Overview

Did you know that health insurance premiums can be tax-deductible for small business owners? If you're self-employed, you can actually deduct 100% of your premiums from your taxable income, as long as you have a net profit. How cool is that? This article dives into the eligibility criteria for these deductions and explores potential tax savings. Plus, it touches on options like Health Savings Accounts (HSAs), which can give your business even more tax benefits. So, if you're looking to save some money, this is definitely worth considering!

Introduction

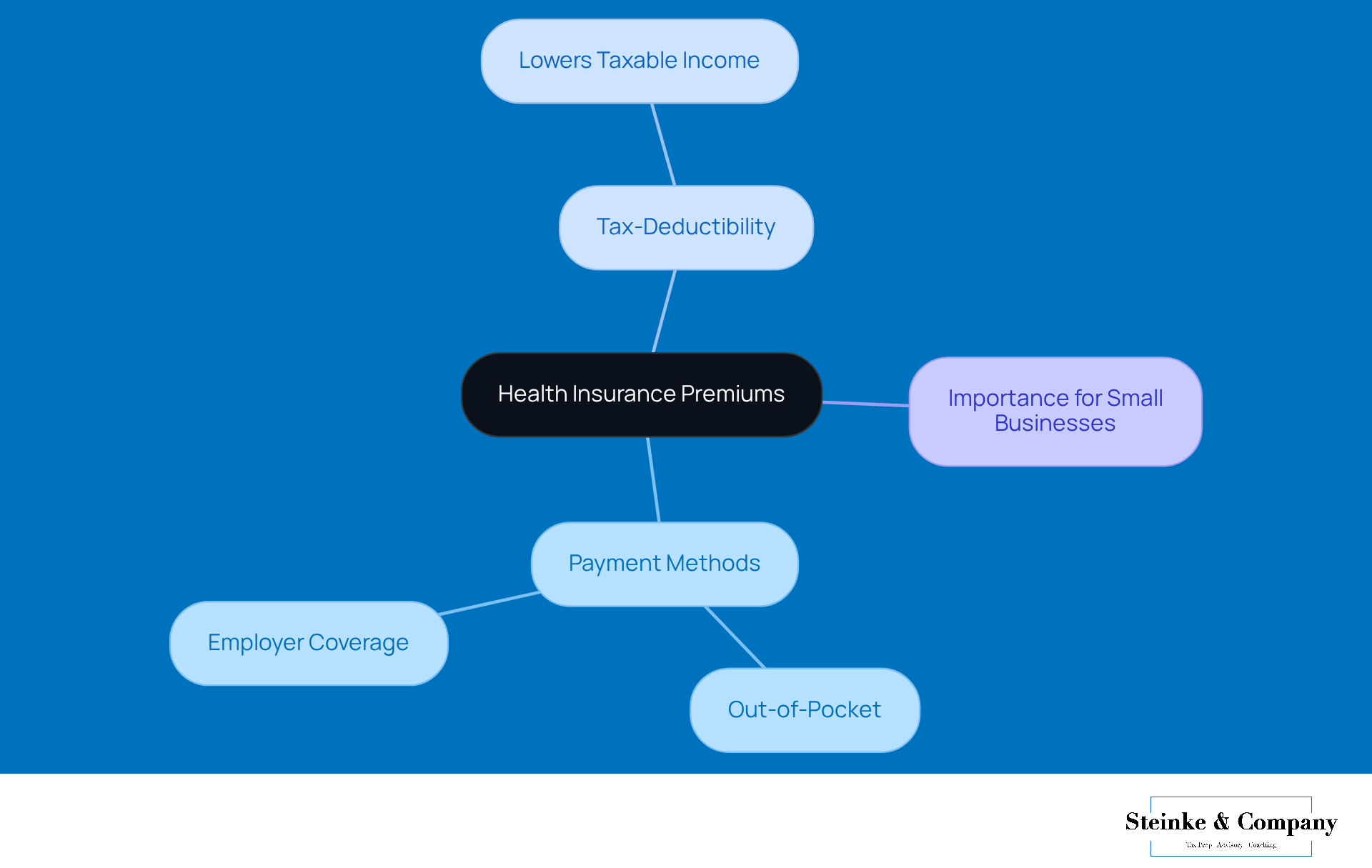

Understanding the ins and outs of health insurance premiums can really change the game for small business owners dealing with the tricky world of taxes. These premiums might actually help lower taxable income, making tax savings a hot topic for financial planning.

But here’s the big question: are health insurance premiums really tax-deductible? And what does that mean for small businesses? Diving into this important connection not only uncovers the perks but also the potential pitfalls that could affect a business’s bottom line.

Define Health Insurance Premiums and Their Role in Taxation

Insurance costs are basically what you pay for medical coverage, usually every month. These payments can come from your pocket or your employer might cover them for you.

Now, here’s something interesting: in the world of taxes, it’s crucial to understand whether health insurance premiums are health insurance premiums tax-deductible. This means they can lower your taxable income, which can lighten your overall tax load.

Understanding this connection is super important for small business owners, as it can really shape their .

So, have you thought about how this might affect your own situation?

Identify Eligibility Criteria for Tax-Deductible Health Insurance Premiums

If you're a small business owner looking to save on taxes, you might be wondering whether health insurance premiums are tax-deductible. Well, you're in luck! Generally, self-employed individuals can deduct 100% of their insurance costs from their taxable income, leading to the inquiry about whether health insurance premiums are tax-deductible, provided they have a net profit for the year. And guess what? You can also .

Now, if your business offers medical insurance to employees, those payments can be deducted as a company expense too! Just remember, it’s crucial to ensure that your insurance plan meets the IRS requirements to confirm whether health insurance premiums are tax-deductible. So, make sure you're on top of that to take full advantage of the benefits!

Examine Benefits and Limitations of Deducting Health Insurance Premiums

One of the biggest perks of knowing whether health insurance premiums are tax-deductible is that it can really help lower your taxable income. This means potential for small business owners like you! Plus, offering wellness benefits can boost employee satisfaction and retention.

But, let’s keep it real—there are some limitations to think about. For example:

- The question of whether health insurance premiums are tax-deductible is only relevant if you itemize your deductions.

- There might be caps on how much you can deduct based on your income.

- Tax regulations can change, which might affect your eligibility and how much you can deduct.

So, it’s super important to stay in the loop about these updates!

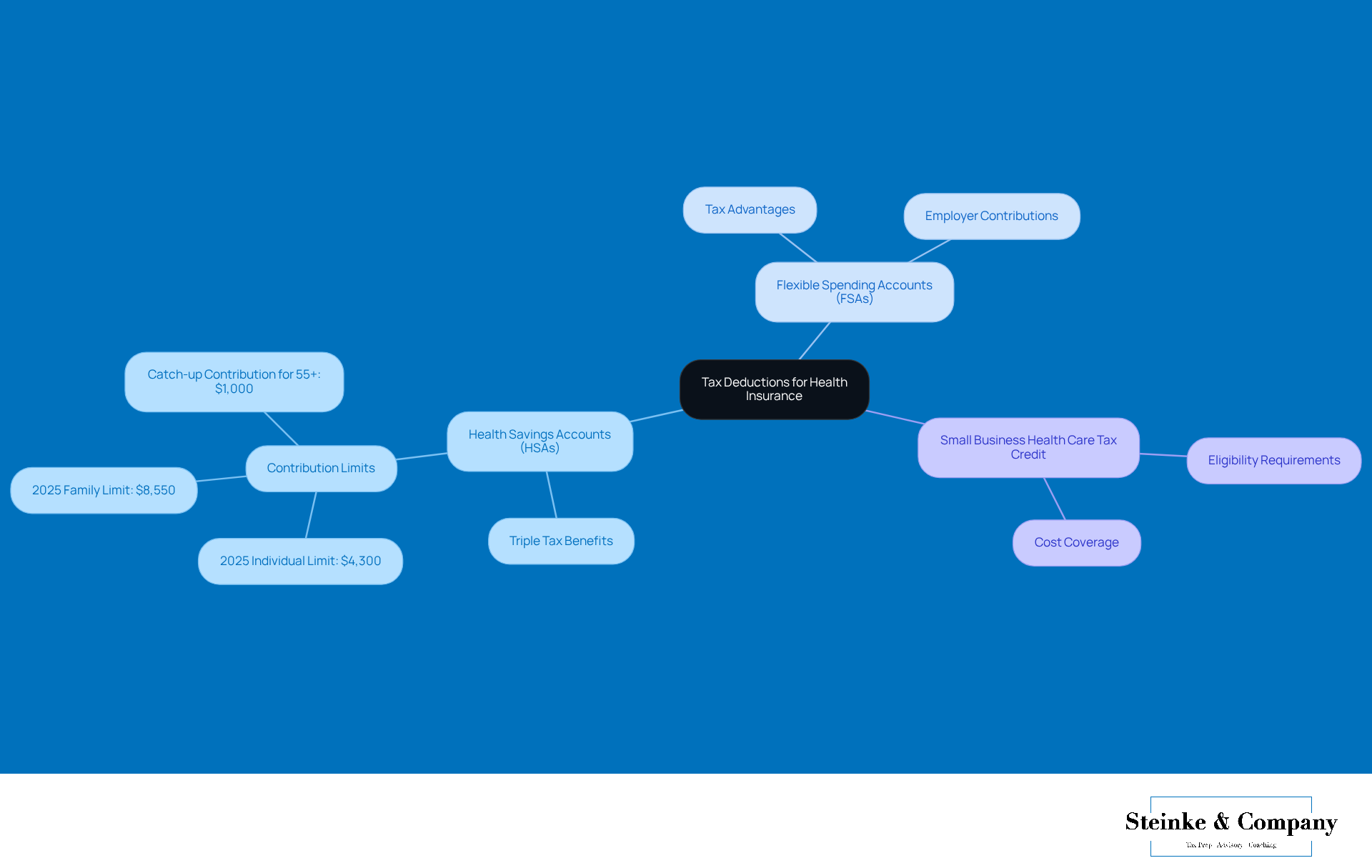

Explore Related Tax Deductions and Considerations for Health Insurance

When it comes to managing medical insurance costs, small business owners have some great options to explore, like Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts let you set aside pre-tax dollars for medical expenses, which can really help lower your taxable income. Did you know that HSAs come with triple tax benefits? That’s right—tax-free contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses! For 2025, you can contribute up to $4,300 to your HSA if you’re an individual, or up to $8,550 for families. Plus, if you’re 55 or older, there’s an extra catch-up contribution of $1,000 available.

But wait, there’s more! If your small business offers health insurance, you might qualify for the Small Business Health Care Tax Credit, which can significantly cut down your costs, particularly if you understand how health insurance premiums are health insurance premiums tax-deductible. This credit is especially helpful for businesses with fewer than 25 full-time equivalent employees, as it can cover up to 50% of the premiums you pay. By understanding whether health insurance premiums are health insurance premiums tax-deductible, you can really optimize your tax strategy and maximize your savings potential.

You might be surprised to learn that many small businesses are now as part of their employee benefits. Not only does this boost employee satisfaction, but it also provides tax advantages for the business. For example, any contributions that employers make to HSAs are tax-deductible, which can further lower the overall taxable income for the organization. So, including HSAs and FSAs in your tax planning strategy is a smart move if you want to navigate the complexities of tax regulations while keeping your finances healthy.

Conclusion

Understanding the tax implications of health insurance premiums is super important for small business owners who want to make the most of their financial strategies. The chance for tax deductions can really make a difference in overall taxable income, helping businesses allocate resources more effectively while still providing essential benefits to their employees.

This article shares some key insights about who can take advantage of tax-deductible health insurance premiums. For instance:

- Self-employed individuals can deduct 100% of their premiums.

- Employee insurance costs can be deducted as a business expense.

Plus, there are great benefits to these deductions, like lower taxable income and happier employees. Of course, there are some limitations that might affect who qualifies and how much can be deducted.

Navigating the ins and outs of health insurance and its tax implications is crucial for small businesses. By staying up-to-date on eligibility requirements and potential deductions, business owners can use these financial tools not just to lighten their tax load, but also to boost their overall business health. Strategies like Health Savings Accounts and understanding available tax credits can really help create a solid financial plan, ensuring that businesses not only thrive but also support their employees’ well-being. So, why not take a closer look at these options and see how they can work for you?

Frequently Asked Questions

What are health insurance premiums?

Health insurance premiums are the costs you pay for medical coverage, typically on a monthly basis. These payments can be made directly from your pocket or covered by your employer.

Are health insurance premiums tax-deductible?

Yes, health insurance premiums can be tax-deductible, meaning they can reduce your taxable income and potentially lower your overall tax burden.

Why is understanding health insurance premiums important for small business owners?

Understanding health insurance premiums is crucial for small business owners because it can significantly influence their financial planning and tax strategies.