Overview

Hey there! Did you know that health insurance payments can be a game changer for small businesses? They’re generally tax deductible, which means you can lower your taxable income and ultimately reduce your tax bill. Pretty neat, right?

Now, here’s the scoop: while premiums for employee coverage are deductible, there are some specific criteria you need to meet. For instance, you’ve got to be part of a qualified medical plan and keep proper documentation. It might sound a bit tedious, but trust me, it can really help small business owners like you manage your tax strategies effectively. So, why not take advantage of this opportunity and see how it can benefit your bottom line?

Introduction

Navigating the financial landscape for small businesses can feel a bit like wandering through a maze, especially when it comes to those tricky tax regulations around health insurance payments. These payments are crucial—they not only provide essential coverage for your employees but also open up a fantastic opportunity for tax deductions that can lighten your financial load.

But let’s be honest: figuring out which payments qualify for those deductions and what criteria you need to meet can leave many business owners scratching their heads.

So, how can small businesses like yours make the most of health insurance payments to fine-tune your tax strategies and boost your overall financial health?

Define Health Insurance Payments and Their Tax Deductibility

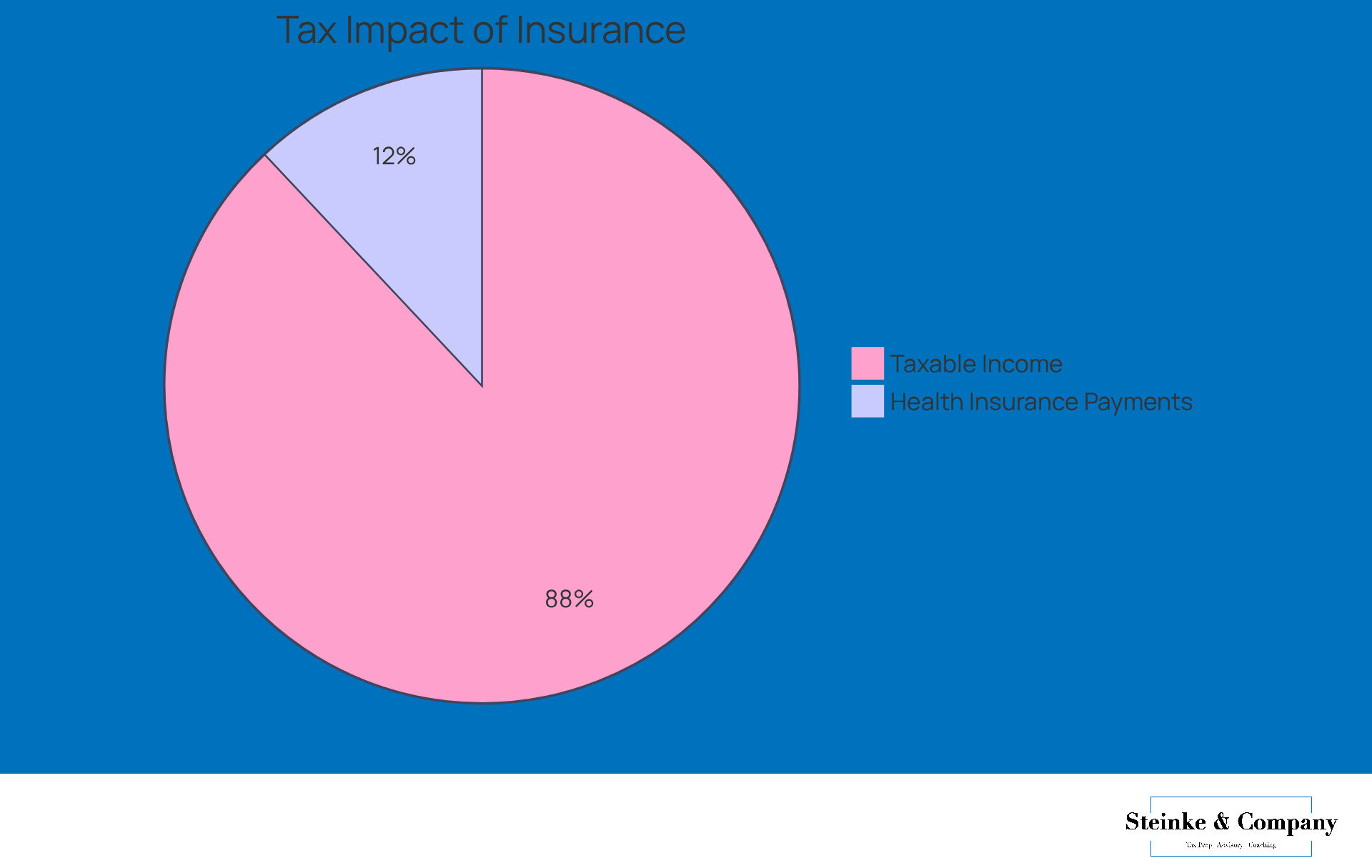

Health insurance payments are those premiums that individuals or companies fork over to secure health coverage for themselves or their employees. For small businesses, it is important to know if health insurance payments are tax deductible, as this can often lower the taxable income and reduce the overall tax bill. This can be a real game-changer for small business owners, leading to . For instance, if a small business owner pays $10,000 in medical premiums, they could potentially reduce their taxable income by that same amount, resulting in significant tax savings depending on their tax rate.

Now, let’s talk about the tax perks associated with health insurance. They play a crucial role in encouraging small businesses to offer wellness benefits to their teams. By providing medical coverage, companies not only boost employee satisfaction and retention but also position themselves more competitively in the job market. Interestingly, recent data shows that the percentage of small businesses offering wellness benefits has dropped from 59.5% in 2010 to 52.6% in 2023. This highlights just how important tax incentives are to help these businesses keep up their health offerings.

Tax experts stress the importance of understanding if health insurance payments are tax deductible regarding the specific tax implications of medical coverage premiums. For example, while payments for employee medical coverage are generally deductible as a business expense, payments for non-employee shareholders aren’t. This distinction can really impact a small business's tax strategy. As one expert pointed out, "Navigating the intricacies of medical deductions is crucial for optimizing tax advantages and ensuring adherence to tax regulations."

In the grand scheme of things, the impact of medical expense tax deductions on small business tax liability can be quite significant. These deductions can empower owners to allocate more resources toward growth and employee well-being. By taking advantage of these deductions, small businesses can not only enhance their financial health but also cultivate a happier, healthier workforce.

Contextualize Health Insurance Payments in Canada

In Canada, medical coverage is mainly provided through a publicly funded system that includes essential healthcare services. But here’s the kicker—many Canadians choose to get private coverage for those extra services that the public framework doesn’t cover. For small businesses in Canada, the premiums they pay for employee coverage are health insurance payments tax deductible, similar to the U.S. Furthermore, many self-employed individuals can also deduct private health insurance premiums for themselves and their families, which is a crucial point for tax planning.

This is where proactive tax planning services from Steinke and Company come into play. By meeting just 1-3 times a year to review tax returns and current financials, small agency owners can uncover those hidden opportunities and craft tailored strategies to reduce their tax burden while encouraging growth. Plus, the cost difference between U.S. and Canadian employers for similar healthcare coverage is significant, which can impact small businesses working with Canadian clients or partners.

Understanding the is essential. For instance, entitlement to paid vacation and statutory holidays differs from the U.S. system, highlighting the various methods of coverage and tax deductibility across borders. This knowledge can really help companies navigate their obligations and fine-tune their tax strategies effectively. So, how are you planning to optimize your approach?

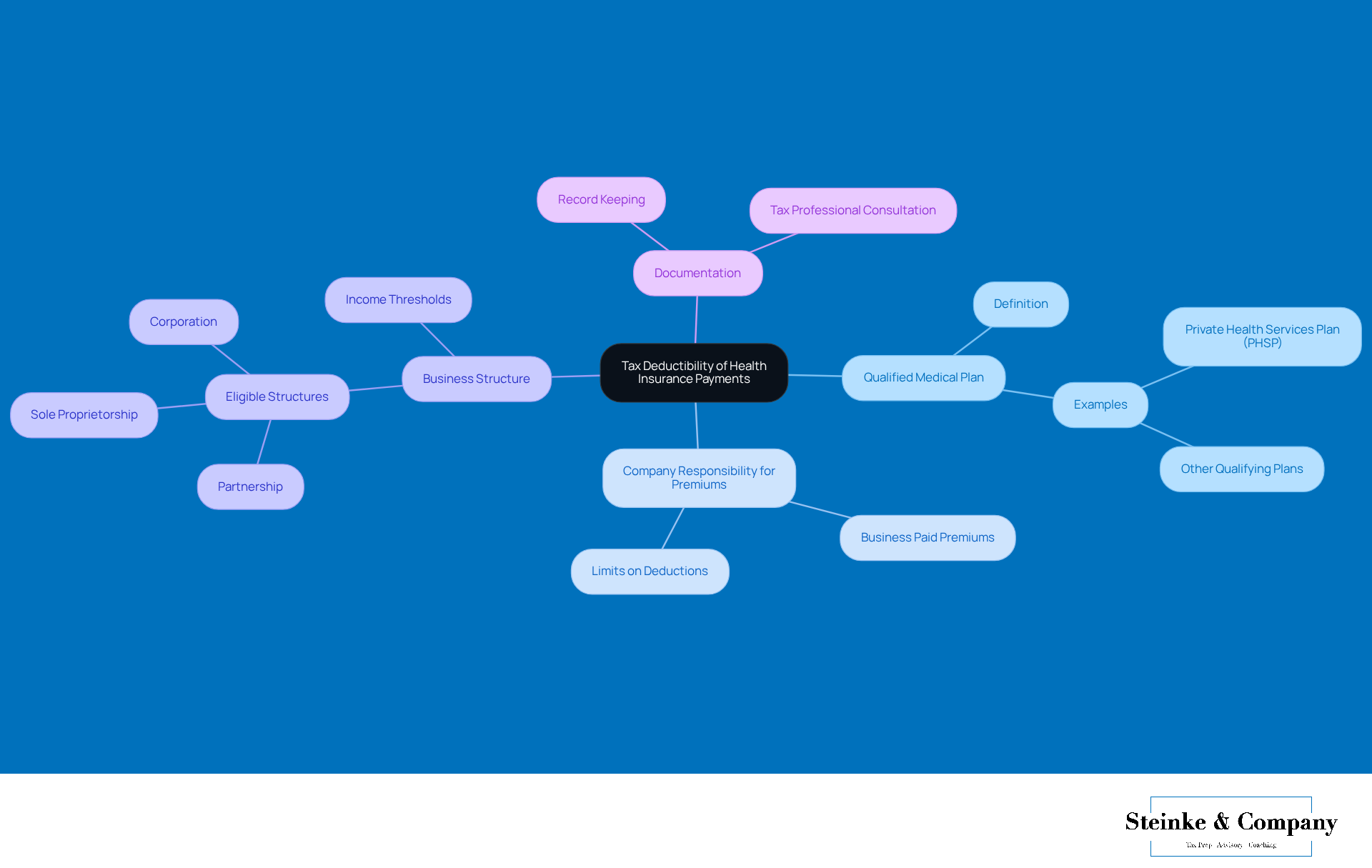

Identify Criteria for Tax Deductibility of Health Insurance Payments

To qualify for tax deductibility, it is essential to determine if health insurance payments are tax deductible and meet certain specific criteria. First off, these payments should be for a qualified medical plan, and the company has to be responsible for the premiums. It's also important to note that the business structure matters; it needs to be a sole proprietorship, partnership, or corporation to claim these deductions.

According to the current IRS guidelines, the question of whether health insurance payments are tax deductible can be answered affirmatively if you can deduct medical coverage premiums as part of a Private Health Services Plan (PHSP) or another qualifying plan. For instance, if you're self-employed and chip in $2,000 each year for your medical coverage, you can subtract that amount from your taxable income, which might help you save on taxes. Pretty neat, right?

But here’s a tip: to really maximize those deductions, it’s a good idea for small business owners to chat with a tax professional. They can help ensure you meet all the necessary criteria and navigate the sometimes tricky tax laws. Plus, don’t forget to keep thorough documentation of all your medical payments. You might need it for or if you ever face an audit.

Provide Examples of Claiming Health Insurance Payments on Taxes

Hey there, small business owners! Did you know that one of the benefits you can enjoy is that health insurance payments are tax deductible? They can help you understand how health insurance payments are tax deductible, which can lower your taxable income and overall tax bill. For example, imagine a business owner shelling out $12,000 a year for medical coverage premiums for themselves and their team. If their business is pulling in $100,000 in revenue, that deduction brings their taxable income down to $88,000, which means a smaller tax bill—pretty neat, right?

Now, let’s say you’re in a partnership where each person takes care of their own medical coverage. In that case, each partner can deduct their premiums on their individual tax returns, as long as they meet the eligibility requirements. This approach not only eases the financial burden of medical coverage but also gives a nice .

And here’s a fun fact: case studies show just how beneficial these deductions can be. Take a small restaurant owner, for instance, who pays $15,000 in medical coverage premiums. They can deduct that amount, which effectively lowers their taxable income and cuts down their tax obligation. Similarly, a consulting firm that provides medical coverage for its employees can subtract the total premiums paid, leading to some significant tax savings.

Accountants often emphasize the importance of understanding these deductions. They’re crucial for a small business’s financial strategy! By understanding whether health insurance payments are tax deductible, small business owners can stay compliant with tax regulations while optimizing their tax outcomes. So, it’s really important to keep yourself updated on the eligibility criteria and the necessary paperwork for these deductions. Trust me, it’s worth it!

Conclusion

Understanding the tax deductibility of health insurance payments is super important for small businesses looking to optimize their financial strategies. When business owners realize that these payments can significantly lower their taxable income, they can really take advantage of this opportunity to improve their tax position and invest more in their teams. The potential for big savings highlights just how crucial it is to be informed about the ins and outs of health insurance tax regulations.

Throughout this article, we’ve shared some key insights about:

- What qualifies for tax deductibility

- How health insurance payments affect business expenses

- The specific rules that apply to different business structures

We also touched on the evolving landscape of employee benefits and why it’s essential for small businesses to tweak their offerings in light of tax incentives. By staying informed and proactive, small business owners can navigate the complexities of tax laws with confidence.

So, what’s the takeaway? Taking advantage of health insurance tax deductions isn’t just about ticking boxes for compliance; it’s about empowering small businesses to flourish. By collaborating with tax professionals and keeping thorough documentation, business owners can maximize their benefits and cultivate a healthier, happier workforce. Embracing these strategies not only boosts financial health but also helps businesses stand out in the marketplace.

Frequently Asked Questions

What are health insurance payments?

Health insurance payments are the premiums that individuals or companies pay to secure health coverage for themselves or their employees.

Are health insurance payments tax deductible for small businesses?

Yes, health insurance payments can be tax deductible for small businesses, which can lower their taxable income and reduce their overall tax bill.

How can tax deductions from health insurance payments benefit small business owners?

Tax deductions from health insurance payments can lead to substantial savings for small business owners, allowing them to reduce their taxable income and potentially save a significant amount on taxes.

What impact do health insurance payments have on employee satisfaction?

Providing medical coverage through health insurance can boost employee satisfaction and retention, making companies more competitive in the job market.

Has the percentage of small businesses offering wellness benefits changed recently?

Yes, the percentage of small businesses offering wellness benefits has decreased from 59.5% in 2010 to 52.6% in 2023.

What is the significance of understanding the tax implications of health insurance payments?

Understanding the tax implications is crucial for small businesses, as payments for employee medical coverage are generally deductible, while payments for non-employee shareholders are not, affecting tax strategy.

How can medical expense tax deductions impact small business tax liability?

Medical expense tax deductions can significantly reduce a small business's tax liability, enabling owners to allocate more resources toward growth and employee well-being.