Overview

Did you know that healthcare insurance premiums can actually be tax deductible for small businesses? This means you can significantly lower your taxable income! It's pretty cool, right? However, the article points out that these deductions depend on a few factors, like your business structure and eligibility criteria. So, it’s really important to chat with a tax professional. They can help you navigate these complexities and make sure you’re maximizing your potential savings. Trust me, it’s worth it!

Introduction

Understanding the financial landscape of small businesses often boils down to one big question: how do you tackle those skyrocketing healthcare insurance premiums? With individual coverage averaging nearly $9,000 a year and family plans climbing over $25,000, it can feel pretty overwhelming. But here’s a bright spot: savvy business owners can take advantage of potential tax deductions on these premiums. Still, figuring out the ins and outs of eligibility and IRS guidelines can be tricky.

So, are healthcare insurance premiums really tax deductible? And how can small businesses make the most of these benefits to lighten their financial load?

Define Healthcare Insurance Premiums

Healthcare insurance costs are those regular payments you make to an insurance provider to keep your health coverage intact. They usually come in the form of monthly, quarterly, or annual payments. Now, these costs can vary quite a bit depending on a few factors—like the type of coverage you choose, your age, and your overall health. For small business owners, especially those offering health benefits to their employees, understanding these costs is super important.

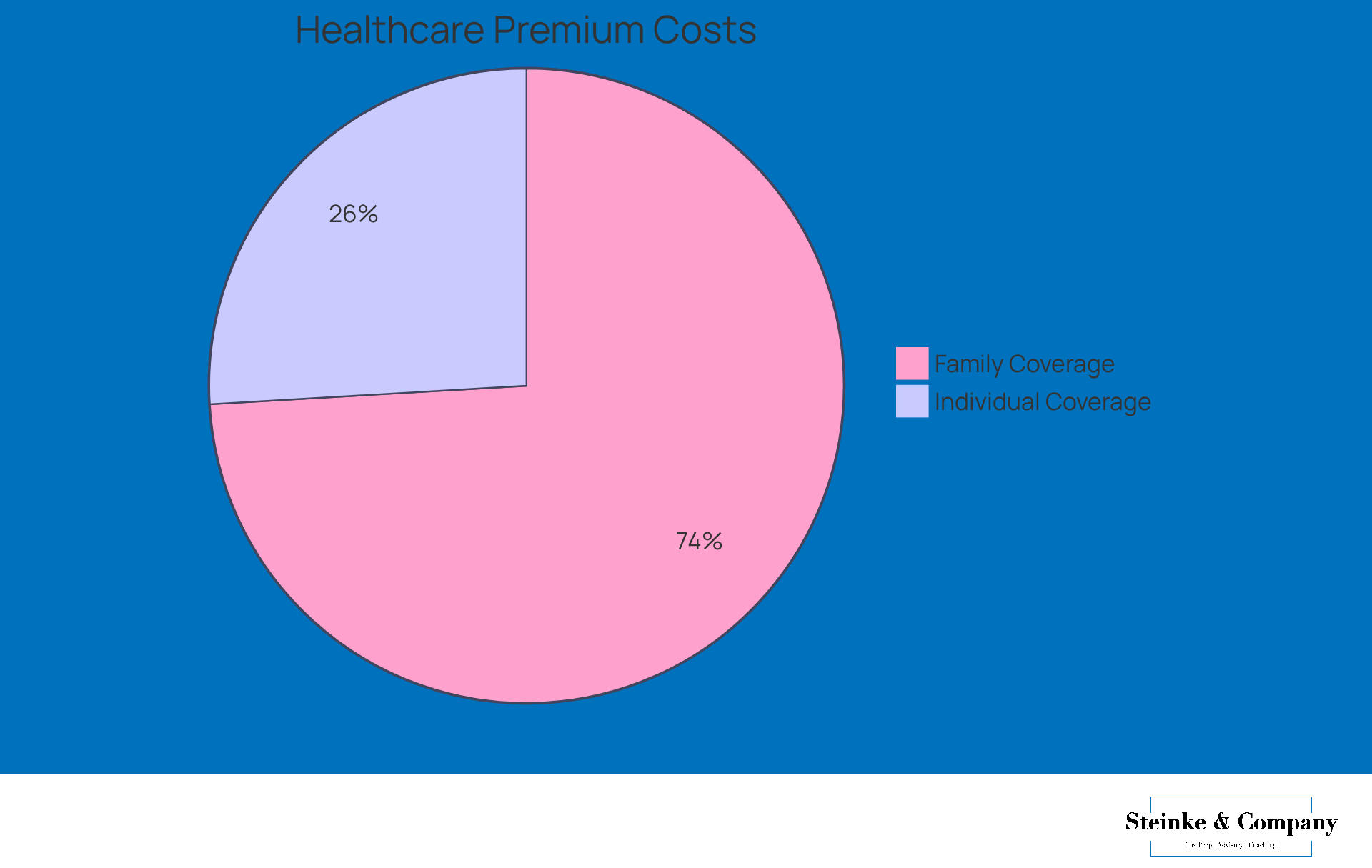

In 2024, the average yearly cost for individual coverage hit $8,951, while family coverage jumped to $25,572, which is a 6% increase from the previous year. Yikes! Such expenses can really put a strain on your finances and may lead you to wonder if are tax deductible. That’s why it’s crucial for small enterprises to manage and plan for these costs effectively. So, how are you planning for your healthcare expenses?

Explore Tax Deductibility of Premiums

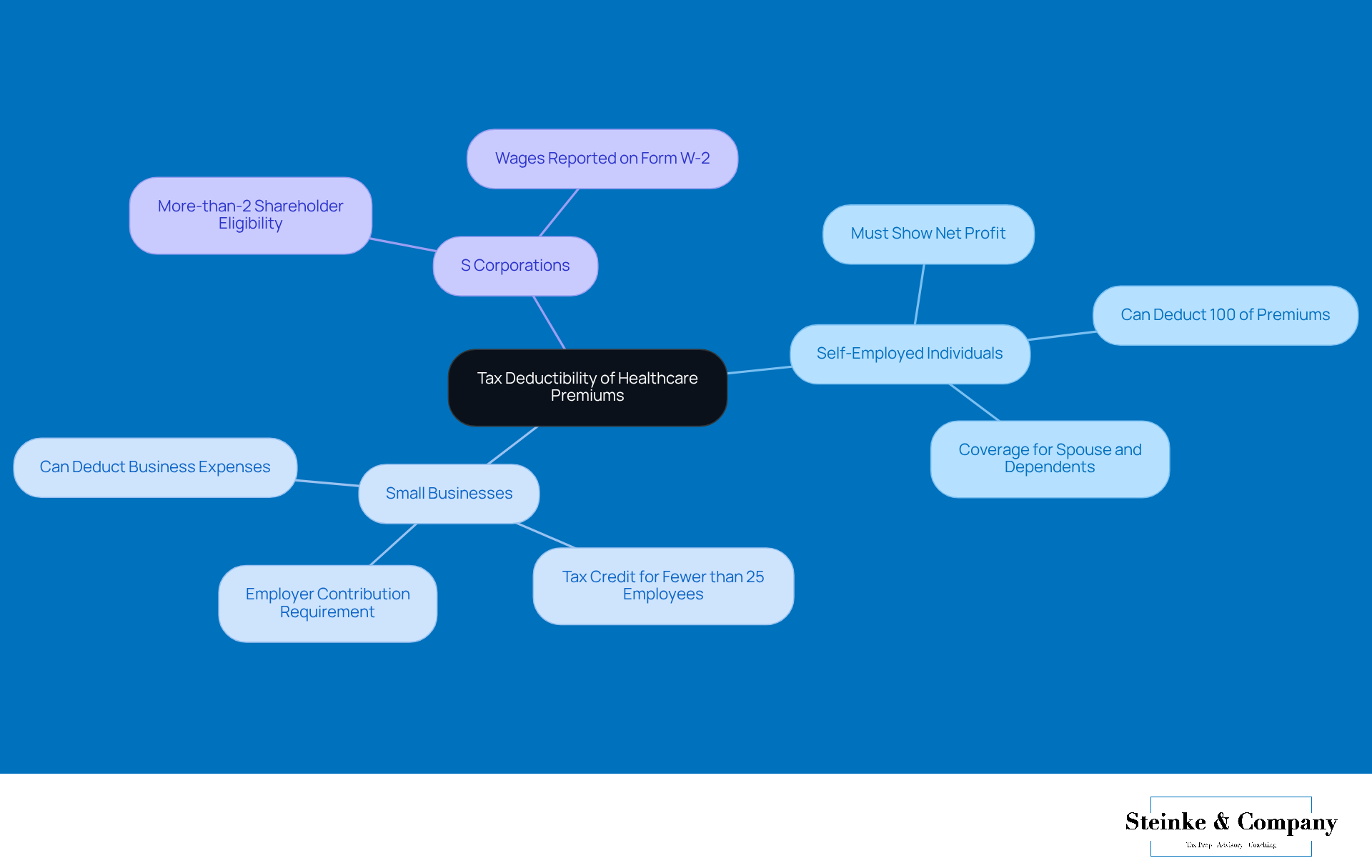

Did you know that for small businesses, healthcare coverage costs are healthcare insurance premiums tax deductible? This can provide a significant financial boost! The Internal Revenue Service (IRS) allows self-employed folks to . This deduction applies to contributions made for themselves, their spouses, and dependents, which can really help lower taxable income. Plus, companies that offer health coverage to their employees can deduct these costs as business expenses, making it easier to manage overall operational costs.

Now, it's important to note that whether or not healthcare insurance premiums are healthcare insurance premiums tax deductible can vary based on the organizational structure and the specific coverage plan. For instance, self-employed individuals need to show a net profit to qualify for the deduction, and the coverage must be set up under the business. And if you're a more-than-2% shareholder of an S corporation, you can also take advantage of this deduction, as long as you're receiving wages reported on Form W-2.

Tax professionals often stress the importance of understanding IRS guidelines to determine if healthcare insurance premiums are healthcare insurance premiums tax deductible, ensuring compliance and maximizing deductions. For example, a self-employed person can deduct 100% of their health coverage premiums, which can significantly reduce their tax bill. In real life, companies with fewer than 10 employees and average salaries of $27,000 or less can snag larger tax credits, making it even more feasible to offer health coverage.

So, if you're a business owner, chatting with a tax advisor can be super helpful to navigate these complexities and really optimize your tax strategies!

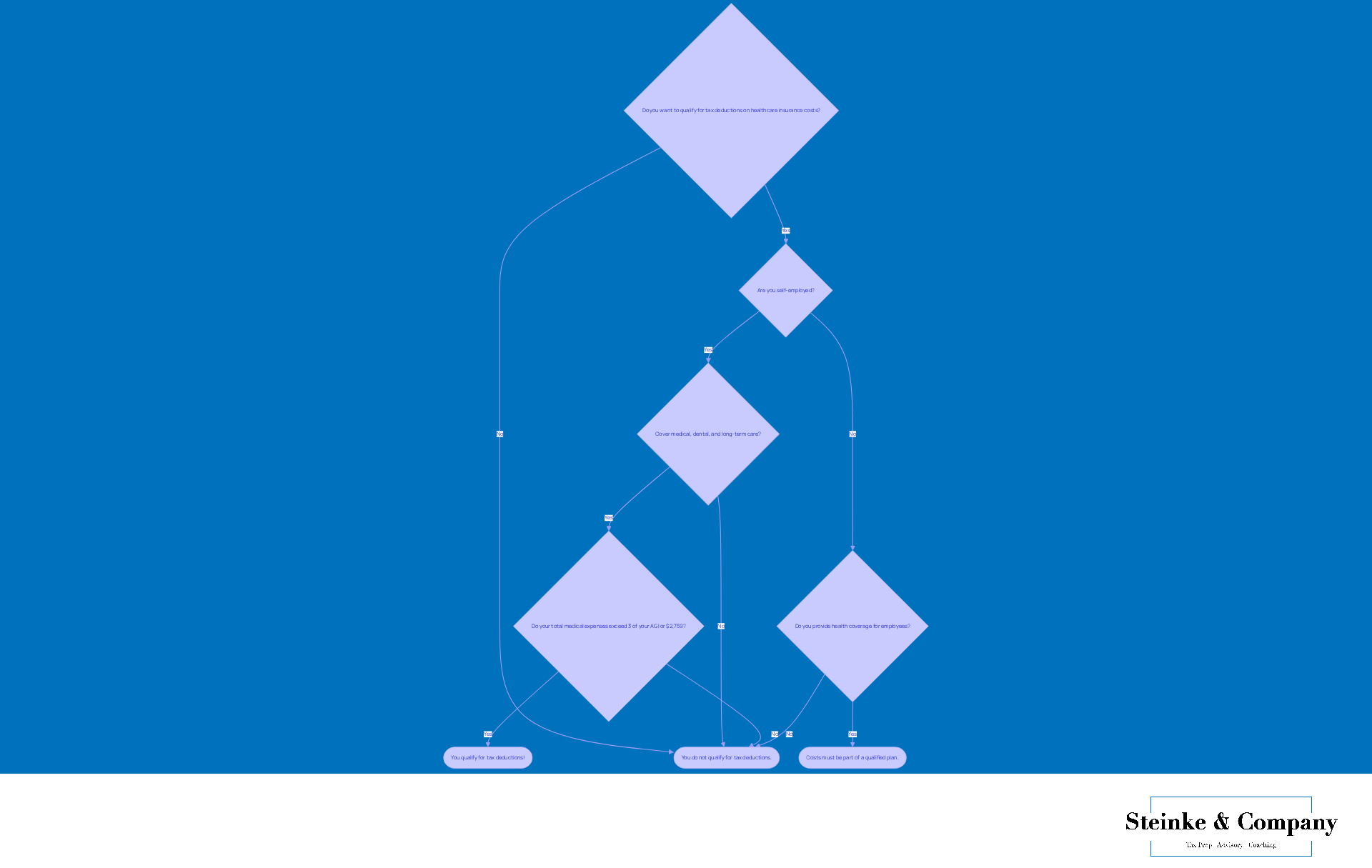

Identify Eligibility Criteria for Deductions

If you want to qualify for tax deductions on healthcare insurance costs, you should know whether healthcare insurance premiums are tax deductible and meet some specific criteria. For those who are self-employed, your payments should cover medical, dental, and long-term care. It’s also important to note that the type of business structure you have matters; sole proprietorships and LLCs typically can deduct these costs. Now, if you run a company that provides health coverage for your employees, those costs must be part of a qualified plan.

Here’s a key point: your total medical expenses, including premiums, need to exceed 3% of your adjusted gross income (AGI) or the fixed dollar amount set by the CRA, which is $2,759 for 2024. So, for example, if you’re self-employed and earning $80,000, you can only claim deductions if your total medical expenses go beyond $2,400—because 3% of $80,000 is $2,400. Understanding whether healthcare insurance premiums are tax deductible is crucial for small business owners who want to manage their tax responsibilities effectively and optimize potential deductions.

You might be wondering who qualifies for these deductions. Well, think about private practice physicians and therapists—they often rack up that can be offset through these tax advantages. It’s all about making the most of what’s available to you!

Summarize Key Insights and Practical Advice

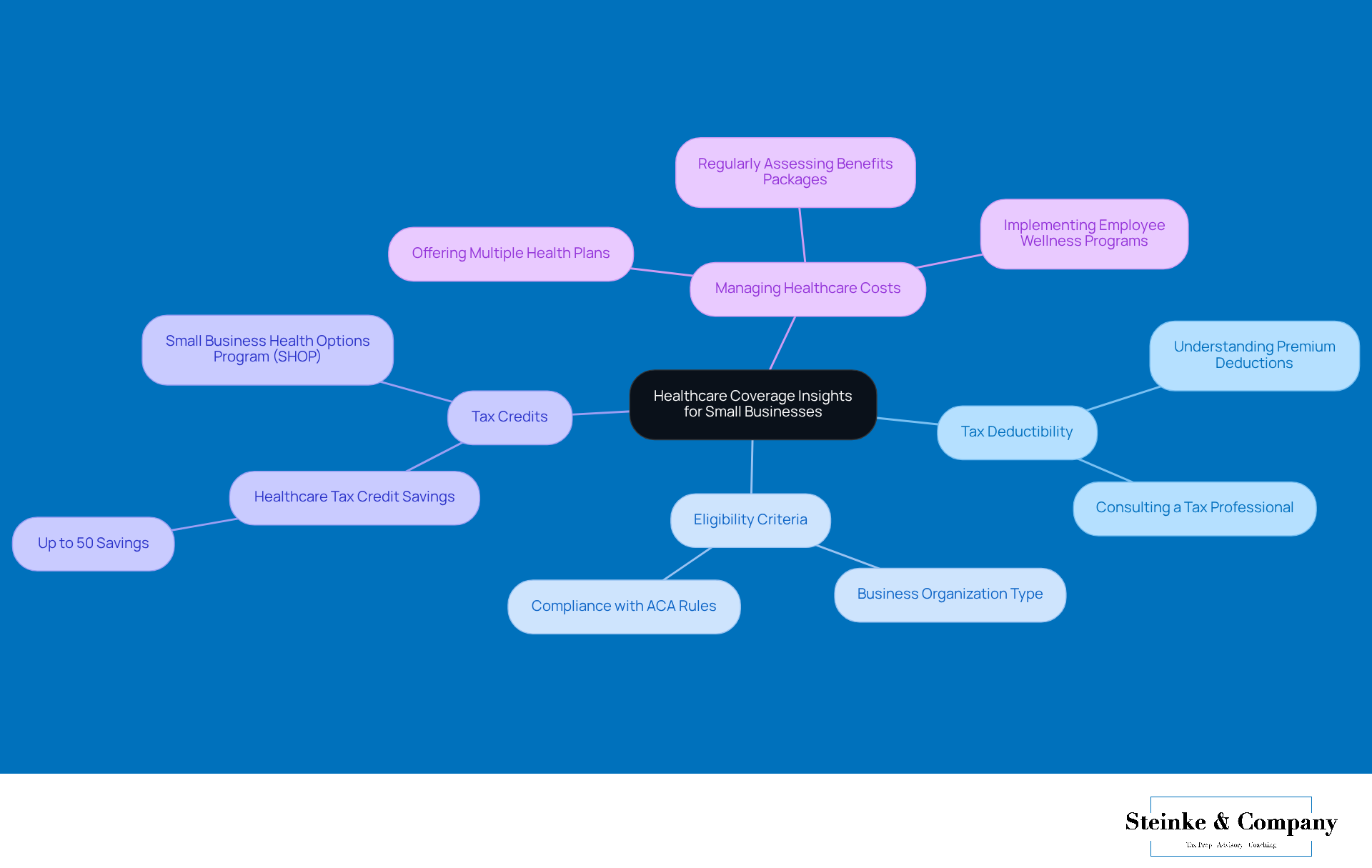

Healthcare coverage costs can really put a strain on small businesses, right? But here's the good news: understanding how tax deductibility works, especially in relation to whether healthcare insurance premiums are healthcare insurance premiums tax deductible, can offer some much-needed relief. To snag those deductions, it's important for entrepreneurs to know the , including whether healthcare insurance premiums are healthcare insurance premiums tax deductible and how their business is organized. That's where a tax professional comes in handy! They can help you navigate the tricky tax regulations and spot opportunities to maximize your deductions.

Did you know that companies qualifying for healthcare tax credits can save up to 50% on expenses because healthcare insurance premiums are healthcare insurance premiums tax deductible? That’s a significant way to ease financial pressures! Plus, consider offering multiple health plan options for your employees. This not only caters to their diverse needs but can also help lower overall costs. By taking a proactive approach to managing healthcare expenses and staying compliant with tax laws, small business owners can boost their financial stability and support their teams effectively. So, why not take a closer look at your healthcare options today?

Conclusion

Understanding the tax deductibility of healthcare insurance premiums is super important for small businesses looking to ease their financial burdens. When business owners realize that these premiums can actually be tax deductible, they can significantly cut down their taxable income and improve their financial management strategies. This knowledge empowers entrepreneurs to make informed choices about their healthcare offerings, ultimately boosting their overall business success.

Throughout this article, we've highlighted some key insights, like the eligibility criteria for tax deductions, the importance of business structure, and the specific requirements set by the IRS. Small business owners, especially those who are self-employed or running S corporations, can take advantage of these deductions if they meet the necessary conditions. Plus, exploring tax credits available for companies with fewer employees can lead to some serious savings, making it easier to provide health coverage.

With these insights in mind, small business owners are encouraged to take proactive steps in evaluating their healthcare options and chatting with tax professionals. By doing this, they can navigate the complexities of tax regulations, optimize their deductions, and ultimately create a healthier and more financially stable business environment. Embracing these strategies will not only help their bottom line but also boost employee satisfaction and retention, creating a win-win situation for everyone involved.

Frequently Asked Questions

What are healthcare insurance premiums?

Healthcare insurance premiums are regular payments made to an insurance provider to maintain health coverage. These payments can be made monthly, quarterly, or annually.

What factors influence the cost of healthcare insurance premiums?

The cost of healthcare insurance premiums can vary based on several factors, including the type of coverage chosen, the individual's age, and their overall health.

What was the average yearly cost for individual and family healthcare coverage in 2024?

In 2024, the average yearly cost for individual healthcare coverage was $8,951, while family coverage averaged $25,572, reflecting a 6% increase from the previous year.

Why is it important for small business owners to understand healthcare insurance costs?

For small business owners offering health benefits to their employees, understanding healthcare insurance costs is crucial for effective financial management and planning for these expenses.