Overview

This article dives into the world of retirement accounts, specifically comparing the tax rates and benefits of 401(k) plans with others out there. You’ll find that 401(k)s really shine with their higher contribution limits and the potential for employer matching—talk about a boost for your retirement savings!

Now, while traditional 401(k) withdrawals are taxed as ordinary income, Roth accounts offer that sweet tax-free growth and withdrawals.

So, if you want to make the most of your retirement, strategic planning is key to optimizing your tax efficiency. Isn’t it exciting to think about how these choices can shape your future?

Introduction

Understanding the nuances of 401(k) tax rates is super important for anyone looking to get the most out of their retirement savings. These plans come with some pretty significant tax advantages that can really shape your financial future.

But as you think about the benefits of 401(k) contributions versus other retirement accounts like IRAs and Roth IRAs, one big question pops up: how do these tax implications affect your long-term financial strategy?

Diving into this comparison not only highlights the immediate perks but also sheds light on the lasting effects on your retirement income and tax liabilities.

Understanding 401(k) Tax Rates

A 401(k) plan is a great way for employees to save for their future using pre-tax funds, which can help lower your taxable income in relation to the 401k tax rate for the year you make those deposits. For 2025, the contribution limit is set at $23,500 for folks under 50. If you’re 50 or older, you can add an extra catch-up contribution of $7,500, bringing your total potential to a whopping $31,000. And here’s a fun fact: workers aged 60 to 63 can actually contribute up to $11,250 in catch-up deposits, really boosting those savings for later in life!

Now, let’s talk about withdrawals. When you take money out of a traditional 401(k), the 401k tax rate applies as it is , which can really impact your tax bill during retirement. This is especially important for high earners, who might face higher tax rates on those withdrawals. The SECURE 2.0 Act has introduced some changes here, requiring high earners—defined as those making over $145,000—to make catch-up contributions on a Roth basis. This means no more pre-tax treatment for these payments. While payments to a Roth 401(k) don’t give you an upfront tax deduction, they do allow for tax-free growth and withdrawals if you meet certain conditions.

Understanding the 401k tax rate and its implications is key for effective financial planning, as it directly influences your current and future tax responsibilities. For instance, consider this: individuals who opt for Roth payments may benefit from tax-free withdrawals down the line, giving them more financial flexibility. So, it’s worth taking a moment to think about your own giving strategies. Are you leaning towards the immediate tax benefits of traditional payments, or do you see the long-term perks of Roth accounts? It’s a decision that could really shape your financial future!

Tax Implications of Alternative Retirement Accounts

Alternative retirement accounts, like Traditional IRAs and Roth IRAs, offer some cool tax perks compared to 401(k) plans. Traditional IRAs let you make —just like 401(k)s—but with a lower limit set at $6,500 for 2025, plus a $1,000 catch-up contribution for those 50 and older. On the flip side, Roth IRAs are funded with after-tax dollars, meaning your contributions won’t lower your taxable income for the year. But here’s the kicker: qualified withdrawals from Roth IRAs are completely tax-free once you retire. This distinction is super important for anyone crafting their long-term tax strategy, as it influences both current tax bills and future income during retirement.

Now, let’s talk about a key piece of retirement planning: Required Minimum Distributions (RMDs). These are the mandatory withdrawals you have to make from 401(k)s and traditional IRAs starting at age 73. These required withdrawals can unexpectedly boost your taxable income, possibly pushing you into a higher tax bracket and affecting your 401k tax rate, leading to bigger tax bills than you might expect. For example, retirees who lean heavily on 401(k) withdrawals could see their 401k tax rate climb due to the taxable nature of those distributions, especially if RMDs bump them up a bracket.

Real-life examples really drive this point home. Imagine a retiree who invested in a Roth IRA—they might find themselves in a lower tax bracket during their later years, allowing them to take out funds without any extra tax worries. Financial advisors often highlight the smart use of Roth IRAs for tax diversification. Bill Shafransky, a Senior Wealth Advisor, recommends that folks approaching higher tax brackets should think about Roth conversions during their lower-income years to keep tax bills down. Plus, using Health Savings Accounts (HSAs) can be a game-changer for saving in your later years, as these accounts allow for tax-free growth and withdrawals for qualified medical expenses, adding another layer of tax efficiency to your financial strategy. And just to give you a heads up, in 2025, the overall limit for 401(k) accounts for individuals aged 60 to 63 is $34,750, which includes a standard limit of $23,500 and an extra catch-up limit of $11,250. This really highlights how thoughtful planning and the use of alternative savings accounts can lead to significant tax savings.

Comparing Tax Benefits: 401(k) vs. Other Retirement Options

When it comes to retirement savings, 401(k) plans really stand out with their high funding limits, the potential for employer matching funds, and the favorable 401k tax rate—talk about a boost to your nest egg! For 2025, you can contribute up to $23,500 to your 401(k), and considering the 401k tax rate, if you’re 50 or older, there’s an extra catch-up contribution of $7,500, bringing the total to a whopping $31,000. That’s a huge advantage compared to Traditional IRAs, which cap out at $7,000, or $8,000 for those aged 50 and above.

But wait, there’s more! Employer matching contributions enhance the attractiveness of 401(k) plans by providing advantages related to the 401k tax rate. On average, employers match about 4.5% of what you put in, which can really ramp up your savings over time. For instance, if you contribute 5% of your salary and your employer matches 50% of that, you’re effectively adding an extra 2.5% of your salary to your savings. That’s a nice little boost that compounds over the years, helping you build a solid retirement fund while encouraging you to save even more.

Now, let’s talk about Roth IRAs. While they don’t offer an immediate tax deduction, they allow for [tax-free growth and withdrawals](https://theglobeandmail.com/investing/markets/markets-news/Motley Fool/30214876/3-retirement-savings-changes-that-take-effect-in-2025), making them a great option if you think you’ll be in a higher tax bracket later on. And don’t forget about Health Savings Accounts (HSAs)! They’re a smart way to save for medical expenses in retirement. You can contribute pre-tax dollars to HSAs, which grow tax-free and can be withdrawn tax-free for qualified medical costs. This double benefit makes HSAs a fantastic complement to your regular savings accounts, especially if you’ve maxed out other options.

As you’re planning for your post-work finances, it’s also crucial to consider how Social Security benefits are taxed and the state tax implications. Some states don’t tax Social Security benefits, while others might, depending on how much you earn. Understanding these nuances—like the role of employer matching in 401(k) plans, the strategic use of HSAs, and the implications of the 401k tax rate on Social Security—is key to optimizing your savings and ensuring a secure financial future. So, what’s your strategy looking like? Let’s make sure you’re on the right track!

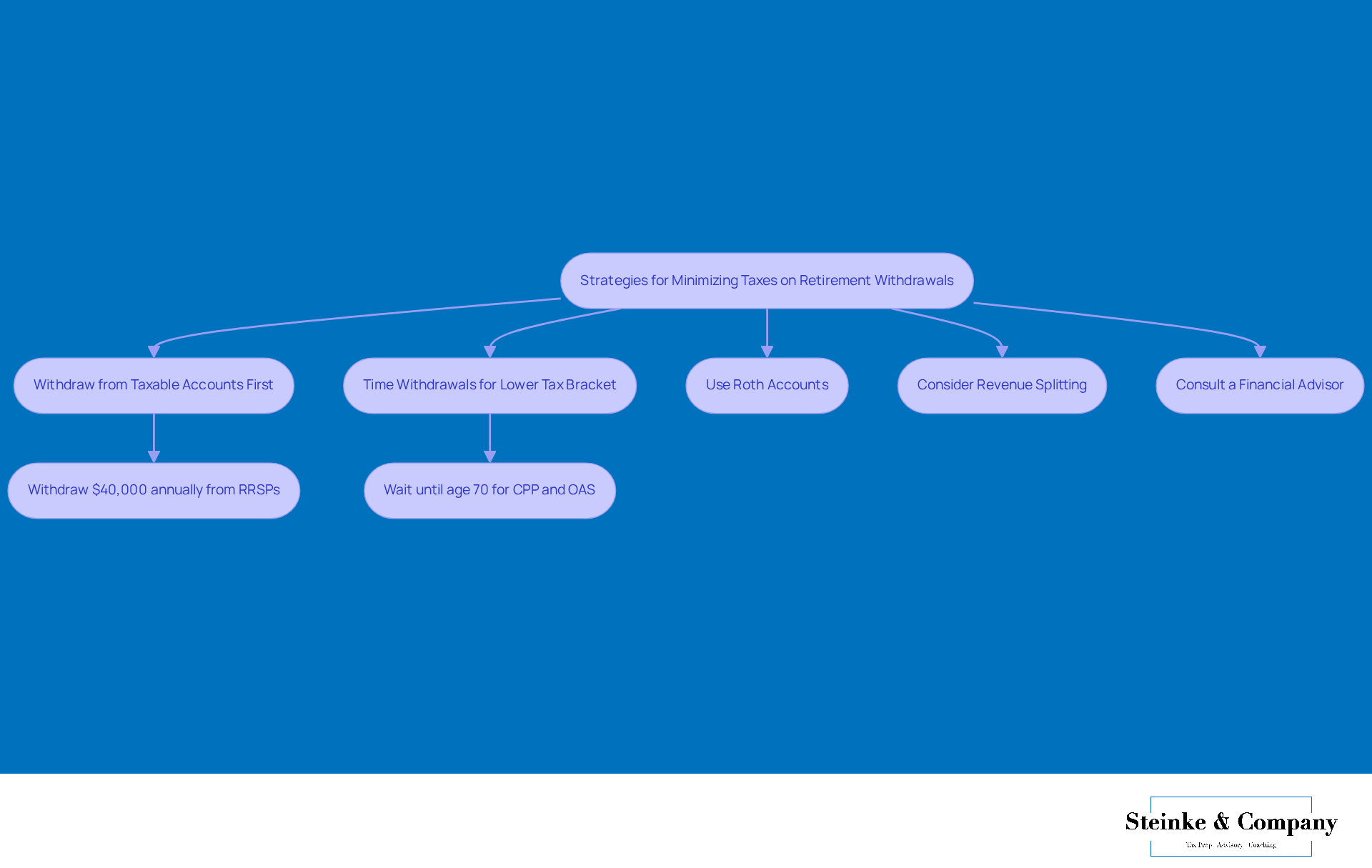

Strategies for Minimizing Taxes on Retirement Withdrawals

If you want to cut down on taxes when withdrawing from your retirement accounts, it’s crucial to consider the 401k tax rate as part of your smart game plan for your income sources. A great place to start? Prioritize taking money out of your taxable accounts first. This way, your tax-deferred accounts like 401(k)s and Traditional IRAs can keep growing. Not only does this help you hold onto the tax benefits of these accounts, but it also helps you keep your taxable income lower in the short run.

Managing your 401k tax rate is super important here. By timing your withdrawals just right, you can stay within those lower tax brackets, which helps minimize your overall 401k tax rate, resulting in less tax to pay overall. For example, consider pulling out smaller amounts from your RRSPs or RRIFs over several years instead of going for a big lump sum. That way, you won’t accidentally bump yourself into a higher tax bracket.

Using Roth accounts for your withdrawals can be a smart move too, since those funds are ! This gives you more flexibility in how you manage your taxable income. And don’t forget about revenue splitting with your spouse! By allocating up to 50 percent of pension earnings to the partner who earns less, couples can improve their tax situation and lower their tax bills.

Real-life stories really show how effective these strategies can be. Take John and Lisa, for instance. They withdrew $40,000 each year from their RRSPs before starting their CPP and OAS, which helped them keep their taxable income low and set them up for higher guaranteed earnings down the line. Then there’s Susan, who cleverly converted part of her RRSP to a RRIF early on, keeping her income below the OAS clawback threshold.

Talking to a financial advisor can really help too. They can provide personalized advice on managing your tax brackets, helping you navigate your unique situation and apply strategies that boost your retirement earnings while cutting down on tax obligations. Plus, waiting to claim government benefits like CPP and OAS until you’re 70 can really help with tax efficiency, allowing you to draw from your registered accounts at a lower 401k tax rate.

And let’s not forget about keeping good records! Maintaining all your tax-related documents is crucial. Keeping these records for the right amount of time helps confirm your earnings and verify your identity when needed. Generally, it’s a good idea to hold onto your tax records for at least three years after filing, but you might need to keep them longer depending on your situation, like if you had any omitted income or specific state rules. This careful recordkeeping not only helps with effective tax management but also keeps you in line with IRS requirements.

Conclusion

Understanding the nuances of 401(k) tax rates compared to other retirement accounts is super important for anyone looking to get the most out of their savings strategy. This article shines a light on the big perks of 401(k) plans, like higher contribution limits and potential employer matching, while also diving into the tax implications that come with withdrawals. Choosing between traditional and Roth accounts can really impact both your current tax situation and your future financial flexibility, so it’s essential to weigh these options carefully.

Key insights to keep in mind include:

- The importance of contribution limits

- The effect of Required Minimum Distributions (RMDs)

- How alternative accounts like IRAs and HSAs can play a role

By looking at the tax benefits of each account type, you can make informed decisions that fit your financial goals. Plus, using strategies to minimize taxes during retirement—like timing your withdrawals just right and managing your accounts efficiently—can give your financial wellbeing a nice boost.

Ultimately, taking a proactive approach to retirement planning—considering the tax implications of 401(k) plans versus other retirement accounts—can lead to some serious long-term benefits. Chatting with a financial advisor and crafting a personalized strategy can really help you navigate your unique situation effectively, ensuring a secure and prosperous retirement. So, remember, understanding tax rates and implications is a fundamental piece of the retirement planning puzzle. Let’s make those retirement dreams a reality!

Frequently Asked Questions

What is a 401(k) plan and how does it affect taxable income?

A 401(k) plan allows employees to save for the future using pre-tax funds, which can help lower their taxable income in the year they make contributions.

What are the contribution limits for a 401(k) plan in 2025?

In 2025, the contribution limit for individuals under 50 is set at $23,500. Those aged 50 or older can make an additional catch-up contribution of $7,500, bringing their total to $31,000. Additionally, workers aged 60 to 63 can contribute up to $11,250 in catch-up deposits.

How are withdrawals from a traditional 401(k) taxed?

Withdrawals from a traditional 401(k) are taxed as ordinary income, which can significantly impact your tax bill during retirement, especially for high earners who may face higher tax rates on those withdrawals.

What changes did the SECURE 2.0 Act introduce regarding catch-up contributions?

The SECURE 2.0 Act requires high earners, defined as those making over $145,000, to make catch-up contributions on a Roth basis, meaning these contributions will not receive pre-tax treatment.

What are the benefits of contributing to a Roth 401(k)?

Contributions to a Roth 401(k) do not provide an upfront tax deduction, but they allow for tax-free growth and withdrawals if certain conditions are met, offering potential long-term financial benefits.

Why is understanding the 401(k) tax rate important for financial planning?

Understanding the 401(k) tax rate and its implications is crucial for effective financial planning, as it influences both current and future tax responsibilities, affecting decisions between traditional and Roth contributions.