Overview

Did you know that HSA contributions are deductible? This means small business owners can enjoy some pretty significant tax advantages! By contributing to an HSA, you can lower your taxable income while also saving for those eligible medical expenses. It’s a win-win! The article really highlights how crucial it is to understand the rules and limits of HSAs. After all, tax-deductible contributions can boost both your personal benefits and those of your employees. So, think of HSAs as a smart financial tool in your toolkit!

Introduction

Hey there, small business owners! Have you ever thought about how Health Savings Accounts (HSAs) could be a game-changer for managing your healthcare costs? They offer a fantastic way to save on taxes while also building a financial cushion for those unexpected medical expenses. Plus, the funds you contribute are tax-deductible and can grow over time, making HSAs not just a safety net but also a smart strategy for your retirement planning.

But here’s the kicker: with all the rules about contribution limits and eligibility, it can feel a bit overwhelming. So, how can you navigate these regulations to truly maximize your benefits? Let’s dive in!

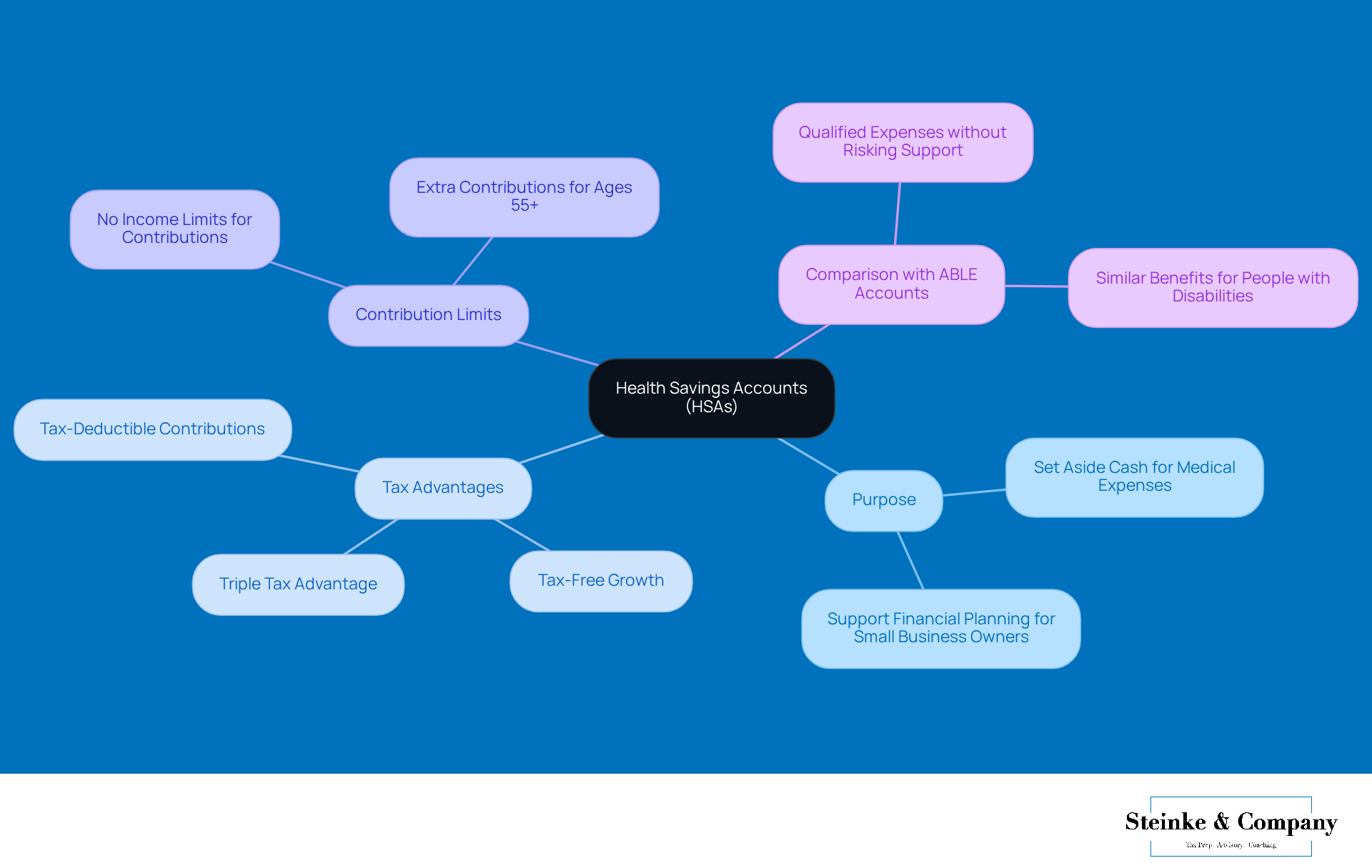

Define Health Savings Accounts (HSAs) and Their Purpose

Health Savings Accounts (HSAs) are pretty neat tax-advantaged savings accounts designed for folks enrolled in high-deductible health plans (HDHPs). The main goal here is to help you set aside some cash for eligible medical expenses while enjoying some sweet tax perks.

- Are HSA contributions deductible? Yes, contributions to HSAs are , and the funds can grow tax-free, providing you with a triple tax advantage. This means you can save for healthcare costs and lower your taxable income—making it important to know if HSA contributions are deductible for small business owners looking to manage healthcare expenses effectively.

- But wait, there’s more! Qualified individuals can contribute to HSAs without any income limits, and if you’re aged 55 or older, you can even make extra contributions to boost your retirement savings. How cool is that?

- And let’s not forget about ABLE accounts, which offer similar benefits for people with disabilities, allowing them to save for qualified expenses without risking their support. Understanding the contribution limits and smart ways to use HSAs, along with the perks of ABLE accounts, can really help small agency owners with their financial planning.

So, have you thought about how these accounts could fit into your financial strategy?

Explore Tax Deductibility of HSA Contributions

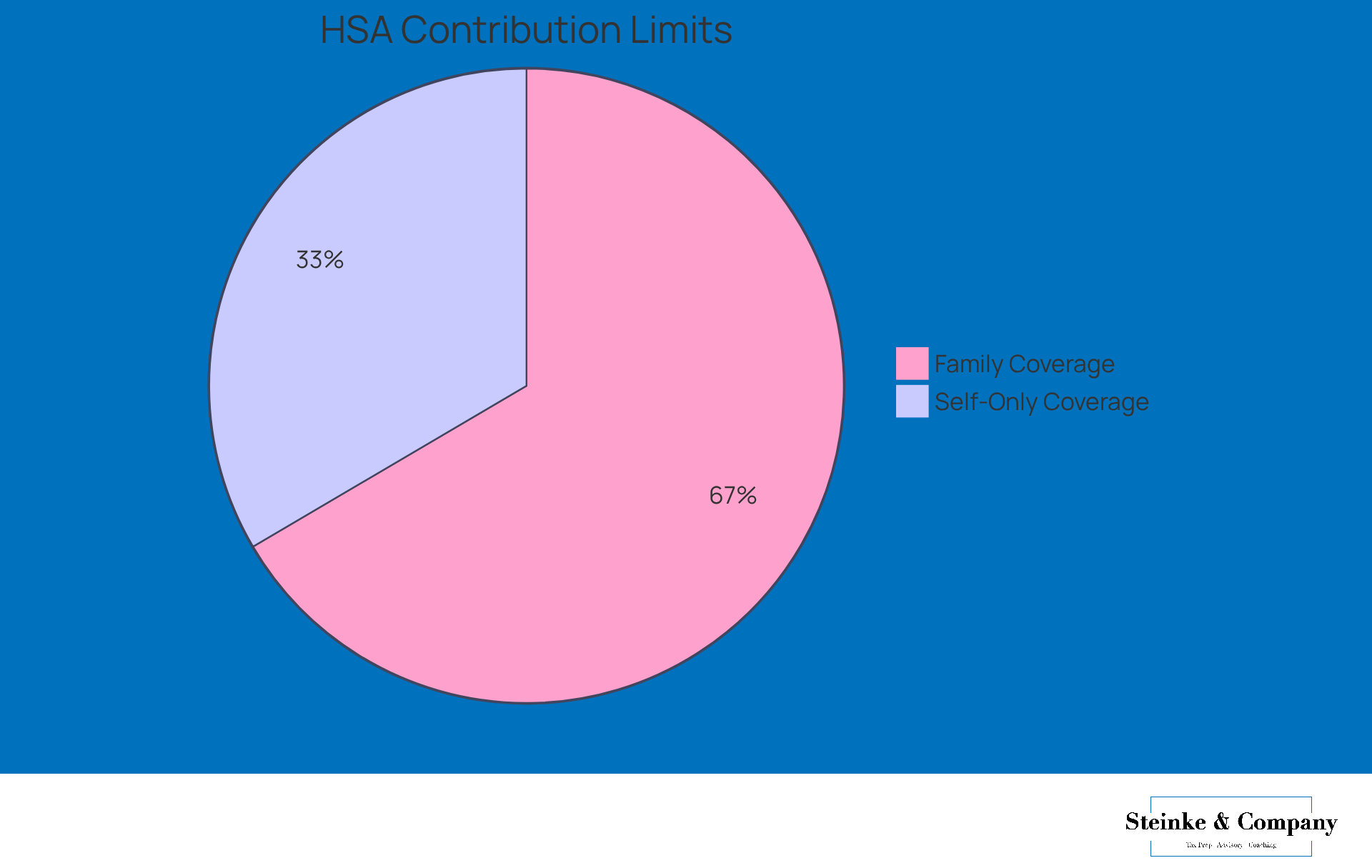

Did you know that the question of whether HSA contributions are deductible is important for tax planning? This means you can , which is pretty neat! For the tax year 2025, if you have self-only coverage, you can contribute up to $4,300. If you’re covering your family, that jumps to $8,550.

But here’s where it gets even better: if your employer contributes to your HSA, those contributions are also tax-deductible for the business. This creates a win-win situation! Not only does it lighten the tax load for small business owners, but it also encourages them to boost their employees' HSAs. It’s a great way to enhance employee benefits without adding extra tax headaches. So, if you’re thinking about your HSA contributions, you might wonder, are HSA contributions deductible? Remember, it’s a smart move for both you and your employer!

Understand HSA Contribution Rules and Eligibility

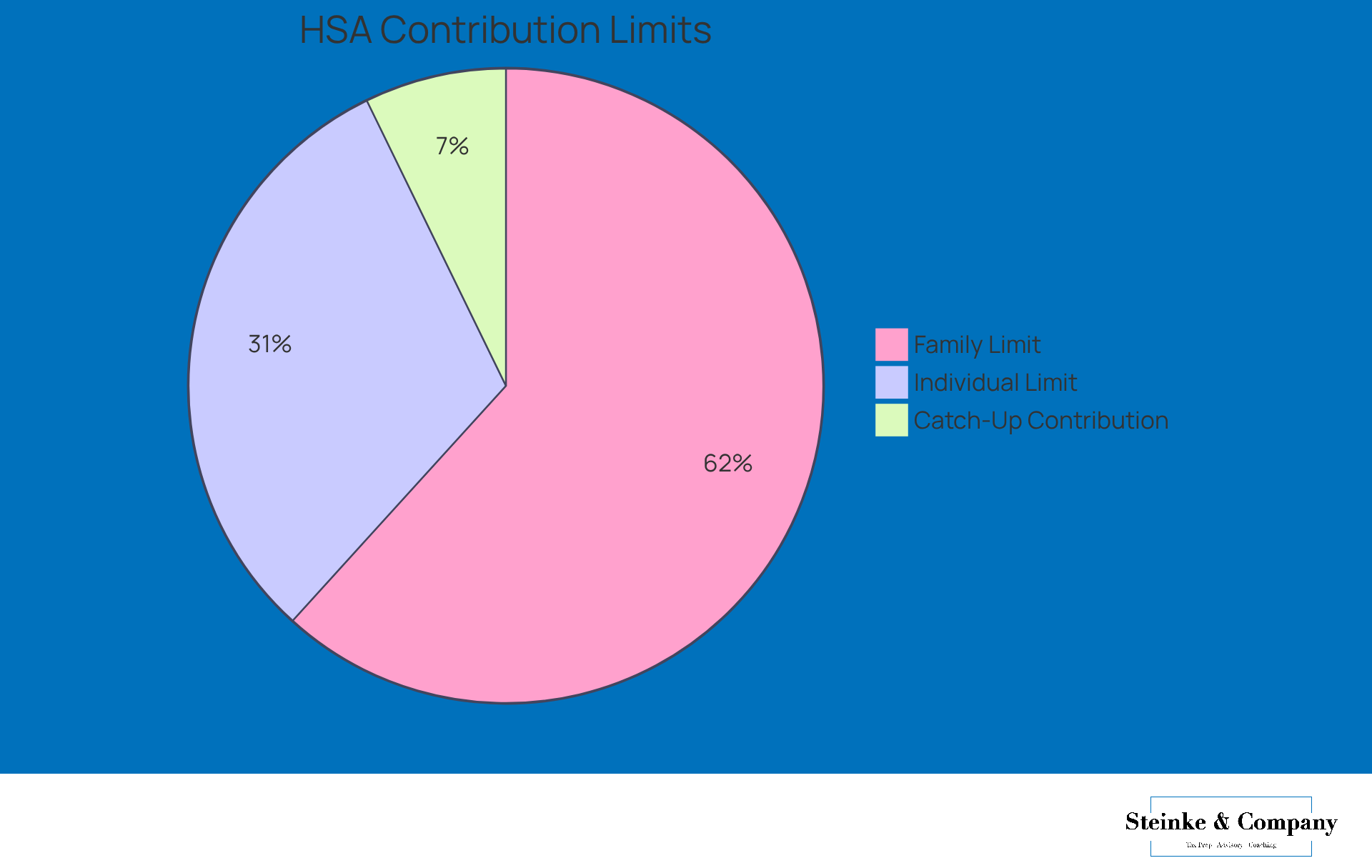

If you’re looking to contribute to a Health Savings Account (HSA), there are a couple of things you need to know. First off, you must be enrolled in a high-deductible health plan (HDHP) and can’t have other health coverage, except for a few specific types. The IRS sets yearly contribution limits, and for 2025, those limits are:

- $4,300 for individuals

- $8,550 for families

Plus, if you’re 55 or older, you can throw in an extra $1,000 as a catch-up contribution.

Now, if you’re a small business owner, it’s super important to ensure your health plans check the boxes for HDHPs so you can take full advantage of these benefits. Understanding these rules can really help you while keeping you compliant with tax regulations. So, let’s get those health plans sorted and make the most of what HSAs have to offer!

Examine Additional Benefits of Health Savings Accounts

When it comes to , understanding whether HSA contributions are deductible can greatly assist small business owners with their financial planning, as health savings accounts (HSAs) offer a whole lot more. For starters, the funds in an HSA can be invested, which means you can grow your savings over time—pretty handy for retirement planning, right? Plus, withdrawals for qualified medical expenses are tax-free, giving you some serious savings on out-of-pocket healthcare costs.

Another great perk? HSAs are portable! That means you can keep your account even if you switch jobs or health plans. This flexibility makes HSAs a fantastic option for small business owners and their employees, allowing them to manage healthcare costs while enjoying long-term savings potential. And if you’ve already maxed out other retirement-plan options, HSAs can be a valuable resource, offering a unique way to save with tax advantages.

Now, to qualify for an HSA, you need to be covered by a high-deductible health plan (HDHP) and meet a few specific criteria—like not being enrolled in Medicare. Each year, there are contribution limits, and if you’re 55 or older, you can contribute a little extra. For instance, in 2023, individuals can contribute up to $3,850, while families can go up to $7,750. So, HSAs really are a smart tool for maximizing those tax benefits, especially when considering if HSA contributions are deductible for boosting your retirement savings!

Conclusion

Health Savings Accounts (HSAs) are a fantastic way for small business owners to take charge of healthcare expenses while enjoying some pretty sweet tax benefits. By getting a handle on how HSA contributions can be deducted, you can lower your taxable income, boost employee benefits, and create a financial cushion for medical costs. This smart strategy not only helps with personal budgeting but also leads to a healthier workforce overall.

In this article, we’ve unpacked some key takeaways about HSAs, like:

- How contributions are tax-deductible

- Who qualifies with high-deductible health plans

- The extra perks these accounts bring—think investment options and portability

Plus, the chance for tax-free growth and withdrawals for qualified medical expenses really highlights why HSAs are such a valuable financial tool for both individuals and businesses.

So, why not take advantage of HSAs? They can help you make better financial choices and manage healthcare costs more effectively. Small business owners should definitely look into these accounts, keep up with contribution limits, and think about how HSAs can fit into their broader financial strategy. Embracing HSAs not only helps navigate the tricky waters of healthcare expenses but also sets your business up for long-term success and sustainability. Ready to dive in?

Frequently Asked Questions

What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged savings account designed for individuals enrolled in high-deductible health plans (HDHPs) to set aside money for eligible medical expenses.

What are the tax benefits of contributing to an HSA?

Contributions to HSAs are tax-deductible, and the funds can grow tax-free, providing a triple tax advantage that helps lower your taxable income while saving for healthcare costs.

Are there any income limits for contributing to an HSA?

No, qualified individuals can contribute to HSAs without any income limits.

Can individuals aged 55 or older contribute more to their HSAs?

Yes, individuals aged 55 or older can make extra contributions to boost their retirement savings.

What are ABLE accounts, and how do they relate to HSAs?

ABLE accounts offer similar benefits to HSAs for people with disabilities, allowing them to save for qualified expenses without risking their support.

How can HSAs and ABLE accounts assist small business owners with financial planning?

Understanding the contribution limits and smart ways to use HSAs and ABLE accounts can help small agency owners manage healthcare expenses effectively and enhance their financial planning.