Overview

Did you know that HSA contributions can be tax deductible for those of you enrolled in a qualified High Deductible Health Plan (HDHP)? This means you can lower your taxable income while enjoying tax-free growth and withdrawals for eligible medical expenses. In this article, we’ll dive into what you need to know about:

- Eligibility criteria

- Contribution limits

- The documentation required to claim these deductions

Understanding these factors is key to maximizing your financial benefits—so let’s get started!

Introduction

Health Savings Accounts (HSAs) are becoming quite the buzzword, especially for folks enrolled in high-deductible health plans. They’re not just a smart way to stash away cash for medical expenses; they also come with some pretty sweet tax perks. Since contributions to HSAs can be tax-deductible, it’s super important to get a handle on the ins and outs of eligibility, contribution limits, and the right paperwork to make the most of these benefits.

But here’s the kicker: many individuals and small business owners are still in the dark about the potential pitfalls and complexities tied to HSA contributions. So, how do you navigate these waters? Let’s dive in and explore how you can fully capitalize on the tax savings that HSAs offer!

Understand Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are a fantastic financial tool for anyone enrolled in high-deductible health plans (HDHPs). They let you save for medical expenses while enjoying some pretty sweet tax perks. To get in on the HSA action, you need to be enrolled in an HDHP, which, for 2025, means having a of $1,650 for self-only coverage and $3,300 for family coverage. The best part? It is important to know that contributions to HSAs are HSA contributions tax deductible, allowing you to lower your taxable income. Plus, the money in these accounts grows tax-free, giving you a triple tax benefit: the contributions are HSA contributions tax deductible, tax-free growth, and tax-free withdrawals for eligible medical expenses.

If you run a service-oriented business, HSAs can be a game changer. For example, a private practice physician can tap into HSA funds to cover out-of-pocket medical expenses, which helps lower overall healthcare costs while maximizing tax savings. In 2025, you can contribute up to $4,300 to your HSA, and households can contribute up to $8,550. That’s a lot of potential savings!

And here’s a little bonus: if you’re 55 or older, you can make an extra catch-up contribution of $1,000, which boosts your ability to save even more for healthcare expenses. As more people turn to HDHPs, understanding how HSAs work becomes super important for anyone looking to optimize their financial strategies. By making the most of HSAs, service-oriented professionals can manage healthcare expenses better and enjoy those tax benefits that come along with these accounts. So, why not consider how HSAs could work for you?

Identify Tax Deductibility Criteria for HSA Contributions

Want to know if HSA contributions are tax deductible? Let’s break it down! First up, Eligibility: You need to be enrolled in a qualified High Deductible Health Plan (HDHP). For 2025, that means your deductible should be at least $1,650 if you’re covering just yourself, or $3,300 for your family. Plus, you can’t have any other health coverage—there are a few exceptions to this rule—and you must be under 65 to qualify.

Next, we have Contribution Limits: For 2025, you can contribute a maximum of $4,300 if you’re an individual or $8,550 for families. And if you’re 55 or older, there’s a little bonus—an extra $1,000 catch-up payment! Just a heads-up: if you go over these limits, you might face a 6% excise tax on the excess.

Now, let’s talk about the Type of Contribution: It’s important to know that contributions made directly to your HSA are HSA contributions tax deductible, but if you’re using pre-tax payroll deductions, those don’t qualify for a deduction.

Finally, there’s Filing Status: It’s super important to report your contributions accurately on your tax return. Make sure to use IRS Form 8889 to claim your deduction effectively. By keeping these criteria in mind, small business owners can significantly reduce their taxable income and make the most of their HSA contributions.

It’s interesting to note that many small business owners aren’t fully tapping into these tax advantages. So, understanding and leveraging HSAs can really help with . Have you looked into your HSA benefits lately?

Track and Document Your HSA Contributions

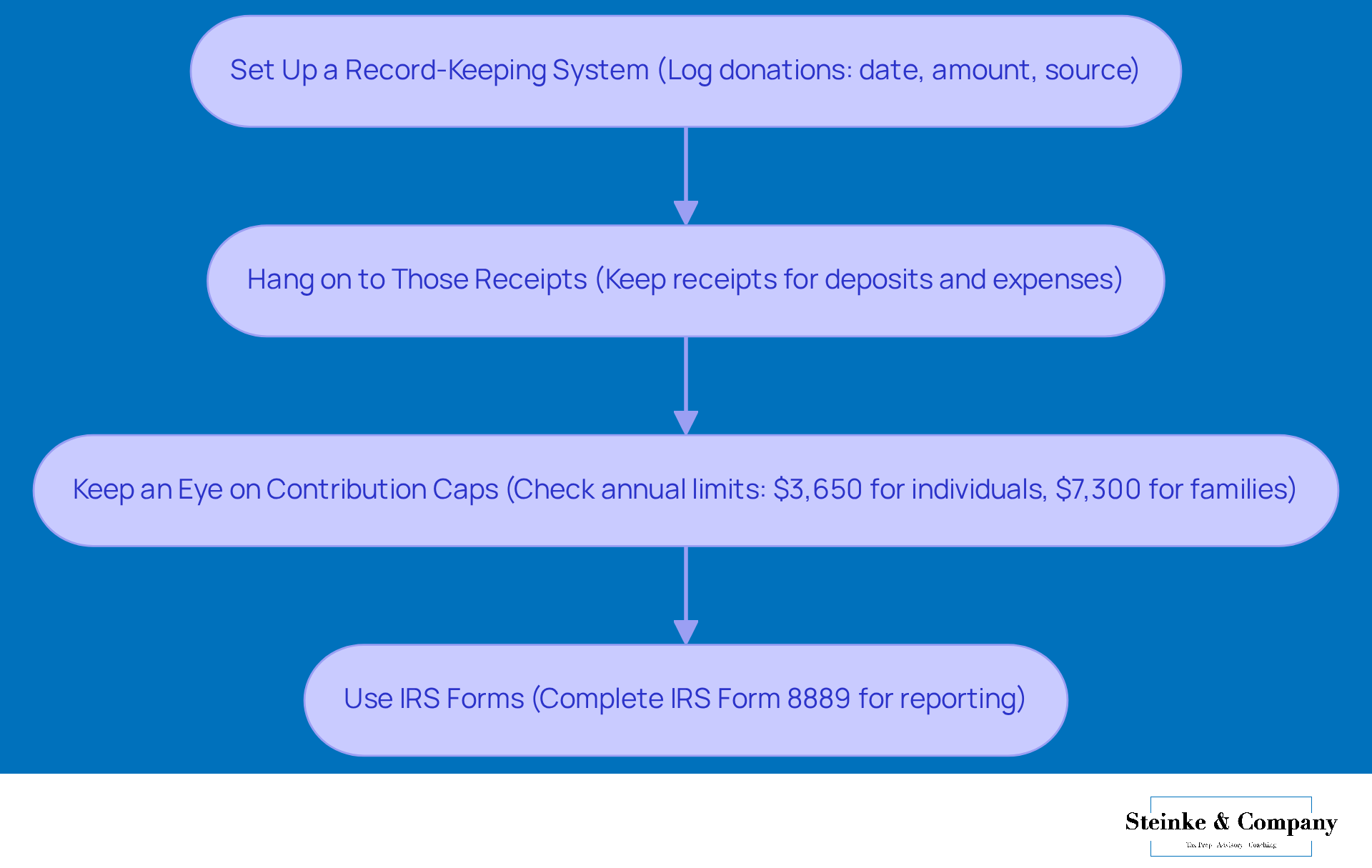

To keep track of your HSA contributions in a smooth and efficient way, here’s a friendly guide to help you out:

- Set Up a Record-Keeping System: Grab a spreadsheet or some financial software and start logging each donation. Make sure to note the date, amount, and where the money came from. This little habit will help you stay on top of your contributions and ensure you don’t go over the yearly limits.

- Hang on to Those Receipts: It’s super important to keep all receipts related to your HSA deposits and any qualified medical expenses. These documents are your best friends when it comes to tax season, helping you back up your claims and understand whether HSA contributions are tax deductible, potentially boosting your tax benefits.

- Keep an Eye on Contribution Caps: Regularly check your contributions against the annual limits. You definitely don’t want to go overboard and face any penalties! For 2022, remember that the max is $3,650 for individuals and $7,300 for families, plus an extra $1,000 catch-up contribution if you’re 55 or older.

- Use IRS Forms: Don’t forget about IRS Form 8889! It’s crucial for accurately reporting your donations and distributions. This form helps you claim your tax deduction and understand if HSA contributions are tax deductible while staying in line with IRS regulations.

And here’s a friendly reminder: keeping accurate records not only helps with your tax filings but also supports your overall financial planning. is key—it makes sure you know how your contributions fit into your broader financial picture. So, let’s get organized and make the most of those HSA benefits!

Avoid Common Mistakes in HSA Contributions

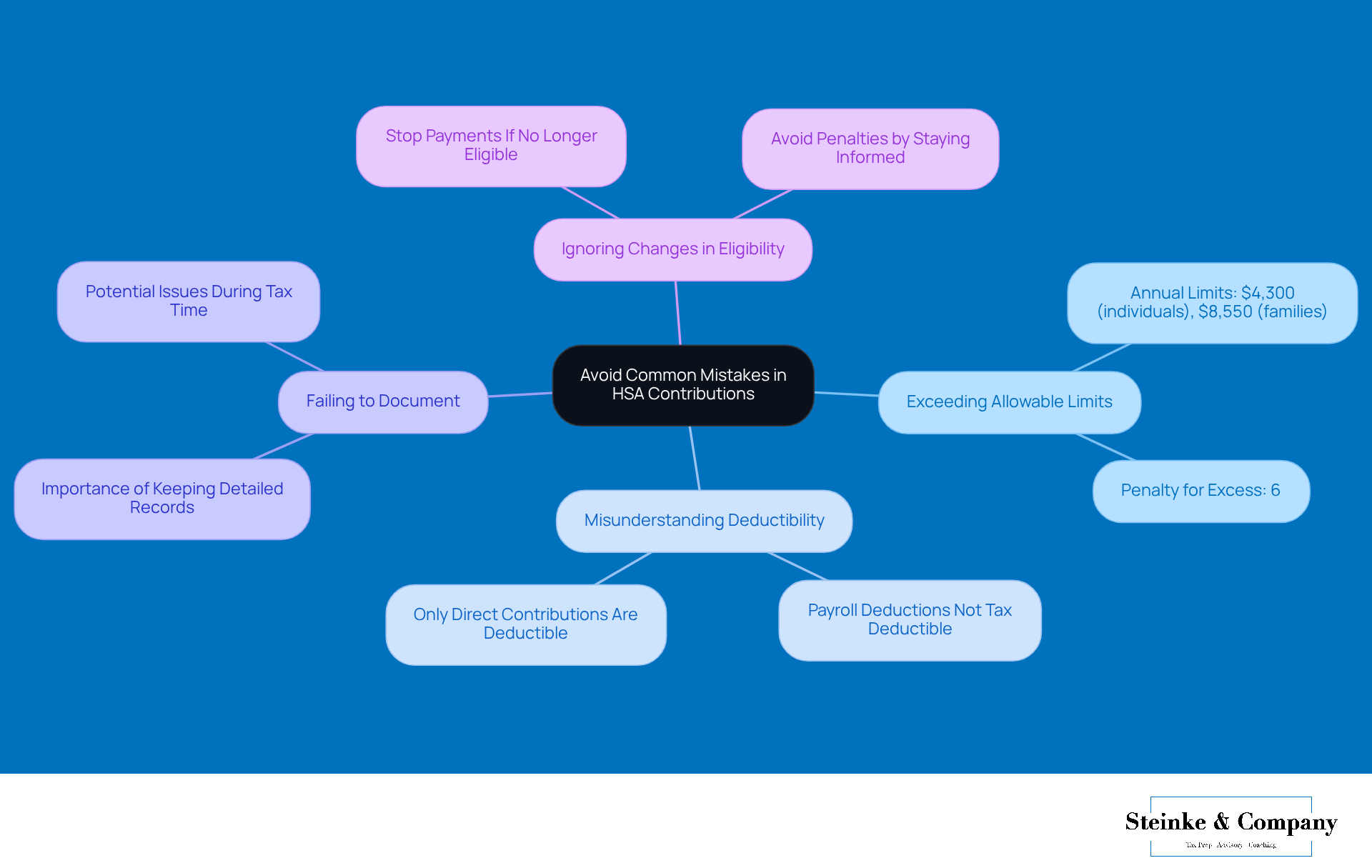

To steer clear of common pitfalls with HSA deposits, here are some handy tips to keep in mind:

- Exceeding Allowable Limits: Make sure you don’t go over the annual limits of $4,300 for individuals and $8,550 for families in 2025. If you do, those excess payments could hit you with a 6% penalty.

- Misunderstanding Deductibility: Just a heads-up—payments made through payroll deductions are not considered as HSA contributions tax deductible. Only direct contributions are HSA contributions tax deductible for that deduction.

- Failing to Document: It’s super important to keep detailed records of all your contributions and expenses. If you don’t, you might run into trouble when tax time rolls around.

- Ignoring Changes in Eligibility: If your health plan changes and you no longer qualify for an HSA, stop those payments right away to avoid any penalties.

By staying aware of these common mistakes, you can navigate your HSA contributions like a pro and keep things running smoothly!

Conclusion

Health Savings Accounts (HSAs) offer a fantastic chance for those of us with high-deductible health plans to enhance our financial strategies while reaping some great tax benefits. It's super important to get a handle on how HSA contributions can be tax-deductible, as this helps you lower your taxable income, grow your savings tax-free, and make tax-free withdrawals for qualified medical expenses. Who wouldn’t want that?

As we dive into this topic, we highlighted some key points about:

- Eligibility criteria

- Contribution limits

- The necessity of keeping accurate records

Remember, to snag those tax deductions, you need to be enrolled in an HDHP and stick to the contribution limits. Plus, keeping thorough documentation and being mindful of common pitfalls can save you from costly mistakes and help you fully enjoy the perks of your HSAs.

So, as healthcare costs keep climbing, using HSAs smartly is becoming more crucial than ever. It’s time for individuals and families to take proactive steps to understand the ins and outs of HSA rules and best practices. By maximizing your contributions and tax deductions, you can not only protect your financial future but also improve your overall healthcare management. Embracing the potential of HSAs isn’t just a financial move; it’s a step towards better health and financial security. Let’s make the most of it together!

Frequently Asked Questions

What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a financial tool for individuals enrolled in high-deductible health plans (HDHPs) that allows them to save for medical expenses while benefiting from tax advantages.

What are the eligibility requirements for opening an HSA?

To open an HSA, you must be enrolled in a high-deductible health plan (HDHP), which, for 2025, requires a minimum deductible of $1,650 for self-only coverage and $3,300 for family coverage.

What are the tax benefits of contributing to an HSA?

Contributions to HSAs are tax-deductible, reducing your taxable income. Additionally, the money in these accounts grows tax-free, and withdrawals for eligible medical expenses are also tax-free, providing a triple tax benefit.

What are the contribution limits for HSAs in 2025?

In 2025, individuals can contribute up to $4,300 to their HSA, while households can contribute up to $8,550.

Is there an additional contribution option for older individuals?

Yes, individuals aged 55 or older can make an extra catch-up contribution of $1,000, allowing them to save more for healthcare expenses.

How can HSAs benefit service-oriented businesses?

HSAs can help service-oriented businesses, such as private practice physicians, cover out-of-pocket medical expenses, thereby lowering overall healthcare costs and maximizing tax savings.

Why is it important to understand HSAs?

As more people enroll in high-deductible health plans, understanding HSAs becomes crucial for optimizing financial strategies and managing healthcare expenses effectively.