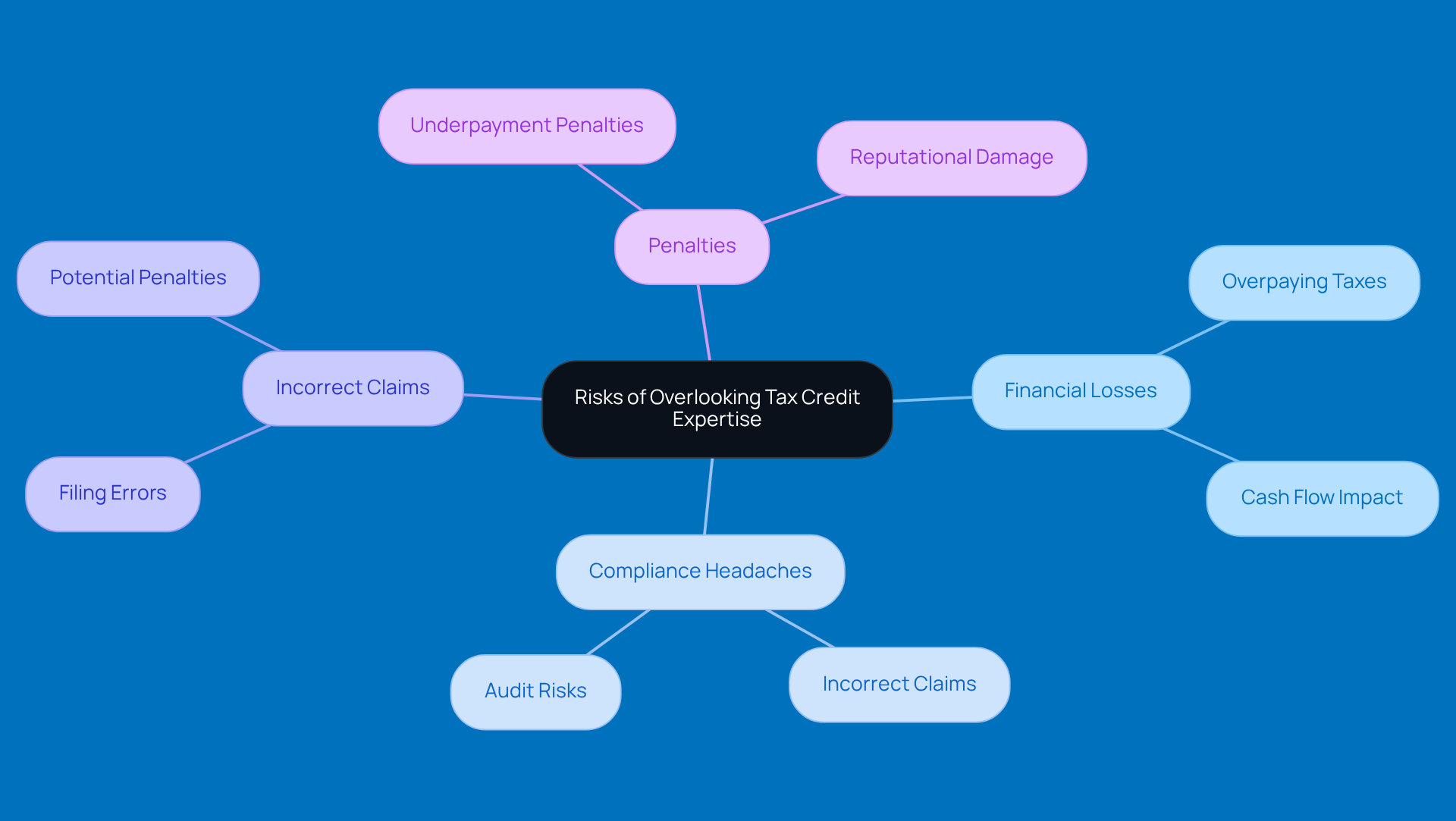

Recognize the Risks of Overlooking Tax Credit Expertise

Not chatting with tax credit consultants can really put small businesses at risk - think financial losses and compliance headaches. A lot of small business owners might not realize just how tricky tax regulations can be, which can lead to missed chances for claiming credits. This kind of oversight can mean overpaying taxes, and that hits cash flow and profits hard.

Plus, without the right guidance, businesses might accidentally file incorrect claims, which can trigger audits and even penalties from tax authorities. It’s super important to understand underpayment penalties; the IRS says you need to pay at least 90% of your current year’s tax liability or 100% of last year’s to dodge those penalties. The fallout from these mistakes can be pretty serious - think reputational damage and strained relationships with the IRS.

By recognizing these risks and the importance of strategies like safe harbor payments and the de minimis exception, business owners can truly see the value in investing in tax credit consultants. It’s not just about protecting their finances; it’s about enhancing their overall strategy too. So, why not take that step? It could make a world of difference!

Integrate Tax Strategies for Sustainable Business Growth

Incorporating tax strategies into your growth plan is key if you want your business to thrive sustainably. Tax credit consultants are like your best friends in this journey, assisting you in aligning these strategies with your corporate goals. They turn tax planning from a boring chore into a proactive part of your overall strategy. For instance, when small businesses make the most of available tax incentives, they can tap into funding that goes right back into operations, marketing, or even employee development. This kind of reinvestment not only boosts productivity but also gives you a competitive edge in the market.

But wait, there’s more! Tax advisors also help you predict your tax obligations and plan accordingly, which is super important for managing cash flow effectively. When you start seeing tax compliance and borrowing as strategic tools rather than just obligations, you’re setting your business up for long-term success and adaptability in a constantly changing economy. Did you know that small businesses that strategically reinvest capital freed up by tax credit consultants often see significant growth? It really highlights how crucial a well-aligned tax strategy is for hitting your business goals.

Conclusion

Tax credit consultants are like your go-to buddies when it comes to navigating the tricky world of tax regulations. They’re essential partners for small businesses, helping you uncover and claim those valuable tax incentives that can really boost your financial stability and growth potential.

Throughout this article, we’ve seen just how important these consultants are. They help small businesses cut down on tax liabilities, steer clear of costly mistakes, and implement smart tax strategies. Whether it’s spotting opportunities like the Employee Retention Credit or Research and Development tax incentives, or making sure you’re compliant with the ever-changing rules, these pros offer support that can lead to some serious savings and reinvestment opportunities.

So, why should you consider engaging tax credit consultants? Well, it’s not just about the money; it’s a strategic move that can help your small business thrive in today’s competitive market. By focusing on tax planning and compliance, you’re not just safeguarding your financial health-you’re setting yourself up for long-term success. Embracing this expertise is a smart step toward tapping into the full potential of available tax benefits, fostering sustainable growth, and hitting those business goals.

Have you thought about how tax credit consultants could make a difference for your business? It might just be the key to unlocking new opportunities!

Frequently Asked Questions

What is the role of tax credit consultants for small businesses?

Tax credit consultants help small businesses navigate tax laws, identify tax incentives, and claim benefits they may not be aware of, such as the Employee Retention Credit (ERC).

Why are tax credit consultants particularly important for small businesses in rural areas?

Small businesses in rural areas often find tax incentives overwhelming and may lack access to full-time tax specialists, making tax credit consultants crucial for improving their tax situations.

What specific services does Steinke and Company offer to small businesses?

Steinke and Company provides proactive tax planning services, helps discover and claim tax incentives, and creates tailored strategies to address the unique needs of small businesses.

How can tax credit consultants improve a small business's financial situation?

By reducing tax liabilities and boosting cash flow through effective tax planning and the identification of available incentives.

What is the significance of understanding underpayment penalties for small business owners?

Knowing how to avoid underpayment penalties is essential for compliance and helps business owners avoid unnecessary fees.

How can tax credit consultants assist small businesses in adapting to changes in tax benefits?

They guide small businesses through evolving tax benefits and help them prepare for tax season, especially after changes like the reduction of COVID-19 tax incentives.

Why should small business owners consider reaching out to tax credit consultants?

Small business owners may be missing out on valuable tax incentives and benefits, and consulting with experts can help them maximize their financial opportunities.