Overview

Did you know that health plan premiums can actually be tax deductible for small businesses? This is especially true for self-employed folks and businesses that offer medical coverage to their employees, as long as they meet certain conditions. It’s pretty neat how these deductions can really help cut down on taxable income!

Understanding tax regulations and keeping your documentation in check is super important to make the most of these financial benefits. So, if you’re a small business owner, it might be worth looking into!

Introduction

Understanding the ins and outs of health plan premiums is super important for small business owners trying to navigate the tricky world of insurance costs and tax obligations. These premiums not only affect your operational expenses but also open up some great opportunities for tax deductions.

But here’s the big question: are health plan premiums really tax deductible? Let’s dive into this topic together, exploring the eligibility criteria, regulations, and practical examples that can help you optimize your financial strategies.

Define Health Plan Premiums and Their Importance

Insurance plan costs are essentially the regular contributions you make to an insurer for medical insurance protection. These costs can vary quite a bit based on several factors, like the type of plan you choose, the extent of coverage you need, and even the age and health condition of those insured.

For small business owners, getting a grip on insurance plan costs is super important, as these expenses can really impact overall operational costs and financial strategies. Plus, understanding how these costs relate to whether health plan premiums are is key for optimizing tax obligations and keeping in line with tax regulations.

By managing insurance costs effectively, small businesses can ease their financial burden and boost their overall operational efficiency.

So, how do you handle your insurance costs? It might be worth taking a closer look!

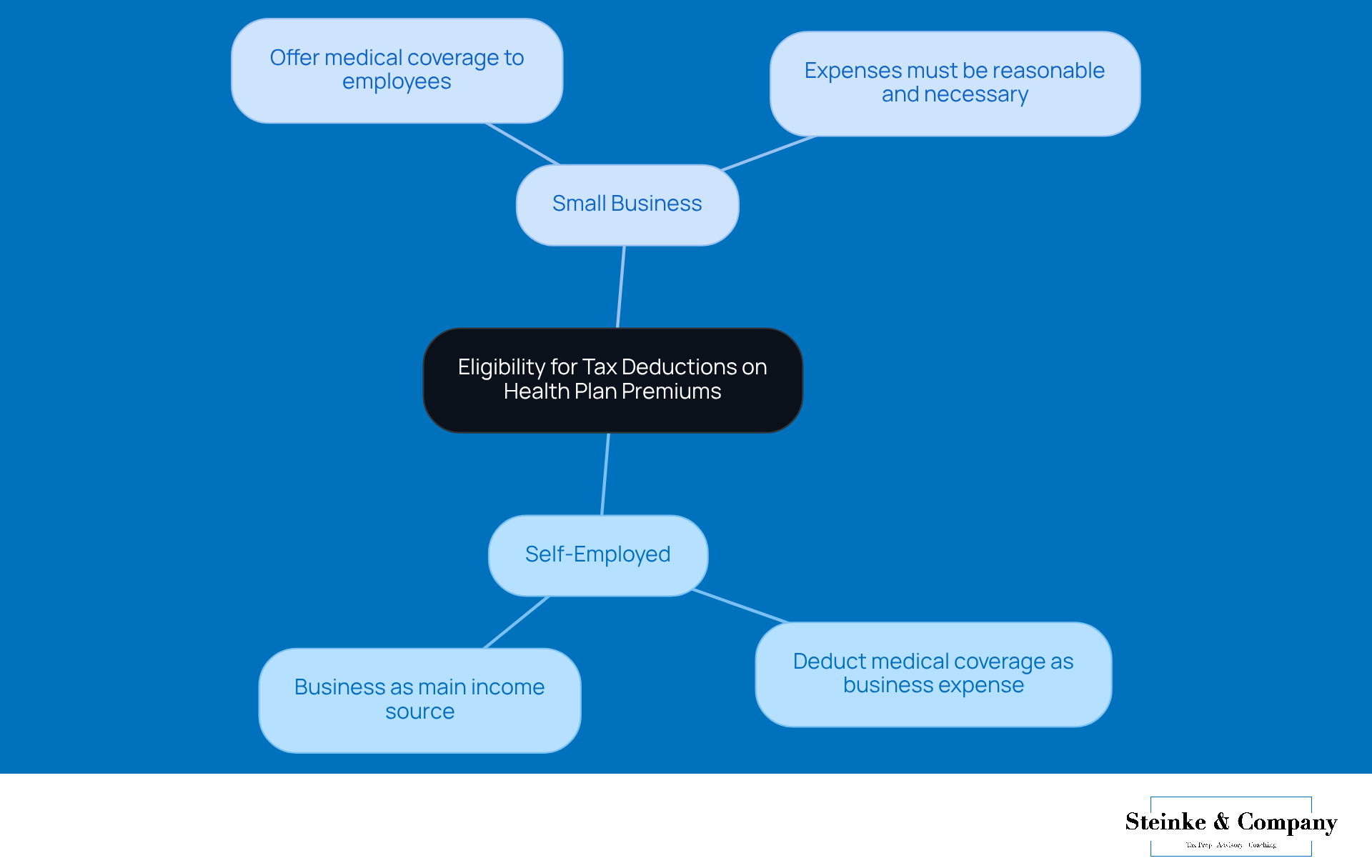

Identify Eligibility for Tax Deductions on Health Plan Premiums

When it comes to qualifying for on your insurance plan costs, it really depends on whether health plan premiums are tax deductible and how your organization is structured along with the type of payments you're making. For instance, if you're self-employed, you can typically deduct the costs of your medical coverage as a business expense, leading to the question of whether health plan premiums are tax deductible, as long as your business is your main source of income. Pretty neat, right?

Now, if you run a small business that offers medical coverage to your employees, you can also consider whether health plan premiums are tax deductible as operational expenses. Just remember, it’s important to ensure that these fees are considered reasonable and necessary for your operations to qualify for those deductions. So, keep that in mind as you navigate through your tax planning!

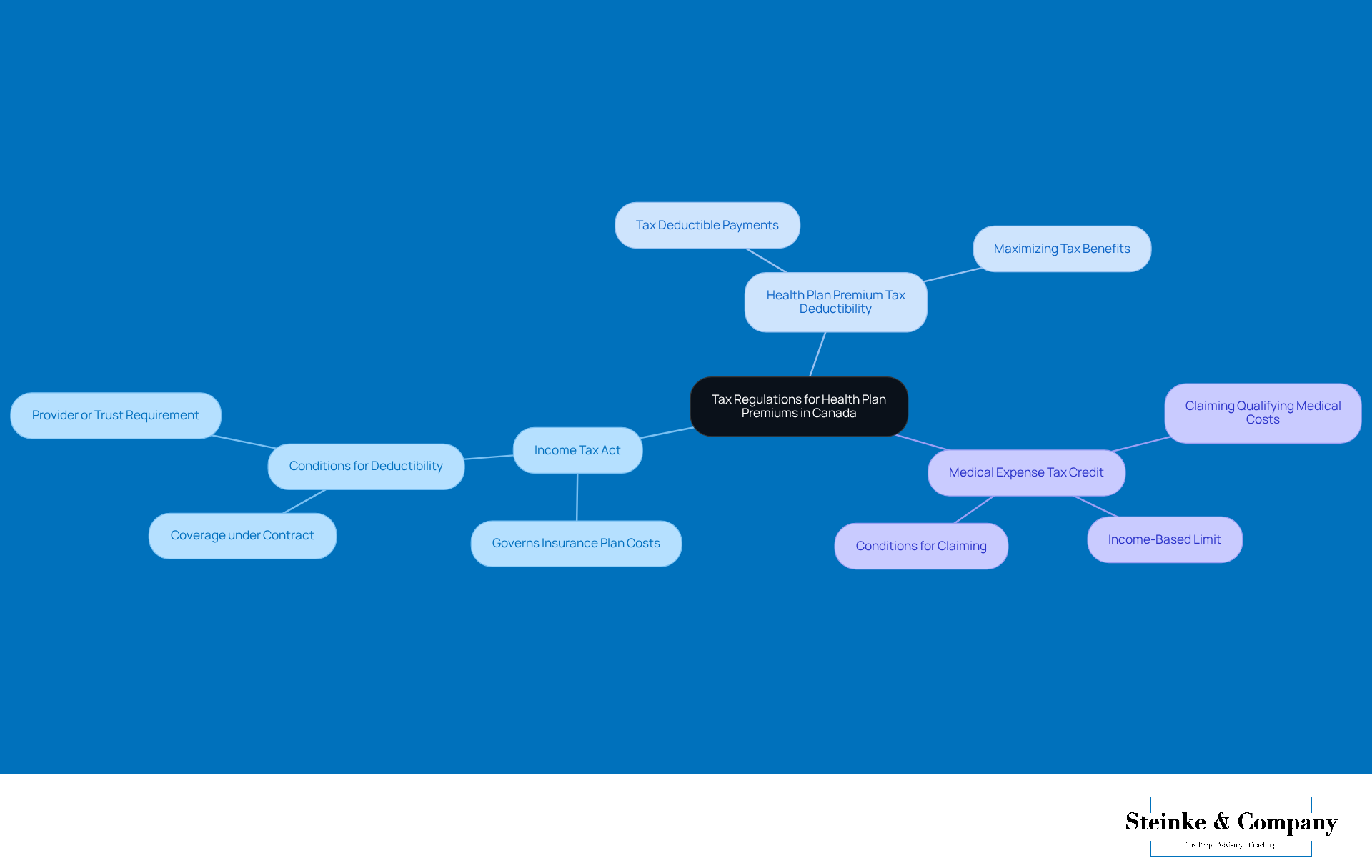

Examine Tax Regulations for Health Plan Premiums in Canada

In Canada, the tax regulation of insurance plan costs is governed by the Income Tax Act. Generally, if you’re making payments for private medical services plans (PHSP), you can subtract those from your business revenue, particularly when considering if health plan premiums are health plan premiums tax deductible—pretty handy, right? Just keep in mind that there are a few conditions to meet. For example, the coverage needs to be under a contract with a provider or a trust.

Also, don’t forget about the Medical Expense Tax Credit! This allows individuals to claim qualifying medical costs, including those pesky medical coverage fees, as long as they exceed a specific limit based on your income, and are health plan premiums tax deductible. Understanding these regulations is super . It helps you maximize your tax benefits while staying compliant with the law. So, why not dive in and make sure you’re getting the most out of your situation?

Illustrate Claiming Deductions: Practical Examples and Scenarios

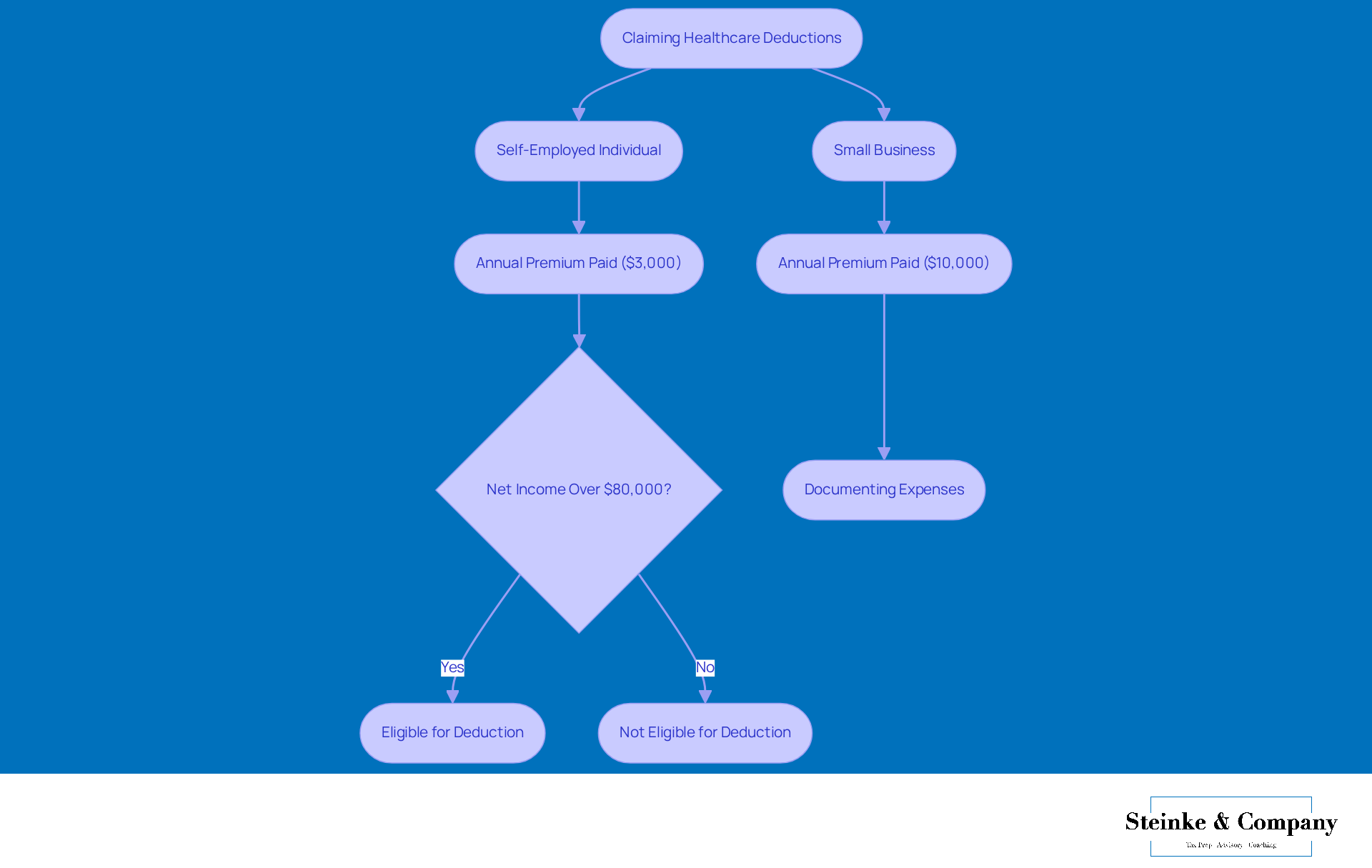

Let’s dive into how you can claim deductions for healthcare plan costs, particularly discussing whether health plan premiums are tax deductible with a couple of relatable examples.

Picture this: a self-employed graphic designer forks out $3,000 a year for medical coverage. Since this is their main gig, they can deduct that entire amount from their taxable income, which helps to lower their overall tax bill. Pretty neat, right?

Now, consider a small consulting firm that spends $10,000 on health insurance premiums for its employees. This expense can be , as long as it’s reasonable and well-documented. Keeping track of those records and receipts is super important for entrepreneurs who want to maximize their deductions and stay on the right side of tax laws.

For instance, if a self-employed individual has a net income of $80,000, deducting their medical coverage costs can significantly shrink their taxable earnings. By grasping these scenarios and maintaining meticulous records, small business owners can confidently navigate the sometimes tricky waters of understanding if health plan premiums are tax deductible.

So, are you ready to tackle your own deductions?

Conclusion

Understanding the tax implications of health plan premiums is super important for small businesses looking to optimize their financial strategies. This article shines a light on the significance of health plan premiums, showing how they can affect operational costs and tax obligations. By getting a handle on the details of tax deductions related to health insurance, small business owners can make savvy decisions that really benefit their bottom line.

So, what are the key insights? Well, it starts with eligibility for tax deductions based on your business structure, dives into the specific regulations governing health plan premiums in Canada, and even shares practical examples of how to claim those deductions effectively. If you're self-employed or run a small business that offers health coverage to employees, these deductions can help you significantly reduce your taxable income. And let's not forget, keeping accurate records and understanding the tax regulations is crucial—it plays a big role in maximizing those potential benefits.

Ultimately, small business owners are encouraged to actively explore their options for health plan premium deductions. By staying informed and compliant with tax regulations, you can not only lighten your financial load but also boost your overall operational efficiency. Taking the time to navigate these aspects can lead to some serious savings, making it a worthwhile endeavor for any small business owner. So, why not dive in and see what you can discover?

Frequently Asked Questions

What are health plan premiums?

Health plan premiums are the regular contributions you make to an insurer for medical insurance protection.

What factors can affect the cost of health plan premiums?

The cost of health plan premiums can vary based on the type of plan chosen, the extent of coverage needed, and the age and health condition of those insured.

Why is it important for small business owners to understand insurance plan costs?

For small business owners, understanding insurance plan costs is crucial as these expenses can significantly impact overall operational costs and financial strategies.

How do health plan premiums relate to tax obligations?

Understanding how health plan premiums are related to tax deductions is key for optimizing tax obligations and ensuring compliance with tax regulations.

What are the potential benefits of managing insurance costs effectively for small businesses?

By managing insurance costs effectively, small businesses can reduce their financial burden and improve their overall operational efficiency.